444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Singapore’s maritime industry stands as one of the world’s most sophisticated and strategically positioned maritime hubs, serving as a critical gateway between East and West. The Singapore maritime industry market encompasses a comprehensive ecosystem of shipping, port operations, maritime services, and offshore marine activities that collectively form the backbone of the nation’s economy. With its strategic location along major shipping routes, Singapore handles approximately 20% of global transshipment volumes and maintains its position as the world’s second-largest container port.

The maritime sector in Singapore demonstrates remarkable resilience and continuous innovation, driven by advanced digital technologies, sustainable practices, and world-class infrastructure. The industry benefits from Singapore’s pro-business environment, robust regulatory framework, and significant government support for maritime development initiatives. Port operations alone contribute substantially to Singapore’s GDP, while the broader maritime ecosystem includes ship management, maritime finance, marine insurance, and specialized maritime services.

Growth trajectories in the Singapore maritime market reflect increasing global trade volumes, rising demand for efficient logistics solutions, and the nation’s commitment to maintaining its competitive edge through technological advancement. The market experiences steady expansion driven by strategic investments in automation, digitalization, and green shipping technologies that position Singapore as a leader in sustainable maritime practices.

The Singapore maritime industry market refers to the comprehensive network of maritime-related businesses, services, and infrastructure that collectively support shipping, port operations, offshore activities, and marine services within Singapore’s territorial waters and economic zones. This market encompasses vessel operations, cargo handling, ship repair and maintenance, maritime finance, marine insurance, and specialized maritime consulting services.

Maritime activities in Singapore span multiple sectors including container shipping, bulk cargo operations, cruise operations, offshore marine engineering, ship management services, and maritime technology development. The market represents a complex ecosystem where international shipping lines, port operators, logistics providers, and maritime service companies collaborate to facilitate global trade and commerce.

Strategic positioning defines Singapore’s maritime market as a critical node in global supply chains, leveraging advanced port infrastructure, efficient customs procedures, and comprehensive maritime services to serve vessels and cargo from around the world. The market’s significance extends beyond traditional shipping to include emerging areas such as maritime digitalization, autonomous vessel technologies, and sustainable shipping solutions.

Singapore’s maritime industry continues to demonstrate exceptional performance and strategic importance in the global maritime landscape. The market benefits from Singapore’s unparalleled geographic advantage, world-class infrastructure, and comprehensive maritime ecosystem that supports diverse shipping and offshore activities. Container throughput maintains steady growth patterns, with the Port of Singapore consistently ranking among the world’s busiest container ports.

Key performance indicators reveal the market’s robust foundation and growth potential. The industry supports thousands of maritime companies, employs a significant portion of Singapore’s workforce, and contributes substantially to national economic output. Digitalization initiatives drive approximately 35% efficiency improvements across various maritime operations, while sustainable shipping practices gain increasing adoption rates.

Market dynamics reflect Singapore’s proactive approach to maritime development, including substantial investments in port automation, digital infrastructure, and green shipping technologies. The government’s Maritime Singapore initiative provides strategic direction and support for industry growth, while private sector investments drive innovation and capacity expansion. Future projections indicate continued market expansion supported by growing regional trade volumes and Singapore’s strategic initiatives to maintain its maritime leadership position.

Strategic advantages position Singapore’s maritime market for sustained growth and global leadership. The following key insights highlight the market’s fundamental strengths and opportunities:

Market penetration across various maritime segments demonstrates Singapore’s comprehensive approach to maritime services. The industry maintains strong positions in container shipping, offshore marine services, ship management, and maritime finance, while expanding into emerging areas such as maritime technology and sustainable shipping solutions.

Global trade expansion serves as the primary driver for Singapore’s maritime industry growth. Increasing international commerce, rising consumer demand, and expanding manufacturing activities across Asia-Pacific regions generate substantial cargo volumes that transit through Singapore’s ports. Regional economic growth particularly in Southeast Asia and China creates sustained demand for efficient maritime logistics and shipping services.

Technological advancement drives significant improvements in operational efficiency and service quality. The adoption of automation technologies, artificial intelligence, and digital platforms enables 25% productivity gains across various maritime operations. Smart port initiatives integrate advanced technologies to optimize vessel scheduling, cargo handling, and logistics coordination, creating competitive advantages for Singapore’s maritime sector.

Government initiatives provide substantial support for maritime industry development through strategic investments, policy frameworks, and international partnerships. The Maritime Singapore initiative includes comprehensive programs for industry transformation, workforce development, and infrastructure enhancement. Sustainability mandates drive adoption of green shipping technologies and alternative fuels, positioning Singapore as a leader in sustainable maritime practices.

