444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Slovakia home appliances market represents a dynamic and evolving sector within Central Europe’s consumer goods landscape. This market encompasses a comprehensive range of household appliances including refrigerators, washing machines, dishwashers, ovens, air conditioners, and small kitchen appliances that serve the daily needs of Slovak households. Market dynamics in Slovakia reflect the country’s economic development, urbanization trends, and changing consumer preferences toward energy-efficient and smart home technologies.

Consumer behavior in Slovakia has shifted significantly toward premium and technologically advanced appliances, driven by rising disposable income and increased awareness of energy conservation. The market demonstrates robust growth potential with 8.2% annual growth rate in smart appliance adoption and 65% penetration rate for energy-efficient models across major appliance categories. Urbanization trends and housing development projects continue to fuel demand for modern home appliances throughout the country.

Regional distribution shows concentrated demand in major cities like Bratislava, Košice, and Prešov, while rural areas increasingly adopt modern appliances as infrastructure development expands. The market benefits from Slovakia’s strategic location within the European Union, facilitating trade relationships and technology transfer from leading appliance manufacturers across Europe and beyond.

The Slovakia home appliances market refers to the comprehensive ecosystem of household electrical and electronic devices designed to perform domestic tasks, enhance living comfort, and improve household efficiency within Slovak territory. This market encompasses both major appliances such as refrigerators, washing machines, and cooking equipment, as well as small appliances including coffee makers, vacuum cleaners, and personal care devices that serve Slovak consumers’ daily needs.

Market scope includes traditional appliances, smart connected devices, energy-efficient models, and emerging technologies that integrate with modern home automation systems. The definition extends beyond mere product sales to encompass installation services, maintenance support, warranty programs, and the growing ecosystem of connected home solutions that characterize contemporary Slovak households.

Industry classification covers white goods (major appliances), brown goods (entertainment electronics), and small domestic appliances, each serving distinct consumer segments and demonstrating unique market characteristics within Slovakia’s evolving retail landscape.

Market performance in Slovakia’s home appliances sector demonstrates consistent growth driven by economic stability, EU membership benefits, and evolving consumer preferences toward modern living solutions. The market exhibits strong fundamentals with 12.5% growth rate in premium appliance segments and increasing adoption of smart home technologies across urban and suburban areas.

Key market drivers include rising household income levels, government energy efficiency incentives, housing market development, and generational shifts toward technology-integrated living spaces. Slovak consumers increasingly prioritize appliances that offer energy savings, connectivity features, and enhanced functionality that aligns with contemporary lifestyle demands.

Competitive landscape features established European brands alongside emerging smart appliance manufacturers, creating a diverse marketplace that serves various consumer segments from budget-conscious buyers to premium technology enthusiasts. Distribution channels have evolved to include traditional retail, e-commerce platforms, and specialized appliance stores that provide comprehensive customer support services.

Future prospects indicate continued market expansion supported by ongoing urbanization, replacement cycles for aging appliances, and increasing consumer awareness of energy-efficient technologies that reduce long-term operating costs while supporting environmental sustainability goals.

Consumer preferences in Slovakia demonstrate clear trends toward appliances that combine functionality, energy efficiency, and smart connectivity features. The following insights characterize current market dynamics:

Market segmentation reveals distinct consumer groups with varying needs, from young professionals seeking compact, efficient solutions to families requiring large-capacity appliances with advanced features that support busy household routines.

Economic prosperity serves as the primary driver for Slovakia’s home appliances market expansion. Rising GDP per capita and increased household disposable income enable consumers to invest in higher-quality appliances that offer enhanced functionality and energy efficiency benefits. Employment growth and wage increases across various sectors support consumer confidence and willingness to make significant appliance purchases.

Housing market development creates substantial demand for home appliances as new construction projects and renovation activities require complete appliance installations. Government housing support programs and favorable mortgage conditions encourage homeownership, directly translating to appliance market growth opportunities.

Energy efficiency regulations and government incentive programs promote adoption of environmentally friendly appliances. EU energy labeling requirements and national energy conservation initiatives drive consumers toward high-efficiency models that reduce long-term operating costs while supporting sustainability objectives.

Technological advancement in smart home solutions attracts consumers seeking convenience, connectivity, and automation features. Internet of Things integration, mobile app controls, and artificial intelligence capabilities transform traditional appliances into intelligent home management systems that appeal to modern Slovak households.

Demographic shifts including urbanization, smaller household sizes, and changing lifestyle preferences create demand for compact, multifunctional appliances that maximize space efficiency while delivering comprehensive functionality for contemporary living arrangements.

