444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Smart Finance Hardware market is a rapidly growing sector that encompasses a wide range of technological devices and solutions aimed at improving financial services and transactions. With the advent of digitalization and the increasing adoption of smart technologies, the finance industry has witnessed a significant transformation, and smart finance hardware plays a crucial role in this evolution.

Meaning

Smart finance hardware refers to the hardware components and devices that enable secure, efficient, and convenient financial operations and services. These devices are equipped with advanced technologies such as biometrics, near field communication (NFC), and encryption, providing enhanced security and seamless integration with digital financial systems.

Executive Summary

The Smart Finance Hardware market has experienced substantial growth in recent years, driven by the rising demand for improved financial services and the need for secure transactions. This market encompasses a wide range of devices, including smart cards, point-of-sale (POS) terminals, payment terminals, biometric devices, and ATM machines, among others.

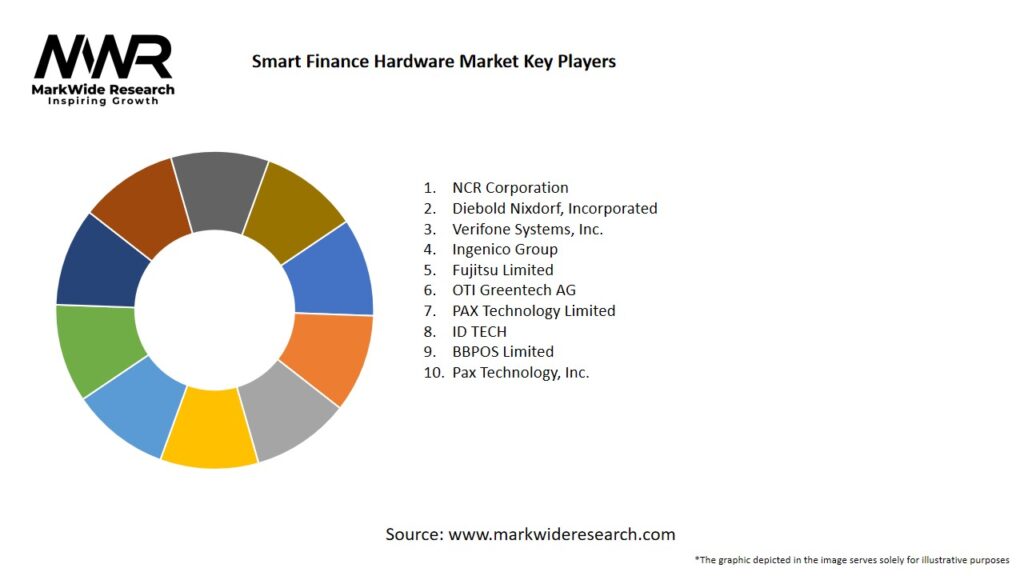

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the Smart Finance Hardware Market:

Digital Banking Adoption: The rise in digital banking services, including online banking, mobile wallets, and mobile POS systems, is driving the need for smart hardware solutions that can support secure and efficient transactions.

Contactless Payments: The increasing popularity of contactless payments is encouraging financial institutions to invest in hardware such as smart POS terminals and mobile payment solutions.

Enhanced Security Needs: As cyber threats and fraud become more prevalent, financial institutions are investing in hardware equipped with biometric authentication, multi-factor authentication, and advanced encryption technologies to ensure security.

Automation of Financial Services: The growing trend towards automation in financial services, such as automated teller machines (ATMs), self-service kiosks, and smart cash management systems, is driving the demand for smart finance hardware.

IoT and Blockchain Integration: The integration of IoT and blockchain technology in smart finance hardware is enabling smarter, more secure, and transparent financial transactions, which is further fueling market growth.

Market Restraints

Despite its growth potential, the Smart Finance Hardware Market faces several challenges:

High Initial Costs: The high upfront investment required for smart finance hardware solutions may deter small and medium-sized financial institutions from adopting these technologies.

Maintenance and Operational Costs: Ongoing maintenance and operational costs associated with smart finance hardware can be expensive, particularly for financial institutions that require large-scale deployment.

Security Concerns: Despite advancements in security technologies, concerns about data privacy and cyber threats associated with the use of connected devices and financial data may limit adoption.

Regulatory Challenges: Regulatory requirements for financial institutions, especially in regions with strict data protection and financial compliance laws, can create barriers to the widespread implementation of smart finance hardware.

