444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia insulin drugs and delivery devices market represents a critical component of the Kingdom’s healthcare infrastructure, addressing the growing prevalence of diabetes mellitus among the population. Market dynamics indicate substantial growth potential driven by increasing diabetes incidence rates, government healthcare initiatives, and technological advancements in insulin delivery systems. The market encompasses various insulin formulations including rapid-acting, long-acting, and intermediate-acting insulin preparations, alongside sophisticated delivery devices such as insulin pens, pumps, and continuous glucose monitoring systems.

Healthcare transformation initiatives under Saudi Vision 2030 have significantly impacted the insulin market landscape, with increased focus on preventive care and chronic disease management. The market demonstrates robust expansion with a projected CAGR of 8.2% through the forecast period, reflecting the urgent need for comprehensive diabetes care solutions. Government investments in healthcare infrastructure and subsidized medication programs have enhanced market accessibility, while rising awareness about diabetes complications drives demand for advanced insulin delivery technologies.

Regional healthcare developments show increasing adoption of modern insulin delivery systems, with approximately 72% of diabetic patients now utilizing pen-based delivery devices compared to traditional vial and syringe methods. The market benefits from strong pharmaceutical distribution networks and growing healthcare professional expertise in diabetes management protocols.

The Saudi Arabia insulin drugs and delivery devices market refers to the comprehensive ecosystem of pharmaceutical products and medical devices designed for diabetes management within the Kingdom. This market encompasses insulin medications in various formulations, delivery mechanisms including pens, pumps, and syringes, plus supporting technologies such as glucose monitoring systems and needle safety devices.

Market scope includes both prescription insulin medications and over-the-counter delivery accessories, serving Type 1 and Type 2 diabetes patients across different age demographics. The definition extends to encompass biosimilar insulin products, innovative delivery technologies, and integrated diabetes management solutions that combine medication delivery with digital health monitoring capabilities.

Healthcare integration aspects involve coordination between pharmaceutical manufacturers, medical device companies, healthcare providers, and government health authorities to ensure comprehensive diabetes care delivery throughout Saudi Arabia’s healthcare system.

Strategic analysis reveals the Saudi Arabia insulin drugs and delivery devices market experiencing unprecedented growth driven by demographic shifts, lifestyle changes, and healthcare system modernization. The market demonstrates strong fundamentals with increasing diabetes prevalence rates reaching approximately 18.3% of the adult population, creating substantial demand for insulin therapy solutions.

Key market drivers include government healthcare spending increases, insurance coverage expansion, and growing awareness of diabetes complications. The market benefits from technological innovations in insulin delivery systems, with smart insulin pens and continuous glucose monitoring devices gaining significant traction among healthcare providers and patients.

Competitive landscape features established pharmaceutical giants alongside emerging biosimilar manufacturers, creating dynamic pricing pressures and innovation incentives. Market accessibility improvements through government subsidy programs have expanded patient reach, while digital health integration trends are reshaping traditional diabetes management approaches.

Future prospects indicate continued market expansion supported by population aging, urbanization trends, and increasing healthcare infrastructure investments. The market shows strong potential for value-based care models and personalized diabetes management solutions.

Market intelligence reveals several critical insights shaping the Saudi Arabia insulin drugs and delivery devices landscape:

Market segmentation analysis shows insulin pens commanding approximately 68% market share in delivery devices, while long-acting insulin formulations represent the fastest-growing pharmaceutical segment. These insights reflect evolving patient preferences toward convenient, effective diabetes management solutions.

Primary growth drivers propelling the Saudi Arabia insulin drugs and delivery devices market include demographic and lifestyle factors creating increased diabetes incidence. The Kingdom’s rapid urbanization and changing dietary patterns contribute significantly to rising Type 2 diabetes prevalence, while genetic predisposition factors affect Type 1 diabetes occurrence rates.

Government healthcare initiatives under Saudi Vision 2030 provide substantial market momentum through increased healthcare spending, infrastructure development, and preventive care programs. The National Transformation Program emphasizes chronic disease management, creating favorable conditions for insulin market expansion.

