444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The security and surveillance storage market represents a rapidly expanding sector within the broader data storage industry, driven by increasing security concerns and technological advancements. This market encompasses specialized storage solutions designed to handle the massive volumes of video data generated by surveillance systems, security cameras, and monitoring equipment across various industries and applications.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.5% as organizations worldwide prioritize security infrastructure investments. The proliferation of high-definition cameras, artificial intelligence integration, and extended retention requirements has created unprecedented demand for robust storage solutions capable of managing continuous data streams.

Key market characteristics include the transition from traditional analog systems to digital platforms, increased adoption of cloud-based storage solutions, and growing emphasis on scalable infrastructure. Organizations across sectors including retail, transportation, healthcare, and government are investing heavily in comprehensive surveillance ecosystems that require sophisticated storage architectures.

Technology evolution within this market reflects broader trends in data storage, including the integration of edge computing, artificial intelligence analytics, and hybrid cloud solutions. These developments enable more efficient data management, reduced bandwidth requirements, and enhanced real-time processing capabilities for security applications.

The security and surveillance storage market refers to the specialized segment of data storage solutions specifically designed to capture, store, manage, and retrieve video surveillance data and security-related information. This market encompasses hardware, software, and services that enable organizations to maintain comprehensive security monitoring systems with reliable data retention and accessibility.

Core components of this market include network video recorders (NVRs), digital video recorders (DVRs), storage area networks (SANs), cloud storage platforms, and hybrid solutions that combine on-premises and cloud-based infrastructure. These systems must handle continuous data ingestion from multiple camera sources while maintaining data integrity and providing rapid access for security personnel.

Operational requirements distinguish surveillance storage from general-purpose storage solutions, including 24/7 write optimization, extended retention periods, redundancy for critical data protection, and compliance with various regulatory standards. The market serves diverse applications from basic perimeter monitoring to sophisticated analytics-driven security intelligence platforms.

Market expansion in the security and surveillance storage sector reflects the convergence of multiple technological and societal trends driving demand for comprehensive monitoring solutions. Organizations across industries are recognizing the strategic value of robust surveillance infrastructure, leading to increased investments in storage technologies that can support evolving security requirements.

Technology integration represents a key differentiator in this market, with vendors developing solutions that incorporate artificial intelligence, machine learning, and advanced analytics capabilities. These innovations enable more efficient storage utilization, automated threat detection, and intelligent data management that reduces operational overhead while enhancing security effectiveness.

Regional growth patterns show particularly strong adoption in North America and Asia-Pacific regions, with North America maintaining approximately 38% market share due to stringent security regulations and advanced technology adoption. Emerging markets demonstrate accelerating growth as infrastructure development and security awareness increase across developing economies.

Competitive dynamics feature established storage vendors expanding into surveillance-specific solutions alongside specialized security technology companies developing integrated platforms. This convergence creates opportunities for innovation while intensifying competition across price points and feature sets.

Primary market drivers encompass several interconnected factors that collectively fuel demand for advanced surveillance storage solutions:

Market segmentation reveals diverse application areas with distinct storage requirements, from small business installations requiring basic recording capabilities to enterprise deployments demanding sophisticated analytics and integration capabilities.

Technological advancement serves as the primary catalyst for market growth, with the transition to 4K and 8K resolution cameras creating exponential increases in data generation. Organizations implementing high-definition surveillance systems require storage solutions capable of handling data rates that can exceed traditional infrastructure capabilities by 400% or more compared to standard definition systems.

Regulatory requirements across industries mandate extended data retention periods, with financial institutions required to maintain surveillance footage for up to seven years and healthcare facilities facing similar long-term storage obligations. These compliance requirements drive demand for cost-effective, long-term storage solutions that maintain data integrity over extended periods.

