444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia self-monitoring blood glucose devices market represents a rapidly expanding healthcare technology sector driven by increasing diabetes prevalence and growing health awareness among the population. Self-monitoring blood glucose devices have become essential tools for diabetes management, enabling patients to track their glucose levels effectively and make informed decisions about their treatment regimens.

Market dynamics in Saudi Arabia reflect the country’s commitment to improving healthcare infrastructure and supporting chronic disease management. The market encompasses traditional glucose meters, continuous glucose monitoring systems, and innovative smart glucose monitoring solutions that integrate with mobile applications and digital health platforms.

Healthcare transformation initiatives in Saudi Arabia, aligned with Vision 2030, have accelerated the adoption of advanced medical technologies. The self-monitoring blood glucose devices market is experiencing robust growth, with CAGR projections of 8.2% reflecting strong demand from both healthcare providers and patients seeking better diabetes management solutions.

Regional factors contributing to market expansion include increasing urbanization, lifestyle changes, and rising disposable income levels. The Saudi government’s focus on preventive healthcare and chronic disease management has created favorable conditions for market growth, with diabetes prevalence rates reaching 18.3% among adults, making effective glucose monitoring solutions increasingly critical.

The Saudi Arabia self-monitoring blood glucose devices market refers to the comprehensive ecosystem of medical devices, technologies, and related services that enable individuals with diabetes to independently monitor their blood glucose levels. These devices range from traditional fingerstick glucose meters to advanced continuous glucose monitoring systems that provide real-time glucose readings.

Self-monitoring capabilities empower patients to take active control of their diabetes management by providing immediate feedback on glucose levels, enabling timely adjustments to medication, diet, and lifestyle factors. The market encompasses various device categories including portable glucose meters, test strips, lancets, continuous glucose monitors, and integrated digital health solutions.

Technology integration has transformed traditional glucose monitoring into sophisticated health management systems. Modern devices feature smartphone connectivity, cloud-based data storage, and artificial intelligence-driven insights that help patients and healthcare providers make more informed treatment decisions.

Market performance in Saudi Arabia’s self-monitoring blood glucose devices sector demonstrates exceptional growth potential driven by demographic trends and healthcare policy initiatives. The market benefits from strong government support for diabetes management programs and increasing patient awareness about the importance of regular glucose monitoring.

Key growth drivers include rising diabetes incidence, technological advancements in glucose monitoring devices, and expanding healthcare accessibility across urban and rural areas. The market shows particular strength in continuous glucose monitoring adoption, with penetration rates increasing by 15.7% annually among Type 1 diabetes patients.

Competitive dynamics feature both international medical device manufacturers and emerging local healthcare technology companies. Market leaders focus on product innovation, affordability, and integration with Saudi Arabia’s digital health initiatives to capture market share in this expanding sector.

Future prospects remain highly favorable, supported by ongoing healthcare infrastructure investments and increasing emphasis on preventive care. The market is positioned for sustained growth as diabetes management becomes increasingly integrated with digital health platforms and telemedicine services.

Strategic insights reveal several critical factors shaping the Saudi Arabia self-monitoring blood glucose devices market:

Primary market drivers propelling growth in Saudi Arabia’s self-monitoring blood glucose devices market stem from multiple interconnected factors. Diabetes prevalence continues to rise significantly, with lifestyle changes and genetic predisposition contributing to increased diagnosis rates across all age groups.

Government healthcare initiatives play a crucial role in market expansion through policy support and funding for diabetes management programs. The Saudi Ministry of Health’s focus on preventive care and chronic disease management creates substantial demand for self-monitoring devices and related technologies.

Technological advancement drives market growth through the development of more accurate, user-friendly, and connected glucose monitoring solutions. Patients increasingly prefer devices that integrate with smartphones and provide comprehensive health tracking capabilities beyond basic glucose measurements.

Healthcare accessibility improvements expand market reach through better distribution networks and patient education programs. The growing network of pharmacies, clinics, and healthcare centers facilitates device availability and supports patient training on proper monitoring techniques.

Economic prosperity enables more patients to invest in advanced glucose monitoring solutions. Rising disposable income levels and expanding health insurance coverage make premium devices more accessible to broader patient populations.

