444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia structural steel fabrication market represents a cornerstone of the Kingdom’s ambitious infrastructure development and economic diversification initiatives. Structural steel fabrication encompasses the cutting, bending, welding, and assembling of steel components to create frameworks for buildings, bridges, industrial facilities, and other construction projects. The market has experienced remarkable expansion driven by Vision 2030’s mega-projects, including NEOM, The Red Sea Project, and Qiddiya, which collectively demand substantial steel fabrication capabilities.

Market dynamics indicate robust growth potential, with the sector benefiting from increased government investment in infrastructure, housing projects, and industrial development. The Kingdom’s strategic location as a gateway between Asia, Africa, and Europe positions it as a regional hub for steel fabrication services. Local manufacturing capabilities have strengthened significantly, with domestic fabricators expanding their production capacity and technological sophistication to meet growing demand.

Industrial diversification efforts under Vision 2030 have catalyzed demand for structural steel fabrication across multiple sectors, including petrochemicals, mining, renewable energy, and transportation infrastructure. The market demonstrates strong growth momentum, with industry analysts projecting a compound annual growth rate of 8.2% through the forecast period. Quality standards and compliance requirements have elevated the technical capabilities of local fabricators, positioning them to compete effectively in regional and international markets.

The Saudi Arabia structural steel fabrication market refers to the comprehensive ecosystem of companies, processes, and services involved in transforming raw steel materials into engineered structural components for construction and industrial applications within the Kingdom. Structural steel fabrication involves precision manufacturing processes including cutting, drilling, welding, and assembly of steel beams, columns, trusses, and other load-bearing elements that form the skeletal framework of buildings and infrastructure projects.

Market participants range from large-scale fabrication facilities serving mega-projects to specialized workshops focusing on custom architectural steelwork. The sector encompasses both primary fabrication activities, where raw steel is processed into basic structural shapes, and secondary fabrication, involving detailed assembly and finishing operations. Value-added services include engineering design support, project management, logistics coordination, and on-site installation assistance.

Technological integration has transformed traditional fabrication methods, with modern facilities incorporating computer-aided design (CAD), automated cutting systems, robotic welding, and digital project management platforms. The market serves diverse end-user segments including commercial construction, residential development, industrial facilities, infrastructure projects, and specialized applications such as stadiums, airports, and cultural venues.

Saudi Arabia’s structural steel fabrication market stands at the forefront of the Kingdom’s construction and infrastructure boom, driven by unprecedented government investment and private sector participation. The market has evolved from serving primarily oil and gas sector requirements to supporting a diversified portfolio of mega-projects, urban development initiatives, and industrial expansion programs. Vision 2030 initiatives have created substantial demand for high-quality structural steel fabrication services across multiple economic sectors.

Market consolidation trends show increasing collaboration between local fabricators and international partners, enhancing technical capabilities and production capacity. The sector benefits from government policies promoting local content requirements, with 65% of fabrication work now sourced domestically compared to previous heavy reliance on imports. Technology adoption has accelerated, with leading fabricators investing in advanced manufacturing equipment and digital integration systems.

Competitive dynamics reflect a maturing market with established players expanding capacity while new entrants focus on specialized niches and value-added services. The market demonstrates resilience through economic cycles, supported by consistent government infrastructure spending and growing private sector construction activity. Quality certifications and international standards compliance have become critical differentiators, with 78% of major fabricators now holding multiple international quality accreditations.

Strategic market positioning reveals several critical insights shaping the Saudi Arabia structural steel fabrication landscape. The market demonstrates strong correlation with broader economic diversification efforts, positioning fabricators as essential partners in the Kingdom’s transformation agenda.

Vision 2030 implementation serves as the primary catalyst driving structural steel fabrication market expansion across Saudi Arabia. The comprehensive economic transformation program has unleashed unprecedented construction activity, creating sustained demand for high-quality fabrication services. Mega-project development including NEOM’s futuristic city, The Red Sea Project’s luxury tourism destination, and Qiddiya’s entertainment complex collectively require massive steel fabrication capabilities, establishing long-term market growth foundations.

Infrastructure modernization initiatives continue generating substantial fabrication opportunities across transportation, utilities, and urban development sectors. The Kingdom’s commitment to developing world-class infrastructure includes expanding airport facilities, constructing high-speed rail networks, and building modern urban centers, all requiring sophisticated structural steel solutions. Housing sector expansion under various government programs creates additional demand for residential and mixed-use development fabrication services.

