444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia delivery apps market represents one of the most dynamic and rapidly evolving sectors within the Kingdom’s digital transformation landscape. This market encompasses a comprehensive ecosystem of mobile applications facilitating food delivery, grocery delivery, pharmacy services, and general merchandise transportation across major cities including Riyadh, Jeddah, Dammam, and Mecca. The sector has experienced unprecedented growth, driven by changing consumer behaviors, government digitization initiatives, and the increasing adoption of smartphone technology among Saudi residents.

Market dynamics indicate that the delivery apps sector is experiencing robust expansion, with growth rates reaching 12.5% CAGR over recent years. This growth trajectory reflects the Kingdom’s Vision 2030 objectives, which emphasize digital innovation and e-commerce development. The market serves a diverse customer base ranging from young professionals seeking convenient meal options to families requiring comprehensive grocery delivery services.

Key market participants include both international platforms and homegrown Saudi applications, creating a competitive landscape that drives innovation and service quality improvements. The sector benefits from substantial smartphone penetration rates of approximately 85% among the Saudi population, providing a strong foundation for continued market expansion and user acquisition.

The Saudi Arabia delivery apps market refers to the comprehensive digital ecosystem of mobile applications and platforms that facilitate on-demand delivery services across various categories including food, groceries, pharmaceuticals, and consumer goods within the Kingdom of Saudi Arabia. These applications connect consumers with restaurants, retailers, and service providers through sophisticated technological platforms that enable ordering, payment processing, real-time tracking, and delivery coordination.

This market encompasses multiple service categories including restaurant food delivery, grocery and supermarket delivery, pharmacy and healthcare product delivery, electronics and consumer goods delivery, and specialized services such as flower delivery and gift services. The platforms typically operate through commission-based revenue models, subscription services, and delivery fee structures that create sustainable business ecosystems for all stakeholders.

The technological infrastructure supporting these applications includes advanced GPS tracking systems, artificial intelligence for route optimization, machine learning algorithms for demand prediction, and integrated payment gateways that support both traditional and digital payment methods popular in Saudi Arabia.

The Saudi Arabia delivery apps market stands as a cornerstone of the Kingdom’s digital economy transformation, demonstrating remarkable resilience and growth potential across multiple service verticals. The market’s evolution reflects broader societal shifts toward convenience-oriented consumption patterns and digital-first service expectations among Saudi consumers.

Food delivery services dominate the market landscape, accounting for approximately 60% of total delivery app transactions, while grocery delivery and pharmacy services represent rapidly growing segments with significant expansion potential. The market benefits from strong government support for digital transformation initiatives and favorable regulatory frameworks that encourage innovation and competition.

Consumer adoption patterns reveal strong preference for applications offering comprehensive service portfolios, competitive pricing structures, and reliable delivery timeframes. The market demonstrates particular strength in urban centers, with Riyadh and Jeddah representing the largest user bases and transaction volumes.

Investment activity in the sector remains robust, with both local and international investors recognizing the long-term growth potential of Saudi Arabia’s delivery apps market. The sector’s alignment with Vision 2030 objectives positions it favorably for continued expansion and technological advancement.

The Saudi Arabia delivery apps market reveals several critical insights that define its current trajectory and future potential:

Several key factors drive the continued expansion and evolution of Saudi Arabia’s delivery apps market, creating a favorable environment for sustained growth and innovation.

Digital transformation initiatives under Vision 2030 provide substantial momentum for delivery app adoption, with government programs actively promoting e-commerce development and digital service utilization. These initiatives include infrastructure investments, regulatory support, and public awareness campaigns that encourage digital service adoption across all demographic segments.

Changing lifestyle patterns among Saudi consumers, particularly younger demographics, create increasing demand for convenience-oriented services. Urbanization trends, longer working hours, and evolving family structures contribute to growing reliance on delivery services for daily necessities and meal solutions.

Smartphone penetration and internet connectivity improvements across the Kingdom provide the technological foundation necessary for widespread delivery app adoption. Enhanced 4G and emerging 5G networks support sophisticated app functionalities and real-time service delivery coordination.

Economic diversification efforts encourage entrepreneurship and small business development, creating opportunities for restaurants, retailers, and service providers to expand their reach through delivery platforms. This ecosystem development supports job creation and economic growth while enhancing service accessibility for consumers.

Despite strong growth potential, the Saudi Arabia delivery apps market faces several challenges that may impact expansion rates and operational efficiency across different service categories.

Regulatory compliance requirements create operational complexities for delivery platforms, particularly regarding food safety standards, business licensing, and cross-border payment processing. These requirements, while necessary for consumer protection, can increase operational costs and implementation timeframes for new market entrants.

