444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia sanitary market represents a dynamic and rapidly evolving sector within the Kingdom’s construction and infrastructure landscape. This comprehensive market encompasses a wide range of sanitary products including bathroom fixtures, fittings, ceramic tiles, plumbing accessories, and modern bathroom solutions that cater to both residential and commercial applications. Market dynamics indicate robust growth driven by Vision 2030 initiatives, urbanization trends, and increasing consumer preferences for premium sanitary solutions.

Infrastructure development across Saudi Arabia has accelerated significantly, with the government’s commitment to diversifying the economy creating substantial demand for high-quality sanitary products. The market benefits from 12.5% annual growth in construction activities, particularly in residential housing projects and commercial developments. Consumer behavior has shifted toward modern, water-efficient, and aesthetically appealing sanitary solutions that align with contemporary lifestyle preferences.

Regional distribution shows concentrated demand in major urban centers including Riyadh, Jeddah, and Dammam, where 68% of market activity occurs. The market landscape features both international brands and local manufacturers competing to meet diverse consumer needs ranging from budget-friendly options to luxury sanitary solutions. Technological advancement in smart bathroom fixtures and water-saving technologies has gained significant traction among environmentally conscious consumers.

The Saudi Arabia sanitary market refers to the comprehensive ecosystem of bathroom and sanitary products, fixtures, and accessories distributed and consumed within the Kingdom. This market encompasses ceramic sanitaryware, bathroom fittings, plumbing fixtures, tiles, accessories, and related installation services that serve residential, commercial, and industrial applications across Saudi Arabia’s diverse construction landscape.

Market scope includes traditional sanitary products such as toilets, washbasins, bidets, and urinals, alongside modern innovations including smart toilets, sensor-activated faucets, and water-efficient fixtures. The definition extends to complementary products like bathroom tiles, mirrors, lighting fixtures, and plumbing accessories that create complete bathroom solutions for end consumers.

Industry classification covers manufacturers, importers, distributors, retailers, and service providers who collectively form the sanitary market value chain. This includes international brands establishing local presence, domestic manufacturers developing indigenous capabilities, and specialized retailers serving diverse consumer segments throughout Saudi Arabia’s expanding urban and suburban markets.

Strategic analysis reveals the Saudi Arabia sanitary market as a high-growth sector benefiting from unprecedented infrastructure development and changing consumer preferences. The market demonstrates resilience and adaptability, with 15.2% growth rate in premium segment adoption reflecting increased disposable income and lifestyle aspirations among Saudi consumers.

Key market drivers include government-led housing initiatives, private sector construction projects, and rising awareness of water conservation technologies. The market has witnessed significant transformation with international brands establishing manufacturing facilities locally, creating employment opportunities and reducing import dependency. Consumer preferences increasingly favor smart bathroom solutions and sustainable sanitary products that offer long-term value.

Competitive landscape features established international players alongside emerging local manufacturers who leverage cost advantages and cultural understanding. Market segmentation shows balanced demand across residential and commercial applications, with 42% market share attributed to residential projects and the remainder serving commercial and institutional requirements.

Future prospects remain highly positive, supported by Vision 2030 objectives, continued urbanization, and evolving consumer expectations for modern bathroom solutions. The market is positioned for sustained growth through technological innovation, strategic partnerships, and expanded distribution networks serving Saudi Arabia’s diverse geographic regions.

Market intelligence reveals several critical insights shaping the Saudi Arabia sanitary market landscape. Consumer behavior analysis indicates growing preference for integrated bathroom solutions that combine functionality with aesthetic appeal, driving demand for coordinated product suites from single manufacturers.

Emerging trends include increased focus on antimicrobial surfaces, touchless fixtures, and modular bathroom systems that offer flexibility in design and installation. These insights guide strategic decision-making for manufacturers, retailers, and service providers operating in Saudi Arabia’s dynamic sanitary market.

Government initiatives serve as the primary catalyst for sanitary market expansion in Saudi Arabia. Vision 2030’s emphasis on housing development, infrastructure modernization, and economic diversification creates substantial demand for sanitary products across multiple sectors. The National Housing Program aims to increase homeownership rates, directly impacting sanitary product consumption in residential applications.

