444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Slovakia e-commerce market represents one of Central Europe’s most dynamic digital commerce landscapes, experiencing remarkable transformation driven by changing consumer behaviors and technological advancement. Digital retail adoption in Slovakia has accelerated significantly, with online shopping penetration reaching 78% of internet users actively engaging in e-commerce activities. The market demonstrates robust growth momentum, supported by improved logistics infrastructure, enhanced payment systems, and increasing smartphone penetration across urban and rural areas.

Consumer preferences have shifted dramatically toward online purchasing, particularly following global digitalization trends that reshaped retail landscapes. Slovak consumers increasingly favor convenient shopping experiences, driving demand for comprehensive e-commerce platforms offering diverse product categories. The market exhibits strong performance across multiple segments, including fashion, electronics, home goods, and groceries, with mobile commerce representing 65% of total online transactions.

Market dynamics indicate sustained expansion supported by favorable demographic trends, rising disposable incomes, and government initiatives promoting digital economy development. The integration of advanced technologies such as artificial intelligence, machine learning, and augmented reality continues enhancing user experiences and operational efficiency for e-commerce platforms operating within Slovakia’s competitive landscape.

The Slovakia e-commerce market refers to the comprehensive ecosystem of online retail activities, digital payment systems, logistics networks, and technology platforms facilitating electronic commerce transactions within Slovakia’s borders. This market encompasses business-to-consumer (B2C), business-to-business (B2B), and consumer-to-consumer (C2C) transactions conducted through digital channels, including websites, mobile applications, and social commerce platforms.

E-commerce infrastructure in Slovakia includes payment gateways, delivery networks, customer service systems, and regulatory frameworks supporting secure online transactions. The market integrates traditional retail concepts with digital innovation, enabling businesses to reach broader customer bases while providing consumers with convenient access to diverse products and services from domestic and international suppliers.

Digital transformation within Slovakia’s retail sector has created new business models, employment opportunities, and economic value chains. The market encompasses various stakeholders, including online retailers, technology providers, logistics companies, payment processors, and regulatory authorities working collaboratively to maintain secure, efficient, and user-friendly e-commerce environments.

Slovakia’s e-commerce sector demonstrates exceptional growth potential, driven by increasing internet penetration, smartphone adoption, and evolving consumer preferences toward digital shopping experiences. The market benefits from strategic geographic positioning within Central Europe, providing access to broader regional markets while maintaining strong domestic demand for online retail services.

Key performance indicators reveal significant market expansion, with online retail adoption growing at 12.3% annually across various demographic segments. The market shows particular strength in fashion, electronics, and home improvement categories, while emerging sectors such as online groceries and digital services gain substantial traction among Slovak consumers.

Competitive landscape features both domestic players and international e-commerce giants establishing strong market presence through localized strategies, partnerships with local logistics providers, and tailored payment solutions. The market’s maturation process involves continuous technological upgrades, improved customer service standards, and enhanced security measures protecting consumer data and financial transactions.

Future projections indicate sustained growth momentum supported by government digitalization initiatives, infrastructure investments, and increasing consumer confidence in online shopping platforms. The market’s evolution toward omnichannel retail experiences and integration of emerging technologies positions Slovakia as a significant player in Central European e-commerce development.

Market intelligence reveals several critical insights shaping Slovakia’s e-commerce landscape and future development trajectory:

Digital infrastructure development serves as a primary catalyst for Slovakia’s e-commerce market expansion. Improved internet connectivity, enhanced mobile networks, and widespread broadband access create favorable conditions for online retail growth. Government investments in digital infrastructure and smart city initiatives further accelerate market development by providing reliable technological foundations for e-commerce operations.

Consumer behavior evolution drives significant market demand as Slovak shoppers embrace digital convenience and variety offered by online platforms. Changing lifestyle patterns, increased time constraints, and preference for comparative shopping experiences motivate consumers to adopt e-commerce solutions. The growing comfort level with digital transactions and improved trust in online security measures contribute to sustained market expansion.

Technological advancement enables innovative e-commerce solutions, including artificial intelligence, machine learning, and augmented reality applications enhancing user experiences. These technologies improve product recommendations, streamline checkout processes, and provide immersive shopping experiences that attract and retain customers. Integration of advanced analytics helps businesses optimize operations and personalize customer interactions effectively.

Logistics network improvements facilitate efficient order fulfillment and delivery services, addressing traditional barriers to e-commerce adoption. Enhanced last-mile delivery options, expanded warehouse networks, and improved supply chain management systems reduce delivery times and costs while increasing customer satisfaction levels across Slovakia’s e-commerce market.