Market challenges in the Saudi Arabia self-monitoring blood glucose devices sector include several factors that may limit growth potential. Cost considerations remain significant for many patients, particularly regarding ongoing expenses for test strips and continuous glucose monitoring supplies.

Technical barriers affect adoption rates among certain patient demographics, especially older adults who may struggle with device operation or smartphone integration features. Digital literacy gaps can limit the effectiveness of advanced monitoring systems that rely on mobile applications and cloud connectivity.

Regulatory complexities may slow the introduction of innovative glucose monitoring technologies. Medical device approval processes and quality standards require substantial time and investment from manufacturers seeking to enter the Saudi market.

Healthcare provider training needs present ongoing challenges as new technologies require continuous education for medical professionals. Ensuring proper patient education and device utilization requires significant investment in training programs and support systems.

Cultural factors may influence device adoption, particularly regarding lifestyle integration and social acceptance of continuous monitoring systems. Some patients may resist visible monitoring devices or frequent testing routines due to social or cultural considerations.

Significant opportunities exist within Saudi Arabia’s self-monitoring blood glucose devices market, driven by evolving healthcare needs and technological capabilities. Digital health integration presents substantial growth potential as healthcare systems increasingly adopt connected medical devices and telemedicine platforms.

Artificial intelligence applications offer opportunities for developing predictive glucose monitoring systems that provide personalized insights and recommendations. These advanced capabilities can improve patient outcomes while creating new revenue streams for device manufacturers and healthcare providers.

Rural market expansion represents an underserved opportunity as healthcare infrastructure improvements reach smaller communities. Market penetration rates in rural areas remain at 23% compared to urban centers, indicating substantial growth potential through targeted distribution and education initiatives.

Pediatric diabetes management creates specialized market opportunities for child-friendly monitoring devices and family-oriented health management systems. The growing recognition of Type 1 diabetes in children drives demand for age-appropriate monitoring solutions.

Corporate wellness programs present opportunities for bulk device sales and employee health monitoring initiatives. Large employers increasingly invest in preventive healthcare programs that include glucose monitoring for at-risk employees.

Market dynamics in Saudi Arabia’s self-monitoring blood glucose devices sector reflect complex interactions between healthcare policy, technology innovation, and patient behavior patterns. Supply chain evolution has improved device availability and reduced costs through enhanced distribution networks and local partnerships.

Competitive pressures drive continuous innovation as manufacturers seek to differentiate their products through improved accuracy, ease of use, and digital connectivity features. Price competition benefits patients while challenging manufacturers to maintain profitability through operational efficiency and value-added services.

Healthcare integration trends influence market dynamics as glucose monitoring becomes part of comprehensive diabetes management ecosystems. Electronic health records integration and clinical decision support systems create new requirements for device compatibility and data sharing capabilities.

Patient empowerment trends shift market dynamics toward consumer-focused solutions that prioritize user experience and lifestyle integration. Patients increasingly demand devices that seamlessly integrate with their daily routines and provide actionable health insights.

Regulatory evolution shapes market dynamics through updated standards for device accuracy, data security, and clinical effectiveness. These changes create both challenges and opportunities for manufacturers adapting to evolving compliance requirements.

Comprehensive research methodology employed in analyzing Saudi Arabia’s self-monitoring blood glucose devices market incorporates multiple data sources and analytical approaches. Primary research includes extensive surveys of healthcare providers, patients, and industry stakeholders to gather firsthand insights about market trends and user preferences.

Secondary research encompasses analysis of government health statistics, medical device registration data, and healthcare spending patterns. MarkWide Research utilizes proprietary databases and industry reports to validate market trends and growth projections.

Quantitative analysis methods include statistical modeling of market size, growth rates, and segment performance. Market segmentation analysis examines device types, distribution channels, and regional variations to provide detailed market insights.

Qualitative research incorporates expert interviews with endocrinologists, diabetes educators, and medical device specialists to understand clinical perspectives and treatment trends. Focus groups with diabetes patients provide insights into device preferences and usage patterns.

Data validation processes ensure research accuracy through cross-referencing multiple sources and conducting sensitivity analysis on key market projections. Regular updates incorporate new market developments and emerging trends to maintain research relevance.