Urbanization acceleration drives consistent market growth as rural populations migrate to urban centers seeking employment and improved living standards. This demographic shift creates demand for modern sanitary facilities in both new construction and renovation projects. Population growth of young, educated consumers with higher disposable income supports premium product adoption and market expansion.

Construction sector boom provides fundamental support for sanitary market growth through residential, commercial, and infrastructure projects. Major developments including NEOM, Red Sea Project, and Qiddiya create substantial demand for high-quality sanitary solutions that meet international standards and aesthetic requirements.

Consumer lifestyle evolution toward modern living standards increases demand for contemporary bathroom solutions. Rising awareness of hygiene, comfort, and design aesthetics drives preference for premium sanitary products that offer superior functionality and visual appeal. Water conservation awareness promotes adoption of efficient sanitary fixtures that reduce consumption while maintaining performance standards.

Economic fluctuations pose challenges to sanitary market stability, particularly during periods of reduced government spending or private sector investment. Oil price volatility can impact construction activity levels, directly affecting demand for sanitary products across residential and commercial segments.

Import dependency creates vulnerability to international supply chain disruptions, currency fluctuations, and trade policy changes. Many premium sanitary products require importation, making the market susceptible to logistics challenges and cost variations that affect pricing strategies and consumer accessibility.

Skilled labor shortage in installation and maintenance services limits market growth potential. Complex sanitary systems require trained technicians for proper installation and ongoing maintenance, creating bottlenecks in project completion and customer satisfaction levels.

Cultural preferences for traditional bathroom layouts and fixtures may slow adoption of modern sanitary solutions in certain market segments. Conservative design preferences and resistance to change can limit market penetration for innovative products and technologies.

Price sensitivity among budget-conscious consumers restricts premium product adoption, particularly in mass market residential segments. Economic pressures on household budgets may delay bathroom renovation projects and reduce spending on high-end sanitary solutions.

Smart bathroom technology presents significant growth opportunities as Saudi consumers embrace digital solutions and home automation systems. Integration of IoT devices, sensor technology, and mobile connectivity in sanitary products creates new market segments and revenue streams for innovative manufacturers.

Sustainable product development offers competitive advantages as environmental consciousness increases among consumers and regulatory bodies. Water-efficient fixtures, recycled materials, and eco-friendly manufacturing processes align with Saudi Arabia’s sustainability goals and consumer preferences.

Local manufacturing expansion provides opportunities for cost reduction, supply chain optimization, and job creation. Establishing production facilities within Saudi Arabia enables companies to serve regional markets more effectively while benefiting from government incentives and reduced logistics costs.

E-commerce platform development creates new distribution channels and customer engagement opportunities. Online retail platforms enable manufacturers and retailers to reach broader audiences, provide detailed product information, and offer convenient purchasing experiences for sanitary products.

After-sales service expansion represents untapped revenue potential through maintenance contracts, replacement parts, and upgrade services. Comprehensive service offerings enhance customer relationships and create recurring revenue streams beyond initial product sales.

Supply chain evolution demonstrates increasing sophistication as manufacturers optimize distribution networks and inventory management systems. Local warehousing facilities and regional distribution centers improve product availability and reduce delivery times for sanitary products across Saudi Arabia’s vast geographic area.

Competitive intensity continues escalating as international brands compete with local manufacturers for market share. This competition drives innovation, improves product quality, and creates pricing pressures that benefit consumers while challenging profit margins for market participants.

Technology integration transforms product offerings and customer experiences through smart features, mobile applications, and connected bathroom ecosystems. These technological advances create differentiation opportunities and premium pricing potential for forward-thinking manufacturers.

Regulatory environment evolves to address water conservation, building standards, and product safety requirements. Compliance with local regulations and international standards becomes increasingly important for market access and consumer acceptance.

