444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia residential construction market represents a dynamic and rapidly evolving sector that plays a crucial role in the Kingdom’s economic diversification strategy under Vision 2030. This market encompasses the development, construction, and delivery of various residential properties including single-family homes, apartments, condominiums, and mixed-use residential complexes across the nation. Market dynamics are significantly influenced by government initiatives, demographic shifts, and evolving consumer preferences for modern housing solutions.

Government support through various housing programs and regulatory reforms has created substantial momentum in the residential construction sector. The market is experiencing robust growth driven by increasing urbanization rates, a growing young population, and enhanced access to mortgage financing. Construction activities are particularly concentrated in major metropolitan areas including Riyadh, Jeddah, and Dammam, with emerging developments in NEOM and other mega-projects contributing to market expansion.

Technological advancement and sustainable construction practices are becoming increasingly important factors shaping market development. The integration of smart home technologies, energy-efficient building materials, and modern construction methodologies is transforming traditional residential construction approaches. Market growth is projected to continue at a compound annual growth rate of 6.2% over the forecast period, supported by favorable demographic trends and continued government investment in housing infrastructure.

The Saudi Arabia residential construction market refers to the comprehensive ecosystem of activities, services, and stakeholders involved in planning, designing, constructing, and delivering residential housing units throughout the Kingdom of Saudi Arabia. This market encompasses various property types including detached houses, townhouses, apartments, luxury villas, and affordable housing units designed to meet diverse demographic and economic segments of the population.

Market scope includes all phases of residential development from land acquisition and planning permissions to construction completion and handover to end users. The sector involves multiple stakeholders including real estate developers, construction companies, architects, engineers, material suppliers, and financial institutions that collectively contribute to housing supply across different price points and geographical locations.

Residential construction activities are characterized by adherence to local building codes, integration of cultural preferences in design, and increasing emphasis on sustainability and energy efficiency. The market serves both Saudi nationals and expatriate residents, with specific programs targeting first-time homebuyers and addressing the Kingdom’s housing shortage through various government-backed initiatives and private sector partnerships.

Market performance in Saudi Arabia’s residential construction sector demonstrates strong fundamentals supported by comprehensive government housing programs and favorable demographic trends. The sector benefits from substantial public investment, regulatory reforms that facilitate homeownership, and growing private sector participation in residential development projects. Construction volume has increased significantly with approximately 78% of new housing projects incorporating modern design standards and energy-efficient features.

Key market drivers include the Kingdom’s young population demographic, urbanization trends, and government initiatives such as the Sakani program that aims to increase homeownership rates among Saudi citizens. The market is experiencing transformation through digitalization of construction processes, adoption of Building Information Modeling (BIM), and integration of smart home technologies that appeal to tech-savvy consumers.

Regional development patterns show concentrated activity in major urban centers while emerging projects in new cities and economic zones create additional growth opportunities. The market benefits from improved access to mortgage financing, with housing loan approvals increasing by 42% year-over-year, making homeownership more accessible to middle-income families. Construction quality standards continue to evolve with greater emphasis on sustainability, durability, and alignment with international building practices.

Market dynamics reveal several critical insights that shape the residential construction landscape in Saudi Arabia. The sector demonstrates resilience and adaptability in response to economic diversification efforts and changing consumer expectations for housing quality and amenities.

Government initiatives serve as the primary catalyst for residential construction market growth in Saudi Arabia. The Sakani housing program, along with other government-backed schemes, provides substantial support for homeownership and drives consistent demand for new residential units. Regulatory reforms have streamlined construction permitting processes, reduced bureaucratic barriers, and created more favorable conditions for real estate development across the Kingdom.

Demographic trends represent another significant driver with Saudi Arabia’s young and growing population creating sustained housing demand. The increasing rate of household formation, coupled with urbanization patterns that concentrate population in major cities, generates continuous need for residential construction projects. Economic diversification efforts under Vision 2030 attract domestic and international investment in real estate development, supporting market expansion.

Financial sector development has improved access to mortgage financing, making homeownership more attainable for middle-income families. Enhanced banking services, competitive interest rates, and government-backed loan guarantees facilitate property purchases and stimulate construction demand. Infrastructure development in transportation, utilities, and telecommunications creates attractive locations for new residential projects and supports property value appreciation.

Cultural and lifestyle changes drive demand for modern housing features including smart home technologies, energy-efficient systems, and contemporary design elements. Growing awareness of sustainability and environmental considerations influences construction practices and material selection, creating opportunities for innovative building solutions.