Security threat evolution compels organizations to implement more comprehensive monitoring systems covering larger areas with higher resolution cameras. The increasing sophistication of security threats requires storage systems that can support real-time analytics, facial recognition, and behavioral analysis applications that demand high-performance storage infrastructure.

Artificial intelligence integration represents a transformative driver, enabling automated threat detection, predictive analytics, and intelligent video management. AI-powered surveillance systems require specialized storage architectures optimized for both continuous recording and intensive computational workloads, creating demand for hybrid solutions combining traditional storage with high-performance computing resources.

Cost reduction initiatives motivate organizations to adopt more efficient storage technologies that reduce total cost of ownership while improving operational efficiency. Cloud-based solutions and intelligent tiering systems enable organizations to optimize storage costs by automatically moving older data to lower-cost storage tiers while maintaining accessibility for compliance requirements.

High implementation costs present significant barriers for many organizations, particularly small and medium-sized businesses seeking to upgrade legacy surveillance systems. The substantial capital investment required for comprehensive storage infrastructure, including hardware, software, and integration services, can delay adoption decisions and limit market expansion in price-sensitive segments.

Technical complexity challenges organizations lacking specialized IT expertise, as modern surveillance storage systems require sophisticated configuration, ongoing maintenance, and integration with existing security infrastructure. The complexity of managing hybrid cloud deployments, ensuring data security, and maintaining system performance can overwhelm organizations without dedicated technical resources.

Data privacy concerns increasingly influence storage deployment decisions, with organizations facing complex regulatory requirements regarding data protection, cross-border data transfer, and individual privacy rights. These concerns can limit cloud adoption and require additional investment in security measures and compliance management systems.

Bandwidth limitations constrain the deployment of cloud-based storage solutions, particularly for organizations with multiple locations or limited internet connectivity. The substantial bandwidth requirements for uploading high-resolution video data to cloud storage platforms can result in prohibitive ongoing costs and performance limitations.

Legacy system integration challenges complicate storage upgrades for organizations with existing surveillance infrastructure, requiring careful planning and potentially expensive integration solutions to maintain operational continuity while implementing new storage technologies.

Edge computing integration presents substantial opportunities for storage vendors to develop solutions that combine local processing capabilities with centralized storage management. Edge storage systems can reduce bandwidth requirements by up to 75% while enabling real-time analytics and reducing latency for critical security applications.

Artificial intelligence advancement creates opportunities for storage solutions optimized for machine learning workloads, including specialized hardware for training security analytics models and high-performance storage for real-time inference applications. The growing adoption of AI-powered surveillance creates demand for storage systems that can efficiently handle both traditional video storage and computational workloads.

Cloud-native solutions offer significant growth potential as organizations increasingly adopt cloud-first strategies for new surveillance deployments. Cloud-based storage platforms provide scalability, reduced infrastructure overhead, and advanced analytics capabilities that appeal to organizations seeking to modernize their security infrastructure.

Vertical market specialization enables vendors to develop tailored solutions for specific industries with unique requirements, such as healthcare facilities requiring HIPAA compliance, retail environments needing loss prevention analytics, or transportation systems requiring integration with traffic management platforms.

Emerging market expansion provides substantial growth opportunities as developing economies invest in security infrastructure for smart city initiatives, industrial development, and public safety improvements. These markets often lack legacy infrastructure constraints, enabling deployment of modern storage architectures from the outset.

Supply chain evolution reflects the increasing convergence of traditional storage vendors with specialized security technology companies, creating integrated solutions that combine storage expertise with surveillance domain knowledge. This convergence enables more optimized solutions while intensifying competition across market segments.

Technology standardization efforts facilitate interoperability between different vendors’ solutions, reducing customer concerns about vendor lock-in and enabling more flexible deployment architectures. Industry standards for video compression, storage protocols, and cloud integration accelerate market adoption by reducing implementation complexity.

