444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The sensors in oil and gas market represents a critical technological foundation driving operational excellence, safety, and efficiency across upstream, midstream, and downstream operations. Advanced sensor technologies have become indispensable for monitoring pressure, temperature, flow rates, chemical composition, and environmental conditions throughout the entire oil and gas value chain. The market encompasses diverse sensor types including pressure sensors, temperature sensors, flow sensors, level sensors, and specialized gas detection sensors designed to withstand harsh industrial environments.

Market dynamics indicate robust growth driven by increasing automation requirements, stringent safety regulations, and the industry’s digital transformation initiatives. The integration of Internet of Things (IoT) capabilities with traditional sensor technologies has created new opportunities for real-time monitoring, predictive maintenance, and data-driven decision making. Industry adoption continues to accelerate at approximately 8.2% CAGR as operators seek to optimize production efficiency while maintaining the highest safety standards.

Technological advancement in sensor miniaturization, wireless communication, and battery life extension has expanded deployment possibilities across remote and challenging operational environments. The market serves critical applications including wellhead monitoring, pipeline integrity assessment, refinery process control, and environmental compliance monitoring, establishing sensors as fundamental components of modern oil and gas infrastructure.

The sensors in oil and gas market refers to the comprehensive ecosystem of sensing devices, monitoring systems, and associated technologies specifically designed to measure, detect, and transmit critical operational parameters within oil and gas facilities. These sophisticated instruments enable continuous monitoring of physical, chemical, and environmental conditions across exploration, production, transportation, refining, and distribution operations.

Sensor applications encompass pressure measurement in drilling operations, temperature monitoring in refinery processes, flow rate detection in pipelines, gas leak identification, and vibration analysis for equipment health assessment. The market includes both traditional wired sensor systems and advanced wireless sensor networks that provide real-time data transmission to centralized control systems and cloud-based analytics platforms.

Modern sensor technologies integrate advanced materials, microelectronics, and communication protocols to deliver accurate, reliable, and durable performance in extreme operating conditions including high temperatures, corrosive environments, and explosive atmospheres. The market serves as a critical enabler of Industry 4.0 initiatives within the oil and gas sector, facilitating digital transformation and intelligent operations management.

Strategic market analysis reveals the sensors in oil and gas market as a rapidly evolving sector characterized by technological innovation, regulatory compliance requirements, and operational efficiency demands. The market demonstrates strong growth momentum driven by increasing automation adoption, safety enhancement initiatives, and the industry’s transition toward smart operations management.

Key market segments include pressure sensors commanding the largest market share, followed by temperature sensors, flow sensors, and specialized gas detection systems. Application diversity spans upstream exploration and production activities, midstream transportation and storage operations, and downstream refining and petrochemical processes. The market benefits from approximately 72% adoption rate of digital sensor technologies among major oil and gas operators.

Competitive landscape features established industrial sensor manufacturers alongside specialized oil and gas technology providers, creating a dynamic ecosystem of innovation and market competition. Regional distribution shows strong demand concentration in major oil and gas producing regions, with emerging markets demonstrating accelerated adoption rates. The market trajectory indicates sustained growth supported by ongoing infrastructure investments and technological advancement initiatives.

Market intelligence reveals several critical insights shaping the sensors in oil and gas market landscape:

Primary market drivers propelling the sensors in oil and gas market include the industry’s fundamental shift toward digitalization and smart operations management. Operational efficiency requirements continue to intensify as operators seek to optimize production output while minimizing operational costs and environmental impact. The integration of advanced sensor technologies enables real-time monitoring, data-driven decision making, and automated process control capabilities.

Safety and regulatory compliance represents another significant driver, with increasingly stringent safety standards requiring comprehensive monitoring of operational parameters, environmental conditions, and potential hazard detection. Regulatory frameworks mandate continuous monitoring of emissions, leak detection, and worker safety conditions, driving consistent demand for specialized sensor technologies.

