444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

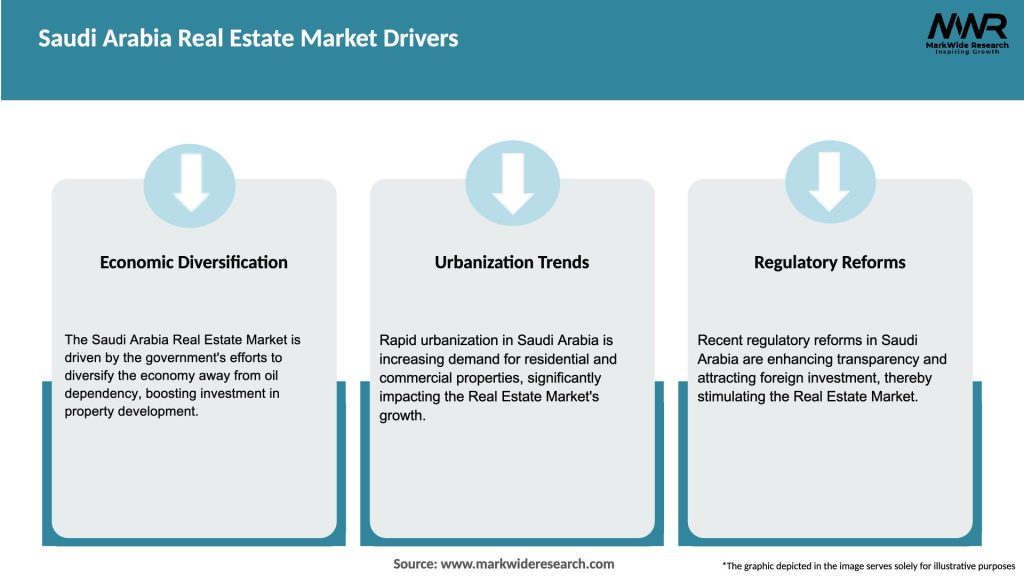

Saudi Arabia’s real estate market has experienced significant growth in recent years, driven by a combination of factors such as population growth, urbanization, government initiatives, and foreign investment. The country’s booming economy and favorable business environment have attracted both local and international investors, making the real estate sector a key contributor to the nation’s economic development.

Meaning

The Saudi Arabia real estate market refers to the buying, selling, renting, and development of properties within the country. It encompasses various segments, including residential, commercial, industrial, and retail properties. The market offers opportunities for individuals, businesses, and investors to participate in property transactions and capitalize on the potential returns offered by the sector.

Executive Summary

The Saudi Arabia real estate market has experienced robust growth in recent years, driven by favorable government policies, population growth, and increasing urbanization. The residential sector has witnessed significant demand, particularly in major cities such as Riyadh, Jeddah, and Dammam. The commercial and retail segments have also shown promising growth, with the development of large-scale projects and the entry of international retailers. However, the market is not without its challenges, including regulatory complexities, rising construction costs, and the impact of the COVID-19 pandemic.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Saudi Arabia real estate market is dynamic and influenced by various factors, including government policies, economic conditions, market trends, and investor sentiment. The market experiences periodic fluctuations in demand and supply, with different segments performing at varying levels. Market dynamics are shaped by the interplay of these factors, creating opportunities and challenges for industry participants.

Regional Analysis

The real estate market in Saudi Arabia exhibits regional variations, with different cities and regions experiencing varying levels of demand and growth. The major cities of Riyadh, Jeddah, and Dammam are the key drivers of the market, attracting significant investments and witnessing robust development. Other regions, such as the Eastern Province and the holy cities of Mecca and Medina, also offer opportunities for real estate development, driven by factors such as pilgrimage tourism and industrial growth.

Competitive Landscape

Leading Companies in the Saudi Arabia Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

