444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Singapore life and non-life insurance market represents one of the most sophisticated and well-regulated insurance ecosystems in Southeast Asia. Singapore’s strategic position as a regional financial hub has fostered a mature insurance landscape characterized by robust regulatory frameworks, technological innovation, and diverse product offerings. The market demonstrates consistent growth momentum with life insurance penetration reaching approximately 8.2% of GDP, significantly higher than the regional average.

Market dynamics in Singapore reflect the country’s affluent population, aging demographics, and increasing awareness of financial protection needs. The insurance sector benefits from strong government support, advanced digital infrastructure, and a competitive landscape featuring both local and international insurers. Digital transformation initiatives have accelerated market evolution, with insurtech adoption rates showing remarkable growth of 15.3% annually across various insurance segments.

Regulatory excellence under the Monetary Authority of Singapore (MAS) has established Singapore as a trusted insurance jurisdiction, attracting regional headquarters and fostering innovation through regulatory sandboxes. The market’s resilience was particularly evident during recent global challenges, maintaining stable premium growth and demonstrating the strength of Singapore’s insurance infrastructure.

The Singapore life and non-life insurance market refers to the comprehensive ecosystem of insurance products and services offered within Singapore’s jurisdiction, encompassing both life insurance coverage for mortality and longevity risks, and general insurance protection against property, casualty, and liability exposures. This market includes traditional life insurance policies, investment-linked products, health insurance, motor insurance, property coverage, marine insurance, and specialized commercial lines.

Life insurance components encompass term life, whole life, endowment policies, annuities, and unit-linked investment products designed to provide financial security and wealth accumulation. Non-life insurance segments include motor insurance, property and casualty coverage, marine and aviation insurance, professional indemnity, and emerging cyber insurance products. The market operates under stringent regulatory oversight ensuring consumer protection and financial stability.

Market participants include domestic insurers, international insurance groups, reinsurers, insurance brokers, and digital insurance platforms. The ecosystem supports Singapore’s role as a regional insurance hub, serving both domestic needs and cross-border insurance solutions for Southeast Asian markets.

Singapore’s insurance market demonstrates exceptional maturity and growth potential, driven by favorable demographics, regulatory excellence, and technological advancement. The market benefits from Singapore’s position as a global financial center, attracting international insurers and fostering innovation in insurance products and distribution channels. Premium growth rates have consistently outpaced regional averages, with life insurance showing particularly strong momentum at 6.8% annual growth.

Key market characteristics include high insurance penetration rates, sophisticated product offerings, and advanced digital adoption. The life insurance segment dominates premium volumes, while non-life insurance shows robust growth in emerging areas such as cyber insurance and parametric products. Regulatory initiatives continue to support market development through progressive policies that balance innovation with consumer protection.

Market outlook remains positive, supported by Singapore’s aging population, increasing wealth levels, and growing awareness of insurance needs. Digital transformation continues to reshape distribution channels and customer engagement, with online insurance sales representing an increasing share of total premiums. The market’s resilience and growth trajectory position Singapore as a leading insurance hub in the Asia-Pacific region.

Strategic market insights reveal several critical trends shaping Singapore’s insurance landscape:

Primary growth drivers propelling Singapore’s insurance market include demographic transitions, economic prosperity, and technological advancement. The country’s rapidly aging population creates substantial demand for life insurance, health coverage, and retirement planning products. Wealth accumulation among Singapore residents drives demand for sophisticated insurance and investment products, with high-net-worth individuals seeking comprehensive protection strategies.

Regulatory support from the Monetary Authority of Singapore continues to foster market growth through progressive policies that encourage innovation while maintaining stability. The regulatory sandbox approach enables insurtech companies to test new products and services, accelerating market evolution. Government initiatives promoting financial literacy and retirement planning further stimulate insurance demand across various demographic segments.

Technological advancement serves as a crucial growth catalyst, enabling insurers to develop innovative products, streamline operations, and enhance customer experiences. Digital platforms facilitate broader market access, while data analytics improve risk assessment and pricing accuracy. Climate change awareness and increasing frequency of natural disasters drive demand for comprehensive property and catastrophe insurance coverage.

Market challenges include intense competition among insurers, regulatory compliance costs, and evolving customer expectations. The highly competitive landscape pressures profit margins, particularly in commoditized insurance segments such as motor insurance. Regulatory requirements impose significant compliance costs, especially for smaller insurers seeking to maintain market presence while meeting stringent capital and operational standards.

