444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia snacks industry market represents one of the most dynamic and rapidly evolving segments within the Kingdom’s food and beverage sector. Market dynamics indicate substantial growth driven by changing consumer preferences, urbanization, and increasing disposable income among Saudi consumers. The snacks market encompasses a diverse range of products including traditional Arabic snacks, international brands, healthy alternatives, and premium offerings that cater to the sophisticated palate of modern Saudi consumers.

Consumer behavior patterns show a significant shift toward convenient, on-the-go snacking solutions, with the market experiencing robust expansion across multiple categories. The industry benefits from a young demographic profile, with approximately 67% of the population under the age of 35, driving demand for innovative and trendy snack products. Retail distribution channels have evolved dramatically, with hypermarkets, convenience stores, and e-commerce platforms becoming primary touchpoints for snack purchases.

Market penetration of international snack brands has accelerated, while local manufacturers continue to innovate with region-specific flavors and traditional recipes adapted for modern consumption patterns. The industry demonstrates remarkable resilience and adaptability, with manufacturers investing heavily in production capabilities and distribution networks to meet growing demand across urban and rural markets throughout the Kingdom.

The Saudi Arabia snacks industry market refers to the comprehensive ecosystem of manufacturers, distributors, retailers, and consumers involved in the production, marketing, and consumption of packaged snack foods within the Kingdom. This market encompasses traditional Arabic snacks, international branded products, healthy alternatives, premium offerings, and innovative fusion products that blend local tastes with global trends.

Market scope includes various product categories such as potato chips, nuts and seeds, crackers, biscuits, traditional sweets, dried fruits, popcorn, and specialty snacks designed for specific dietary requirements. The industry operates through multiple distribution channels including hypermarkets, supermarkets, convenience stores, traditional grocery stores, vending machines, and increasingly popular e-commerce platforms.

Industry significance extends beyond mere food consumption, representing a cultural bridge between traditional Saudi culinary preferences and modern lifestyle demands. The market reflects broader socioeconomic trends including urbanization, women’s workforce participation, busy lifestyles, and evolving consumer sophistication that drives demand for convenient, high-quality snacking options.

Strategic analysis reveals the Saudi Arabia snacks industry as a high-growth market characterized by strong consumer demand, increasing brand diversification, and significant investment in local manufacturing capabilities. The market benefits from favorable demographics, rising disposable income, and government initiatives supporting food security and local production under the Vision 2030 framework.

Key growth drivers include the expanding retail infrastructure, increasing health consciousness leading to demand for nutritious snack options, and the growing popularity of premium and artisanal products among affluent consumers. The market shows particular strength in the healthy snacks segment, which has experienced growth rates exceeding 12% annually as consumers prioritize wellness and nutritional value.

Competitive landscape features a mix of international giants, regional players, and emerging local brands, creating a dynamic environment that fosters innovation and consumer choice. The industry demonstrates strong potential for continued expansion, supported by infrastructure development, technological advancement in food processing, and evolving consumer preferences that favor convenience without compromising quality or cultural relevance.

Consumer preferences in the Saudi snacks market reveal several critical trends that shape industry dynamics and growth opportunities:

Market segmentation analysis indicates that traditional snacks maintain strong cultural significance while modern categories experience rapid adoption among younger demographics. The intersection of tradition and innovation creates unique opportunities for brands that successfully navigate cultural sensitivities while meeting contemporary consumer expectations.

Demographic advantages serve as primary catalysts for snacks industry growth, with Saudi Arabia’s young population driving demand for diverse, convenient, and innovative snack products. The Kingdom’s urbanization rate of approximately 84% creates concentrated consumer markets with sophisticated retail infrastructure supporting snack distribution and accessibility.

Economic prosperity and rising disposable income enable consumers to explore premium snack categories and international brands previously considered luxury items. Government initiatives under Vision 2030 promote local manufacturing and food security, encouraging investment in domestic snack production facilities and creating favorable conditions for industry expansion.

Lifestyle transformation driven by increased women’s workforce participation, longer working hours, and busy family schedules creates sustained demand for convenient snacking solutions. The growing entertainment and tourism sectors generate additional consumption opportunities through cinemas, theme parks, sporting events, and cultural festivals that require diverse snack offerings.