High initial costs associated with premium and smart appliances create barriers for price-sensitive consumer segments. While long-term operational savings justify investments, upfront expenses can deter purchases, particularly among lower-income households or those prioritizing immediate affordability over advanced features.

Economic uncertainty periods can significantly impact consumer spending on non-essential appliance upgrades. Inflation concerns, employment instability, or broader economic challenges may cause consumers to delay appliance replacements or opt for basic models rather than premium alternatives.

Technical complexity of modern smart appliances may discourage adoption among older consumers or those uncomfortable with technology integration. Installation requirements, connectivity setup, and ongoing maintenance needs can create perceived barriers that limit market penetration in certain demographic segments.

Limited service infrastructure in rural areas poses challenges for appliance adoption and maintenance. Inadequate repair services, parts availability, and technical support in remote regions can influence consumer decisions toward simpler, more serviceable appliance options.

Market saturation in certain appliance categories, particularly among urban households with existing modern appliances, may slow growth rates as replacement cycles extend and consumers delay upgrades until existing appliances require replacement due to failure rather than feature enhancement desires.

Smart home integration presents significant opportunities as Slovak consumers increasingly embrace connected living solutions. The convergence of home appliances with IoT platforms, voice assistants, and mobile applications creates new market segments for innovative manufacturers willing to invest in advanced technology development and user-friendly interfaces.

Energy efficiency focus opens opportunities for manufacturers specializing in ultra-efficient appliances that exceed current standards. Government incentive programs and consumer cost-consciousness create favorable conditions for products that demonstrate measurable energy savings and environmental benefits.

Rural market expansion offers untapped potential as infrastructure development and rising rural incomes increase appliance accessibility. Targeted distribution strategies, financing options, and service network expansion can unlock significant growth opportunities in previously underserved areas.

Replacement market dynamics create opportunities as aging appliances installed during Slovakia’s economic transition period reach end-of-life stages. This replacement cycle coincides with consumer desires for modern features, creating natural upgrade opportunities for manufacturers offering compelling value propositions.

Sustainability trends enable opportunities for eco-friendly appliance manufacturers and circular economy business models. Recycling programs, refurbishment services, and sustainable manufacturing practices appeal to environmentally conscious consumers while supporting regulatory compliance requirements.

Supply chain evolution significantly influences Slovakia’s home appliances market dynamics. European Union membership facilitates seamless trade relationships, enabling efficient distribution networks and competitive pricing structures. Manufacturing proximity within Central Europe reduces logistics costs and delivery times, benefiting both retailers and consumers through improved availability and service responsiveness.

Consumer behavior patterns demonstrate increasing sophistication in appliance selection criteria. Slovak consumers research extensively before purchases, comparing energy ratings, feature sets, and long-term value propositions. Digital influence grows as online reviews, comparison platforms, and social media recommendations shape purchasing decisions significantly.

Retail channel transformation reflects broader market dynamics as traditional appliance stores compete with e-commerce platforms and big-box retailers. Omnichannel strategies become essential for success, combining physical showrooms for product demonstration with online convenience and competitive pricing structures.

Technology integration pace accelerates as manufacturers introduce increasingly sophisticated features while maintaining user-friendly interfaces. Innovation cycles shorten as consumer expectations for advanced functionality grow, requiring continuous product development and market adaptation strategies.

Regulatory environment continues evolving with enhanced energy efficiency standards, safety requirements, and environmental regulations that influence product development priorities and market positioning strategies across all appliance categories.

Primary research approach encompasses comprehensive data collection through structured surveys, consumer interviews, and retailer consultations across Slovakia’s major urban centers and representative rural areas. Quantitative analysis includes statistical sampling methods ensuring demographic representation and geographic coverage that accurately reflects market conditions throughout the country.

Secondary research integration incorporates government statistical data, industry association reports, and regulatory documentation to provide contextual framework for market analysis. Data validation processes ensure accuracy through cross-referencing multiple sources and expert verification of key findings and trend interpretations.

Market segmentation analysis employs advanced analytical techniques to identify consumer clusters, purchasing behavior patterns, and preference correlations that inform strategic recommendations. Competitive intelligence gathering includes retail price monitoring, product feature analysis, and market share estimation through multiple data collection methodologies.

Trend analysis methodology combines historical data review with forward-looking projections based on economic indicators, demographic shifts, and technology adoption patterns. Expert consultation with industry professionals, retailers, and consumer behavior specialists provides qualitative insights that complement quantitative findings.