Economic uncertainties and market volatility can impact insurance demand, particularly for investment-linked products and discretionary coverage. Rising interest rates affect life insurance product attractiveness and insurer investment returns. Talent shortages in specialized areas such as actuarial science, data analytics, and cybersecurity pose operational challenges for insurers seeking to expand capabilities.

Customer behavior shifts toward self-service and digital channels require substantial technology investments, while maintaining traditional distribution networks. The increasing sophistication of customers demands more transparent products and competitive pricing, challenging traditional insurance business models. Cyber threats and data security concerns create operational risks and potential liability exposures for insurance companies.

Significant opportunities exist in emerging insurance segments, digital transformation, and regional expansion. The growing awareness of cyber risks creates substantial demand for specialized cyber insurance products across corporate and individual segments. Climate change adaptation drives opportunities for parametric insurance products and innovative risk transfer solutions addressing weather-related exposures.

Healthcare insurance expansion presents substantial growth potential as Singapore’s population ages and healthcare costs rise. Insurers can develop comprehensive health insurance products addressing preventive care, chronic disease management, and long-term care needs. Wealth management integration offers opportunities to combine insurance protection with investment and estate planning services for affluent customers.

Regional market expansion leverages Singapore’s hub status to serve growing insurance demand across Southeast Asia. Digital platforms enable insurers to reach underserved markets and develop innovative distribution models. Partnership opportunities with fintech companies, healthcare providers, and technology platforms create new customer acquisition channels and product development possibilities.

Market dynamics in Singapore’s insurance sector reflect the interplay between regulatory evolution, technological advancement, and changing consumer preferences. The competitive landscape continues to intensify as traditional insurers face challenges from insurtech startups and digital-native companies. Customer expectations have shifted toward seamless digital experiences, personalized products, and transparent pricing, forcing insurers to reimagine their value propositions.

Distribution channel evolution shows significant transformation, with digital channels gaining prominence while traditional agency networks adapt to changing customer behaviors. Insurance companies are investing heavily in omnichannel strategies that integrate online and offline touchpoints. Product innovation cycles have accelerated, with insurers launching new products addressing emerging risks such as cyber threats, climate change, and demographic shifts.

Regulatory dynamics continue to shape market development, with MAS implementing forward-looking policies that balance innovation encouragement with consumer protection. The regulatory approach supports Singapore’s position as a regional insurance hub while ensuring market stability. Investment performance and interest rate environments significantly influence life insurance product attractiveness and insurer profitability, creating ongoing strategic challenges for market participants.

Comprehensive research methodology employed for analyzing Singapore’s insurance market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with insurance executives, regulatory officials, and industry experts to gather qualitative insights on market trends, challenges, and opportunities. Secondary research encompasses analysis of regulatory filings, industry reports, and financial statements from major market participants.

Quantitative analysis utilizes statistical modeling to identify market trends, growth patterns, and correlation factors affecting insurance demand. Data collection covers premium volumes, policy counts, claim ratios, and market share distributions across different insurance segments. Market segmentation analysis examines customer demographics, product preferences, and distribution channel effectiveness to provide detailed market insights.

Regulatory analysis reviews policy developments, compliance requirements, and regulatory impact assessments to understand market dynamics. Competitive intelligence gathering includes analysis of product offerings, pricing strategies, and market positioning of major insurers. Technology assessment evaluates digital transformation initiatives, insurtech adoption, and innovation trends shaping market evolution.

Singapore’s unique position as a city-state creates a concentrated yet sophisticated insurance market with distinct characteristics compared to larger regional markets. The market benefits from Singapore’s strategic location, serving as a regional headquarters for international insurers and a gateway to Southeast Asian markets. Market concentration in Singapore enables insurers to achieve operational efficiencies while serving a highly educated and affluent customer base.

Comparative analysis with regional markets reveals Singapore’s superior insurance penetration rates and product sophistication. Life insurance penetration significantly exceeds regional averages, reflecting higher income levels and greater financial awareness. Non-life insurance segments show strong development across motor, property, and commercial lines, supported by Singapore’s advanced economy and regulatory framework.

Cross-border opportunities leverage Singapore’s hub status to serve regional insurance demand through digital platforms and partnership arrangements. The market’s regulatory credibility and operational excellence attract international insurers seeking regional expansion. Regional market share in specialized segments such as marine insurance and reinsurance demonstrates Singapore’s importance in the broader Asia-Pacific insurance ecosystem, with the country maintaining approximately 12.5% of regional marine insurance premiums.

