444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The smart furniture market represents an innovative and rapidly evolving segment at the intersection of furniture manufacturing, consumer electronics, and Internet of Things (IoT) technologies. This dynamic sector encompasses furniture products integrated with electronic components, sensors, connectivity features, and intelligent functionalities that enhance user convenience, optimize space utilization, and create interconnected living and working environments. Smart furniture ranges from beds with sleep tracking capabilities and adjustable firmness settings to desks featuring wireless charging, height adjustment controls, and integrated lighting systems. The market demonstrates exceptional growth momentum driven by increasing urbanization creating space optimization needs, rising consumer adoption of smart home technologies, growing health and wellness consciousness, and technological advancements making intelligent furniture features more affordable and accessible.

Product categories span smart beds and mattresses, intelligent seating solutions, multifunctional storage systems, connected tables and desks, and integrated entertainment furniture incorporating displays and audio systems. Regional dynamics reveal strong demand in developed markets where smart home adoption reaches maturity while emerging economies demonstrate accelerating interest as middle-class populations expand and technology awareness increases. According to MarkWide Research analysis, the sector is experiencing remarkable expansion with projected growth at a CAGR of 12.4% through the forecast period. Industry participants include traditional furniture manufacturers integrating technology into product lines, technology companies entering furniture markets, specialized smart furniture startups, and integrated home automation providers offering comprehensive connected living solutions across residential and commercial applications globally.

The smart furniture market refers to the global industry encompassing design, manufacturing, distribution, and integration of furniture products featuring electronic components, sensors, connectivity capabilities, and intelligent functionalities. This includes furniture with embedded IoT technology, voice control integration, automated adjustment mechanisms, health monitoring sensors, wireless charging capabilities, ambient lighting systems, and connectivity with smart home ecosystems enabling enhanced user experiences, space optimization, and lifestyle convenience.

Market transformation in smart furniture reflects fundamental shifts in consumer expectations toward connected, multifunctional, and personalized living spaces. The sector has evolved from niche luxury products targeting early technology adopters to increasingly mainstream offerings appealing to diverse consumer segments across residential and commercial markets. Key growth drivers include accelerating smart home ecosystem adoption, urban living space constraints requiring multifunctional solutions, remote work proliferation creating home office furniture demand, and health consciousness driving interest in ergonomic and wellness-focused furniture. The market landscape features diverse stakeholders including established furniture manufacturers, consumer electronics companies, specialized smart furniture brands, and technology platform providers enabling furniture connectivity and control.

Consumer preferences increasingly favor furniture that seamlessly blends aesthetic design with technological functionality, avoiding overtly “tech-forward” appearances while delivering meaningful convenience and performance benefits. Technology integration challenges include ensuring reliability, managing power requirements, maintaining intuitive user interfaces, and achieving cost points acceptable to mainstream consumers beyond early adopter segments. Distribution strategies combine traditional furniture retail channels with online direct-to-consumer models, technology retailers, and specialized showrooms enabling customers to experience smart furniture functionality before purchase.

Market research indicates that approximately 68% of consumers express interest in furniture with integrated technology features when the premium remains within reasonable price ranges compared to conventional alternatives. The manufacturing ecosystem demonstrates increasing sophistication with furniture designers collaborating with electronics engineers, software developers creating companion mobile applications, and supply chains integrating both traditional furniture materials and electronic components requiring specialized handling and quality control throughout production processes.

Critical market dynamics shaping the smart furniture landscape include:

Multiple catalysts propel growth in the smart furniture market. Smart home ecosystem maturity creates foundation for smart furniture adoption with consumers owning voice assistants, smart lighting, and connected devices expecting furniture to integrate within these environments. Urbanization trends globally concentrate populations in cities where residential space premiums drive demand for multifunctional furniture maximizing utility per square foot. Remote work normalization following global workplace transformations creates sustained demand for home office furniture with ergonomic features, productivity enhancements, and professional functionality. Health consciousness among consumers elevates interest in sleep tracking beds, posture-monitoring chairs, and activity-encouraging furniture addressing wellness priorities. Technology cost reduction through economies of scale in sensor production, electronics manufacturing, and connectivity components makes smart features increasingly affordable for mainstream furniture products. Younger consumer preferences toward technology integration and connected lifestyles drive market growth as millennials and younger generations represent growing furniture purchasing demographics.