Consumer education initiatives by manufacturers and retailers increase awareness of product benefits, installation requirements, and maintenance procedures. Educational programs support market development by addressing knowledge gaps and building confidence in modern sanitary solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Saudi Arabia sanitary market. Primary research includes structured interviews with industry executives, distributors, retailers, and end consumers to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of government publications, industry reports, trade statistics, and company financial statements to establish market baselines and validate primary findings. This approach ensures comprehensive coverage of market dynamics and competitive landscape factors.

Data collection methods include online surveys, telephone interviews, focus group discussions, and field observations at retail locations and construction sites. These diverse approaches capture quantitative metrics and qualitative insights that inform strategic recommendations and market projections.

Market segmentation analysis examines product categories, price ranges, distribution channels, and customer demographics to identify growth opportunities and competitive positioning strategies. Segmentation provides granular insights into market dynamics and consumer behavior patterns.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert consultations, and statistical analysis techniques. Quality assurance measures maintain research integrity and support confident decision-making for market participants and stakeholders.

Central Region dominates the Saudi Arabia sanitary market with Riyadh serving as the primary consumption center. This region accounts for 38% of total market demand driven by government projects, commercial developments, and high-income residential communities. The presence of major construction companies and distribution networks supports robust market activity.

Western Region represents the second-largest market segment, with Jeddah and Mecca driving substantial demand for sanitary products. Religious tourism, commercial port activities, and urban development projects create consistent market demand. The region shows 24% market share with strong growth potential in hospitality and residential sectors.

Eastern Region benefits from oil industry prosperity and industrial development, generating significant demand for both residential and commercial sanitary solutions. Dammam and Al-Khobar serve as regional hubs with 19% market contribution supported by petrochemical industry investments and expatriate housing requirements.

Northern and Southern Regions represent emerging markets with growing infrastructure development and population centers. These regions collectively account for 19% of market activity with substantial growth potential as government development programs expand beyond traditional urban centers.

Regional preferences vary based on climate conditions, cultural factors, and economic development levels. Coastal regions show higher demand for corrosion-resistant fixtures, while inland areas prioritize water-efficient solutions and durability features suited to desert climate conditions.

Market leadership features a diverse mix of international brands and local manufacturers competing across multiple product segments and price points. Established players leverage brand recognition, distribution networks, and product innovation to maintain competitive advantages in the Saudi Arabia sanitary market.

Competitive strategies include local manufacturing investments, exclusive distribution partnerships, and customized product development for Saudi market requirements. Companies differentiate through design innovation, sustainability features, and comprehensive after-sales support services.

Product segmentation reveals diverse market categories serving different consumer needs and applications within the Saudi Arabia sanitary market. Each segment demonstrates unique growth patterns, competitive dynamics, and consumer preferences that influence strategic positioning and market development approaches.

By Product Type:

By Application:

By Price Range:

Ceramic sanitaryware maintains its position as the largest market category, representing traditional bathroom fixtures that form the foundation of sanitary installations. This category benefits from consistent demand across all market segments, with growth driven by replacement cycles and new construction projects. Innovation focus includes water-saving technologies, antimicrobial surfaces, and improved durability features.

Bathroom fittings demonstrate strong growth potential through design innovation and smart technology integration. Consumers increasingly view fittings as design elements that enhance bathroom aesthetics and functionality. Premium fittings with sensor activation, temperature control, and water conservation features gain market traction among quality-conscious consumers.

Smart sanitary products represent the fastest-growing category, driven by technology adoption and lifestyle preferences. These products integrate connectivity, automation, and user customization features that appeal to tech-savvy consumers. Market penetration remains limited but shows strong growth trajectory as awareness and infrastructure support expand.

Tiles and surfaces complement core sanitary products by providing complete bathroom solutions. This category benefits from renovation trends and design consciousness among Saudi consumers. Natural stone and premium ceramic tiles gain popularity for luxury applications, while practical solutions serve mass market requirements.

Accessories and complementary products offer high-margin opportunities through coordinated design suites and functional enhancements. These products support upselling strategies and improve customer satisfaction through comprehensive bathroom solutions that address diverse user needs and preferences.

