444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Singapore aerospace industry market represents one of the most dynamic and strategically important sectors in Southeast Asia’s economic landscape. Singapore has established itself as a premier aerospace hub, leveraging its strategic location, world-class infrastructure, and supportive government policies to attract global aerospace manufacturers, maintenance providers, and technology innovators. The industry encompasses aircraft manufacturing, maintenance repair and overhaul (MRO) services, aerospace engineering, and advanced technology development.

Market dynamics indicate robust growth driven by increasing air travel demand, fleet modernization initiatives, and Singapore’s position as a regional aviation gateway. The sector benefits from the country’s excellent connectivity, skilled workforce, and business-friendly environment. With major international players establishing significant operations in Singapore, the market continues to expand at a compound annual growth rate of 6.2%, reflecting strong fundamentals and strategic positioning.

Government support through initiatives like the Aerospace Transformation Programme and substantial investments in research and development have strengthened Singapore’s competitive advantage. The industry’s focus on innovation, sustainability, and digital transformation aligns with global aerospace trends, positioning Singapore as a leader in next-generation aerospace technologies and services.

The Singapore aerospace industry market refers to the comprehensive ecosystem of aerospace-related activities, companies, and services operating within Singapore’s borders. This includes aircraft manufacturing, component production, maintenance repair and overhaul services, aerospace engineering, research and development, and supporting infrastructure that collectively contribute to the nation’s aerospace capabilities and economic growth.

Industry scope encompasses both commercial and defense aerospace sectors, featuring original equipment manufacturers (OEMs), tier-one suppliers, MRO service providers, technology developers, and educational institutions. The market represents Singapore’s strategic positioning as a regional aerospace hub, facilitating connectivity between global aerospace supply chains and Asian markets.

Economic significance extends beyond direct aerospace activities to include logistics, finance, insurance, and professional services that support the industry. Singapore’s aerospace market serves as a critical component of the country’s advanced manufacturing strategy and its vision to become a global innovation hub in high-technology industries.

Singapore’s aerospace industry has emerged as a cornerstone of the nation’s advanced manufacturing sector, demonstrating remarkable resilience and growth potential. The market benefits from strategic government investments, world-class infrastructure, and a highly skilled workforce that supports both established aerospace giants and innovative startups. Current market conditions reflect strong demand across multiple segments, with MRO services accounting for approximately 45% of total industry activity.

Key performance indicators highlight the industry’s robust health, with employment in the aerospace sector growing by 8.3% annually over the past five years. The market’s diversification across commercial aviation, defense, and emerging technologies like urban air mobility positions Singapore favorably for sustained growth. Major international aerospace companies have established regional headquarters and manufacturing facilities, contributing to technology transfer and local capability development.

Strategic initiatives including the Aerospace Industry Transformation Map and significant R&D investments in sustainable aviation technologies demonstrate Singapore’s commitment to maintaining its competitive edge. The industry’s focus on digitalization, automation, and green technologies aligns with global aerospace trends and customer demands for more efficient, environmentally friendly solutions.

Market analysis reveals several critical insights that define Singapore’s aerospace industry landscape:

Growth drivers propelling Singapore’s aerospace industry forward encompass both domestic factors and global aerospace trends. The increasing demand for air travel across Asia-Pacific, driven by rising middle-class populations and economic growth, creates substantial opportunities for aerospace companies operating from Singapore. Regional airlines are expanding their fleets and upgrading existing aircraft, generating significant demand for manufacturing, MRO services, and component supply.

Government initiatives play a crucial role in market expansion, with targeted investments in aerospace infrastructure, research facilities, and skills development programs. The Aerospace Industry Transformation Map outlines strategic priorities for technology advancement, workforce development, and market expansion. These initiatives have attracted major international aerospace companies to establish significant operations in Singapore, creating a multiplier effect throughout the industry ecosystem.

Technological advancement serves as another key driver, with Singapore positioning itself at the forefront of aerospace innovation. The focus on sustainable aviation technologies, digital transformation, and advanced manufacturing processes aligns with global industry trends and customer demands. Singapore’s aerospace companies are investing heavily in research and development, particularly in areas like electric aircraft, autonomous systems, and smart manufacturing technologies.