Cybersecurity concerns present ongoing challenges for Slovakia’s e-commerce market development, as consumers remain cautious about sharing personal and financial information online. Data breaches, identity theft, and online fraud incidents can undermine consumer confidence and slow market adoption rates. Businesses must invest significantly in security infrastructure and compliance measures to address these concerns effectively.

Digital divide issues limit market penetration in certain demographic segments and geographic regions within Slovakia. Older populations and rural communities may lack digital literacy skills or reliable internet access necessary for e-commerce participation. These gaps create uneven market development and limit the overall addressable market for online retailers.

Regulatory complexity poses challenges for e-commerce businesses navigating evolving legal frameworks, tax requirements, and consumer protection regulations. Compliance costs and administrative burdens can particularly impact smaller businesses seeking to establish online presence. Cross-border e-commerce faces additional regulatory hurdles related to customs, VAT, and product standards.

Logistics limitations in certain regions may restrict delivery options and increase operational costs for e-commerce businesses. Infrastructure constraints, traffic congestion, and geographic challenges can impact delivery times and service quality, potentially affecting customer satisfaction and market growth in specific areas of Slovakia.

Cross-border expansion presents significant opportunities for Slovak e-commerce businesses to access broader Central European markets. Strategic partnerships with international logistics providers and payment processors can facilitate market entry into neighboring countries, leveraging Slovakia’s geographic advantages and established trade relationships within the European Union framework.

Emerging technology integration offers opportunities for differentiation and competitive advantage through implementation of cutting-edge solutions. Virtual reality shopping experiences, voice commerce, blockchain-based security systems, and Internet of Things applications can create unique value propositions attracting tech-savvy consumers and improving operational efficiency.

Niche market development provides opportunities for specialized e-commerce platforms targeting specific consumer segments or product categories. Artisanal goods, local products, sustainable merchandise, and customized solutions represent underserved market segments with growth potential. These niches can support premium pricing strategies and build strong customer loyalty.

B2B e-commerce expansion represents a substantial opportunity as businesses increasingly digitize procurement processes and supply chain management. Professional services, industrial equipment, and business software sales through online channels can generate significant revenue streams while improving efficiency for business customers across various industries.

Competitive intensity continues escalating as both domestic and international players vie for market share in Slovakia’s growing e-commerce sector. Established retailers expand online presence while pure-play e-commerce companies strengthen their positions through improved service offerings, competitive pricing strategies, and enhanced customer experiences. This competition drives innovation and benefits consumers through better services and value propositions.

Technology evolution reshapes market dynamics by enabling new business models, improving operational efficiency, and creating enhanced customer experiences. Artificial intelligence, machine learning, and automation technologies help businesses optimize inventory management, personalize marketing efforts, and streamline fulfillment processes. These technological advances create competitive advantages for early adopters while raising performance standards across the industry.

Consumer expectations continuously evolve, demanding faster delivery times, seamless user experiences, and comprehensive customer service support. According to MarkWide Research analysis, customer satisfaction directly correlates with repeat purchase behavior and brand loyalty in Slovakia’s e-commerce market. Businesses must adapt quickly to changing expectations to maintain competitive positions.

Regulatory developments influence market dynamics through evolving data protection requirements, consumer rights legislation, and tax policies affecting e-commerce operations. Businesses must remain agile in adapting to regulatory changes while maintaining compliance and operational efficiency. These dynamics create both challenges and opportunities for market participants.

Primary research methodologies employed in analyzing Slovakia’s e-commerce market include comprehensive surveys of consumers, retailers, and industry stakeholders. Direct interviews with key market participants provide qualitative insights into market trends, challenges, and opportunities. Focus groups and consumer behavior studies offer detailed understanding of purchasing patterns, preferences, and decision-making processes affecting e-commerce adoption.

Secondary research incorporates analysis of government statistics, industry reports, financial statements, and academic studies related to Slovakia’s digital economy development. Market data from regulatory authorities, trade associations, and technology providers contributes to comprehensive market understanding. Historical trend analysis and comparative studies with similar markets provide context for current market conditions.

Data validation processes ensure accuracy and reliability of market insights through triangulation of multiple data sources and expert verification. Statistical analysis techniques identify significant trends and correlations within the dataset. Quality assurance measures include peer review processes and consistency checks across different data collection methods.