Manufacturers benefit from expanding market opportunities driven by construction growth and consumer preference evolution. Local production capabilities reduce costs, improve supply chain control, and enable customization for Saudi market requirements. Brand building opportunities exist through quality differentiation and customer service excellence.

Distributors and retailers gain from market expansion and product diversification opportunities. Growing consumer awareness creates demand for expert advice and comprehensive product selection. Service integration through installation and maintenance offerings provides additional revenue streams and customer loyalty benefits.

Construction companies access improved product availability, competitive pricing, and technical support services that enhance project efficiency and quality. Partnership opportunities with sanitary product suppliers enable value-added services and differentiated project offerings for end clients.

End consumers benefit from increased product choice, competitive pricing, and improved quality standards. Market competition drives innovation and customer service improvements that enhance overall satisfaction and value proposition. Technology advancement provides access to modern bathroom solutions that improve comfort and efficiency.

Government stakeholders achieve economic diversification objectives through local manufacturing development and job creation. Infrastructure improvement supports urbanization goals and quality of life enhancement for Saudi citizens and residents.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart bathroom integration emerges as a dominant trend transforming the Saudi Arabia sanitary market landscape. Consumers increasingly demand connected fixtures that offer personalized experiences, water usage monitoring, and mobile device control capabilities. This trend drives premium product adoption and creates opportunities for technology-focused manufacturers.

Sustainability consciousness influences purchasing decisions as environmental awareness grows among Saudi consumers. Water-efficient fixtures, sustainable materials, and eco-friendly manufacturing processes become important selection criteria. Green building certifications and government water conservation initiatives support this trend development.

Design aesthetics gain prominence as bathrooms evolve from purely functional spaces to lifestyle environments. Contemporary designs, coordinated product suites, and luxury finishes appeal to affluent consumers seeking to create spa-like experiences in residential settings. Customization options enable personalized bathroom solutions.

Online retail growth transforms distribution channels and customer engagement approaches. E-commerce platforms provide convenient product research, comparison, and purchasing experiences that appeal to tech-savvy consumers. Digital marketing strategies become essential for brand visibility and customer acquisition.

Local manufacturing expansion reduces import dependency while creating employment opportunities and cost advantages. International brands establish production facilities to serve regional markets more effectively. Supply chain localization improves responsiveness and reduces logistics complexities.

Manufacturing investments by international brands demonstrate confidence in Saudi Arabia’s market potential and strategic importance. Recent facility announcements create local production capacity and supply chain optimization opportunities that benefit the entire sanitary market ecosystem.

Technology partnerships between sanitary product manufacturers and smart home technology companies accelerate innovation in connected bathroom solutions. These collaborations create integrated systems that enhance user experiences and differentiate product offerings in competitive markets.

Distribution network expansion improves product availability across Saudi Arabia’s diverse geographic regions. New retail formats, including specialized showrooms and online platforms, enhance customer access and shopping experiences for sanitary products.

Sustainability initiatives by leading manufacturers address environmental concerns and regulatory requirements. Water conservation technologies, recycled materials, and energy-efficient production processes support corporate responsibility objectives and consumer preferences.

Market consolidation activities through acquisitions and strategic partnerships reshape competitive dynamics. These developments create stronger market positions, expanded product portfolios, and improved operational efficiencies for participating companies.

MarkWide Research recommends that market participants focus on local manufacturing capabilities to reduce import dependency and improve cost competitiveness. Establishing production facilities within Saudi Arabia enables companies to serve regional markets more effectively while benefiting from government incentives and reduced logistics expenses.

Technology integration should be prioritized to capture growing demand for smart bathroom solutions. Companies investing in IoT connectivity, mobile applications, and user customization features will gain competitive advantages in premium market segments where consumers value innovation and convenience.

Sustainability positioning becomes increasingly important as environmental consciousness grows among consumers and regulatory bodies. Water-efficient products, sustainable materials, and eco-friendly manufacturing processes create differentiation opportunities and align with Saudi Arabia’s environmental objectives.

Distribution channel diversification through e-commerce platforms and specialized retail formats improves market reach and customer engagement. Online presence becomes essential for brand visibility and customer acquisition in digitally connected consumer markets.

