444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia Out Of Home (OOH) delivery market represents a rapidly evolving sector that has transformed the traditional food service landscape across the Kingdom. This dynamic market encompasses various delivery services including restaurant meals, groceries, pharmaceuticals, and retail products delivered directly to consumers outside their homes. The market has experienced unprecedented growth, particularly accelerated by changing consumer behaviors and technological advancements in logistics and mobile applications.

Market dynamics indicate that the Saudi OOH delivery sector is expanding at a remarkable CAGR of 18.5%, driven by increasing urbanization, rising disposable incomes, and a tech-savvy population that embraces digital convenience. The market encompasses multiple delivery channels including third-party aggregators, direct restaurant delivery services, cloud kitchens, and specialized delivery platforms catering to specific product categories.

Geographic distribution shows that major metropolitan areas including Riyadh, Jeddah, and Dammam account for approximately 75% of total market activity, while emerging cities are witnessing rapid adoption of OOH delivery services. The market benefits from Saudi Arabia’s Vision 2030 initiative, which emphasizes digital transformation and entrepreneurship, creating a favorable environment for delivery service innovations and investments.

The Saudi Arabia Out Of Home delivery market refers to the comprehensive ecosystem of services that facilitate the transportation and delivery of various products including food, beverages, groceries, pharmaceuticals, and retail items to consumers at locations other than their primary residences, such as offices, educational institutions, recreational facilities, and public spaces.

Service categories within this market include restaurant food delivery, grocery and supermarket delivery, pharmacy and healthcare product delivery, retail and e-commerce delivery, and specialized services such as flower delivery and gift services. The market operates through various business models including marketplace aggregators, direct merchant delivery, hybrid platforms, and dedicated logistics providers.

Technology integration plays a crucial role in market operations, encompassing mobile applications, GPS tracking systems, payment gateways, customer relationship management platforms, and artificial intelligence-driven route optimization. The market also includes supporting infrastructure such as cloud kitchens, dark stores, micro-fulfillment centers, and last-mile delivery networks that enable efficient service delivery across urban and suburban areas.

Market performance in Saudi Arabia’s OOH delivery sector demonstrates exceptional growth trajectory, with the industry experiencing significant expansion across all major service categories. The market benefits from strong demographic trends, including a young population with 65% under the age of 35, high smartphone penetration rates, and increasing acceptance of digital payment methods.

Competitive landscape features both international players and local companies competing across various segments. Major international platforms have established strong market presence while local entrepreneurs have developed innovative solutions tailored to Saudi cultural preferences and regulatory requirements. The market shows healthy competition with no single player dominating more than 30% market share.

Investment activity remains robust, with venture capital funding supporting both established players and emerging startups. Government initiatives supporting digital transformation and small business development have created additional growth catalysts. The market demonstrates strong resilience and adaptability, having successfully navigated various economic conditions while maintaining consistent growth patterns.

Future projections indicate continued expansion driven by infrastructure development, regulatory support, and evolving consumer preferences toward convenience-oriented services. The market is expected to maintain its growth momentum while diversifying into new service categories and geographic regions throughout the Kingdom.

Consumer behavior analysis reveals significant shifts in purchasing patterns and service expectations within the Saudi OOH delivery market. The following key insights demonstrate the market’s evolution and growth potential:

Demographic advantages serve as primary growth catalysts for the Saudi OOH delivery market. The Kingdom’s young population demonstrates high comfort levels with digital technologies and mobile commerce, creating a natural customer base for delivery services. Urbanization trends concentrate populations in metropolitan areas where delivery services achieve optimal efficiency and coverage.

Economic factors including rising disposable incomes and changing lifestyle preferences support market expansion. Professional working populations, particularly dual-income households, increasingly value time-saving services that delivery platforms provide. The growing participation of women in the workforce has created additional demand for convenient meal and grocery solutions.

Technology infrastructure improvements across Saudi Arabia enable reliable service delivery. High-speed internet connectivity, widespread smartphone adoption, and robust telecommunications networks provide the foundation for sophisticated delivery platforms. Government investments in digital infrastructure support continued market development and service innovation.

