444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia refrigerated truck market represents a rapidly expanding segment within the Kingdom’s transportation and logistics infrastructure. Cold chain logistics have become increasingly critical as Saudi Arabia diversifies its economy and enhances food security initiatives under Vision 2030. The market encompasses various vehicle types including light-duty refrigerated vans, medium-duty trucks, and heavy-duty refrigerated trailers designed to maintain temperature-controlled environments during transportation.

Market dynamics are driven by the Kingdom’s growing food and pharmaceutical sectors, expanding retail chains, and increasing consumer demand for fresh and frozen products. The refrigerated truck market serves multiple industries including food and beverage distribution, pharmaceutical logistics, chemical transportation, and agricultural product delivery. Growth projections indicate the market is expanding at a robust CAGR of 8.2%, reflecting strong demand across various temperature-sensitive cargo segments.

Infrastructure development initiatives and the establishment of modern distribution centers have created substantial opportunities for refrigerated transportation solutions. The market benefits from government investments in cold storage facilities, improved road networks, and regulatory frameworks supporting food safety standards. Regional distribution shows concentrated activity in major urban centers including Riyadh, Jeddah, and Dammam, with expanding coverage to secondary cities and rural areas.

The Saudi Arabia refrigerated truck market refers to the comprehensive ecosystem of temperature-controlled commercial vehicles, associated technologies, and supporting services designed to maintain specific temperature ranges during the transportation of perishable goods throughout the Kingdom. This market encompasses the manufacturing, distribution, leasing, and maintenance of refrigerated trucks and trailers equipped with advanced cooling systems.

Core components include insulated cargo compartments, refrigeration units, temperature monitoring systems, and specialized loading equipment. The market serves critical functions in preserving food quality, maintaining pharmaceutical efficacy, and ensuring compliance with health and safety regulations. Operational scope extends from last-mile delivery vehicles to long-haul transportation solutions connecting major distribution hubs across Saudi Arabia’s vast geographic landscape.

Strategic positioning of the Saudi Arabia refrigerated truck market reflects the Kingdom’s commitment to building a resilient cold chain infrastructure supporting economic diversification goals. The market demonstrates strong growth momentum driven by expanding retail sectors, increasing food imports, and growing pharmaceutical distribution requirements. Technology adoption rates show 72% of operators implementing advanced temperature monitoring systems to ensure cargo integrity and regulatory compliance.

Investment trends indicate substantial capital allocation toward fleet modernization and expansion programs. Major logistics companies are upgrading their refrigerated truck fleets with energy-efficient systems and IoT-enabled monitoring capabilities. Market penetration analysis reveals significant opportunities in underserved regions, particularly in the northern and southern provinces where cold chain infrastructure development is accelerating.

Competitive landscape features both international manufacturers and local assembly operations, creating a diverse supplier ecosystem. The market benefits from favorable government policies supporting logistics sector development and foreign investment in transportation infrastructure. Future outlook projects continued expansion driven by Vision 2030 initiatives and growing consumer expectations for fresh product availability.

Market intelligence reveals several critical insights shaping the Saudi Arabia refrigerated truck market landscape:

Primary growth drivers propelling the Saudi Arabia refrigerated truck market include comprehensive economic and social factors aligned with national development objectives. Food security enhancement represents a fundamental driver as the Kingdom seeks to reduce import dependency and build strategic food reserves. This initiative requires extensive cold chain infrastructure to preserve agricultural products and maintain quality throughout distribution networks.

Population growth and urbanization trends create expanding consumer markets demanding consistent access to fresh and frozen products. Demographic shifts show 68% of the population now residing in urban areas, concentrating demand for efficient cold chain logistics. Rising disposable incomes and changing lifestyle preferences drive consumption of premium food products requiring temperature-controlled transportation.

Healthcare sector expansion generates specialized demand for pharmaceutical-grade refrigerated transportation. The growing biotechnology and vaccine manufacturing sectors require precise temperature control capabilities throughout the supply chain. Retail modernization initiatives by major chains necessitate sophisticated cold storage and distribution systems to maintain competitive advantages in fresh product categories.

Government investment in logistics infrastructure creates favorable conditions for refrigerated truck market growth. Vision 2030 initiatives specifically target logistics sector development as a key economic diversification strategy. Regulatory frameworks supporting food safety and pharmaceutical quality standards mandate temperature-controlled transportation for specific product categories.