Industrial diversification efforts drive fabrication demand across emerging sectors including renewable energy, mining, manufacturing, and logistics. The development of industrial cities and special economic zones requires extensive structural steel frameworks for manufacturing facilities, warehouses, and supporting infrastructure. Local content requirements mandated by government policies encourage domestic fabrication capacity expansion, creating competitive advantages for Saudi-based companies while reducing import dependency and supporting economic localization objectives.

Raw material price volatility represents a significant challenge for structural steel fabricators, with global steel prices subject to international market fluctuations, trade policies, and supply chain disruptions. Cost management pressures intensify during periods of rapid price increases, requiring fabricators to implement sophisticated procurement strategies and maintain flexible pricing models to preserve project profitability while remaining competitive in bid processes.

Skilled workforce shortages continue constraining market growth potential, particularly for specialized welding, quality control, and project management positions. The technical nature of modern fabrication requires extensive training and certification, creating bottlenecks in capacity expansion efforts. Competition for talent with other construction and manufacturing sectors intensifies recruitment challenges, necessitating comprehensive workforce development programs and competitive compensation packages.

Regulatory compliance complexity increases operational costs and project timelines, with fabricators required to meet multiple international standards, safety regulations, and quality certifications. Environmental regulations impose additional requirements for waste management, emissions control, and sustainable practices, requiring ongoing investment in compliance systems and monitoring capabilities. Project scheduling dependencies create operational challenges when fabrication timelines must align with complex construction schedules, often requiring flexible production capacity and inventory management strategies.

Export market expansion presents substantial growth opportunities for Saudi structural steel fabricators, leveraging the Kingdom’s strategic geographic position and competitive manufacturing costs. Regional demand growth across GCC countries, Africa, and Asia creates accessible markets for high-quality fabrication services, particularly for specialized applications requiring advanced technical capabilities and international quality standards compliance.

Technology integration opportunities enable fabricators to differentiate through advanced manufacturing capabilities, including robotic welding systems, automated cutting equipment, and digital project management platforms. Industry 4.0 adoption offers potential for significant productivity improvements, quality enhancements, and cost reductions while positioning companies for future market leadership. Sustainable fabrication practices create competitive advantages as green building requirements and environmental consciousness drive demand for eco-friendly construction solutions.

Value-added service expansion allows fabricators to capture additional revenue streams through engineering design support, project management services, logistics coordination, and installation assistance. Specialized market segments including renewable energy infrastructure, entertainment facilities, and cultural projects offer premium pricing opportunities for fabricators with appropriate technical capabilities and quality certifications. Strategic partnerships with international engineering firms and construction companies provide access to global expertise and expanded market opportunities.

Supply chain integration has become increasingly sophisticated, with leading fabricators establishing strategic relationships with steel suppliers, logistics providers, and construction contractors to ensure seamless project delivery. Vertical integration trends show some fabricators expanding into related services including engineering design, project management, and installation services to capture additional value and strengthen client relationships.

Competitive intensity continues increasing as market growth attracts new entrants while established players expand capacity and capabilities. Price competition remains significant for standard fabrication services, driving companies to focus on value-added offerings, quality differentiation, and operational efficiency improvements. Technology adoption rates vary significantly across market participants, creating competitive advantages for early adopters while challenging traditional operators to modernize their capabilities.

Customer expectations evolution demands higher quality standards, faster delivery timelines, and comprehensive service offerings from fabrication providers. Project complexity increases require fabricators to develop specialized expertise in architectural steelwork, complex geometries, and high-performance applications. Sustainability requirements are becoming standard expectations rather than optional features, necessitating investment in environmentally responsible practices and materials sourcing strategies.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Saudi Arabia structural steel fabrication market. Primary research activities included extensive interviews with industry executives, fabrication facility managers, project developers, and government officials involved in construction and infrastructure development initiatives.

Secondary research components encompassed analysis of government publications, industry reports, trade association data, and company financial statements to establish market trends, competitive positioning, and growth projections. Data validation processes involved cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market assumptions.

Quantitative analysis utilized statistical modeling techniques to project market growth rates, segment performance, and competitive dynamics. Qualitative assessment methods included expert opinion surveys, focus group discussions, and case study development to understand market nuances and strategic implications. Market segmentation analysis employed both top-down and bottom-up approaches to ensure comprehensive coverage of all relevant market categories and applications.

Riyadh region dominates the structural steel fabrication market, accounting for approximately 38% of total market activity due to its concentration of government projects, commercial development, and industrial facilities. The capital city’s ongoing expansion includes numerous mega-projects requiring sophisticated fabrication services, from government buildings and cultural facilities to residential complexes and transportation infrastructure. Fabrication capacity in the Riyadh region has expanded significantly to meet growing demand, with several new facilities establishing operations to serve local and regional markets.

