444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia secure logistics market represents a rapidly evolving sector that encompasses specialized transportation, storage, and distribution services for high-value, sensitive, and critical cargo. This market has experienced unprecedented growth driven by the Kingdom’s Vision 2030 initiative, increasing e-commerce activities, and heightened security requirements across various industries. Secure logistics services in Saudi Arabia include armored transportation, cash-in-transit operations, precious metals handling, pharmaceutical cold chain management, and high-tech equipment distribution.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over the recent forecast period. The Kingdom’s strategic position as a regional hub for trade and commerce, combined with substantial investments in infrastructure development, has positioned Saudi Arabia as a leading market for secure logistics services in the Middle East region. Digital transformation initiatives and advanced tracking technologies have further enhanced the sector’s capabilities and reliability.

Industry stakeholders include international logistics giants, regional specialized providers, government entities, and technology solution providers who collectively contribute to the market’s sophisticated ecosystem. The integration of artificial intelligence, IoT sensors, and blockchain technology has revolutionized traditional secure logistics operations, enabling real-time monitoring and enhanced security protocols throughout the supply chain.

The Saudi Arabia secure logistics market refers to the comprehensive ecosystem of specialized transportation, warehousing, and distribution services designed to handle high-value, sensitive, or security-critical cargo with enhanced protection measures, advanced tracking systems, and stringent compliance protocols.

Secure logistics operations encompass multiple specialized service categories including armored vehicle transportation for cash and valuables, temperature-controlled pharmaceutical distribution, high-security warehousing for precious metals and jewelry, and specialized handling of sensitive government and military supplies. These services require specialized personnel training, advanced security clearances, and compliance with both national and international security standards.

Technology integration plays a crucial role in modern secure logistics, incorporating GPS tracking, biometric access controls, tamper-evident packaging, real-time monitoring systems, and encrypted communication protocols. The market also includes value-added services such as risk assessment, insurance coordination, customs clearance for sensitive goods, and emergency response capabilities.

Strategic market positioning reveals that Saudi Arabia’s secure logistics sector has emerged as a critical component of the Kingdom’s economic diversification strategy. The market benefits from substantial government support, increasing private sector investment, and growing demand from multiple industry verticals including banking, healthcare, retail, and manufacturing sectors.

Key growth drivers include the expansion of e-commerce platforms requiring secure last-mile delivery, increasing cash circulation in the banking sector, growth in pharmaceutical imports requiring cold chain logistics, and rising demand for precious metals and luxury goods transportation. The market has demonstrated resilience with adoption rates increasing by 34% among small and medium enterprises seeking professional secure logistics services.

Competitive landscape features a mix of international players establishing regional operations and local companies expanding their service portfolios. Technology adoption has accelerated significantly, with digital integration rates reaching 67% across major service providers. The market’s future trajectory appears promising with continued infrastructure investments and regulatory support driving sustained growth.

Market segmentation analysis reveals diverse opportunities across multiple service categories and end-user industries. The following key insights highlight the market’s current dynamics:

Regional distribution shows concentrated activity in major metropolitan areas including Riyadh, Jeddah, and Dammam, with expanding coverage to secondary cities and industrial zones. The market demonstrates strong correlation with economic activity centers and transportation infrastructure development.

Economic diversification initiatives under Vision 2030 have created substantial demand for secure logistics services across emerging sectors. The Kingdom’s focus on developing non-oil industries has generated increased requirements for specialized transportation and storage of high-value materials, equipment, and products.

Digital transformation acceleration has driven demand for secure logistics services as businesses increasingly rely on high-value technology equipment, data storage devices, and sensitive electronic components. The growing fintech sector and digital payment systems have also increased the need for secure cash management and ATM replenishment services.

Infrastructure development projects including NEOM, Red Sea Project, and various megacity developments require specialized logistics for construction materials, equipment, and supplies. These projects demand enhanced security measures and reliable supply chain management throughout their development phases.