Space optimization innovation including beds with integrated storage, desks with cable management systems, and sofas with charging stations addresses practical consumer needs beyond pure technology appeal. Voice control proliferation makes smart furniture interaction intuitive and accessible, eliminating concerns about complex control interfaces or smartphone dependencies. Personalization demand enables smart furniture to remember user preferences for adjustments, lighting, and configurations, delivering customized experiences for multiple household members. Commercial real estate evolution toward flexible workspaces, hotel room differentiation, and healthcare patient experience drives institutional smart furniture adoption. Entertainment integration with furniture incorporating speakers, displays, and media connectivity appeals to consumers seeking streamlined living spaces without separate audio-visual equipment. Wireless charging ubiquity makes integrated charging pads expected furniture features rather than premium additions, with adoption rates exceeding 45% in premium furniture segments targeting technology-conscious consumers.

Significant challenges constrain market growth despite favorable overall dynamics. Price premiums for smart furniture relative to conventional alternatives limit mainstream adoption, particularly in price-sensitive markets and among consumers prioritizing furniture aesthetics and durability over technological features. Technology obsolescence concerns create hesitation among consumers worried about furniture remaining functionally relevant as connectivity standards, smart home platforms, and control technologies evolve. Reliability uncertainties around electronic component longevity compared to traditional furniture lifespans generate skepticism about long-term value and potential repair costs. Design compromises sometimes necessary to accommodate electronics, wiring, and connectivity features detract from aesthetic purity that furniture-focused consumers prioritize.

Power management challenges including battery replacement requirements, charging cable visibility, or electrical outlet dependencies create practical inconveniences reducing smart furniture appeal. Privacy concerns around sensors, cameras, and data collection in furniture raise consumer awareness issues requiring transparent communication and robust security measures. Installation complexity for some smart furniture products requiring electrical connections, network configuration, or professional assembly creates barriers compared to conventional furniture simplicity. Compatibility fragmentation across smart home platforms, voice assistants, and control standards confuses consumers and potentially limits functionality depending on existing home automation ecosystems.

Limited consumer awareness about smart furniture benefits and available products constrains demand growth, requiring substantial marketing education investments. Distribution challenges arise from smart furniture requiring different retail experiences enabling functionality demonstration compared to conventional furniture showroom displays. Repair and maintenance complexities when electronic components fail contrast unfavorably with traditional furniture repair or reupholstery options, potentially creating waste concerns. Building restrictions in some residential settings around electrical modifications or wireless signal generation limit smart furniture installation feasibility, with approximately 18% of potential customers facing regulatory or practical barriers to adoption.

Substantial opportunities exist for market participants across the value chain. Modular design approaches enabling consumers to add smart features to conventional furniture through attachable modules reduce entry barriers while creating upgrade paths from basic to advanced functionality. Subscription services including software features, content access, or enhanced functionality create recurring revenue streams beyond initial furniture purchases. Commercial market expansion through office furniture with occupancy sensing, hotel room furniture with guest customization, and healthcare furniture with patient monitoring capabilities represents substantial growth potential. Emerging market penetration as middle-class populations in Asia, Latin America, and Africa adopt smart home technologies and prioritize modern, space-efficient furniture solutions.

Senior living applications including beds with fall detection, chairs with mobility assistance, and furniture with medication reminders address aging population needs and healthcare cost management. Rental and hospitality sectors enable smart furniture differentiation in competitive markets while amortizing technology costs across multiple users over furniture lifecycles. Data analytics services aggregating furniture usage patterns, sleep quality metrics, and workspace utilization provide value-added services to consumers and commercial clients. Sustainable technology integration using recycled materials, renewable energy charging, and modular electronics enabling component upgrades without complete furniture replacement appeals to environmentally conscious consumers.