Pricing dynamics demonstrate ongoing pressure for cost reduction, with cloud storage services driving down per-gigabyte costs while hardware vendors focus on improving performance per dollar. This pricing evolution makes advanced surveillance storage accessible to smaller organizations while enabling larger deployments to achieve better economies of scale.

Innovation cycles accelerate as vendors compete to integrate emerging technologies including 5G connectivity, quantum storage research, and advanced compression algorithms. These innovations enable more efficient storage utilization and enhanced functionality while maintaining competitive differentiation.

Customer expectations continue evolving toward integrated platforms that combine storage, analytics, and management capabilities in unified solutions. Organizations increasingly prefer vendors that can provide comprehensive surveillance ecosystems rather than point solutions requiring complex integration efforts.

Primary research methodologies employed in analyzing the security and surveillance storage market include comprehensive surveys of end-users across various industries, in-depth interviews with technology vendors and system integrators, and detailed case studies of successful deployments. These primary sources provide insights into actual usage patterns, performance requirements, and decision-making criteria that influence market dynamics.

Secondary research encompasses analysis of industry reports, vendor documentation, regulatory filings, and technology specifications to understand market trends, competitive positioning, and technological capabilities. This research includes evaluation of patent filings, product announcements, and strategic partnerships that indicate future market direction.

Market modeling techniques incorporate multiple data sources to project growth trends, segment analysis, and regional variations in market development. Statistical analysis of historical data combined with forward-looking indicators enables accurate forecasting of market evolution and identification of emerging opportunities.

Validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and continuous monitoring of market developments. Regular updates to research findings reflect the dynamic nature of technology markets and changing customer requirements.

North America maintains market leadership with approximately 38% of global market share, driven by stringent regulatory requirements, advanced technology adoption, and substantial security infrastructure investments. The region benefits from mature surveillance markets, high-resolution camera adoption, and sophisticated analytics requirements that drive demand for advanced storage solutions.

United States dominates the North American market through extensive deployment across government facilities, critical infrastructure, and commercial properties. Federal regulations requiring surveillance data retention, combined with state and local security mandates, create consistent demand for compliant storage solutions.

Asia-Pacific represents the fastest-growing regional market, with growth rates exceeding 15% annually driven by rapid urbanization, smart city initiatives, and increasing security awareness. Countries including China, India, and Southeast Asian nations are implementing comprehensive surveillance infrastructure as part of broader digital transformation efforts.

Europe demonstrates steady growth influenced by GDPR compliance requirements, critical infrastructure protection initiatives, and modernization of legacy surveillance systems. The region’s emphasis on data privacy creates demand for storage solutions that provide strong security controls and compliance management capabilities.

Middle East and Africa show accelerating adoption driven by infrastructure development, security concerns, and government initiatives to enhance public safety. Oil and gas facilities, transportation hubs, and urban development projects create substantial demand for surveillance storage solutions.

Latin America exhibits growing market potential as economic development and urbanization drive security infrastructure investments. Brazil, Mexico, and other major economies are implementing surveillance systems for public safety and commercial security applications.

Market leaders in the security and surveillance storage sector include established technology companies that have expanded their storage portfolios to address surveillance-specific requirements:

Competitive strategies focus on differentiation through specialized features including AI integration, cloud connectivity, and industry-specific compliance capabilities. Vendors increasingly offer complete surveillance ecosystems rather than standalone storage products, creating higher customer value and stronger competitive positioning.

Innovation leadership drives competitive advantage through development of next-generation technologies including edge computing integration, advanced compression algorithms, and intelligent data lifecycle management. Companies investing in research and development maintain stronger market positions and customer loyalty.

By Technology:

By Application:

By Deployment:

Network Video Recorders represent the largest market segment, accounting for approximately 45% of total market share due to widespread adoption of IP camera systems and digital surveillance infrastructure. NVR systems offer superior image quality, remote accessibility, and integration capabilities that appeal to modern security deployments.