Healthcare sector expansion has significantly increased demand for pharmaceutical cold chain logistics, medical equipment transportation, and secure storage of sensitive healthcare supplies. The COVID-19 pandemic further emphasized the importance of reliable and secure medical supply chains.

E-commerce growth has created new market opportunities for secure last-mile delivery services, particularly for high-value consumer electronics, jewelry, and luxury goods. Online retail platforms require trusted logistics partners capable of handling valuable merchandise with appropriate security measures.

High operational costs associated with maintaining specialized security equipment, trained personnel, and compliance requirements create barriers for market entry and expansion. The significant capital investment required for armored vehicles, security systems, and facility upgrades limits the number of potential service providers.

Regulatory complexity and stringent licensing requirements create challenges for new market entrants and international companies seeking to establish operations. The need for multiple security clearances, permits, and ongoing compliance monitoring adds operational complexity and costs.

Skilled workforce shortage in specialized security logistics roles limits market growth potential. The requirement for trained security personnel, certified drivers, and technical specialists creates recruitment and retention challenges for service providers.

Technology integration costs for implementing advanced tracking, monitoring, and security systems require substantial ongoing investment. Smaller operators may struggle to keep pace with technological advancement requirements while maintaining competitive pricing.

Insurance and liability concerns associated with handling high-value cargo create additional cost pressures and operational constraints. The need for comprehensive coverage and risk management protocols adds complexity to service delivery models.

Regional expansion potential exists for Saudi-based secure logistics providers to extend services throughout the GCC region and broader Middle East markets. The Kingdom’s strategic location and advanced infrastructure provide competitive advantages for regional service delivery.

Technology innovation opportunities include developing AI-powered route optimization, blockchain-based cargo tracking, and IoT-enabled security monitoring systems. Companies investing in advanced technology solutions can differentiate their services and capture premium market segments.

Public-private partnerships offer opportunities for collaboration on large-scale infrastructure projects and government logistics requirements. These partnerships can provide stable revenue streams and support market expansion initiatives.

Specialized service development in emerging areas such as cryptocurrency storage, renewable energy equipment logistics, and space technology transportation presents new market opportunities. Early movers in these specialized segments can establish competitive advantages.

Cross-border trade facilitation services for secure international logistics present significant growth opportunities as regional trade volumes increase. Specialized customs handling and international security compliance services are increasingly in demand.

Supply chain integration trends show increasing collaboration between secure logistics providers and their clients to develop customized solutions. This integration approach has resulted in efficiency improvements of 28% across major client relationships while enhancing security protocols and reducing operational risks.

Competitive pressures have intensified as international players enter the market and local companies expand their capabilities. This competition has driven innovation in service delivery models, pricing strategies, and technology adoption while maintaining high security standards.

Customer expectations continue to evolve toward real-time visibility, enhanced security features, and integrated service offerings. Clients increasingly demand comprehensive solutions that combine transportation, storage, and value-added services under single-provider arrangements.

Regulatory evolution reflects the government’s commitment to maintaining high security standards while facilitating business growth. Recent regulatory updates have streamlined certain licensing processes while maintaining rigorous security requirements.

Technology disruption continues to reshape traditional service delivery models with automation, artificial intelligence, and advanced analytics transforming operational capabilities. Companies successfully implementing these technologies report operational cost reductions of 15% while improving service quality.

Comprehensive market analysis was conducted using multiple research approaches including primary interviews with industry stakeholders, secondary data analysis from government sources, and detailed examination of company financial reports and strategic announcements.

Primary research activities included structured interviews with secure logistics service providers, client organizations across various industries, technology solution providers, and regulatory officials. These interviews provided insights into market trends, challenges, and growth opportunities from multiple stakeholder perspectives.

Secondary research sources encompassed government statistical databases, industry association reports, company annual reports, and specialized trade publications. This comprehensive data collection approach ensured accuracy and completeness of market information.

Data validation processes included cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and reviewing preliminary results with industry experts to ensure accuracy and relevance.