Custom integration services for luxury residences and commercial installations create premium service revenue opportunities beyond standardized product sales. Partnership opportunities between furniture manufacturers and technology companies leverage complementary strengths accelerating innovation and market credibility. Healthcare integration with furniture monitoring patient movements, vital signs, and fall risks creates opportunities in medical facilities and home healthcare markets. Educational applications including classroom furniture with device charging, collaborative features, and occupancy analytics serve evolving educational environment needs.

Complex interactions between technological, consumer, and industry forces shape market evolution. Technology advancement pace creates both opportunities through enhanced capabilities and challenges around obsolescence management and consumer confidence in long-term relevance. Smart home platform competition among technology giants influences furniture manufacturer partnership strategies and consumer compatibility considerations. Consumer expectation evolution sees smart features transitioning from novelty status to expected functionality, particularly in premium furniture segments and younger consumer demographics. Design philosophy tensions between furniture aesthetics and technology integration require careful balance maintaining visual appeal while delivering functional benefits. Supply chain complexity increases as furniture manufacturers integrate electronic components requiring specialized sourcing, quality control, and assembly processes.

Retail channel evolution combines physical showrooms enabling product experience with online purchasing convenience and direct-to-consumer models reducing distribution costs. Standardization efforts around connectivity protocols, charging standards, and smart home integration reduce consumer confusion while enabling broader ecosystem compatibility. Investment patterns see venture capital flowing into smart furniture startups while traditional furniture manufacturers pursue strategic acquisitions and internal development programs. Consumer education requirements demand substantial marketing investments communicating value propositions beyond basic feature descriptions to demonstrate lifestyle benefits. Economic sensitivity affects premium product demand with smart furniture facing headwinds during economic uncertainty when consumers prioritize essential purchases. Generational preferences show stronger smart furniture adoption among younger demographics comfortable with technology integration, with penetration rates approximately 3.5 times higher among consumers under age 40 compared to older demographics. Real estate trends toward smaller urban apartments and flexible living spaces align favorably with multifunctional smart furniture value propositions.

Comprehensive research underpinning this analysis employed multiple methodologies ensuring accuracy and market insight. Primary research included structured interviews with smart furniture manufacturers, furniture retailers, technology integration specialists, and interior designers providing firsthand perspectives on product development challenges, consumer preferences, and market opportunities. Consumer surveys assessed awareness levels, purchase intentions, feature preferences, and price sensitivity across demographic segments and geographic regions. Secondary research synthesized information from furniture industry publications, consumer electronics reports, smart home market analyses, and patent databases understanding technology trends and competitive positioning. Market sizing utilized furniture market data, smart home adoption statistics, and penetration rate estimates across product categories building comprehensive demand models.

Retail channel analysis examined distribution strategies, pricing patterns, and merchandising approaches across traditional furniture stores, online retailers, and specialized smart home retailers. Competitive assessment evaluated major market participants analyzing product portfolios, technology partnerships, pricing strategies, and market positioning approaches. Technology evaluation examined emerging capabilities including advanced sensors, artificial intelligence integration, sustainable power solutions, and connectivity innovations potentially impacting future product development. Regional analysis investigated market characteristics across major regions considering smart home adoption rates, urbanization levels, housing characteristics, and consumer purchasing power. Application analysis assessed smart furniture adoption across residential, commercial office, hospitality, healthcare, and educational settings identifying segment-specific requirements and opportunities. Trend identification evaluated consumer lifestyle shifts, workplace transformations, and technology adoption patterns projecting future demand trajectories. Expert validation involved consulting with furniture designers, electronics engineers, and retail strategists verifying findings and incorporating nuanced insights reflecting practical market realities.

