444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia solar power market represents one of the most dynamic and rapidly expanding renewable energy sectors in the Middle East region. As the Kingdom pursues its ambitious Vision 2030 initiative, solar energy has emerged as a cornerstone of the nation’s economic diversification strategy. The market demonstrates exceptional growth potential driven by abundant solar resources, government support, and increasing private sector participation.

Market dynamics indicate that Saudi Arabia possesses some of the world’s highest solar irradiation levels, with annual direct normal irradiance exceeding 2,500 kWh/m² in many regions. This natural advantage, combined with declining technology costs and supportive regulatory frameworks, has positioned the Kingdom as a regional leader in solar energy deployment. The market encompasses various technologies including photovoltaic systems, concentrated solar power, and hybrid solutions.

Strategic initiatives such as the National Renewable Energy Program (NREP) and the Saudi Green Initiative have accelerated market development. The government’s commitment to generating 50% of electricity from renewable sources by 2030 has created substantial opportunities for both domestic and international solar power developers. Major projects like the Al Shuaibah and Sakaka solar plants demonstrate the Kingdom’s serious commitment to solar energy transformation.

The Saudi Arabia solar power market refers to the comprehensive ecosystem of solar energy generation, distribution, and utilization within the Kingdom of Saudi Arabia. This market encompasses the development, installation, operation, and maintenance of solar photovoltaic systems, concentrated solar power facilities, and associated infrastructure designed to harness the country’s abundant solar resources for electricity generation and various industrial applications.

Market scope includes utility-scale solar installations, distributed generation systems, residential rooftop solutions, and specialized applications for industrial processes. The market also encompasses supporting services such as project development, engineering procurement and construction, operations and maintenance, and energy storage integration. Additionally, it covers the regulatory framework, financing mechanisms, and policy initiatives that facilitate solar energy adoption across different sectors of the Saudi economy.

Saudi Arabia’s solar power market stands at the forefront of the Kingdom’s renewable energy transformation, driven by Vision 2030 objectives and the need for economic diversification. The market benefits from world-class solar resources, with some regions receiving over 2,800 hours of sunshine annually, creating optimal conditions for solar energy generation.

Key market drivers include government initiatives targeting renewable energy capacity expansion, declining solar technology costs, and growing environmental consciousness. The National Renewable Energy Program aims to develop significant renewable energy capacity, with solar power representing the largest component of this ambitious plan. According to MarkWide Research analysis, the market demonstrates strong fundamentals supported by regulatory clarity and international investment interest.

Investment flows into the sector have accelerated significantly, with major international developers and technology providers establishing local partnerships. The market structure encompasses both public and private sector participation, with competitive bidding processes yielding some of the world’s most competitive solar electricity tariffs. This competitive environment has attracted global attention and positioned Saudi Arabia as a preferred destination for solar energy investments.

Strategic market insights reveal several critical factors shaping the Saudi Arabia solar power landscape:

Government policy initiatives serve as the primary catalyst for Saudi Arabia’s solar power market expansion. The Kingdom’s Vision 2030 strategy emphasizes renewable energy development as a cornerstone of economic diversification, creating a supportive environment for solar power investments. The National Renewable Energy Program provides clear targets and implementation frameworks that guide market development.

Economic factors significantly influence market growth, particularly the declining costs of solar technology and the competitive electricity tariffs achieved in recent projects. The Kingdom’s abundant solar resources enable developers to achieve exceptional capacity factors, improving project economics and attracting international investment. Additionally, the desire to reduce domestic oil consumption for electricity generation and preserve hydrocarbon resources for export creates strong economic incentives for solar power adoption.

Environmental considerations increasingly drive solar power development as Saudi Arabia commits to carbon neutrality goals and sustainable development objectives. The Kingdom’s participation in global climate initiatives and its leadership role in regional environmental protection efforts support renewable energy expansion. Furthermore, growing awareness of air quality issues and the environmental benefits of clean energy sources contribute to market momentum.