Market sizing methodology utilized bottom-up analysis based on service provider revenues, client spending patterns, and industry growth indicators. This approach provided reliable market characterization while accounting for various service segments and regional variations.

Riyadh metropolitan area represents the largest regional market segment, accounting for approximately 42% of total market activity. The capital city’s concentration of government institutions, financial services, and corporate headquarters drives substantial demand for secure logistics services across multiple categories.

Western region dynamics centered around Jeddah and Mecca show strong growth in precious metals transportation, international trade logistics, and religious tourism-related secure services. The region benefits from major port facilities and serves as a gateway for international secure cargo movements.

Eastern Province markets including Dammam and Al-Khobar demonstrate robust industrial secure logistics demand driven by petrochemical facilities, manufacturing operations, and technology sector development. The region’s industrial base requires specialized handling of sensitive equipment and materials.

Emerging regional markets in secondary cities show increasing adoption of secure logistics services as economic development spreads beyond major metropolitan areas. These markets present growth opportunities for service expansion and network development.

Cross-regional connectivity requirements have increased as businesses operate across multiple locations within the Kingdom. This trend has driven demand for integrated logistics networks capable of providing consistent security standards across all regions.

Market leadership is distributed among several key players offering complementary service portfolios and regional coverage. The competitive environment includes:

Competitive strategies focus on technology differentiation, service specialization, and geographic expansion. Leading companies invest heavily in advanced security systems, employee training, and fleet modernization to maintain competitive advantages.

Market consolidation trends show increasing merger and acquisition activity as companies seek to expand capabilities and geographic coverage. Strategic partnerships between local and international players are becoming more common.

Service-based segmentation reveals distinct market categories with varying growth trajectories and competitive dynamics:

By Service Type:

By End-User Industry:

Geographic segmentation shows concentration in major urban centers with expanding coverage to secondary markets and industrial zones.

Cash-in-transit operations continue to dominate market activity despite increasing digital payment adoption. The segment benefits from ATM network expansion, retail cash requirements, and banking sector growth. Service providers report utilization rates of 78% across their armored vehicle fleets.

Pharmaceutical cold chain logistics represents the fastest-growing segment driven by healthcare sector expansion and increasing pharmaceutical imports. Specialized temperature-controlled vehicles and storage facilities require significant investment but command premium pricing.

Precious metals transportation serves the Kingdom’s substantial gold trading market and jewelry industry. This segment requires specialized handling procedures, high-security storage facilities, and comprehensive insurance coverage.

High-tech equipment logistics has emerged as a significant growth category supporting the Kingdom’s technology sector development. Services include secure transportation of servers, networking equipment, and sensitive electronic components.

Cross-border secure logistics facilitates regional trade in high-value goods requiring enhanced security measures. This category benefits from the Kingdom’s strategic location and growing regional trade relationships.

Service providers benefit from stable revenue streams, premium pricing opportunities, and strong barriers to entry that protect market positions. The specialized nature of secure logistics creates customer loyalty and long-term contract opportunities.

Client organizations gain access to professional security expertise, risk mitigation services, and compliance support that would be costly to develop internally. Outsourcing secure logistics allows companies to focus on core business activities while ensuring cargo security.

Technology suppliers find growing demand for advanced security systems, tracking solutions, and monitoring equipment. The market’s emphasis on technology adoption creates opportunities for innovative solution providers.

Financial institutions benefit from reliable cash management services that reduce operational risks and ensure regulatory compliance. Secure logistics partnerships enable banks to expand ATM networks and improve customer service.

Government entities gain access to specialized capabilities for handling sensitive materials and supporting national security objectives. Professional secure logistics services enhance government operational efficiency while maintaining security standards.

Economic development benefits include job creation in specialized security roles, technology sector growth, and enhanced business confidence in high-value cargo transportation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration has become the dominant trend reshaping secure logistics operations. Companies are implementing IoT sensors, blockchain tracking, and AI-powered route optimization to enhance security and operational efficiency. MarkWide Research analysis indicates that technology adoption rates have increased significantly across the sector.