North America leads smart furniture adoption with approximately 38% global market share, driven by high smart home penetration, early technology adoption tendencies, and substantial home office furniture demand following remote work normalization. United States particularly demonstrates strong market development with technology-conscious consumers, established furniture retail infrastructure, and numerous smart furniture startups and established manufacturers competing actively. Canada shows similar adoption patterns though at smaller absolute market size, with particular strength in ergonomic office furniture and space-optimization solutions for urban markets. Europe represents a sophisticated market with emphasis on design aesthetics, sustainability, and quality, requiring smart furniture to meet high standards for both technological performance and furniture craftsmanship. Germany leads European adoption with engineering orientation, premium furniture market, and strong smart home interest driving demand.

Scandinavian countries demonstrate high adoption rates reflecting minimalist design preferences aligning well with integrated technology approaches and advanced smart home infrastructure. United Kingdom shows growing adoption particularly in London and urban centers where space optimization and modern lifestyle preferences drive smart furniture interest. Asia-Pacific demonstrates the fastest growth trajectory with CAGR exceeding 15%, led by rapid urbanization, technology enthusiasm, and expanding middle-class populations. China represents enormous potential with massive urban population, smart home ecosystem development, and domestic manufacturers entering smart furniture markets aggressively. Japan shows strong adoption particularly for space-saving multifunctional furniture aligned with compact urban living spaces and technology integration acceptance. South Korea demonstrates high smart home penetration creating favorable environment for smart furniture adoption. India emerges as growing market with expanding middle class, increasing smart device ownership, and furniture market modernization. Middle East shows selective adoption particularly in Gulf Cooperation Council countries pursuing luxury residential development and smart city initiatives. Latin America and Africa remain emerging markets with limited current penetration but long-term potential as urbanization progresses and technology costs decline enabling broader accessibility.

The competitive environment features diverse participants with varying strategies and capabilities:

By Product Type: The market segments into smart beds and mattresses featuring sleep tracking, temperature control, and adjustable positioning; smart seating including office chairs with posture monitoring and sofas with integrated features; smart tables and desks with wireless charging, height adjustment, and cable management; smart storage solutions with automated access and inventory tracking; and entertainment furniture incorporating displays, speakers, and media connectivity. Smart beds represent the largest product category by value while smart office furniture demonstrates strongest growth momentum.

By Technology: Classification includes IoT-enabled furniture with internet connectivity and app control, voice-controlled furniture integrating with smart home assistants, sensor-equipped furniture monitoring usage patterns and health metrics, motorized adjustment systems enabling automated positioning, and wireless charging furniture with integrated power delivery. IoT connectivity increasingly becomes standard across product categories while health monitoring sensors represent premium features.

By End User: Market applications span residential consumers seeking lifestyle convenience and space optimization, commercial offices requiring workplace productivity and employee wellness solutions, hospitality sector including hotels and short-term rentals, healthcare facilities utilizing patient monitoring furniture, and educational institutions adopting collaborative and technology-enabled learning environments. Residential applications dominate current volumes while commercial segments demonstrate higher average transaction values.

By Distribution Channel: Segments include furniture specialty stores offering experiential showrooms, online direct-to-consumer sales enabling competitive pricing, home improvement retailers carrying smart home products, consumer electronics stores positioning smart furniture alongside connected devices, and contract furniture dealers serving commercial and institutional customers. Online channels grow rapidly though physical retail remains important for high-consideration purchases.

By Price Range: Categories encompass entry-level smart furniture with basic connectivity and charging features at modest premiums, mid-range products with comprehensive smart features at moderate price points, and premium offerings with advanced capabilities, superior materials, and extensive customization options. Mid-range products demonstrate strongest growth as features democratize beyond early adopter segments.

Smart Beds and Mattresses represent the most mature smart furniture category with established consumer awareness and demonstrated value propositions. Sleep tracking capabilities monitor sleep stages, heart rate, and respiratory patterns providing insights through companion mobile applications. Temperature regulation through heating and cooling systems enables personalized comfort preferences for couples with different temperature sensitivities. Adjustable bases with programmable positioning serve reading, television viewing, and sleeping positions with memory functions for individual users. Integration capabilities with smart home systems enable automatic adjustments based on routines or environmental conditions.

