444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia property and casualty insurance market represents one of the most dynamic and rapidly evolving insurance sectors in the Middle East region. Market dynamics indicate substantial growth potential driven by economic diversification initiatives, regulatory reforms, and increasing awareness of risk management across various industries. The sector encompasses comprehensive coverage for property damage, liability protection, and casualty insurance products serving both individual and commercial clients throughout the Kingdom.

Regulatory transformation has been a key catalyst for market expansion, with the Saudi Central Bank (SAMA) implementing progressive policies that enhance market accessibility and consumer protection. The insurance penetration rate has shown consistent improvement, reaching approximately 2.8% of GDP, reflecting growing market maturity and adoption across diverse economic sectors.

Vision 2030 initiatives have significantly influenced market development, with infrastructure projects, industrial diversification, and urban development creating substantial demand for comprehensive insurance coverage. The market demonstrates robust growth trajectory with annual growth rates consistently exceeding 8.5% CAGR, positioning Saudi Arabia as a leading insurance market in the Gulf Cooperation Council region.

Digital transformation has emerged as a critical market driver, with insurtech innovations and online platforms revolutionizing customer engagement and operational efficiency. Traditional insurance companies are increasingly adopting digital technologies to enhance service delivery and expand market reach across urban and rural areas.

The Saudi Arabia property and casualty insurance market refers to the comprehensive ecosystem of insurance products and services that provide financial protection against property damage, liability claims, and various casualty risks within the Kingdom of Saudi Arabia. This market encompasses multiple insurance categories including motor insurance, property insurance, general liability coverage, marine insurance, and specialized commercial lines.

Property insurance components include residential and commercial property coverage, protecting against risks such as fire, theft, natural disasters, and other perils that may cause physical damage to buildings, equipment, and personal belongings. Casualty insurance elements focus on liability protection, covering legal obligations arising from bodily injury or property damage caused to third parties.

Market participants include domestic insurance companies, international insurers, reinsurance companies, insurance brokers, and regulatory authorities working together to create a comprehensive risk management framework. The sector operates under strict regulatory oversight ensuring consumer protection, financial stability, and market integrity.

Regulatory framework established by the Saudi Central Bank ensures standardized practices, fair pricing mechanisms, and adequate capital requirements for all market participants, creating a stable and transparent operating environment for sustainable market growth.

Market performance in Saudi Arabia’s property and casualty insurance sector demonstrates exceptional resilience and growth potential, driven by economic diversification, regulatory modernization, and increasing risk awareness across multiple industries. The sector has experienced sustained expansion with growth rates consistently outpacing regional averages and contributing significantly to the Kingdom’s financial services sector development.

Key growth drivers include mandatory motor insurance implementation, expanding construction and infrastructure projects, growing small and medium enterprise sector, and increasing foreign investment requiring comprehensive risk coverage. Digital adoption has accelerated significantly, with approximately 45% of insurance transactions now conducted through digital channels, enhancing customer experience and operational efficiency.

Competitive landscape features both established domestic insurers and international companies, creating a dynamic environment that promotes innovation, competitive pricing, and enhanced service quality. Market concentration remains moderate, with the top five insurers holding approximately 60% market share, allowing for healthy competition and market entry opportunities.

Future prospects appear highly favorable, supported by ongoing economic transformation, infrastructure development, and regulatory initiatives that promote market expansion and product innovation. The sector is positioned to benefit from emerging risks associated with technology adoption, climate change, and evolving business models across various industries.

Market segmentation reveals diverse opportunities across multiple insurance categories, with motor insurance representing the largest segment, followed by property insurance and general liability coverage. Commercial lines demonstrate particularly strong growth potential, driven by industrial expansion and increasing business sophistication.

Emerging trends include parametric insurance products, usage-based insurance models, and integrated risk management solutions that combine traditional coverage with preventive risk mitigation services. Customer expectations are evolving toward personalized products, transparent pricing, and seamless digital experiences across all touchpoints.