Technological advancement drivers include innovation in insulin delivery systems, smart device integration, and continuous glucose monitoring technologies. These developments improve patient compliance, treatment outcomes, and quality of life, driving market demand for advanced solutions.

Healthcare accessibility improvements through expanded insurance coverage, subsidized medication programs, and increased healthcare facility distribution enhance market penetration. Growing healthcare professional expertise in diabetes management protocols supports appropriate insulin therapy utilization.

Patient awareness campaigns and diabetes education programs increase understanding of treatment importance, complications prevention, and available therapy options, driving informed healthcare decisions and treatment adherence.

Cost considerations represent significant market restraints, particularly for advanced insulin delivery devices and continuous glucose monitoring systems. Despite government subsidies, out-of-pocket expenses for premium diabetes management technologies remain substantial for many patients.

Healthcare infrastructure limitations in remote regions create access challenges for specialized diabetes care and advanced insulin delivery systems. Rural healthcare facilities may lack necessary expertise and resources for comprehensive diabetes management programs.

Cultural factors and traditional medicine preferences sometimes conflict with modern insulin therapy approaches, creating patient compliance challenges. Social stigma associated with diabetes diagnosis and insulin dependency can delay treatment initiation and adherence.

Regulatory complexities surrounding new insulin formulations and delivery device approvals can slow market entry for innovative products. Import regulations and quality control requirements may create supply chain challenges for international manufacturers.

Healthcare professional training gaps in advanced diabetes management techniques and new technology utilization can limit optimal treatment delivery and patient outcomes, affecting market growth potential.

Digital health integration presents substantial opportunities for market expansion through connected insulin delivery devices, mobile health applications, and telemedicine platforms. These technologies enable remote patient monitoring, treatment optimization, and improved healthcare provider communication.

Biosimilar insulin development opportunities offer cost-effective alternatives to branded products, potentially expanding market accessibility while maintaining therapeutic efficacy. Government support for biosimilar adoption creates favorable market conditions for manufacturers.

Preventive care programs expansion opportunities include early diabetes screening, pre-diabetes intervention, and lifestyle modification support services. These initiatives can reduce long-term healthcare costs while improving patient outcomes.

Healthcare infrastructure development in underserved regions creates opportunities for market expansion and improved diabetes care delivery. Mobile health clinics and telemedicine solutions can bridge geographic access gaps.

Public-private partnerships opportunities exist for diabetes education programs, research initiatives, and innovative care delivery models. Collaboration between government agencies, healthcare providers, and pharmaceutical companies can accelerate market development.

Personalized medicine approaches offer opportunities for tailored insulin therapy regimens based on genetic factors, lifestyle patterns, and individual response characteristics, potentially improving treatment outcomes and patient satisfaction.

Supply chain dynamics in the Saudi Arabia insulin drugs and delivery devices market reflect complex interactions between international pharmaceutical manufacturers, local distributors, healthcare providers, and regulatory authorities. MarkWide Research analysis indicates increasing supply chain resilience through diversified sourcing strategies and local manufacturing initiatives.

Pricing dynamics demonstrate government influence through subsidy programs and price regulation mechanisms, balancing patient affordability with manufacturer sustainability. Market competition between branded and biosimilar products creates downward pricing pressure while maintaining quality standards.

Innovation dynamics show accelerating technology adoption rates, with approximately 45% of newly diagnosed patients starting treatment with advanced delivery devices rather than traditional methods. This trend reflects growing healthcare provider confidence in modern diabetes management technologies.

Regulatory dynamics involve evolving approval processes for new insulin formulations and delivery devices, with streamlined pathways for proven technologies while maintaining safety standards. Government initiatives support faster access to innovative diabetes management solutions.

Patient behavior dynamics indicate increasing acceptance of insulin therapy and willingness to adopt new delivery technologies, driven by education programs and improved treatment outcomes. Healthcare provider recommendations significantly influence patient technology choices.

Comprehensive research approach utilized multiple data collection methods including primary research through healthcare provider interviews, patient surveys, and pharmaceutical industry stakeholder consultations. Secondary research incorporated government health statistics, medical literature reviews, and industry reports analysis.