Smart Office Desks constitute a rapidly growing category driven by remote work trends and ergonomic awareness. Height adjustment systems with programmable presets encourage position changes throughout workdays addressing sedentary lifestyle concerns. Integrated cable management maintains clean aesthetics while accommodating multiple device charging requirements. Wireless charging surfaces eliminate desktop cable clutter enabling seamless device power delivery. Occupancy sensing in commercial environments provides workplace utilization data informing space planning and real estate optimization decisions. Reminder systems prompt users to change positions or take breaks supporting wellness initiatives.

Multifunctional Smart Furniture addresses urban space constraints through innovative designs maximizing utility per square foot. Murphy beds with automated raising and lowering mechanisms transform living spaces from bedrooms to offices or entertainment areas. Smart storage systems with inventory tracking and automated access control optimize closet and pantry organization. Expandable tables with motorized extension mechanisms accommodate varying entertainment needs without manual effort. Integration complexity requires careful engineering ensuring mechanical reliability while incorporating electronic controls and sensors.

Smart Seating Solutions span office chairs with posture monitoring and sofas with integrated entertainment features. Ergonomic sensors detect poor sitting posture and provide alerts encouraging position adjustments supporting spinal health. Massage and heating functions in residential seating enhance comfort and relaxation. Integrated speakers and connectivity in entertainment seating create immersive experiences without separate audio equipment. Material challenges include incorporating electronics within upholstered furniture while maintaining comfort, durability, and cleanability.

Commercial Smart Furniture serves workplace transformation toward activity-based working and employee experience optimization. Occupancy sensors provide real-time workspace availability data supporting hot-desking and flexible seating arrangements. Environmental monitoring tracks air quality, lighting levels, and noise supporting workplace wellness initiatives. Utilization analytics inform real estate decisions and space design improvements based on actual usage patterns rather than assumptions. Integration with workplace platforms enables desk booking, collaboration space reservation, and facility management through unified systems, with adoption rates in new office developments exceeding 40% in major urban markets.

Furniture Manufacturers gain differentiation opportunities in competitive markets through smart feature integration enabling premium positioning and potentially higher margins compared to conventional furniture products. Technology partnerships provide access to capabilities beyond core furniture competencies while potentially creating licensing revenue opportunities from proprietary innovations.

Technology Companies access large furniture markets expanding addressable opportunities for sensors, connectivity modules, and software platforms beyond traditional consumer electronics applications. Data generation from smart furniture usage creates potential value through analytics services and ecosystem integration.

Retailers benefit from smart furniture creating differentiated shopping experiences, driving store traffic, and potentially commanding higher margins compared to commodity furniture products. Experiential retail opportunities enable showroom differentiation through interactive demonstrations impossible with conventional furniture.

Commercial Real Estate operators utilize smart furniture generating workplace analytics, enabling flexible space utilization, and creating competitive advantages in attracting and retaining tenants prioritizing modern workplace experiences.

Healthcare Facilities leverage smart furniture for patient monitoring, fall prevention, and care quality improvement while potentially reducing staffing requirements through automated monitoring capabilities.

Consumers ultimately benefit from enhanced convenience, space optimization, health insights, and lifestyle integration that smart furniture delivers, improving daily living experiences and potentially providing long-term wellness benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and Wellness Integration transforms smart furniture from convenience features toward active health monitoring and optimization tools. Sleep optimization platforms analyze sleep patterns, adjust temperature and positioning automatically, and provide actionable insights improving sleep quality. Ergonomic monitoring systems in office furniture detect poor posture, remind users to change positions, and track sitting versus standing time encouraging healthier work habits. Activity encouragement through furniture that tracks sedentary periods and prompts movement supports wellness initiatives in both residential and commercial environments. Biometric integration potentially incorporating heart rate monitoring, stress detection, and breathing pattern analysis expands furniture from passive objects to active health partners.