Supply chain optimization requirements from global businesses create demand for Singapore’s comprehensive maritime services. Companies seek efficient, reliable, and cost-effective logistics solutions that Singapore’s maritime ecosystem provides through integrated port operations, advanced cargo handling, and extensive connectivity networks.

Intense regional competition poses challenges to Singapore’s maritime market growth as neighboring ports invest heavily in infrastructure development and capacity expansion. Competitive pressures from ports in Malaysia, Thailand, and other regional locations create pricing pressures and require continuous innovation to maintain market share and competitive positioning.

High operational costs associated with Singapore’s advanced infrastructure and skilled workforce create cost pressures for maritime operators. Land constraints limit physical expansion opportunities for port facilities and related maritime infrastructure, requiring innovative solutions and efficient space utilization to accommodate growing cargo volumes and vessel sizes.

Regulatory complexity in international maritime operations creates compliance challenges and operational complexities. Evolving environmental regulations, safety requirements, and security standards require substantial investments in systems, training, and operational modifications. Cybersecurity concerns related to increasing digitalization create risks and require significant investments in security infrastructure and protocols.

Economic volatility and global trade uncertainties impact shipping volumes and maritime activity levels. Geopolitical tensions and trade disputes can disrupt established shipping routes and cargo flows, affecting Singapore’s position as a transshipment hub and maritime service center.

Digital transformation presents substantial opportunities for Singapore’s maritime industry to enhance operational efficiency and service quality. Blockchain technology adoption for supply chain transparency, smart contracts for shipping operations, and artificial intelligence for predictive maintenance create new revenue streams and competitive advantages. Data analytics applications enable optimized vessel routing, cargo planning, and resource allocation.

Green shipping initiatives offer significant growth opportunities as environmental regulations drive demand for sustainable maritime solutions. Singapore’s investments in alternative fuel infrastructure, including ammonia and hydrogen bunkering facilities, position the nation to capture growing demand for clean shipping technologies. Carbon-neutral shipping services create premium market segments with higher value propositions.

Regional expansion opportunities exist through strategic partnerships and investments in emerging Southeast Asian markets. Belt and Road Initiative projects create new trade routes and cargo flows that benefit Singapore’s maritime services. Cruise industry recovery following global disruptions presents opportunities for expanded passenger vessel operations and related maritime services.

Maritime technology development creates opportunities for Singapore to become a global center for maritime innovation. Autonomous vessel technologies, advanced port automation systems, and maritime cybersecurity solutions represent high-growth market segments where Singapore’s expertise and infrastructure provide competitive advantages.

Supply and demand dynamics in Singapore’s maritime market reflect the complex interplay between global trade patterns, regional economic growth, and infrastructure capacity. Container throughput demonstrates steady growth trends supported by increasing trade volumes and Singapore’s strategic positioning as a transshipment hub. Demand fluctuations correlate with seasonal trade patterns, economic cycles, and global supply chain requirements.

Competitive dynamics involve continuous innovation and service enhancement as Singapore maintains its leadership position against regional competitors. Service differentiation through advanced technology adoption, comprehensive maritime services, and operational excellence creates sustainable competitive advantages. Pricing dynamics reflect value-based positioning rather than cost competition, emphasizing service quality and reliability.

Technology adoption cycles drive market evolution as digital solutions transform traditional maritime operations. Investment patterns show increasing focus on automation, sustainability, and digital infrastructure development. Regulatory dynamics influence market development through environmental standards, safety requirements, and international compliance frameworks that shape operational practices and investment priorities.

Partnership dynamics create collaborative ecosystems where shipping lines, port operators, logistics providers, and technology companies work together to optimize maritime operations and service delivery. Innovation cycles accelerate through public-private partnerships and industry collaboration initiatives.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Singapore’s maritime industry market. Primary research includes extensive interviews with industry executives, port operators, shipping companies, and maritime service providers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of government publications, industry reports, trade statistics, and regulatory documents to establish market foundations and validate primary research findings. Data triangulation methods ensure accuracy and reliability by cross-referencing multiple information sources and analytical approaches.

Quantitative analysis utilizes statistical methods to analyze cargo throughput data, vessel traffic patterns, and economic indicators that influence maritime market performance. Qualitative assessment examines market dynamics, competitive positioning, and strategic trends through expert interviews and industry observations.

Market modeling techniques project future trends and growth scenarios based on historical data patterns, economic indicators, and industry development factors. Validation processes include expert reviews and industry feedback to ensure research accuracy and practical relevance for market participants and stakeholders.

