444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Si-OLED microdisplay market is witnessing robust growth due to the increasing demand for high-resolution displays in applications such as augmented reality (AR), virtual reality (VR), and heads-up displays (HUDs). Si-OLED microdisplays offer superior image quality, energy efficiency, and compactness compared to traditional display technologies, driving their adoption across various industries.

Meaning

Si-OLED microdisplays, also known as silicon-based organic light-emitting diode microdisplays, are advanced display panels that utilize organic compounds to emit light when an electric current is applied. These microdisplays are integrated into electronic devices such as AR glasses, VR headsets, and HUDs to provide users with immersive visual experiences. The combination of silicon technology and OLEDs enables Si-OLED microdisplays to deliver high-resolution images, vibrant colors, and low power consumption, making them ideal for portable and wearable applications.

Executive Summary

The Si-OLED microdisplay market is experiencing rapid growth, driven by increasing demand for compact, high-resolution displays in consumer electronics, automotive, healthcare, and aerospace industries. Key market players are focusing on developing innovative Si-OLED microdisplay solutions with enhanced brightness, efficiency, and reliability to meet the evolving needs of end-users. With advancements in microdisplay technology and expanding application areas, the Si-OLED microdisplay market presents lucrative opportunities for manufacturers and suppliers worldwide.

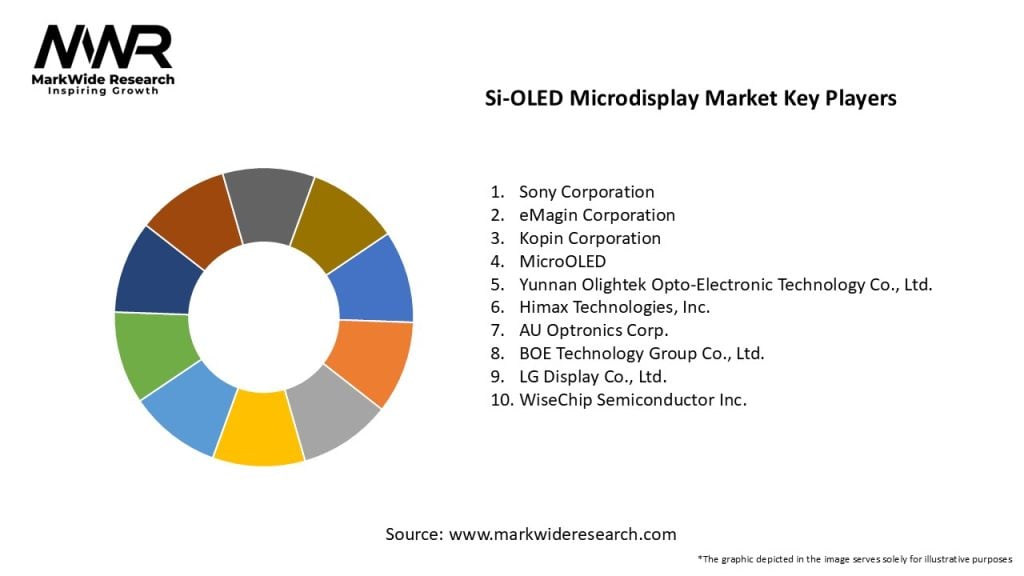

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The Si-OLED microdisplay market is propelled by several factors:

Market Restraints

Despite the favorable market conditions, the Si-OLED microdisplay market faces some challenges:

Market Opportunities

Despite the challenges, the Si-OLED microdisplay market offers significant growth opportunities:

Market Dynamics

The Si-OLED microdisplay market is characterized by dynamic trends and evolving consumer preferences influenced by technological advancements, industry regulations, competitive dynamics, and macroeconomic factors. Key market players must anticipate and respond to these market dynamics by adopting agile business strategies, fostering innovation, and forging strategic partnerships to maintain their competitive edge and capitalize on emerging opportunities.

