444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia share office space market represents a transformative segment within the Kingdom’s evolving commercial real estate landscape. This dynamic sector encompasses coworking spaces, flexible office solutions, and shared workspace environments that cater to the growing demand for adaptable business infrastructure. Market dynamics indicate substantial growth driven by Vision 2030 initiatives, entrepreneurial ecosystem development, and changing workplace preferences among businesses and professionals.

Flexible workspace solutions have gained significant traction across major Saudi cities, particularly in Riyadh, Jeddah, and Dammam. The market demonstrates robust expansion with annual growth rates exceeding 12%, reflecting the Kingdom’s commitment to diversifying its economy and fostering innovation-driven business environments. Coworking operators are strategically positioning themselves to capture opportunities arising from digital transformation initiatives and the growing startup ecosystem.

Government support through various programs and regulatory frameworks has created favorable conditions for shared office space development. The sector benefits from increased foreign investment, technological advancement adoption, and evolving corporate real estate strategies that prioritize flexibility and cost optimization. Market penetration continues to expand as traditional businesses recognize the value proposition of flexible workspace solutions.

The Saudi Arabia share office space market refers to the commercial real estate segment comprising flexible workspace solutions, coworking facilities, and shared office environments that provide businesses with adaptable, cost-effective alternatives to traditional office leasing arrangements while fostering collaboration and innovation.

Shared office spaces encompass various models including hot desking, dedicated desks, private offices within shared environments, meeting rooms, and collaborative areas. These facilities typically offer comprehensive services such as high-speed internet, administrative support, networking opportunities, and flexible lease terms that accommodate diverse business needs and growth trajectories.

Market participants include international coworking operators, local workspace providers, real estate developers, and technology-enabled platforms that facilitate workspace booking and management. The ecosystem supports startups, small and medium enterprises, freelancers, remote workers, and established corporations seeking flexible expansion options or project-based workspace solutions.

Strategic market positioning within Saudi Arabia’s share office space sector reflects the Kingdom’s broader economic transformation objectives and changing workplace dynamics. The market demonstrates exceptional growth potential driven by Vision 2030 implementation, entrepreneurial ecosystem development, and increasing adoption of flexible work arrangements across various industry sectors.

Key growth drivers include government initiatives supporting small business development, foreign investment attraction, and digital economy advancement. The sector benefits from regulatory framework improvements that facilitate business establishment and operation, creating favorable conditions for both workspace operators and their clients. Technology integration enhances operational efficiency and user experience, contributing to market expansion.

Market challenges encompass traditional business culture adaptation, competitive pricing pressures, and the need for continuous service innovation to meet evolving client expectations. However, opportunity identification reveals significant potential in underserved markets, specialized workspace solutions, and technology-enhanced service delivery models that address specific industry requirements.

Market intelligence reveals several critical insights shaping the Saudi Arabia share office space landscape:

Vision 2030 implementation serves as the primary catalyst driving Saudi Arabia’s share office space market expansion. This comprehensive economic transformation program emphasizes entrepreneurship development, small business support, and innovation ecosystem creation, directly benefiting flexible workspace demand. Government initiatives include funding programs, regulatory simplification, and infrastructure development that support coworking space establishment and operation.

Entrepreneurial ecosystem growth represents another significant driver, with increasing numbers of startups and small businesses seeking cost-effective office solutions. The Kingdom’s focus on technology sector development and digital economy advancement creates substantial demand for flexible workspace environments that foster collaboration and innovation. Startup incubators and accelerator programs often utilize shared office spaces to support their portfolio companies.

Corporate real estate strategy evolution drives demand as established companies recognize the benefits of flexible workspace solutions for specific projects, temporary expansions, and satellite office requirements. Cost optimization initiatives lead many organizations to explore alternatives to traditional long-term lease commitments, particularly for non-core business functions and project-based teams.

Foreign investment attraction contributes to market growth as international companies entering the Saudi market often prefer flexible office arrangements during initial establishment phases. Economic diversification efforts create opportunities for various business sectors that benefit from shared workspace environments and the networking opportunities they provide.