Infrastructure aging across global oil and gas facilities creates substantial opportunities for sensor deployment in asset integrity monitoring, predictive maintenance, and equipment health assessment applications. Cost optimization pressures encourage adoption of sensor-enabled automation technologies that reduce manual labor requirements while improving operational accuracy and reliability. The market benefits from approximately 15% improvement in operational efficiency through comprehensive sensor network implementation.

Digital transformation initiatives within the oil and gas industry drive demand for IoT-enabled sensor technologies that support data analytics, machine learning, and artificial intelligence applications. Remote operations capabilities become increasingly important as operators seek to minimize personnel exposure to hazardous environments while maintaining operational continuity.

Market challenges facing the sensors in oil and gas market include significant capital investment requirements for comprehensive sensor network deployment and integration with existing operational systems. Implementation complexity associated with retrofitting legacy facilities and integrating diverse sensor technologies creates barriers to adoption, particularly for smaller operators with limited technical resources.

Harsh operating environments characteristic of oil and gas operations pose ongoing challenges for sensor durability, reliability, and maintenance requirements. Extreme conditions including high temperatures, corrosive chemicals, vibration, and explosive atmospheres demand specialized sensor designs that command premium pricing and may require frequent replacement or calibration.

Cybersecurity concerns related to connected sensor networks and data transmission create hesitation among operators regarding potential vulnerabilities and security breaches. Data management complexity associated with large-scale sensor deployments requires sophisticated data processing, storage, and analytics capabilities that may exceed existing organizational capabilities.

Skilled workforce limitations constrain market growth as sensor technology deployment, maintenance, and data interpretation require specialized technical expertise that may be scarce in certain regions or market segments. Standardization challenges across different sensor technologies and communication protocols create integration difficulties and increase implementation costs.

Emerging opportunities within the sensors in oil and gas market center on the convergence of advanced sensor technologies with artificial intelligence, machine learning, and edge computing capabilities. Predictive analytics integration creates substantial value propositions through early fault detection, optimized maintenance scheduling, and improved operational planning based on comprehensive sensor data analysis.

Wireless sensor network expansion presents significant opportunities for cost-effective deployment in remote locations, temporary installations, and challenging environments where traditional wired systems prove impractical. Battery technology improvements and energy harvesting capabilities enable long-term autonomous sensor operation, reducing maintenance requirements and operational costs.

Environmental monitoring applications offer growing opportunities as regulatory requirements intensify and corporate sustainability initiatives expand. Emission detection sensors, air quality monitoring systems, and water quality assessment technologies address increasing environmental compliance demands while supporting corporate environmental responsibility objectives.

Digital twin technology integration creates opportunities for comprehensive facility modeling and simulation capabilities supported by extensive sensor data collection. Cloud-based analytics platforms enable scalable data processing and insights generation, making advanced analytics accessible to operators of all sizes. The market opportunity includes approximately 35% potential efficiency gains through comprehensive sensor network optimization.

Market dynamics within the sensors in oil and gas sector reflect the complex interplay between technological advancement, regulatory requirements, operational demands, and economic factors. Technology evolution continues to drive market transformation through miniaturization, improved accuracy, enhanced durability, and expanded communication capabilities that enable new applications and deployment scenarios.

Competitive pressures encourage continuous innovation in sensor performance, cost-effectiveness, and integration capabilities. Market consolidation trends create opportunities for comprehensive solution providers while challenging specialized niche players to differentiate their offerings through unique value propositions and technical capabilities.

Economic cyclicality characteristic of the oil and gas industry influences sensor market demand patterns, with investment levels fluctuating based on commodity prices, capital availability, and strategic priorities. Geopolitical factors affect regional market dynamics, technology transfer, and supply chain considerations that impact sensor availability and pricing structures.

Regulatory evolution continues to shape market requirements through updated safety standards, environmental compliance mandates, and operational reporting requirements. Industry digitalization accelerates sensor adoption as operators recognize the strategic value of data-driven operations management and predictive maintenance capabilities. Market dynamics indicate approximately 28% annual growth in wireless sensor deployments across major oil and gas operations.