Sustainability initiatives are gaining prominence as companies seek to reduce environmental impact while maintaining security standards. Electric armored vehicles, optimized routing systems, and green facility operations are becoming competitive differentiators.

Service integration trends show clients preferring comprehensive logistics solutions from single providers rather than managing multiple vendor relationships. This trend drives consolidation and encourages service portfolio expansion among market participants.

Real-time visibility demands from clients have increased substantially, requiring investment in advanced tracking and communication systems. Customers expect instant updates on cargo status, location, and security conditions throughout the transportation process.

Customization requirements continue to grow as clients seek tailored solutions for specific industry needs. Service providers are developing specialized capabilities for unique cargo types and security requirements.

Technology partnerships between secure logistics providers and technology companies have accelerated the development of innovative security solutions. Recent collaborations focus on autonomous vehicle technology, advanced surveillance systems, and predictive analytics capabilities.

Regulatory updates have streamlined certain licensing processes while maintaining rigorous security standards. New guidelines for cross-border operations and technology integration have provided clearer frameworks for market participants.

Infrastructure investments in specialized secure storage facilities and transportation hubs have expanded market capacity. Major projects include new armored vehicle maintenance facilities and high-security distribution centers.

International expansion activities by Saudi-based companies have increased regional market presence. Several domestic providers have established operations in neighboring GCC countries to serve regional clients.

Workforce development programs have been launched to address skilled labor shortages in security logistics roles. Training partnerships between companies and educational institutions aim to develop specialized expertise.

Technology investment priorities should focus on integrated platforms that combine tracking, security monitoring, and client communication capabilities. Companies investing in comprehensive technology solutions will gain competitive advantages and improve operational efficiency.

Market expansion strategies should consider both geographic diversification within the Kingdom and selective regional expansion opportunities. Companies with strong domestic positions can leverage their expertise in neighboring markets.

Service portfolio development should align with emerging client needs in specialized segments such as pharmaceutical logistics, e-commerce security, and cross-border operations. Early investment in these areas can establish market leadership positions.

Partnership strategies with technology providers, international logistics companies, and government entities can accelerate growth and capability development. Strategic alliances enable access to specialized expertise and market opportunities.

Workforce development initiatives should prioritize recruitment and training programs for specialized security roles. Companies with superior human capital will maintain service quality advantages and support sustainable growth.

Market growth trajectory remains positive with continued expansion expected across all major service segments. The combination of economic diversification, infrastructure development, and technology adoption will sustain demand growth throughout the forecast period.

Technology evolution will continue to reshape service delivery models with autonomous vehicles, artificial intelligence, and advanced analytics becoming standard capabilities. Companies successfully implementing these technologies will capture market share and improve profitability.

Regional integration opportunities will expand as GCC economic cooperation deepens and cross-border trade increases. Saudi-based secure logistics providers are well-positioned to serve regional markets and capture growth opportunities.

Regulatory environment is expected to evolve toward greater standardization and international alignment while maintaining high security standards. These changes will facilitate market growth and international cooperation.

MWR projections indicate that the market will continue expanding with growth rates exceeding 8% annually driven by economic diversification and increasing security awareness. The sector’s strategic importance to the Kingdom’s economic development ensures continued government support and investment.

Saudi Arabia’s secure logistics market represents a dynamic and rapidly evolving sector with substantial growth potential driven by economic diversification, infrastructure development, and increasing security requirements across multiple industries. The market benefits from strong government support, strategic geographic positioning, and growing demand from diverse client segments.

Key success factors for market participants include technology adoption, service specialization, geographic expansion, and workforce development. Companies that successfully integrate advanced security technologies while maintaining high service standards will capture market leadership positions and sustainable competitive advantages.

Future market development will be shaped by continued digital transformation, regional integration opportunities, and evolving client requirements for comprehensive security solutions. The sector’s alignment with Vision 2030 objectives ensures continued growth support and strategic importance to the Kingdom’s economic development goals.