Economic diversification initiatives under Vision 2030 serve as the primary catalyst for insurance market expansion, creating new industries, business opportunities, and risk exposures that require comprehensive coverage solutions. Infrastructure development projects including NEOM, Red Sea Project, and various smart city initiatives generate substantial demand for construction, professional liability, and specialized insurance products.

Regulatory mandates have significantly expanded market reach, particularly through compulsory motor insurance requirements and emerging regulations for specific industry sectors. Financial sector development initiatives promote insurance market growth through enhanced capital markets, banking sector expansion, and increased foreign investment requiring risk management solutions.

Demographic trends including urbanization, population growth, and increasing disposable income create expanding customer bases for both personal and commercial insurance products. Business sector growth driven by small and medium enterprise development, foreign direct investment, and industrial diversification generates increasing demand for comprehensive commercial insurance coverage.

Technology adoption across various sectors creates new risk exposures while simultaneously enabling innovative insurance products and delivery mechanisms. Climate awareness and environmental considerations drive demand for specialized coverage addressing weather-related risks, environmental liability, and sustainable business practices.

Consumer awareness campaigns and financial literacy initiatives increase understanding of insurance benefits, driving voluntary coverage adoption beyond mandatory requirements across various demographic segments and geographic regions.

Price sensitivity remains a significant challenge, particularly in personal lines insurance where consumers often prioritize cost over comprehensive coverage, limiting premium growth and product sophistication. Cultural factors and traditional risk management approaches in certain segments create resistance to insurance adoption, requiring extensive education and awareness initiatives.

Regulatory complexity and evolving compliance requirements create operational challenges for insurers, particularly smaller companies with limited resources for regulatory adaptation and system upgrades. Economic volatility associated with oil price fluctuations can impact consumer spending patterns and business investment decisions affecting insurance demand.

Talent shortage in specialized insurance disciplines including actuarial science, underwriting, and claims management constrains market development and innovation capabilities. Technology infrastructure limitations in certain regions and customer segments restrict digital channel adoption and operational efficiency improvements.

Competition intensity from both domestic and international insurers creates pricing pressure that may compromise profitability and limit investment in product development and customer service enhancement. Reinsurance costs and capacity constraints for certain risk categories can limit product availability and pricing competitiveness.

Claims inflation driven by increasing repair costs, medical expenses, and legal settlements creates pressure on loss ratios and requires continuous pricing adjustments and risk management improvements.

Digital transformation presents unprecedented opportunities for market expansion through innovative product delivery, enhanced customer engagement, and operational efficiency improvements. Insurtech partnerships enable traditional insurers to leverage cutting-edge technologies for product innovation, risk assessment, and customer service enhancement.

Emerging risk categories including cyber liability, environmental risks, and technology-related exposures create new product development opportunities and revenue streams. Parametric insurance products addressing weather risks, commodity price fluctuations, and other measurable events offer innovative solutions for traditional coverage gaps.

Cross-selling opportunities through integrated financial services platforms and bancassurance partnerships enable comprehensive customer relationship development and premium growth. Commercial lines expansion driven by industrial diversification, foreign investment, and infrastructure development creates substantial growth potential.

Regional expansion opportunities within the Gulf Cooperation Council region and broader Middle East market provide growth avenues for established Saudi insurers. Product innovation including usage-based insurance, micro-insurance products, and specialized coverage for emerging industries addresses evolving customer needs.

Data analytics and artificial intelligence applications enable improved risk assessment, fraud detection, and personalized pricing strategies that enhance competitiveness and profitability. Sustainability initiatives create opportunities for green insurance products and environmental risk management solutions.

Supply-side dynamics reflect increasing competition among domestic and international insurers, driving innovation, competitive pricing, and enhanced service quality. Market consolidation trends through mergers and acquisitions create larger, more efficient organizations capable of serving diverse customer needs and managing complex risks.

Demand-side factors demonstrate growing sophistication among commercial customers seeking comprehensive risk management solutions, while personal lines customers increasingly value convenience, transparency, and digital service delivery. Regulatory evolution continues shaping market structure through enhanced consumer protection, capital requirements, and operational standards.

