444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia real estate brokerage market represents a dynamic and rapidly evolving sector within the Kingdom’s broader economic transformation landscape. As part of the ambitious Vision 2030 initiative, the real estate brokerage industry has experienced unprecedented growth, driven by regulatory reforms, digital transformation, and increasing foreign investment opportunities. The market encompasses residential, commercial, and industrial property transactions, with licensed brokers playing an increasingly vital role in facilitating property deals across major cities including Riyadh, Jeddah, and Dammam.

Market dynamics indicate robust expansion, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This growth trajectory reflects the Kingdom’s commitment to diversifying its economy away from oil dependency while creating a more transparent and efficient real estate ecosystem. The introduction of the Real Estate General Authority (REGA) has standardized brokerage practices, enhanced consumer protection, and established professional licensing requirements that have elevated industry standards.

Digital transformation has emerged as a key catalyst, with approximately 73% of brokerage firms now utilizing advanced property management systems and online platforms. The integration of artificial intelligence, virtual reality tours, and blockchain technology for property verification has revolutionized traditional brokerage operations, making them more efficient and customer-centric.

The Saudi Arabia real estate brokerage market refers to the comprehensive ecosystem of licensed professionals, firms, and digital platforms that facilitate the buying, selling, leasing, and management of real estate properties throughout the Kingdom. This market encompasses all intermediary services that connect property owners with potential buyers or tenants, providing valuation, marketing, negotiation, and transaction completion services.

Real estate brokerage in Saudi Arabia operates under strict regulatory frameworks established by REGA, ensuring that all practitioners meet professional standards and ethical guidelines. The market includes both traditional brokerage firms and innovative proptech companies that leverage technology to streamline property transactions and enhance customer experiences.

Key components of this market include residential brokerage services for apartments, villas, and compounds, commercial brokerage for office spaces and retail properties, industrial brokerage for warehouses and manufacturing facilities, and specialized services such as property management and investment advisory. The sector serves both domestic and international clients, reflecting Saudi Arabia’s growing appeal as a regional business hub and investment destination.

Strategic transformation defines the current state of Saudi Arabia’s real estate brokerage market, as the industry adapts to new regulatory requirements while embracing technological innovation. The market has demonstrated remarkable resilience and growth potential, supported by government initiatives that promote transparency, professionalism, and foreign investment accessibility.

Regulatory evolution has been a cornerstone of market development, with REGA implementing comprehensive licensing systems that have increased the number of qualified brokers by 45% over the past three years. This professionalization has enhanced consumer confidence and attracted international brokerage firms seeking to establish operations in the Kingdom.

Technology adoption has accelerated significantly, with digital platforms now accounting for approximately 68% of initial property inquiries. Virtual property tours, AI-powered matching algorithms, and mobile applications have become standard tools for modern brokerage firms, enabling them to serve clients more effectively while reducing operational costs.

Market segmentation reveals strong performance across all property types, with residential brokerage maintaining the largest share, followed by commercial and industrial segments. The emergence of specialized services such as luxury property brokerage and international investment facilitation has created new revenue streams and market opportunities.

Fundamental shifts in market dynamics have created numerous opportunities for growth and innovation within Saudi Arabia’s real estate brokerage sector. The following insights highlight the most significant trends and developments:

Economic diversification initiatives under Vision 2030 serve as the primary catalyst driving growth in Saudi Arabia’s real estate brokerage market. The government’s commitment to reducing oil dependency has led to substantial investments in infrastructure, tourism, and business development, creating unprecedented demand for professional real estate services.

Foreign investment liberalization has opened new market segments, with recent regulatory changes allowing non-Saudi nationals to own property in designated areas. This policy shift has generated significant interest from international investors and expatriate residents, requiring specialized brokerage services to navigate complex legal and cultural considerations.

Urbanization trends continue to drive demand for brokerage services, as approximately 84% of the Saudi population now lives in urban areas. This concentration has created robust markets in major cities while generating opportunities for brokers to facilitate both residential relocations and commercial expansions.

Digital transformation has become a crucial driver, enabling brokers to reach wider audiences and provide more sophisticated services. The adoption of proptech solutions has improved operational efficiency while creating new revenue opportunities through premium digital services and enhanced customer experiences.

Demographic changes also contribute to market growth, with a young, tech-savvy population driving demand for modern housing solutions and digital-first brokerage services. This demographic shift has encouraged innovation in service delivery and marketing approaches.