Technological advancements in solar power systems, including improved efficiency, reliability, and cost-effectiveness, enhance market attractiveness. The integration of energy storage technologies and smart grid capabilities creates additional value propositions for solar power projects. Innovation in concentrated solar power technology, particularly suited to Saudi Arabia’s climate conditions, opens new market opportunities.

Infrastructure challenges present significant constraints to rapid solar power market expansion. The existing electrical grid infrastructure requires substantial upgrades and modifications to accommodate large-scale renewable energy integration. Grid stability concerns and the need for backup power systems during low solar generation periods create technical and economic challenges that must be addressed through careful planning and investment.

Financial barriers include the high upfront capital requirements for solar power projects, particularly for utility-scale installations. While operating costs are low, the initial investment can be substantial, requiring sophisticated financing mechanisms and long-term commitment from developers and investors. Access to competitive financing and the development of local financial markets for renewable energy projects remain ongoing challenges.

Regulatory complexities and bureaucratic processes can slow project development and implementation timelines. While the government has made significant progress in streamlining approval processes, coordination between various agencies and compliance with multiple regulatory requirements can create delays. The need for environmental assessments, land acquisition procedures, and grid connection approvals adds complexity to project development.

Technical limitations include the intermittent nature of solar power generation and the need for energy storage or backup systems to ensure reliable electricity supply. Dust and sandstorm conditions in certain regions can affect solar panel efficiency and require specialized maintenance protocols. Additionally, the lack of local technical expertise and skilled workforce in some areas of solar technology can constrain market development.

Utility-scale development presents the most significant opportunity in Saudi Arabia’s solar power market. The Kingdom’s vast available land areas, exceptional solar resources, and government support for large-scale renewable energy projects create ideal conditions for major solar installations. Opportunities exist for both photovoltaic and concentrated solar power technologies, with potential for hybrid systems that combine multiple renewable energy sources.

Industrial applications offer substantial growth potential as energy-intensive industries seek to reduce operational costs and environmental impact. Solar power integration in petrochemical facilities, mining operations, desalination plants, and manufacturing facilities presents attractive opportunities for specialized solar solutions. The development of industrial solar parks and dedicated renewable energy zones creates additional market segments.

Distributed generation opportunities are emerging in commercial and residential sectors as awareness of solar power benefits increases. Rooftop solar installations, community solar programs, and distributed energy resources create new market segments with different technical and financial requirements. The potential for net metering and feed-in tariff programs could accelerate distributed solar adoption.

Export opportunities may develop as Saudi Arabia builds renewable energy manufacturing capabilities and expertise. The Kingdom’s strategic location and growing technical capabilities position it to serve regional markets and potentially export solar power through interconnected electrical grids. Additionally, the development of green hydrogen production using solar power creates new value chains and export opportunities.

Supply chain dynamics in the Saudi Arabia solar power market are evolving rapidly as the Kingdom seeks to develop local manufacturing capabilities and reduce dependence on imported components. The government’s emphasis on local content requirements and technology transfer creates opportunities for domestic and international companies to establish manufacturing facilities and supply chain operations within the Kingdom.

Competitive dynamics have intensified as international solar developers and technology providers compete for market share in one of the world’s most promising solar markets. The competitive bidding processes for major projects have resulted in record-low electricity tariffs, demonstrating the economic competitiveness of solar power. This competition drives innovation and cost reduction while ensuring optimal value for consumers and the government.

Investment dynamics show strong international interest in Saudi Arabia’s solar power market, with major global renewable energy companies establishing local partnerships and joint ventures. The Kingdom’s sovereign wealth fund and development institutions actively support renewable energy investments, creating a favorable investment climate. According to MWR analysis, investment flows are expected to accelerate as more projects reach financial closure and demonstrate successful implementation.