Technology integration transforms traditional insurance operations through automated underwriting, digital claims processing, and artificial intelligence-powered customer service. Distribution channel evolution includes expanding digital platforms, insurance aggregators, and direct-to-consumer models complementing traditional agent and broker networks.

Risk landscape changes driven by economic diversification, climate change, and technological advancement require continuous product adaptation and underwriting expertise development. Customer behavior shifts toward digital engagement, personalized products, and transparent pricing influence product development and service delivery strategies.

Capital market development provides enhanced funding opportunities for insurance companies while creating new investment options for insurance reserves and surplus funds, improving overall financial performance and market stability.

Comprehensive analysis of the Saudi Arabia property and casualty insurance market employs multiple research methodologies ensuring accurate, reliable, and actionable insights for industry stakeholders. Primary research includes extensive interviews with insurance company executives, regulatory officials, industry associations, and key market participants across various segments and geographic regions.

Secondary research encompasses analysis of regulatory filings, financial statements, industry reports, and market data from authoritative sources including the Saudi Central Bank, insurance companies, and industry associations. Quantitative analysis utilizes statistical modeling, trend analysis, and market sizing methodologies to provide accurate market assessments and growth projections.

Qualitative research includes focus groups with insurance customers, in-depth interviews with industry experts, and analysis of market trends, competitive dynamics, and regulatory developments. Data validation processes ensure accuracy through cross-referencing multiple sources, expert review, and statistical verification of key findings.

Market segmentation analysis employs detailed examination of product categories, customer segments, distribution channels, and geographic regions to provide comprehensive market understanding. Competitive intelligence gathering includes analysis of company strategies, market positioning, product offerings, and performance metrics across all major market participants.

Regulatory analysis encompasses detailed review of current and proposed regulations, compliance requirements, and policy implications for market development and competitive dynamics.

Geographic distribution across Saudi Arabia reveals significant market concentration in major urban centers, with Riyadh, Jeddah, and Dammam metropolitan areas accounting for approximately 70% of total premium volume. Central Region dominance reflects the concentration of government institutions, major corporations, and high-income demographics driving both personal and commercial insurance demand.

Western Region demonstrates strong growth potential driven by Red Sea Project development, religious tourism expansion, and port city commercial activities. Jeddah market shows particular strength in commercial lines insurance, reflecting the city’s position as a major business and trade center with diverse industrial activities.

Eastern Region benefits from oil industry concentration, petrochemical facilities, and industrial development creating substantial demand for specialized commercial insurance products. Dammam and Al-Khobar markets demonstrate sophisticated risk management requirements and higher insurance penetration rates among commercial customers.

Northern and Southern regions represent emerging opportunities with lower current penetration rates but significant growth potential driven by infrastructure development, agricultural expansion, and tourism initiatives. Rural market development remains challenging but offers long-term expansion opportunities through digital channels and innovative product offerings.

Cross-regional trends include increasing standardization of products and services, expanding digital channel adoption, and growing awareness of insurance benefits across all geographic segments and demographic groups.

Market leadership is distributed among several key players, creating a competitive environment that promotes innovation, competitive pricing, and enhanced customer service. Domestic insurers maintain strong market positions through local expertise, regulatory relationships, and established distribution networks.

International presence includes global insurance companies operating through local partnerships, joint ventures, and direct market entry, bringing international expertise and capital resources. Competitive strategies focus on digital transformation, product innovation, customer service excellence, and strategic partnerships to enhance market position.

Market dynamics encourage consolidation through mergers and acquisitions, creating larger, more efficient organizations capable of competing effectively in evolving market conditions and serving diverse customer needs across multiple segments.

Product segmentation reveals diverse market opportunities across multiple insurance categories, each with distinct characteristics, growth patterns, and competitive dynamics. Motor insurance represents the largest segment, driven by mandatory coverage requirements and growing vehicle ownership across all demographic segments.