Regional Analysis

The Si-OLED microdisplay market exhibits varying trends and growth prospects across different regions:

Competitive Landscape

Leading Companies in the Si-OLED Microdisplay Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Si-OLED microdisplay market can be segmented based on various factors, including:

Category-wise Insights

Each category of Si-OLED microdisplays offers unique features, benefits, and applications tailored to different industries and end-user requirements:

Key Benefits for Industry Participants and Stakeholders

The Si-OLED microdisplay market offers several benefits for manufacturers, suppliers, and end-users:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the Si-OLED microdisplay market:

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the Si-OLED microdisplay market:

Key Industry Developments

Analyst Suggestions

Based on market trends and developments, analysts suggest the following strategies for industry participants:

Future Outlook

The future outlook for the Si-OLED microdisplay market is promising, with continued growth and innovation expected in the coming years. As demand for high-resolution displays in AR/VR devices, automotive HUDs, and wearable electronics continues to rise, Si-OLED microdisplay manufacturers are poised to capitalize on these opportunities by offering advanced display solutions tailored to diverse applications and end-user requirements. By embracing technological advancements, fostering collaboration, and staying attuned to market dynamics, industry participants can navigate challenges and unlock the full potential of the Si-OLED microdisplay market.

Conclusion

In conclusion, the Si-OLED microdisplay market represents a dynamic and rapidly evolving segment of the display industry, driven by advancements in OLED technology, increasing adoption of AR/VR applications, and growing demand for compact and energy-efficient display solutions. Despite challenges such as high production costs, supply chain disruptions, and competitive pressures, the market offers significant growth opportunities for manufacturers, suppliers, and end-users seeking immersive visual experiences, enhanced productivity, and innovative product solutions. By embracing innovation, collaboration, and sustainability, industry participants can position themselves for success and contribute to the continued advancement of Si-OLED microdisplay technology in the global marketplace.

What is Si-OLED Microdisplay?

Si-OLED Microdisplay refers to a type of display technology that utilizes organic light-emitting diodes (OLEDs) on a silicon substrate, enabling high-resolution images and efficient power consumption. This technology is commonly used in applications such as augmented reality (AR), virtual reality (VR), and wearable devices.

What are the key players in the Si-OLED Microdisplay Market?

Key players in the Si-OLED Microdisplay Market include Sony Corporation, MicroOLED, eMagin Corporation, and OLEDWorks, among others. These companies are actively involved in the development and commercialization of advanced microdisplay technologies for various applications.

What are the growth factors driving the Si-OLED Microdisplay Market?

The Si-OLED Microdisplay Market is driven by the increasing demand for high-resolution displays in AR and VR applications, advancements in display technology, and the growing adoption of wearable devices. Additionally, the need for energy-efficient display solutions is propelling market growth.

What challenges does the Si-OLED Microdisplay Market face?

The Si-OLED Microdisplay Market faces challenges such as high manufacturing costs, technical complexities in production, and competition from alternative display technologies like LCD and microLED. These factors can hinder market expansion and adoption.

What opportunities exist in the Si-OLED Microdisplay Market?

Opportunities in the Si-OLED Microdisplay Market include the potential for innovation in display applications, such as in automotive displays and smart glasses. The growing interest in immersive technologies also presents avenues for market growth.

What trends are shaping the Si-OLED Microdisplay Market?

Trends shaping the Si-OLED Microdisplay Market include the miniaturization of display components, the integration of artificial intelligence in display technologies, and the increasing focus on enhancing user experience in AR and VR environments. These trends are influencing product development and market strategies.

Si-OLED Microdisplay Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Displays, Head-Mounted Displays, Projectors, Smart Glasses |

| Application | Virtual Reality, Augmented Reality, Automotive Displays, Medical Imaging |

| End User | Consumer Electronics, Healthcare, Defense, Industrial |

| Technology | MicroLED, OLED, LCD, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Si-OLED Microdisplay Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at