Analytical frameworks applied include Porter’s Five Forces analysis, SWOT assessment, and market segmentation studies providing structured evaluation of competitive dynamics and market opportunities. Quantitative modeling techniques project future market scenarios based on current trends and identified drivers. These methodologies ensure comprehensive and reliable market intelligence for stakeholders.

Bratislava region dominates Slovakia’s e-commerce market, accounting for 45% of total online retail activity due to higher income levels, advanced digital infrastructure, and concentrated urban population. The capital city serves as the primary hub for e-commerce operations, hosting major distribution centers and technology companies. Consumer adoption rates in Bratislava exceed national averages, with sophisticated shopping behaviors and preference for premium online services.

Western Slovakia demonstrates strong e-commerce growth driven by industrial development and proximity to Austrian and Czech markets. Cities like Trnava and Nitra show increasing online shopping adoption, supported by improving logistics networks and rising disposable incomes. Cross-border shopping activities are particularly prevalent in this region, with consumers accessing international e-commerce platforms frequently.

Central Slovakia exhibits moderate e-commerce penetration with significant growth potential as digital infrastructure improvements reach smaller cities and towns. Banská Bystrica and surrounding areas benefit from government digitalization initiatives and increasing internet connectivity. Rural e-commerce adoption accelerates as logistics providers expand delivery networks to previously underserved areas.

Eastern Slovakia represents an emerging market for e-commerce development, with Košice leading regional growth initiatives. Infrastructure investments and educational programs promoting digital literacy contribute to increasing online shopping adoption. The region shows particular strength in B2B e-commerce as manufacturing companies digitize procurement processes and supply chain management systems.

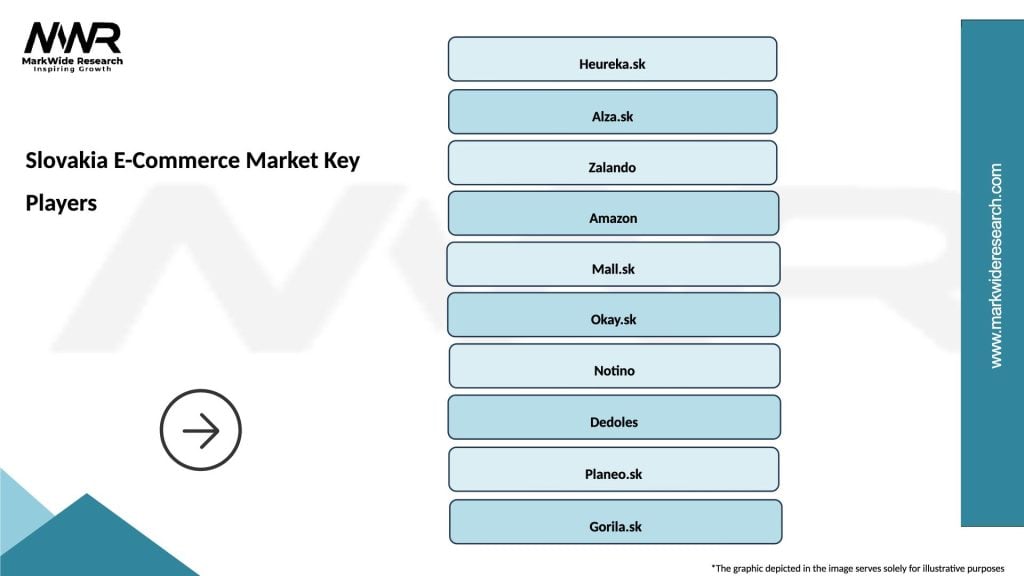

Market leadership in Slovakia’s e-commerce sector features a diverse mix of domestic and international players competing across various segments and customer demographics:

Competitive strategies focus on customer experience enhancement, logistics optimization, and technology innovation. Market leaders invest heavily in mobile applications, personalization engines, and customer service capabilities to differentiate their offerings. Price competition remains intense, particularly in commodity categories, while premium segments emphasize service quality and brand reputation.

By Product Category:

By Business Model:

By Device Type:

Fashion and Apparel dominates Slovakia’s e-commerce landscape with sophisticated consumer preferences driving demand for international brands and local designers. Online fashion retailers benefit from social media marketing, influencer partnerships, and virtual try-on technologies. Seasonal trends and fast fashion cycles create dynamic inventory management challenges while generating consistent revenue streams throughout the year.

Electronics and Technology represents a high-value segment characterized by informed consumers conducting extensive research before purchases. Product reviews, technical specifications, and price comparisons significantly influence buying decisions. Retailers in this category invest heavily in expert content, customer support, and warranty services to build trust and differentiate their offerings from competitors.

