444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The serum substitutes market serves as a crucial component in cell culture and tissue engineering applications, offering alternatives to traditional fetal bovine serum (FBS). Serum substitutes are designed to provide essential nutrients, growth factors, and cytokines necessary for cell growth and proliferation, while mitigating the risks associated with using animal-derived sera. These substitutes are widely used in research laboratories, biopharmaceutical companies, and academic institutions for various cell culture applications, including cell therapy, vaccine production, and regenerative medicine.

Meaning

Serum substitutes refer to chemically defined formulations containing growth factors, hormones, and supplements that mimic the nutritional composition of fetal bovine serum (FBS) without using animal-derived components. These substitutes offer a safe and standardized alternative for supporting cell growth and viability in vitro, reducing batch-to-batch variability, and meeting regulatory requirements for cell-based therapies and biomanufacturing processes.

Executive Summary

The serum substitutes market is experiencing significant growth, driven by the rising demand for animal-free cell culture solutions, advancements in biotechnology, and increasing regulatory scrutiny on the use of animal-derived sera. Key market players are focusing on developing serum-free formulations, optimizing media compositions, and expanding product portfolios to cater to diverse research needs and application requirements. However, challenges such as high development costs, limited scalability, and performance variability remain significant barriers to market growth.

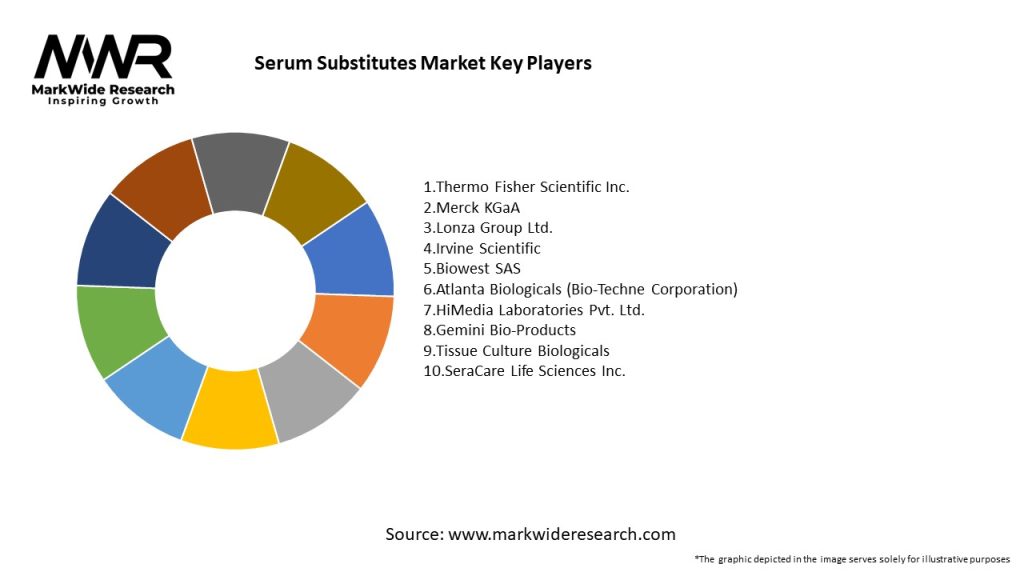

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The serum substitutes market operates in a dynamic environment influenced by various factors, including technological advancements, regulatory changes, competitive pressures, and market trends. Understanding these dynamics is essential for market players to identify opportunities, mitigate risks, and formulate effective strategies to navigate the evolving landscape and achieve long-term success in the global cell culture market.

Regional Analysis

The serum substitutes market exhibits regional variations influenced by factors such as regulatory frameworks, research infrastructure, biopharmaceutical industry trends, and market dynamics. Key regions contributing to market growth include:

Competitive Landscape

Leading Companies in the Serum Substitutes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