Regulatory support through Vision 2030 initiatives encourages entrepreneurship and digital business development. Streamlined business registration processes, support for small and medium enterprises, and favorable policies toward technology companies create an enabling environment for market participants. Food safety regulations and delivery service standards ensure consumer protection while maintaining market growth.

Operational challenges present significant constraints for OOH delivery market participants in Saudi Arabia. High operational costs associated with maintaining delivery fleets, fuel expenses, and driver compensation impact profitability margins. Traffic congestion in major cities affects delivery times and operational efficiency, particularly during peak hours and religious observances.

Regulatory compliance requirements create complexity for market participants. Food safety standards, business licensing requirements, and labor regulations necessitate substantial compliance investments. Seasonal restrictions during Ramadan and other religious periods require operational adjustments that affect revenue consistency throughout the year.

Market saturation in primary metropolitan areas intensifies competition and reduces profit margins. Customer acquisition costs have increased as platforms compete for market share, while customer loyalty remains challenging to maintain in a highly competitive environment. Price sensitivity among certain consumer segments limits premium service adoption.

Infrastructure limitations in emerging markets and suburban areas constrain geographic expansion. Address standardization challenges, limited GPS accuracy in certain areas, and inadequate parking facilities for delivery vehicles create operational difficulties. Weather conditions, particularly extreme heat during summer months, affect delivery operations and customer demand patterns.

Geographic expansion presents substantial growth opportunities as secondary and tertiary cities develop infrastructure and consumer awareness. Emerging urban centers show strong potential for delivery service adoption, with less competitive environments allowing for market share establishment. Rural area penetration remains largely untapped, offering long-term expansion possibilities.

Service diversification enables market participants to capture additional revenue streams. Pharmacy delivery, retail goods delivery, and specialized services such as document delivery or pet supplies represent growing opportunities. B2B delivery services for offices and institutions offer higher-value transactions and predictable demand patterns.

Technology innovation creates competitive advantages and operational efficiencies. Artificial intelligence for demand forecasting, autonomous delivery vehicles, and drone delivery systems represent future growth catalysts. Integration with smart city initiatives and IoT technologies can enhance service quality and operational optimization.

Partnership opportunities with retailers, restaurants, and service providers enable market expansion without significant capital investment. Strategic alliances with telecommunications companies, payment processors, and logistics providers can enhance service capabilities and market reach. Government partnerships for public service delivery present additional revenue opportunities.

Competitive intensity shapes market dynamics through pricing strategies, service quality improvements, and innovation initiatives. Market participants continuously invest in technology upgrades, customer experience enhancements, and operational efficiency improvements to maintain competitive positions. The dynamic nature of competition drives overall market development and service standardization.

Supply chain evolution demonstrates increasing sophistication as market participants optimize logistics networks. Cloud kitchen development, micro-fulfillment centers, and strategic warehouse locations improve delivery efficiency and cost management. Integration between different service providers creates comprehensive delivery ecosystems that serve diverse consumer needs.

Consumer expectations continue evolving toward faster delivery times, broader service selections, and enhanced user experiences. Platform features such as real-time tracking, flexible payment options, and personalized recommendations become standard requirements rather than competitive differentiators. Quality consistency and reliability emerge as key factors in customer retention and platform success.

Seasonal variations create cyclical demand patterns that require adaptive operational strategies. Religious observances, weather conditions, and cultural events significantly influence order volumes and service requirements. Successful market participants develop flexible operational models that accommodate these variations while maintaining service quality and profitability.

Data collection for analyzing the Saudi Arabia OOH delivery market employed comprehensive primary and secondary research methodologies. Primary research included structured interviews with industry executives, platform operators, restaurant partners, and consumer focus groups across major metropolitan areas. Survey data collection encompassed diverse demographic segments to ensure representative market insights.

Secondary research incorporated analysis of industry reports, government statistics, regulatory filings, and company financial disclosures. Market intelligence gathering included monitoring of platform performance metrics, pricing strategies, and service expansion announcements. Academic research and industry publications provided additional context for market trend analysis.

Analytical frameworks utilized quantitative and qualitative assessment methodologies to evaluate market dynamics, competitive positioning, and growth projections. Statistical analysis of transaction data, user behavior patterns, and market share evolution provided quantitative foundations for market insights. Qualitative analysis incorporated expert opinions, industry best practices, and regulatory impact assessments.