Singapore’s insurance market features a diverse competitive landscape combining established local insurers, international insurance groups, and emerging digital players. The market structure reflects Singapore’s open economy and regulatory framework that welcomes foreign participation while supporting domestic insurers.

Major market participants include:

Competitive dynamics emphasize product innovation, digital transformation, and customer experience enhancement. Insurers compete through comprehensive product portfolios, competitive pricing, and superior service delivery. Market consolidation trends show strategic partnerships and acquisitions as companies seek to strengthen market positions and expand capabilities.

Market segmentation reveals distinct characteristics across various insurance categories and customer segments. The Singapore insurance market demonstrates sophisticated segmentation reflecting diverse customer needs and risk profiles.

By Product Type:

By Customer Segment:

Life Insurance Category dominates Singapore’s insurance market, driven by strong savings culture and retirement planning needs. The segment benefits from favorable tax treatment and regulatory support for long-term savings products. Investment-linked policies show particular strength, combining insurance protection with investment opportunities. Product innovation focuses on flexible premium structures and enhanced rider benefits addressing evolving customer needs.

Health Insurance Segment demonstrates robust growth driven by aging demographics and rising healthcare costs. Insurers are developing comprehensive health insurance products addressing preventive care, chronic disease management, and long-term care needs. Corporate health insurance remains a significant growth driver as employers enhance employee benefits packages to attract and retain talent.

Motor Insurance Category faces challenges from market saturation and price competition, leading insurers to focus on value-added services and telematics-based products. Usage-based insurance and digital claims processing are transforming the segment. The transition toward electric vehicles creates opportunities for specialized coverage and new risk assessment models.

Property Insurance Segment benefits from Singapore’s robust real estate market and increasing property values. Climate change concerns drive demand for comprehensive coverage addressing weather-related risks. Commercial property insurance shows growth potential as businesses seek protection against operational disruptions and cyber threats.

Insurance Companies benefit from Singapore’s stable regulatory environment, sophisticated customer base, and strategic regional position. The market offers opportunities for product innovation, digital transformation, and regional expansion. Operational advantages include access to skilled talent, advanced technology infrastructure, and supportive government policies promoting financial services development.

Customers enjoy comprehensive insurance protection, competitive pricing, and innovative product offerings addressing diverse risk management needs. Singapore’s regulatory framework ensures consumer protection and fair treatment. Digital platforms provide convenient access to insurance products and services, enhancing customer experience and accessibility.

Regulatory Authorities benefit from a well-functioning insurance market that contributes to financial stability and economic development. The sector supports Singapore’s position as a regional financial hub and attracts international investment. Innovation initiatives in the insurance sector contribute to Singapore’s reputation as a technology and innovation leader.

Economic Stakeholders benefit from insurance market contributions to capital formation, risk transfer, and economic stability. The sector provides employment opportunities and supports related industries including banking, asset management, and professional services. Regional economic integration through insurance services strengthens Singapore’s role in Southeast Asian economic development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping Singapore’s insurance market, with insurers investing heavily in technology platforms, data analytics, and artificial intelligence capabilities. Customer engagement models are evolving toward omnichannel approaches that integrate digital and traditional touchpoints. Mobile applications and online platforms are becoming primary customer interaction channels, with digital insurance sales showing substantial growth momentum.

Product personalization emerges as a key differentiator, with insurers leveraging data analytics to develop customized insurance solutions addressing individual customer needs and risk profiles. Usage-based insurance models gain traction across motor and property insurance segments, utilizing telematics and IoT devices for risk assessment and pricing.

ESG integration influences product development and investment strategies, with insurers developing sustainable insurance products and incorporating environmental considerations into underwriting processes. Climate risk assessment becomes increasingly sophisticated, with insurers utilizing advanced modeling techniques to evaluate weather-related exposures. Cyber insurance demand continues expanding as businesses recognize cybersecurity risks, with insurers developing specialized products addressing digital threats and data protection requirements.

Recent industry developments highlight the dynamic nature of Singapore’s insurance market and ongoing transformation initiatives. Regulatory innovations include the introduction of digital banking licenses and expanded regulatory sandboxes enabling insurtech experimentation. The Monetary Authority of Singapore continues implementing progressive policies supporting market development while maintaining stability.

Technology partnerships between traditional insurers and fintech companies are accelerating, creating innovative distribution models and product offerings. Artificial intelligence adoption in claims processing, underwriting, and customer service is improving operational efficiency and customer experience. Blockchain technology applications in insurance are being explored for smart contracts and fraud prevention.