Regulatory complexity presents ongoing challenges for brokerage firms, particularly smaller operators who may struggle to meet evolving compliance requirements. The need for continuous professional development and licensing renewals can strain resources and limit market entry for new participants.

Market volatility related to oil price fluctuations continues to impact consumer confidence and spending patterns, despite diversification efforts. Economic uncertainty can lead to delayed property decisions and reduced transaction volumes, affecting brokerage revenues.

Cultural barriers remain significant in certain market segments, particularly regarding female participation in property transactions and international buyer integration. Traditional practices and preferences can limit the adoption of modern brokerage approaches and technologies.

Competition intensity has increased substantially as the market matures, with both domestic and international firms competing for market share. This competitive pressure can compress commission rates and require substantial marketing investments to maintain visibility.

Technology infrastructure limitations in some regions can hinder the implementation of advanced digital solutions, creating disparities in service quality between urban and rural markets. The need for continuous technology upgrades also represents a significant ongoing investment requirement.

Mega-project developments present extraordinary opportunities for specialized brokerage services, with initiatives like NEOM, The Red Sea Project, and Qiddiya requiring sophisticated real estate expertise. These projects will generate demand for luxury residential, commercial, and hospitality property services over the next decade.

Proptech innovation offers significant potential for market differentiation and efficiency gains. Opportunities exist for developing AI-powered valuation tools, blockchain-based transaction systems, and virtual reality marketing platforms that can enhance service delivery while reducing operational costs.

International expansion represents a growing opportunity as Saudi brokerage firms develop expertise that can be exported to other Gulf Cooperation Council (GCC) markets. The experience gained in managing complex regulatory environments and diverse client needs provides competitive advantages in regional markets.

Sustainable development focus creates opportunities for brokers specializing in green buildings and energy-efficient properties. As environmental consciousness grows, demand for expertise in sustainable real estate solutions will increase significantly.

Investment advisory services present lucrative opportunities for brokers to expand beyond traditional transaction services. The growing sophistication of Saudi investors creates demand for comprehensive real estate investment guidance and portfolio management services.

Supply and demand dynamics in Saudi Arabia’s real estate brokerage market reflect the broader economic transformation occurring throughout the Kingdom. The balance between available properties and buyer interest varies significantly across different regions and property types, creating complex market conditions that require sophisticated brokerage expertise.

Competitive landscape evolution has intensified as both local and international firms establish stronger market presence. Traditional family-owned brokerages now compete with technology-driven startups and established international brands, leading to innovation in service delivery and pricing strategies.

Regulatory influence continues to shape market dynamics through ongoing policy adjustments and enforcement activities. REGA’s active oversight has improved market transparency while creating compliance costs that particularly impact smaller operators. The regulatory environment encourages consolidation and professionalization within the industry.

Technology disruption has fundamentally altered market dynamics, with digital platforms now facilitating approximately 62% of property searches. This shift has reduced barriers to market entry for tech-savvy operators while challenging traditional brokers to adapt their business models.

Customer expectations have evolved significantly, with clients now demanding comprehensive digital services, transparent pricing, and rapid response times. These changing expectations drive continuous innovation and service enhancement across the industry.

Comprehensive analysis of Saudi Arabia’s real estate brokerage market employs multiple research methodologies to ensure accuracy and depth of insights. Primary research involves direct engagement with industry stakeholders, including licensed brokers, regulatory officials, and market participants across different segments and regions.

Data collection processes incorporate both quantitative and qualitative research approaches. Structured surveys capture statistical information about market performance, technology adoption rates, and business practices, while in-depth interviews provide contextual understanding of market challenges and opportunities.

Secondary research analysis examines government publications, regulatory announcements, industry reports, and academic studies to establish comprehensive market context. This approach ensures that findings reflect both current market conditions and historical trends that influence ongoing developments.

Market validation procedures involve cross-referencing data from multiple sources and conducting follow-up interviews to confirm key findings. Expert panels comprising industry veterans and regulatory specialists review preliminary findings to ensure accuracy and relevance.

Analytical frameworks utilize established market research methodologies adapted for the unique characteristics of Saudi Arabia’s real estate sector. This includes consideration of cultural factors, regulatory influences, and economic conditions that specifically impact brokerage operations in the Kingdom.