Regional market distribution across Saudi Arabia reveals significant variations in self-monitoring blood glucose device adoption and usage patterns. Riyadh region dominates market share with 34% of total device sales, driven by high population density, advanced healthcare infrastructure, and strong purchasing power.

Western region including Jeddah and Mecca shows robust growth with 28% market share, benefiting from medical tourism and diverse population demographics. The region’s commercial activity and international connectivity facilitate access to advanced glucose monitoring technologies.

Eastern Province accounts for 22% of market activity, supported by industrial development and expatriate communities with high health awareness levels. Oil industry employment provides stable income levels that support premium device adoption.

Northern regions demonstrate emerging growth potential with increasing healthcare investments and infrastructure development. Rural area penetration remains limited but shows improvement through government health initiatives and mobile healthcare programs.

Southern regions present opportunities for market expansion through targeted distribution strategies and culturally appropriate patient education programs. Healthcare accessibility improvements continue to drive device adoption in previously underserved areas.

Competitive dynamics in Saudi Arabia’s self-monitoring blood glucose devices market feature established international manufacturers alongside emerging regional players. Market leadership is characterized by companies that successfully combine product innovation with local market understanding and distribution capabilities.

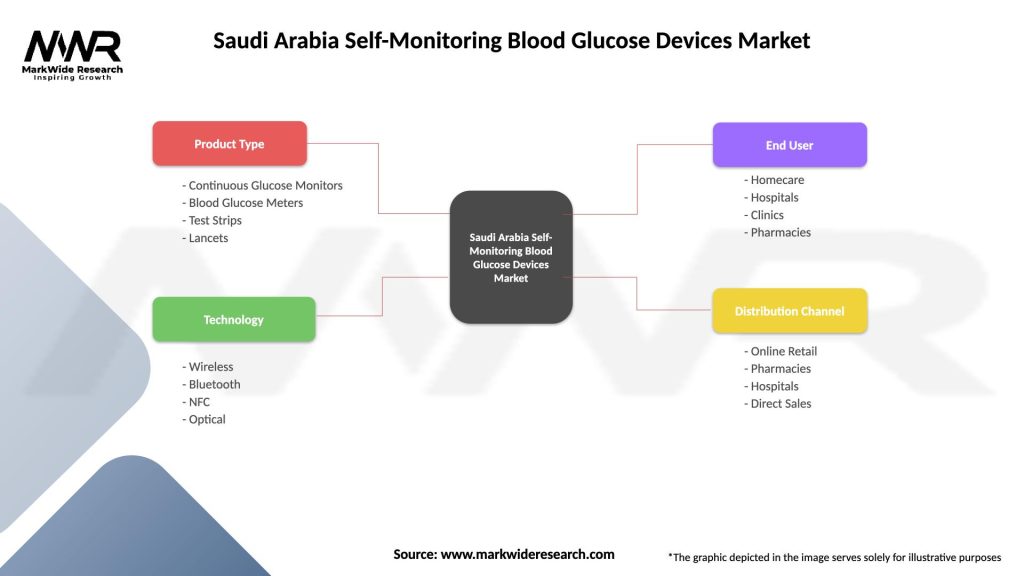

Market segmentation analysis reveals distinct categories within Saudi Arabia’s self-monitoring blood glucose devices market, each with unique characteristics and growth patterns.

By Device Type:

By End User:

By Distribution Channel:

Traditional glucose meters maintain market dominance through proven reliability and cost-effectiveness. These devices serve as the foundation of diabetes self-monitoring, offering accurate readings with minimal complexity. Market maturity in this category drives manufacturers to focus on improved user experience and competitive pricing strategies.

Continuous glucose monitoring systems represent the fastest-growing category with annual growth rates of 18.5%. These advanced devices appeal to patients seeking comprehensive glucose tracking without frequent fingerstick testing. Technology improvements and decreasing costs expand accessibility across broader patient populations.

Smart glucose meters bridge traditional monitoring with digital health capabilities. These devices integrate with mobile applications to provide trend analysis, medication reminders, and healthcare provider connectivity. Adoption rates among younger patients reach 67%, indicating strong future growth potential.