Quality assurance protocols ensure research reliability through systematic data verification, methodology transparency, and continuous refinement of analytical approaches based on market feedback and validation results.

Bratislava region dominates Slovakia’s home appliances market with 35% market share, reflecting the capital’s economic prosperity, high population density, and concentration of affluent households. Premium appliance adoption reaches highest levels in this region, with consumers demonstrating strong preferences for smart, energy-efficient, and design-focused products that complement modern urban living spaces.

Eastern Slovakia including Košice and surrounding areas represents 25% market share with growing demand driven by industrial development and urban expansion. Consumer preferences balance functionality with value, showing increasing interest in mid-range appliances that offer modern features without premium pricing structures.

Central Slovakia accounts for 22% market share with diverse consumer segments ranging from urban professionals to rural households upgrading from basic appliances. Market characteristics include strong demand for reliable, serviceable appliances with emphasis on durability and local service availability.

Western Slovakia beyond Bratislava contributes 18% market share with steady growth supported by proximity to Austrian and Czech markets. Cross-border influence affects consumer preferences and purchasing patterns, with increased exposure to international appliance brands and technologies.

Rural areas across all regions show accelerating adoption rates as infrastructure improvements and rising incomes enable appliance upgrades. Distribution challenges require targeted strategies including mobile showrooms, local dealer networks, and enhanced service support to capture this emerging market segment effectively.

Market leadership in Slovakia’s home appliances sector features established European manufacturers alongside emerging smart appliance specialists. The competitive environment demonstrates healthy diversity with companies competing on innovation, value, and service excellence.

Competitive strategies emphasize differentiation through technology innovation, energy efficiency leadership, and comprehensive customer service programs. Market positioning varies from premium luxury brands to value-focused alternatives, ensuring coverage across diverse consumer segments and price points.

Distribution partnerships play crucial roles in competitive success, with manufacturers developing strong relationships with major retailers, e-commerce platforms, and specialized appliance dealers throughout Slovakia’s retail landscape.

By Product Category:

By Technology Level:

By Price Range:

By Distribution Channel:

Refrigeration appliances maintain the largest market share with 28% category dominance, driven by essential household needs and regular replacement cycles. Energy efficiency becomes the primary selection criterion as consumers prioritize long-term operational cost savings. Smart refrigerators with connectivity features gain traction among tech-savvy households seeking advanced food management capabilities.

Washing machines represent 22% market share with strong demand for front-loading, energy-efficient models that offer superior cleaning performance while minimizing water and energy consumption. Capacity preferences vary by household size, with compact models popular in urban apartments and larger capacity units preferred by families.

Cooking appliances including ovens, cooktops, and ranges account for 18% market share with increasing interest in induction technology and smart cooking features. Design integration becomes important as open-plan living spaces require appliances that complement interior aesthetics while delivering professional-grade cooking performance.

Dishwashers show rapid adoption growth with 15% market share as Slovak households embrace convenience and water efficiency benefits. Installation rates increase particularly in new construction and kitchen renovation projects where built-in integration enhances functionality and space utilization.

Small appliances collectively represent 17% market share with diverse subcategories including coffee machines, vacuum cleaners, and personal care devices. Innovation pace accelerates in this segment as manufacturers introduce specialized features and connectivity options that appeal to specific consumer needs and lifestyle preferences.

Manufacturers benefit from Slovakia’s strategic location within the European Union, enabling efficient distribution networks and access to broader Central European markets. Regulatory harmonization simplifies compliance requirements while skilled workforce availability supports local manufacturing and service operations that enhance competitiveness.

Retailers capitalize on growing consumer sophistication and willingness to invest in quality appliances that offer long-term value. Market expansion opportunities exist across urban and rural segments as infrastructure development and rising incomes create new customer bases requiring comprehensive appliance solutions.

Consumers gain access to advanced appliance technologies that improve household efficiency, reduce energy consumption, and enhance living comfort. Competitive marketplace ensures diverse product options, competitive pricing, and comprehensive service support that maximize purchase value and ownership satisfaction.

Service providers benefit from increasing demand for installation, maintenance, and repair services as appliance complexity grows and consumers prioritize professional support. Business opportunities expand through specialized services including smart home integration, energy auditing, and extended warranty programs.

Government stakeholders achieve energy conservation and environmental objectives through appliance efficiency improvements while supporting economic development through manufacturing, retail, and service sector growth that creates employment and tax revenue opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration emerges as the dominant trend transforming Slovakia’s home appliances market. Consumers increasingly demand appliances that connect to home networks, offer mobile app control, and integrate with voice assistants for enhanced convenience and automation capabilities.