Technology dynamics reflect the rapid advancement of solar power technologies and their adaptation to Saudi Arabia’s specific climate and operational conditions. The integration of artificial intelligence, Internet of Things, and advanced materials in solar systems enhances performance and reliability. Additionally, the convergence of solar power with energy storage, electric vehicle charging, and smart grid technologies creates new market dynamics and opportunities.

Primary research methodologies employed in analyzing the Saudi Arabia solar power market include comprehensive interviews with industry stakeholders, government officials, project developers, and technology providers. Direct engagement with market participants provides insights into current challenges, opportunities, and future development plans. Field visits to existing solar installations and project sites offer practical understanding of operational conditions and technical requirements.

Secondary research approaches involve extensive analysis of government publications, industry reports, regulatory documents, and academic studies related to Saudi Arabia’s renewable energy sector. Review of project announcements, tender documents, and financial disclosures provides quantitative data on market development trends. International benchmarking studies help contextualize Saudi Arabia’s solar power market within global renewable energy trends.

Data validation processes ensure accuracy and reliability of market information through cross-referencing multiple sources and expert verification. Statistical analysis of historical data and trend identification support market projections and growth estimates. Regular updates and monitoring of market developments maintain current and relevant insights for stakeholders and decision-makers.

Analytical frameworks incorporate economic modeling, technology assessment, and policy analysis to provide comprehensive market understanding. Scenario planning and sensitivity analysis help identify potential market developments under different conditions. Integration of quantitative and qualitative research methods ensures balanced and thorough market evaluation.

Northern regions of Saudi Arabia, including Tabuk and Al Jouf provinces, demonstrate exceptional potential for solar power development due to high solar irradiation levels and available land resources. The Sakaka Solar Project in Al Jouf province serves as a flagship development showcasing the region’s solar power capabilities. These areas benefit from proximity to major population centers and existing electrical infrastructure, facilitating grid integration and power distribution.

Central regions encompassing Riyadh and surrounding provinces represent significant market opportunities driven by high electricity demand from urban centers and industrial facilities. The capital region’s growing population and economic activity create substantial electricity requirements that solar power can help meet. Additionally, the presence of government institutions and decision-making centers in central regions facilitates policy implementation and project coordination.

Eastern provinces offer unique opportunities for solar power integration with industrial facilities, particularly in the petrochemical and energy sectors. The region’s concentration of energy-intensive industries creates demand for reliable and cost-effective electricity supply. Solar power development in eastern regions can support industrial competitiveness while reducing environmental impact of industrial operations.

Western regions including Mecca and Medina provinces present opportunities for solar power development to support religious tourism and urban development. The Red Sea coastal areas offer potential for solar-powered desalination and tourism infrastructure. Additionally, the planned NEOM megacity project in the northwest creates unprecedented opportunities for integrated renewable energy systems and smart city applications.

International developers dominate the Saudi Arabia solar power market, bringing global expertise and financial capabilities to major projects:

Local partnerships and joint ventures are increasingly common as international companies seek to establish long-term presence in the Saudi market. These collaborations combine global technical expertise with local market knowledge and regulatory understanding. The development of local capabilities through technology transfer and training programs creates sustainable competitive advantages.

Government entities including the Saudi Power Procurement Company and the Renewable Energy Project Development Office play crucial roles in market development through project tendering, contract management, and regulatory oversight. Their involvement ensures alignment with national energy objectives and maintains competitive market conditions.

By Technology:

By Application:

By End User:

Utility-scale photovoltaic represents the largest and fastest-growing segment of Saudi Arabia’s solar power market. These large-scale installations benefit from economies of scale, competitive bidding processes, and government support for renewable energy development. Recent projects have achieved remarkable cost competitiveness, with electricity tariffs reaching record-low levels that demonstrate the economic viability of solar power generation.

