444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia land-based fuel transportation market represents a critical component of the Kingdom’s energy infrastructure, facilitating the movement of petroleum products, refined fuels, and petrochemicals across vast geographical distances. This market encompasses various transportation modes including pipeline networks, tanker trucks, and rail transport systems that collectively ensure efficient fuel distribution throughout the country. The sector has experienced remarkable transformation driven by Saudi Arabia’s Vision 2030 initiative and the ongoing diversification of the energy sector.

Market dynamics indicate substantial growth potential, with the sector expanding at a robust CAGR of 6.2% over the forecast period. The Kingdom’s strategic position as a global energy hub, combined with increasing domestic fuel consumption and growing export activities, continues to drive demand for advanced transportation infrastructure. Technological innovations in pipeline monitoring, automated loading systems, and digital fleet management are revolutionizing traditional fuel transportation methods.

Infrastructure development remains a key focus area, with significant investments in expanding pipeline capacity and modernizing existing transportation networks. The market benefits from Saudi Arabia’s extensive refining capacity and the need to efficiently distribute products to domestic markets while maintaining export capabilities. Environmental considerations and safety regulations are increasingly influencing transportation methods and technology adoption across the sector.

The Saudi Arabia land-based fuel transportation market refers to the comprehensive network of infrastructure, services, and technologies used to transport liquid fuels, petroleum products, and related energy commodities across terrestrial routes within the Kingdom. This market encompasses the movement of various fuel types including crude oil, refined gasoline, diesel fuel, jet fuel, and petrochemical products through dedicated transportation systems.

Transportation modalities within this market include extensive pipeline networks that form the backbone of fuel distribution, road-based tanker truck operations for last-mile delivery and specialized routes, and emerging rail transport solutions for bulk fuel movement. The market also includes supporting infrastructure such as loading terminals, storage facilities, and distribution hubs that facilitate efficient fuel handling and transfer operations.

Operational scope covers both domestic distribution networks serving local markets, industrial facilities, and retail outlets, as well as export-oriented transportation systems connecting production facilities to international shipping terminals. The market integrates advanced technologies including pipeline monitoring systems, automated loading equipment, and digital logistics platforms to ensure safe, efficient, and environmentally compliant fuel transportation operations.

Strategic positioning of Saudi Arabia as a global energy leader drives the land-based fuel transportation market’s continued expansion and modernization. The Kingdom’s vast geographical expanse and distributed population centers necessitate sophisticated transportation networks to ensure reliable fuel supply across all regions. Government initiatives under Vision 2030 are accelerating infrastructure development and technological adoption throughout the sector.

Market growth is supported by increasing domestic energy consumption, with transportation fuel demand growing at 4.8% annually driven by population growth and economic diversification. The sector benefits from substantial investments in pipeline infrastructure, with new projects enhancing connectivity between production facilities, refineries, and distribution centers. Digital transformation initiatives are improving operational efficiency and safety standards across transportation networks.

Competitive landscape features a mix of state-owned enterprises, international logistics companies, and specialized fuel transportation providers. The market is characterized by ongoing consolidation and strategic partnerships aimed at expanding service capabilities and geographical coverage. Regulatory frameworks continue to evolve, emphasizing safety standards, environmental protection, and operational efficiency in fuel transportation operations.

Infrastructure expansion represents the most significant market driver, with pipeline capacity increasing by 15% over the past three years to meet growing transportation demands. The Kingdom’s strategic focus on developing integrated transportation networks is creating new opportunities for technology providers and logistics companies.

Economic diversification under Saudi Arabia’s Vision 2030 is creating substantial demand for enhanced fuel transportation infrastructure. The Kingdom’s ambitious industrial development projects, including NEOM and other mega-cities, require reliable fuel supply networks that drive investment in transportation capabilities. Population growth and urbanization trends are increasing domestic fuel consumption, necessitating expanded distribution networks.

Infrastructure modernization initiatives are accelerating market growth as aging transportation systems require upgrades and replacements. The government’s commitment to developing world-class energy infrastructure includes significant investments in pipeline networks, storage facilities, and distribution terminals. Technological advancement in transportation systems is improving efficiency and reducing operational costs, making infrastructure investments more attractive.