Market Opportunities

The Smart Finance Hardware Market presents numerous opportunities for growth and innovation:

Growth in Emerging Markets: The adoption of digital banking and fintech services is growing rapidly in emerging economies, creating significant opportunities for the deployment of smart finance hardware in regions such as Asia-Pacific, Africa, and Latin America.

Integration of AI and Blockchain: The integration of AI-powered analytics and blockchain for enhanced security and real-time transaction verification presents new opportunities for developing smarter and more secure financial hardware solutions.

Smart ATM Solutions: There is growing demand for smart ATMs that provide enhanced security features, contactless payments, and self-service functionalities, presenting opportunities for hardware developers to innovate.

Mobile Payment Solutions: The growing adoption of mobile payment technologies, including mobile wallets and contactless payment methods, is creating a significant demand for mobile POS systems and other smart financial hardware.

Customization and Personalization: Financial institutions are looking for customized hardware solutions to cater to specific needs, such as digital banking, customer verification, and fraud prevention, opening up opportunities for tailored hardware solutions.

Market Dynamics

The Smart Finance Hardware Market is influenced by several dynamic factors:

Technological Advancements: Advances in biometric technology, AI, IoT, and machine learning are enhancing the capabilities of smart finance hardware, improving security, transaction speed, and user experience.

Shifting Consumer Preferences: Consumers are increasingly preferring convenient, automated, and secure financial transactions, driving demand for self-service kiosks, ATMs, and mobile POS systems.

Competition from Fintech Startups: Fintech companies are innovating rapidly, offering new digital banking and payment solutions that are challenging traditional banking models and pushing the need for more advanced hardware solutions.

Economic Factors: Economic factors, including disposable income and the increasing purchasing power of consumers, are contributing to the adoption of advanced financial hardware solutions in both developed and emerging economies.

Regional Analysis

The Smart Finance Hardware Market shows strong regional differences in adoption:

North America: North America, particularly the United States and Canada, is the largest market for smart finance hardware, driven by advanced banking infrastructure, high fintech adoption, and a strong focus on security and automation.

Europe: Europe is a significant market for smart finance hardware, particularly in the UK, Germany, and France, where digital banking is well-established and there is a high demand for secure financial transactions and automated services.

Asia-Pacific: The Asia-Pacific region is expected to experience rapid growth due to the increasing adoption of mobile payments, digital banking services, and the growing demand for secure financial hardware in countries like China, India, and Japan.

Latin America: In Latin America, countries like Brazil and Mexico are witnessing growing adoption of mobile banking and digital payment solutions, creating significant opportunities for the smart finance hardware market.

Middle East & Africa: The Middle East & Africa region is expanding as governments and financial institutions invest in digital banking infrastructure and secure transaction systems, driving the demand for smart finance hardware.

Competitive Landscape

Leading Companies in the Smart Finance Hardware Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

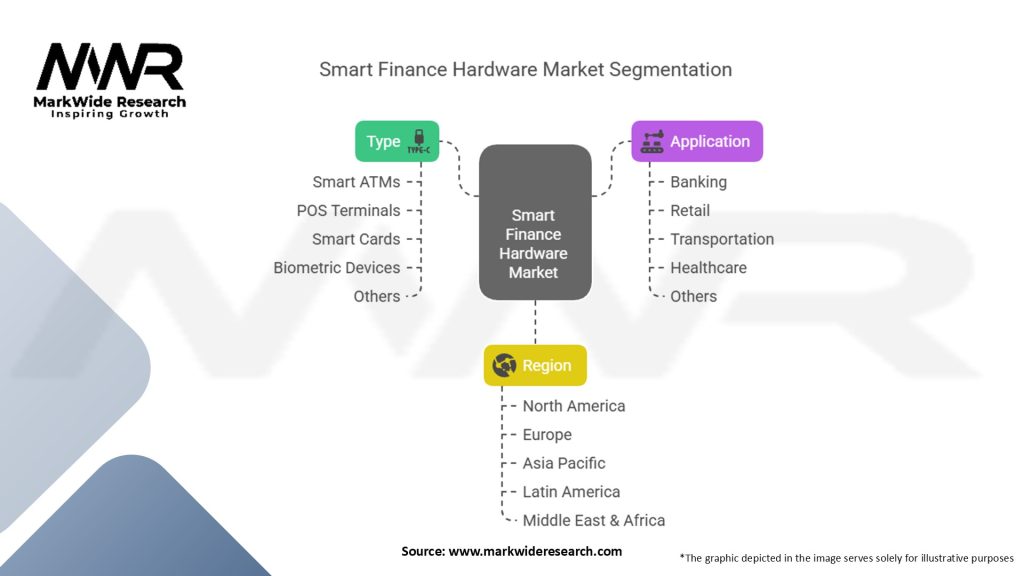

Segmentation

The Smart Finance Hardware Market can be segmented based on various factors:

By Hardware Type: ATMs, POS Terminals, Biometric Authentication Devices, Digital Kiosks, Smart Cash Management Systems.