Traditional business culture presents challenges for share office space adoption, as some organizations maintain preferences for conventional office arrangements and may perceive shared environments as less prestigious or secure. Cultural adaptation requirements necessitate careful consideration of local business practices, privacy expectations, and professional interaction norms that may differ from international coworking standards.

Competitive pricing pressures create challenges for operators seeking to maintain profitability while offering attractive rates to attract clients. Market saturation risks in prime locations may lead to oversupply situations that pressure rental rates and occupancy levels. Operational cost management becomes critical as operators must balance service quality with competitive pricing strategies.

Regulatory compliance complexity may pose challenges for international operators unfamiliar with local business regulations, licensing requirements, and operational standards. Real estate market dynamics including property availability, rental costs, and development timelines can impact expansion plans and operational viability for workspace providers.

Technology infrastructure requirements demand significant investment in high-speed internet, security systems, and facility management platforms. Service differentiation challenges arise as the market becomes more competitive, requiring continuous innovation and value proposition enhancement to maintain client attraction and retention.

Underserved market segments present substantial opportunities for expansion, particularly in secondary cities and emerging business districts where demand for flexible workspace solutions is growing but supply remains limited. Specialized workspace concepts targeting specific industries such as technology, creative services, and professional consulting offer differentiation opportunities and premium pricing potential.

Corporate partnership development creates opportunities for long-term contracts and stable revenue streams through arrangements with established companies seeking flexible workspace solutions for their teams. Government sector engagement may provide opportunities to support public sector innovation initiatives and entrepreneurship development programs through specialized workspace offerings.

Technology-enhanced services offer opportunities for operational efficiency improvement and enhanced user experience through IoT integration, mobile applications, and automated facility management systems. Community building initiatives can create additional revenue streams through events, training programs, and networking services that add value beyond basic workspace provision.

International expansion partnerships with global coworking operators can provide access to established operational expertise, brand recognition, and international client networks. Real estate development collaboration offers opportunities to integrate flexible workspace concepts into new commercial developments and mixed-use projects.

Supply and demand dynamics within Saudi Arabia’s share office space market reflect the interplay between growing workspace demand and expanding operator capacity. Market equilibrium varies significantly across different geographic regions, with major cities experiencing higher demand density while secondary markets present growth opportunities with less competitive pressure.

Pricing dynamics demonstrate flexibility based on location, service levels, and contract terms, with operators offering various packages to accommodate different client segments. Occupancy rate optimization remains crucial for operator profitability, with successful facilities achieving occupancy levels exceeding 75% through effective marketing and service delivery strategies.

Competitive dynamics intensify as both international and local operators expand their presence, leading to service innovation and differentiation strategies. Market consolidation trends may emerge as smaller operators seek partnerships or acquisition opportunities to compete effectively against larger, well-funded competitors.

Technology adoption dynamics influence operational efficiency and user experience, with successful operators investing in digital platform integration and smart building technologies. Client retention dynamics emphasize the importance of community building, networking facilitation, and value-added services beyond basic workspace provision.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Saudi Arabia’s share office space market. Primary research includes structured interviews with industry stakeholders, workspace operators, real estate developers, and end-users to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, real estate market data, and economic indicators relevant to the commercial workspace sector. Market observation through facility visits, competitor analysis, and service evaluation provides practical insights into operational practices and market positioning strategies.

Data triangulation ensures research validity by cross-referencing information from multiple sources and validating findings through expert consultations. Quantitative analysis incorporates statistical modeling and trend analysis to project market development scenarios and identify growth patterns.

MarkWide Research methodology emphasizes rigorous data validation and comprehensive stakeholder engagement to deliver actionable market intelligence. Continuous monitoring of market developments ensures research findings remain current and relevant for strategic decision-making purposes.

Riyadh metropolitan area dominates the Saudi Arabia share office space market, accounting for approximately 45% of total market activity. The capital city benefits from government sector presence, corporate headquarters concentration, and robust startup ecosystem development. Business district expansion in areas such as King Abdullah Financial District and Olaya creates additional opportunities for flexible workspace development.