Export market expansion continues to drive demand for enhanced transportation capacity, particularly for refined products and petrochemicals. Saudi Arabia’s growing refining capacity requires sophisticated distribution networks to move products to international markets efficiently. Strategic partnerships with international energy companies are creating new transportation requirements and investment opportunities throughout the sector.

Capital intensity of fuel transportation infrastructure represents a significant barrier to market entry and expansion. The substantial investments required for pipeline construction, terminal development, and fleet acquisition limit participation to well-capitalized organizations. Regulatory complexity surrounding fuel transportation operations requires extensive compliance capabilities and specialized expertise.

Environmental regulations are becoming increasingly stringent, requiring costly upgrades to existing transportation systems and operational procedures. The need for advanced safety systems, emission control technologies, and environmental monitoring equipment adds significant costs to transportation operations. Technical complexity of modern fuel transportation systems requires specialized maintenance and operational expertise that may be limited in certain market segments.

Geopolitical considerations can impact transportation planning and investment decisions, particularly for cross-border and export-oriented infrastructure. Market concentration in certain geographical areas creates dependency risks and limits diversification opportunities for transportation operators. Seasonal demand variations can create capacity utilization challenges and impact the economic viability of certain transportation investments.

Digital transformation presents significant opportunities for improving operational efficiency and creating new service offerings in fuel transportation. The integration of IoT sensors, artificial intelligence, and predictive analytics can optimize transportation routes, reduce maintenance costs, and enhance safety performance. Automation technologies offer potential for reducing labor costs and improving operational consistency across transportation networks.

Renewable energy integration is creating new transportation requirements for biofuels, hydrogen, and other alternative energy carriers. The Kingdom’s commitment to renewable energy development under Vision 2030 will require specialized transportation infrastructure and capabilities. Circular economy initiatives are driving demand for waste-to-fuel transportation services and reverse logistics capabilities.

Regional expansion opportunities exist as Saudi Arabia strengthens energy partnerships with neighboring countries and develops cross-border transportation infrastructure. The Kingdom’s strategic location provides opportunities to serve as a regional energy hub, requiring enhanced transportation connectivity. Public-private partnerships offer mechanisms for accelerating infrastructure development while sharing investment risks and operational responsibilities.

Supply chain integration is reshaping the fuel transportation landscape as companies seek to optimize end-to-end logistics operations. The trend toward vertical integration among energy companies is creating demand for comprehensive transportation solutions that span from production to final delivery. Collaborative logistics models are emerging as companies share transportation infrastructure and resources to improve efficiency and reduce costs.

Technology convergence is enabling new operational models and service offerings in fuel transportation. The integration of satellite monitoring, blockchain technology, and mobile applications is creating more transparent and efficient transportation operations. Data analytics capabilities are enabling predictive maintenance, route optimization, and demand forecasting that improve overall system performance.

Regulatory evolution continues to shape market dynamics as authorities implement new safety, environmental, and operational standards. The emphasis on sustainability and carbon footprint reduction is driving adoption of cleaner transportation technologies and operational practices. International standards alignment is improving interoperability and facilitating cross-border transportation operations.

Comprehensive analysis of the Saudi Arabia land-based fuel transportation market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, government officials, and transportation operators to gather firsthand insights into market dynamics and trends. Secondary research encompasses analysis of government publications, industry reports, and regulatory documents to understand policy frameworks and market structure.

Data collection processes involve systematic gathering of operational statistics, infrastructure capacity data, and investment information from various industry sources. Market modeling techniques are applied to analyze transportation flows, capacity utilization, and demand patterns across different geographical regions and fuel types. Competitive intelligence gathering includes analysis of major market participants, their service offerings, and strategic positioning.

Validation procedures ensure data accuracy through cross-referencing multiple sources and expert review processes. MarkWide Research employs rigorous quality control measures to verify statistical data and market projections. Trend analysis incorporates historical data patterns, current market conditions, and forward-looking indicators to develop comprehensive market insights and forecasts.

Eastern Province dominates the Saudi Arabia land-based fuel transportation market, accounting for 58% of total transportation activity due to the concentration of oil production facilities, refineries, and export terminals. The region benefits from extensive pipeline infrastructure connecting major production sites to processing facilities and distribution centers. Dammam and Jubail serve as critical transportation hubs with sophisticated loading and storage facilities.