Validation processes ensured data accuracy through cross-referencing multiple sources and expert review panels. Market projections underwent sensitivity analysis to account for various economic and regulatory scenarios. Continuous monitoring of market developments ensures ongoing accuracy of research findings and projections.

Riyadh metropolitan area dominates the Saudi OOH delivery market, accounting for approximately 35% of national market activity. The capital city benefits from high population density, strong economic activity, and advanced infrastructure supporting efficient delivery operations. Government offices, corporate headquarters, and educational institutions create consistent B2B demand alongside robust consumer markets.

Jeddah region represents the second-largest market segment with 25% market share, driven by its commercial significance and diverse population. The city’s status as a major business hub and gateway for international trade creates unique delivery service requirements. Cultural diversity and international business presence influence service offerings and operational approaches.

Eastern Province including Dammam and Khobar shows strong growth potential with 20% market representation. The region’s industrial base and oil industry presence create distinct market characteristics with higher disposable incomes and specific service requirements. Infrastructure development and population growth support continued market expansion.

Emerging markets including Medina, Taif, and other secondary cities demonstrate accelerated growth rates exceeding established markets. These regions benefit from reduced competition, lower operational costs, and increasing consumer awareness of delivery services. Infrastructure improvements and economic development initiatives support market development in these areas.

Market leadership in the Saudi OOH delivery sector features diverse players competing across various service categories and geographic regions. The competitive environment demonstrates healthy rivalry without excessive market concentration, promoting innovation and service quality improvements.

Competitive strategies focus on technology innovation, service quality enhancement, and market expansion. Platform differentiation occurs through user experience design, delivery speed optimization, restaurant partnership quality, and customer service excellence. Investment in logistics infrastructure and technology capabilities creates sustainable competitive advantages.

By Service Type:

By Delivery Model:

By Customer Segment:

Food delivery segment maintains market leadership with consistent growth across all major cities. Restaurant partnerships continue expanding as establishments recognize delivery channels as essential revenue streams. Cloud kitchen development accelerates as operators optimize for delivery-only operations, reducing overhead costs while maintaining food quality standards.

Grocery delivery category shows exceptional growth potential with consumer adoption increasing 40% annually. Supermarket chains invest in dedicated delivery infrastructure while specialized grocery platforms develop efficient fulfillment operations. Fresh produce delivery presents technical challenges that successful platforms address through cold chain logistics and quality assurance protocols.

Pharmacy delivery services benefit from regulatory support and consumer health awareness. Prescription medication delivery requires specialized handling and compliance with healthcare regulations. Over-the-counter products and health supplements represent additional growth opportunities with less regulatory complexity.

Retail delivery expansion encompasses diverse product categories from electronics to fashion items. Partnership development with major retailers enables comprehensive product selection while maintaining delivery efficiency. Same-day delivery expectations drive logistics optimization and inventory management improvements.

For Consumers:

For Merchants and Restaurants:

For Delivery Platforms:

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration accelerates across all market segments with artificial intelligence, machine learning, and predictive analytics becoming standard platform features. Route optimization algorithms improve delivery efficiency while customer behavior analysis enables personalized service offerings. Integration with smart city initiatives and IoT devices creates enhanced user experiences and operational capabilities.

Sustainability initiatives gain prominence as platforms implement environmentally conscious practices. Electric vehicle adoption for delivery fleets, sustainable packaging requirements, and carbon footprint reduction programs respond to growing environmental awareness. Green delivery options become competitive differentiators while supporting corporate social responsibility objectives.

Hyperlocal services emerge as platforms focus on neighborhood-level service optimization. Local merchant partnerships, community-specific offerings, and culturally relevant services create competitive advantages. Micro-fulfillment centers and local inventory management enable faster delivery times and reduced operational costs.

Payment innovation continues evolving with cryptocurrency acceptance, buy-now-pay-later options, and integrated loyalty programs. Digital wallet integration and seamless payment experiences become essential platform features. Subscription-based delivery services and membership programs create recurring revenue streams while enhancing customer retention.