Regional connectivity continues to strengthen Singapore’s position as an aerospace hub, with excellent air, sea, and digital connections facilitating efficient supply chain operations and market access. The country’s strategic location enables aerospace companies to serve customers across Asia-Pacific while maintaining connections to global markets and suppliers.

Market challenges facing Singapore’s aerospace industry include several structural and cyclical factors that require strategic management. High operational costs, particularly labor and real estate expenses, can impact competitiveness compared to other regional aerospace hubs. While Singapore offers numerous advantages, companies must carefully manage cost structures to maintain profitability and competitive pricing.

Talent competition represents another significant restraint, as the global aerospace industry competes for skilled professionals in engineering, manufacturing, and technology development. Singapore’s small domestic talent pool requires continuous investment in education, training, and international talent attraction programs. The industry faces ongoing challenges in recruiting and retaining specialized professionals, particularly in emerging technology areas.

Supply chain dependencies create potential vulnerabilities, as Singapore’s aerospace industry relies heavily on global supply networks for raw materials, components, and specialized equipment. Disruptions in international trade, geopolitical tensions, or supply chain bottlenecks can impact operations and project timelines. Companies must develop resilient supply chain strategies and local sourcing capabilities where possible.

Regulatory complexity in the aerospace industry requires significant compliance investments and expertise. International aviation regulations, safety standards, and certification requirements create barriers to entry and ongoing operational challenges. Smaller companies may struggle with the resources required for comprehensive regulatory compliance and certification processes.

Emerging opportunities in Singapore’s aerospace industry are driven by technological innovation, market expansion, and evolving customer needs. The growing focus on sustainable aviation presents significant opportunities for companies developing electric aircraft, sustainable aviation fuels, and carbon-neutral technologies. Singapore’s commitment to environmental sustainability and its strong research capabilities position the country well to capitalize on the green aviation transition.

Urban air mobility represents a transformative opportunity, with Singapore actively exploring applications for electric vertical takeoff and landing (eVTOL) aircraft in urban transportation. The country’s compact geography, advanced infrastructure, and supportive regulatory environment make it an ideal testbed for urban air mobility solutions. Companies involved in eVTOL development, infrastructure, and operations can benefit from Singapore’s progressive approach to emerging aviation technologies.

Digital transformation across the aerospace industry creates opportunities for Singapore-based companies to develop and deploy advanced technologies. Areas like predictive maintenance, supply chain optimization, digital twins, and autonomous systems offer significant growth potential. Singapore’s strong technology sector and aerospace expertise create synergies for developing innovative digital solutions.

Regional market expansion provides opportunities for Singapore aerospace companies to serve growing markets across Southeast Asia, India, and China. The region’s economic growth, increasing air travel demand, and fleet modernization requirements create substantial market opportunities for companies with Singapore operations. Strategic partnerships and joint ventures can facilitate market entry and expansion across the region.

Market dynamics in Singapore’s aerospace industry reflect the interplay of global aerospace trends, regional economic conditions, and local competitive factors. The industry operates within a complex ecosystem where technological innovation, regulatory requirements, and market demand create both opportunities and challenges. MarkWide Research analysis indicates that market dynamics are increasingly influenced by sustainability requirements, digital transformation, and supply chain resilience considerations.

Competitive dynamics feature both collaboration and competition among industry participants, with companies forming strategic partnerships to access new markets, share development costs, and leverage complementary capabilities. The presence of major international aerospace companies alongside local firms creates a dynamic environment that fosters innovation and knowledge transfer. Competition for talent, customers, and government support drives continuous improvement and strategic differentiation.

Technology cycles significantly impact market dynamics, with aerospace companies investing heavily in next-generation technologies while maintaining existing product lines and services. The industry’s long development cycles and high capital requirements create both stability and challenges, as companies must balance current market demands with future technology investments. Digital transformation initiatives are accelerating, with companies adopting new technologies to improve efficiency and competitiveness.