Central Region represents 25% of market activity, driven primarily by domestic fuel distribution requirements for the Riyadh metropolitan area and surrounding industrial zones. The region’s transportation network focuses on delivering refined products from coastal refineries to inland consumption centers. Infrastructure development in this region emphasizes pipeline connectivity and strategic storage facilities to ensure supply security.

Western Region accounts for 12% of transportation volume, with activities centered around the Jeddah and Yanbu industrial complexes. The region serves as an important gateway for fuel exports through Red Sea ports and supports domestic distribution to western population centers. Northern and Southern Regions collectively represent the remaining 5% of market activity, with growing importance as new industrial projects and population centers develop in these areas.

Market leadership is characterized by a combination of state-owned enterprises and international logistics companies that provide comprehensive fuel transportation services. The competitive environment emphasizes operational excellence, safety performance, and technological innovation as key differentiating factors.

By Transportation Mode: The market segments into pipeline transportation, which dominates with the largest market share due to efficiency and cost-effectiveness for long-distance fuel movement. Road transportation serves critical last-mile delivery functions and specialized routes where pipeline access is limited. Rail transportation represents an emerging segment with growing importance for bulk fuel movement and intermodal logistics solutions.

By Fuel Type: Crude oil transportation constitutes the largest segment, moving raw materials from production sites to refineries and export terminals. Refined products including gasoline, diesel, and jet fuel represent significant transportation volumes for domestic distribution and export markets. Petrochemical products require specialized transportation capabilities due to their unique handling requirements and safety considerations.

By End-User: Industrial customers including power plants, manufacturing facilities, and petrochemical complexes represent major transportation demand. Commercial users such as fuel retailers, distributors, and logistics companies require reliable transportation services. Export operations constitute a growing segment as Saudi Arabia expands its refined product and petrochemical export capabilities.

Pipeline Transportation: This category dominates the market with superior efficiency and cost-effectiveness for high-volume, long-distance fuel movement. Recent investments in smart pipeline technology have enhanced monitoring capabilities and operational safety. Capacity expansion projects are addressing growing transportation demands while incorporating advanced leak detection and automated control systems.

Road Transportation: The tanker truck segment provides essential flexibility and accessibility for fuel distribution to locations not served by pipeline infrastructure. Fleet modernization initiatives are improving safety standards and operational efficiency through advanced vehicle technologies. Digital fleet management systems are optimizing route planning and reducing operational costs.

Specialized Transportation: This category includes heated product transportation, hazardous material handling, and multi-product pipeline operations that require specialized equipment and expertise. Technology integration is enhancing safety and operational capabilities in these specialized applications. Regulatory compliance requirements drive continuous improvement in specialized transportation services.

Operational Efficiency: Advanced fuel transportation systems provide significant cost savings through optimized routing, reduced handling requirements, and improved asset utilization. Integrated logistics platforms enable better coordination between transportation modes and improved supply chain visibility. Automated systems reduce labor costs and improve operational consistency across transportation networks.

Safety Enhancement: Modern transportation infrastructure incorporates advanced safety systems that significantly reduce the risk of accidents and environmental incidents. Real-time monitoring capabilities enable immediate response to operational anomalies and potential safety issues. Training programs and safety protocols ensure high standards of operational safety across all transportation activities.

Market Access: Comprehensive transportation networks provide reliable access to domestic and international markets for fuel products. Strategic infrastructure positioning enables efficient distribution to key consumption centers and export terminals. Flexible transportation options allow adaptation to changing market conditions and customer requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization Revolution: The integration of digital technologies is transforming fuel transportation operations through real-time monitoring, predictive maintenance, and automated control systems. IoT sensors and satellite connectivity are enabling unprecedented visibility into transportation operations and asset performance. Data analytics platforms are optimizing transportation routes and improving operational efficiency across the entire supply chain.

Sustainability Focus: Environmental considerations are driving adoption of cleaner transportation technologies and operational practices throughout the industry. Carbon footprint reduction initiatives are influencing transportation mode selection and infrastructure investment decisions. Circular economy principles are creating new opportunities for waste-to-fuel transportation and reverse logistics services.