Concentrated solar power technology offers unique advantages in Saudi Arabia’s climate conditions, particularly the ability to provide dispatchable power through thermal energy storage. This technology segment addresses grid stability concerns and provides reliable electricity generation even during periods of low solar irradiation. The integration of thermal storage systems enables concentrated solar power plants to operate as baseload power sources.

Industrial solar applications are gaining traction as energy-intensive industries seek to reduce operational costs and environmental impact. Solar power integration in petrochemical facilities, mining operations, and manufacturing plants demonstrates the versatility and economic benefits of renewable energy adoption. These applications often require customized solutions and specialized engineering to meet specific industrial requirements.

Distributed generation segment shows emerging potential as awareness of solar power benefits increases among commercial and residential users. Rooftop solar installations, community solar programs, and distributed energy resources create new market opportunities with different technical and financial characteristics compared to utility-scale projects. The development of net metering and distributed generation policies will significantly influence this segment’s growth trajectory.

Economic benefits for industry participants include access to one of the world’s most attractive solar power markets with exceptional resource conditions and government support. Developers and investors can achieve competitive returns through cost-effective project development and operation. The competitive bidding environment ensures optimal pricing while maintaining healthy profit margins for efficient operators.

Strategic advantages include early market entry opportunities in a rapidly expanding renewable energy sector. Companies establishing strong positions in Saudi Arabia’s solar power market can leverage this experience for regional expansion and technology development. The Kingdom’s strategic location and growing influence in global energy markets provide platforms for broader business development.

Technology benefits arise from operating in challenging but rewarding conditions that drive innovation and performance optimization. The extreme climate conditions and high-performance requirements in Saudi Arabia push technology boundaries and create opportunities for breakthrough developments. Successful operation in this market demonstrates technology reliability and performance capabilities.

Stakeholder value creation extends beyond immediate participants to include local communities, environmental benefits, and national economic development. Solar power projects create employment opportunities, support local supply chains, and contribute to economic diversification objectives. Additionally, environmental benefits from reduced carbon emissions and air pollution provide broader societal value.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration trends show increasing adoption of advanced solar technologies including bifacial panels, tracking systems, and smart inverters that maximize energy generation and system efficiency. The integration of artificial intelligence and machine learning for predictive maintenance and performance optimization represents a significant technological advancement. Additionally, the convergence of solar power with energy storage systems creates more reliable and dispatchable renewable energy solutions.

Financing innovation trends include the development of new financial instruments and structures specifically designed for renewable energy projects. Green bonds, Islamic finance products, and blended financing mechanisms are becoming more prevalent in project funding. The emergence of corporate power purchase agreements and direct investment by end users creates alternative financing pathways that reduce dependence on traditional project finance.

Localization trends reflect the government’s emphasis on developing domestic capabilities in solar power manufacturing, installation, and maintenance. Technology transfer agreements, local content requirements, and workforce development programs are driving the creation of indigenous solar power industry capabilities. This trend supports economic diversification objectives while reducing dependence on imported technologies and services.

Sustainability trends encompass broader environmental and social considerations in solar power project development. Circular economy principles, recycling programs for solar panels, and comprehensive environmental impact assessments are becoming standard practice. Additionally, community engagement and social impact programs ensure that solar power development benefits local populations and supports sustainable development goals.

Major project announcements continue to demonstrate the scale and ambition of Saudi Arabia’s solar power development plans. The Al Shuaibah solar project and other large-scale installations showcase the Kingdom’s commitment to renewable energy expansion. These projects set new benchmarks for cost competitiveness and technical performance while attracting international attention and investment.

Regulatory developments include the establishment of new frameworks for distributed generation, energy storage integration, and grid modernization. The Saudi Electricity Regulatory Authority has introduced updated regulations that facilitate renewable energy development while maintaining grid stability and reliability. These regulatory advances create clearer pathways for project development and investment.

Partnership formations between international technology providers and local companies are accelerating technology transfer and capability development. Joint ventures, licensing agreements, and strategic alliances enable knowledge sharing and local capacity building. These partnerships combine global expertise with local market understanding to create sustainable competitive advantages.