Regulatory dynamics continue to evolve, with international aviation authorities updating safety standards, environmental requirements, and certification processes. Singapore’s aerospace companies must navigate complex regulatory environments while maintaining compliance across multiple jurisdictions. The country’s strong regulatory framework and international cooperation facilitate market access and operational efficiency.

Research approach for analyzing Singapore’s aerospace industry market employs comprehensive methodologies combining primary and secondary research techniques. The analysis incorporates data from industry associations, government agencies, company reports, and expert interviews to provide accurate and current market insights. Quantitative analysis focuses on market trends, growth patterns, and performance metrics, while qualitative research explores strategic factors, competitive dynamics, and future opportunities.

Data collection methods include structured interviews with industry executives, government officials, and academic researchers to gather firsthand insights into market conditions and trends. Secondary research encompasses analysis of industry publications, government statistics, company financial reports, and international aerospace market studies. The methodology ensures comprehensive coverage of all major market segments and stakeholders.

Analytical framework applies established market research techniques including SWOT analysis, Porter’s Five Forces model, and value chain analysis to understand competitive dynamics and strategic positioning. Trend analysis and forecasting models help identify future market directions and growth opportunities. The research methodology emphasizes accuracy, objectivity, and practical relevance for industry stakeholders and decision-makers.

Validation processes ensure research findings are accurate and reliable through cross-referencing multiple data sources, expert review, and statistical verification. The methodology includes regular updates to reflect changing market conditions and emerging trends. Quality assurance measures maintain high standards for data accuracy and analytical rigor throughout the research process.

Singapore’s position within the broader Asia-Pacific aerospace market demonstrates the country’s strategic importance and competitive advantages. The region accounts for approximately 35% of global aerospace market growth, with Singapore serving as a critical hub connecting regional and international markets. The country’s aerospace industry benefits from strong regional demand while maintaining global market access through excellent connectivity and infrastructure.

Competitive positioning relative to other regional aerospace hubs shows Singapore’s strengths in high-value activities like MRO services, engineering, and technology development. While countries like China and India offer lower-cost manufacturing capabilities, Singapore differentiates itself through quality, innovation, and strategic location advantages. The country’s aerospace industry captures approximately 12% of regional MRO market share, reflecting its strong competitive position.

Market integration with neighboring countries creates opportunities for supply chain optimization and market expansion. Singapore aerospace companies serve customers across Southeast Asia, leveraging the country’s excellent logistics infrastructure and business environment. Regional trade agreements and economic partnerships facilitate market access and operational efficiency for Singapore-based aerospace companies.

Growth patterns across the Asia-Pacific region indicate continued expansion in air travel demand, fleet modernization, and aerospace services. Singapore’s aerospace industry is well-positioned to benefit from regional growth trends while contributing to the development of aerospace capabilities across Southeast Asia. The country’s role as a regional innovation hub supports technology transfer and capability development throughout the region.

Market leaders in Singapore’s aerospace industry include both international corporations and local companies that have established significant operations and capabilities. The competitive landscape features a mix of original equipment manufacturers, service providers, and technology companies that collectively create a comprehensive aerospace ecosystem.

Competitive strategies focus on innovation, operational excellence, and strategic partnerships to maintain market position and drive growth. Companies invest heavily in research and development, particularly in sustainable aviation technologies and digital solutions. Strategic alliances and joint ventures enable market expansion and capability development while sharing risks and costs.

Market segmentation of Singapore’s aerospace industry reveals distinct categories based on activity type, customer segments, and technology applications. Each segment demonstrates unique characteristics, growth patterns, and competitive dynamics that contribute to the overall industry ecosystem.

By Activity Type:

By Customer Segment:

By Technology Focus:

Manufacturing segment represents a significant portion of Singapore’s aerospace industry, with companies producing aircraft components, systems, and complete aircraft. The segment benefits from Singapore’s advanced manufacturing capabilities, skilled workforce, and strategic location for serving regional and global markets. Manufacturing activities focus increasingly on high-value, technology-intensive products that leverage Singapore’s innovation capabilities and quality standards.