Data validation processes involved cross-referencing multiple sources, expert panel reviews, and statistical analysis to ensure accuracy and reliability. Market sizing methodologies utilized bottom-up and top-down approaches for comprehensive market assessment.

Primary research components included structured interviews with endocrinologists, diabetes educators, hospital administrators, and pharmaceutical executives across major Saudi Arabian cities. Patient focus groups provided insights into treatment preferences and technology adoption patterns.

Secondary research encompassed analysis of Ministry of Health statistics, Saudi Food and Drug Authority reports, pharmaceutical import data, and international diabetes management guidelines. Academic research and clinical studies provided therapeutic efficacy and safety data.

Market modeling techniques incorporated demographic projections, epidemiological trends, healthcare spending patterns, and technology adoption curves to develop comprehensive market forecasts and scenario analysis.

Riyadh region dominates the Saudi Arabia insulin drugs and delivery devices market, accounting for approximately 35% of total market share due to high population density, advanced healthcare infrastructure, and concentration of specialized diabetes centers. The region benefits from government healthcare investments and proximity to major pharmaceutical distribution networks.

Eastern Province represents the second-largest market segment with strong growth potential driven by industrial development, expatriate population, and expanding healthcare facilities. The region shows increasing adoption of advanced insulin delivery technologies among healthcare providers.

Makkah region demonstrates significant market presence supported by religious tourism, urban population growth, and healthcare infrastructure development. The region benefits from government investments in healthcare capacity expansion and diabetes care programs.

Western regions including Jeddah show growing market penetration with approximately 22% regional market share, driven by commercial activity, international healthcare standards adoption, and increasing diabetes awareness programs.

Northern and Southern regions represent emerging market opportunities with government initiatives to improve healthcare access and diabetes care delivery in underserved areas. Mobile health programs and telemedicine solutions support market expansion in these regions.

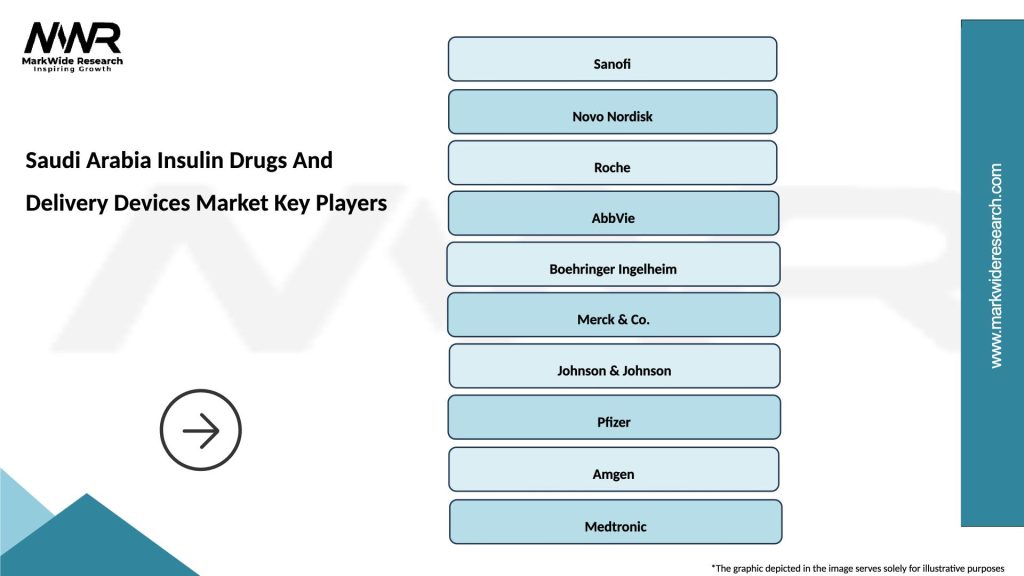

Market leadership in the Saudi Arabia insulin drugs and delivery devices sector features established pharmaceutical companies with strong local presence and comprehensive product portfolios:

Competitive strategies focus on product innovation, healthcare provider education, patient support programs, and strategic partnerships with local healthcare institutions. Companies invest significantly in clinical research and regulatory compliance to maintain market position.