Construction cost pressures present significant challenges for the residential construction market in Saudi Arabia. Rising material costs, particularly for imported construction components, impact project economics and may affect affordability for certain market segments. Labor market dynamics including skilled worker shortages and dependency on expatriate labor create potential bottlenecks in project execution and completion timelines.

Economic volatility related to oil price fluctuations can influence government spending on housing programs and affect overall market confidence. While diversification efforts continue, the economy’s sensitivity to energy market conditions may impact long-term investment decisions in residential development projects. Regulatory complexity in certain aspects of construction permitting and compliance requirements can delay project initiation and increase development costs.

Land availability and acquisition challenges in prime urban locations limit development opportunities and may drive projects to less desirable areas with longer commute times and limited amenities. Infrastructure constraints in some regions require additional investment in utilities and transportation before residential development becomes viable, adding to overall project costs.

Market competition from established developers and new market entrants can pressure profit margins and require increased marketing investments to differentiate projects. Consumer financing limitations for certain income segments may restrict market reach despite improved mortgage availability, particularly affecting first-time homebuyers with limited credit history.

Affordable housing development presents substantial opportunities as government programs continue to address housing shortages and promote homeownership among Saudi citizens. The gap between housing supply and demand creates space for innovative developers to deliver cost-effective solutions while maintaining quality standards. Sustainable construction practices offer differentiation opportunities through green building certifications, energy-efficient designs, and environmentally conscious material selection.

Technology integration creates opportunities for smart home features, automated building systems, and digital construction methodologies that appeal to tech-savvy consumers and improve operational efficiency. Mixed-use development projects that combine residential units with retail, office, and recreational facilities address changing lifestyle preferences and optimize land utilization in urban areas.

Regional expansion into emerging economic zones, new cities, and previously underdeveloped areas offers first-mover advantages and potentially lower land acquisition costs. Luxury housing segments benefit from growing high-net-worth populations and international residents seeking premium residential options with world-class amenities and services.

Modular and prefabricated construction technologies present opportunities to reduce construction timelines, improve quality control, and achieve cost efficiencies while meeting growing housing demand. Public-private partnerships in housing development create opportunities for private sector participation in government-backed projects with reduced market risk and assured demand.

Supply and demand dynamics in the Saudi Arabia residential construction market reflect the interplay between government housing initiatives, demographic trends, and economic conditions. Housing demand consistently outpaces supply in major urban centers, creating opportunities for developers while maintaining price stability and investment attractiveness. The market demonstrates cyclical patterns influenced by government budget allocations, oil revenues, and broader economic performance.

Competitive dynamics involve both established local developers and international companies seeking to capitalize on market growth opportunities. Market consolidation trends show larger developers acquiring smaller firms to achieve economies of scale and expand geographical presence. Competition drives innovation in design, construction methods, and customer service while maintaining focus on affordability and quality.

Regulatory dynamics continue evolving with government efforts to streamline processes, improve transparency, and attract investment. MarkWide Research analysis indicates that regulatory improvements have reduced project approval timelines by 35% over the past three years, enhancing market efficiency and developer confidence. Policy changes regarding foreign ownership, mortgage regulations, and construction standards create both opportunities and adaptation requirements for market participants.

Technology adoption dynamics show accelerating integration of digital tools, sustainable materials, and modern construction techniques. Market maturation leads to increased sophistication in project marketing, customer service, and after-sales support as developers compete for market share in an increasingly competitive environment.

Research approach for analyzing the Saudi Arabia residential construction market employs comprehensive primary and secondary research methodologies to ensure accurate and reliable market insights. Primary research includes structured interviews with industry executives, construction companies, real estate developers, government officials, and end consumers to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of government publications, industry reports, construction permits data, housing statistics, and economic indicators relevant to residential construction activities. Data collection methods include surveys of construction companies, analysis of project announcements, review of regulatory changes, and monitoring of market transactions to build comprehensive market understanding.

Market sizing methodology utilizes construction permit data, housing unit completions, and development project announcements to estimate market activity levels and growth trends. Qualitative analysis incorporates expert opinions, industry best practices, and competitive intelligence to provide context for quantitative findings and identify emerging market trends.

Validation processes include cross-referencing multiple data sources, conducting follow-up interviews with key stakeholders, and applying statistical analysis techniques to ensure data accuracy and reliability. Regional analysis methodology segments the market by major metropolitan areas and emerging development zones to provide granular insights into local market conditions and opportunities.

Riyadh region dominates the residential construction market with the highest concentration of development projects and construction activity. The capital city benefits from government presence, major corporate headquarters, and substantial infrastructure investment that drives housing demand. Construction volume in Riyadh accounts for approximately 32% of national residential development, with projects ranging from affordable housing to luxury developments catering to diverse income segments.

