444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The transportation infrastructure construction market in Saudi Arabia is experiencing significant growth and development. With its ambitious Vision 2030 plan, the Saudi Arabian government is making substantial investments in infrastructure projects, including transportation, to diversify its economy and reduce its dependence on oil. This strategic focus on infrastructure development has created numerous opportunities for local and international construction companies, leading to a thriving market in the country.

Meaning

Transportation infrastructure construction refers to the planning, design, and implementation of various transportation projects that aim to enhance the movement of people and goods within a region or country. These projects include the construction and expansion of roads, highways, bridges, tunnels, airports, seaports, rail networks, and public transportation systems. In the case of Saudi Arabia, the transportation infrastructure construction market encompasses the development of these systems to support the country’s economic growth and improve connectivity both domestically and internationally.

Executive Summary

The Saudi Arabia transportation infrastructure construction market has witnessed significant growth in recent years due to the government’s Vision 2030 plan and its focus on developing the country’s infrastructure. The market presents numerous opportunities for construction companies to participate in large-scale projects and contribute to the modernization of the transportation network. However, there are also challenges and constraints that need to be addressed, such as regulatory hurdles, financing issues, and project delays. Despite these challenges, the market is expected to continue growing in the coming years, driven by government investments and the need for improved transportation connectivity.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The transportation infrastructure construction market in Saudi Arabia is characterized by a dynamic and evolving landscape. The market dynamics are influenced by various factors, including government policies, economic conditions, regulatory frameworks, and technological advancements. The government’s Vision 2030 plan and its commitment to diversifying the economy are the primary drivers of market growth. Additionally, the market is shaped by regional integration efforts, population growth, global connectivity needs, and the demand for sustainable and smart transportation solutions. However, the market also faces challenges such as regulatory hurdles, financing constraints, project delays, political instability, and a shortage of skilled labor. Overall, the market offers substantial opportunities for construction companies to contribute to the country’s infrastructure development and capitalize on the growing demand for transportation projects.

Regional Analysis

Saudi Arabia is divided into several regions, each with its unique characteristics and transportation infrastructure needs. The key regions for transportation infrastructure construction include:

Each region presents unique opportunities and challenges for transportation infrastructure construction, depending on its economic activities, population density, and strategic importance.

Competitive Landscape

Leading Companies in the Saudi Arabia Transportation Infrastructure Construction Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

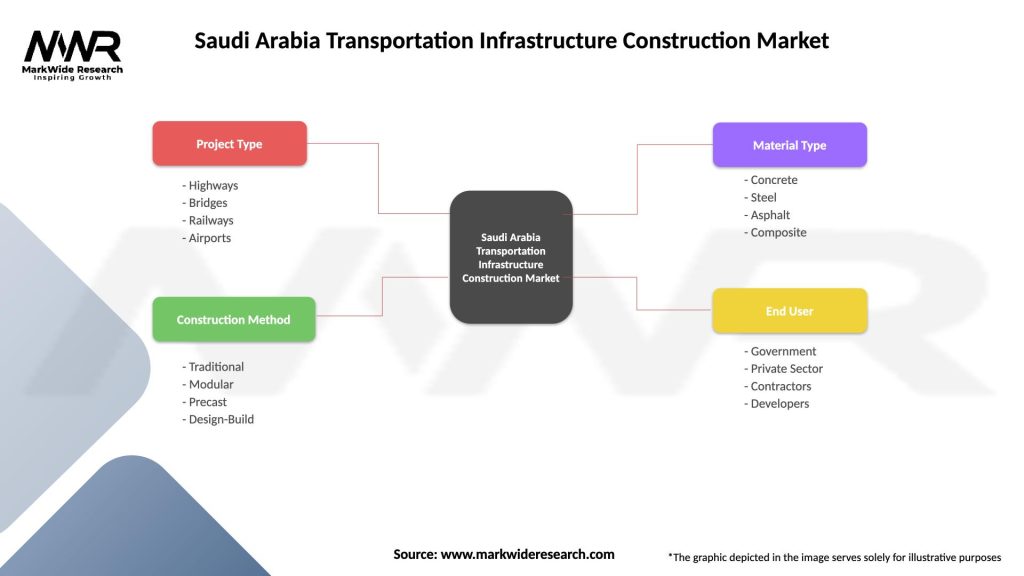

The transportation infrastructure construction market in Saudi Arabia can be segmented based on the following factors:

Segmentation helps stakeholders in the market to understand specific submarkets, target their efforts effectively, and align their strategies with the unique requirements of each segment.

Category-wise Insights

Understanding the unique insights and requirements of each category enables industry participants to focus their efforts on specific sectors and leverage the opportunities within them.

Key Benefits for Industry Participants and Stakeholders

Participating in the transportation infrastructure construction market in Saudi Arabia offers several benefits for industry participants and stakeholders, including:

Understanding the benefits associated with participation in the market helps industry participants and stakeholders make informed decisions and develop strategies to maximize their returns.