Eastern Province represents the second-largest market segment with 28% market share, driven primarily by industrial and petrochemical sector demand. The region’s established industrial base creates consistent requirements for specialized fabrication services, including process equipment structures, storage facilities, and industrial buildings. Port facilities and logistics infrastructure in the Eastern Province support both domestic market service and export operations to regional markets.

Western Region including Jeddah and Mecca captures 22% of market activity, benefiting from The Red Sea Project development, religious tourism infrastructure, and commercial construction projects. Fabrication capabilities in the Western Region focus on architectural steelwork, commercial buildings, and specialized applications for tourism and hospitality sectors. Remaining regions collectively account for 12% of market share, with growing activity in northern and southern provinces driven by industrial development and infrastructure projects supporting Vision 2030 initiatives.

Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment reflects a mix of established Saudi companies, international fabricators with local operations, and emerging players focusing on specialized market segments.

By Application: The market segments into several distinct application categories, each with unique requirements and growth characteristics. Commercial construction represents the largest segment, encompassing office buildings, retail centers, hotels, and mixed-use developments. Industrial fabrication serves manufacturing facilities, warehouses, processing plants, and specialized industrial structures. Infrastructure projects include bridges, transportation facilities, utilities, and public buildings.

By End-User Sector: Market segmentation reveals diverse customer bases with varying requirements and procurement processes. Government projects constitute a major segment through Vision 2030 initiatives and public infrastructure development. Private sector construction includes commercial real estate, residential development, and corporate facilities. Industrial clients encompass petrochemical companies, manufacturing operations, and logistics providers.

By Product Type: Fabrication services are categorized by structural component types and complexity levels. Standard structural steel includes beams, columns, and basic framework elements for conventional construction. Architectural steelwork involves complex geometries, decorative elements, and specialized finishes for premium projects. Heavy industrial fabrication encompasses large-scale structures, process equipment supports, and specialized industrial applications requiring advanced engineering and manufacturing capabilities.

Commercial Construction Segment: This category demonstrates robust growth driven by urban development initiatives and private sector investment in commercial real estate. Office building construction requires sophisticated fabrication services for modern architectural designs, while retail and hospitality projects demand specialized steelwork for unique structural and aesthetic requirements. Quality standards in commercial construction continue elevating, requiring fabricators to maintain international certifications and advanced manufacturing capabilities.

Industrial Fabrication Category: The industrial segment shows steady expansion supported by manufacturing sector growth and industrial diversification efforts. Petrochemical facilities require specialized fabrication services for process equipment structures, storage facilities, and safety systems. Manufacturing plants demand precise fabrication for production equipment supports, building frameworks, and material handling systems. Technical complexity in industrial applications necessitates advanced engineering capabilities and strict quality control processes.

Infrastructure Development Segment: This category benefits from substantial government investment in transportation, utilities, and public facilities. Transportation infrastructure including airports, rail systems, and bridges requires specialized fabrication expertise for complex structural applications. Utility projects encompass power generation facilities, water treatment plants, and telecommunications infrastructure. Public buildings including schools, hospitals, and government facilities create consistent demand for quality fabrication services with emphasis on durability and safety compliance.

Fabrication Companies benefit from sustained market growth driven by Vision 2030 initiatives and infrastructure development programs. Revenue diversification opportunities allow fabricators to serve multiple market segments while reducing dependency on any single sector. Technology investment returns provide competitive advantages through improved productivity, quality, and cost efficiency. Skilled workforce development creates long-term competitive advantages and supports company growth strategies.

Construction Industry Stakeholders gain access to improved fabrication capabilities, shorter delivery timelines, and enhanced quality standards from local suppliers. Cost advantages from local sourcing reduce project expenses while supporting supply chain reliability. Technical collaboration with fabricators enables optimized structural designs and construction methodologies. Project scheduling flexibility improves through reliable local fabrication capacity and responsive service capabilities.

Government and Economic Development benefit from job creation, technology transfer, and industrial capacity building within the Kingdom. Local content enhancement reduces import dependency while supporting economic diversification objectives. Export potential development creates opportunities for regional market expansion and foreign exchange earnings. Infrastructure development support enables successful implementation of Vision 2030 mega-projects and urban development initiatives through reliable fabrication services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping structural steel fabrication operations through advanced software integration, automated manufacturing systems, and data-driven decision making. Building Information Modeling (BIM) adoption enables precise project planning, clash detection, and seamless coordination between design and fabrication phases. Automated cutting and welding systems improve accuracy while reducing labor requirements and production timelines.