Strategic partnerships with local distributors, construction companies, and technology providers enhance market penetration and service capabilities. Collaborative approaches enable companies to leverage local expertise while expanding their market presence and customer relationships.

Long-term prospects for the Saudi Arabia sanitary market remain highly positive, supported by continued economic diversification, urbanization trends, and infrastructure development initiatives. MWR analysis projects sustained growth driven by government housing programs, private sector construction activity, and evolving consumer preferences for modern bathroom solutions.

Technology advancement will continue transforming product offerings and customer experiences through smart features, connectivity, and automation capabilities. The market expects 35% growth in smart sanitary product adoption over the next five years as infrastructure support and consumer awareness expand.

Market maturation will bring increased competition, product standardization, and service differentiation as key success factors. Companies that invest in local capabilities, customer relationships, and innovation will achieve sustainable competitive advantages in evolving market conditions.

Regional expansion opportunities exist as Saudi Arabia serves as a hub for neighboring markets in the Gulf region and broader Middle East. Successful companies will leverage their Saudi market presence to access regional growth opportunities and achieve economies of scale.

Sustainability focus will intensify as water conservation becomes increasingly important in arid climate conditions. Products and technologies that address environmental challenges while maintaining performance standards will capture growing market share and premium pricing opportunities.

The Saudi Arabia sanitary market presents exceptional opportunities for growth and development within a dynamic economic environment shaped by Vision 2030 initiatives and changing consumer preferences. Market participants benefit from strong government support, expanding construction activity, and evolving lifestyle trends that drive demand for modern sanitary solutions across residential and commercial applications.

Strategic success requires understanding of local market dynamics, consumer preferences, and regulatory requirements while maintaining competitive positioning through innovation, quality, and service excellence. Companies that invest in local manufacturing capabilities, technology integration, and sustainability initiatives will achieve long-term market leadership and profitability.

Future growth depends on continued economic diversification, infrastructure development, and consumer education initiatives that expand market opportunities and drive adoption of advanced sanitary products. The market’s evolution toward smart, sustainable, and aesthetically appealing solutions creates substantial value creation potential for forward-thinking industry participants and stakeholders.

What is Sanitary?

Sanitary refers to products and systems designed to maintain hygiene and health standards, particularly in bathrooms and kitchens. This includes items such as toilets, sinks, faucets, and other plumbing fixtures that ensure cleanliness and sanitation in residential and commercial spaces.

What are the key players in the Saudi Arabia Sanitary Market?

Key players in the Saudi Arabia Sanitary Market include companies like Al Moammar Information Systems, Roca Sanitario, and Kohler, which offer a range of sanitary products and solutions for various applications, including residential and commercial sectors, among others.

What are the growth factors driving the Saudi Arabia Sanitary Market?

The growth of the Saudi Arabia Sanitary Market is driven by increasing urbanization, rising construction activities, and a growing focus on hygiene and sanitation in both residential and commercial buildings. Additionally, government initiatives to improve infrastructure contribute to market expansion.

What challenges does the Saudi Arabia Sanitary Market face?

The Saudi Arabia Sanitary Market faces challenges such as fluctuating raw material prices and the need for compliance with stringent regulations. Additionally, competition from low-cost imports can impact local manufacturers.

What opportunities exist in the Saudi Arabia Sanitary Market?

Opportunities in the Saudi Arabia Sanitary Market include the increasing demand for eco-friendly and water-saving sanitary products. Innovations in smart sanitary technology also present avenues for growth as consumers seek more efficient and sustainable solutions.

What trends are shaping the Saudi Arabia Sanitary Market?

Trends in the Saudi Arabia Sanitary Market include a shift towards modern and minimalist designs, the integration of smart technology in sanitary fixtures, and a growing emphasis on sustainability. These trends reflect changing consumer preferences and a focus on enhancing user experience.

