444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The seed accelerators market plays a pivotal role in the startup ecosystem by providing early-stage companies with mentorship, funding, and resources to accelerate their growth. These programs typically operate on a fixed-term basis and culminate in a demo day where startups pitch to potential investors.

Meaning

Seed accelerators are programs designed to support early-stage startups through mentorship, funding, and educational components. They aim to help entrepreneurs refine their business models, validate their ideas, and prepare for rapid growth and scalability. Seed accelerators often take equity in participating startups in exchange for their services.

Executive Summary

The seed accelerators market has grown rapidly in response to the proliferation of startups across various industries seeking support to navigate the complexities of early-stage growth. These programs offer structured frameworks, access to mentor networks, and exposure to investors, positioning startups for success in competitive markets.

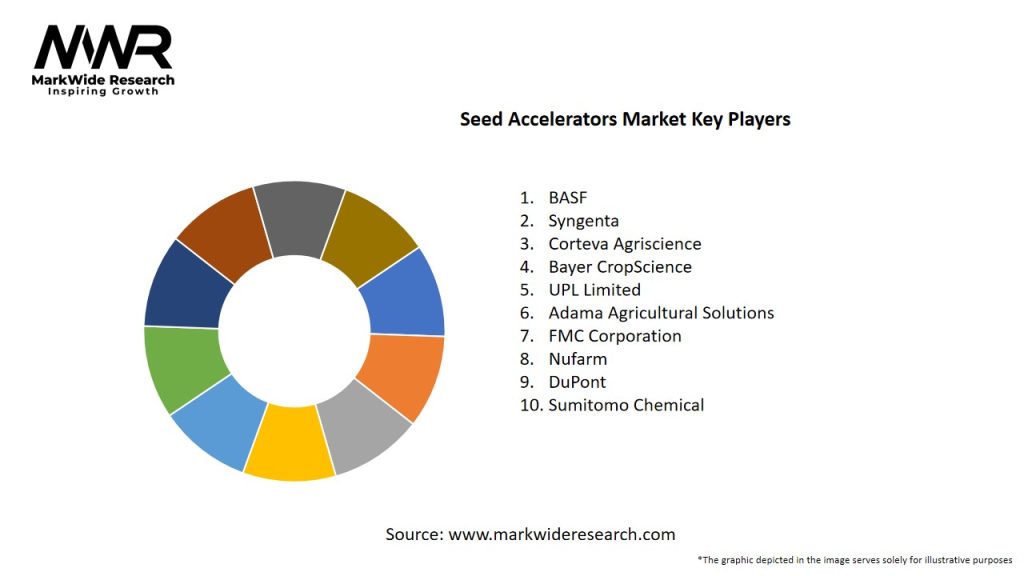

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The seed accelerators market operates within a dynamic ecosystem influenced by technological advancements, investor sentiment, regulatory frameworks, and market trends. These dynamics shape program offerings, participant outcomes, and the overall competitiveness of the accelerator landscape.

Regional Analysis

The seed accelerators market exhibits regional variations based on economic conditions, regulatory environments, and entrepreneurial ecosystems. Key regions include:

Competitive Landscape

Leading Companies in the Seed Accelerators Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