Comprehensive research methodology employed for sensors in oil and gas market analysis incorporates multiple data collection approaches, analytical frameworks, and validation processes to ensure accuracy, reliability, and actionable insights. Primary research activities include extensive interviews with industry executives, technology providers, end-users, and subject matter experts across the oil and gas value chain.

Secondary research components encompass analysis of industry reports, regulatory filings, patent databases, technical publications, and market intelligence sources to establish comprehensive market understanding. Data triangulation methods validate findings through cross-referencing multiple information sources and analytical approaches to ensure consistency and accuracy.

Market sizing methodologies utilize bottom-up and top-down analytical approaches incorporating production data, installation rates, technology adoption patterns, and regional market characteristics. Forecasting models integrate historical trends, current market dynamics, technological development trajectories, and regulatory impact assessments to project future market evolution.

Quality assurance processes include peer review, expert validation, and continuous monitoring of market developments to maintain research accuracy and relevance. MarkWide Research analytical frameworks ensure comprehensive coverage of market segments, competitive landscape, and emerging trends that influence market trajectory and strategic decision making.

North American markets demonstrate strong leadership in sensors in oil and gas adoption, driven by extensive shale oil and gas operations, advanced technology infrastructure, and stringent safety regulations. United States operations account for approximately 42% market share globally, supported by continuous innovation in sensor technologies and comprehensive deployment across upstream and downstream operations.

European markets emphasize environmental compliance and safety enhancement applications, with North Sea operations serving as testing grounds for advanced sensor technologies in challenging offshore environments. Regulatory frameworks in Europe drive demand for comprehensive monitoring systems supporting environmental protection and worker safety objectives.

Asia-Pacific regions represent the fastest-growing market segment, with China and India leading expansion efforts in oil and gas infrastructure development and modernization. Middle Eastern markets focus on production optimization and facility modernization initiatives, leveraging sensor technologies to maintain competitive advantages in global energy markets.

Latin American operations demonstrate increasing adoption of sensor technologies for offshore drilling, pipeline monitoring, and refinery optimization applications. African markets show growing interest in sensor-enabled technologies for exploration activities and infrastructure development projects. Regional analysis indicates approximately 18% annual growth in sensor adoption across emerging oil and gas markets.

Competitive dynamics within the sensors in oil and gas market feature established industrial technology providers alongside specialized oil and gas solution developers, creating a diverse ecosystem of innovation and market competition. Market leaders leverage comprehensive product portfolios, global service networks, and extensive industry experience to maintain competitive advantages.

Key market participants include:

Competitive strategies emphasize technological innovation, strategic partnerships, and comprehensive service offerings that address evolving customer requirements. Market differentiation occurs through specialized applications expertise, integration capabilities, and value-added services supporting customer operational objectives.

Market segmentation analysis reveals diverse categories within the sensors in oil and gas market, each addressing specific operational requirements and application scenarios across the industry value chain.

By Sensor Type:

By Application:

By Technology:

Pressure sensor applications dominate market demand due to critical importance in wellhead monitoring, pipeline integrity assessment, and process control applications. Advanced pressure sensing technologies incorporate digital communication protocols, self-diagnostic capabilities, and enhanced accuracy specifications that support demanding oil and gas operational requirements.

Temperature monitoring solutions serve essential roles in refinery process control, pipeline monitoring, and equipment health assessment applications. High-temperature sensor technologies designed for extreme operating conditions enable monitoring in challenging environments including downhole applications and high-temperature processing units.

Flow measurement systems provide critical data for production optimization, custody transfer, and process control applications across the oil and gas value chain. Ultrasonic and electromagnetic flow sensors offer non-intrusive measurement capabilities that minimize maintenance requirements while providing accurate flow data.