Test strips and consumables generate recurring revenue streams representing the largest market segment by value. Consumable sales account for approximately 75% of total market revenue, creating stable income for manufacturers and distributors.

Pediatric-specific devices address unique needs of children with diabetes through colorful designs, simplified interfaces, and family-friendly features. This specialized category shows strong growth as childhood diabetes diagnosis rates increase.

Healthcare providers benefit from improved patient outcomes through better glucose monitoring compliance and data-driven treatment decisions. Clinical efficiency increases as connected devices provide real-time patient data and reduce routine monitoring appointments.

Patients gain greater control over their diabetes management through convenient, accurate monitoring solutions. Quality of life improvements result from reduced testing burden and better glucose control, leading to fewer complications and hospitalizations.

Device manufacturers access a growing market with strong government support and increasing health awareness. Revenue opportunities expand through both device sales and recurring consumable purchases, creating sustainable business models.

Healthcare systems achieve cost savings through reduced diabetes complications and improved preventive care outcomes. Resource optimization occurs as self-monitoring reduces healthcare provider workload and enables more efficient care delivery.

Insurance providers benefit from reduced long-term healthcare costs through better diabetes management and complication prevention. Risk reduction strategies increasingly include coverage for advanced monitoring devices as cost-effective interventions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation dominates current market trends as glucose monitoring devices increasingly integrate with smartphone applications and cloud-based health platforms. Connected health ecosystems enable comprehensive diabetes management through data sharing between patients, healthcare providers, and family members.

Artificial intelligence integration emerges as a significant trend, with devices incorporating predictive algorithms and personalized recommendations. Machine learning capabilities help patients anticipate glucose fluctuations and optimize their management strategies.

Miniaturization trends drive development of smaller, more discreet monitoring devices that integrate seamlessly into daily life. Wearable technology advancement enables continuous monitoring without lifestyle disruption or social stigma concerns.

Personalization focus shapes product development as manufacturers create customizable monitoring solutions tailored to individual patient needs and preferences. User experience optimization becomes a key differentiator in competitive markets.

Sustainability initiatives influence device design and manufacturing processes as environmental consciousness grows among consumers and healthcare organizations. Eco-friendly materials and recycling programs become important market considerations.

Recent industry developments highlight significant advances in glucose monitoring technology and market expansion strategies. Regulatory approvals for next-generation continuous glucose monitoring systems have accelerated market adoption and improved patient access to advanced monitoring solutions.

Strategic partnerships between device manufacturers and healthcare providers create integrated care models that improve patient outcomes while expanding market reach. MWR analysis indicates these collaborations drive market penetration increases of 12.3% in participating healthcare networks.

Technology breakthroughs in non-invasive glucose monitoring represent potential market disruption as companies develop innovative sensing technologies. Clinical trials and regulatory submissions for breakthrough devices indicate significant future market changes.

Investment activities in Saudi Arabian healthcare technology companies demonstrate growing confidence in market potential. Venture capital funding supports local innovation and market-specific product development initiatives.

Government initiatives including national diabetes prevention programs and healthcare digitization projects create favorable conditions for market expansion and technology adoption.

Market entry strategies should prioritize local partnerships and cultural adaptation to succeed in Saudi Arabia’s unique healthcare environment. Distribution network development requires understanding of regional healthcare infrastructure and patient access patterns.

Product development focus should emphasize user-friendly interfaces and Arabic language support to maximize market penetration. Cultural sensitivity in device design and marketing approaches will determine success in diverse patient populations.

Pricing strategies must balance affordability with sustainability, considering both premium and value segments. Insurance collaboration can improve device accessibility while ensuring manufacturer profitability.

Technology investment should prioritize connectivity features and data analytics capabilities that align with Saudi Arabia’s digital health initiatives. Innovation focus on continuous glucose monitoring and AI-powered insights will drive competitive advantage.

Regulatory compliance requires early engagement with Saudi health authorities and understanding of evolving medical device standards. Quality assurance and clinical evidence generation support successful market entry and expansion.