Cloud storage solutions demonstrate the highest growth rates, with adoption increasing by over 20% annually as organizations recognize the benefits of scalable, remotely managed storage platforms. Cloud solutions eliminate the need for on-premises infrastructure while providing advanced analytics and artificial intelligence capabilities.

Edge storage systems emerge as a rapidly growing category, driven by the need to reduce bandwidth costs and enable real-time processing for AI-powered surveillance applications. Edge solutions process and store data locally while synchronizing critical information with centralized systems.

Hybrid deployments gain popularity among large organizations seeking to optimize costs while maintaining control over sensitive data. These solutions combine local storage for immediate access with cloud storage for long-term retention and backup purposes.

Industry-specific solutions show strong growth as vendors develop specialized offerings for healthcare, retail, transportation, and other vertical markets with unique compliance and operational requirements.

End-user organizations benefit from improved security posture through comprehensive surveillance coverage, reduced operational costs via efficient storage management, and enhanced compliance capabilities meeting regulatory requirements. Modern storage solutions enable organizations to implement sophisticated security analytics while managing total cost of ownership effectively.

Technology vendors gain access to a rapidly growing market with opportunities for recurring revenue through cloud services and ongoing support contracts. The surveillance storage market provides vendors with differentiation opportunities through specialized features and vertical market expertise.

System integrators benefit from increased project complexity and value-added services opportunities as surveillance systems become more sophisticated. Integration partners can develop specialized expertise in surveillance storage deployment and management, creating competitive advantages in the security market.

Cloud service providers find new revenue opportunities through surveillance-specific storage services, analytics platforms, and managed services. The continuous data generation from surveillance systems creates predictable, long-term revenue streams for cloud providers.

Hardware manufacturers benefit from increased demand for specialized storage devices optimized for surveillance workloads, including high-capacity drives, ruggedized systems, and edge computing platforms designed for security applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming the surveillance storage market, with AI-powered analytics requiring specialized storage architectures optimized for both continuous recording and intensive computational workloads. Organizations implementing AI-driven surveillance report efficiency improvements of up to 60% in threat detection and response capabilities.

Cloud-First Strategies gain momentum as organizations recognize the benefits of scalable, remotely managed storage platforms that eliminate infrastructure overhead while providing advanced capabilities. Cloud adoption in surveillance applications grows at rates exceeding 25% annually as concerns about data security and compliance diminish.

Edge Computing Deployment accelerates as organizations seek to reduce bandwidth costs and enable real-time processing for time-sensitive security applications. Edge storage solutions process data locally while synchronizing critical information with centralized systems, reducing bandwidth requirements by up to 75% in typical deployments.

Hybrid Architecture Adoption increases among large organizations implementing storage strategies that combine on-premises systems for immediate access with cloud platforms for long-term retention and analytics. These hybrid approaches optimize costs while maintaining control over sensitive security data.

Compression Technology Advancement enables more efficient storage utilization through advanced video compression algorithms that maintain image quality while reducing storage requirements. Modern compression technologies can reduce storage needs by 40-50% compared to traditional methods without compromising investigative capabilities.

Strategic partnerships between storage vendors and surveillance system manufacturers create integrated solutions that simplify deployment and improve performance. These collaborations enable optimized storage architectures specifically designed for surveillance workloads while reducing integration complexity for end users.

Acquisition activity intensifies as larger technology companies acquire specialized surveillance storage vendors to expand their security portfolios and gain access to vertical market expertise. These acquisitions accelerate product development and market expansion while providing acquired companies with greater resources for innovation.

Product launches focus on AI-integrated storage platforms that combine traditional video storage with machine learning capabilities for automated threat detection and behavioral analytics. Recent product introductions emphasize ease of deployment, cloud connectivity, and intelligent data management features.

Regulatory developments influence product design and market strategies as governments worldwide implement new requirements for surveillance data retention, privacy protection, and cybersecurity standards. Vendors adapt their solutions to address evolving compliance requirements while maintaining operational efficiency.