Gas detection technologies address critical safety requirements through continuous monitoring of potentially hazardous atmospheric conditions. Multi-gas detection systems provide comprehensive monitoring capabilities for hydrogen sulfide, methane, carbon monoxide, and other hazardous gases commonly encountered in oil and gas operations. Category analysis indicates approximately 25% market share for pressure sensors, representing the largest individual segment.

Wireless sensor networks demonstrate rapid growth as operators recognize benefits including reduced installation costs, flexible deployment options, and enhanced monitoring capabilities for remote locations. Battery-powered wireless sensors enable long-term autonomous operation in locations where power infrastructure is unavailable or impractical.

Operational efficiency enhancement represents the primary benefit for oil and gas operators implementing comprehensive sensor networks. Real-time monitoring capabilities enable immediate response to operational anomalies, optimization of production parameters, and reduction of unplanned downtime through predictive maintenance strategies.

Safety improvement benefits include enhanced worker protection through continuous atmospheric monitoring, early leak detection, and automated emergency response systems. Risk mitigation advantages encompass reduced environmental incidents, improved regulatory compliance, and enhanced operational safety records that support corporate reputation and regulatory standing.

Cost reduction opportunities emerge through optimized maintenance scheduling, reduced manual inspection requirements, and improved operational efficiency. Data-driven decision making capabilities enable operators to optimize production processes, reduce energy consumption, and minimize waste generation through comprehensive operational insights.

Regulatory compliance benefits include automated reporting capabilities, continuous monitoring documentation, and enhanced ability to demonstrate environmental and safety compliance to regulatory authorities. Competitive advantages result from improved operational performance, reduced costs, and enhanced safety records that differentiate operators in competitive markets.

Technology providers benefit from expanding market opportunities, recurring service revenue streams, and opportunities for innovation in sensor technologies and integrated solutions. Service companies gain opportunities for specialized installation, maintenance, and data analytics services supporting sensor network operations. Market participants report approximately 20% reduction in operational costs through comprehensive sensor network implementation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless sensor adoption continues accelerating as operators recognize advantages including reduced installation costs, flexible deployment options, and enhanced monitoring capabilities for remote locations. Battery technology improvements enable extended autonomous operation periods, reducing maintenance requirements and operational costs while expanding deployment possibilities.

Artificial intelligence integration with sensor networks creates opportunities for advanced analytics, pattern recognition, and predictive maintenance capabilities that enhance operational efficiency and equipment reliability. Machine learning algorithms analyze sensor data patterns to identify optimization opportunities and predict potential equipment failures before they occur.

Edge computing deployment enables real-time data processing at sensor network locations, reducing communication bandwidth requirements while improving response times for critical operational decisions. Digital twin technology integration creates comprehensive facility models supported by extensive sensor data collection and analysis capabilities.

Environmental monitoring expansion reflects increasing regulatory requirements and corporate sustainability initiatives driving demand for comprehensive emission detection and environmental compliance monitoring systems. Cybersecurity enhancement becomes increasingly important as sensor networks expand and connectivity increases, requiring robust security protocols and data protection measures.

Miniaturization trends enable sensor deployment in previously inaccessible locations while reducing installation complexity and costs. Multi-parameter sensors provide comprehensive monitoring capabilities in single devices, reducing installation requirements and system complexity. Market trends indicate approximately 45% growth in wireless sensor deployments over traditional wired systems.

Recent industry developments demonstrate accelerating innovation and market expansion within the sensors in oil and gas sector. Technology partnerships between sensor manufacturers and oil and gas operators create opportunities for customized solutions addressing specific operational challenges and requirements.

Acquisition activities among sensor technology providers consolidate market capabilities while expanding product portfolios and geographic reach. Research and development investments focus on enhanced sensor durability, improved accuracy, and expanded communication capabilities that address evolving industry requirements.

Regulatory developments including updated safety standards and environmental compliance requirements drive demand for advanced monitoring capabilities and comprehensive sensor network deployment. Industry standards evolution promotes interoperability and integration capabilities across different sensor technologies and communication protocols.

