444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Singapore home insurance market represents a dynamic and rapidly evolving sector within the nation’s comprehensive insurance landscape. As one of Asia’s most developed financial hubs, Singapore has witnessed substantial growth in residential property ownership and corresponding insurance protection needs. The market demonstrates robust expansion driven by increasing property values, enhanced consumer awareness, and evolving regulatory frameworks that prioritize homeowner protection.

Market dynamics indicate significant growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This growth trajectory reflects Singapore’s stable economic environment, rising disposable incomes, and the government’s continued emphasis on homeownership through various housing policies. The market encompasses diverse insurance products ranging from basic fire coverage to comprehensive home protection plans that include contents insurance, personal liability coverage, and additional living expenses protection.

Digital transformation has become a defining characteristic of the Singapore home insurance market, with approximately 72% of consumers now preferring online channels for policy research and purchase. This shift has prompted traditional insurers to enhance their digital capabilities while creating opportunities for insurtech companies to introduce innovative products and services. The market’s sophistication is further evidenced by the growing demand for customizable insurance solutions that cater to Singapore’s diverse housing landscape, from public housing flats to luxury condominiums and landed properties.

The Singapore home insurance market refers to the comprehensive ecosystem of insurance products, services, and providers that offer financial protection for residential properties and their contents within Singapore’s unique housing environment. This market encompasses various insurance solutions designed to protect homeowners against risks including fire, theft, natural disasters, and liability claims arising from property ownership.

Home insurance in Singapore typically includes multiple coverage components that address the specific needs of property owners in this tropical city-state. The market serves diverse customer segments, from first-time homebuyers purchasing Housing Development Board (HDB) flats to affluent individuals owning multiple private properties. Insurance providers offer tailored solutions that consider Singapore’s specific risk factors, including monsoon seasons, urban density challenges, and the unique characteristics of different property types prevalent in the market.

Singapore’s home insurance market demonstrates exceptional resilience and growth potential, positioning itself as a critical component of the nation’s financial services sector. The market benefits from Singapore’s stable political environment, robust regulatory framework, and sophisticated consumer base that increasingly recognizes the importance of comprehensive property protection. Recent market analysis reveals that insurance penetration rates have reached 68% among private property owners, indicating substantial market maturity while highlighting opportunities for further expansion.

Key market drivers include rising property values, increased natural disaster awareness, and evolving consumer expectations for digital insurance experiences. The market has successfully adapted to changing demographics, with younger homeowners showing 45% higher preference for comprehensive coverage packages compared to previous generations. This trend reflects enhanced financial literacy and risk awareness among Singapore’s educated population.

Competitive dynamics within the market are intensifying as traditional insurers face challenges from digital-first providers and insurtech startups. The market’s future growth trajectory appears promising, supported by government initiatives promoting homeownership and the continuous development of Singapore’s property market. Innovation in product design, distribution channels, and customer service delivery continues to reshape the competitive landscape, creating value for both insurers and policyholders.

Market intelligence reveals several critical insights that define the current state and future direction of Singapore’s home insurance sector:

Property value appreciation serves as a fundamental driver for Singapore’s home insurance market growth. As residential property prices continue to rise, homeowners increasingly recognize the need for adequate insurance coverage to protect their substantial investments. This trend is particularly pronounced in the private property segment, where insurance adoption rates have shown consistent upward momentum.

Government housing policies play a crucial role in market expansion, with initiatives promoting homeownership creating a larger pool of potential insurance customers. The Housing Development Board’s various schemes and the government’s commitment to maintaining housing affordability contribute to sustained market growth. Additionally, regulatory requirements for mortgage-related insurance coverage ensure a steady demand base for basic protection products.

Climate change awareness has emerged as a significant market driver, with Singapore’s tropical climate and increasing extreme weather events highlighting the importance of comprehensive property protection. Recent flooding incidents and severe weather patterns have elevated consumer awareness about natural disaster risks, driving demand for enhanced coverage options. MarkWide Research indicates that weather-related claims have influenced 78% of recent policy upgrades, demonstrating the direct impact of climate considerations on insurance purchasing decisions.