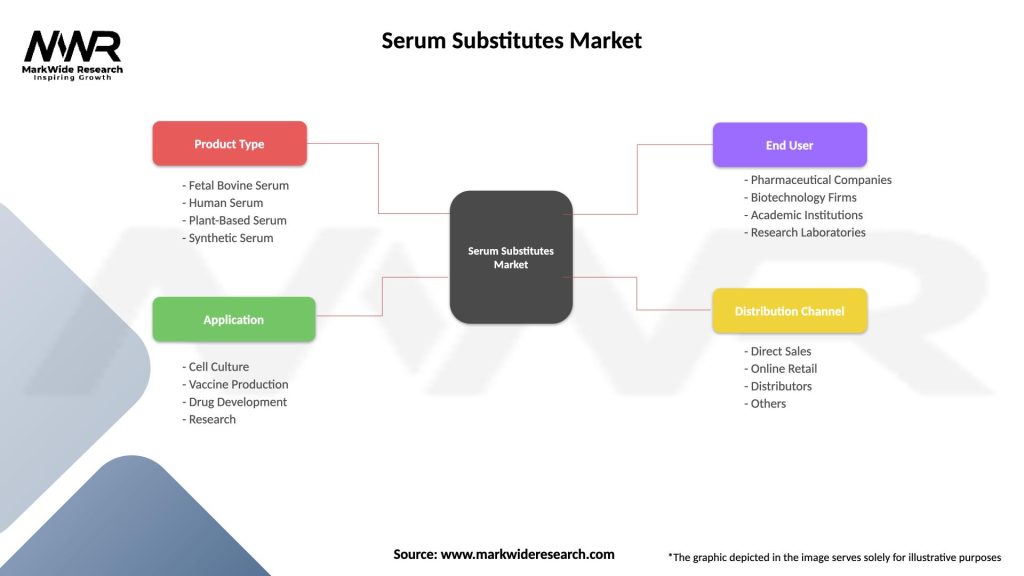

Segmentation

The serum substitutes market can be segmented based on various factors, including:

Segmentation provides insights into market dynamics, customer preferences, and demand trends, enabling companies to tailor their product offerings, marketing strategies, and distribution channels to specific market segments and geographic regions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The serum substitutes market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats in the serum substitutes market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the serum substitutes market, influencing demand dynamics, supply chain operations, and research priorities across the biopharmaceutical and life sciences sectors:

Key Industry Developments

Analyst Suggestion

Future Outlook

The serum substitutes market is poised for significant growth and innovation in the coming years, driven by advancements in cell culture technologies, increasing adoption of serum-free and chemically defined media formulations, and growing demand for animal-free cell culture solutions across diverse research, clinical, and industrial applications. Key trends shaping the future outlook of the serum substitutes market include:

Conclusion

In summary, the serum substitutes market is poised for robust growth and innovation, driven by advancements in cell culture technologies, expanding applications in regenerative medicine and cell therapy, and increasing emphasis on personalized medicine and precision healthcare solutions. Continued investments in research and development, regulatory compliance, and market expansion initiatives are expected to shape the future landscape of the serum substitutes market and drive its evolution as a key enabler of advanced biopharmaceutical development and personalized therapeutics.

What is Serum Substitutes?

Serum substitutes are products designed to replace animal serum in various applications, particularly in cell culture and biotechnology. They provide essential nutrients and growth factors necessary for cell growth and maintenance without the ethical and supply chain issues associated with animal-derived serum.

What are the key players in the Serum Substitutes Market?

Key players in the Serum Substitutes Market include Thermo Fisher Scientific, Merck KGaA, and Corning Incorporated, among others. These companies are known for their innovative products and extensive research in developing serum-free alternatives for various applications.

What are the growth factors driving the Serum Substitutes Market?

The Serum Substitutes Market is driven by the increasing demand for animal-free products in research and biopharmaceutical manufacturing. Additionally, advancements in cell culture technologies and a growing focus on ethical sourcing are contributing to market growth.

What challenges does the Serum Substitutes Market face?

Challenges in the Serum Substitutes Market include the high cost of production and the need for extensive validation of serum-free products. Additionally, variability in product performance compared to traditional serum can hinder adoption in some applications.

What opportunities exist in the Serum Substitutes Market?

The Serum Substitutes Market presents opportunities for innovation in product development, particularly in creating customized formulations for specific cell types. The growing trend towards sustainable and ethical research practices also opens new avenues for market expansion.

What trends are shaping the Serum Substitutes Market?

Trends in the Serum Substitutes Market include the increasing adoption of serum-free media in cell therapy and regenerative medicine. Additionally, there is a rising interest in plant-based and synthetic alternatives to traditional serum, reflecting broader sustainability goals in the life sciences.

Serum Substitutes Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fetal Bovine Serum, Human Serum, Plant-Based Serum, Synthetic Serum |

| Application | Cell Culture, Vaccine Production, Drug Development, Research |

| End User | Pharmaceutical Companies, Biotechnology Firms, Academic Institutions, Research Laboratories |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Serum Substitutes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at