444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The social media analytical-based insurance market is a rapidly growing sector within the insurance industry. In today’s digital age, social media has become an integral part of people’s lives, and businesses are leveraging its power to connect with their target audience. With the vast amount of data generated on social media platforms, insurance companies have recognized the value of utilizing social media analytics to gain insights and make informed decisions.

Meaning

Social media analytical-based insurance refers to the use of data gathered from social media platforms to assess risks, monitor customer behavior, and improve the overall efficiency of insurance operations. By analyzing social media data, insurance companies can gain valuable insights into customer preferences, sentiments, and behavior patterns, enabling them to develop personalized insurance products and enhance customer engagement.

Executive Summary

The social media analytical-based insurance market is experiencing significant growth due to the increasing adoption of social media platforms and the need for data-driven decision-making in the insurance industry. Insurance companies are using advanced analytics tools to extract actionable insights from social media data, which helps them identify potential risks, detect fraudulent claims, and tailor insurance offerings to meet customer needs.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

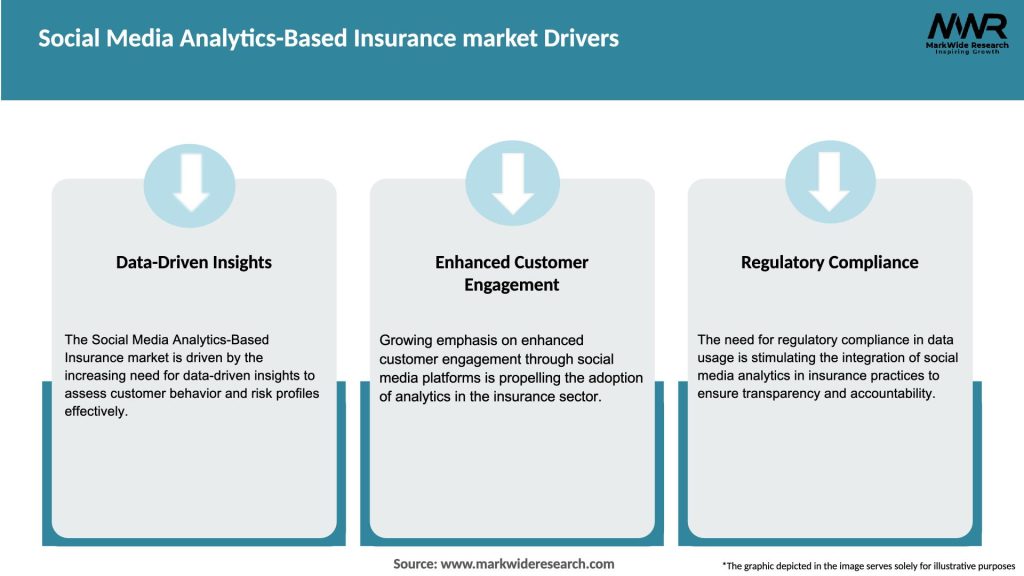

The social media analytical-based insurance market is driven by the convergence of social media platforms and advanced analytics technologies. The increasing availability of social media data, coupled with the need for data-driven decision-making, has fueled the growth of this market. Insurance companies are leveraging social media analytics to gain a competitive advantage, enhance customer engagement, and optimize their operations.

Furthermore, the growing demand for personalized insurance products and the need for efficient fraud detection and risk assessment are also driving market growth. Insurance companies are investing in social media analytics tools and expertise to harness the power of social media data and extract actionable insights.

However, there are certain challenges that need to be addressed. Data privacy and security concerns pose significant hurdles for insurance companies leveraging social media analytics. Stricter regulations and the need for transparent data handling practices require insurers to adopt robust data protection measures.

Additionally, the quality and accuracy of social media data can impact the effectiveness of analytics. Insurers need to ensure that the data they analyze is reliable and relevant to make informed decisions.

Despite these challenges, the social media analytical-based insurance market presents ample opportunities for growth. Collaborations with social media platforms, enhanced customer engagement, product innovation, and improved risk management are some of the key areas where insurers can capitalize on the potential of social media analytics.

Regional Analysis

The adoption of social media analytical-based insurance varies across regions. North America is leading the market, primarily driven by the presence of major insurance companies and the high penetration of social media platforms. The region has witnessed significant investments in analytics infrastructure and talent, enabling insurers to leverage social media data effectively.

Europe is also a prominent market for social media analytical-based insurance, with countries like the United Kingdom, Germany, and France leading the way. The European market is characterized by a strong focus on data privacy and security, prompting insurance companies to adopt robust data protection measures.

Asia Pacific is expected to witness substantial growth in the social media analytical-based insurance market. The region has a large population of social media users, and insurance companies are recognizing the potential of social media analytics to tap into this vast market.

Latin America and the Middle East & Africa are relatively nascent markets but offer significant growth opportunities. The increasing adoption of social media platforms and the need for data-driven decision-making are driving insurance companies in these regions to explore social media analytics.