MRO services constitute the largest segment of Singapore’s aerospace industry, with the country serving as a regional hub for aircraft maintenance and repair services. The segment captures approximately 45% of total industry activity, reflecting Singapore’s strategic position and comprehensive service capabilities. MRO providers serve airlines across Asia-Pacific while maintaining global customer relationships and certifications.

Engineering services demonstrate strong growth potential as aerospace companies increasingly outsource design and development activities to specialized providers. Singapore’s engineering capabilities span multiple aerospace disciplines, from aerodynamics and structures to avionics and systems integration. The segment benefits from the country’s strong educational institutions and research infrastructure that support advanced engineering capabilities.

Research and development activities focus on emerging technologies like sustainable aviation, urban air mobility, and digital solutions. Singapore’s aerospace R&D benefits from government support, international collaboration, and strong links between industry and academia. The segment plays a crucial role in positioning Singapore at the forefront of aerospace innovation and technology development.

Strategic advantages for companies operating in Singapore’s aerospace industry include access to regional markets, world-class infrastructure, and supportive business environment. Companies benefit from Singapore’s strategic location, which provides efficient access to major Asian markets while maintaining global connectivity. The country’s excellent logistics infrastructure, including Changi Airport and Seletar Aerospace Park, supports efficient operations and supply chain management.

Operational benefits include access to a highly skilled workforce, advanced manufacturing facilities, and comprehensive support services. Singapore’s aerospace industry ecosystem provides companies with access to specialized suppliers, service providers, and research institutions that support operational excellence and innovation. The country’s strong regulatory framework and international agreements facilitate market access and operational efficiency.

Innovation advantages stem from Singapore’s commitment to research and development, technology advancement, and knowledge creation. Companies benefit from government incentives for R&D activities, access to research institutions, and collaboration opportunities with international partners. The focus on emerging technologies like sustainable aviation and digital solutions positions Singapore aerospace companies at the forefront of industry innovation.

Market access benefits include preferential trade agreements, strong diplomatic relationships, and excellent connectivity to global markets. Singapore’s aerospace companies can efficiently serve customers across Asia-Pacific while maintaining access to international markets and supply chains. The country’s reputation for quality and reliability enhances market access and customer confidence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping Singapore’s aerospace industry, with companies investing heavily in sustainable aviation technologies, carbon-neutral operations, and environmental compliance. The industry is developing electric aircraft, sustainable aviation fuels, and carbon offset programs to meet growing environmental requirements. Singapore’s aerospace companies are positioning themselves as leaders in sustainable aviation solutions, with 78% of major companies implementing comprehensive sustainability programs.

Digital transformation continues to accelerate across all segments of Singapore’s aerospace industry, with companies adopting artificial intelligence, machine learning, and advanced analytics to improve operations and customer service. Digital technologies enable predictive maintenance, supply chain optimization, and enhanced customer experiences. The adoption of Industry 4.0 technologies is transforming manufacturing processes and service delivery models.

Urban air mobility emergence creates new market opportunities as Singapore explores applications for electric vertical takeoff and landing aircraft in urban transportation. The country’s compact geography and advanced infrastructure make it an ideal environment for testing and deploying urban air mobility solutions. Regulatory frameworks and infrastructure development are advancing to support this emerging market segment.

Supply chain localization trends reflect efforts to reduce dependencies and improve resilience through regional supplier development and local capability building. Singapore aerospace companies are investing in local supplier networks and regional partnerships to enhance supply chain security and efficiency. This trend supports the development of aerospace capabilities across Southeast Asia while strengthening Singapore’s position as a regional hub.

Major investments in Singapore’s aerospace industry include significant facility expansions, technology development programs, and strategic partnerships that strengthen the country’s competitive position. Recent developments include new manufacturing facilities, research centers, and training institutes that enhance Singapore’s aerospace capabilities and capacity.

Technology partnerships between Singapore aerospace companies and international partners are advancing innovation in sustainable aviation, digital solutions, and advanced manufacturing. These collaborations leverage Singapore’s strategic position and capabilities while accessing global expertise and markets. Joint ventures and strategic alliances are creating new opportunities for technology development and market expansion.