Operational challenges present significant restraints affecting Saudi Arabia refrigerated truck market development. High capital costs associated with refrigerated vehicle acquisition and maintenance create barriers for smaller logistics operators. Initial investment requirements for specialized equipment, including refrigeration units and temperature monitoring systems, can be substantial compared to conventional truck operations.

Energy consumption concerns impact operational economics as refrigeration systems require continuous power generation during transportation. Fuel costs represent a significant portion of operating expenses, particularly for long-haul routes across Saudi Arabia’s extensive geographic area. Maintenance complexity of refrigeration systems requires specialized technical expertise and spare parts availability, potentially increasing downtime and operational costs.

Skilled workforce shortages in refrigerated transport operations limit market expansion capabilities. Operators require trained drivers familiar with temperature control systems and regulatory compliance procedures. Infrastructure limitations in certain regions may restrict effective cold chain coverage, particularly in remote areas where supporting facilities are limited.

Regulatory compliance requirements, while driving market demand, also create operational constraints requiring continuous monitoring and documentation. Technology integration challenges may arise as operators adapt to advanced monitoring systems and digital compliance platforms.

Emerging opportunities within the Saudi Arabia refrigerated truck market reflect evolving economic conditions and technological advancement. NEOM development and other mega-projects create substantial demand for cold chain logistics supporting construction workforce catering and eventual residential populations. These developments require comprehensive refrigerated transportation networks for food service and retail operations.

Agricultural sector modernization presents significant opportunities as local farming operations expand production capacity. Greenhouse agriculture initiatives and vertical farming projects generate fresh produce requiring immediate cold chain integration. Export potential for Saudi agricultural products to regional markets creates demand for refrigerated transportation to ports and border crossings.

Pharmaceutical manufacturing expansion offers specialized market segments with premium pricing potential. The Kingdom’s growing biotechnology sector requires sophisticated temperature-controlled logistics for raw materials and finished products. Vaccine production capabilities necessitate ultra-low temperature transportation solutions representing high-value market opportunities.

Technology partnerships with international refrigeration system manufacturers create opportunities for local assembly and service operations. Leasing models and fleet management services present alternative revenue streams for market participants. Sustainability initiatives drive demand for electric and hybrid refrigerated vehicles, creating opportunities for early adopters of green technology solutions.

Complex interactions between supply and demand factors shape the Saudi Arabia refrigerated truck market dynamics. Seasonal variations in food consumption patterns create fluctuating demand for cold chain services, with peak requirements during Ramadan and Hajj periods. Import dependency for many food products generates consistent baseline demand for refrigerated transportation from ports to distribution centers.

Competitive pressures drive continuous innovation in refrigeration technology and operational efficiency. Market participants invest in advanced systems offering improved fuel efficiency and reduced environmental impact. Customer expectations for product quality and delivery reliability influence service standards and technology adoption rates throughout the industry.

Economic diversification initiatives create new market segments while traditional sectors continue expanding. Supply chain optimization efforts by major retailers and food service companies drive demand for integrated cold chain solutions. Regional integration opportunities through GCC trade agreements may expand market scope beyond domestic boundaries.

Technology disruption through IoT integration and autonomous vehicle development may fundamentally alter market dynamics. Regulatory evolution continues shaping operational requirements and compliance standards, influencing equipment specifications and service delivery models.

Comprehensive analysis of the Saudi Arabia refrigerated truck market employs multiple research methodologies to ensure accurate and actionable insights. Primary research includes structured interviews with industry stakeholders, including fleet operators, equipment manufacturers, logistics service providers, and regulatory officials. Survey methodologies capture quantitative data on fleet sizes, utilization rates, and investment plans across different market segments.

Secondary research incorporates analysis of government publications, industry reports, trade association data, and company financial statements. Market sizing methodologies combine bottom-up analysis of fleet registrations with top-down assessment of cold chain logistics demand across various industries. Trend analysis examines historical data patterns and correlates market developments with broader economic indicators.

Expert validation processes ensure research findings align with industry realities and market conditions. Cross-referencing multiple data sources provides verification of key statistics and market projections. Regional analysis incorporates geographic factors affecting market development and infrastructure requirements across different provinces within Saudi Arabia.

Geographic distribution of the Saudi Arabia refrigerated truck market reflects population centers and economic activity concentration. Central Region dominates market activity with Riyadh serving as the primary logistics hub, accounting for approximately 35% of market share. The region benefits from extensive distribution center networks and proximity to major food processing facilities.