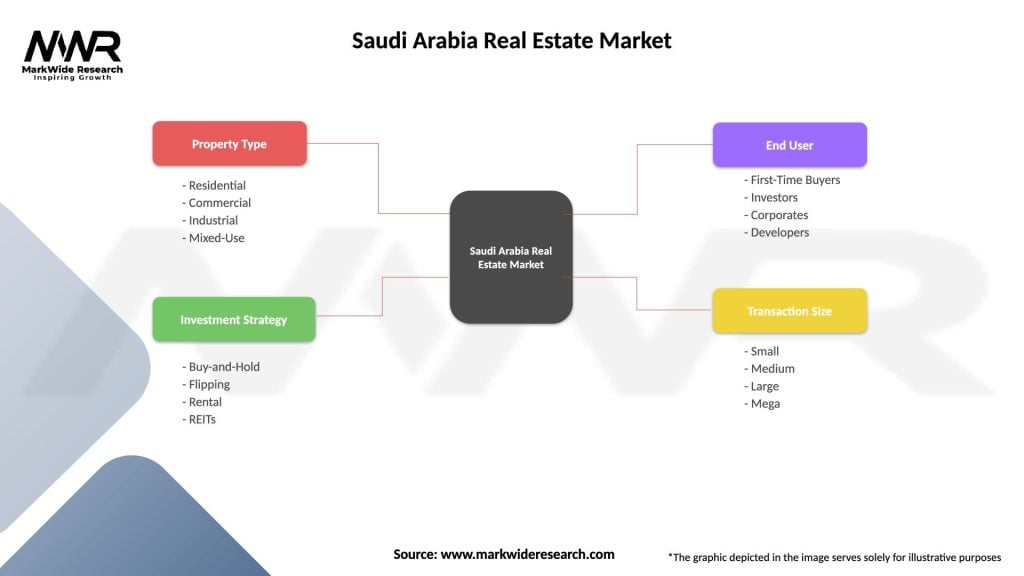

Segmentation

The Saudi Arabia real estate market can be segmented into residential, commercial, industrial, and retail properties. Each segment has its own dynamics and drivers, catering to different customer requirements and investment preferences. The residential segment comprises villas, apartments, and townhouses, while the commercial segment includes office buildings, business parks, and mixed-use developments. The industrial segment covers warehouses, factories, and logistics facilities, while the retail segment encompasses shopping malls, retail outlets, and high-street properties.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Saudi Arabia real estate market. The sector experienced disruptions in construction activities due to lockdown measures and supply chain disruptions. Project deliveries were delayed, and sales transactions were affected as potential buyers adopted a cautious approach. However, the market has shown resilience, with digital platforms and virtual property tours gaining traction. The pandemic has accelerated the adoption of technology in the real estate sector, leading to increased online property listings, virtual meetings, and digital transactions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Saudi Arabia real estate market remains positive. The government’s focus on economic diversification, infrastructure development, and tourism promotion will continue to drive demand in the residential, commercial, industrial, and retail segments. The implementation of Vision 2030 initiatives and the completion of mega-projects such as NEOM, the Red Sea Project, and Qiddiya will further boost the market. While challenges such as regulatory complexity, rising construction costs, and economic uncertainties exist, the overall outlook indicates a thriving real estate market in Saudi Arabia.

Conclusion

The Saudi Arabia real estate market presents significant opportunities for investors, developers, and industry participants. The sector has witnessed robust growth driven by population growth, urbanization, government initiatives, and foreign investment. The residential, commercial, industrial, and retail segments have all shown promising potential. Despite challenges such as regulatory complexities and the impact of the COVID-19 pandemic, the market’s future outlook remains positive. To succeed in this dynamic market, industry participants should embrace technology, focus on sustainability, understand market segments, collaborate, and stay updated with market trends. With the government’s continued support and the country’s favorable business environment, the Saudi Arabia real estate market is poised for continued growth and development in the coming years.

What is Saudi Arabia Real Estate?

Saudi Arabia Real Estate refers to the buying, selling, and leasing of properties within the country, including residential, commercial, and industrial sectors. It encompasses various activities such as property development, investment, and management.

What are the key players in the Saudi Arabia Real Estate Market?

Key players in the Saudi Arabia Real Estate Market include companies like Emaar The Economic City, Dar Al Arkan, and JLL. These firms are involved in various aspects of real estate development, investment, and management, among others.

What are the growth factors driving the Saudi Arabia Real Estate Market?

The growth of the Saudi Arabia Real Estate Market is driven by factors such as urbanization, government initiatives to boost housing supply, and increasing foreign investment. Additionally, the Vision 2030 plan aims to diversify the economy and enhance the real estate sector.

What challenges does the Saudi Arabia Real Estate Market face?

Challenges in the Saudi Arabia Real Estate Market include regulatory hurdles, fluctuating oil prices affecting economic stability, and a potential oversupply of residential units. These factors can impact investor confidence and market dynamics.

What opportunities exist in the Saudi Arabia Real Estate Market?

Opportunities in the Saudi Arabia Real Estate Market include the development of smart cities, increased demand for affordable housing, and the growth of tourism-related properties. The government’s focus on economic diversification also presents new investment avenues.

What trends are shaping the Saudi Arabia Real Estate Market?

Trends in the Saudi Arabia Real Estate Market include a shift towards sustainable building practices, the rise of mixed-use developments, and the integration of technology in property management. These trends reflect changing consumer preferences and regulatory requirements.

Saudi Arabia Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Residential, Commercial, Industrial, Mixed-Use |

| Investment Strategy | Buy-and-Hold, Flipping, Rental, REITs |

| End User | First-Time Buyers, Investors, Corporates, Developers |

| Transaction Size | Small, Medium, Large, Mega |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Saudi Arabia Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at