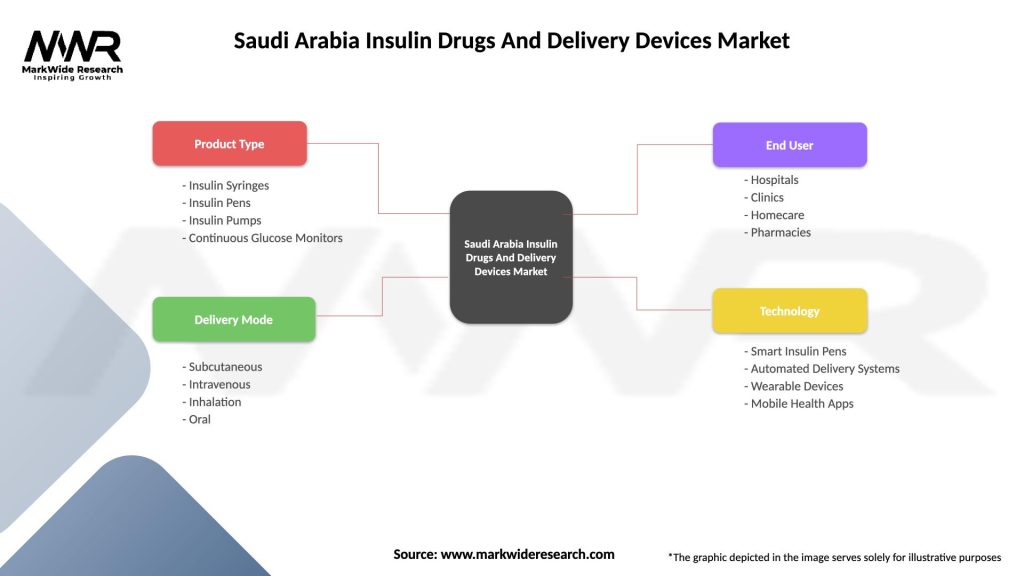

By Product Type:

By Insulin Type:

By Delivery Method:

By End User:

Insulin drugs category demonstrates strong growth with long-acting insulin formulations showing the highest demand increase, driven by improved patient compliance and reduced injection frequency. Biosimilar insulin products gain market acceptance with approximately 28% adoption rate among newly initiated patients, reflecting cost-effectiveness and therapeutic equivalence.

Delivery devices category shows rapid technological advancement with smart insulin pens incorporating dose tracking, reminder systems, and mobile app connectivity. Insulin pumps experience growing adoption among Type 1 diabetes patients, with continuous glucose monitor integration improving treatment outcomes.

Monitoring devices category benefits from technological innovation in continuous glucose monitoring systems, flash glucose monitoring, and smartphone-integrated devices. These technologies improve diabetes management through real-time glucose data and trend analysis capabilities.

Digital health integration across all categories creates comprehensive diabetes management ecosystems combining medication delivery, glucose monitoring, and data analytics. Healthcare providers increasingly recommend integrated solutions for optimal patient outcomes.

Patient preference trends favor convenient, discreet delivery methods with minimal lifestyle impact. Pen devices maintain popularity due to portability and ease of use, while pump therapy grows among patients requiring intensive insulin management.

Healthcare providers benefit from improved patient outcomes through advanced insulin delivery technologies, better glucose control, and reduced diabetes complications. Enhanced monitoring capabilities enable more precise treatment adjustments and proactive intervention strategies.

Patients experience improved quality of life through convenient delivery methods, reduced injection frequency, and better glucose management. Advanced technologies provide greater flexibility in daily activities while maintaining optimal diabetes control.

Pharmaceutical companies gain market opportunities through innovation in insulin formulations, delivery devices, and integrated diabetes management solutions. Strong market demand supports research and development investments in next-generation products.

Healthcare systems achieve cost efficiencies through reduced diabetes complications, improved patient compliance, and preventive care approaches. Early intervention and optimal treatment reduce long-term healthcare costs and resource utilization.