Western Region represents the second-largest market segment, with Jeddah’s port facilities driving import-related cold chain demand. Makkah and Madinah create seasonal spikes in refrigerated transportation requirements during pilgrimage periods. The region accounts for roughly 28% of total market activity, supported by established retail chains and food service operations.

Eastern Region shows strong growth potential driven by industrial development and petrochemical sector expansion. Dammam metropolitan area serves as a key distribution point for imported goods and regional manufacturing output. The region represents approximately 22% of market share with growing pharmaceutical and chemical transportation requirements.

Northern and Southern regions present emerging opportunities as infrastructure development accelerates. Agricultural projects in these areas generate increasing demand for cold chain services. Combined market share of 15% is expected to grow as regional connectivity improves and economic diversification initiatives expand.

Market competition in the Saudi Arabia refrigerated truck sector features a diverse mix of international manufacturers, local assemblers, and specialized service providers. Leading players have established comprehensive service networks and strategic partnerships to capture market opportunities:

Competitive strategies focus on technology innovation, service network expansion, and local partnership development. Market differentiation occurs through energy efficiency improvements, IoT integration capabilities, and specialized applications for pharmaceutical and chemical transportation.

Market segmentation analysis reveals distinct categories within the Saudi Arabia refrigerated truck market based on vehicle type, application, and temperature range requirements. Vehicle type segmentation includes light-duty vans for urban delivery, medium-duty trucks for regional distribution, and heavy-duty trailers for long-haul transportation.

By Vehicle Type:

By Application:

By Temperature Range:

Food and beverage segment represents the largest category within the Saudi Arabia refrigerated truck market, accounting for approximately 65% of total demand. This segment benefits from expanding retail chains, growing food service industry, and increasing consumer preference for fresh products. Dairy products and fresh produce transportation drive consistent demand for chilled transport solutions.

Pharmaceutical segment shows the highest growth rate at 12.5% annually, driven by healthcare sector expansion and increasing focus on specialized medical treatments. Vaccine distribution requirements create demand for ultra-low temperature capabilities and precise monitoring systems. This segment commands premium pricing due to stringent regulatory requirements and specialized equipment needs.

Chemical transportation represents a specialized but growing segment requiring customized refrigeration solutions. Petrochemical industry expansion in the Eastern Region generates demand for temperature-controlled transport of specialty chemicals and raw materials. This category requires specialized safety features and regulatory compliance capabilities.

Emerging categories include e-commerce fulfillment for online grocery platforms and agricultural export logistics. Flower transportation from local greenhouse operations and imported products creates niche market opportunities requiring precise temperature and humidity control.

Fleet operators benefit from expanding market opportunities and premium pricing for specialized refrigerated transportation services. Operational advantages include reduced product spoilage, improved customer satisfaction, and compliance with regulatory requirements. Advanced refrigeration systems provide fuel efficiency improvements of up to 15% compared to older technologies.

Equipment manufacturers gain access to a growing market with strong government support for logistics infrastructure development. Local assembly opportunities reduce import costs and provide closer customer relationships. Service revenue from maintenance and parts supply creates recurring income streams beyond initial equipment sales.

End-user industries achieve improved supply chain reliability and product quality maintenance. Retailers can expand fresh product offerings and reduce inventory losses through effective cold chain management. Pharmaceutical companies ensure product efficacy and regulatory compliance through temperature-controlled transportation.

Economic stakeholders benefit from job creation in logistics, maintenance, and supporting services. Food security improvements support national strategic objectives and reduce import dependency risks. Technology transfer through international partnerships enhances local technical capabilities and knowledge development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration represents the most significant trend shaping the Saudi Arabia refrigerated truck market. IoT sensors and telematics systems enable real-time temperature monitoring and predictive maintenance capabilities. Data analytics platforms help optimize routes and reduce fuel consumption while maintaining cargo integrity.

Sustainability initiatives drive adoption of energy-efficient refrigeration systems and alternative fuel technologies. Electric refrigerated vehicles are gaining attention for urban delivery applications, with pilot programs showing 30% reduction in operating costs for short-range operations. Solar-powered auxiliary systems supplement traditional refrigeration units during stationary periods.

Service integration trends show logistics providers offering comprehensive cold chain solutions beyond basic transportation. Temperature-controlled warehousing and last-mile delivery services create integrated value propositions. Digital platforms enable customers to track shipments and monitor temperature compliance in real-time.