Retail evolution including hypermarket expansion, convenience store proliferation, and e-commerce growth provides multiple touchpoints for snack purchases, increasing market accessibility and consumer convenience. Modern retail formats offer extensive product variety and promotional opportunities that stimulate trial and repeat purchases across different snack categories.

Regulatory challenges including stringent food safety standards, labeling requirements, and import regulations can create barriers for new market entrants and increase compliance costs for existing players. The complexity of navigating halal certification processes and cultural sensitivities requires significant investment in regulatory expertise and product adaptation.

Health concerns regarding processed foods and their association with obesity and lifestyle diseases create consumer hesitation toward traditional snack categories. Government health initiatives and public awareness campaigns about nutrition may negatively impact demand for high-calorie, high-sodium, or heavily processed snack products.

Supply chain vulnerabilities including dependence on imported raw materials, packaging components, and finished products expose the industry to global price volatility and supply disruptions. Logistics challenges in serving remote areas of the Kingdom can limit market penetration and increase distribution costs for snack manufacturers.

Cultural sensitivities require careful product development and marketing approaches, potentially limiting innovation speed and increasing development costs. The need to balance international appeal with local preferences creates complexity in product formulation, packaging design, and promotional strategies that may constrain market expansion efforts.

Health and wellness trends create substantial opportunities for manufacturers to develop innovative snack products that combine nutritional benefits with appealing taste profiles. The growing demand for protein-rich snacks has increased by approximately 18% annually, indicating strong market potential for products targeting fitness-conscious consumers and active lifestyles.

Local production initiatives supported by government incentives offer opportunities for establishing manufacturing facilities that serve both domestic and regional export markets. Investment in local production can reduce costs, improve supply chain reliability, and create products specifically tailored to Saudi consumer preferences and cultural requirements.

Digital commerce expansion provides platforms for direct consumer engagement, personalized marketing, and innovative distribution models including subscription services and social commerce. E-commerce channels enable smaller brands to reach consumers without extensive retail partnerships, democratizing market access and fostering innovation.

Premium market development offers significant revenue potential as affluent consumers seek artisanal, organic, and specialty snack products that reflect sophisticated tastes and lifestyle aspirations. The luxury snack segment demonstrates particular promise for brands that can deliver exceptional quality, unique flavors, and premium packaging experiences.

Competitive intensity continues to escalate as international brands expand their Saudi presence while local manufacturers invest in innovation and brand building. This dynamic environment fosters product improvement, pricing competition, and marketing innovation that ultimately benefits consumers through increased choice and value.

Technology integration transforms manufacturing processes, supply chain management, and consumer engagement strategies throughout the snacks industry. Advanced production technologies enable customization, efficiency improvements, and quality enhancements that support market differentiation and operational excellence.

Consumer empowerment through social media and digital platforms creates new dynamics in brand perception, product discovery, and purchase decision-making. Brands must navigate increasingly sophisticated consumers who research products extensively and share experiences widely, requiring authentic engagement and consistent quality delivery.

Seasonal fluctuations create predictable demand patterns that require strategic inventory management and promotional planning. The Ramadan period typically generates snack sales increases of 35-40%, requiring manufacturers and retailers to optimize production and distribution capabilities for peak demand periods.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and actionable insights into the Saudi Arabia snacks industry market. Primary research includes extensive consumer surveys, retailer interviews, manufacturer consultations, and industry expert discussions that provide firsthand market intelligence and trend identification.

Secondary research incorporates analysis of government statistics, industry reports, trade publications, and economic indicators that contextualize market trends within broader economic and social developments. Data triangulation ensures reliability and validity of market insights through cross-verification of information sources.

Market segmentation analysis utilizes demographic data, purchasing behavior studies, and product category performance metrics to identify growth opportunities and consumer preferences. Geographic analysis considers regional variations in consumption patterns, distribution challenges, and cultural preferences across different areas of the Kingdom.

Competitive intelligence gathering includes monitoring of product launches, pricing strategies, promotional activities, and market share developments among key industry players. This analysis provides insights into competitive dynamics and strategic positioning opportunities for market participants.