Regulatory developments include new certification frameworks for urban air mobility, updated safety standards, and environmental regulations that shape industry operations. Singapore’s progressive regulatory approach supports innovation while maintaining high safety and quality standards. The country’s regulatory framework serves as a model for other markets in the region.

Workforce development initiatives include new training programs, educational partnerships, and skills development schemes that address industry talent needs. Singapore’s aerospace industry works closely with educational institutions to develop specialized programs and ensure workforce readiness for emerging technologies and market requirements.

Strategic recommendations for Singapore’s aerospace industry focus on maintaining competitive advantages while addressing emerging challenges and opportunities. MWR analysis suggests that companies should prioritize sustainability initiatives, digital transformation, and regional market expansion to ensure long-term success. Investment in emerging technologies like urban air mobility and sustainable aviation will be critical for maintaining Singapore’s leadership position.

Operational improvements should focus on cost optimization, supply chain resilience, and workforce development to enhance competitiveness. Companies should explore automation opportunities, regional sourcing strategies, and strategic partnerships to improve operational efficiency and reduce costs. Continuous investment in employee training and development will be essential for maintaining technical capabilities and innovation capacity.

Market expansion strategies should leverage Singapore’s strategic position and capabilities to access growing regional markets while maintaining global competitiveness. Companies should consider strategic partnerships, joint ventures, and local presence in key markets to capture growth opportunities. Focus on high-value services and technology-intensive products will help differentiate Singapore aerospace companies in competitive markets.

Innovation investment should prioritize areas with strong growth potential and alignment with Singapore’s competitive advantages. Sustainable aviation technologies, digital solutions, and urban air mobility represent key areas for strategic investment. Collaboration with research institutions, government agencies, and international partners will be essential for successful innovation and technology development.

Growth projections for Singapore’s aerospace industry indicate continued expansion driven by regional market growth, technology advancement, and strategic positioning. The industry is expected to maintain strong growth momentum with a projected compound annual growth rate of 6.2% over the next five years. This growth will be supported by increasing air travel demand, fleet modernization requirements, and Singapore’s strategic investments in aerospace capabilities.

Technology evolution will significantly shape the industry’s future, with sustainable aviation, digital transformation, and urban air mobility creating new market opportunities and competitive dynamics. Singapore’s aerospace companies are well-positioned to capitalize on these trends through strategic investments, partnerships, and innovation initiatives. The integration of artificial intelligence, advanced materials, and electric propulsion technologies will transform aerospace operations and service delivery.

Market expansion opportunities across Asia-Pacific will drive growth for Singapore aerospace companies, with regional markets expected to account for 60% of industry growth over the next decade. Singapore’s strategic position and comprehensive capabilities provide competitive advantages for serving expanding regional markets while maintaining global market access. Strategic partnerships and local presence will be key success factors for market expansion.

Sustainability requirements will increasingly influence industry development, with environmental regulations, customer demands, and corporate commitments driving investment in sustainable aviation technologies. Singapore’s aerospace industry is positioning itself as a leader in sustainable aviation solutions, with significant investments in research, development, and implementation of environmentally friendly technologies and practices.

Singapore’s aerospace industry represents a dynamic and strategically important sector that has successfully established itself as a regional hub for aerospace manufacturing, services, and innovation. The industry’s strong fundamentals, including strategic location, world-class infrastructure, skilled workforce, and supportive government policies, provide a solid foundation for continued growth and development. With major international companies establishing significant operations alongside successful local firms, Singapore has created a comprehensive aerospace ecosystem that serves both regional and global markets.

Future prospects remain highly positive, with the industry well-positioned to capitalize on emerging opportunities in sustainable aviation, urban air mobility, and digital transformation. The focus on innovation, quality, and strategic partnerships will be essential for maintaining competitive advantages and driving continued growth. Singapore’s aerospace industry is expected to play an increasingly important role in the country’s advanced manufacturing strategy and its vision to become a global innovation hub.

Strategic success will depend on the industry’s ability to adapt to changing market conditions, embrace new technologies, and maintain its competitive positioning in an increasingly dynamic global aerospace market. With strong government support, continued investment in capabilities, and strategic focus on high-value activities, Singapore’s aerospace industry is well-prepared to navigate future challenges and capitalize on emerging opportunities in the evolving aerospace landscape.

