444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Saudi Arabia health insurance market has witnessed significant growth in recent years. Health insurance, also known as medical insurance or healthcare coverage, plays a crucial role in providing financial protection to individuals and families against high healthcare expenses. It offers a range of benefits, including coverage for hospitalization, outpatient services, prescription medications, and preventive care.

Meaning

Health insurance refers to a contract between an individual or a group and an insurance company, where the insurer agrees to provide financial assistance for medical expenses in exchange for regular premium payments. It ensures that policyholders have access to quality healthcare services without worrying about the high costs associated with medical treatments and procedures.

Executive Summary

The Saudi Arabia health insurance market is experiencing steady growth due to various factors, including increasing awareness about the importance of health insurance, the growing population, and the government’s initiatives to improve healthcare infrastructure. This report provides valuable insights into the market, highlighting key trends, drivers, restraints, opportunities, and regional analysis.

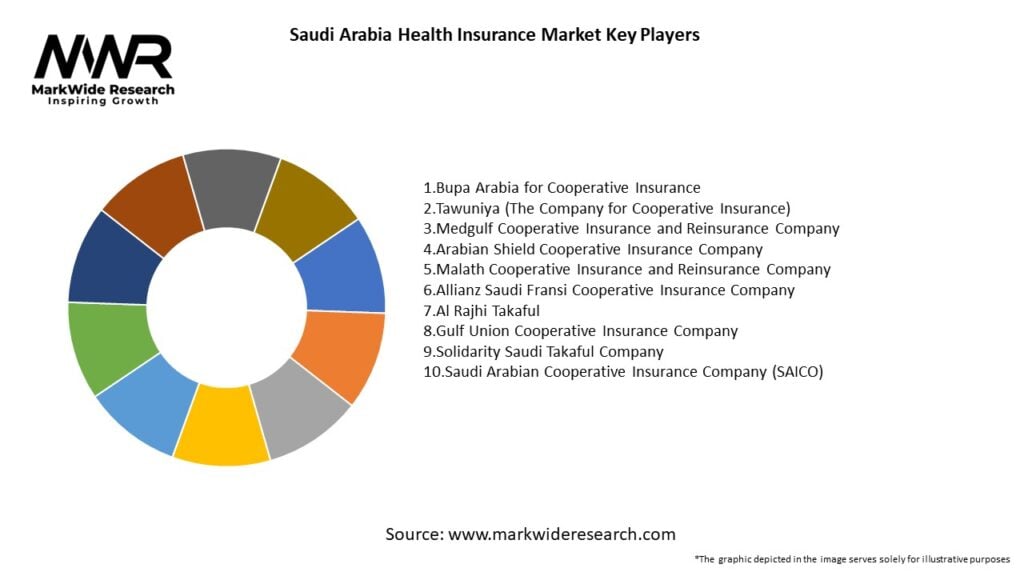

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Saudi Arabia health insurance market is characterized by intense competition among insurers, with players striving to offer innovative products and services to attract and retain customers. The market dynamics are influenced by factors such as changing customer preferences, advancements in technology, regulatory reforms, and demographic shifts.

Regional Analysis

The Saudi Arabia health insurance market exhibits regional variations in terms of market penetration and insurance coverage. The major regions contributing to the market include Riyadh, Jeddah, Mecca, Medina, and Dammam. These regions have well-established healthcare facilities and a higher concentration of insurance providers.

Competitive Landscape

Leading Companies in the Saudi Arabia Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Saudi Arabia health insurance market can be segmented based on the type of insurance plans, including individual health insurance, group health insurance, and government-sponsored health insurance. Furthermore, the market can also be segmented based on the distribution channel, such as insurance brokers, agents, and online platforms.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a profound impact on the Saudi Arabia health insurance market. The outbreak highlighted the importance of health insurance as individuals and businesses sought financial protection against the high costs of testing, treatment, and hospitalization. The pandemic also accelerated the adoption of digital health solutions, such as telemedicine and online claims processing, to ensure continuity of care and minimize in-person interactions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Saudi Arabia health insurance market looks promising, driven by factors such as increasing healthcare awareness, government support, technological advancements, and the rising demand for comprehensive coverage. The market is expected to witness continued growth, with insurers leveraging digital technologies, expanding their product portfolios, and collaborating with healthcare providers to meet evolving customer needs.