Regulatory compliance automation through digital documentation and blockchain technology ensures traceability and reduces administrative burden. Predictive maintenance systems minimize downtime and extend equipment life cycles. Fleet optimization software improves asset utilization and reduces empty mile operations.

Recent developments within the Saudi Arabia refrigerated truck market demonstrate accelerating modernization and expansion activities. Major logistics companies have announced significant fleet expansion programs incorporating advanced refrigeration technologies and monitoring systems. These investments reflect growing confidence in market growth prospects and customer demand evolution.

Technology partnerships between international equipment manufacturers and local service providers enhance market accessibility and support capabilities. Training programs developed in collaboration with technical institutes address skilled workforce requirements and improve service quality standards. MarkWide Research analysis indicates these partnerships are crucial for sustainable market development.

Infrastructure projects including new cold storage facilities and distribution centers create integrated logistics networks supporting refrigerated truck operations. Port expansions in Jeddah and Dammam improve import handling capabilities for temperature-sensitive products. Road network improvements facilitate efficient cold chain connectivity between major urban centers.

Regulatory updates strengthen food safety standards and pharmaceutical transportation requirements, driving demand for compliant refrigerated vehicles. Environmental regulations encourage adoption of cleaner refrigeration technologies and fuel-efficient systems. Digital transformation initiatives by government agencies streamline licensing and compliance procedures for logistics operators.

Strategic recommendations for Saudi Arabia refrigerated truck market participants focus on technology adoption and service differentiation. Fleet operators should prioritize investments in IoT-enabled monitoring systems and predictive maintenance capabilities to improve operational efficiency and customer service quality. Fuel management systems and route optimization software can significantly reduce operating costs.

Equipment manufacturers should consider local assembly operations to reduce costs and improve market responsiveness. Service network expansion in secondary cities presents growth opportunities as cold chain infrastructure develops. Training partnerships with technical institutes can address skilled workforce shortages while building customer loyalty.

Market entry strategies should emphasize specialized applications and premium service segments where pricing power is stronger. Pharmaceutical logistics and chemical transportation offer higher margins and growth potential. Sustainability positioning through energy-efficient technologies appeals to environmentally conscious customers and regulatory preferences.

Partnership development with major retailers and food service companies creates stable demand and long-term contracts. Regional expansion strategies should target emerging economic zones and agricultural development areas. Digital platform integration enhances customer experience and operational transparency, creating competitive advantages in increasingly sophisticated markets.

Long-term prospects for the Saudi Arabia refrigerated truck market remain highly positive, supported by fundamental economic and demographic trends. Vision 2030 implementation continues driving logistics infrastructure development and economic diversification initiatives. Population growth and urbanization trends sustain demand for efficient cold chain services across multiple sectors.

Technology evolution will fundamentally transform market dynamics over the next decade. Autonomous refrigerated vehicles may revolutionize logistics operations, while electric powertrains become viable for longer-range applications. MWR projections indicate technology adoption rates will accelerate as costs decrease and performance improves.

Market expansion into regional markets through GCC integration creates additional growth opportunities. Agricultural export potential from Saudi farming operations may generate substantial demand for specialized refrigerated transportation. Pharmaceutical manufacturing growth supports premium market segments with stringent temperature control requirements.

Sustainability mandates will increasingly influence equipment selection and operational practices. Carbon reduction targets may accelerate adoption of alternative fuel technologies and energy-efficient systems. Circular economy principles could create new business models around equipment sharing and lifecycle optimization.

The Saudi Arabia refrigerated truck market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by economic diversification, infrastructure development, and changing consumer expectations. Government support through Vision 2030 initiatives creates favorable conditions for market expansion and technology adoption. Diverse applications across food, pharmaceutical, and chemical sectors provide multiple growth vectors and risk diversification opportunities.

Technology integration and sustainability trends will shape future market development, creating opportunities for innovative solutions and service models. Regional expansion potential and specialized market segments offer attractive growth prospects for established and emerging market participants. Strategic positioning around advanced technologies, service excellence, and regulatory compliance will determine competitive success in this evolving marketplace.

The market’s fundamental strength lies in its alignment with national strategic objectives and essential infrastructure requirements supporting economic growth and food security. Continued investment in cold chain capabilities will enhance Saudi Arabia’s position as a regional logistics hub while supporting domestic economic diversification goals. Long-term outlook remains highly positive as market participants adapt to evolving customer needs and technological capabilities in this critical transportation sector.