Sustainability integration has become a critical market trend, with fabricators implementing environmentally responsible practices including waste reduction, energy efficiency, and sustainable material sourcing. Green building certifications increasingly require fabricators to demonstrate environmental compliance and sustainable practices throughout the manufacturing process. Circular economy principles encourage steel recycling and reuse strategies, creating new business models and cost optimization opportunities.

Quality standardization continues advancing through international certification adoption and best practice implementation across the industry. Lean manufacturing principles help fabricators optimize operations, reduce waste, and improve delivery performance. Customer service enhancement includes comprehensive project support services, technical consultation, and post-delivery assistance. Workforce development initiatives focus on technical training, safety certification, and career advancement programs to address skilled labor shortages while improving overall industry capabilities.

Capacity expansion initiatives have accelerated across the Saudi structural steel fabrication sector, with multiple companies announcing significant facility upgrades and new production lines. Technology investments include advanced CNC cutting systems, robotic welding equipment, and integrated project management software platforms designed to improve efficiency and quality standards. Strategic partnerships between local fabricators and international technology providers facilitate knowledge transfer and capability enhancement.

Quality certification achievements demonstrate industry maturation, with MarkWide Research noting that leading fabricators have obtained multiple international standards including ISO 9001, AWS welding certifications, and specialized industry accreditations. Workforce development programs launched in collaboration with technical institutes and international training organizations address skilled labor shortages while elevating industry standards.

Export market penetration has begun showing results, with Saudi fabricators securing contracts for regional projects and establishing distribution partnerships in neighboring countries. Sustainability initiatives include implementation of environmental management systems, waste reduction programs, and energy efficiency improvements across fabrication facilities. Digital integration projects encompass enterprise resource planning systems, customer relationship management platforms, and advanced manufacturing execution systems designed to optimize operations and enhance customer service capabilities.

Strategic positioning recommendations emphasize the importance of technology investment and quality differentiation for long-term competitive success. Fabrication companies should prioritize advanced manufacturing equipment acquisition, workforce development programs, and international certification achievement to capture premium market opportunities. Specialization strategies in high-value segments such as architectural steelwork, complex industrial applications, and export markets offer superior profitability potential compared to commodity fabrication services.

Operational excellence initiatives should focus on lean manufacturing implementation, digital integration, and customer service enhancement to improve competitive positioning. Supply chain optimization through strategic supplier relationships, inventory management systems, and logistics coordination can provide cost advantages and delivery reliability improvements. Risk management strategies including raw material price hedging, project diversification, and financial planning help navigate market volatility and economic uncertainties.

Growth strategy development should consider both domestic market expansion and regional export opportunities, leveraging Saudi Arabia’s strategic location and competitive advantages. Partnership opportunities with international engineering firms, construction companies, and technology providers can accelerate capability development and market access. Sustainability integration represents both a competitive necessity and differentiation opportunity as environmental requirements become standard market expectations rather than optional features.

Market growth projections indicate continued expansion driven by Vision 2030 implementation, infrastructure development, and industrial diversification initiatives. MarkWide Research analysis suggests the sector will maintain robust growth momentum with increasing sophistication in fabrication capabilities and service offerings. Technology adoption acceleration will likely create competitive separation between early adopters and traditional operators, emphasizing the importance of modernization investments.

Demand patterns evolution points toward increased requirements for complex architectural steelwork, specialized industrial applications, and sustainable fabrication practices. Export market development offers substantial growth potential, with Saudi fabricators positioned to capture 25% of regional market share through strategic expansion and quality differentiation. Workforce development success will be critical for realizing growth potential, requiring continued investment in training programs and career development initiatives.

Industry consolidation trends may accelerate as market growth attracts investment while competitive pressures favor larger, more capable operators. Sustainability requirements will likely become mandatory rather than optional, necessitating comprehensive environmental management system implementation across the industry. Digital transformation completion will separate market leaders from followers, with advanced manufacturing and project management capabilities becoming standard competitive requirements rather than differentiating advantages.

Saudi Arabia’s structural steel fabrication market stands at a pivotal juncture, positioned for sustained growth through Vision 2030 implementation while facing the imperative for technological advancement and operational excellence. The market demonstrates remarkable resilience and growth potential, supported by unprecedented government investment, private sector participation, and strategic economic diversification initiatives. Industry transformation from traditional fabrication methods to advanced manufacturing capabilities reflects broader economic modernization efforts and positions Saudi fabricators for regional leadership.

Competitive dynamics will likely intensify as market growth attracts new entrants while established players expand capabilities and capacity. Success factors increasingly emphasize quality differentiation, technology integration, and comprehensive service offerings rather than price competition alone. Sustainability integration and workforce development represent critical success factors for long-term market participation and growth.

