444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Saudi Arabia poultry meat market has witnessed significant growth in recent years. Poultry meat refers to the meat obtained from chickens, turkeys, ducks, and other domestic birds. It is a popular protein source due to its affordability, versatility, and nutritional value. The Saudi Arabian market for poultry meat is driven by factors such as population growth, changing dietary preferences, and the rising demand for processed and convenience food products.

Meaning

Poultry meat refers to the meat derived from domestic birds, primarily chickens, turkeys, and ducks. It is a common protein source consumed by people worldwide due to its affordability, high protein content, and relatively low fat content compared to other meat types. Poultry meat is available in various cuts, such as breasts, thighs, wings, and ground meat.

Executive Summary

The Saudi Arabia poultry meat market has experienced robust growth, driven by factors such as the growing population, increasing disposable income, urbanization, and changing consumer preferences. The market is characterized by the high consumption of poultry meat products, both fresh and processed. Poultry meat is a staple in the Saudi Arabian diet and holds a significant share in the overall meat market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Saudi Arabia poultry meat market is highly competitive, with a significant number of local and international players. Market dynamics are influenced by factors such as changing consumer preferences, government regulations, price fluctuations of feed and raw materials, and technological advancements in production and processing.

Regional Analysis

The Saudi Arabia poultry meat market can be analyzed based on different regions, including Riyadh, Jeddah, Dammam, and others. Riyadh, as the capital and largest city, holds a substantial share in the market. Jeddah and Dammam also contribute significantly due to their population size and growing urbanization.

Competitive Landscape

Leading Companies in the Saudi Arabia Poultry Meat Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

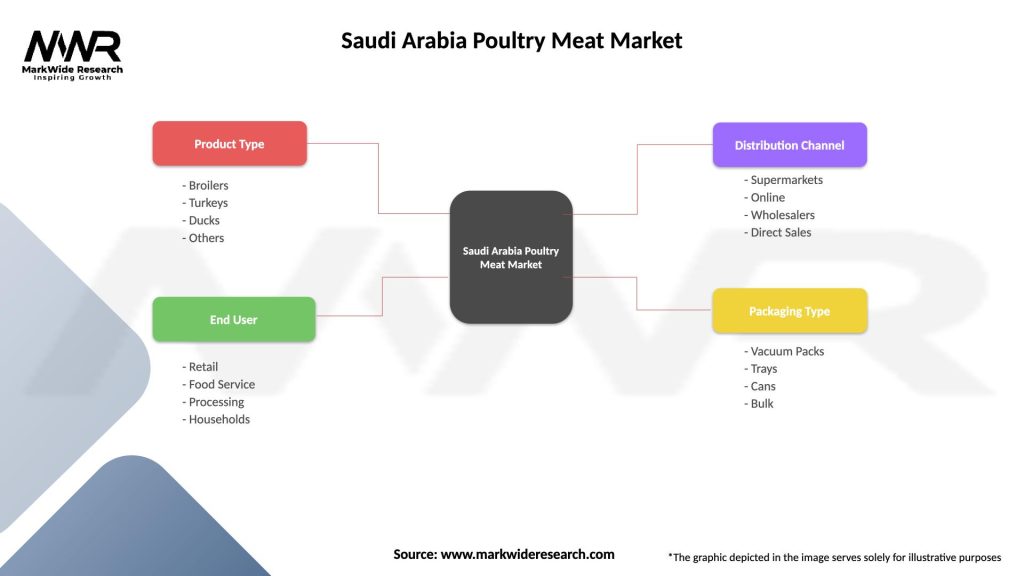

Segmentation

The Saudi Arabia poultry meat market can be segmented based on the following criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the Saudi Arabia poultry meat market. While the market experienced disruptions due to temporary closures of foodservice establishments and supply chain challenges, there was an overall increase in retail sales of poultry meat products as consumers shifted towards home cooking and stocked up on essential food items.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Saudi Arabia poultry meat market looks promising, driven by population growth, changing dietary preferences, and the expanding processed poultry products segment. Industry participants that focus on product quality, innovation, and sustainability are likely to succeed. However, challenges such as disease outbreaks, price fluctuations, and environmental concerns require proactive measures and continuous adaptation to maintain a competitive edge.

Conclusion

The Saudi Arabia poultry meat market is experiencing significant growth, driven by population expansion, changing dietary preferences, and increasing demand for convenience food products. The market offers profitable opportunities for industry participants, with a wide range of poultry meat products available. However, challenges related to disease outbreaks, price fluctuations, and environmental concerns must be addressed. By prioritizing quality, innovation, and sustainability, the market is expected to continue its growth trajectory, meeting the evolving consumer demands and contributing to the overall food and agricultural sector in Saudi Arabia.

What is Poultry Meat?

Poultry meat refers to the flesh of domesticated birds, primarily chickens, turkeys, ducks, and geese, raised for human consumption. In Saudi Arabia, poultry meat is a significant source of protein and is widely consumed across various culinary traditions.

What are the key companies in the Saudi Arabia Poultry Meat Market?

Key companies in the Saudi Arabia Poultry Meat Market include Al-Watania Poultry, Almarai, and National Poultry Company. These companies play a crucial role in the production and distribution of poultry products in the region, among others.

What are the growth factors driving the Saudi Arabia Poultry Meat Market?

The growth of the Saudi Arabia Poultry Meat Market is driven by increasing consumer demand for protein-rich foods, rising population, and the expansion of fast-food chains. Additionally, government initiatives to enhance local poultry production contribute to market growth.

What challenges does the Saudi Arabia Poultry Meat Market face?

The Saudi Arabia Poultry Meat Market faces challenges such as fluctuating feed prices, disease outbreaks among poultry, and competition from imported meat products. These factors can impact production costs and market stability.

What opportunities exist in the Saudi Arabia Poultry Meat Market?

Opportunities in the Saudi Arabia Poultry Meat Market include the potential for export growth, increasing consumer interest in organic and free-range poultry products, and advancements in poultry farming technologies. These trends can enhance market competitiveness.

What trends are shaping the Saudi Arabia Poultry Meat Market?

Trends in the Saudi Arabia Poultry Meat Market include a shift towards healthier eating habits, the rise of convenience foods, and the adoption of sustainable farming practices. These trends are influencing consumer preferences and production methods.

Saudi Arabia Poultry Meat Market

| Segmentation Details | Description |

|---|---|

| Product Type | Broilers, Turkeys, Ducks, Others |

| End User | Retail, Food Service, Processing, Households |

| Distribution Channel | Supermarkets, Online, Wholesalers, Direct Sales |

| Packaging Type | Vacuum Packs, Trays, Cans, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Saudi Arabia Poultry Meat Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at