What is Secure Logistics?

Secure logistics refers to the processes and systems involved in the safe and efficient transportation, storage, and handling of goods, particularly those that are sensitive or high-value. This includes measures to prevent theft, damage, and loss during transit and storage.

What are the key players in the Saudi Arabia Secure Logistics Market?

Key players in the Saudi Arabia Secure Logistics Market include Aramex, DHL, and Agility Logistics, which provide a range of secure transportation and warehousing solutions tailored to various industries, among others.

What are the main drivers of growth in the Saudi Arabia Secure Logistics Market?

The main drivers of growth in the Saudi Arabia Secure Logistics Market include the increasing demand for e-commerce, the rise in international trade, and the need for enhanced supply chain security. These factors are pushing companies to invest in secure logistics solutions.

What challenges does the Saudi Arabia Secure Logistics Market face?

Challenges in the Saudi Arabia Secure Logistics Market include regulatory compliance issues, the high cost of implementing advanced security technologies, and the need for skilled personnel to manage secure logistics operations. These factors can hinder market growth.

What opportunities exist in the Saudi Arabia Secure Logistics Market?

Opportunities in the Saudi Arabia Secure Logistics Market include the expansion of the logistics infrastructure, the adoption of innovative technologies like IoT and blockchain for enhanced security, and the growing focus on sustainability in logistics practices.

What trends are shaping the Saudi Arabia Secure Logistics Market?

Trends shaping the Saudi Arabia Secure Logistics Market include the increasing integration of technology in logistics operations, a shift towards automation and real-time tracking, and a heightened emphasis on cybersecurity measures to protect sensitive data and goods.

Saudi Arabia Secure Logistics Market

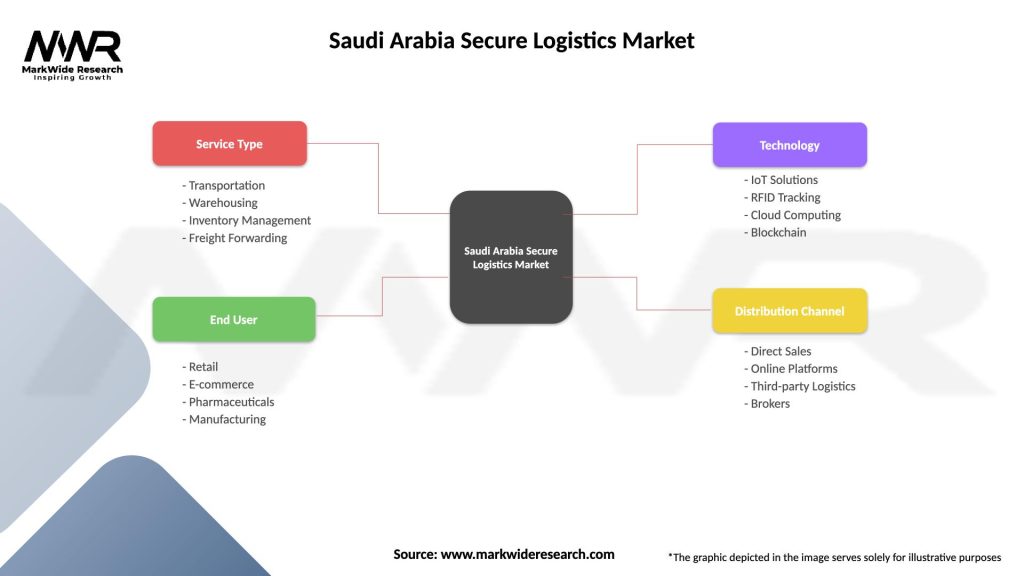

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Inventory Management, Freight Forwarding |

| End User | Retail, E-commerce, Pharmaceuticals, Manufacturing |

| Technology | IoT Solutions, RFID Tracking, Cloud Computing, Blockchain |

| Distribution Channel | Direct Sales, Online Platforms, Third-party Logistics, Brokers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Secure Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at