Technological advancement continues to drive market evolution, with smart home technologies creating new insurance needs and opportunities. The integration of IoT devices, security systems, and home automation technologies has created demand for specialized coverage that traditional policies may not adequately address. This technological shift is attracting tech-savvy consumers who value innovative insurance solutions that align with their digital lifestyles.

High premium costs represent a significant constraint for market expansion, particularly among first-time homebuyers and younger demographics with limited disposable income. The comprehensive nature of modern home insurance policies, while providing extensive protection, can result in premium levels that some consumers find prohibitive. This cost sensitivity is especially evident in the HDB flat segment, where residents may prioritize basic coverage over comprehensive protection packages.

Complex policy terms and insurance jargon continue to create barriers for consumer understanding and adoption. Despite regulatory efforts to improve transparency, many potential customers find insurance policies difficult to comprehend, leading to hesitation in purchasing decisions. This complexity is compounded by the diverse range of coverage options and add-on features that, while beneficial, can overwhelm consumers during the selection process.

Limited awareness about specific coverage benefits remains a challenge, particularly regarding newer insurance products such as cyber liability and smart home protection. Many homeowners maintain basic fire insurance without fully understanding the comprehensive protection available through modern home insurance policies. This knowledge gap represents both a constraint and an opportunity for market education initiatives.

Regulatory compliance costs impact insurers’ ability to offer competitive pricing while maintaining profitability. The need to comply with evolving regulations, maintain adequate reserves, and invest in technology infrastructure creates operational expenses that may be reflected in premium pricing. These compliance requirements, while necessary for market stability, can constrain pricing flexibility and market accessibility.

Digital transformation initiatives present substantial opportunities for market expansion and efficiency improvement. The development of user-friendly mobile applications, AI-powered chatbots, and streamlined online claim processes can significantly enhance customer experience while reducing operational costs. Insurers that successfully leverage digital technologies can capture market share from traditional competitors and attract younger, tech-savvy customers.

Product innovation offers extensive opportunities for differentiation and market growth. The development of usage-based insurance models, parametric coverage for natural disasters, and integrated smart home protection packages can address evolving consumer needs. Additionally, the creation of micro-insurance products for specific risks or short-term coverage needs can expand market accessibility and attract price-sensitive segments.

Partnership strategies with property developers, real estate agencies, and financial institutions can create new distribution channels and customer acquisition opportunities. Collaborative approaches that integrate insurance offerings into property purchase processes or mortgage applications can streamline customer journeys while expanding market reach. These partnerships can also facilitate the development of tailored insurance products that address specific property types or customer segments.

Regional expansion opportunities exist for Singapore-based insurers to leverage their expertise in serving similar markets across Southeast Asia. The experience gained in Singapore’s sophisticated insurance environment can be valuable in developing insurance markets throughout the region, creating growth opportunities beyond domestic boundaries.

Competitive intensity within Singapore’s home insurance market continues to escalate as traditional insurers face challenges from digital-first providers and international entrants. This competition drives innovation in product design, pricing strategies, and customer service delivery, ultimately benefiting consumers through improved offerings and competitive premiums. The market’s maturity level allows for sophisticated competitive strategies that focus on value creation rather than simple price competition.

Consumer behavior evolution significantly influences market dynamics, with modern homeowners expecting personalized, convenient, and transparent insurance experiences. The shift toward digital channels has accelerated, with mobile app usage for insurance management increasing by 89% over recent years. This behavioral change requires insurers to continuously adapt their service delivery models and invest in technology infrastructure to meet evolving expectations.

Regulatory environment changes continue to shape market dynamics through enhanced consumer protection measures and standardization requirements. The Monetary Authority of Singapore’s ongoing initiatives to improve market transparency and consumer outcomes create both challenges and opportunities for market participants. These regulatory developments generally support long-term market stability while requiring insurers to adapt their operations and compliance frameworks.

Economic factors including interest rates, property market conditions, and overall economic growth significantly impact market dynamics. Singapore’s stable economic environment generally supports positive market conditions, though global economic uncertainties can influence consumer spending patterns and insurance purchasing decisions. The correlation between property market performance and insurance demand creates cyclical elements within the overall growth trajectory.