Central Region dominance centered around Riyadh represents the largest snacks consumption market, accounting for approximately 42% of total market share due to high population density, elevated income levels, and extensive retail infrastructure. The region’s cosmopolitan consumer base drives demand for diverse product categories including international brands and premium offerings.

Western Region markets including Jeddah and Mecca demonstrate strong growth potential driven by religious tourism, commercial activity, and cultural diversity. The region’s position as a gateway for international trade facilitates product variety and brand availability, creating sophisticated consumer expectations and competitive market conditions.

Eastern Region development benefits from oil industry prosperity and industrial growth, generating high disposable income levels that support premium snack consumption. The region’s expatriate population contributes to demand for international products while local consumers increasingly embrace innovative snack categories.

Northern and Southern regions present emerging opportunities as infrastructure development and economic diversification create new consumer markets. These areas show particular potential for traditional and culturally relevant snack products that resonate with local preferences and consumption patterns.

Market leadership reflects a diverse ecosystem of international corporations, regional manufacturers, and emerging local brands that compete across multiple product categories and price segments:

Competitive strategies emphasize product innovation, cultural adaptation, distribution excellence, and brand building that resonates with Saudi consumer values and preferences. Success requires balancing international expertise with local market knowledge and cultural sensitivity.

Product category segmentation reveals distinct market dynamics and growth opportunities across different snack types:

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Savory snacks category maintains market leadership through continuous innovation in flavors, textures, and packaging formats that appeal to Saudi taste preferences. Potato chips represent the largest subcategory, with local flavors such as kabsa and shawarma gaining popularity alongside traditional options. The segment benefits from strong brand loyalty and frequent consumption patterns.

Healthy snacks segment demonstrates the fastest growth trajectory, with annual expansion rates reaching 15% as consumers prioritize wellness and nutritional value. Products featuring natural ingredients, reduced sodium, and added proteins resonate strongly with fitness-conscious consumers and parents seeking better options for children.

Traditional snacks category maintains cultural significance while adapting to modern packaging and distribution requirements. Dates-based products and Arabic sweets benefit from religious and cultural associations, experiencing particular demand during Ramadan and festive occasions. Innovation focuses on convenience packaging and extended shelf life.

Premium snacks segment shows robust growth among affluent consumers seeking artisanal quality and unique flavor experiences. International gourmet brands and locally-produced premium products command higher margins while building brand prestige and consumer loyalty through superior quality and exclusive positioning.

Manufacturers benefit from expanding market opportunities, favorable demographics, and government support for local production initiatives. The growing consumer base provides sustainable demand growth while cultural preferences create opportunities for product differentiation and premium positioning.

Retailers gain from high-margin product categories, frequent purchase cycles, and strong consumer traffic generation that snacks provide. The category’s impulse purchase nature and broad appeal make it essential for retail success across multiple store formats and geographic locations.

Consumers enjoy increasing product variety, improved quality standards, and competitive pricing resulting from market competition. Access to both traditional favorites and innovative new products enhances choice while meeting diverse lifestyle and dietary requirements.

Investors find attractive opportunities in a growing market supported by favorable demographics, economic prosperity, and evolving consumer preferences. The industry’s resilience and essential nature provide stability while innovation potential offers growth prospects.

Supply chain partners including packaging companies, logistics providers, and ingredient suppliers benefit from industry expansion and increasing sophistication in product development and distribution requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness integration represents the most significant trend reshaping the Saudi snacks market, with consumers increasingly seeking products that combine indulgence with nutritional benefits. Functional snacks incorporating probiotics, vitamins, and natural ingredients show strong growth potential as health consciousness becomes mainstream.

Premiumization trend drives consumer willingness to pay higher prices for superior quality, authentic ingredients, and unique flavor experiences. Artisanal and craft snack brands gain traction among affluent consumers seeking differentiation from mass-market offerings through quality and exclusivity.

Sustainability focus influences packaging choices, ingredient sourcing, and manufacturing processes as environmentally conscious consumers favor brands demonstrating social responsibility. Eco-friendly packaging adoption rates have increased by 22% among leading snack brands responding to consumer environmental concerns.