Jeddah market dynamics reflect the city’s commercial significance and gateway position, representing roughly 30% of market share. The city’s diverse business environment, including trade, services, and emerging technology sectors, supports varied workspace demand patterns. Economic city development projects provide opportunities for integrated workspace solutions within larger commercial developments.

Eastern Province markets, particularly Dammam and Khobar, contribute approximately 15% of market activity, driven by energy sector presence and industrial diversification initiatives. Petrochemical industry support services and emerging technology companies create demand for flexible workspace solutions that accommodate project-based requirements and international collaboration needs.

Secondary city development in locations such as Medina, Tabuk, and Abha represents emerging opportunities with 10% combined market share but significant growth potential. Regional development programs and economic diversification initiatives support workspace demand growth in these markets, often with less competitive pressure than major metropolitan areas.

Market leadership within Saudi Arabia’s share office space sector encompasses both international operators and local providers, each bringing distinct advantages and market positioning strategies:

Competitive differentiation strategies include location selection, service quality, pricing models, technology integration, and community development initiatives. Market positioning varies from premium corporate-focused offerings to startup-friendly collaborative environments, allowing operators to target specific client segments effectively.

Partnership strategies emerge as operators collaborate with real estate developers, government agencies, and corporate clients to expand market presence and service delivery capabilities. Innovation focus drives continuous service enhancement and technology adoption to maintain competitive advantages.

By Workspace Type:

By Client Segment:

By Service Level:

Technology sector demand represents the fastest-growing category within Saudi Arabia’s share office space market, driven by government digitalization initiatives and startup ecosystem development. Software development companies, fintech startups, and digital service providers particularly value collaborative environments that foster innovation and networking opportunities. Growth rates in this segment exceed overall market averages by approximately 8-10 percentage points.

Professional services including consulting, legal, and financial advisory firms demonstrate strong adoption of flexible workspace solutions for project-based requirements and client meeting facilities. Service delivery flexibility allows these businesses to scale workspace needs according to project demands and client engagement patterns.

Creative industries encompassing design, marketing, and media companies benefit from collaborative workspace environments that encourage creativity and cross-pollination of ideas. Community aspects of shared office spaces particularly appeal to creative professionals seeking inspiration and networking opportunities.

International business development represents a significant category as foreign companies utilize flexible workspace solutions during market entry phases. Risk mitigation through flexible lease terms allows international businesses to test market viability before committing to permanent office establishments.

Workspace operators benefit from recurring revenue models, scalable business operations, and opportunities for service diversification beyond basic office provision. Asset utilization optimization allows operators to maximize revenue per square foot through flexible space allocation and dynamic pricing strategies.

Real estate developers gain opportunities to enhance property values through mixed-use developments that incorporate flexible workspace concepts. Tenant diversification reduces leasing risks while creating vibrant commercial environments that attract various business types and support community development.

End-user businesses benefit from reduced capital requirements, operational flexibility, and access to professional networking opportunities. Cost optimization through flexible lease terms and shared services allows businesses to allocate resources more effectively toward core business activities.

Government stakeholders benefit from economic diversification support, entrepreneurship ecosystem development, and job creation within the commercial real estate and business services sectors. Vision 2030 alignment demonstrates progress toward economic transformation objectives through private sector development and innovation promotion.

Investors gain access to growing market segments with attractive return potential and alignment with broader economic development trends. Portfolio diversification opportunities emerge through various investment models including direct ownership, partnership arrangements, and technology platform investments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid work model adoption represents a fundamental trend reshaping workspace demand patterns, with companies implementing flexible work arrangements that combine remote work with office presence. Workspace utilization optimization drives demand for flexible solutions that accommodate varying occupancy levels and usage patterns throughout different time periods.

Technology-enabled workspace management emerges as a critical trend, with operators investing in IoT sensors, mobile applications, and automated systems to enhance user experience and operational efficiency. Smart building integration provides data-driven insights for space optimization and service personalization.

Community-focused workspace design emphasizes social interaction, networking facilitation, and collaborative environment creation beyond basic office provision. Event programming and professional development opportunities become integral components of workspace offerings, adding value and differentiation.