Government agencies advance public health objectives through improved diabetes care access, reduced disease burden, and enhanced healthcare system efficiency. Investment in diabetes management infrastructure supports broader healthcare transformation goals.

Technology companies find opportunities in digital health integration, data analytics, and connected device development. Collaboration with healthcare providers and pharmaceutical companies creates comprehensive diabetes management ecosystems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the Saudi Arabia insulin drugs and delivery devices market, with connected devices, mobile applications, and telemedicine platforms becoming integral components of diabetes management. Smart insulin pens with dose tracking and reminder capabilities show rapid adoption rates.

Personalized medicine trends focus on individualized insulin therapy regimens based on patient characteristics, lifestyle factors, and glucose response patterns. Healthcare providers increasingly utilize continuous glucose monitoring data to optimize treatment protocols.

Biosimilar adoption accelerates as healthcare systems seek cost-effective alternatives to branded insulin products while maintaining therapeutic efficacy. Government support for biosimilar utilization creates favorable market conditions for manufacturers and patients.

Integrated care models combine insulin therapy with comprehensive diabetes management services including nutrition counseling, exercise programs, and psychological support. These holistic approaches improve patient outcomes and treatment adherence.

Preventive care emphasis shifts focus toward early diabetes detection, pre-diabetes intervention, and lifestyle modification programs. Healthcare systems invest in screening programs and community health initiatives to reduce diabetes incidence.

Artificial intelligence integration in glucose monitoring and insulin dosing algorithms provides predictive analytics and automated treatment recommendations. These technologies enhance clinical decision-making and patient self-management capabilities.

Regulatory advancements include streamlined approval processes for biosimilar insulin products and innovative delivery devices, facilitating faster market access for new technologies. The Saudi Food and Drug Authority implements updated guidelines supporting diabetes care innovation.

Healthcare infrastructure expansion includes new specialized diabetes centers, upgraded hospital facilities, and enhanced primary care capabilities. Government investments in healthcare capacity support growing patient demand for diabetes services.

Technology partnerships between pharmaceutical companies and digital health firms create integrated diabetes management platforms combining medication delivery with monitoring and data analytics capabilities. These collaborations accelerate innovation and market development.

Research initiatives focus on next-generation insulin formulations, advanced delivery systems, and artificial intelligence applications in diabetes management. MWR data indicates increasing research and development investments by major market participants.

Educational programs expansion includes healthcare provider training, patient education initiatives, and community awareness campaigns. These programs improve diabetes care quality and treatment adherence rates across the Kingdom.

Supply chain optimization efforts include local manufacturing initiatives, strategic inventory management, and diversified sourcing strategies to ensure consistent product availability and reduce dependency on international suppliers.

Market participants should prioritize digital health integration and connected device development to capitalize on growing demand for comprehensive diabetes management solutions. Investment in mobile health platforms and data analytics capabilities will provide competitive advantages.

Healthcare providers should enhance diabetes care capabilities through staff training programs, technology adoption, and integrated care model implementation. Collaboration with pharmaceutical companies and technology firms can improve patient outcomes and operational efficiency.

Government agencies should continue supporting diabetes care through infrastructure investments, subsidy programs, and regulatory framework optimization. Focus on preventive care initiatives and underserved region access improvement will maximize public health impact.

Pharmaceutical companies should accelerate biosimilar development, expand patient support programs, and invest in innovative delivery technologies. Strategic partnerships with local healthcare providers and distributors will strengthen market position.

Technology companies should focus on diabetes-specific solutions including continuous glucose monitoring, insulin delivery automation, and predictive analytics platforms. Regulatory compliance and clinical validation will be critical for market success.

Healthcare investors should consider opportunities in diabetes technology companies, integrated care providers, and digital health platforms serving the Saudi Arabian market. Growing patient population and government support create favorable investment conditions.

Market projections indicate continued robust growth in the Saudi Arabia insulin drugs and delivery devices market, driven by demographic trends, healthcare system modernization, and technological advancement. The market is expected to maintain strong momentum with projected growth rates of 8.5% CAGR through the next decade.