Sustainable Technology Integration addresses environmental concerns around electronic waste and furniture lifecycle management. Modular electronic components enable upgrades or repairs without complete furniture replacement extending product lifecycles and reducing waste. Recycled materials in both furniture construction and electronic components appeal to environmentally conscious consumers. Solar charging integration for low-power features reduces electrical grid dependence while demonstrating sustainability commitment. Design for disassembly facilitates end-of-life material recovery and recycling addressing disposal challenges inherent in technology-integrated furniture.

Voice Control Standardization makes smart furniture operation intuitive and accessible across consumer demographics. Integration with mainstream voice assistants eliminates learning curves associated with proprietary control systems. Natural language processing enables conversational furniture control rather than memorizing specific commands. Multi-user voice recognition personalizes experiences automatically based on who issues commands without manual profile switching. Privacy-conscious implementations through local processing and user control over data collection address consumer concerns about always-listening devices.

Subscription Service Models create ongoing customer relationships and recurring revenue beyond initial furniture sales. Premium feature access through subscriptions enables basic functionality at lower initial prices while generating continuing income from engaged users. Content and coaching services including sleep optimization programs, ergonomic guidance, and wellness coaching add value beyond hardware capabilities. Software updates and enhancements delivered through subscriptions maintain product relevance and functionality as technologies evolve. Data analytics services particularly in commercial applications provide actionable insights justifying ongoing service fees.

Artificial Intelligence Integration enables smart furniture to learn user preferences and optimize performance automatically. Predictive adjustments based on historical patterns and contextual information enhance convenience without manual intervention. Personalization across multiple users through automatic recognition and preference application serves household members individually. Anomaly detection for health monitoring applications identifies unusual patterns potentially indicating medical concerns warranting professional attention. Efficiency optimization manages power consumption intelligently balancing performance with energy conservation, with AI-enabled features achieving up to 35% better energy efficiency compared to static control approaches.

Recent years have witnessed numerous significant developments influencing market trajectories. Major furniture manufacturers announced smart product lines integrating technology into established brands bringing credibility and distribution scale to smart furniture markets. Technology company entries including consumer electronics brands and smart home platform providers validated market potential while bringing technical expertise and marketing resources. Strategic partnerships between furniture manufacturers and technology companies created integrated solutions leveraging complementary strengths and accelerating innovation. Investment activity in smart furniture startups reached substantial levels with venture capital recognizing market potential and funding product development and market expansion. Standardization progress around wireless charging, connectivity protocols, and smart home integration reduced consumer confusion and improved interoperability.

Retail innovations including experiential showrooms, augmented reality applications, and direct-to-consumer strategies transformed how consumers discover and purchase smart furniture. Commercial sector adoption particularly in workplace environments demonstrated smart furniture value propositions and created reference cases supporting residential market development. Patent activity increased significantly with companies protecting innovations in mechanical systems, sensor integration, control algorithms, and unique feature combinations. Material innovations enabled better electronic integration within furniture while maintaining aesthetic quality and durability standards. Sustainability initiatives addressed concerns about electronic waste and lifecycle management through modular designs and recycling programs demonstrating industry responsibility.

Strategic positioning in the smart furniture market requires comprehensive understanding of consumer technology adoption patterns, interior design trends, and smart home ecosystem integration capabilities. MarkWide Research analysis indicates that manufacturers should prioritize seamless connectivity with major smart home platforms including Apple HomeKit, Google Home, and Amazon Alexa to maximize market appeal. Product development strategies should focus on solving real consumer pain points such as space optimization, charging convenience, and ambient comfort rather than adding technology features for novelty purposes.

Market entry approaches should emphasize partnerships with furniture retailers, interior designers, and smart home technology providers to create integrated shopping experiences. Educational initiatives targeting consumers through showroom demonstrations, virtual reality experiences, and influencer collaborations can significantly enhance product understanding and purchase consideration. Digital marketing campaigns should highlight practical benefits and lifestyle enhancements rather than purely technical specifications to resonate with broader consumer segments.