Infrastructure limitations in certain regions, particularly smaller cities and rural areas, constrain market expansion potential. Limited address systems, traffic congestion in major cities, and parking restrictions can impact delivery efficiency and service quality standards.

Competition intensity among delivery platforms creates pricing pressures that may impact profitability and sustainability for market participants. Price wars and promotional campaigns, while beneficial for consumers, can strain platform economics and reduce investment capacity for service improvements.

Cultural preferences for traditional shopping experiences among certain demographic segments may limit adoption rates, particularly for grocery and personal care product categories where consumers prefer physical inspection before purchase.

The Saudi Arabia delivery apps market presents numerous opportunities for expansion, innovation, and value creation across multiple dimensions of service delivery and customer engagement.

Geographic expansion into smaller cities and emerging urban centers offers significant growth potential, with many regions currently underserved by comprehensive delivery platforms. These markets present opportunities for first-mover advantages and community-focused service development.

Service category diversification beyond traditional food and grocery delivery creates opportunities for platforms to capture larger shares of consumer spending. Categories such as pharmacy delivery, electronics, home services, and specialized products represent substantial untapped potential.

Technology integration opportunities include artificial intelligence for personalized recommendations, blockchain for supply chain transparency, and Internet of Things integration for smart delivery solutions. These technological advances can enhance service quality while creating competitive differentiation.

Partnership development with local businesses, government entities, and international brands can expand service offerings while supporting local economic development. Strategic partnerships can also facilitate market entry for international platforms seeking Saudi market access.

The interplay of various factors shapes the Saudi Arabia delivery apps market’s evolution, creating a complex ecosystem where technological innovation, consumer behavior, and regulatory frameworks converge to influence market outcomes.

Supply and demand dynamics demonstrate strong consumer appetite for delivery services, with demand often exceeding supply capacity during peak periods. This imbalance creates opportunities for new market entrants while encouraging existing platforms to expand their delivery networks and operational capabilities.

Competitive dynamics feature both collaboration and competition among market participants, with platforms sometimes partnering for logistics optimization while competing for customer acquisition and retention. This dynamic environment drives continuous innovation and service improvement initiatives.

Technological advancement cycles influence market evolution through regular introduction of new features, improved user interfaces, and enhanced operational efficiency tools. According to MarkWide Research analysis, platforms investing in advanced technology solutions demonstrate 18% higher customer retention rates compared to basic service providers.

Economic factors including oil prices, government spending, and consumer confidence levels impact market growth rates and spending patterns across different service categories. The market demonstrates resilience during economic fluctuations while maintaining growth momentum through service diversification.

Comprehensive market analysis of the Saudi Arabia delivery apps market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights across all market segments and geographic regions.

Primary research activities include structured interviews with industry executives, platform operators, restaurant partners, and consumer focus groups representing diverse demographic segments. These interviews provide qualitative insights into market trends, challenges, and opportunities from multiple stakeholder perspectives.

Secondary research components encompass analysis of public company financial reports, government statistics, industry publications, and regulatory documents. This research foundation supports quantitative analysis and trend identification across market segments.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews for clarification, and employing statistical analysis techniques to ensure data accuracy and reliability. Market sizing and growth projections undergo rigorous validation through multiple analytical approaches.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and competitive positioning analysis to provide comprehensive market understanding. These frameworks support strategic insights and recommendations for market participants and stakeholders.

The Saudi Arabia delivery apps market demonstrates significant regional variations in adoption rates, service preferences, and growth potential across different provinces and urban centers throughout the Kingdom.

Riyadh Province leads the market with approximately 35% of total market share, driven by high population density, strong economic activity, and advanced digital infrastructure. The capital city demonstrates the highest adoption rates for premium delivery services and innovative platform features.

Makkah Province including Jeddah represents the second-largest market segment, accounting for roughly 28% of market activity. This region shows particular strength in food delivery services and benefits from significant tourist and pilgrimage-related demand fluctuations.

Eastern Province centered around Dammam and Khobar captures approximately 20% market share, with strong industrial and expatriate communities driving demand for diverse delivery services. The region demonstrates high adoption rates for grocery and pharmacy delivery applications.

Emerging regions including Qassim, Asir, and Tabuk provinces represent growing opportunities with increasing smartphone penetration and urbanization trends. These markets show 22% annual growth rates in delivery app adoption, indicating substantial expansion potential for platform operators.

The competitive environment within Saudi Arabia’s delivery apps market features a diverse mix of international platforms, regional players, and local startups, each contributing unique value propositions and service capabilities.