Riyadh region dominates the Saudi real estate brokerage market, accounting for approximately 38% of total market activity. As the capital and largest city, Riyadh offers the most diverse property portfolio and attracts the highest concentration of both domestic and international brokerage firms. The presence of government institutions, major corporations, and diplomatic missions creates consistent demand for high-end residential and commercial properties.

Western region, anchored by Jeddah and Mecca, represents the second-largest market segment with approximately 28% market share. This region benefits from its strategic location as a gateway to international markets and its significance in religious tourism. The ongoing development of the Red Sea Project and other mega-developments is expected to significantly boost brokerage opportunities.

Eastern Province, centered around Dammam and Al Khobar, captures roughly 22% of market activity, driven primarily by the oil and petrochemical industries. This region attracts significant expatriate populations and industrial investments, creating steady demand for both residential and commercial brokerage services.

Emerging regions including the Northern and Southern provinces collectively account for the remaining 12% of market share but show promising growth potential. Government initiatives to develop these areas through infrastructure investments and economic zones are creating new opportunities for forward-thinking brokerage firms.

Regional specialization has become increasingly important, with brokers developing expertise in local market conditions, cultural preferences, and regulatory nuances specific to their operating areas.

Market leadership in Saudi Arabia’s real estate brokerage sector is distributed among several categories of operators, each bringing distinct advantages and serving different market segments. The competitive environment continues to evolve as new entrants challenge established players.

Competitive strategies vary significantly, with some firms emphasizing technology innovation while others focus on relationship-building and local market expertise. The most successful operators typically combine digital capabilities with deep understanding of Saudi cultural and business practices.

Service type segmentation reveals distinct market categories within Saudi Arabia’s real estate brokerage industry, each requiring specialized expertise and serving different client needs:

By Property Type:

By Service Scope:

By Client Type:

Residential brokerage maintains the largest market segment, driven by ongoing urbanization and demographic changes. The category has evolved significantly with the introduction of mortgage financing options and foreign ownership rights in designated areas. Luxury residential represents a particularly dynamic sub-segment, with high-net-worth individuals seeking premium properties in exclusive compounds and developments.

Commercial brokerage has experienced robust growth as businesses expand operations to support economic diversification initiatives. The demand for modern office spaces, retail locations, and mixed-use developments has created opportunities for brokers specializing in commercial transactions. Co-working spaces and flexible office solutions have emerged as significant growth areas.

Industrial brokerage benefits from Saudi Arabia’s focus on manufacturing and logistics development. The establishment of special economic zones and industrial cities has generated substantial demand for warehouse, manufacturing, and distribution facilities. Logistics real estate has become particularly important as e-commerce growth drives demand for fulfillment centers.

Investment brokerage serves sophisticated clients seeking real estate as an asset class. This category requires specialized knowledge of market trends, regulatory requirements, and financial analysis. The growing interest in real estate investment trusts (REITs) has created additional opportunities for brokers with investment expertise.

International brokerage addresses the needs of foreign investors and multinational corporations. This specialized category requires cultural sensitivity, language capabilities, and deep understanding of cross-border transaction requirements.

Professional brokers benefit from enhanced market credibility through standardized licensing and regulatory oversight. The improved professional standards have increased consumer confidence while creating opportunities for higher commission rates and expanded service offerings. Technology integration enables brokers to serve more clients efficiently while reducing operational costs.

Property owners gain access to professional marketing services, accurate valuations, and qualified buyer networks. The regulatory framework provides protection against fraudulent practices while ensuring transparent transaction processes. Digital platforms expand property exposure beyond traditional marketing channels.

Buyers and tenants benefit from improved market transparency, professional guidance, and standardized service quality. The regulatory environment provides consumer protection while ensuring that brokers meet professional competency standards. Online platforms enable efficient property searches and comparison shopping.

Investors receive sophisticated market analysis, investment advisory services, and access to exclusive opportunities. Professional brokers provide valuable insights into market trends, regulatory changes, and emerging opportunities that can enhance investment returns.

Government stakeholders achieve improved market transparency, increased tax compliance, and enhanced economic data collection. The regulated brokerage industry supports broader economic development goals while providing employment opportunities for Saudi nationals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues to reshape the Saudi real estate brokerage landscape, with artificial intelligence and machine learning technologies becoming increasingly prevalent. Virtual property tours have become standard practice, enabling clients to explore properties remotely while reducing time-to-decision cycles.

Sustainability focus is emerging as a significant trend, with approximately 35% of high-end buyers now prioritizing energy-efficient and environmentally friendly properties. This shift is driving brokers to develop expertise in green building certifications and sustainable development practices.