Infrastructure Modernization: Aging transportation infrastructure is being upgraded with advanced materials, smart monitoring systems, and automated control capabilities. Modular construction approaches are reducing infrastructure development timelines and costs. Resilience planning is becoming increasingly important in infrastructure design and operational planning.

Major Infrastructure Projects: Saudi Arabia has announced several mega-infrastructure projects that will significantly expand fuel transportation capacity and capabilities. The East-West Pipeline expansion project will increase crude oil transportation capacity and enhance export capabilities. New terminal facilities are being developed to support growing petrochemical exports and domestic distribution requirements.

Technology Partnerships: Strategic partnerships between Saudi companies and international technology providers are accelerating the adoption of advanced transportation technologies. Digital transformation initiatives are being implemented across major transportation networks to improve efficiency and safety. Research and development collaborations are focusing on next-generation transportation solutions and alternative fuel handling capabilities.

Regulatory Updates: New safety and environmental regulations are being implemented to enhance transportation standards and operational practices. International standards alignment is improving interoperability and facilitating cross-border transportation operations. Licensing frameworks are being updated to accommodate new technologies and service models in fuel transportation.

Investment Prioritization: MarkWide Research recommends focusing investment on digital infrastructure and advanced monitoring systems that can provide immediate operational benefits and long-term competitive advantages. Pipeline capacity expansion should be prioritized in high-growth regions to meet increasing transportation demands. Safety system upgrades represent essential investments that reduce operational risks and ensure regulatory compliance.

Technology Adoption: Companies should accelerate adoption of predictive analytics and artificial intelligence to optimize transportation operations and reduce maintenance costs. Blockchain technology implementation can improve supply chain transparency and reduce administrative costs. Mobile applications and digital platforms should be developed to enhance customer service and operational coordination.

Strategic Partnerships: Collaboration with technology providers, international logistics companies, and government agencies can accelerate capability development and market expansion. Joint ventures may be appropriate for large infrastructure projects that require substantial capital investment. Knowledge sharing partnerships can help develop local expertise and technical capabilities.

Growth Trajectory: The Saudi Arabia land-based fuel transportation market is positioned for sustained growth driven by continued economic diversification and infrastructure development under Vision 2030. MWR analysis indicates that transportation capacity will need to expand significantly to meet projected demand growth over the next decade. Technology integration will be critical for achieving the efficiency and safety improvements required to support market expansion.

Infrastructure Evolution: Future transportation networks will feature increased automation, enhanced connectivity, and improved environmental performance through advanced technologies and operational practices. Smart pipeline systems will become the standard for new infrastructure development, incorporating real-time monitoring and predictive maintenance capabilities. Intermodal transportation solutions will provide greater flexibility and efficiency in fuel distribution operations.

Market Transformation: The sector will experience significant transformation as alternative fuels, digital technologies, and sustainability requirements reshape transportation requirements and operational models. Regional integration will create new opportunities for cross-border transportation services and infrastructure development. Innovation ecosystems will emerge around major transportation hubs, fostering technology development and operational excellence.

The Saudi Arabia land-based fuel transportation market represents a dynamic and rapidly evolving sector that plays a crucial role in the Kingdom’s energy infrastructure and economic development. Strong fundamentals including substantial government investment, growing domestic demand, and expanding export capabilities position the market for continued growth and modernization. The sector’s transformation through digital technologies, infrastructure expansion, and operational excellence initiatives creates significant opportunities for industry participants and stakeholders.

Strategic positioning as a global energy hub, combined with ambitious Vision 2030 objectives, ensures continued investment and development in fuel transportation capabilities. The market’s evolution toward greater efficiency, enhanced safety, and improved environmental performance reflects broader industry trends and regulatory requirements. Technology adoption and infrastructure modernization will be critical success factors for companies operating in this competitive and rapidly changing market environment.

Future success in the Saudi Arabia land-based fuel transportation market will depend on the ability to adapt to changing market conditions, embrace technological innovation, and maintain the highest standards of operational excellence and safety performance. The sector’s continued development will support Saudi Arabia’s broader economic objectives while contributing to global energy security and supply chain efficiency.

What is Land-Based Fuel Transportation?