Digital engagement transforms marketing strategies and consumer relationships through social media, influencer partnerships, and personalized communication. Brands leverage digital platforms for product launches, consumer feedback, and community building that enhances loyalty and market penetration.

Flavor innovation combines traditional Arabic tastes with international influences, creating fusion products that appeal to diverse consumer preferences. Local flavors adapted to modern snack formats demonstrate strong market acceptance and differentiation potential.

Manufacturing investments by international companies establish local production facilities to serve the Saudi market and broader GCC region. These developments reduce costs, improve supply chain reliability, and demonstrate long-term commitment to the market while creating employment opportunities.

Product launches featuring health-focused formulations, premium ingredients, and cultural flavor profiles reflect industry adaptation to evolving consumer preferences. MarkWide Research analysis indicates that new product introductions have increased by 28% annually as companies compete for market share through innovation.

Distribution partnerships between international brands and local retailers expand market reach while providing expertise in consumer preferences and cultural requirements. These collaborations facilitate market entry and accelerate brand establishment in competitive environments.

Technology adoption in manufacturing processes improves efficiency, quality control, and customization capabilities that support market differentiation. Advanced packaging technologies extend shelf life and enhance product appeal while reducing waste and environmental impact.

Regulatory developments including updated food safety standards and labeling requirements drive industry compliance improvements while potentially creating barriers for smaller players. These changes ultimately benefit consumers through enhanced product safety and transparency.

Market entry strategies should prioritize cultural understanding and local partnership development to navigate regulatory requirements and consumer preferences effectively. Success requires balancing international expertise with regional market knowledge and authentic consumer engagement approaches.

Product development focus should emphasize health and wellness attributes while maintaining taste appeal and cultural relevance. Innovation opportunities exist in functional snacks, traditional flavor modernization, and premium quality positioning that commands higher margins.

Distribution optimization requires multi-channel approaches that include traditional retail, modern trade, and digital commerce platforms. E-commerce investment becomes increasingly critical as online shopping adoption accelerates among younger consumers.

Brand building strategies should leverage digital platforms for consumer engagement while respecting cultural values and preferences. Authentic storytelling and community involvement create stronger consumer connections than purely promotional approaches.

Supply chain development should prioritize local sourcing where possible to reduce costs, improve reliability, and support government localization initiatives. Investment in regional manufacturing capabilities provides competitive advantages and market access benefits.

Growth trajectory remains strongly positive for the Saudi Arabia snacks industry, supported by favorable demographics, economic prosperity, and evolving consumer lifestyles. MWR projections indicate sustained market expansion with annual growth rates expected to maintain 8-10% over the next five years across most product categories.

Innovation acceleration will drive market differentiation as companies invest in research and development to create products that meet evolving consumer demands for health, convenience, and cultural relevance. Technology integration in manufacturing and distribution will enhance efficiency and consumer experience.

Market consolidation may occur as successful brands expand their presence while smaller players struggle with competitive pressures and regulatory requirements. Strategic partnerships and acquisitions could reshape the competitive landscape while maintaining market dynamism.

Sustainability integration will become increasingly important as environmental consciousness grows among consumers and regulatory requirements evolve. Companies that proactively address sustainability concerns will gain competitive advantages and consumer loyalty.

Regional expansion opportunities will emerge as successful Saudi market strategies provide platforms for broader GCC penetration. The Kingdom’s market size and sophistication make it an ideal testing ground for regional expansion strategies.

The Saudi Arabia snacks industry market represents a compelling growth opportunity characterized by favorable demographics, economic prosperity, and evolving consumer preferences that support sustained expansion. The market’s combination of traditional cultural elements and modern lifestyle demands creates unique positioning opportunities for brands that successfully navigate local requirements while delivering international quality standards.

Industry dynamics favor companies that prioritize innovation, cultural sensitivity, and consumer engagement through multiple channels including digital platforms and traditional retail networks. The growing emphasis on health and wellness creates particular opportunities for products that combine nutritional benefits with appealing taste profiles and convenient consumption formats.

Success factors include understanding local consumer preferences, building strong distribution networks, investing in quality and innovation, and maintaining authentic brand positioning that resonates with Saudi cultural values. The market rewards companies that demonstrate long-term commitment through local investment and community engagement while delivering consistent product quality and value.