Home and Garden experiences strong growth driven by increased home ownership and renovation activities. Large-item logistics present unique challenges requiring specialized delivery services and installation support. Seasonal patterns affect demand significantly, with spring and summer months generating peak sales volumes for gardening and outdoor living products.

Health and Beauty benefits from growing wellness consciousness and premium product positioning. Personalized recommendations, subscription services, and expert advice content drive customer engagement and loyalty. Regulatory compliance for cosmetics and health products requires careful attention to product descriptions and marketing claims.

Retailers and Merchants benefit from expanded market reach, reduced operational costs, and enhanced customer insights through e-commerce platforms. Digital channels enable 24/7 sales operations, automated inventory management, and data-driven marketing strategies. Small businesses gain access to sophisticated tools and services previously available only to large enterprises, leveling competitive playing fields.

Consumers enjoy convenient shopping experiences, competitive pricing, and extensive product selection through Slovakia’s e-commerce market. Time savings, home delivery options, and easy price comparisons enhance shopping efficiency. Access to international products and niche items previously unavailable locally expands consumer choice significantly.

Technology Providers find growing demand for e-commerce solutions, payment systems, and logistics technologies. Software developers, cybersecurity firms, and digital marketing agencies benefit from increasing business digitalization. Innovation opportunities in artificial intelligence, augmented reality, and mobile applications create new revenue streams.

Logistics Companies experience increased demand for delivery services, warehousing solutions, and supply chain management. Last-mile delivery innovations and same-day service options create competitive advantages. Integration with e-commerce platforms through APIs and tracking systems improves operational efficiency and customer satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Mobile-First Approach dominates Slovakia’s e-commerce evolution as businesses prioritize smartphone optimization and mobile application development. Progressive web applications and mobile payment integration enhance user experiences while reducing friction in purchase processes. Mobile commerce growth outpaces desktop shopping, requiring responsive design and touch-optimized interfaces.

Sustainability Focus influences consumer choices and business strategies across Slovakia’s e-commerce market. Eco-friendly packaging, carbon-neutral delivery options, and sustainable product lines attract environmentally conscious consumers. Circular economy principles drive growth in second-hand marketplaces and product refurbishment services.

Personalization Technology enables customized shopping experiences through artificial intelligence and machine learning algorithms. Product recommendations, dynamic pricing, and targeted marketing campaigns improve conversion rates and customer satisfaction. Behavioral analytics and predictive modeling help businesses anticipate consumer needs and optimize inventory management.

Social Commerce Integration blends social media engagement with e-commerce functionality, creating seamless shopping experiences within social platforms. Influencer partnerships, user-generated content, and social proof mechanisms drive product discovery and purchase decisions. Live streaming and interactive content formats engage consumers and build brand communities.

Infrastructure Investments continue expanding across Slovakia’s e-commerce ecosystem, with major logistics providers establishing new distribution centers and fulfillment facilities. MWR data indicates significant capital allocation toward automation technologies and warehouse expansion projects supporting market growth. These investments reduce delivery times and improve service quality for consumers nationwide.

Payment Innovation accelerates through partnerships between financial institutions and e-commerce platforms, introducing new payment methods and security features. Buy-now-pay-later services gain popularity among younger consumers, while cryptocurrency payment options emerge for tech-savvy segments. Digital wallet adoption increases as consumers seek convenient and secure transaction methods.

Cross-Border Facilitation improves through simplified customs procedures and enhanced logistics partnerships with neighboring countries. EU digital single market initiatives reduce barriers for international e-commerce transactions. Multilingual customer support and localized marketing strategies help businesses expand beyond domestic markets effectively.

Regulatory Modernization addresses e-commerce challenges through updated consumer protection laws, data privacy regulations, and digital taxation frameworks. Government initiatives promote digital literacy and cybersecurity awareness among consumers and businesses. These developments create more secure and trustworthy e-commerce environments supporting market growth.

Market Entry Strategies should focus on localization and partnership development for businesses seeking to establish presence in Slovakia’s e-commerce market. Understanding local consumer preferences, payment methods, and cultural nuances proves essential for success. Strategic alliances with established logistics providers and payment processors can accelerate market penetration while reducing operational risks.

Technology Investment priorities should emphasize mobile optimization, security infrastructure, and customer experience enhancement. Businesses must allocate resources toward responsive design, fast loading times, and intuitive user interfaces. Cybersecurity measures and compliance systems require ongoing investment to maintain consumer trust and regulatory compliance.