By End-User: Banks, Retailers, Fintech Companies, Government and Public Sector.

By Application: Digital Payments, Customer Verification, Transaction Management, Cash Management, Self-Service Banking.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Smart Finance Hardware Market offers several benefits:

Improved Efficiency: Automated financial hardware solutions improve transaction speed, reduce human error, and enhance customer service.

Enhanced Security: Advanced security features such as biometric authentication and encryption ensure secure financial transactions and protect customer data.

Cost-Effectiveness: Self-service machines and automated systems reduce labor costs and improve operational efficiency for financial institutions.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends in the Smart Finance Hardware Market include:

Integration of AI and Blockchain: AI and blockchain are increasingly being integrated into financial hardware to improve transaction verification, security, and transparency.

Expansion of Digital Payment Solutions: The adoption of digital payment systems and mobile banking is pushing the demand for advanced smart finance hardware solutions.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Smart Finance Hardware market. The outbreak and subsequent lockdowns led to a surge in online transactions, prompting increased demand for secure payment solutions. The need for contactless payments and touchless transactions also rose during the pandemic, driving the adoption of smart finance hardware devices. The industry witnessed accelerated digital transformation, as financial institutions and businesses sought to adapt to the new normal.

Key Industry Developments

The Smart Finance Hardware market has witnessed several noteworthy developments:

Analyst Suggestions

Based on market analysis and trends, analysts offer the following suggestions:

Future Outlook

The future of the Smart Finance Hardware market looks promising, with substantial growth opportunities on the horizon. The increasing adoption of digital payment solutions, the integration of advanced technologies, and the demand for secure and convenient financial transactions are expected to drive market growth. Moreover, the expansion of the market into emerging economies and the continuous innovation in smart finance hardware devices will further fuel the industry’s development.

Conclusion

The Smart Finance Hardware market is experiencing significant growth as digitalization and the need for secure financial transactions continue to rise. Smart cards, POS terminals, payment terminals, biometric devices, and ATM machines are revolutionizing the finance industry by providing enhanced security, convenience, and efficiency. Although the market faces challenges related to cost and data security, it also presents numerous opportunities for industry players. By embracing innovation, addressing affordability concerns, and prioritizing data security, stakeholders in the Smart Finance Hardware market can position themselves for success in the future.

What is Smart Finance Hardware?

Smart Finance Hardware refers to devices and technologies designed to enhance financial transactions and management, including point-of-sale systems, smart payment terminals, and financial data analytics tools.

Who are the key players in the Smart Finance Hardware Market?

Key players in the Smart Finance Hardware Market include Square, Inc., PayPal Holdings, Inc., and Verifone Systems, among others.

What are the main drivers of growth in the Smart Finance Hardware Market?

The growth of the Smart Finance Hardware Market is driven by the increasing adoption of digital payment solutions, the rise of e-commerce, and the demand for enhanced security features in financial transactions.

What challenges does the Smart Finance Hardware Market face?

Challenges in the Smart Finance Hardware Market include the rapid pace of technological change, cybersecurity threats, and the need for compliance with evolving financial regulations.

What opportunities exist in the Smart Finance Hardware Market?

Opportunities in the Smart Finance Hardware Market include the expansion of contactless payment technologies, the integration of artificial intelligence for fraud detection, and the growth of mobile payment solutions.

What trends are shaping the Smart Finance Hardware Market?

Trends in the Smart Finance Hardware Market include the increasing use of biometric authentication, the rise of blockchain technology for secure transactions, and the growing emphasis on user-friendly interfaces.

Smart Finance Hardware Market:

| Segmentation | Details |

|---|---|

| Type | Smart ATMs, POS Terminals, Smart Cards, Biometric Devices, Others |

| Application | Banking, Retail, Transportation, Healthcare, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Smart Finance Hardware Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at