By Product Type:

By Customer Segment:

By Distribution Channel:

Motor Insurance Category demonstrates exceptional market dominance with consistent growth driven by mandatory coverage requirements and expanding vehicle ownership. Premium growth reflects increasing vehicle values, enhanced coverage options, and growing awareness of comprehensive protection benefits beyond basic third-party liability requirements.

Property Insurance Category shows significant expansion potential driven by real estate development, increasing property values, and growing awareness of natural disaster risks. Commercial property insurance demonstrates particularly strong growth as businesses recognize the importance of comprehensive asset protection and business interruption coverage.

Liability Insurance Category experiences rapid growth as businesses become more sophisticated in risk management and face increasing regulatory requirements for professional liability coverage. Product liability and directors and officers insurance show emerging demand among larger corporations and international businesses operating in Saudi Arabia.

Specialty Lines Category including marine, aviation, and engineering insurance benefit from economic diversification and infrastructure development initiatives. Cyber liability insurance emerges as a high-growth category driven by digital transformation and increasing cyber risk awareness across all business sectors.

Takaful Products represent a significant and growing segment, appealing to customers seeking Sharia-compliant insurance solutions across all major product categories, with particular strength in personal lines and small business segments.

Insurance Companies benefit from expanding market opportunities, diversified revenue streams, and enhanced profitability through improved risk assessment, digital operational efficiency, and innovative product development. Market growth provides opportunities for premium expansion, customer base development, and competitive positioning enhancement.

Customers and Policyholders gain access to comprehensive risk protection, competitive pricing, enhanced service quality, and innovative coverage solutions addressing evolving risk exposures. Digital transformation improves customer experience through convenient policy management, faster claims processing, and transparent communication.

Regulatory Authorities achieve enhanced market stability, consumer protection, and financial sector development supporting broader economic objectives. Market development contributes to financial system resilience and risk management capabilities across the economy.

Economic Development benefits include increased foreign investment attraction, business confidence enhancement, and risk management infrastructure supporting Vision 2030 objectives. Insurance availability enables business expansion, infrastructure development, and economic diversification initiatives.

Employment Creation across insurance companies, brokerages, and supporting services contributes to job market development and professional skill enhancement. Technology adoption drives innovation, efficiency improvements, and competitive advantage development across the financial services sector.

Reinsurance Partners benefit from market expansion, risk diversification opportunities, and enhanced partnership relationships with growing Saudi insurance market participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Approach transforms customer engagement through mobile applications, online policy management, and artificial intelligence-powered customer service. Insurtech Integration enables traditional insurers to leverage innovative technologies for product development, risk assessment, and operational efficiency improvements.

Personalization Trends include usage-based insurance models, customized coverage options, and dynamic pricing strategies based on individual risk profiles and behavior patterns. Data Analytics applications enhance underwriting accuracy, fraud detection, and customer segmentation capabilities.

Sustainability Focus drives development of green insurance products, environmental risk coverage, and sustainable business practices across the insurance value chain. Climate Risk Management becomes increasingly important as businesses and individuals seek protection against weather-related exposures.

Regulatory Technology adoption streamlines compliance processes, reporting requirements, and regulatory communication through automated systems and digital platforms. Customer Experience enhancement through omnichannel service delivery, transparent pricing, and simplified policy management processes.

Partnership Strategies include collaborations with technology companies, financial institutions, and industry specialists to expand product offerings and market reach. Islamic Insurance Growth reflects increasing demand for Sharia-compliant products across all market segments and customer demographics.

Regulatory Modernization includes implementation of risk-based capital requirements, enhanced consumer protection measures, and digital transformation guidelines promoting market development and stability. MarkWide Research analysis indicates that regulatory reforms have contributed to improved market confidence and increased foreign investment in the insurance sector.

Technology Investments by major insurers focus on artificial intelligence, blockchain applications, and Internet of Things integration for enhanced risk assessment and customer service delivery. Digital Platform Launches by leading insurance companies provide comprehensive online services including policy purchase, claims reporting, and customer support.

Strategic Partnerships between insurance companies and technology providers, banks, and international insurers enhance product capabilities, market reach, and operational efficiency. Market Consolidation activities include mergers and acquisitions creating larger, more competitive organizations with enhanced service capabilities.