The future outlook remains highly positive, with multiple growth drivers supporting continued market expansion and sophistication. Strategic positioning through technology investment, quality certification, and market specialization will determine competitive success in an evolving landscape characterized by increasing customer expectations and international competition. Saudi Arabia’s structural steel fabrication market is well-positioned to support the Kingdom’s transformation agenda while creating substantial value for industry participants and stakeholders.

What is Structural Steel Fabrication?

Structural Steel Fabrication refers to the process of cutting, bending, and assembling steel structures to create frameworks for buildings, bridges, and other infrastructure. This process is essential in construction and engineering, ensuring that structures are durable and meet safety standards.

What are the key players in the Saudi Arabia Structural Steel Fabrication Market?

Key players in the Saudi Arabia Structural Steel Fabrication Market include companies like Saudi Steel Pipe Company, Al Rajhi Steel Industries, and Al-Babtain Group, among others. These companies are involved in various aspects of steel fabrication, including manufacturing and supply.

What are the growth factors driving the Saudi Arabia Structural Steel Fabrication Market?

The growth of the Saudi Arabia Structural Steel Fabrication Market is driven by increasing construction activities, government investments in infrastructure projects, and a rising demand for energy-efficient buildings. Additionally, the Vision Saudi initiative aims to enhance urban development, further boosting the market.

What challenges does the Saudi Arabia Structural Steel Fabrication Market face?

The Saudi Arabia Structural Steel Fabrication Market faces challenges such as fluctuating raw material prices, skilled labor shortages, and regulatory compliance issues. These factors can impact production costs and project timelines.

What opportunities exist in the Saudi Arabia Structural Steel Fabrication Market?

Opportunities in the Saudi Arabia Structural Steel Fabrication Market include the growing demand for prefabricated structures and modular construction techniques. Additionally, advancements in technology and automation present avenues for increased efficiency and reduced costs.

What trends are shaping the Saudi Arabia Structural Steel Fabrication Market?

Trends in the Saudi Arabia Structural Steel Fabrication Market include the adoption of sustainable practices, such as recycling steel and using eco-friendly materials. Furthermore, the integration of digital technologies like Building Information Modeling (BIM) is enhancing project management and design accuracy.

Saudi Arabia Structural Steel Fabrication Market

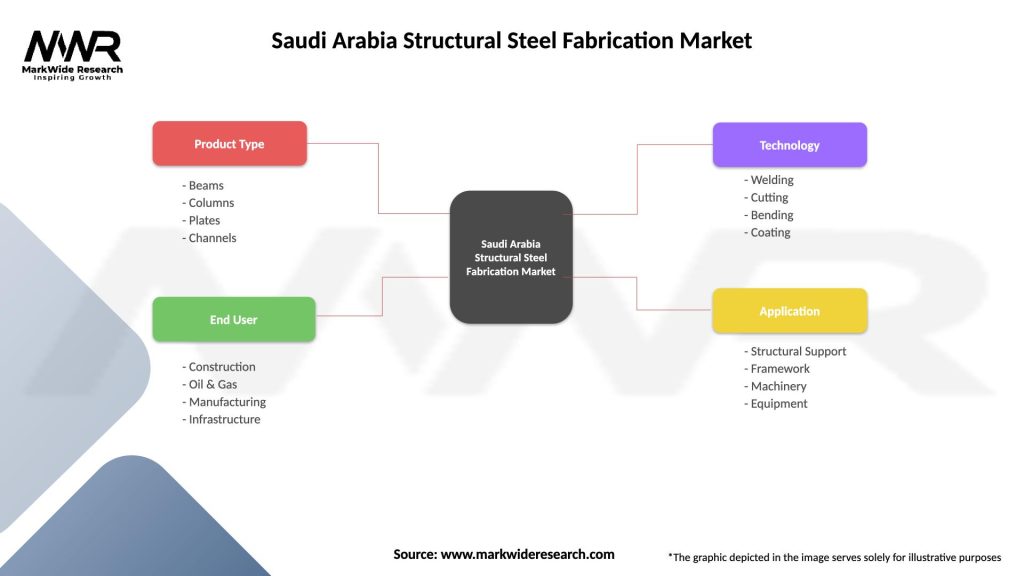

| Segmentation Details | Description |

|---|---|

| Product Type | Beams, Columns, Plates, Channels |

| End User | Construction, Oil & Gas, Manufacturing, Infrastructure |

| Technology | Welding, Cutting, Bending, Coating |

| Application | Structural Support, Framework, Machinery, Equipment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Structural Steel Fabrication Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at