Conclusion

The Saudi Arabia health insurance market is experiencing significant growth, driven by factors such as mandatory health insurance schemes, increasing healthcare costs, and growing awareness among the population. Despite challenges related to limited coverage options and complex regulations, the market presents ample opportunities for insurers, healthcare providers, and stakeholders. By embracing digital transformation, focusing on preventive care, and tailoring insurance products, industry participants can thrive in this evolving landscape and contribute to improving healthcare access and outcomes in the country.

What is the Saudi Arabia health insurance?

The Saudi Arabia health insurance refers to the system of coverage that provides financial protection for medical expenses incurred by individuals in the country. It encompasses various plans and policies designed to meet the healthcare needs of residents and expatriates alike.

Who are the major players in the Saudi Arabia health insurance market?

Major players in the Saudi Arabia health insurance market include companies like Bupa Arabia, Tawuniya, and Medgulf, which offer a range of health insurance products and services. These companies compete to provide comprehensive coverage and innovative solutions to meet consumer demands, among others.

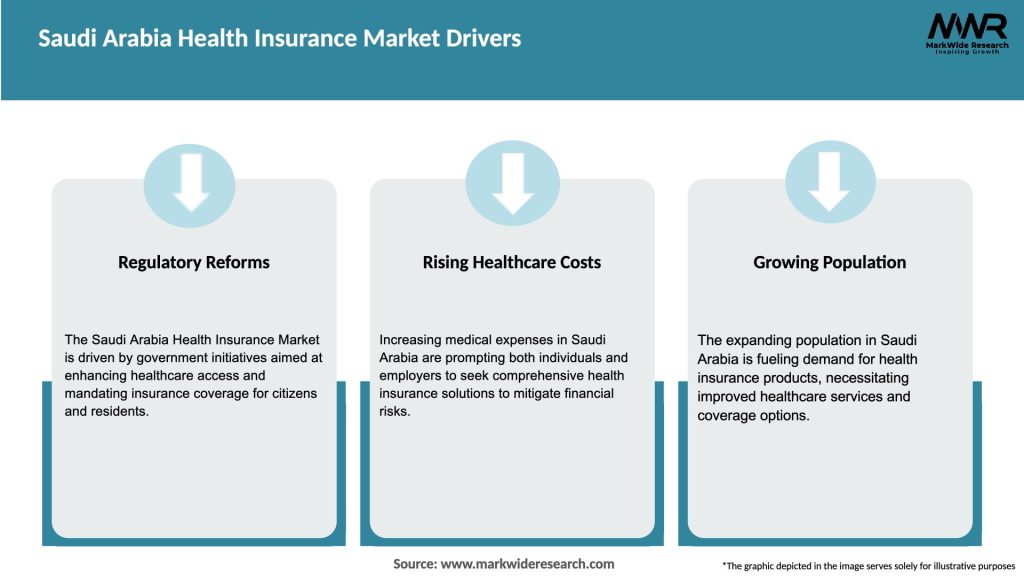

What are the key drivers of growth in the Saudi Arabia health insurance market?

Key drivers of growth in the Saudi Arabia health insurance market include the increasing population, rising healthcare costs, and government initiatives aimed at enhancing healthcare access. Additionally, the growing awareness of health insurance benefits among consumers contributes to market expansion.

What challenges does the Saudi Arabia health insurance market face?

The Saudi Arabia health insurance market faces challenges such as regulatory changes, high competition among insurers, and the need for improved customer service. These factors can impact profitability and customer retention in a rapidly evolving market.

What opportunities exist in the Saudi Arabia health insurance market?

Opportunities in the Saudi Arabia health insurance market include the potential for digital transformation, the introduction of innovative insurance products, and the expansion of coverage to underserved populations. These factors can enhance service delivery and customer engagement.

What trends are shaping the Saudi Arabia health insurance market?

Trends shaping the Saudi Arabia health insurance market include the increasing adoption of telemedicine, personalized health plans, and a focus on preventive care. These trends reflect a shift towards more consumer-centric healthcare solutions.

Saudi Arabia Health Insurance Market

| Segmentation | Details |

|---|---|

| Type | Individual Health Insurance, Group Health Insurance |

| Service Provider | Public, Private |

| Region | Saudi Arabia |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Saudi Arabia Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at