Energy efficiency prioritization drives purchasing decisions as Slovak consumers become more environmentally conscious and cost-aware. High-efficiency models with superior energy ratings gain market preference despite higher initial costs, as long-term operational savings justify investments.

Compact and multifunctional designs respond to urbanization trends and smaller living spaces common in Slovak cities. Space optimization becomes crucial as consumers seek appliances that maximize functionality while minimizing footprint requirements in modern apartments and homes.

Sustainable manufacturing and circular economy principles influence consumer preferences toward brands demonstrating environmental responsibility. Recycling programs, sustainable materials, and extended product lifecycles become important differentiating factors in competitive positioning strategies.

Personalization capabilities through artificial intelligence and machine learning enable appliances to adapt to individual household patterns and preferences. Customized experiences enhance user satisfaction while improving operational efficiency through intelligent automation and optimization features.

Health and wellness focus drives demand for appliances that support healthy living, including air purifiers, water filtration systems, and cooking appliances that preserve nutritional value while ensuring food safety and quality.

Technology partnerships between appliance manufacturers and software companies accelerate smart home integration capabilities. Collaboration initiatives focus on developing seamless connectivity solutions that enhance user experience while maintaining security and reliability standards.

Retail channel evolution includes expansion of e-commerce platforms and omnichannel strategies that combine online convenience with physical showroom experiences. Digital transformation enables virtual product demonstrations, augmented reality features, and enhanced customer service capabilities.

Service network expansion addresses growing demand for professional installation, maintenance, and repair services across Slovakia’s geographic regions. Training programs develop skilled technicians capable of servicing increasingly complex smart appliances and connected home systems.

Sustainability initiatives include manufacturer commitments to carbon-neutral production, recyclable packaging, and extended product lifecycle programs. Environmental compliance exceeds regulatory requirements as companies pursue competitive advantages through demonstrated environmental leadership.

Market consolidation trends include strategic acquisitions and partnerships that strengthen distribution networks, expand product portfolios, and enhance technological capabilities. Industry restructuring creates opportunities for specialized companies while challenging traditional business models.

Government policy support includes energy efficiency incentive programs, appliance recycling initiatives, and smart home infrastructure development that facilitate market growth and technology adoption across consumer segments.

Market entry strategies should prioritize understanding Slovak consumer preferences for reliability, energy efficiency, and value-oriented pricing. MarkWide Research analysis indicates successful market penetration requires comprehensive service network development and local partnership establishment to ensure customer satisfaction and brand loyalty.

Product development focus should emphasize energy efficiency improvements, smart connectivity features, and compact designs that address Slovak market requirements. Innovation priorities include user-friendly interfaces, reliable performance, and integration capabilities that enhance rather than complicate household management routines.

Distribution channel optimization requires balanced approaches combining traditional retail presence with e-commerce capabilities and specialized appliance stores. Channel partnerships should provide comprehensive customer support including consultation, installation, and ongoing service to maximize customer satisfaction and repeat business opportunities.

Pricing strategies must balance competitive positioning with value perception, recognizing Slovak consumers’ price sensitivity while demonstrating long-term ownership benefits. Value communication should emphasize total cost of ownership including energy savings, durability, and service support rather than focusing solely on initial purchase prices.

Service excellence becomes crucial for competitive differentiation as appliance complexity increases and consumer expectations rise. Investment priorities should include technician training, parts inventory management, and customer service capabilities that support positive ownership experiences throughout product lifecycles.

Market growth trajectory indicates continued expansion driven by economic development, urbanization trends, and evolving consumer preferences toward modern appliance solutions. Growth projections suggest sustained demand across all appliance categories with particular strength in smart and energy-efficient segments that align with contemporary lifestyle requirements.

Technology integration will accelerate as Internet of Things capabilities become standard features rather than premium options. Smart home ecosystems will drive appliance selection criteria as consumers seek seamless integration and comprehensive automation capabilities that enhance convenience and efficiency.

Sustainability focus will intensify as environmental consciousness grows and regulatory requirements become more stringent. Circular economy principles including product lifecycle extension, repair services, and recycling programs will become essential business model components for long-term success.

Market maturation will shift competitive focus toward service excellence, brand differentiation, and customer relationship management as product features become increasingly standardized. Value-added services including installation, maintenance, and smart home integration will become crucial revenue streams and competitive advantages.

Regional expansion opportunities will emerge as rural infrastructure development and rising incomes create new market segments requiring targeted distribution and service strategies. MWR projections indicate 15% annual growth potential in previously underserved areas as accessibility barriers diminish and consumer awareness increases.