Comprehensive market analysis for Singapore’s home insurance sector employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive surveys and interviews with key market participants, including insurance providers, brokers, and consumers across different demographic segments. This approach provides direct insights into market trends, consumer preferences, and competitive dynamics that shape the industry landscape.

Secondary research encompasses analysis of regulatory filings, industry reports, and financial statements from major market participants. Government statistics, housing market data, and economic indicators provide contextual information that supports market trend analysis and future projections. Academic research and industry publications contribute additional perspectives on market evolution and emerging trends.

Data validation processes ensure research accuracy through cross-referencing multiple sources and employing statistical analysis techniques to identify patterns and trends. Market sizing methodologies consider various factors including property ownership rates, insurance penetration levels, and premium pricing trends. Qualitative analysis complements quantitative findings to provide comprehensive market understanding.

Expert consultation with industry professionals, regulatory officials, and market analysts provides additional validation and insights into market dynamics. These consultations help identify emerging trends, potential challenges, and growth opportunities that may not be apparent through data analysis alone. The combination of multiple research approaches ensures comprehensive coverage of market factors and reliable trend identification.

Singapore’s geographic concentration creates unique market dynamics compared to larger countries with diverse regional characteristics. The city-state’s compact size allows for standardized insurance products and consistent risk assessment across the entire market. However, distinct characteristics exist between different residential areas, from high-density public housing estates to exclusive private residential districts, each presenting specific insurance needs and risk profiles.

Central Business District and surrounding areas demonstrate the highest insurance penetration rates, with premium residential properties showing 94% coverage adoption. These areas typically feature higher property values and more sophisticated insurance needs, including enhanced liability coverage and valuable items protection. The concentration of affluent residents in these areas drives demand for comprehensive insurance packages and premium service levels.

Public housing estates represent the largest customer segment by volume, though with generally lower premium values per policy. These areas show growing insurance awareness, particularly among younger residents and families with higher education levels. Government initiatives promoting financial literacy and insurance awareness in these communities contribute to steady market expansion in this segment.

Suburban private housing areas, including landed properties and private condominiums, demonstrate strong growth potential with increasing insurance sophistication. Residents in these areas often require specialized coverage for unique property features, landscaping, and higher-value contents. The market in these areas benefits from word-of-mouth referrals and community-based marketing approaches that build trust and awareness.

Market leadership in Singapore’s home insurance sector is distributed among several established players, each with distinct competitive advantages and market positioning strategies. The competitive environment encourages continuous innovation and service improvement, benefiting consumers through enhanced product offerings and competitive pricing.

Competitive strategies vary significantly among market participants, with traditional insurers focusing on relationship-based selling and comprehensive service offerings, while newer entrants emphasize digital convenience and competitive pricing. This diversity creates a dynamic market environment that serves different customer preferences and needs effectively.