Product Innovation initiatives include parametric insurance products, cyber liability coverage, and specialized solutions for emerging industries and risk categories. Distribution Channel Expansion through digital aggregators, bancassurance partnerships, and direct-to-consumer platforms increases market accessibility.

Capital Market Development provides enhanced funding opportunities for insurance companies while creating new investment options for insurance reserves and surplus management, improving overall financial performance and market stability.

Market Entry Strategies should focus on digital-first approaches, strategic partnerships with local organizations, and specialized product offerings addressing unmet market needs. New entrants should prioritize regulatory compliance, capital adequacy, and technology infrastructure development to compete effectively in the evolving market landscape.

Product Development recommendations include emphasis on commercial lines expansion, specialty insurance products, and innovative coverage solutions for emerging risks. Customer segmentation strategies should target underserved markets including small and medium enterprises, rural customers, and specific industry sectors with tailored product offerings.

Technology Investment priorities should include customer relationship management systems, automated underwriting platforms, and data analytics capabilities for improved risk assessment and operational efficiency. Digital transformation initiatives should focus on customer experience enhancement and operational cost reduction.

Distribution Strategy optimization should balance traditional channels with digital platforms, ensuring comprehensive market coverage and customer accessibility. Partnership development with banks, technology companies, and industry specialists can enhance market reach and product capabilities.

Risk Management focus should include robust reinsurance programs, diversified product portfolios, and strong capital management practices to ensure financial stability and growth sustainability. Regulatory compliance should be viewed as a competitive advantage rather than a compliance burden, with proactive engagement in regulatory development processes.

Long-term prospects for the Saudi Arabia property and casualty insurance market remain exceptionally positive, supported by continued economic diversification, infrastructure development, and regulatory modernization initiatives. Market expansion is expected to accelerate with projected growth rates of 9.2% CAGR over the next five years, driven by increasing insurance awareness and mandatory coverage expansion.

Digital transformation will continue reshaping the industry landscape, with technology adoption enabling new business models, enhanced customer experiences, and improved operational efficiency. MWR projections indicate that digital channels will account for approximately 65% of insurance transactions within the next decade, fundamentally changing customer engagement patterns.

Product innovation will focus on emerging risk categories including cyber liability, climate change-related coverage, and technology-enabled insurance solutions. Commercial lines growth is expected to outpace personal lines expansion, driven by business sector development and increasing risk management sophistication.

Regulatory evolution will continue supporting market development through enhanced consumer protection, capital market integration, and international best practice adoption. Regional integration opportunities within the Gulf Cooperation Council will create expanded market access and risk diversification benefits.

Sustainability considerations will become increasingly important, with environmental, social, and governance factors influencing product development, investment strategies, and operational practices across the insurance industry. Market maturation will result in more sophisticated risk management solutions and enhanced professional standards throughout the sector.

The Saudi Arabia property and casualty insurance market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by economic diversification, regulatory modernization, and increasing risk awareness across multiple industries. Market fundamentals remain strong, supported by Vision 2030 initiatives, infrastructure development, and progressive regulatory frameworks that promote sustainable market expansion.

Digital transformation continues reshaping the industry landscape, creating opportunities for innovation, enhanced customer engagement, and operational efficiency improvements. Competitive dynamics foster market development through product innovation, service quality enhancement, and strategic partnerships that benefit all market participants and stakeholders.

Future growth prospects appear highly favorable, with expanding commercial opportunities, emerging risk categories, and technology-enabled solutions driving market development. Regulatory support and economic diversification initiatives provide a stable foundation for sustainable long-term growth and market maturation.

The sector’s evolution toward greater sophistication, digital integration, and comprehensive risk management solutions positions Saudi Arabia as a leading insurance market in the Middle East region, offering substantial opportunities for existing participants and new market entrants seeking to capitalize on this dynamic and growing market environment.

What is Property and Casualty Insurance?