Pilot project implementations demonstrate advanced sensor applications including predictive maintenance, automated process control, and comprehensive facility monitoring systems. MarkWide Research analysis indicates increasing collaboration between technology providers and end-users in developing customized sensor solutions for specific operational challenges.

Investment activities in sensor technology startups and innovative applications accelerate market development and technology advancement. Digital transformation initiatives within major oil and gas companies drive comprehensive sensor network deployments supporting data-driven operations management and optimization strategies.

Strategic recommendations for market participants emphasize the importance of comprehensive technology integration, customer-focused solution development, and long-term partnership strategies. Technology providers should prioritize wireless sensor development, cybersecurity enhancement, and integration capabilities that address evolving customer requirements and operational challenges.

Investment priorities should focus on research and development activities supporting sensor durability improvements, accuracy enhancements, and communication protocol advancement. Partnership strategies with oil and gas operators enable collaborative development of customized solutions addressing specific operational challenges and requirements.

Market entry strategies for new participants should emphasize specialized applications expertise, unique value propositions, and comprehensive service capabilities that differentiate offerings in competitive markets. Geographic expansion opportunities exist in emerging oil and gas markets where infrastructure development and modernization initiatives create demand for advanced sensor technologies.

Service development represents significant opportunities for recurring revenue generation through maintenance, calibration, data analytics, and consulting services supporting sensor network operations. Digital capabilities including cloud-based analytics, mobile applications, and remote monitoring services enhance value propositions and customer relationships.

Risk management strategies should address cybersecurity concerns, technology obsolescence risks, and economic cyclicality impacts through diversified portfolios and flexible business models. MWR analysis suggests focusing on comprehensive solutions that integrate multiple sensor technologies with advanced analytics and service capabilities.

Future market trajectory for sensors in oil and gas indicates sustained growth driven by continued digitalization, regulatory compliance requirements, and operational efficiency demands. Technology evolution will emphasize wireless capabilities, artificial intelligence integration, and enhanced cybersecurity features that address emerging operational requirements and security concerns.

Market expansion opportunities exist in emerging economies where oil and gas infrastructure development creates demand for comprehensive monitoring and control systems. Application diversification will extend sensor deployment into new operational areas including environmental monitoring, carbon capture systems, and renewable energy integration applications.

Innovation trajectories focus on sensor miniaturization, improved accuracy, extended battery life, and enhanced communication capabilities that enable new deployment scenarios and applications. Integration trends will emphasize comprehensive platforms combining multiple sensor technologies with advanced analytics and automated response capabilities.

Regulatory evolution will continue driving market demand through updated safety standards, environmental compliance requirements, and operational reporting mandates. Sustainability initiatives within the oil and gas industry create opportunities for environmental monitoring sensors and emission detection systems supporting corporate environmental responsibility objectives.

Market projections indicate continued growth at approximately 8.5% CAGR over the forecast period, supported by ongoing infrastructure investments, technology advancement, and regulatory compliance requirements. Competitive dynamics will favor comprehensive solution providers offering integrated sensor technologies with advanced analytics and service capabilities.

The sensors in oil and gas market represents a dynamic and essential technology sector supporting operational excellence, safety enhancement, and regulatory compliance across the global energy industry. Market fundamentals remain strong, driven by continuous digitalization initiatives, stringent safety requirements, and the industry’s focus on operational efficiency optimization.

Technology advancement continues reshaping market opportunities through wireless sensor networks, artificial intelligence integration, and enhanced cybersecurity capabilities that address evolving operational requirements. Competitive landscape evolution favors comprehensive solution providers offering integrated technologies, advanced analytics, and specialized service capabilities that deliver measurable value to oil and gas operators.

Future growth prospects remain positive, supported by ongoing infrastructure investments, regulatory compliance requirements, and the industry’s commitment to safety and environmental responsibility. Market participants positioned with innovative technologies, strong customer relationships, and comprehensive service capabilities are well-positioned to capitalize on emerging opportunities and sustained market expansion in the sensors in oil and gas sector.

What is Sensors in Oil and Gas?