Western region including Jeddah and Mecca shows strong market activity driven by religious tourism, commercial activities, and port operations. The region’s strategic location and economic diversity create sustained housing demand, particularly for mid-market and luxury residential projects. Coastal development opportunities along the Red Sea provide unique positioning for premium residential communities with waterfront amenities.

Eastern Province centered around Dammam and Al Khobar benefits from oil industry presence and industrial activities that generate employment and housing demand. The region shows 24% market share in residential construction with particular strength in company-sponsored housing and expatriate residential communities. Industrial city development creates additional opportunities for worker housing and family residential projects.

Emerging regions including NEOM, Qiddiya, and other mega-project locations represent future growth opportunities with planned residential communities designed to international standards. These developments incorporate smart city concepts, sustainable design principles, and modern amenities that set new benchmarks for residential construction in the Kingdom.

Market leadership in Saudi Arabia’s residential construction sector includes both established local developers and international companies with strong regional presence. The competitive environment demonstrates consolidation trends as larger firms acquire smaller developers to expand market reach and achieve operational efficiencies.

Competitive strategies focus on differentiation through design innovation, construction quality, customer service, and strategic location selection. Market positioning varies from affordable housing specialists to luxury developers, with many companies expanding across multiple market segments to diversify revenue streams and market risk.

By Property Type: The residential construction market segments into various property categories serving different consumer needs and price points. Single-family homes represent the largest segment, particularly popular among Saudi families seeking privacy and traditional living arrangements. Apartment complexes serve urban professionals and smaller households, while luxury villas cater to high-income segments demanding premium amenities and exclusive locations.

By Price Range: Market segmentation includes affordable housing supported by government programs, mid-market properties targeting middle-income families, and luxury developments for high-net-worth individuals. Each segment requires different construction approaches, financing structures, and marketing strategies to address specific customer requirements and preferences.

By Target Customer: Segmentation includes first-time homebuyers benefiting from government assistance programs, upgrading families seeking larger or better-located properties, and investment buyers purchasing properties for rental income or capital appreciation. Expatriate housing represents a distinct segment with specific requirements for international-standard amenities and services.

By Construction Method: Traditional construction methods dominate the market, while modular construction and prefabricated systems gain traction for their efficiency and quality benefits. Green building approaches represent a growing segment focused on sustainability and energy efficiency.

Affordable Housing Category: This segment benefits from substantial government support through programs like Sakani, which provides subsidies and financing assistance to eligible Saudi citizens. Construction focus emphasizes cost efficiency while maintaining quality standards and cultural appropriateness. Projects typically feature standardized designs, efficient space utilization, and basic amenities that meet essential housing needs without compromising safety or comfort.

Mid-Market Housing Category: Representing the largest market segment by volume, mid-market housing serves middle-income families seeking modern amenities and convenient locations. Design features include multiple bedrooms, modern kitchens, parking facilities, and community amenities such as playgrounds and retail spaces. This category shows 43% market share in terms of unit volume and demonstrates steady demand growth.

Luxury Housing Category: Premium residential developments target high-income Saudi nationals and expatriate executives seeking world-class living experiences. Luxury features include private pools, smart home systems, concierge services, and exclusive community amenities. Projects often incorporate international architectural styles while respecting local cultural preferences and privacy requirements.

Mixed-Use Category: Integrated developments combining residential units with retail, office, and recreational facilities address urban lifestyle preferences and optimize land utilization. Mixed-use projects create vibrant communities with reduced commute times and enhanced convenience for residents, particularly appealing to young professionals and small families.

For Developers: The Saudi Arabia residential construction market offers substantial growth opportunities supported by government initiatives, demographic trends, and economic diversification efforts. Market stability provided by consistent housing demand and government backing reduces investment risks while enabling long-term planning and development strategies. Access to financing, streamlined regulatory processes, and growing consumer purchasing power create favorable conditions for profitable project development.

For Construction Companies: Sustained market activity provides steady revenue streams and opportunities for capacity expansion and technology investment. Skill development opportunities arise from exposure to diverse project types, modern construction methods, and international quality standards. Long-term contracts and repeat business relationships with established developers create predictable income and operational efficiency.

For Financial Institutions: Growing mortgage lending opportunities supported by government guarantees and improving economic conditions create new revenue streams with manageable risk profiles. Market expansion in housing finance aligns with national objectives for increased homeownership and financial sector development.