Platform consolidation activities reshape the competitive landscape as major players acquire smaller competitors or form strategic alliances. Merger and acquisition activity focuses on technology capabilities, market access, and operational synergies. International platforms establish local partnerships to navigate regulatory requirements and cultural preferences.

Infrastructure investments by both private companies and government entities support market expansion. Cloud kitchen development accelerates with dedicated facilities optimized for delivery operations. Logistics hub construction and distribution center expansion improve service coverage and delivery efficiency across urban and suburban areas.

Regulatory developments include food safety standards, delivery vehicle regulations, and labor protection measures. Government initiatives supporting small business development and entrepreneurship create favorable conditions for market participants. Digital commerce regulations provide clarity for platform operations while ensuring consumer protection.

Technology partnerships between delivery platforms and technology providers enhance service capabilities. Integration with payment processors, mapping services, and telecommunications companies improves operational efficiency. Collaboration with automotive companies and logistics providers supports fleet management and delivery optimization initiatives.

MarkWide Research recommends that market participants focus on operational efficiency improvements and technology innovation to maintain competitive advantages. Investment in logistics infrastructure, particularly in emerging markets, presents significant growth opportunities. Platforms should prioritize customer experience enhancement and service quality consistency to build sustainable market positions.

Geographic expansion strategies should emphasize secondary cities where competition remains limited and operational costs are lower. Market participants should develop localized service offerings that address specific regional preferences and cultural requirements. Partnership development with local merchants and service providers enables efficient market entry and community integration.

Service diversification beyond traditional food delivery creates additional revenue streams and reduces dependence on single market segments. Healthcare delivery, retail logistics, and B2B services represent high-growth opportunities with different competitive dynamics. Investment in specialized capabilities and regulatory compliance enables successful category expansion.

Technology investment should focus on artificial intelligence, automation, and data analytics capabilities that improve operational efficiency and customer experience. Predictive analytics for demand forecasting, route optimization, and inventory management create sustainable competitive advantages. Integration with emerging technologies such as autonomous vehicles and drone delivery systems positions platforms for future market evolution.

Market expansion projections indicate continued robust growth with annual growth rates exceeding 15% expected through the next five years. Geographic expansion into secondary and tertiary cities will drive significant portion of growth as infrastructure development and consumer awareness increase. Service category diversification will contribute additional growth momentum beyond traditional food delivery segments.

Technology evolution will transform operational capabilities with autonomous delivery vehicles, drone systems, and AI-powered logistics optimization becoming mainstream. Integration with smart city infrastructure and IoT devices will enhance service quality and operational efficiency. Blockchain technology adoption may improve supply chain transparency and payment processing capabilities.

Regulatory environment development will provide greater clarity and standardization for market participants. Government support for digital business development and entrepreneurship will continue creating favorable conditions for market growth. International trade agreements and cross-border commerce facilitation may enable regional expansion opportunities.

Consumer behavior evolution toward greater convenience orientation and digital service adoption will sustain market demand. Generational shifts toward mobile-first commerce and subscription-based services will influence platform development strategies. Environmental consciousness and sustainability preferences will drive operational practice changes and service offering modifications.

The Saudi Arabia Out Of Home delivery market demonstrates exceptional growth potential driven by favorable demographics, technology infrastructure, and government support initiatives. Market participants benefit from strong consumer adoption rates, expanding service categories, and geographic expansion opportunities that create sustainable competitive advantages.

Strategic success in this dynamic market requires focus on operational efficiency, technology innovation, and customer experience excellence. Platform differentiation through service quality, delivery speed, and merchant partnership quality creates sustainable market positions. Investment in logistics infrastructure and technology capabilities enables scalable growth and competitive advantage maintenance.

Future market development will be characterized by continued expansion, service diversification, and technology integration that enhances operational capabilities and customer satisfaction. According to MWR analysis, successful market participants will be those that adapt quickly to changing consumer preferences while maintaining operational excellence and financial sustainability. The market’s evolution toward greater sophistication and service integration positions Saudi Arabia as a leading regional market for OOH delivery services with significant long-term growth potential.

What is Out Of Home (OOH) Delivery?