Sensors in Oil and Gas refer to devices used to monitor and collect data on various parameters such as pressure, temperature, and flow rates in oil and gas operations. These sensors play a crucial role in enhancing operational efficiency and safety in the industry.

What are the key companies in the Sensors in Oil and Gas Market?

Key companies in the Sensors in Oil and Gas Market include Honeywell, Siemens, and Emerson Electric, which provide advanced sensor technologies for monitoring and control in oil and gas applications, among others.

What are the growth factors driving the Sensors in Oil and Gas Market?

The growth of the Sensors in Oil and Gas Market is driven by the increasing demand for automation in oil extraction processes, the need for real-time monitoring to enhance safety, and the rising focus on reducing operational costs through efficient resource management.

What challenges does the Sensors in Oil and Gas Market face?

Challenges in the Sensors in Oil and Gas Market include the harsh environmental conditions that can affect sensor performance, the high costs associated with advanced sensor technologies, and the need for skilled personnel to interpret sensor data effectively.

What future opportunities exist in the Sensors in Oil and Gas Market?

Future opportunities in the Sensors in Oil and Gas Market include the integration of IoT technologies for enhanced data analytics, the development of wireless sensor networks for remote monitoring, and the increasing adoption of smart sensors that can provide predictive maintenance insights.

What trends are shaping the Sensors in Oil and Gas Market?

Trends shaping the Sensors in Oil and Gas Market include the growing emphasis on digital transformation, the rise of automation technologies, and the increasing use of advanced materials in sensor design to improve durability and accuracy.

Sensors in Oil and Gas Market

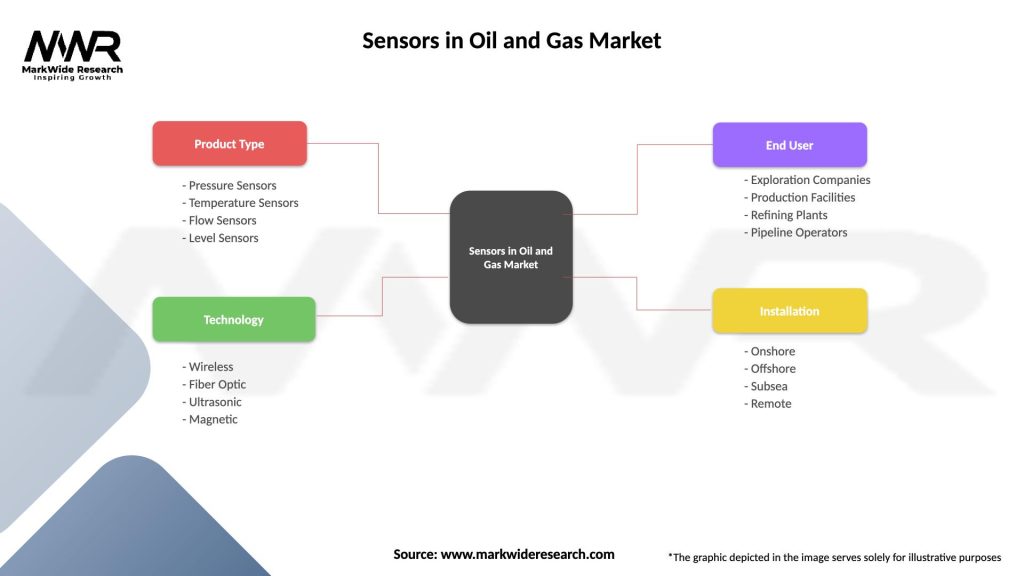

| Segmentation Details | Description |

|---|---|

| Product Type | Pressure Sensors, Temperature Sensors, Flow Sensors, Level Sensors |

| Technology | Wireless, Fiber Optic, Ultrasonic, Magnetic |

| End User | Exploration Companies, Production Facilities, Refining Plants, Pipeline Operators |

| Installation | Onshore, Offshore, Subsea, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sensors in Oil and Gas Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at