Technology evolution will focus on artificial intelligence integration, automated insulin delivery systems, and predictive glucose management platforms. These innovations will transform diabetes care from reactive treatment to proactive management approaches.

Healthcare delivery models will increasingly emphasize integrated care, telemedicine, and patient-centered approaches. Digital health platforms will become standard components of diabetes management, improving access and outcomes across diverse patient populations.

Market accessibility will improve through continued government support, biosimilar adoption, and innovative financing models. Approximately 85% of diabetic patients are projected to have access to modern insulin delivery technologies within the next five years.

Regional development will focus on underserved areas through mobile health initiatives, telemedicine programs, and healthcare infrastructure expansion. These efforts will reduce geographic disparities in diabetes care access and quality.

Innovation pipeline includes next-generation insulin formulations, smart delivery devices, and integrated monitoring systems that will further improve patient outcomes and treatment convenience. Research investments continue to accelerate across all market segments.

The Saudi Arabia insulin drugs and delivery devices market represents a dynamic and rapidly evolving healthcare sector with substantial growth potential driven by increasing diabetes prevalence, government healthcare investments, and technological innovation. Market fundamentals remain strong with robust demand from a growing patient population and supportive regulatory environment.

Strategic opportunities exist across all market segments, from traditional insulin formulations to advanced digital health platforms. The convergence of pharmaceutical innovation, medical device technology, and digital health solutions creates comprehensive diabetes management ecosystems that improve patient outcomes while reducing healthcare costs.

Future success in this market will depend on stakeholder collaboration, continued innovation, and patient-centered care approaches. Healthcare providers, pharmaceutical companies, technology firms, and government agencies must work together to address the growing diabetes burden while ensuring sustainable, accessible, and effective treatment solutions for all Saudi Arabian patients requiring insulin therapy.

What is Insulin Drugs And Delivery Devices?

Insulin Drugs And Delivery Devices refer to the medications and tools used to manage diabetes by delivering insulin to patients. This includes various forms of insulin, such as rapid-acting and long-acting, as well as delivery devices like syringes, pens, and pumps.

What are the key players in the Saudi Arabia Insulin Drugs And Delivery Devices Market?

Key players in the Saudi Arabia Insulin Drugs And Delivery Devices Market include Novo Nordisk, Sanofi, and Eli Lilly, among others. These companies are known for their innovative products and extensive distribution networks in the region.

What are the growth factors driving the Saudi Arabia Insulin Drugs And Delivery Devices Market?

The growth of the Saudi Arabia Insulin Drugs And Delivery Devices Market is driven by the increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in insulin delivery technologies. Additionally, government initiatives to improve healthcare access contribute to market expansion.

What challenges does the Saudi Arabia Insulin Drugs And Delivery Devices Market face?

Challenges in the Saudi Arabia Insulin Drugs And Delivery Devices Market include high costs of advanced delivery devices, regulatory hurdles, and the need for patient education on diabetes management. These factors can hinder market growth and accessibility.

What opportunities exist in the Saudi Arabia Insulin Drugs And Delivery Devices Market?

Opportunities in the Saudi Arabia Insulin Drugs And Delivery Devices Market include the development of smart insulin delivery systems, increasing investment in healthcare infrastructure, and the potential for telemedicine solutions in diabetes management. These trends can enhance patient outcomes and market growth.

What trends are shaping the Saudi Arabia Insulin Drugs And Delivery Devices Market?

Trends shaping the Saudi Arabia Insulin Drugs And Delivery Devices Market include the rise of personalized medicine, the integration of digital health technologies, and the growing demand for biosimilar insulin products. These trends are expected to influence product development and patient care strategies.

Saudi Arabia Insulin Drugs And Delivery Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Syringes, Insulin Pens, Insulin Pumps, Continuous Glucose Monitors |

| Delivery Mode | Subcutaneous, Intravenous, Inhalation, Oral |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Technology | Smart Insulin Pens, Automated Delivery Systems, Wearable Devices, Mobile Health Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Insulin Drugs And Delivery Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at