Market consolidation activities include strategic partnerships and acquisitions as insurers seek to strengthen market positions and expand capabilities. Product launches focus on emerging risk categories such as cyber insurance, parametric products, and climate-related coverage. According to MarkWide Research analysis, these developments position Singapore’s insurance market for continued growth and innovation leadership in the region.

Strategic recommendations for insurance market participants emphasize digital transformation acceleration, customer experience enhancement, and regional expansion opportunities. Insurers should prioritize technology investments in data analytics, artificial intelligence, and digital platforms to maintain competitive advantages. Customer-centric approaches focusing on personalized products and seamless service delivery will differentiate successful market participants.

Product development strategies should address emerging risks and demographic trends, particularly cyber insurance, climate-related coverage, and aging population needs. Partnership strategies with technology companies, healthcare providers, and financial institutions can create new distribution channels and product innovation opportunities. Insurers should leverage Singapore’s regional hub status to expand into growing Southeast Asian markets.

Operational excellence initiatives should focus on process automation, regulatory compliance efficiency, and talent development in specialized areas. Risk management capabilities require enhancement to address evolving threats including cyber risks, climate change, and operational disruptions. MWR analysis suggests that insurers adopting comprehensive digital strategies while maintaining strong risk management practices will achieve superior market performance and sustainable growth.

Singapore’s insurance market outlook remains highly positive, supported by favorable demographic trends, regulatory excellence, and technological advancement. The market is projected to maintain steady growth momentum, with digital insurance adoption expected to reach 75% penetration across key customer segments within the next five years. Life insurance demand will benefit from aging demographics and increasing wealth levels, while emerging insurance segments show substantial growth potential.

Technology integration will continue transforming market dynamics, with artificial intelligence, blockchain, and IoT applications becoming standard industry practices. Regulatory evolution will support innovation while maintaining market stability, with Singapore maintaining its position as a progressive insurance jurisdiction. Climate change adaptation will drive demand for innovative risk transfer solutions and parametric insurance products.

Regional expansion opportunities will leverage Singapore’s hub status to serve growing insurance demand across Southeast Asia. Market consolidation may accelerate as insurers seek scale advantages and technological capabilities. According to MarkWide Research projections, Singapore’s insurance market will continue outperforming regional averages, maintaining its position as a leading insurance hub in the Asia-Pacific region with sustained innovation and growth leadership.

Singapore’s life and non-life insurance market represents a mature, sophisticated, and rapidly evolving ecosystem that serves as a model for regional insurance development. The market’s strength lies in its regulatory excellence, technological advancement, and strategic position as a regional financial hub. Growth prospects remain robust, driven by demographic transitions, digital transformation, and emerging risk categories requiring innovative insurance solutions.

Market participants must navigate an increasingly competitive landscape while adapting to changing customer expectations and technological disruptions. Success factors include digital transformation capabilities, product innovation, customer experience excellence, and strategic partnerships. The market’s resilience and adaptability position it well for continued growth and leadership in the Asia-Pacific insurance sector.

Future success in Singapore’s insurance market will depend on insurers’ ability to balance innovation with risk management, leverage technology for competitive advantage, and capitalize on regional expansion opportunities. The market’s trajectory suggests continued evolution toward more personalized, digital, and comprehensive insurance solutions serving Singapore’s sophisticated customer base and broader regional market needs.

What is Life and Non-Life Insurance?

Life and Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection against the risk of death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