Sustainability integration gains importance as businesses prioritize environmentally responsible workspace solutions. Green building certifications and energy-efficient operations become competitive advantages for workspace operators targeting environmentally conscious clients.

Industry-specific workspace concepts develop to serve specialized sectors such as technology, creative industries, and professional services with tailored facilities and services. Vertical integration strategies may emerge as operators expand into related services such as business consulting, networking facilitation, and growth support programs.

Major operator expansions continue across Saudi Arabia’s primary markets, with international brands establishing flagship locations and local operators scaling their presence. MarkWide Research analysis indicates increasing investment in premium locations and comprehensive service offerings to capture growing market demand.

Government initiative launches supporting entrepreneurship and small business development create additional demand drivers for flexible workspace solutions. Regulatory framework enhancements facilitate business establishment and operation, benefiting both workspace operators and their clients.

Technology platform developments enable improved workspace booking, management, and user experience through mobile applications and integrated systems. Partnership announcements between workspace operators and real estate developers indicate growing integration of flexible workspace concepts into commercial development projects.

Investment activity increases as both local and international investors recognize market potential and growth opportunities. Acquisition and merger activities may accelerate as the market matures and operators seek scale advantages and market consolidation benefits.

Service innovation introductions include specialized offerings for specific industries, enhanced technology integration, and comprehensive business support services beyond basic workspace provision. Corporate partnership developments demonstrate growing acceptance of flexible workspace solutions among established companies.

Market entry strategies should prioritize location selection in high-demand areas with strong transportation connectivity and business ecosystem presence. Service differentiation becomes crucial as competition intensifies, requiring operators to develop unique value propositions that address specific market segment needs.

Technology investment should focus on user experience enhancement and operational efficiency improvement through integrated platforms and smart building solutions. Community building initiatives can create competitive advantages and improve client retention through networking facilitation and professional development programming.

Partnership development with real estate developers, corporate clients, and government agencies can provide stable revenue streams and market expansion opportunities. Financial planning should account for initial investment requirements and longer payback periods typical in emerging markets.

Cultural adaptation strategies must consider local business practices, privacy expectations, and professional interaction preferences to ensure market acceptance. Regulatory compliance preparation should include thorough understanding of licensing requirements, operational standards, and ongoing compliance obligations.

Scalability planning should incorporate flexible expansion models that can adapt to market development patterns and demand fluctuations. Risk management strategies should address potential challenges including economic volatility, competitive pressure, and regulatory changes.

Market expansion trajectory indicates continued growth driven by economic diversification initiatives, entrepreneurship ecosystem development, and evolving workplace preferences. MWR projections suggest sustained growth rates as market awareness increases and service offerings mature to meet diverse client requirements.

Geographic expansion will likely extend beyond major metropolitan areas to secondary cities and emerging business districts, creating opportunities for early market entrants. Service evolution toward comprehensive business ecosystem platforms may differentiate successful operators from basic workspace providers.

Technology integration advancement will enhance operational efficiency and user experience, with successful operators leveraging data analytics for space optimization and service personalization. Sustainability focus will become increasingly important as environmental consciousness grows among businesses and consumers.

Market maturation may lead to consolidation activities as operators seek scale advantages and market leadership positions. Corporate adoption acceleration will drive demand growth as established companies recognize flexible workspace benefits for specific applications and strategic initiatives.

Investment attraction will continue as market potential becomes more evident and operational models prove successful. Innovation opportunities in specialized workspace concepts, technology solutions, and service delivery models will create competitive advantages for forward-thinking operators.

Saudi Arabia’s share office space market presents compelling opportunities within the Kingdom’s broader economic transformation landscape. Vision 2030 alignment creates favorable conditions for market development through entrepreneurship support, economic diversification initiatives, and regulatory framework improvements that benefit both workspace operators and their clients.

Market fundamentals demonstrate strong growth potential driven by evolving workplace preferences, startup ecosystem development, and increasing corporate adoption of flexible workspace solutions. Competitive dynamics favor operators who can effectively combine location advantages, service differentiation, and technology integration to create compelling value propositions for diverse client segments.

