444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Saudi Arabia methanol market stands as a pivotal segment within the global chemical industry, characterized by the production, consumption, and export of methanol—a versatile chemical compound with myriad industrial applications. Positioned as a key player in the methanol market landscape, Saudi Arabia boasts significant production capacity and strategic advantages, contributing to its prominence as a major methanol producer and exporter on the world stage.

Meaning

The Saudi Arabia methanol market revolves around the production, distribution, and utilization of methanol—a vital chemical compound derived from natural gas or other feedstocks via a catalytic process. Methanol finds extensive application across various industries, including chemicals, fuels, pharmaceuticals, and automotive, owing to its versatility and cost-effectiveness. Within the Saudi context, methanol serves as a cornerstone of the nation’s petrochemical sector, driving economic growth and industrial development.

Executive Summary

The Saudi Arabia methanol market epitomizes resilience and dynamism, fueled by robust demand from both domestic and international markets. With a strong emphasis on diversifying its economy and leveraging its abundant hydrocarbon resources, Saudi Arabia has emerged as a leading methanol producer, capitalizing on its strategic location, favorable investment climate, and advanced production infrastructure. Amidst evolving market dynamics and geopolitical shifts, understanding the key drivers, challenges, and opportunities within the Saudi methanol market is essential for industry stakeholders to navigate effectively and capitalize on emerging trends.

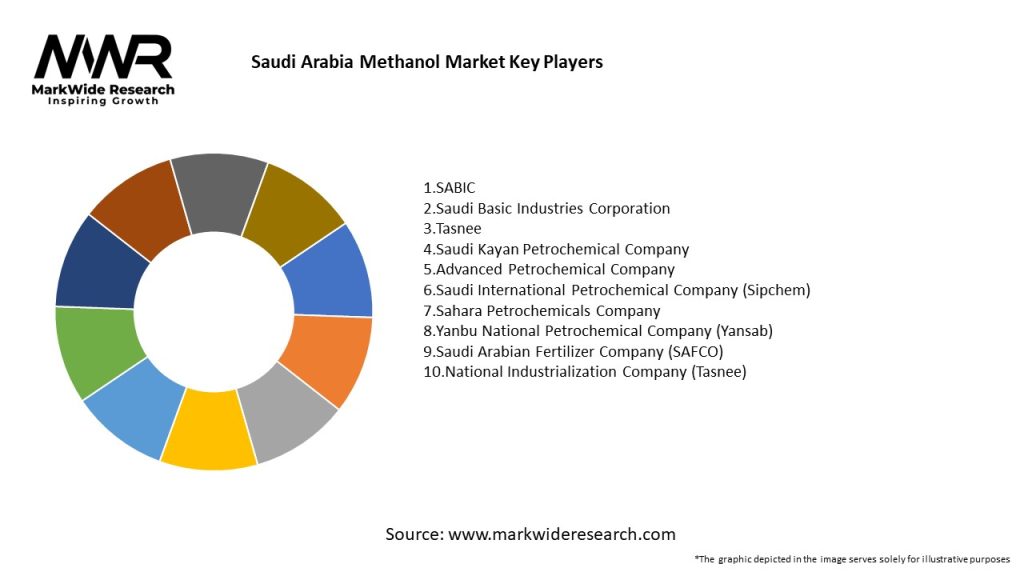

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Saudi Arabia methanol market operates within a dynamic landscape shaped by evolving regulatory frameworks, technological advancements, and shifting market dynamics. Navigating through these dynamics requires agility, innovation, and strategic foresight to capitalize on emerging opportunities and mitigate potential risks.

Regional Analysis

Competitive Landscape

Leading Companies in Saudi Arabia Methanol Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Saudi Arabia methanol market can be segmented based on various parameters, including production method, end-use industry, and distribution channel, enabling targeted market analysis and strategic decision-making to optimize market penetration and growth.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic exerted profound impacts on the Saudi methanol market, disrupting supply chains, dampening demand, and precipitating economic uncertainties. While temporary disruptions were witnessed, the resilience of the methanol industry and proactive mitigation measures helped mitigate adverse effects and foster recovery.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Saudi Arabia methanol market is poised for sustained growth and transformation, driven by robust domestic demand, strategic export opportunities, and investments in sustainable technologies. Despite challenges posed by global uncertainties and market dynamics, the resilience, adaptability, and innovation within the Saudi methanol industry bode well for its future trajectory and contribution to national economic development.

Conclusion

In conclusion, the Saudi Arabia methanol market represents a vital component of the nation’s chemical industry landscape, underpinned by abundant feedstock resources, strategic export infrastructure, and a conducive investment climate. Positioned as a global leader in methanol production and innovation, Saudi Arabia stands poised to capitalize on emerging opportunities, navigate through challenges, and emerge as a frontrunner in sustainable chemical manufacturing and industrial development. By embracing technological advancements, fostering collaborative partnerships, and prioritizing sustainability, the Saudi methanol industry can chart a course towards sustainable growth, resilience, and competitiveness in the global market arena.

What is Methanol?

Methanol is a colorless, volatile liquid that is used as a solvent, antifreeze, fuel, and as a feedstock for the production of chemicals. In Saudi Arabia, methanol is primarily produced from natural gas and is a key component in various industrial applications.

What are the key players in the Saudi Arabia Methanol Market?

Key players in the Saudi Arabia Methanol Market include Saudi Methanol Company (Ar-Razi), Methanol Chemicals Company (Chemanol), and SABIC. These companies are involved in the production and distribution of methanol for various applications, including energy and chemical manufacturing, among others.

What are the growth factors driving the Saudi Arabia Methanol Market?

The growth of the Saudi Arabia Methanol Market is driven by increasing demand for methanol in the production of formaldehyde, acetic acid, and as a fuel alternative. Additionally, the expansion of the petrochemical industry in the region contributes to the rising consumption of methanol.

What challenges does the Saudi Arabia Methanol Market face?

The Saudi Arabia Methanol Market faces challenges such as fluctuating natural gas prices and environmental regulations that may impact production processes. Additionally, competition from alternative fuels and chemicals can pose a threat to market stability.

What opportunities exist in the Saudi Arabia Methanol Market?

Opportunities in the Saudi Arabia Methanol Market include the potential for increased exports to emerging markets and the development of new applications in renewable energy. The growing interest in methanol as a clean fuel alternative also presents avenues for market expansion.

What trends are shaping the Saudi Arabia Methanol Market?

Trends in the Saudi Arabia Methanol Market include advancements in production technologies and a shift towards sustainable practices. There is also a growing focus on the use of methanol in fuel cells and as a hydrogen carrier, reflecting the global push for cleaner energy solutions.

Saudi Arabia Methanol Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fuel Grade, Chemical Grade, Industrial Grade, Food Grade |

| Application | Energy Production, Chemical Manufacturing, Agriculture, Automotive |

| End User | Manufacturers, Distributors, Retailers, Exporters |

| Delivery Mode | Bulk Transport, Container Shipping, Pipeline, Tanker Truck |

Leading Companies in Saudi Arabia Methanol Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at