Proptech integration has accelerated, with blockchain technology being explored for property verification and transaction security. Smart contracts and digital documentation are streamlining traditional processes while reducing fraud risks and transaction costs.

Specialization trends show brokers increasingly focusing on specific property types or client segments rather than maintaining general practices. This specialization enables deeper expertise development and premium service pricing.

International connectivity is growing as Saudi brokers establish partnerships with global real estate networks, enabling them to serve international clients more effectively while accessing broader market opportunities.

Data analytics utilization has become crucial for competitive advantage, with successful brokers leveraging market data to provide superior client advisory services and identify emerging opportunities.

Regulatory milestones have significantly shaped the industry landscape, with REGA implementing comprehensive licensing requirements that have professionalized the sector. The introduction of standardized commission structures and ethical guidelines has improved market transparency and consumer confidence.

Technology partnerships between traditional brokerages and proptech companies have accelerated innovation adoption. Major firms are investing in custom platforms that integrate property search, virtual tours, and transaction management capabilities.

International expansion initiatives have seen leading Saudi brokerage firms establishing operations in other GCC markets, leveraging their expertise in regulated environments and diverse client service.

Merger and acquisition activity has increased as firms seek to achieve scale advantages and expand service capabilities. Consolidation trends are creating larger, more sophisticated operators capable of serving complex client needs.

Educational initiatives have been launched to develop professional competencies, with universities and professional organizations offering specialized real estate programs and continuing education opportunities.

Sustainability certifications are being integrated into brokerage services, with firms developing capabilities to advise clients on green building standards and energy efficiency considerations.

MarkWide Research analysis indicates that successful brokerage firms should prioritize technology investment while maintaining strong local market relationships. The combination of digital capabilities and cultural understanding provides sustainable competitive advantages in the Saudi market.

Specialization strategies are recommended for smaller firms seeking to compete effectively against larger operators. Developing expertise in specific property types, client segments, or geographic areas can enable premium pricing and client loyalty.

Partnership development with proptech companies, financial institutions, and international real estate networks can expand service capabilities without requiring substantial internal investment. Strategic alliances enable access to specialized expertise and broader market reach.

Professional development investment is crucial for maintaining competitive positioning as market sophistication increases. Continuous training in technology, regulations, and market analysis ensures service quality and client satisfaction.

Market diversification across property types and client segments can reduce risk exposure while capturing growth opportunities in different market cycles. Balanced portfolios provide more stable revenue streams.

International capability development positions firms to serve growing foreign investment interest while potentially expanding to regional markets. Cross-border expertise becomes increasingly valuable as markets integrate.

Growth trajectory for Saudi Arabia’s real estate brokerage market remains positive, with MWR projecting continued expansion driven by economic diversification and demographic trends. The market is expected to maintain robust growth rates as Vision 2030 initiatives generate sustained demand for professional real estate services.

Technology evolution will continue reshaping industry practices, with artificial intelligence, virtual reality, and blockchain technologies becoming standard tools. Firms that successfully integrate these technologies while maintaining personal service quality will capture disproportionate market share.

Regulatory development is expected to continue, with additional consumer protection measures and professional standards likely to be implemented. These changes will further professionalize the industry while potentially creating compliance challenges for smaller operators.

Market consolidation trends are anticipated to accelerate, with successful firms acquiring smaller competitors to achieve scale advantages and expand geographic coverage. This consolidation will create more sophisticated service providers capable of serving complex client needs.

International integration will increase as Saudi brokers develop capabilities to serve global clients while potentially expanding operations to regional markets. Cross-border expertise will become a significant competitive advantage.

Sustainability focus will intensify, with environmental considerations becoming increasingly important in property transactions. Brokers with green building expertise will capture growing market segments focused on sustainable development.

Saudi Arabia’s real estate brokerage market stands at a transformative juncture, characterized by regulatory maturation, technological innovation, and expanding economic opportunities. The industry has successfully navigated the transition from traditional practices to modern, regulated operations while maintaining growth momentum despite global economic uncertainties.

Strategic positioning for future success requires balancing technology adoption with relationship-building capabilities, as clients increasingly demand both digital convenience and personalized service. The most successful firms will be those that can integrate advanced proptech solutions while maintaining deep understanding of local market dynamics and cultural preferences.