The Slovakia home appliances market presents compelling opportunities for manufacturers, retailers, and service providers willing to understand and adapt to local consumer preferences and market dynamics. Market fundamentals remain strong with consistent economic growth, rising household incomes, and evolving lifestyle preferences that support sustained demand for modern appliance solutions.

Success factors include comprehensive understanding of Slovak consumer values emphasizing reliability, energy efficiency, and long-term value rather than premium features alone. Strategic positioning requires balanced approaches that combine competitive pricing with quality assurance and comprehensive service support throughout the customer lifecycle.

Future opportunities center on smart home integration, sustainability leadership, and service excellence as differentiating factors in an increasingly competitive marketplace. Market participants who invest in understanding local requirements, developing appropriate distribution networks, and providing exceptional customer experiences will capture the greatest share of Slovakia’s expanding home appliances market potential.

What is Home Appliances?

Home appliances refer to electrical or mechanical devices used in households for various tasks, including cooking, cleaning, and food preservation. Common examples include refrigerators, washing machines, and microwaves.

What are the key players in the Slovakia Home Appliances Market?

Key players in the Slovakia Home Appliances Market include companies like Whirlpool, Electrolux, and BSH Hausgeräte, which offer a range of products from kitchen appliances to laundry solutions, among others.

What are the growth factors driving the Slovakia Home Appliances Market?

The growth of the Slovakia Home Appliances Market is driven by increasing consumer demand for energy-efficient appliances, rising disposable incomes, and a growing trend towards smart home technologies.

What challenges does the Slovakia Home Appliances Market face?

Challenges in the Slovakia Home Appliances Market include intense competition among manufacturers, fluctuating raw material prices, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Slovakia Home Appliances Market?

Opportunities in the Slovakia Home Appliances Market include the expansion of e-commerce platforms, increasing interest in sustainable and eco-friendly appliances, and the potential for smart home integration.

What trends are shaping the Slovakia Home Appliances Market?

Trends in the Slovakia Home Appliances Market include the rise of connected appliances, a focus on energy efficiency, and the growing popularity of multifunctional devices that save space and enhance convenience.

Slovakia Home Appliances Market

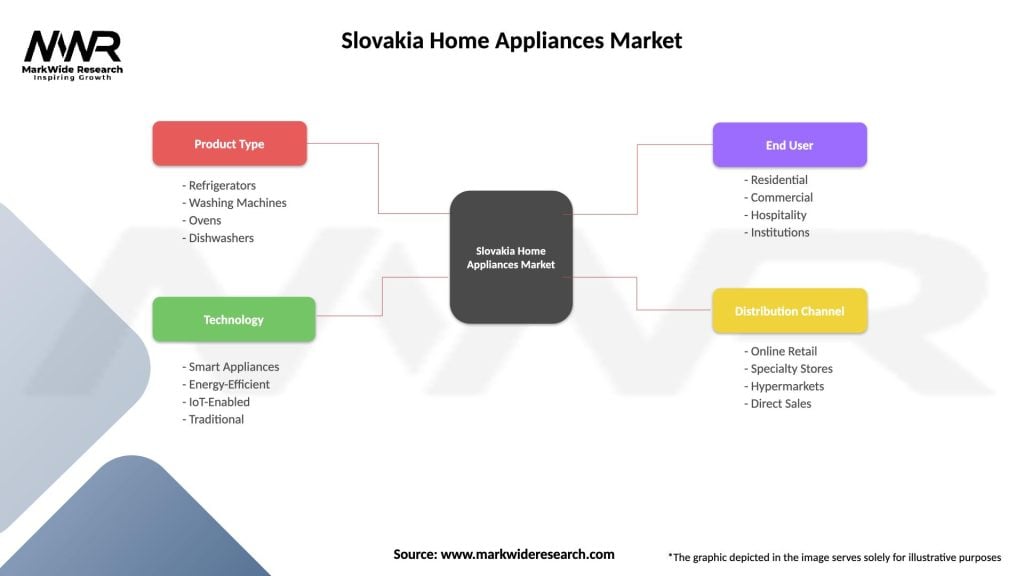

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerators, Washing Machines, Ovens, Dishwashers |

| Technology | Smart Appliances, Energy-Efficient, IoT-Enabled, Traditional |

| End User | Residential, Commercial, Hospitality, Institutions |

| Distribution Channel | Online Retail, Specialty Stores, Hypermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Slovakia Home Appliances Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at