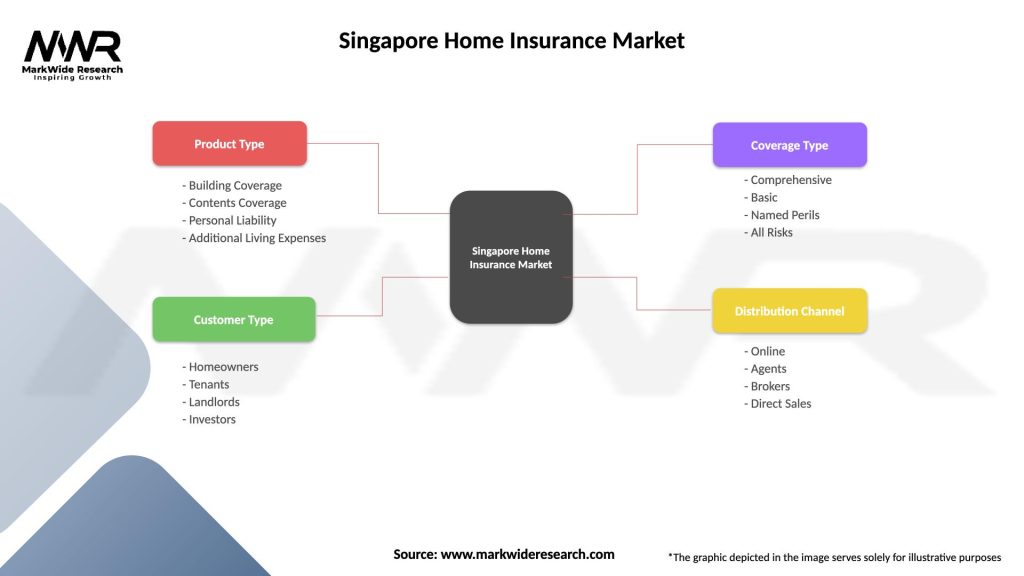

Property type segmentation represents the primary market division within Singapore’s home insurance landscape, reflecting the diverse housing options available in the city-state:

By Property Type:

By Coverage Type:

By Distribution Channel:

HDB flat insurance represents the most significant category by volume, serving approximately 80% of Singapore’s resident population. This segment demonstrates steady growth driven by increasing awareness and government initiatives promoting financial protection. The standardized nature of HDB flats allows for streamlined underwriting processes and competitive pricing, making insurance more accessible to middle-income families. Recent trends show growing interest in contents coverage and personal liability protection among HDB residents.

Private condominium insurance shows the highest growth rates, reflecting Singapore’s expanding private property market and increasing affluence among residents. This category typically requires more sophisticated coverage including common area protection, enhanced liability limits, and specialized coverage for luxury amenities. The segment benefits from higher premium values and lower claims frequency, making it attractive for insurers seeking profitable growth opportunities.

Landed property insurance represents the premium segment with the most complex insurance needs and highest premium values. This category requires specialized underwriting expertise and customized coverage solutions addressing unique risks such as extensive landscaping, swimming pools, and high-value architectural features. MWR analysis indicates that this segment shows premium growth rates of 12.5% annually, driven by property value appreciation and enhanced coverage requirements.

Digital insurance products are emerging as a distinct category, offering simplified coverage options and streamlined purchasing processes. These products appeal particularly to younger demographics and tech-savvy consumers who value convenience and transparency. The category is characterized by competitive pricing, quick policy issuance, and mobile-first customer service approaches that differentiate it from traditional insurance offerings.

Insurance providers benefit from Singapore’s stable regulatory environment and sophisticated consumer base, which supports sustainable business growth and profitability. The market’s maturity allows for predictable risk assessment and pricing models, while the educated consumer base appreciates comprehensive coverage options and is willing to pay appropriate premiums for quality protection. Digital transformation opportunities enable insurers to improve operational efficiency while enhancing customer experience.

Consumers gain access to comprehensive protection for their most significant financial investments, with competitive pricing driven by market competition. The regulatory framework ensures fair treatment and transparent policy terms, while technological advancement provides convenient access to insurance services and efficient claims processing. Educational initiatives and market transparency help consumers make informed decisions about their insurance needs.

Property developers benefit from insurance market sophistication that supports property sales by providing buyers with confidence in their investment protection. Partnerships with insurance providers can enhance the property purchase experience and provide additional value to customers. The availability of comprehensive insurance options supports property market stability and buyer confidence.

Financial institutions leverage home insurance requirements to strengthen customer relationships and provide comprehensive financial services. Mortgage lending is supported by mandatory insurance coverage, while cross-selling opportunities create additional revenue streams. The stable insurance market contributes to overall financial sector stability and growth.

Government stakeholders benefit from a well-functioning insurance market that supports homeownership policies and provides financial protection for citizens. The insurance sector contributes to economic stability and reduces the potential burden on government resources in case of widespread property damage. Regulatory oversight ensures market integrity and consumer protection while supporting economic growth objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first insurance models are transforming the Singapore home insurance landscape, with insurers investing heavily in mobile applications, AI-powered customer service, and automated underwriting systems. This trend reflects changing consumer expectations for convenient, transparent, and efficient insurance experiences. The adoption of digital channels has accelerated significantly, with online policy management usage increasing by 134% among younger demographics.

Personalization and customization trends are driving the development of flexible insurance products that allow consumers to tailor coverage to their specific needs and risk profiles. This approach moves beyond traditional one-size-fits-all policies to offer modular coverage options and usage-based pricing models. The trend supports better risk alignment and customer satisfaction while enabling insurers to optimize their pricing strategies.