Infrastructure investments in grid modernization, transmission capacity expansion, and smart grid technologies support renewable energy integration. The development of renewable energy zones and dedicated transmission infrastructure facilitates large-scale solar power development. Additionally, investments in energy storage facilities and grid balancing capabilities address intermittency challenges associated with solar power generation.

Strategic recommendations for market participants include focusing on long-term partnerships and local capability development to establish sustainable competitive positions. Companies should invest in understanding local market conditions, regulatory requirements, and cultural considerations that influence project success. Building strong relationships with government entities, local partners, and community stakeholders is essential for long-term market success.

Technology recommendations emphasize the importance of selecting appropriate technologies for Saudi Arabia’s specific climate and operational conditions. Dust-resistant designs, high-temperature performance capabilities, and robust maintenance protocols are crucial for successful project implementation. Additionally, integration of energy storage and grid stabilization technologies should be considered to enhance project value and grid compatibility.

Financial recommendations include developing comprehensive financing strategies that leverage multiple funding sources and risk mitigation mechanisms. Understanding Islamic finance principles and local banking practices can provide access to additional funding sources. Additionally, structuring projects to meet local content requirements while maintaining economic viability requires careful planning and execution.

Operational recommendations focus on establishing robust operations and maintenance capabilities that can handle the challenging environmental conditions in Saudi Arabia. Developing local technical expertise through training programs and technology transfer initiatives ensures sustainable project operation. Additionally, implementing advanced monitoring and control systems enables proactive maintenance and performance optimization.

Market growth projections indicate continued expansion of Saudi Arabia’s solar power market driven by government policy support, improving technology economics, and growing electricity demand. The Kingdom’s commitment to generating 50% of electricity from renewable sources by 2030 provides clear growth trajectory for solar power development. According to MarkWide Research projections, the market is expected to maintain strong growth momentum throughout the forecast period.

Technology evolution will likely focus on improving efficiency, reliability, and cost-effectiveness of solar power systems. Advanced materials, improved manufacturing processes, and innovative system designs will continue to drive performance improvements. The integration of digital technologies, artificial intelligence, and Internet of Things capabilities will enhance system monitoring, maintenance, and optimization.

Market maturation is expected to bring increased competition, standardization of practices, and development of local supply chains. As the market grows, economies of scale and learning curve effects will further reduce costs and improve project economics. The emergence of secondary markets for solar assets and refinancing opportunities will provide additional liquidity and investment options.

Regional expansion opportunities may develop as Saudi Arabia builds expertise and capabilities in solar power development. The Kingdom’s strategic location and growing technical capabilities position it to serve regional markets and potentially export solar power through interconnected electrical grids. Additionally, the development of green hydrogen production using solar power creates new value chains and export opportunities that could significantly expand the market’s scope and impact.

Saudi Arabia’s solar power market represents one of the most promising renewable energy opportunities globally, combining exceptional natural resources with strong government support and growing international investment interest. The Kingdom’s Vision 2030 initiative and National Renewable Energy Program provide comprehensive frameworks for sustainable market development, while competitive bidding processes ensure cost-effective project implementation.

Market fundamentals remain exceptionally strong, supported by world-class solar irradiation levels, abundant land resources, and substantial financial capacity for renewable energy investments. The successful implementation of flagship projects demonstrates the technical and economic viability of solar power in Saudi Arabia’s challenging climate conditions. Furthermore, the development of local capabilities and supply chains creates sustainable foundations for long-term market growth.

Future prospects indicate continued market expansion driven by technology advancement, cost reduction, and increasing adoption across utility-scale, industrial, and distributed generation segments. The integration of energy storage, smart grid technologies, and advanced materials will enhance solar power system performance and reliability. As Saudi Arabia progresses toward its renewable energy targets, the solar power market will play an increasingly important role in the Kingdom’s energy mix and economic diversification strategy, creating substantial opportunities for industry participants and contributing to global renewable energy development.