Out Of Home (OOH) Delivery refers to the service of delivering food, beverages, and other products to consumers outside their homes, typically in public spaces or workplaces. This includes services like food trucks, kiosks, and delivery from restaurants to parks or offices.

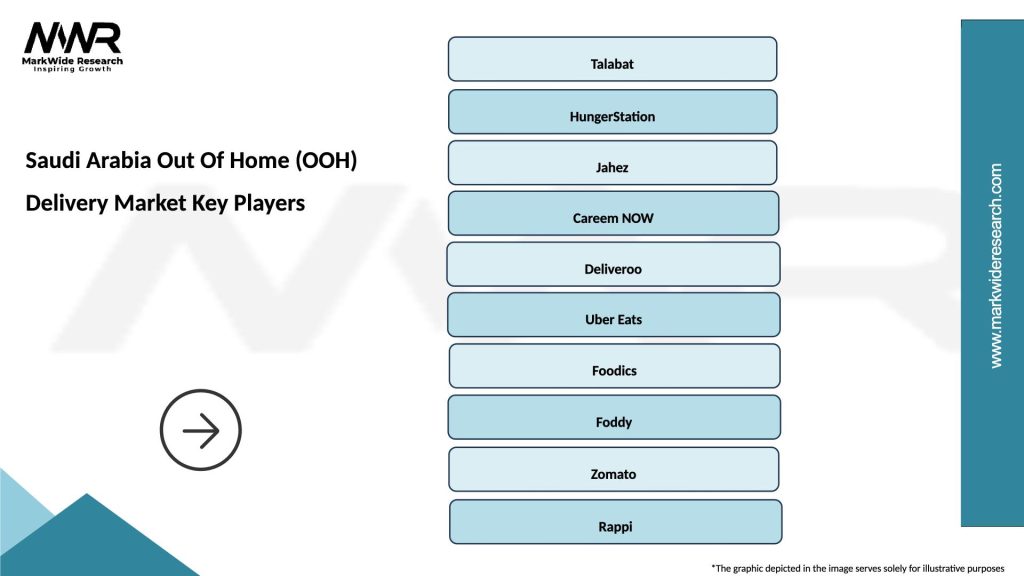

What are the key players in the Saudi Arabia Out Of Home (OOH) Delivery Market?

Key players in the Saudi Arabia Out Of Home (OOH) Delivery Market include companies like Talabat, HungerStation, and Jahez, which provide various delivery services across the region. These companies compete by offering diverse menus and efficient delivery options, among others.

What are the growth factors driving the Saudi Arabia Out Of Home (OOH) Delivery Market?

The growth of the Saudi Arabia Out Of Home (OOH) Delivery Market is driven by increasing urbanization, a growing preference for convenience among consumers, and the rise of digital platforms facilitating easy ordering. Additionally, the expansion of food and beverage options contributes to market growth.

What challenges does the Saudi Arabia Out Of Home (OOH) Delivery Market face?

Challenges in the Saudi Arabia Out Of Home (OOH) Delivery Market include intense competition among delivery services, regulatory hurdles, and logistical issues related to timely deliveries. These factors can impact service quality and customer satisfaction.

What opportunities exist in the Saudi Arabia Out Of Home (OOH) Delivery Market?

Opportunities in the Saudi Arabia Out Of Home (OOH) Delivery Market include the potential for partnerships with local businesses, the introduction of innovative delivery methods, and the expansion into underserved areas. These factors can enhance service reach and customer engagement.

What trends are shaping the Saudi Arabia Out Of Home (OOH) Delivery Market?

Trends in the Saudi Arabia Out Of Home (OOH) Delivery Market include the increasing use of mobile apps for ordering, a focus on sustainability in packaging, and the integration of AI for optimizing delivery routes. These trends are transforming how consumers interact with delivery services.

Saudi Arabia Out Of Home (OOH) Delivery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Ads, Street Furniture, Digital Displays |

| Customer Type | Advertisers, Brands, Agencies, Local Businesses |

| Technology | LED, LCD, Projection, Augmented Reality |

| Distribution Channel | Direct Sales, Online Platforms, Partnerships, Resellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Out Of Home (OOH) Delivery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at