Smart home integration represents an emerging trend that combines insurance coverage with IoT technology to provide proactive risk management and enhanced customer value. Smart sensors, security systems, and home automation technologies create opportunities for dynamic pricing and preventive risk management approaches. This trend appeals particularly to tech-savvy consumers who value innovative solutions and proactive protection.

Sustainability and climate resilience considerations are increasingly influencing insurance product development and risk assessment practices. Insurers are developing specialized coverage for green buildings, renewable energy systems, and climate-resilient construction features. This trend reflects growing environmental awareness and the need to address evolving climate-related risks in Singapore’s tropical environment.

Ecosystem partnerships are becoming more prevalent as insurers collaborate with property developers, smart home technology providers, and financial services companies to create integrated customer experiences. These partnerships enable comprehensive service offerings and create additional value for customers while expanding market reach for participating companies.

Regulatory enhancements by the Monetary Authority of Singapore continue to strengthen consumer protection and market transparency. Recent initiatives include standardized policy comparison tools, enhanced disclosure requirements, and streamlined claims processes that benefit both consumers and insurers. These developments support market confidence and sustainable growth while maintaining Singapore’s reputation as a well-regulated financial center.

Technology investments across the industry have accelerated, with major insurers launching comprehensive digital transformation programs. These investments focus on improving customer experience, enhancing operational efficiency, and developing new product capabilities. The integration of artificial intelligence, machine learning, and data analytics is revolutionizing underwriting, pricing, and claims management processes.

Product innovation initiatives have resulted in the launch of several new insurance categories, including cyber liability coverage for smart homes, parametric insurance for natural disasters, and usage-based pricing models. These innovations address evolving consumer needs and risk profiles while creating differentiation opportunities for insurers in a competitive market.

Market consolidation activities include strategic partnerships, acquisitions, and joint ventures that reshape the competitive landscape. These developments enable participants to achieve scale advantages, expand capabilities, and enhance market position while providing customers with improved service offerings and competitive pricing.

Sustainability initiatives across the industry include the development of green insurance products, carbon-neutral operations, and support for sustainable building practices. These initiatives align with Singapore’s national sustainability goals while addressing growing consumer interest in environmentally responsible business practices.

Digital transformation acceleration should remain a top priority for all market participants, with particular focus on mobile-first customer experiences and AI-powered service delivery. Insurers that successfully leverage technology to improve customer convenience and operational efficiency will gain significant competitive advantages in the evolving market landscape. Investment in user-friendly interfaces and seamless digital journeys will be crucial for attracting and retaining customers.

Product diversification strategies should focus on emerging risks and underserved market segments, including cyber liability, climate resilience, and specialized coverage for unique property types. The development of modular insurance products that allow customization will appeal to sophisticated consumers while enabling better risk pricing and management. Innovation in coverage options and service delivery will drive differentiation in an increasingly competitive market.

Partnership development with proptech companies, real estate platforms, and financial services providers can create new distribution channels and enhance customer value propositions. Strategic alliances that integrate insurance into property purchase and management processes will improve customer convenience while expanding market reach. These partnerships should focus on creating seamless customer experiences and mutual value creation.

Data analytics capabilities should be enhanced to improve risk assessment, pricing accuracy, and customer insights. The integration of IoT data, property information, and customer behavior analytics can enable more sophisticated underwriting and personalized product offerings. Investment in data infrastructure and analytical capabilities will support competitive advantages and operational efficiency improvements.

Customer education initiatives remain important for market expansion, particularly in segments with lower insurance awareness or penetration rates. Educational programs that explain coverage benefits, claims processes, and risk management can drive market growth while improving customer satisfaction. These initiatives should leverage digital channels and community partnerships to maximize reach and effectiveness.

Market growth prospects for Singapore’s home insurance sector remain positive, supported by continued property market development, increasing consumer awareness, and technological innovation. MarkWide Research projects sustained expansion driven by demographic trends, regulatory support, and evolving consumer expectations for comprehensive protection. The market’s maturity level provides stability while innovation opportunities create potential for enhanced growth rates.