For End Consumers: Improved housing options, enhanced financing accessibility, and government support programs make homeownership more attainable across income segments. Quality improvements in construction standards, design innovation, and community amenities enhance living experiences while providing long-term value appreciation potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration: Environmental consciousness drives increasing adoption of green building practices, energy-efficient systems, and sustainable construction materials. LEED certification and other green building standards become more prevalent as developers respond to consumer preferences and government environmental initiatives. Solar panel integration, water conservation systems, and energy-efficient HVAC systems represent standard features in new developments.

Smart Home Technology: Integration of Internet of Things (IoT) devices, home automation systems, and smart security features appeals to tech-savvy consumers and enhances property value. Digital infrastructure including high-speed internet, smart meters, and automated building management systems become essential components of modern residential developments.

Modular Construction Growth: Prefabricated and modular construction methods gain popularity for their efficiency, quality control, and cost benefits. Construction innovation includes 3D printing applications, advanced materials, and automated construction processes that reduce project timelines and improve consistency. MWR analysis indicates that modular construction adoption has increased by 28% annually among major developers.

Community-Centric Design: Residential projects increasingly emphasize community amenities, social spaces, and integrated services that enhance resident lifestyle and social interaction. Walkable neighborhoods with retail, recreational, and educational facilities within residential developments address changing urban living preferences and reduce transportation dependency.

Government Program Expansion: The Sakani housing program continues expanding with enhanced financing options, increased subsidy amounts, and streamlined application processes. Recent developments include partnerships with private developers to accelerate housing delivery and introduction of rent-to-own programs that provide flexible homeownership pathways for qualified applicants.

Mega-Project Launches: Major developments including NEOM residential communities, Qiddiya entertainment city housing, and Red Sea Project residential components represent significant market expansion opportunities. International partnerships bring global expertise and investment to these projects while establishing new benchmarks for residential construction quality and innovation.

Technology Adoption: Construction companies increasingly adopt Building Information Modeling (BIM), project management software, and digital collaboration tools to improve efficiency and quality. Digitalization initiatives include online permit applications, virtual property tours, and digital contract management systems that streamline development processes.

Financing Innovation: New mortgage products, Islamic financing structures, and government-backed loan programs improve homeownership accessibility. Financial sector developments include longer loan terms, competitive interest rates, and simplified approval processes that support market growth and consumer access to housing finance.

Market Entry Strategy: New market participants should focus on specific market segments or geographical areas to establish competitive positioning before expanding scope. Partnership approaches with established local developers, construction companies, or government entities can provide market access and reduce entry barriers while leveraging local expertise and relationships.

Technology Investment: Companies should prioritize adoption of modern construction technologies, project management systems, and customer relationship management tools to improve operational efficiency and competitive positioning. Digital transformation initiatives including online marketing, virtual sales processes, and automated customer service can enhance market reach and operational effectiveness.

Quality Focus: Emphasis on construction quality, customer service, and after-sales support creates competitive differentiation and supports premium pricing strategies. Quality certification through international standards and green building programs enhances market credibility and appeals to quality-conscious consumers.

Regional Diversification: Expansion beyond major urban centers into emerging regions and new development zones provides growth opportunities and reduces market concentration risks. Market research into local preferences, infrastructure development plans, and demographic trends should guide regional expansion strategies and project positioning.

Market growth prospects for Saudi Arabia’s residential construction sector remain positive, supported by continued government commitment to housing programs, favorable demographic trends, and ongoing economic diversification efforts. Long-term demand drivers including urbanization, household formation, and lifestyle changes create sustained market opportunities for well-positioned developers and construction companies.

Technology evolution will continue transforming construction methods, building features, and customer experiences. Innovation adoption in areas such as sustainable materials, smart home systems, and automated construction processes will differentiate successful market participants and drive industry standards higher. MarkWide Research projects that technology-enabled construction methods will represent 55% of new projects within the next five years.

Market maturation trends indicate increasing sophistication in consumer preferences, construction quality standards, and service expectations. Competitive dynamics will likely favor companies that invest in technology, maintain high quality standards, and develop strong customer relationships. Market consolidation may continue as larger firms acquire smaller developers to achieve scale advantages and market coverage.

Regulatory environment improvements will likely continue with further streamlining of approval processes, enhanced transparency, and additional support for homeownership programs. International integration through foreign investment, technology transfer, and global best practices adoption will elevate industry standards and create new opportunities for growth and innovation in the residential construction market.

The Saudi Arabia residential construction market presents compelling opportunities for growth and investment, supported by strong government backing, favorable demographics, and ongoing economic transformation initiatives. Market fundamentals including sustained housing demand, improved financing accessibility, and regulatory support create a positive environment for industry participants across the value chain.