Pricing strategies must balance innovation premiums with consumer value perception across different product categories. Tiered product offerings ranging from basic smart features to fully integrated premium solutions can address diverse market segments and price sensitivity levels. Subscription models for software updates, maintenance services, and feature enhancements present opportunities for recurring revenue generation beyond initial product sales.

Supply chain optimization requires collaboration with technology component suppliers ensuring consistent quality and timely availability of electronics, sensors, and connectivity modules. Quality assurance protocols must address both furniture durability standards and electronic component reliability to maintain brand reputation. After-sales support infrastructure including technical helpdesks, firmware update systems, and warranty services becomes critical for customer satisfaction and repeat purchase behavior.

Sustainability initiatives should emphasize eco-friendly materials, energy-efficient electronics, and modular designs supporting product longevity and component upgradability. Data privacy and cybersecurity measures must be transparently communicated to address growing consumer concerns about connected devices in residential environments. International expansion strategies should consider regional preferences, electrical standards, and smart home platform dominance variations across different geographic markets.

The smart furniture market is positioned for exponential growth driven by accelerating smart home adoption, advancing IoT technologies, and evolving consumer expectations for integrated living spaces through 2030 and beyond. Market projections indicate substantial expansion supported by declining technology costs, improved wireless connectivity standards including WiFi 6 and Matter protocol, and increasing consumer familiarity with connected home devices. Urbanization trends and space-constrained living environments will continue driving demand for multifunctional smart furniture solutions optimizing limited residential areas.

Technology evolution will center on artificial intelligence integration enabling predictive comfort adjustments, personalized user experiences, and health monitoring capabilities embedded within everyday furniture. Voice control and gesture recognition will become standard features eliminating traditional control interfaces and creating more intuitive interaction methods. Wireless charging integration will expand beyond desks and nightstands to sofas, dining tables, and outdoor furniture categories as power delivery standards continue advancing.

Product innovation will focus on sustainable materials, modular designs, and upgradeable technology components extending product lifecycles and reducing environmental impact. Health and wellness features including posture monitoring, circadian lighting, and ergonomic adjustments will gain prominence as consumers prioritize wellbeing in residential environments. Augmented reality applications will revolutionize furniture shopping experiences enabling virtual placement, customization visualization, and interactive product demonstrations before purchase.

Market expansion opportunities will emerge in commercial segments including smart offices, hospitality environments, and co-working spaces requiring flexible, technology-enabled furniture solutions. Integration capabilities with building management systems and enterprise IoT platforms will create new business-to-business market segments. Subscription services offering furniture-as-a-service models with embedded technology updates and maintenance will appeal to younger demographics preferring flexibility over ownership.

Regional growth will accelerate in Asia-Pacific markets where rapid urbanization, technology adoption, and space constraints create ideal conditions for smart furniture penetration. Innovation investment in sustainable electronics, biodegradable materials, and circular economy principles will shape long-term market dynamics and competitive positioning across the global smart furniture landscape.

The smart furniture market represents a transformative convergence of traditional furniture craftsmanship and cutting-edge technology, driven by smart home proliferation, consumer demand for multifunctional solutions, and evolving residential lifestyle preferences. Market dynamics demonstrate exceptional growth potential supported by declining IoT component costs, improved connectivity standards, and increasing consumer acceptance of connected home devices. Innovation momentum and cross-industry collaboration continue expanding product capabilities and market opportunities across residential and commercial segments.

Strategic success in this emerging market requires balancing aesthetic design principles with functional technology integration while maintaining user-friendly experiences. Companies that prioritize seamless smart home ecosystem compatibility, sustainable manufacturing practices, and genuine consumer value creation will be best positioned to capture opportunities in this evolving sector. Distribution partnerships with established furniture retailers and technology platforms have become essential for market access and consumer education initiatives.

Innovation leadership in space optimization, health monitoring, and personalized comfort solutions positions smart furniture as an integral component of modern living environments. Technology advancement in artificial intelligence, wireless power delivery, and sustainable materials continues creating new value propositions and market differentiation opportunities. Consumer adoption barriers including pricing concerns and technology complexity are gradually diminishing through improved product design and competitive market dynamics.