What is Refrigerated Truck?

Refrigerated trucks are specialized vehicles designed to transport perishable goods at controlled temperatures. They are essential for industries such as food and pharmaceuticals, ensuring that products remain fresh and safe during transit.

What are the key players in the Saudi Arabia Refrigerated Truck Market?

Key players in the Saudi Arabia Refrigerated Truck Market include Al-Futtaim Motors, Isuzu Motors, and Hino Motors, among others. These companies are known for their innovative refrigerated transport solutions and extensive distribution networks.

What are the growth factors driving the Saudi Arabia Refrigerated Truck Market?

The growth of the Saudi Arabia Refrigerated Truck Market is driven by the increasing demand for fresh food products, the expansion of the e-commerce sector, and the rising awareness of food safety standards. Additionally, the growth of the pharmaceutical industry also contributes to market expansion.

What challenges does the Saudi Arabia Refrigerated Truck Market face?

The Saudi Arabia Refrigerated Truck Market faces challenges such as high operational costs, limited infrastructure for cold chain logistics, and regulatory compliance issues. These factors can hinder the efficiency and growth of refrigerated transport services.

What opportunities exist in the Saudi Arabia Refrigerated Truck Market?

Opportunities in the Saudi Arabia Refrigerated Truck Market include advancements in refrigeration technology, the potential for increased exports of perishable goods, and the growing trend of online grocery shopping. These factors are likely to enhance the demand for refrigerated transport solutions.

What trends are shaping the Saudi Arabia Refrigerated Truck Market?

Trends shaping the Saudi Arabia Refrigerated Truck Market include the adoption of eco-friendly refrigeration systems, the integration of IoT for real-time monitoring, and the increasing focus on energy efficiency. These innovations are expected to improve operational efficiency and reduce environmental impact.

Saudi Arabia Refrigerated Truck Market

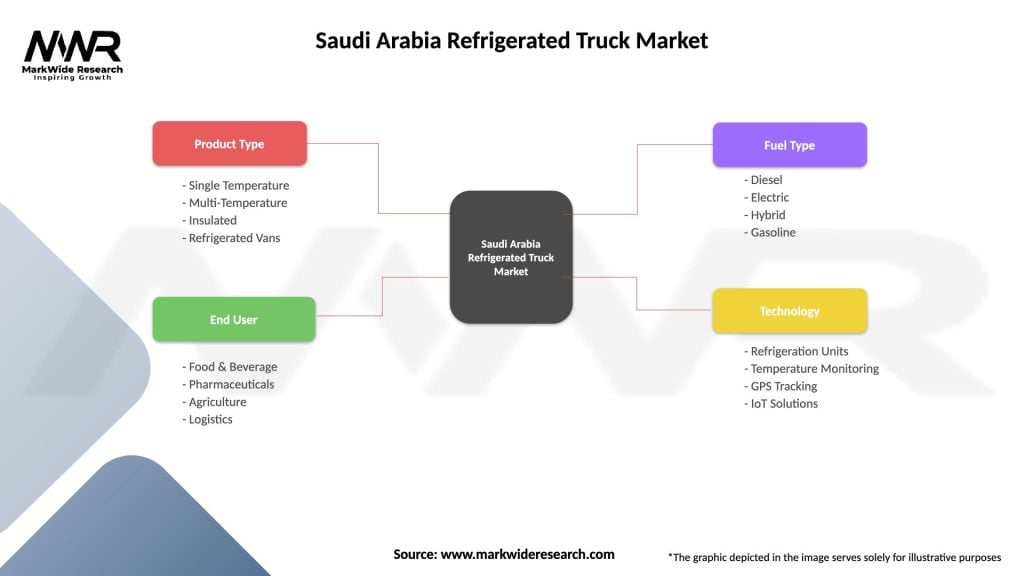

| Segmentation Details | Description |

|---|---|

| Product Type | Single Temperature, Multi-Temperature, Insulated, Refrigerated Vans |

| End User | Food & Beverage, Pharmaceuticals, Agriculture, Logistics |

| Fuel Type | Diesel, Electric, Hybrid, Gasoline |

| Technology | Refrigeration Units, Temperature Monitoring, GPS Tracking, IoT Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Refrigerated Truck Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at