Success factors include strategic location selection, cultural adaptation, comprehensive service offerings, and strong community building capabilities that extend beyond basic workspace provision. Future market development will likely favor operators who can scale effectively while maintaining service quality and client satisfaction standards that support long-term business relationships and market leadership positions.

What is Share Office Space?

Share office space refers to a flexible workspace arrangement where individuals or companies share office facilities and resources. This model is popular among startups and freelancers looking for cost-effective solutions and collaborative environments.

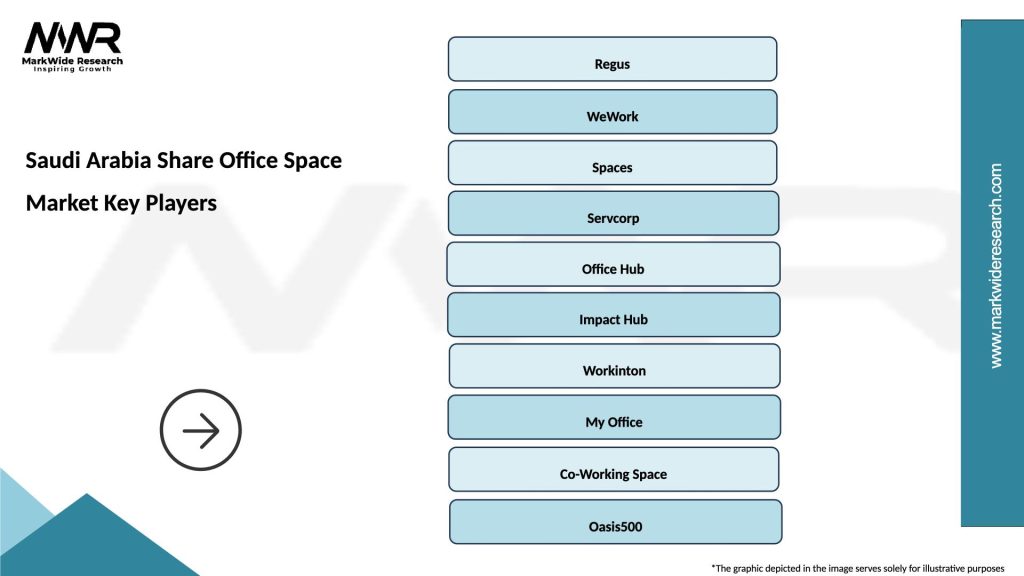

What are the key players in the Saudi Arabia Share Office Space Market?

Key players in the Saudi Arabia Share Office Space Market include WeWork, Regus, and Spaces, which offer various coworking solutions tailored to different business needs, among others.

What are the growth factors driving the Saudi Arabia Share Office Space Market?

The growth of the Saudi Arabia Share Office Space Market is driven by the increasing number of startups, the rise in remote working trends, and the demand for flexible office solutions that cater to diverse business needs.

What challenges does the Saudi Arabia Share Office Space Market face?

Challenges in the Saudi Arabia Share Office Space Market include fluctuating demand due to economic conditions, competition from traditional office spaces, and the need for continuous innovation to meet evolving client expectations.

What opportunities exist in the Saudi Arabia Share Office Space Market?

Opportunities in the Saudi Arabia Share Office Space Market include the potential for expansion into underserved regions, the integration of technology for enhanced user experience, and the growing trend of hybrid work models among businesses.

What trends are shaping the Saudi Arabia Share Office Space Market?

Trends shaping the Saudi Arabia Share Office Space Market include the rise of niche coworking spaces catering to specific industries, increased focus on sustainability in office design, and the incorporation of wellness features to enhance employee productivity.

Saudi Arabia Share Office Space Market

| Segmentation Details | Description |

|---|---|

| Product Type | Co-working Spaces, Private Offices, Meeting Rooms, Virtual Offices |

| Customer Type | Startups, Freelancers, SMEs, Corporates |

| Service Type | Flexible Leasing, Short-term Rentals, Long-term Rentals, Membership Plans |

| Industry Vertical | Technology, Finance, Creative, Consulting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Share Office Space Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at