The competitive landscape will continue evolving as both traditional furniture manufacturers and technology companies compete for market leadership in this convergence category. Long-term success will require ongoing investment in research and development, user experience optimization, and sustainability initiatives to meet increasingly sophisticated consumer expectations and environmental standards. Consumer-focused approaches emphasizing reliability, privacy protection, and lifestyle enhancement will become increasingly critical differentiators in this innovative and rapidly expanding smart furniture market.

What is smart furniture?

Smart furniture refers to innovative furniture pieces that incorporate technology to enhance functionality and user experience. This includes features like built-in charging ports, adjustable settings, and connectivity with smart home systems.

Who are the key players in the Smart Furniture Market?

Key players in the Smart Furniture Market include IKEA, Herman Miller, and Steelcase, among others. These companies are known for integrating technology into their furniture designs to meet modern consumer needs.

What are the main drivers of growth in the Smart Furniture Market?

The growth of the Smart Furniture Market is driven by increasing consumer demand for convenience, the rise of smart home technology, and the growing trend of remote work, which has led to a need for multifunctional furniture.

What challenges does the Smart Furniture Market face?

Challenges in the Smart Furniture Market include high production costs, the complexity of integrating technology into furniture, and consumer skepticism regarding the durability and reliability of smart features.

What future opportunities exist in the Smart Furniture Market?

Future opportunities in the Smart Furniture Market include the development of more sustainable materials, the integration of artificial intelligence for personalized experiences, and expanding into emerging markets where smart home adoption is increasing.

What trends are shaping the Smart Furniture Market?

Trends in the Smart Furniture Market include the rise of modular furniture designs, increased focus on sustainability, and the incorporation of health and wellness features, such as ergonomic designs and air purification systems.

Smart Furniture Market

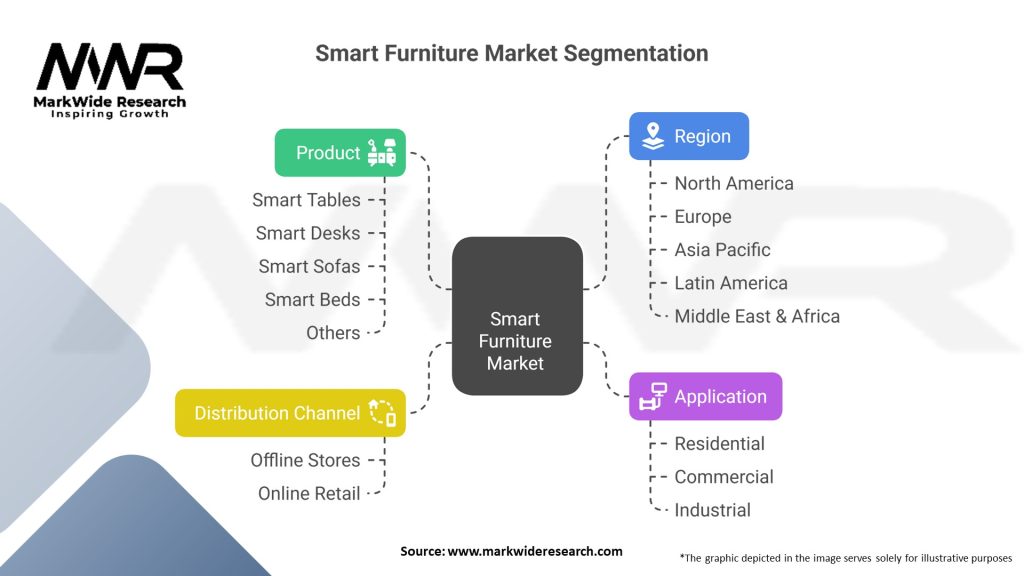

| Segmentation Details | Information |

|---|---|

| Product | Smart Tables, Smart Desks, Smart Sofas, Smart Beds, Others |

| Application | Residential, Commercial, Industrial |

| Distribution Channel | Offline Stores, Online Retail |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Smart Furniture Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at