Property and Casualty Insurance refers to a type of insurance that provides coverage for property loss and liability for damages to others. It encompasses various policies, including homeowners, auto, and commercial insurance, protecting individuals and businesses from financial losses due to unforeseen events.

What are the key players in the Saudi Arabia Property and Casualty Insurance Market?

Key players in the Saudi Arabia Property and Casualty Insurance Market include Tawuniya, Bupa Arabia, and Al Rajhi Takaful, among others. These companies offer a range of insurance products tailored to meet the needs of consumers and businesses in the region.

What are the growth factors driving the Saudi Arabia Property and Casualty Insurance Market?

The growth of the Saudi Arabia Property and Casualty Insurance Market is driven by increasing urbanization, a growing middle class, and rising awareness of the importance of insurance. Additionally, government initiatives to promote insurance penetration contribute to market expansion.

What challenges does the Saudi Arabia Property and Casualty Insurance Market face?

The Saudi Arabia Property and Casualty Insurance Market faces challenges such as regulatory compliance, competition among insurers, and the need for digital transformation. These factors can impact profitability and operational efficiency for insurance providers.

What opportunities exist in the Saudi Arabia Property and Casualty Insurance Market?

Opportunities in the Saudi Arabia Property and Casualty Insurance Market include the development of innovative insurance products, expansion into underserved segments, and the integration of technology to enhance customer experience. The growing demand for digital solutions presents a significant opportunity for insurers.

What trends are shaping the Saudi Arabia Property and Casualty Insurance Market?

Trends shaping the Saudi Arabia Property and Casualty Insurance Market include the rise of insurtech, increased focus on customer-centric services, and the adoption of data analytics for risk assessment. These trends are transforming how insurance products are developed and delivered.

Saudi Arabia Property and Casualty Insurance Market

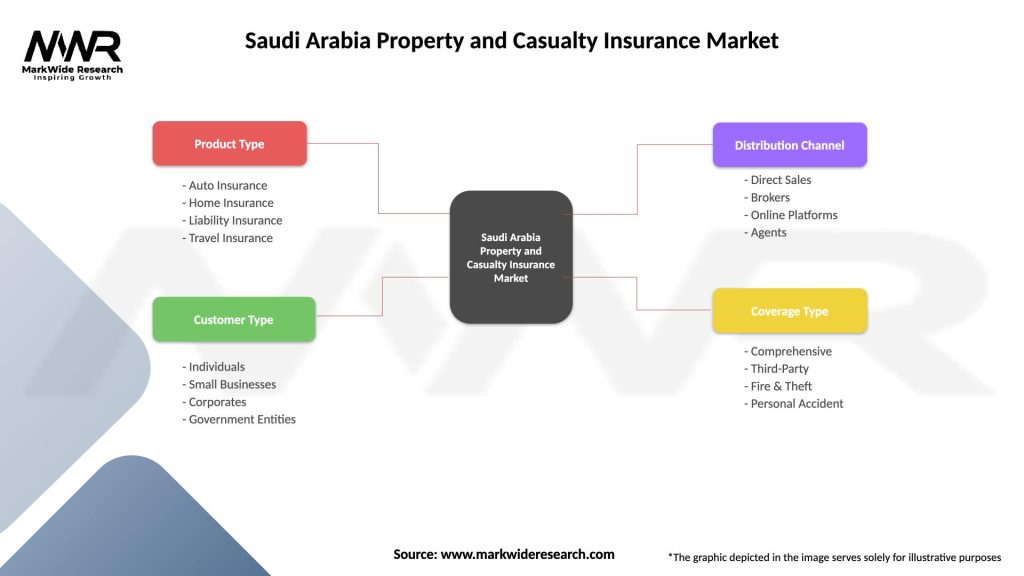

| Segmentation Details | Description |

|---|---|

| Product Type | Auto Insurance, Home Insurance, Liability Insurance, Travel Insurance |

| Customer Type | Individuals, Small Businesses, Corporates, Government Entities |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Coverage Type | Comprehensive, Third-Party, Fire & Theft, Personal Accident |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Property and Casualty Insurance Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at