Singapore’s maritime market operates within a dynamic regional context that significantly influences industry performance and growth opportunities. Southeast Asian markets represent the primary regional driver, with Singapore serving as the central hub for maritime activities across ASEAN countries. Regional trade integration through various economic partnerships creates sustained demand for Singapore’s maritime services.

China market dynamics substantially impact Singapore’s maritime industry through extensive trade relationships and cargo flows. Chinese manufacturing and export activities generate significant container volumes that transit through Singapore’s ports, while Chinese investments in regional infrastructure create new trade opportunities. Market share in China-Southeast Asia trade routes reaches approximately 40% of total regional volumes.

India and South Asian markets present growing opportunities as economic development drives increased trade volumes and maritime activity. Regional connectivity improvements and trade agreement implementations create new cargo flows that benefit Singapore’s strategic positioning. Middle Eastern markets contribute to Singapore’s role as a global maritime hub through energy trade and transshipment activities.

European and American markets maintain significant importance through established trade relationships and shipping routes. Trans-Pacific trade volumes create substantial opportunities for Singapore’s maritime services, while Atlantic trade connections support diversified market exposure and risk management strategies.

Singapore’s maritime industry features a diverse competitive landscape encompassing international shipping lines, port operators, maritime service providers, and technology companies. Market leadership positions are established through operational excellence, technological innovation, and comprehensive service offerings.

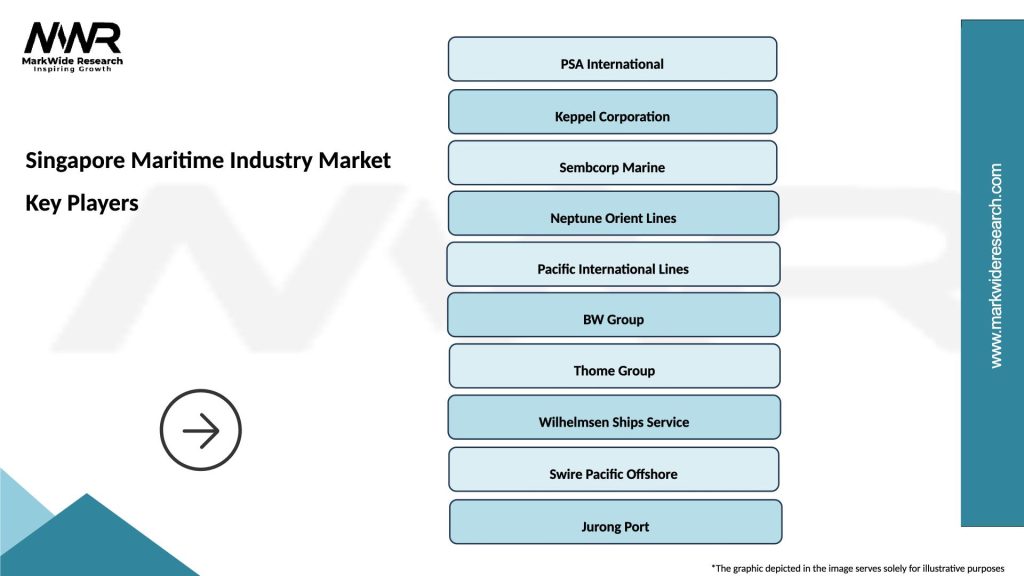

Major market participants include:

Competitive strategies focus on technological differentiation, operational efficiency, and comprehensive service portfolios. Innovation investments in automation, digitalization, and sustainability create competitive advantages and market differentiation. Strategic partnerships and joint ventures enable market expansion and capability enhancement across various maritime segments.

Singapore’s maritime industry market demonstrates clear segmentation across multiple dimensions that reflect the diverse nature of maritime activities and services. Segmentation analysis provides insights into market dynamics, growth opportunities, and competitive positioning across different maritime sectors.

By Service Type:

By Cargo Type:

By Technology Level:

Container operations represent the largest segment of Singapore’s maritime market, accounting for approximately 65% of total port throughput. Container shipping benefits from Singapore’s strategic location, advanced terminal facilities, and comprehensive connectivity networks. Growth drivers include increasing regional trade, e-commerce expansion, and supply chain optimization requirements from global businesses.

Bulk cargo operations serve regional commodity trade and industrial requirements through specialized handling facilities and storage infrastructure. Liquid cargo segments, including petroleum products and chemicals, benefit from Singapore’s position as a regional refining and petrochemical hub. Market dynamics reflect commodity price cycles and regional industrial development patterns.