Customer Acquisition strategies should leverage digital marketing channels, social media engagement, and influencer partnerships to build brand awareness and drive traffic. Search engine optimization, content marketing, and targeted advertising campaigns generate qualified leads. Customer retention programs and loyalty initiatives help maximize lifetime value and reduce acquisition costs.

Operational Excellence demands focus on supply chain optimization, inventory management, and customer service quality. Businesses should implement advanced analytics and automation technologies to improve efficiency and reduce costs. Continuous monitoring of key performance indicators enables data-driven decision making and rapid response to market changes.

Market Evolution indicates continued expansion of Slovakia’s e-commerce sector, driven by technological advancement and changing consumer behaviors. MarkWide Research projects sustained growth momentum supported by infrastructure investments and government digitalization initiatives. The market’s maturation process will likely involve consolidation among smaller players while creating opportunities for specialized niche providers.

Technology Integration will reshape shopping experiences through artificial intelligence, augmented reality, and Internet of Things applications. Voice commerce and conversational AI will gain prominence as smart speaker adoption increases. Blockchain technology may enhance supply chain transparency and payment security, building greater consumer confidence in online transactions.

Cross-Border Expansion opportunities will multiply as EU digital single market initiatives reduce barriers and simplify international e-commerce operations. Slovak businesses may leverage their strategic location to serve broader Central European markets. International players will continue entering the Slovak market, intensifying competition while bringing innovation and investment.

Sustainability Initiatives will become increasingly important as environmental consciousness influences consumer choices and regulatory requirements. Green logistics, circular economy principles, and carbon footprint reduction will differentiate successful e-commerce businesses. These trends create opportunities for innovative companies addressing environmental challenges while meeting consumer demands.

Slovakia’s e-commerce market presents compelling opportunities for growth and innovation within Central Europe’s dynamic digital economy landscape. The market’s strong fundamentals, including advanced digital infrastructure, educated consumers, and strategic geographic positioning, support sustained expansion across multiple sectors and business models. Technological advancement continues driving market evolution, creating new possibilities for enhanced customer experiences and operational efficiency.

Market participants must navigate competitive dynamics while addressing challenges related to cybersecurity, regulatory compliance, and changing consumer expectations. Success requires strategic focus on mobile optimization, personalization, and omnichannel integration. The market’s future development depends on continued investment in technology, logistics infrastructure, and customer service capabilities that differentiate leading players from competitors.

Long-term prospects remain positive as demographic trends, government support, and EU integration facilitate market expansion. The convergence of e-commerce with emerging technologies, sustainability initiatives, and cross-border opportunities creates multiple pathways for growth and innovation. Slovakia’s e-commerce market is positioned to play an increasingly important role in Central Europe’s digital transformation and economic development.

What is E-Commerce?

E-Commerce refers to the buying and selling of goods and services over the internet. It encompasses various business models, including B2C, B2B, and C2C, and involves online transactions, digital marketing, and customer engagement.

What are the key players in the Slovakia E-Commerce Market?

The Slovakia E-Commerce Market features several prominent companies, including Heureka, Alza, and Mall.sk, which provide a range of products and services online. These companies compete in various segments such as electronics, fashion, and home goods, among others.

What are the growth factors driving the Slovakia E-Commerce Market?

The Slovakia E-Commerce Market is driven by increasing internet penetration, the rise of mobile shopping, and changing consumer behaviors favoring online purchases. Additionally, the convenience of home delivery and a growing number of payment options contribute to market growth.

What challenges does the Slovakia E-Commerce Market face?

The Slovakia E-Commerce Market faces challenges such as logistical issues, competition from international players, and concerns over data security. Additionally, regulatory compliance and consumer trust are critical factors that can impact market dynamics.

What opportunities exist in the Slovakia E-Commerce Market?

The Slovakia E-Commerce Market presents opportunities for growth in niche segments such as organic products and local artisan goods. Furthermore, advancements in technology, such as AI and personalized shopping experiences, can enhance customer engagement and drive sales.

What trends are shaping the Slovakia E-Commerce Market?

Current trends in the Slovakia E-Commerce Market include the increasing use of social media for shopping, the rise of subscription services, and a focus on sustainability in product offerings. Additionally, the integration of augmented reality in online shopping experiences is gaining traction.

Slovakia E-Commerce Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electronics, Fashion, Home Goods, Beauty |

| Customer Type | Individuals, Businesses, Institutions, Nonprofits |

| Distribution Channel | Online Marketplaces, Brand Websites, Social Media, Mobile Apps |

| Price Tier | Budget, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Slovakia E-Commerce Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at