Competitive Landscape

Leading Companies in Social Media Analytics-Based Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

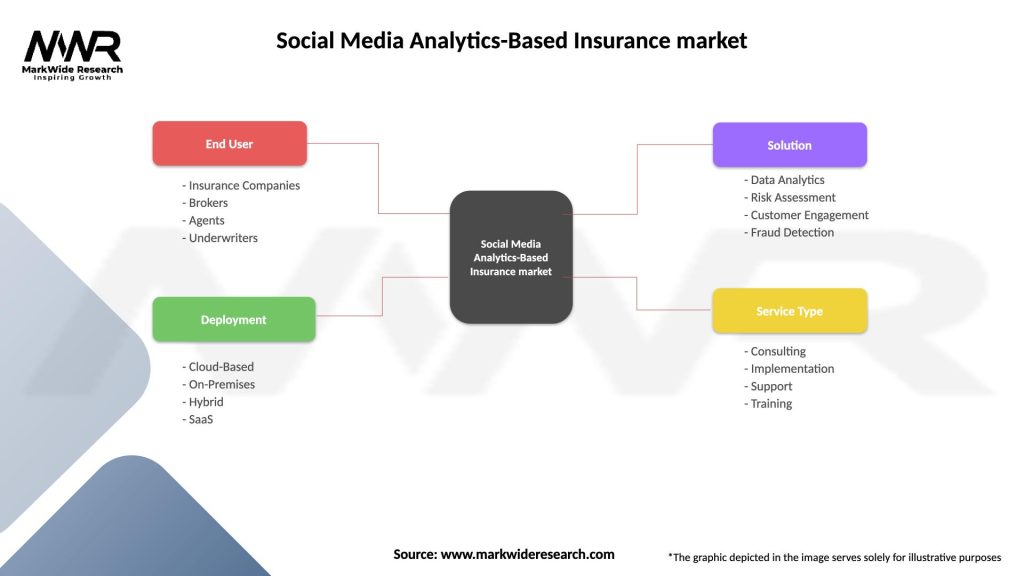

The social media analytical-based insurance market can be segmented based on the following factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the social media analytical-based insurance market. As people worldwide turned to social media for information, entertainment, and communication during lockdowns and social distancing measures, the volume of social media data increased substantially. Insurance companies recognized the importance of leveraging this data to understand changing customer needs and sentiments.

The pandemic also highlighted the importance of risk assessment and fraud detection in the insurance industry. Social media analytics played a crucial role in helping insurers identify potential risks associated with COVID-19, such as travel restrictions, business interruptions, and changes in customer behavior. It also helped insurers detect fraudulent claims related to the pandemic.

Insurance companies that had already embraced social media analytics were better equipped to adapt to the changing landscape and respond to customer needs during the pandemic. The crisis accelerated the adoption of social media analytics by insurance companies, further driving market growth.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the social media analytical-based insurance market looks promising. As social media continues to grow in popularity and usage, insurance companies will increasingly rely on social media analytics to gain a competitive edge. The adoption of advanced technologies like artificial intelligence and machine learning will further enhance the capabilities of social media analytics in the insurance industry.

Personalization of insurance offerings will become a key differentiator, with insurance companies leveraging social media data to tailor products and services based on individual customer preferences and needs. Real-time monitoring and predictive analytics will enable insurers to proactively assess risks, detect fraudulent activities, and provide timely interventions.

However, insurance companies must address the challenges related to data privacy and security, data quality, and integration with existing systems. Stricter regulations and the need for transparent data handling practices will require insurers to invest in robust data protection measures.

Conclusion

The social media analytical-based insurance market presents immense opportunities for insurance companies to improve customer engagement, enhance risk management, optimize costs, and make data-driven decisions. By harnessing the power of social media analytics, insurance companies can stay ahead in a rapidly evolving digital landscape and deliver tailored insurance solutions to meet customer expectations.

What is Social Media Analytics-Based Insurance?

Social Media Analytics-Based Insurance refers to the integration of social media data and analytics into the insurance sector to assess risks, enhance customer engagement, and improve underwriting processes. This approach leverages user-generated content and social interactions to inform insurance decisions.

What are the key players in the Social Media Analytics-Based Insurance market?

Key players in the Social Media Analytics-Based Insurance market include companies like Allstate, Progressive, and State Farm, which utilize social media insights to refine their products and services. These companies are focusing on innovative strategies to enhance customer experience and risk assessment, among others.

What are the growth factors driving the Social Media Analytics-Based Insurance market?

The growth of the Social Media Analytics-Based Insurance market is driven by the increasing use of social media platforms for customer engagement, the rise in data analytics capabilities, and the demand for personalized insurance products. Additionally, the ability to monitor customer sentiment and behavior through social media is enhancing risk assessment.

What challenges does the Social Media Analytics-Based Insurance market face?

Challenges in the Social Media Analytics-Based Insurance market include data privacy concerns, the accuracy of social media data, and the integration of social media analytics with traditional insurance models. Insurers must navigate regulatory frameworks while ensuring effective data utilization.

What opportunities exist in the Social Media Analytics-Based Insurance market?

Opportunities in the Social Media Analytics-Based Insurance market include the potential for developing new insurance products tailored to social media behaviors, enhancing customer service through real-time engagement, and leveraging predictive analytics for better risk management. These innovations can lead to improved customer loyalty and retention.

What trends are shaping the Social Media Analytics-Based Insurance market?

Trends in the Social Media Analytics-Based Insurance market include the increasing adoption of artificial intelligence for data analysis, the rise of influencer marketing in insurance, and the growing importance of customer feedback from social media platforms. These trends are influencing how insurers approach marketing and customer relationship management.

Social Media Analytics-Based Insurance market

| Segmentation Details | Description |

|---|---|

| End User | Insurance Companies, Brokers, Agents, Underwriters |

| Deployment | Cloud-Based, On-Premises, Hybrid, SaaS |

| Solution | Data Analytics, Risk Assessment, Customer Engagement, Fraud Detection |

| Service Type | Consulting, Implementation, Support, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Social Media Analytics-Based Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at