444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview The Singapore remittance market serves as a crucial link in facilitating the transfer of funds between residents and non-residents, both domestically and internationally. Remittance services play a vital role in supporting the financial needs of migrant workers, expatriates, and individuals sending money to family members or businesses overseas. With Singapore’s status as a global financial hub and its diverse population of foreign workers and expatriates, the remittance market in the country is dynamic and highly competitive.

Meaning Remittance refers to the transfer of money from one individual or entity to another, typically across borders or to a different geographical location. In Singapore, remittance services are provided by banks, money transfer operators (MTOs), and digital payment platforms, allowing individuals to send money to family members, friends, or businesses in their home countries or other countries around the world. These services are essential for supporting the financial needs of migrant workers, expatriates, and individuals with international connections.

Executive Summary The Singapore remittance market is experiencing steady growth, driven by factors such as increasing migration, globalization, and the expansion of digital financial services. With a diverse population of foreign workers, expatriates, and international students, Singapore serves as a key remittance hub in the Asia-Pacific region. Key players in the market are leveraging technology, strategic partnerships, and innovative service offerings to meet the evolving needs of customers and maintain a competitive edge in the industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics The Singapore remittance market operates in a dynamic and competitive environment shaped by factors such as economic trends, regulatory developments, technological innovations, and customer preferences. Understanding market dynamics, identifying emerging trends, and responding to changing consumer needs are crucial for remittance service providers to remain competitive and sustain growth in the long term.

Regional Analysis As a leading financial hub in the Asia-Pacific region, Singapore serves as a key remittance market with strong domestic and international connections. The country’s strategic location, advanced infrastructure, and robust regulatory framework contribute to its attractiveness as a remittance destination. Singapore’s remittance market benefits from its proximity to neighboring countries, strong trade relationships, and diverse population, making it a significant player in the global remittance industry.

Competitive Landscape

Leading Companies in Singapore Remittance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

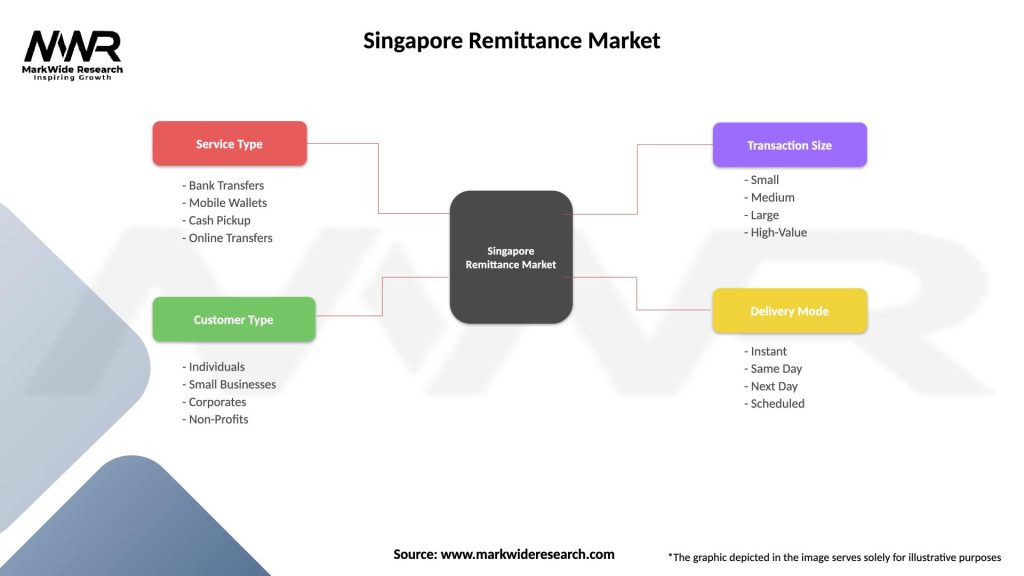

Segmentation The Singapore remittance market can be segmented based on various factors including:

Segmentation provides insights into customer preferences, transaction patterns, and market dynamics, enabling remittance service providers to tailor their products and services to meet the needs of specific customer segments and enhance market competitiveness.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis Strengths:

Market Key Trends

Covid-19 Impact The COVID-19 pandemic has had a significant impact on the Singapore remittance market, leading to disruptions in economic activities, travel restrictions, and changes in consumer behavior. While the initial lockdown measures and border closures affected remittance volumes and transaction flows, the subsequent shift towards digital channels and online remittance solutions helped mitigate the impact. Remittance providers adapted their business models, enhanced digital capabilities, and introduced flexible options to meet customer needs, such as contactless transactions, online verification, and remote account opening. Despite challenges such as economic uncertainty, exchange rate fluctuations, and regulatory changes, the Singapore remittance market has demonstrated resilience and adaptability in navigating the crisis and supporting the financial needs of customers.

Key Industry Developments

Analyst Suggestions

Future Outlook The Singapore remittance market is expected to witness continued growth and evolution in the coming years, driven by factors such as increasing migration, digitalization, regulatory reforms, and changing consumer preferences. While challenges such as regulatory compliance, competition, and economic uncertainties may persist, opportunities for market expansion, innovation, and partnership collaboration are expected to drive growth and sustainability in the long term. Remittance providers that embrace digital transformation, prioritize regulatory compliance, focus on customer experience, and explore strategic partnerships will be well-positioned to thrive in the dynamic and competitive remittance landscape in Singapore.

Conclusion The Singapore remittance market plays a crucial role in facilitating cross-border transactions, supporting the financial needs of migrant workers, expatriates, and individuals with international connections. With the country’s status as a global financial hub, diverse population, and strong regulatory framework, Singapore offers a conducive environment for remittance providers to innovate, expand, and thrive. Despite challenges such as regulatory compliance, competition, and economic uncertainties, the market presents significant opportunities for industry participants to leverage digital technologies, strengthen customer relationships, and drive growth in the evolving remittance landscape. By embracing digital transformation, enhancing regulatory compliance, focusing on customer experience, and exploring strategic partnerships, remittance providers can navigate challenges, seize opportunities, and contribute to the growth and development of the remittance market in Singapore.

What is Remittance?

Remittance refers to the transfer of money by a foreign worker to their home country, often to support family members. In the context of Singapore, it plays a crucial role in the economy, particularly for expatriates sending funds back to their families in various countries.

What are the key players in the Singapore Remittance Market?

Key players in the Singapore Remittance Market include companies like Western Union, MoneyGram, and TransferWise, which provide various remittance services. These companies compete on factors such as transfer speed, fees, and exchange rates, among others.

What are the growth factors driving the Singapore Remittance Market?

The Singapore Remittance Market is driven by factors such as the increasing number of foreign workers in Singapore, the rise in digital payment solutions, and the growing demand for fast and cost-effective money transfer services. Additionally, the economic stability of Singapore attracts more expatriates.

What challenges does the Singapore Remittance Market face?

Challenges in the Singapore Remittance Market include regulatory compliance, competition from fintech startups, and fluctuating exchange rates. These factors can impact the profitability and operational efficiency of remittance service providers.

What opportunities exist in the Singapore Remittance Market?

Opportunities in the Singapore Remittance Market include the expansion of digital remittance services, partnerships with local banks, and the potential for blockchain technology to enhance transaction security and reduce costs. These innovations can attract more users and improve service delivery.

What trends are shaping the Singapore Remittance Market?

Trends in the Singapore Remittance Market include the increasing adoption of mobile wallets, the rise of peer-to-peer transfer platforms, and a focus on customer-centric services. These trends reflect changing consumer preferences and the need for more convenient remittance options.

Singapore Remittance Market

| Segmentation Details | Description |

|---|---|

| Service Type | Bank Transfers, Mobile Wallets, Cash Pickup, Online Transfers |

| Customer Type | Individuals, Small Businesses, Corporates, Non-Profits |

| Transaction Size | Small, Medium, Large, High-Value |

| Delivery Mode | Instant, Same Day, Next Day, Scheduled |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Singapore Remittance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at