Land-Based Fuel Transportation refers to the methods and systems used to transport fuel via land routes, including road and rail networks. This encompasses various types of vehicles and infrastructure designed for the efficient movement of fuels such as gasoline, diesel, and natural gas.

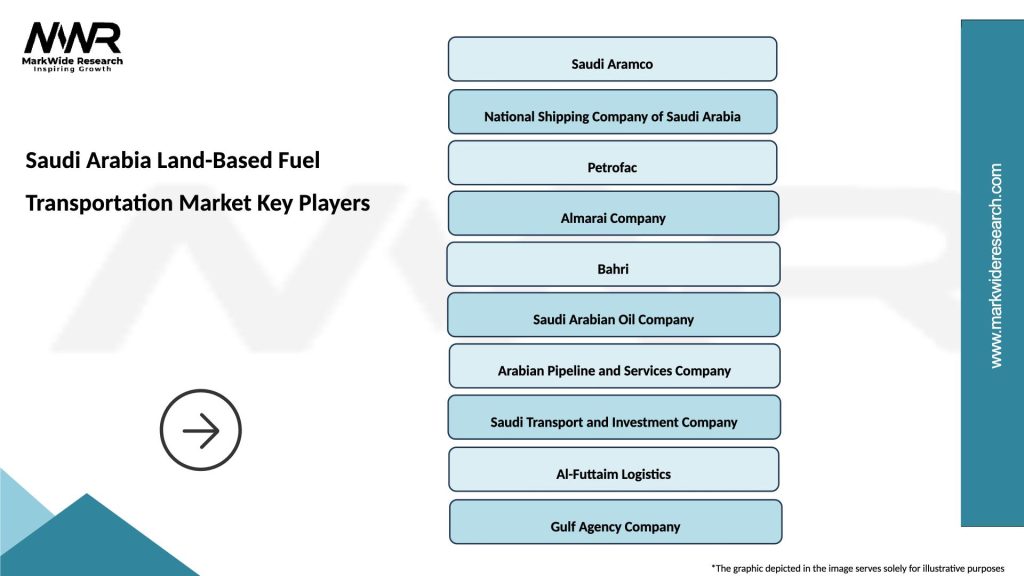

What are the key players in the Saudi Arabia Land-Based Fuel Transportation Market?

Key players in the Saudi Arabia Land-Based Fuel Transportation Market include Saudi Aramco, National Shipping Company of Saudi Arabia (Bahri), and Almarai Company, among others. These companies play significant roles in the logistics and distribution of fuel across the region.

What are the growth factors driving the Saudi Arabia Land-Based Fuel Transportation Market?

The growth of the Saudi Arabia Land-Based Fuel Transportation Market is driven by increasing fuel demand due to urbanization, expansion of the transportation sector, and government investments in infrastructure. Additionally, the rise in industrial activities contributes to the need for efficient fuel transportation solutions.

What challenges does the Saudi Arabia Land-Based Fuel Transportation Market face?

The Saudi Arabia Land-Based Fuel Transportation Market faces challenges such as regulatory compliance, fluctuating fuel prices, and the need for modernization of transportation infrastructure. These factors can impact operational efficiency and profitability for companies in the sector.

What opportunities exist in the Saudi Arabia Land-Based Fuel Transportation Market?

Opportunities in the Saudi Arabia Land-Based Fuel Transportation Market include the adoption of advanced technologies like GPS tracking and automated logistics systems. Additionally, the growing focus on sustainability and alternative fuels presents avenues for innovation and expansion.

What trends are shaping the Saudi Arabia Land-Based Fuel Transportation Market?

Trends shaping the Saudi Arabia Land-Based Fuel Transportation Market include the increasing use of digital technologies for fleet management and the shift towards greener transportation solutions. Moreover, the integration of smart logistics is enhancing operational efficiency and reducing environmental impact.

Saudi Arabia Land-Based Fuel Transportation Market

| Segmentation Details | Description |

|---|---|

| Fuel Type | Diesel, Gasoline, Biofuel, Ethanol |

| Vehicle Type | Trucks, Tankers, Buses, Vans |

| Service Type | Transportation, Storage, Distribution, Refueling |

| End User | Logistics Companies, Retailers, Government, Industrial Users |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Land-Based Fuel Transportation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at