Market opportunities remain substantial, particularly in specialized segments such as luxury residential, international investment, and sustainable development. The ongoing implementation of Vision 2030 initiatives ensures continued demand for professional brokerage services across all property types and client segments.

Industry evolution toward greater professionalization and specialization creates both challenges and opportunities for market participants. Firms that invest in professional development, technology capabilities, and strategic partnerships will be best positioned to capitalize on the market’s continued expansion and increasing sophistication.

What is Saudi Arabia Real Estate Brokerage?

Saudi Arabia Real Estate Brokerage refers to the services provided by licensed professionals who facilitate the buying, selling, and leasing of properties in Saudi Arabia. This includes residential, commercial, and industrial real estate transactions.

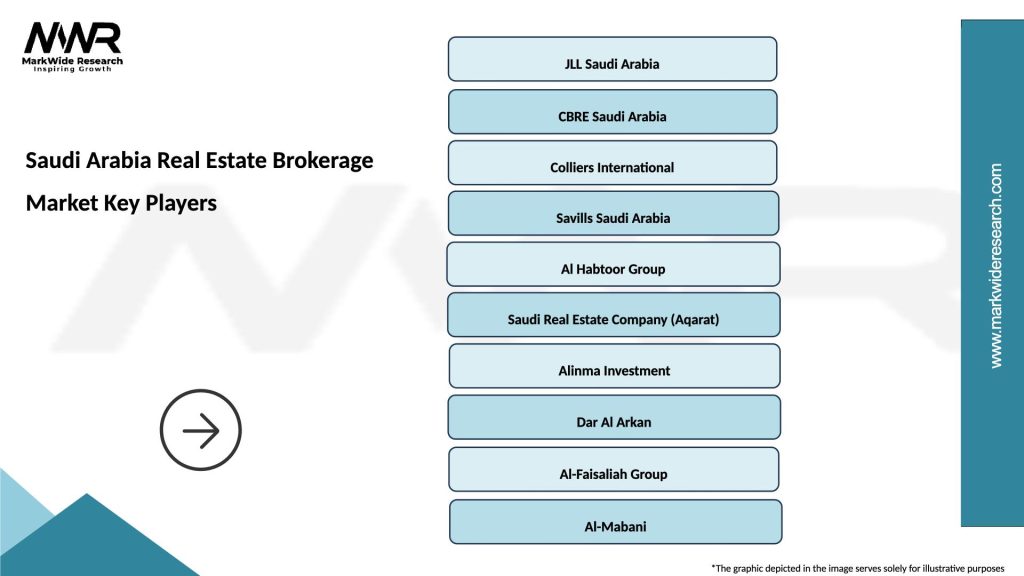

What are the key players in the Saudi Arabia Real Estate Brokerage Market?

Key players in the Saudi Arabia Real Estate Brokerage Market include companies like Ejar, Property Finder, and Al Habib Real Estate, which provide various services such as property listings, market analysis, and client representation, among others.

What are the growth factors driving the Saudi Arabia Real Estate Brokerage Market?

The growth of the Saudi Arabia Real Estate Brokerage Market is driven by factors such as urbanization, increasing population, and government initiatives aimed at boosting housing development. Additionally, the rise in foreign investment in real estate is contributing to market expansion.

What challenges does the Saudi Arabia Real Estate Brokerage Market face?

Challenges in the Saudi Arabia Real Estate Brokerage Market include regulatory hurdles, fluctuating property prices, and competition from online platforms. These factors can impact the profitability and operational efficiency of brokerage firms.

What opportunities exist in the Saudi Arabia Real Estate Brokerage Market?

Opportunities in the Saudi Arabia Real Estate Brokerage Market include the growing demand for affordable housing, the development of smart cities, and the potential for digital transformation in property transactions. These trends can enhance service delivery and customer engagement.

What trends are shaping the Saudi Arabia Real Estate Brokerage Market?

Trends shaping the Saudi Arabia Real Estate Brokerage Market include the increasing use of technology for virtual property tours, the rise of online real estate platforms, and a focus on sustainable building practices. These innovations are changing how properties are marketed and sold.

Saudi Arabia Real Estate Brokerage Market

| Segmentation Details | Description |

|---|---|

| Property Type | Residential, Commercial, Industrial, Mixed-Use |

| Service Type | Sales, Leasing, Property Management, Valuation |

| Customer Type | Investors, Homebuyers, Tenants, Corporates |

| Transaction Type | Buy, Sell, Rent, Auction |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Real Estate Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at