What is Solar Power?

Solar power refers to the energy harnessed from the sun’s rays, which can be converted into electricity or heat. It is a renewable energy source that plays a crucial role in reducing carbon emissions and promoting sustainability.

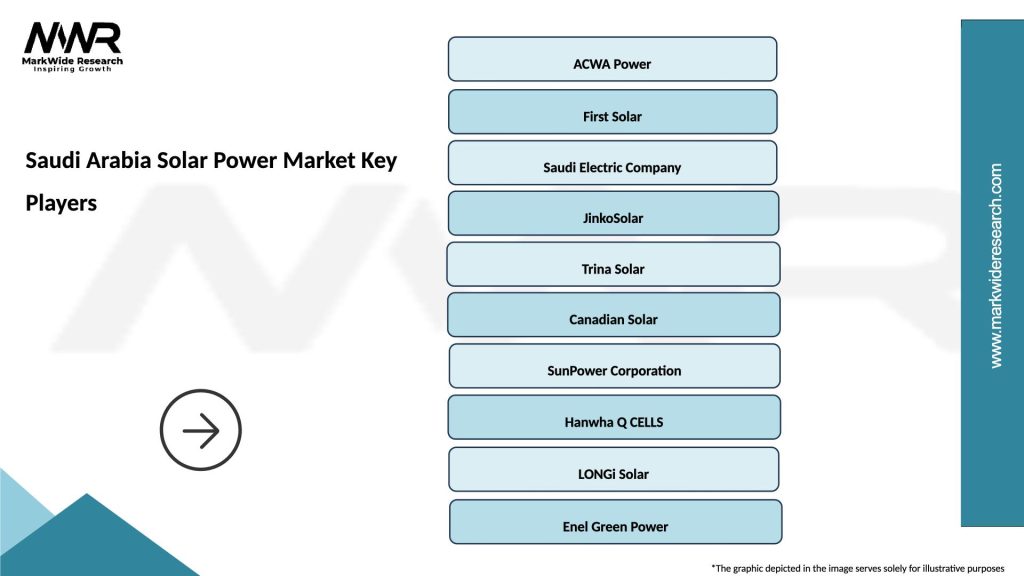

What are the key players in the Saudi Arabia Solar Power Market?

Key players in the Saudi Arabia Solar Power Market include companies like ACWA Power, First Solar, and JinkoSolar, which are involved in the development and deployment of solar energy projects, among others.

What are the growth factors driving the Saudi Arabia Solar Power Market?

The growth of the Saudi Arabia Solar Power Market is driven by factors such as government initiatives to diversify energy sources, increasing investments in renewable energy, and the country’s abundant solar resources.

What challenges does the Saudi Arabia Solar Power Market face?

Challenges in the Saudi Arabia Solar Power Market include high initial investment costs, regulatory hurdles, and the need for technological advancements to improve efficiency and storage solutions.

What future opportunities exist in the Saudi Arabia Solar Power Market?

Future opportunities in the Saudi Arabia Solar Power Market include the expansion of solar farms, advancements in solar technology, and potential partnerships with international firms to enhance project development.

What trends are shaping the Saudi Arabia Solar Power Market?

Trends in the Saudi Arabia Solar Power Market include the increasing adoption of photovoltaic systems, the integration of energy storage solutions, and a growing focus on sustainability and environmental impact.

Saudi Arabia Solar Power Market

| Segmentation Details | Description |

|---|---|

| Technology | Photovoltaic, Concentrated Solar Power, Bifacial Modules, Thin-Film |

| End User | Residential, Commercial, Industrial, Utilities |

| Installation Type | Ground-Mounted, Rooftop, Floating, Building-Integrated |

| Application | Power Generation, Off-Grid Systems, Solar Water Heating, Desalination |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Solar Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at