What is Singapore Aerospace Industry?

The Singapore Aerospace Industry encompasses the design, manufacturing, and maintenance of aircraft and aerospace components. It includes various segments such as commercial aviation, military aviation, and space technology.

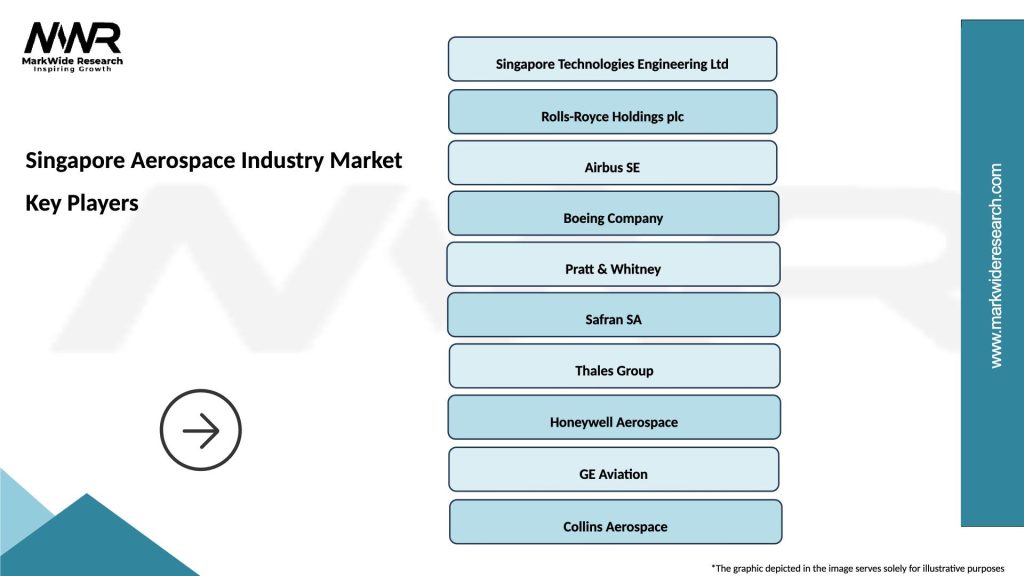

What are the key players in the Singapore Aerospace Industry Market?

Key players in the Singapore Aerospace Industry Market include Singapore Technologies Aerospace, Rolls-Royce, and Boeing. These companies are involved in various aspects of aerospace manufacturing and services, contributing significantly to the industry’s growth.

What are the growth factors driving the Singapore Aerospace Industry Market?

The growth of the Singapore Aerospace Industry Market is driven by increasing air travel demand, advancements in aerospace technology, and the strategic location of Singapore as a regional aviation hub. Additionally, government support and investment in aerospace research and development play a crucial role.

What challenges does the Singapore Aerospace Industry Market face?

The Singapore Aerospace Industry Market faces challenges such as high operational costs, competition from emerging markets, and the need for continuous innovation. Additionally, regulatory compliance and environmental concerns are significant factors that companies must navigate.

What opportunities exist in the Singapore Aerospace Industry Market?

Opportunities in the Singapore Aerospace Industry Market include the expansion of unmanned aerial vehicles (UAVs), growth in space exploration initiatives, and the development of sustainable aviation technologies. These areas present potential for innovation and investment.

What trends are shaping the Singapore Aerospace Industry Market?

Trends shaping the Singapore Aerospace Industry Market include the increasing adoption of digital technologies, such as artificial intelligence and data analytics, in aircraft maintenance and operations. Additionally, there is a growing focus on sustainability and reducing carbon emissions in aviation.

Singapore Aerospace Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Commercial Aircraft, Military Aircraft, Helicopters, Drones |

| Technology | Avionics, Propulsion Systems, Composite Materials, Navigation Systems |

| End User | Aerospace OEMs, Maintenance Repair Overhaul (MRO) Providers, Government Agencies, Airlines |

| Application | Passenger Transport, Cargo Transport, Surveillance, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Singapore Aerospace Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at