Technology standardization efforts facilitate interoperability between different vendors’ solutions, reducing customer concerns about vendor lock-in and enabling more flexible deployment architectures. Industry standards for video compression, storage protocols, and cloud integration accelerate market adoption.

MarkWide Research analysis indicates that organizations should prioritize storage solutions offering AI integration capabilities and cloud connectivity to future-proof their surveillance investments. The convergence of artificial intelligence and surveillance storage creates opportunities for enhanced security effectiveness while optimizing operational costs.

Investment priorities should focus on scalable architectures that can accommodate growing data volumes and evolving analytics requirements. Organizations implementing surveillance storage systems should consider hybrid deployments that combine local processing capabilities with cloud-based long-term storage and analytics platforms.

Vendor selection criteria should emphasize proven expertise in surveillance applications, comprehensive support services, and roadmaps for emerging technology integration. Organizations should evaluate vendors based on their ability to provide complete surveillance ecosystems rather than standalone storage products.

Implementation strategies should incorporate phased deployment approaches that enable organizations to modernize surveillance infrastructure while maintaining operational continuity. Gradual migration from legacy systems to modern storage platforms reduces risk while enabling organizations to realize benefits incrementally.

Compliance planning requires careful consideration of data retention requirements, privacy regulations, and cybersecurity standards that influence storage architecture decisions. Organizations should work with vendors that demonstrate expertise in regulatory compliance and can adapt solutions to evolving requirements.

Market evolution indicates continued strong growth driven by increasing security threats, regulatory requirements, and technological advancement. MarkWide Research projects that the surveillance storage market will maintain robust expansion as organizations worldwide prioritize comprehensive security infrastructure investments.

Technology integration will accelerate the convergence of storage, analytics, and artificial intelligence in unified platforms that provide comprehensive surveillance capabilities. Future solutions will emphasize autonomous operation, predictive maintenance, and intelligent data lifecycle management that reduces operational overhead.

Cloud adoption will continue expanding as organizations recognize the benefits of scalable, remotely managed storage platforms. Cloud-based surveillance storage is expected to achieve market penetration rates exceeding 55% within the next five years as security concerns diminish and capabilities improve.

Edge computing integration will enable new deployment models that optimize bandwidth utilization while providing real-time processing capabilities for time-sensitive security applications. Edge storage solutions will become increasingly sophisticated, incorporating AI processing and autonomous decision-making capabilities.

Vertical market specialization will drive development of industry-specific solutions tailored to unique requirements in healthcare, retail, transportation, and other sectors. These specialized solutions will command premium pricing while providing enhanced value through optimized features and compliance capabilities.

The security and surveillance storage market represents a dynamic and rapidly expanding sector driven by increasing security concerns, technological advancement, and regulatory requirements across multiple industries. Organizations worldwide are recognizing the strategic importance of comprehensive surveillance infrastructure, creating substantial opportunities for storage vendors and technology providers.

Key growth drivers including artificial intelligence integration, cloud adoption, and edge computing deployment will continue shaping market evolution while creating new opportunities for innovation and differentiation. The convergence of storage, analytics, and artificial intelligence enables more sophisticated security solutions that provide enhanced effectiveness while optimizing operational costs.

Market participants that focus on integrated solutions, vertical market expertise, and emerging technology adoption will be best positioned to capitalize on growth opportunities. The increasing complexity of surveillance requirements creates demand for vendors that can provide comprehensive ecosystems rather than standalone storage products.

Future success in this market will depend on the ability to adapt to evolving customer requirements, regulatory changes, and technological advancement while maintaining competitive pricing and superior performance. Organizations that invest in scalable, AI-integrated storage solutions will be well-positioned to address future security challenges while optimizing their surveillance infrastructure investments.

What is Security And Surveillance Storage?