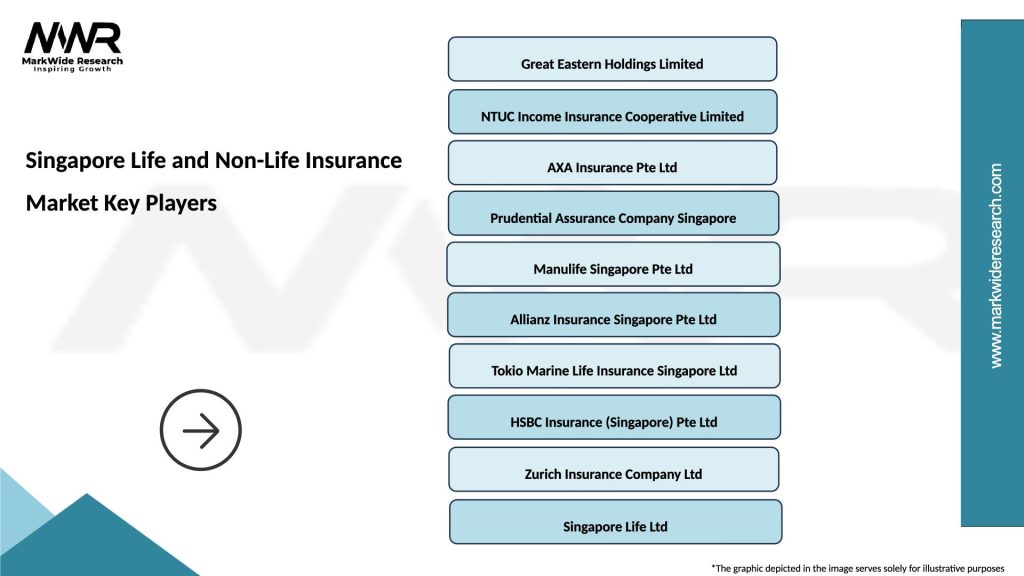

What are the key players in the Singapore Life and Non-Life Insurance Market?

Key players in the Singapore Life and Non-Life Insurance Market include Great Eastern Life, NTUC Income, and AIA Singapore. These companies offer a range of products catering to both individual and corporate clients, among others.

What are the growth factors driving the Singapore Life and Non-Life Insurance Market?

The growth of the Singapore Life and Non-Life Insurance Market is driven by increasing awareness of insurance products, a growing aging population, and rising disposable incomes. Additionally, the expansion of digital insurance platforms is enhancing accessibility.

What challenges does the Singapore Life and Non-Life Insurance Market face?

Challenges in the Singapore Life and Non-Life Insurance Market include intense competition among insurers, regulatory compliance requirements, and the need for continuous innovation to meet changing consumer preferences. These factors can impact profitability and market share.

What opportunities exist in the Singapore Life and Non-Life Insurance Market?

Opportunities in the Singapore Life and Non-Life Insurance Market include the potential for product diversification, the rise of insurtech solutions, and increasing demand for personalized insurance products. These trends can lead to enhanced customer engagement and retention.

What trends are shaping the Singapore Life and Non-Life Insurance Market?

Trends shaping the Singapore Life and Non-Life Insurance Market include the adoption of digital technologies, a focus on sustainability in insurance practices, and the integration of artificial intelligence for risk assessment. These innovations are transforming how insurance products are developed and delivered.

Singapore Life and Non-Life Insurance Market

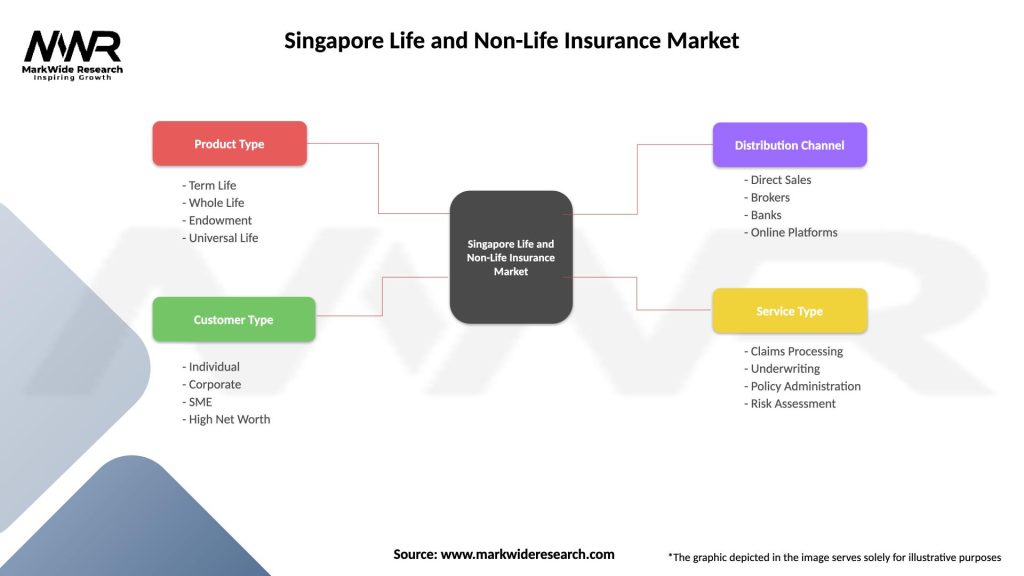

| Segmentation Details | Description |

|---|---|

| Product Type | Term Life, Whole Life, Endowment, Universal Life |

| Customer Type | Individual, Corporate, SME, High Net Worth |

| Distribution Channel | Direct Sales, Brokers, Banks, Online Platforms |

| Service Type | Claims Processing, Underwriting, Policy Administration, Risk Assessment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Singapore Life and Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at