Future prospects remain highly positive as the Saudi Arabia snacks industry continues evolving to meet changing consumer needs while maintaining strong growth momentum supported by demographic advantages and economic development. Companies that adapt quickly to market trends while maintaining operational excellence will capture the most significant opportunities in this dynamic and expanding market.

What is Snacks?

Snacks refer to small portions of food typically consumed between meals. In the context of the Saudi Arabia Snacks Industry, this includes a variety of products such as chips, nuts, and confectionery items that cater to local tastes and preferences.

What are the key players in the Saudi Arabia Snacks Industry Market?

Key players in the Saudi Arabia Snacks Industry include companies like Almarai, Snack Foods, and Mondelez International, which offer a range of snack products tailored to the local market, among others.

What are the growth factors driving the Saudi Arabia Snacks Industry Market?

The growth of the Saudi Arabia Snacks Industry is driven by factors such as increasing urbanization, changing consumer lifestyles, and a growing preference for convenient food options. Additionally, the rise in disposable income has led to higher spending on snacks.

What challenges does the Saudi Arabia Snacks Industry Market face?

The Saudi Arabia Snacks Industry faces challenges such as intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards healthier snack options. These factors can impact profitability and market share.

What opportunities exist in the Saudi Arabia Snacks Industry Market?

Opportunities in the Saudi Arabia Snacks Industry include the introduction of innovative flavors, the expansion of online retail channels, and the growing demand for healthier snack alternatives. These trends can help companies capture new market segments.

What trends are shaping the Saudi Arabia Snacks Industry Market?

Trends in the Saudi Arabia Snacks Industry include a shift towards organic and natural ingredients, the popularity of plant-based snacks, and the increasing use of social media for marketing. These trends reflect changing consumer preferences and health consciousness.

Saudi Arabia Snacks Industry Market

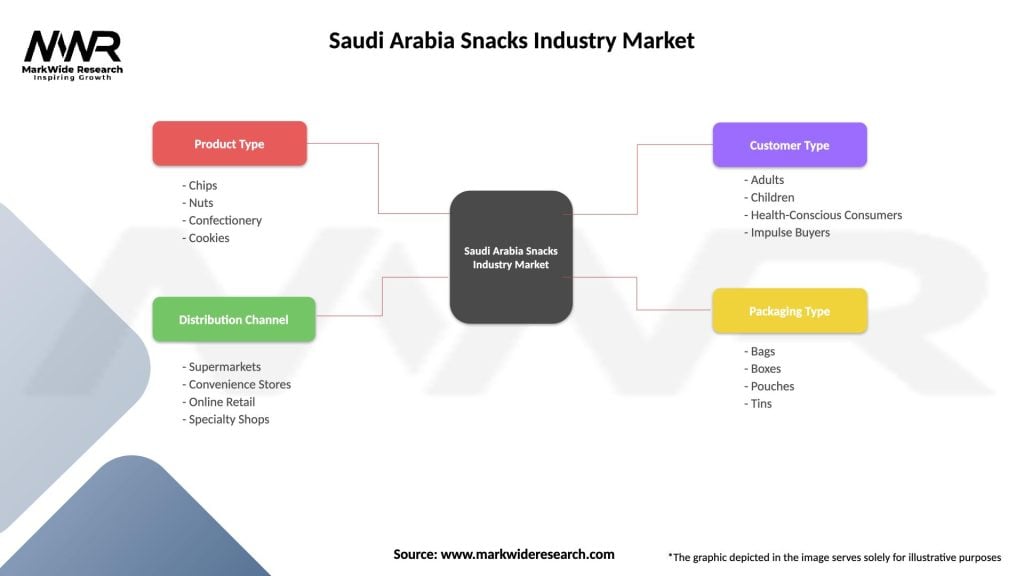

| Segmentation Details | Description |

|---|---|

| Product Type | Chips, Nuts, Confectionery, Cookies |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Shops |

| Customer Type | Adults, Children, Health-Conscious Consumers, Impulse Buyers |

| Packaging Type | Bags, Boxes, Pouches, Tins |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Snacks Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at