Security and surveillance storage refers to the systems and technologies used to store video footage and data collected from security cameras and surveillance equipment. This includes various storage solutions such as cloud storage, network video recorders (NVRs), and digital video recorders (DVRs).

What are the key players in the Security And Surveillance Storage Market?

Key players in the Security And Surveillance Storage Market include companies like Hikvision, Dahua Technology, and Axis Communications. These companies are known for their innovative storage solutions and surveillance technologies, among others.

What are the main drivers of the Security And Surveillance Storage Market?

The main drivers of the Security And Surveillance Storage Market include the increasing need for public safety, the rise in crime rates, and the growing adoption of smart city initiatives. Additionally, advancements in storage technology and the demand for high-definition video surveillance are contributing to market growth.

What challenges does the Security And Surveillance Storage Market face?

Challenges in the Security And Surveillance Storage Market include concerns over data privacy and security, the high costs associated with advanced storage solutions, and the complexity of integrating new technologies with existing systems. These factors can hinder widespread adoption and implementation.

What opportunities exist in the Security And Surveillance Storage Market?

Opportunities in the Security And Surveillance Storage Market include the growing demand for cloud-based storage solutions and the integration of artificial intelligence in surveillance systems. Additionally, the expansion of IoT devices presents new avenues for innovative storage solutions.

What trends are shaping the Security And Surveillance Storage Market?

Trends shaping the Security And Surveillance Storage Market include the shift towards cloud storage, the increasing use of edge computing for real-time data processing, and the development of advanced analytics for video surveillance. These trends are enhancing the efficiency and effectiveness of security systems.

Security And Surveillance Storage Market

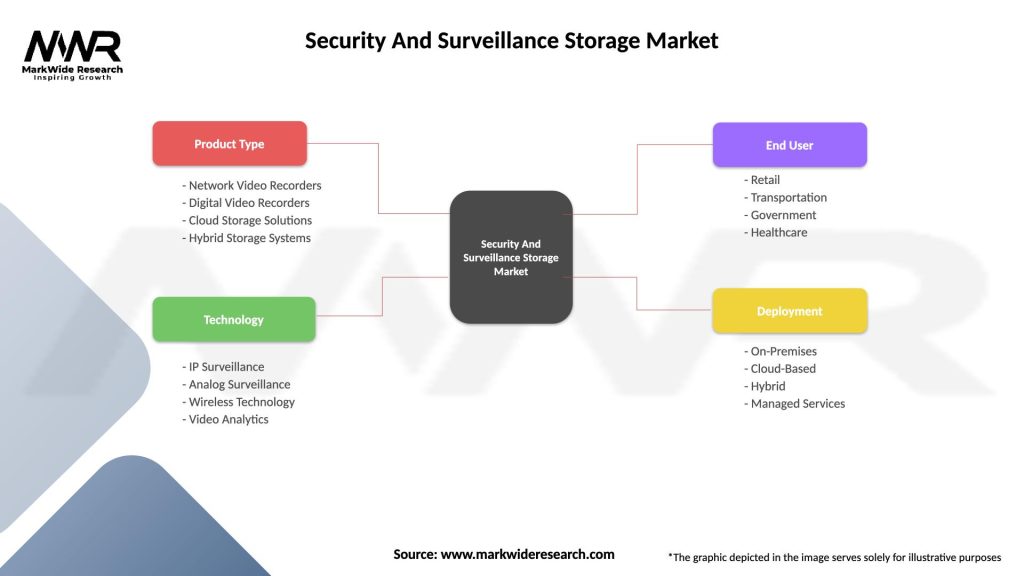

| Segmentation Details | Description |

|---|---|

| Product Type | Network Video Recorders, Digital Video Recorders, Cloud Storage Solutions, Hybrid Storage Systems |

| Technology | IP Surveillance, Analog Surveillance, Wireless Technology, Video Analytics |

| End User | Retail, Transportation, Government, Healthcare |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Security And Surveillance Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at