Future market prospects for Saudi Arabia’s self-monitoring blood glucose devices sector remain highly favorable, driven by sustained diabetes prevalence growth and continued healthcare system modernization. Market expansion is expected to accelerate with projected growth rates of 9.1% CAGR over the next five years.

Technology evolution will transform glucose monitoring from reactive testing to predictive health management through artificial intelligence and continuous monitoring integration. MarkWide Research projects that continuous glucose monitoring adoption will reach 45% penetration among Type 1 diabetes patients by 2028.

Healthcare integration trends will create comprehensive diabetes management ecosystems connecting patients, providers, and health systems through shared data platforms. Telemedicine expansion will drive demand for connected monitoring devices that support remote patient care.

Market democratization through improved affordability and insurance coverage will expand access to advanced monitoring technologies across broader patient populations. Rural market development presents significant growth opportunities as healthcare infrastructure improvements continue.

Innovation pipeline developments in non-invasive monitoring and implantable sensors may revolutionize glucose monitoring approaches, creating new market segments and competitive dynamics in the coming decade.

Saudi Arabia’s self-monitoring blood glucose devices market represents a dynamic and rapidly expanding healthcare technology sector with exceptional growth potential. The convergence of rising diabetes prevalence, government healthcare initiatives, and technological advancement creates favorable conditions for sustained market expansion and innovation.

Market fundamentals remain strong, supported by demographic trends, economic prosperity, and healthcare system modernization efforts aligned with Vision 2030 objectives. The transition from traditional glucose monitoring to connected, intelligent health management systems positions the market for transformational growth in the coming years.

Strategic opportunities exist across multiple market segments, from traditional glucose meters to advanced continuous monitoring systems and AI-powered health management platforms. Success in this market requires understanding of local healthcare dynamics, cultural considerations, and patient needs while delivering innovative, accessible solutions that improve diabetes management outcomes for Saudi Arabian patients.

What is Self-Monitoring Blood Glucose Devices?

Self-Monitoring Blood Glucose Devices are tools that allow individuals, particularly those with diabetes, to measure their blood glucose levels at home. These devices help in managing diabetes by providing real-time data on blood sugar levels, which is crucial for effective treatment and lifestyle adjustments.

What are the key players in the Saudi Arabia Self-Monitoring Blood Glucose Devices Market?

Key players in the Saudi Arabia Self-Monitoring Blood Glucose Devices Market include Abbott Laboratories, Roche Diagnostics, and Johnson & Johnson. These companies are known for their innovative products and significant market presence, among others.

What are the growth factors driving the Saudi Arabia Self-Monitoring Blood Glucose Devices Market?

The growth of the Saudi Arabia Self-Monitoring Blood Glucose Devices Market is driven by the increasing prevalence of diabetes, rising health awareness, and advancements in technology. Additionally, the growing demand for home healthcare solutions is contributing to market expansion.

What challenges does the Saudi Arabia Self-Monitoring Blood Glucose Devices Market face?

Challenges in the Saudi Arabia Self-Monitoring Blood Glucose Devices Market include regulatory hurdles, high costs of advanced devices, and competition from alternative monitoring methods. These factors can hinder market growth and consumer adoption.

What opportunities exist in the Saudi Arabia Self-Monitoring Blood Glucose Devices Market?

Opportunities in the Saudi Arabia Self-Monitoring Blood Glucose Devices Market include the development of smart devices with connectivity features and the potential for partnerships with healthcare providers. Additionally, increasing government initiatives to promote diabetes management can enhance market prospects.

What trends are shaping the Saudi Arabia Self-Monitoring Blood Glucose Devices Market?

Trends in the Saudi Arabia Self-Monitoring Blood Glucose Devices Market include the integration of digital health technologies, such as mobile apps for data tracking, and the rise of continuous glucose monitoring systems. These innovations are transforming how patients manage their diabetes.

Saudi Arabia Self-Monitoring Blood Glucose Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Continuous Glucose Monitors, Blood Glucose Meters, Test Strips, Lancets |

| Technology | Wireless, Bluetooth, NFC, Optical |

| End User | Homecare, Hospitals, Clinics, Pharmacies |

| Distribution Channel | Online Retail, Pharmacies, Hospitals, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Self-Monitoring Blood Glucose Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at