Offshore marine services demonstrate strong performance driven by regional oil and gas activities, renewable energy projects, and maritime infrastructure development. Ship repair and maintenance services benefit from Singapore’s strategic location along major shipping routes and comprehensive maritime infrastructure. Technology integration enhances service quality and operational efficiency across all maritime segments.

Maritime finance and insurance services support global shipping operations through comprehensive financial products and risk management solutions. Digital services represent emerging high-growth segments including maritime cybersecurity, blockchain applications, and data analytics solutions that enhance operational efficiency and transparency.

Shipping companies benefit from Singapore’s comprehensive maritime ecosystem through efficient port operations, competitive costs, and extensive connectivity networks. Operational advantages include reduced vessel turnaround times, optimized cargo handling, and access to comprehensive maritime services. Cost efficiencies result from economies of scale, operational optimization, and competitive service pricing.

Cargo owners gain advantages through reliable logistics services, efficient supply chain solutions, and comprehensive cargo handling capabilities. Supply chain optimization benefits include reduced transit times, improved cargo security, and enhanced visibility throughout the logistics process. Risk management advantages include comprehensive insurance coverage and reliable service delivery.

Maritime service providers benefit from Singapore’s business-friendly environment, skilled workforce, and comprehensive regulatory framework. Market access advantages include proximity to major shipping routes, established customer relationships, and extensive business networks. Innovation opportunities exist through technology partnerships, research collaboration, and government support programs.

Government stakeholders realize economic benefits through substantial contributions to GDP, employment generation, and tax revenues. Strategic advantages include enhanced national competitiveness, regional influence, and economic diversification. Social benefits encompass job creation, skills development, and economic multiplier effects throughout the broader economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration represents the most significant trend transforming Singapore’s maritime industry. Smart port technologies including IoT sensors, artificial intelligence, and blockchain applications create operational efficiencies and enhanced service quality. Data analytics applications enable predictive maintenance, optimized vessel scheduling, and improved cargo handling processes that reduce costs and enhance reliability.

Sustainability initiatives drive fundamental changes in maritime operations and service delivery. Green shipping technologies including alternative fuels, energy-efficient vessels, and carbon reduction programs gain increasing adoption. Environmental compliance requirements create new market segments for sustainable maritime solutions and services. Circular economy principles influence port operations and waste management practices.

Automation expansion continues across all maritime segments, with automated container terminals achieving 30% efficiency improvements compared to traditional operations. Robotic systems enhance cargo handling capabilities while reducing labor costs and improving safety performance. Autonomous vessel technologies represent emerging trends that will reshape maritime operations and service delivery models.

Supply chain integration trends create demand for comprehensive logistics solutions that extend beyond traditional maritime services. End-to-end visibility requirements drive adoption of integrated digital platforms and real-time tracking systems. Customer experience focus leads to enhanced service personalization and responsive customer support capabilities.

Infrastructure investments continue to enhance Singapore’s maritime capabilities and competitive positioning. Port expansion projects increase handling capacity and accommodate larger vessels, while technology upgrades improve operational efficiency and service quality. Tuas Port development represents a major infrastructure initiative that will consolidate container operations and create the world’s largest automated port.

Strategic partnerships between government agencies, private companies, and international organizations drive industry development and innovation. Research collaborations with universities and technology companies accelerate maritime innovation and workforce development. International agreements enhance trade relationships and create new market opportunities for Singapore’s maritime services.

Regulatory developments include enhanced environmental standards, cybersecurity requirements, and safety protocols that shape industry practices. Digital transformation initiatives receive government support through funding programs and regulatory frameworks that encourage technology adoption. Workforce development programs ensure adequate skilled labor supply for evolving maritime industry requirements.

Market consolidation trends create larger, more efficient maritime service providers with enhanced capabilities and global reach. Technology acquisitions enable traditional maritime companies to expand their digital capabilities and service offerings. Sustainability investments position Singapore as a leader in green shipping and environmental stewardship.

MarkWide Research recommends that maritime industry participants focus on digital transformation initiatives to maintain competitive advantages and operational efficiency. Technology investments in automation, data analytics, and digital platforms create sustainable differentiation and improved service quality. Strategic partnerships with technology providers and innovation companies accelerate capability development and market positioning.

Sustainability integration should be prioritized as environmental regulations and customer demands drive market evolution. Green technology adoption including alternative fuels, energy-efficient operations, and carbon reduction programs create competitive advantages and regulatory compliance. Investment strategies should balance short-term operational requirements with long-term sustainability objectives.

Workforce development requires continuous attention as technological advancement and industry evolution create new skill requirements. Training programs should focus on digital literacy, technology integration, and advanced maritime operations. Talent retention strategies become critical as competition for skilled maritime professionals intensifies across the region.