Saudi Arabia Sanitary Market

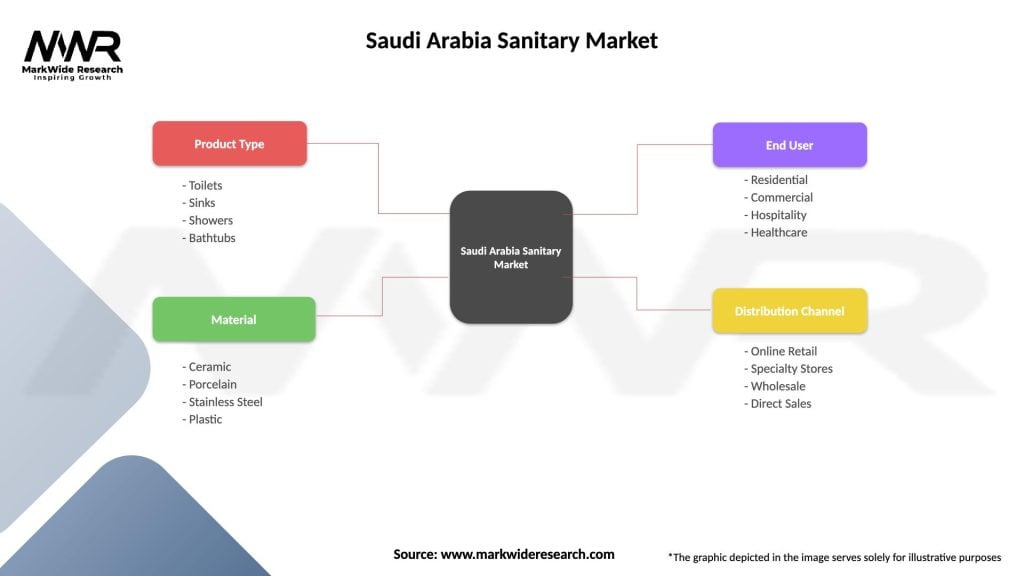

| Segmentation Details | Description |

|---|---|

| Product Type | Toilets, Sinks, Showers, Bathtubs |

| Material | Ceramic, Porcelain, Stainless Steel, Plastic |

| End User | Residential, Commercial, Hospitality, Healthcare |

| Distribution Channel | Online Retail, Specialty Stores, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

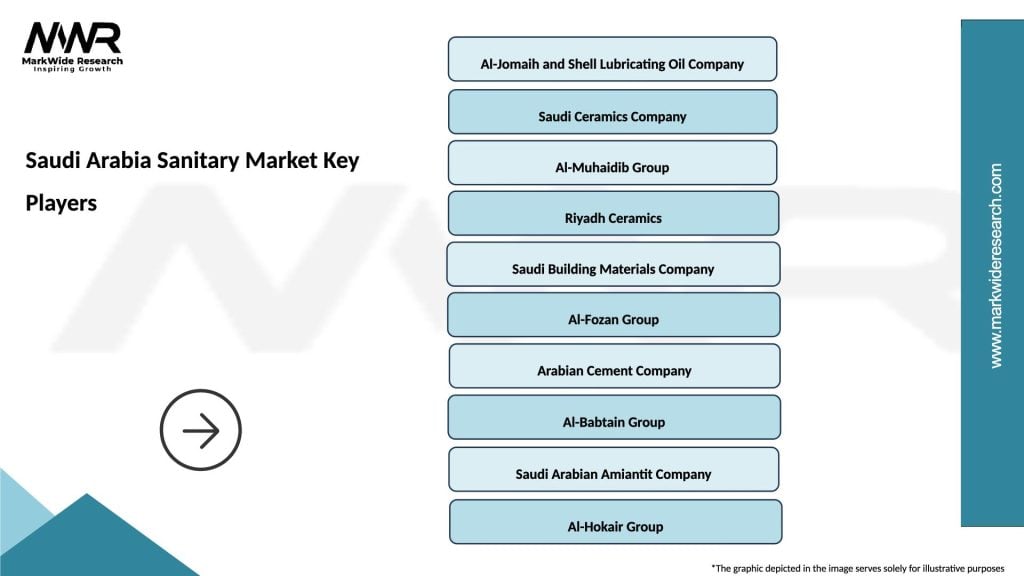

Leading companies in the Saudi Arabia Sanitary Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at