Success factors in this market include understanding local consumer preferences, maintaining high construction quality standards, leveraging technology for operational efficiency, and developing strategic partnerships with government entities and established market players. Future growth will likely favor companies that embrace innovation, prioritize sustainability, and deliver superior customer experiences while maintaining competitive pricing strategies.

The market’s evolution toward greater sophistication, technology integration, and sustainability focus creates opportunities for differentiation and premium positioning. Long-term prospects remain positive as Vision 2030 initiatives, demographic trends, and economic diversification efforts continue supporting residential construction demand and market development throughout the Kingdom of Saudi Arabia.

What is Residential Construction?

Residential construction refers to the building and renovation of homes, apartments, and other living spaces. It encompasses various activities including design, planning, and construction management, focusing on creating safe and comfortable living environments.

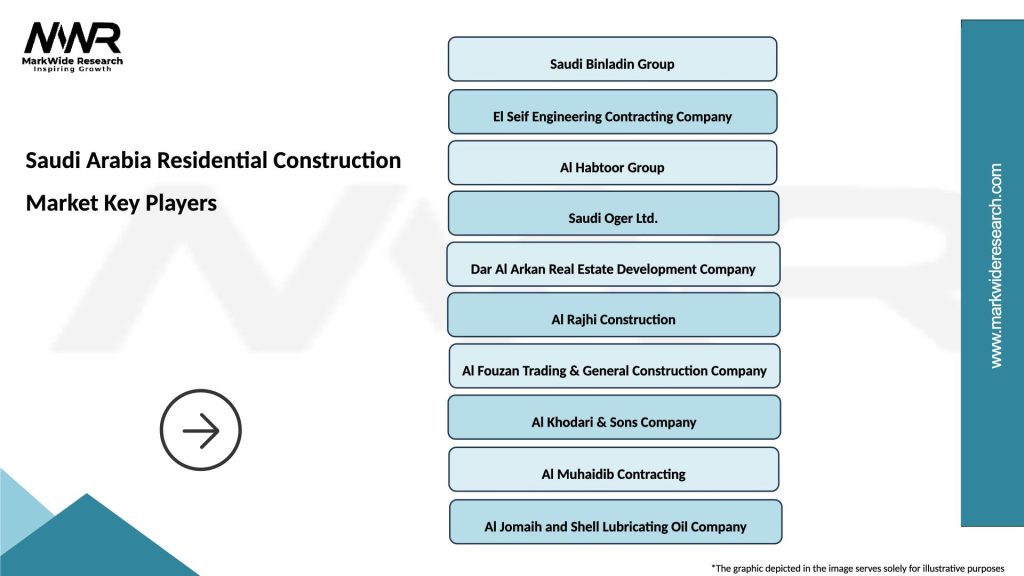

What are the key players in the Saudi Arabia Residential Construction Market?

Key players in the Saudi Arabia Residential Construction Market include Saudi Binladin Group, El Seif Engineering Contracting Company, and Dar Al Arkan. These companies are involved in various residential projects, contributing to the growth and development of housing in the region, among others.

What are the main drivers of the Saudi Arabia Residential Construction Market?

The main drivers of the Saudi Arabia Residential Construction Market include population growth, urbanization, and government initiatives aimed at increasing housing availability. Additionally, rising disposable incomes and a focus on affordable housing are significant factors fueling market growth.

What challenges does the Saudi Arabia Residential Construction Market face?

The Saudi Arabia Residential Construction Market faces challenges such as fluctuating material costs, regulatory hurdles, and labor shortages. These factors can impact project timelines and overall construction costs, posing risks to developers and investors.

What opportunities exist in the Saudi Arabia Residential Construction Market?

Opportunities in the Saudi Arabia Residential Construction Market include the development of smart homes and sustainable building practices. Additionally, the government’s Vision initiative aims to enhance housing supply, creating potential for new residential projects and investments.

What trends are shaping the Saudi Arabia Residential Construction Market?

Trends shaping the Saudi Arabia Residential Construction Market include the increasing adoption of green building technologies and the integration of smart home features. Furthermore, there is a growing emphasis on mixed-use developments that combine residential, commercial, and recreational spaces.

Saudi Arabia Residential Construction Market

| Segmentation Details | Description |

|---|---|

| Product Type | Single-Family Homes, Multi-Family Units, Townhouses, Villas |

| Material | Concrete, Steel, Wood, Glass |

| Technology | Smart Home Systems, Energy-Efficient Solutions, Modular Construction, Prefabricated Elements |

| End User | Homeowners, Real Estate Developers, Investors, Contractors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Residential Construction Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at