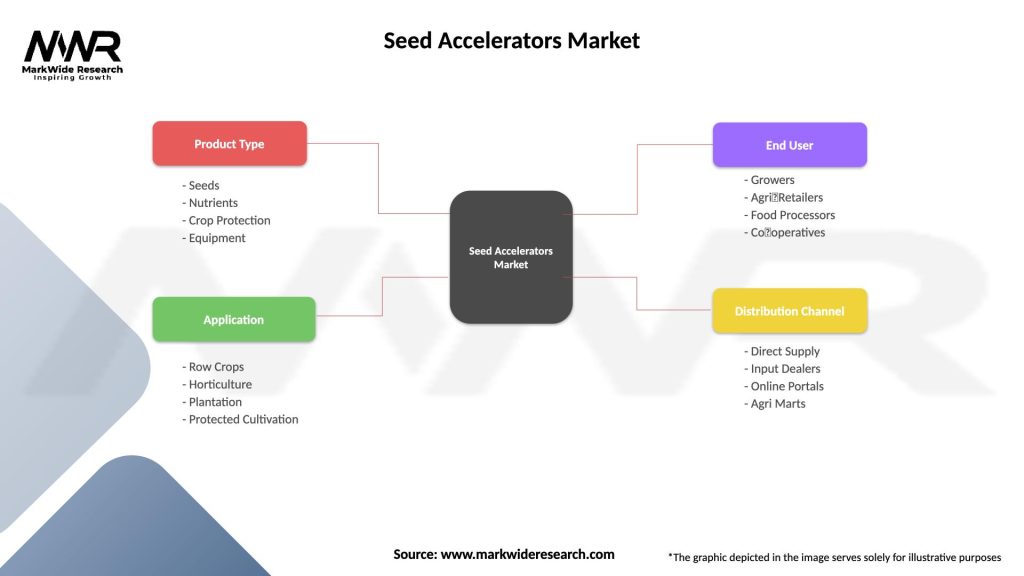

Segmentation

Segmentation of the seed accelerators market includes:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis of the seed accelerators market reveals:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic accelerated digital transformation in the seed accelerators market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The seed accelerators market is poised for continued growth and evolution:

Conclusion

The seed accelerators market represents a dynamic and transformative force within the global startup ecosystem, providing critical support for early-stage ventures. As entrepreneurship continues to thrive globally, accelerators will play an increasingly vital role in fostering innovation, driving economic growth, and addressing societal challenges. By offering access to capital, mentorship, and strategic networks, accelerators empower startups to scale their operations, enter new markets, and contribute to job creation and industry disruption.

In conclusion, the seed accelerators market is positioned for sustained growth and innovation as it adapts to evolving entrepreneurial landscapes and global market dynamics. Embracing digital transformation, enhancing diversity and inclusion, and prioritizing sustainability will be key drivers of success for accelerators in the future. As startups continue to seek support in navigating early-stage challenges, accelerators will remain instrumental in shaping the future of industries, fostering innovation, and driving economic prosperity worldwide.

What is Seed Accelerators?

Seed accelerators are programs designed to support early-stage startups through mentorship, funding, and resources. They typically provide a structured environment for startups to develop their business models and prepare for investment.

What are the key players in the Seed Accelerators Market?

Key players in the Seed Accelerators Market include Y Combinator, Techstars, and Seedcamp, which are known for their extensive networks and resources that help startups grow. These companies provide mentorship, funding, and access to a community of entrepreneurs, among others.

What are the growth factors driving the Seed Accelerators Market?

The Seed Accelerators Market is driven by the increasing number of startups seeking funding and mentorship, the rise of entrepreneurship as a career path, and the growing interest from investors in early-stage companies. Additionally, the demand for innovation in various industries fuels the need for accelerator programs.

What challenges does the Seed Accelerators Market face?

Challenges in the Seed Accelerators Market include the saturation of accelerator programs, which can lead to increased competition for startups, and the difficulty in measuring the long-term success of participating companies. Additionally, economic fluctuations can impact funding availability.

What opportunities exist in the Seed Accelerators Market?

Opportunities in the Seed Accelerators Market include the potential for expansion into emerging markets, the development of specialized accelerators focusing on specific industries, and the integration of technology to enhance program offerings. These factors can help attract a diverse range of startups.

What trends are shaping the Seed Accelerators Market?

Trends in the Seed Accelerators Market include a shift towards remote and hybrid accelerator programs, increased focus on diversity and inclusion within startup ecosystems, and the rise of corporate accelerators partnering with startups for innovation. These trends are reshaping how accelerators operate and engage with entrepreneurs.

Seed Accelerators Market

| Segmentation Details | Description |

|---|---|

| Product Type | Seeds, Nutrients, Crop Protection, Equipment |

| Application | Row Crops, Horticulture, Plantation, Protected Cultivation |

| End User | Growers, Agri‑Retailers, Food Processors, Co‑operatives |

| Distribution Channel | Direct Supply, Input Dealers, Online Portals, Agri Marts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Seed Accelerators Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at