Market diversification strategies should explore emerging segments including maritime technology, offshore renewable energy, and specialized logistics services. Regional expansion opportunities exist through strategic partnerships and investments in growing Southeast Asian markets. Risk management approaches should address cybersecurity, geopolitical uncertainties, and economic volatility impacts on maritime operations.

Singapore’s maritime industry demonstrates strong growth prospects supported by strategic positioning, technological advancement, and comprehensive government support. Market expansion is projected to continue at steady rates driven by regional economic growth, increasing trade volumes, and Singapore’s strategic initiatives to maintain maritime leadership. Digital transformation will accelerate across all maritime segments, creating new service capabilities and operational efficiencies.

Sustainability trends will reshape industry practices and create new market opportunities for green shipping technologies and services. Alternative fuel adoption is expected to reach 15% of total fuel consumption within the next decade, while carbon-neutral shipping services create premium market segments. Environmental compliance requirements will drive continued innovation and investment in sustainable maritime solutions.

Technology integration will continue transforming maritime operations through automation, artificial intelligence, and blockchain applications. Autonomous vessel technologies represent significant future opportunities that will revolutionize shipping operations and service delivery models. Data-driven decision making will become standard practice across all maritime segments, enhancing efficiency and customer service quality.

Regional dynamics will continue supporting Singapore’s maritime market growth through expanding Southeast Asian economies and increasing trade integration. MWR analysis indicates that Singapore’s strategic investments in infrastructure, technology, and sustainability position the nation to capture growing regional opportunities while maintaining global maritime leadership. Long-term prospects remain positive based on fundamental market drivers and Singapore’s competitive advantages in the global maritime industry.

Singapore’s maritime industry market represents a dynamic and strategically important sector that continues to demonstrate resilience, innovation, and growth potential. The market’s success stems from Singapore’s unparalleled geographic advantages, world-class infrastructure, and comprehensive maritime ecosystem that serves global shipping and trade requirements. Strategic positioning at the crossroads of major shipping routes, combined with advanced port facilities and comprehensive maritime services, creates sustainable competitive advantages that support long-term market leadership.

Market dynamics reflect the complex interplay of global trade patterns, technological advancement, and regulatory evolution that shape industry development. The successful integration of digital technologies, sustainability initiatives, and operational excellence demonstrates Singapore’s commitment to maintaining its position as the world’s leading maritime hub. Future growth prospects remain strong, supported by regional economic expansion, increasing trade volumes, and Singapore’s strategic investments in maritime innovation and infrastructure development.

Industry participants and stakeholders benefit from Singapore’s comprehensive maritime ecosystem through operational efficiencies, strategic location advantages, and access to world-class maritime services. The market’s continued evolution toward digitalization, sustainability, and automation creates new opportunities for growth and differentiation while maintaining Singapore’s fundamental strengths in global maritime operations and services.

What is Singapore Maritime Industry?

The Singapore Maritime Industry encompasses a wide range of activities related to shipping, logistics, and maritime services, including shipbuilding, port operations, and marine engineering.

What are the key players in the Singapore Maritime Industry Market?

Key players in the Singapore Maritime Industry Market include companies like Sembcorp Marine, Keppel Corporation, and PSA International, which are involved in shipbuilding, port management, and maritime logistics, among others.

What are the growth factors driving the Singapore Maritime Industry Market?

The growth of the Singapore Maritime Industry Market is driven by increasing global trade, advancements in shipping technology, and the strategic location of Singapore as a major shipping hub in Asia.

What challenges does the Singapore Maritime Industry Market face?

The Singapore Maritime Industry Market faces challenges such as rising operational costs, environmental regulations, and competition from other regional ports, which can impact profitability and growth.

What opportunities exist in the Singapore Maritime Industry Market?

Opportunities in the Singapore Maritime Industry Market include the expansion of digital technologies in shipping, the growth of green shipping initiatives, and the development of smart port solutions to enhance efficiency.

What trends are shaping the Singapore Maritime Industry Market?

Trends shaping the Singapore Maritime Industry Market include the adoption of automation in port operations, the increasing focus on sustainability, and the integration of advanced data analytics for better decision-making.

Singapore Maritime Industry Market

| Segmentation Details | Description |

|---|---|

| Type | Cargo Ships, Tankers, Bulk Carriers, Container Vessels |

| Technology | Navigation Systems, Communication Equipment, Engine Technologies, Safety Gear |

| End User | Shipping Companies, Port Authorities, Logistics Providers, Freight Forwarders |

| Service Type | Maintenance, Repair, Shipbuilding, Consultancy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Singapore Maritime Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at