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis provides a comprehensive understanding of the transportation infrastructure construction market in Saudi Arabia:

Strengths:

Weaknesses:

Opportunities:

Threats:

Conducting a SWOT analysis helps industry participants and stakeholders assess the market’s internal and external factors, enabling them to leverage strengths, mitigate weaknesses, capitalize on opportunities, and address potential threats.

Market Key Trends

The transportation infrastructure construction market in Saudi Arabia is shaped by several key trends:

Staying informed about these key trends allows industry participants to adapt their strategies, incorporate new technologies, and deliver innovative solutions that align with market demands.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the transportation infrastructure construction market in Saudi Arabia. The pandemic caused disruptions in global supply chains, travel restrictions, and economic uncertainties, leading to delays and reevaluations of ongoing and planned projects. However, the Saudi Arabian government has implemented measures to mitigate the impact and ensure the continuity of infrastructure development. This includes the introduction of strict health and safety protocols at construction sites, financial support for affected projects, and the acceleration of digitalization initiatives to enable remote work and project management. As the situation gradually stabilizes, the market is expected to rebound, driven by the government’s commitment to infrastructure investments as part of its economic recovery and diversification plans.

Key Industry Developments

The transportation infrastructure construction market in Saudi Arabia has witnessed several notable industry developments in recent years:

These industry developments highlight the country’s commitment to infrastructure development and the opportunities available for construction companies in the transportation sector.

Analyst Suggestions

Following these suggestions can help industry participants navigate the market successfully, capitalize on opportunities, and overcome challenges in the transportation infrastructure construction sector in Saudi Arabia.

Future Outlook

The future outlook for the transportation infrastructure construction market in Saudi Arabia is promising. The government’s Vision 2030 plan and its commitment to infrastructure development are expected to drive substantial investments in the coming years. The market will continue to offer opportunities for construction companies to participate in large-scale projects, such as the development of airports, seaports, rail networks, and road infrastructure. Additionally, the focus on sustainability, smart transportation solutions, and digitalization will shape the future of the market. Collaboration between the public and private sectors, especially through PPPs, will play a crucial role in realizing the country’s infrastructure goals. Despite challenges such as regulatory complexities, financing constraints, and skills shortages, the market’s long-term outlook remains positive, supported by the government’s dedication to economic diversification and the growing demand for improved transportation connectivity.

Conclusion

The transportation infrastructure construction market in Saudi Arabia is experiencing significant growth and offers numerous opportunities for industry participants and stakeholders. With the government’s Vision 2030 plan and its focus on infrastructure development, the market is witnessing substantial investments in roads, highways, airports, seaports, rail networks, and public transportation systems. However, challenges such as regulatory complexities, financing constraints, and project delays need to be addressed. By leveraging key market insights, embracing collaboration, adopting advanced technologies, focusing on sustainability, and investing in workforce development, construction companies can position themselves for success in the Saudi Arabian transportation infrastructure construction market. The future outlook for the market is optimistic, driven by the government’s commitment to economic diversification and the need for enhanced transportation connectivity.

What is Transportation Infrastructure Construction?

Transportation Infrastructure Construction refers to the development and maintenance of essential facilities and systems that support the movement of people and goods. This includes roads, bridges, railways, airports, and ports, which are crucial for economic growth and connectivity.

What are the key players in the Saudi Arabia Transportation Infrastructure Construction Market?

Key players in the Saudi Arabia Transportation Infrastructure Construction Market include Saudi Binladin Group, Al Arrab Contracting Company, and El Seif Engineering Contracting Company, among others.

What are the main drivers of growth in the Saudi Arabia Transportation Infrastructure Construction Market?

The main drivers of growth in the Saudi Arabia Transportation Infrastructure Construction Market include the government’s Vision program aimed at enhancing infrastructure, increasing urbanization, and the need for improved logistics and transportation networks to support economic diversification.

What challenges does the Saudi Arabia Transportation Infrastructure Construction Market face?

Challenges in the Saudi Arabia Transportation Infrastructure Construction Market include regulatory hurdles, fluctuating material costs, and the need for skilled labor, which can impact project timelines and budgets.

What opportunities exist in the Saudi Arabia Transportation Infrastructure Construction Market?

Opportunities in the Saudi Arabia Transportation Infrastructure Construction Market include investments in smart transportation systems, expansion of public transport networks, and the development of sustainable infrastructure projects that align with environmental goals.

What trends are shaping the Saudi Arabia Transportation Infrastructure Construction Market?

Trends shaping the Saudi Arabia Transportation Infrastructure Construction Market include the adoption of advanced construction technologies, increased focus on sustainability, and the integration of digital solutions for project management and efficiency.

Saudi Arabia Transportation Infrastructure Construction Market

| Segmentation Details | Description |

|---|---|

| Project Type | Highways, Bridges, Railways, Airports |

| Construction Method | Traditional, Modular, Precast, Design-Build |

| Material Type | Concrete, Steel, Asphalt, Composite |

| End User | Government, Private Sector, Contractors, Developers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Saudi Arabia Transportation Infrastructure Construction Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at