Technology integration will continue to reshape the industry landscape, with artificial intelligence, machine learning, and IoT technologies becoming standard components of insurance operations. These technological advances will enable more accurate risk assessment, personalized pricing, and proactive risk management approaches that benefit both insurers and customers. The successful integration of technology will determine competitive positioning in the future market.

Regulatory evolution is expected to continue supporting market development through enhanced consumer protection measures and innovation-friendly policies. The balance between consumer protection and market innovation will remain a key focus for regulatory authorities, with initiatives likely to support digital transformation while maintaining market stability and integrity.

Consumer behavior trends indicate continued preference for digital channels, personalized products, and comprehensive coverage options. Future market success will depend on insurers’ ability to meet these evolving expectations while maintaining competitive pricing and service quality. The integration of insurance with broader financial services and property management platforms will become increasingly important for customer retention and satisfaction.

Regional expansion opportunities may emerge as Singapore-based insurers leverage their expertise to serve similar markets across Southeast Asia. The experience gained in Singapore’s sophisticated market environment provides valuable capabilities that can be applied in developing insurance markets throughout the region, creating growth opportunities beyond domestic boundaries.

Singapore’s home insurance market represents a dynamic and sophisticated sector that continues to evolve in response to changing consumer needs, technological advancement, and regulatory development. The market’s strong foundation, built on regulatory stability, economic prosperity, and consumer sophistication, provides an excellent platform for continued growth and innovation. Key success factors include digital transformation capabilities, product innovation, and customer-centric service delivery that meets the evolving expectations of Singapore’s educated and affluent population.

Future market development will be shaped by technological integration, regulatory evolution, and changing consumer preferences that favor convenience, personalization, and comprehensive protection. Insurers that successfully navigate these trends while maintaining operational efficiency and competitive pricing will capture the greatest opportunities for growth and market leadership. The market’s maturity level supports sustainable development while innovation opportunities create potential for enhanced value creation for all stakeholders.

Strategic positioning for long-term success requires balanced investment in technology, product development, and customer experience enhancement. The Singapore home insurance market’s future remains bright, supported by fundamental economic and demographic trends that drive continued demand for property protection. Market participants that embrace innovation while maintaining focus on customer value and operational excellence will thrive in this evolving landscape, contributing to the overall strength and sophistication of Singapore’s insurance sector.

What is Home Insurance?

Home insurance is a type of property insurance that covers private residences. It provides financial protection against damages to the home and its contents, as well as liability coverage for accidents that may occur on the property.

What are the key players in the Singapore Home Insurance Market?

Key players in the Singapore Home Insurance Market include companies like NTUC Income, AIG Singapore, and AXA Insurance. These companies offer a variety of home insurance products tailored to meet the needs of homeowners, among others.

What are the growth factors driving the Singapore Home Insurance Market?

The growth of the Singapore Home Insurance Market is driven by factors such as increasing property ownership, rising awareness of the importance of insurance, and the growing trend of home renovations. Additionally, urbanization and the need for financial security contribute to market expansion.

What challenges does the Singapore Home Insurance Market face?

The Singapore Home Insurance Market faces challenges such as intense competition among insurers, the need for continuous innovation in product offerings, and the impact of natural disasters on claims. Additionally, regulatory changes can also pose challenges for insurance providers.

What opportunities exist in the Singapore Home Insurance Market?

Opportunities in the Singapore Home Insurance Market include the potential for digital transformation in policy management and claims processing. There is also a growing demand for customized insurance solutions that cater to specific homeowner needs, as well as the integration of smart home technology.

What trends are shaping the Singapore Home Insurance Market?

Trends shaping the Singapore Home Insurance Market include the increasing adoption of technology for underwriting and claims management, the rise of eco-friendly insurance products, and a focus on customer-centric services. Additionally, the use of data analytics is becoming more prevalent in assessing risk and pricing policies.

Singapore Home Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Building Coverage, Contents Coverage, Personal Liability, Additional Living Expenses |

| Customer Type | Homeowners, Tenants, Landlords, Investors |

| Coverage Type | Comprehensive, Basic, Named Perils, All Risks |

| Distribution Channel | Online, Agents, Brokers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Singapore Home Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at