444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Social banking is a revolutionary approach that combines the principles of traditional banking with social responsibility and community development. It involves financial institutions integrating social and environmental factors into their operations to promote sustainable and inclusive economic growth. The social banking market has gained significant traction in recent years, as consumers are increasingly seeking ethical and socially responsible banking options. This market overview provides a comprehensive analysis of the key aspects and trends shaping the social banking sector.

Meaning

social banking refers to a banking model that goes beyond profit-making and emphasizes social impact and community development. It involves providing financial services that align with environmental sustainability, social responsibility, and ethical practices. Social banks prioritize lending to social enterprises, investing in sustainable projects, and supporting initiatives that address social and environmental challenges. By adopting a people-centric approach, social banking aims to create positive change and foster financial inclusion.

Executive Summary

The executive summary of the social banking market highlights the key findings and insights obtained from the research. It provides a concise overview of the market size, growth rate, and major trends observed. Additionally, it outlines the opportunities and challenges faced by industry participants and offers recommendations for stakeholders to thrive in this evolving landscape.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the Social Banking Market:

Market Restraints

Despite its growth potential, the Social Banking Market faces several challenges:

Market Opportunities

The Social Banking Market offers several opportunities for growth:

Market Dynamics

The Social Banking Market is influenced by various technological, social, and economic factors:

Regional Analysis

The Social Banking Market exhibits regional variations in adoption and market maturity:

Competitive Landscape

Leading Companies in the Social Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

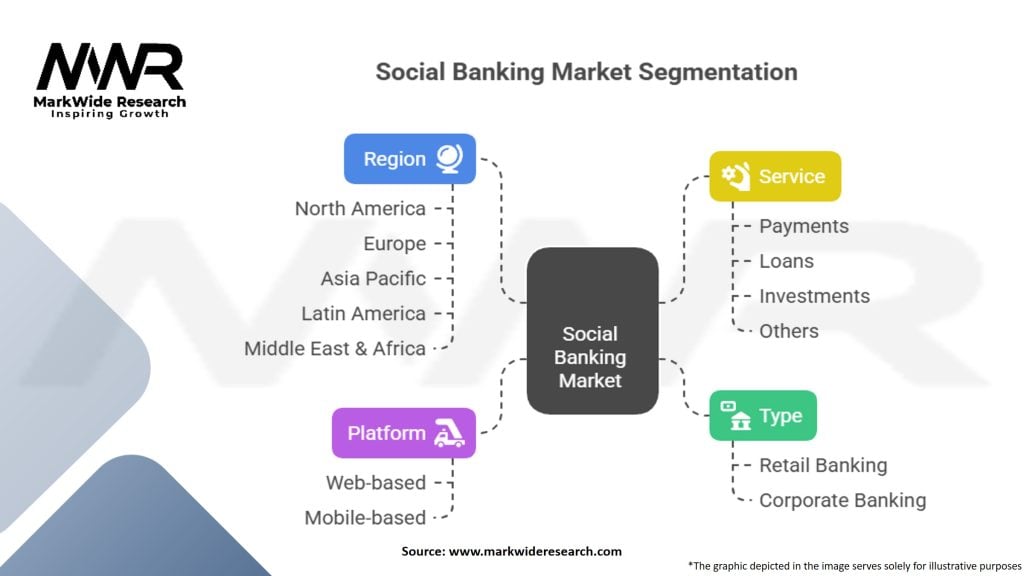

Segmentation

The Social Banking Market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of digital and mobile banking services, further boosting the demand for social banking platforms. As more consumers turned to digital tools for financial transactions during lockdowns, social banking became more integral in maintaining customer engagement and service delivery.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the social banking market appears promising, with continued growth expected in the coming years. As consumers become more socially conscious and demand ethical banking options, social banks have the opportunity to expand their customer base and make a significant impact. The integration of technology, data analytics, and artificial intelligence can enhance the efficiency and effectiveness of social banking operations. Collaboration between social banks, traditional banks, and impact investors can lead to hybrid models that mainstream social and environmental considerations. Ultimately, the future outlook for the social banking market is one of continuous evolution and positive transformation.

Conclusion

The social banking market is a dynamic and rapidly evolving sector that merges financial services with social and environmental considerations. It offers an alternative to traditional banking by prioritizing social impact, sustainability, and financial inclusion. As consumer awareness and demand for ethical banking options continue to grow, social banks have the opportunity to drive positive change and create shared value. By embracing innovation, collaboration, and customer-centricity, social banks can navigate the challenges and seize the opportunities presented by this emerging market.

What is Social Banking?

Social Banking refers to financial services that prioritize social and environmental impact alongside traditional banking functions. It often includes community-focused lending, ethical investment options, and support for sustainable projects.

What are the key players in the Social Banking Market?

Key players in the Social Banking Market include Triodos Bank, Amalgamated Bank, and Beneficial State Bank, which focus on ethical banking practices and community development, among others.

What are the main drivers of growth in the Social Banking Market?

The main drivers of growth in the Social Banking Market include increasing consumer demand for ethical financial products, a growing awareness of social responsibility, and the rise of sustainable investment practices.

What challenges does the Social Banking Market face?

Challenges in the Social Banking Market include regulatory hurdles, competition from traditional banks, and the need for greater consumer education about the benefits of social banking.

What opportunities exist in the Social Banking Market?

Opportunities in the Social Banking Market include expanding digital banking solutions, partnerships with social enterprises, and the potential for innovative financial products that cater to underserved communities.

What trends are shaping the Social Banking Market?

Trends shaping the Social Banking Market include the integration of technology for better customer engagement, a focus on transparency in operations, and the increasing importance of environmental, social, and governance (ESG) criteria in investment decisions.

Social Banking Market

| Segmentation | Details |

|---|---|

| Type | Retail Banking, Corporate Banking |

| Platform | Web-based, Mobile-based |

| Service | Payments, Loans, Investments, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Social Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at