Market positioning strategies vary significantly among competitors, with some focusing on price competitiveness while others emphasize service quality, delivery speed, or specialized offerings. This diversity creates a dynamic competitive environment that benefits consumers through improved services and competitive pricing.

The Saudi Arabia delivery apps market can be analyzed through multiple segmentation approaches that reveal distinct patterns in consumer behavior, service preferences, and growth opportunities across different market dimensions.

By Service Category:

By Delivery Model:

By Customer Segment:

Food delivery services maintain market leadership through strong consumer adoption and frequent usage patterns. This category benefits from diverse restaurant partnerships, competitive pricing strategies, and continuous service innovation. Growth drivers include expanding cuisine variety, improved delivery times, and enhanced food quality assurance measures.

Grocery delivery platforms demonstrate the highest growth potential, with increasing consumer acceptance of online grocery shopping and home delivery services. This segment benefits from partnerships with major supermarket chains, fresh product handling capabilities, and comprehensive product catalogs that meet diverse household needs.

Pharmacy delivery services represent a specialized but rapidly growing segment, driven by aging population demographics, chronic disease management needs, and convenience preferences for healthcare products. This category requires specialized handling, regulatory compliance, and professional consultation capabilities.

General merchandise delivery leverages existing e-commerce infrastructure to provide comprehensive product delivery services. This category benefits from integration with online shopping platforms, diverse product offerings, and competitive pricing structures that attract price-sensitive consumers.

Specialty delivery services including flowers, gifts, and seasonal products create opportunities for premium pricing and differentiated service offerings. These services often demonstrate higher profit margins while serving specific occasion-based demand patterns.

Delivery platform operators benefit from scalable business models that generate revenue through multiple streams including commission fees, delivery charges, and advertising revenues. The digital nature of these platforms enables rapid expansion, data-driven optimization, and efficient resource allocation across different markets and service categories.

Restaurant and retail partners gain access to expanded customer bases, increased sales volumes, and reduced marketing costs through platform partnerships. These collaborations enable small businesses to compete effectively with larger establishments while maintaining focus on core competencies in food preparation or product sourcing.

Consumers enjoy enhanced convenience, time savings, and access to diverse product and service options through comprehensive delivery platforms. The competitive market environment ensures competitive pricing, service quality improvements, and continuous innovation in user experience design.

Delivery personnel and logistics providers benefit from flexible employment opportunities, technology-enabled efficiency improvements, and growing demand for delivery services. The sector creates numerous job opportunities while supporting skill development in logistics, customer service, and technology utilization.

Government and regulatory bodies benefit from increased economic activity, tax revenue generation, and digital transformation advancement. The sector supports Vision 2030 objectives while creating opportunities for regulatory innovation and consumer protection framework development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a dominant trend, with platforms implementing AI-powered recommendation engines, demand forecasting, and route optimization systems. These technologies enhance user experience while improving operational efficiency and reducing delivery costs.

Sustainability initiatives gain prominence as platforms introduce eco-friendly packaging options, electric vehicle delivery fleets, and carbon offset programs. Consumer awareness of environmental impact drives demand for sustainable delivery solutions and corporate responsibility programs.

Hyperlocal service development focuses on neighborhood-specific offerings, local business partnerships, and community-centered service models. This trend supports local economic development while creating more personalized and culturally relevant service experiences.

Subscription model adoption increases across multiple service categories, with platforms offering monthly or annual subscription plans that provide delivery fee discounts, priority service, and exclusive access to promotions. These models improve customer retention while providing predictable revenue streams.

Voice commerce integration through smart speakers and voice assistants creates new ordering channels and enhances accessibility for diverse user groups. This trend aligns with broader smart home adoption and hands-free technology preferences.

Social commerce features including group ordering, social sharing, and community reviews enhance user engagement while leveraging social networks for customer acquisition and retention strategies.

Recent industry developments demonstrate the dynamic nature of Saudi Arabia’s delivery apps market, with continuous innovation, strategic partnerships, and service expansion initiatives shaping the competitive landscape.

Technology partnerships between delivery platforms and fintech companies have enhanced payment processing capabilities, introduced buy-now-pay-later options, and improved financial inclusion for underbanked consumers. These collaborations support broader digital economy development while expanding service accessibility.

Government initiatives including the Saudi Food and Drug Authority’s digital platform integration requirements have standardized food safety protocols while enabling better consumer protection and quality assurance across delivery services.

Investment activities from both local and international venture capital firms continue to support market expansion, with funding directed toward technology development, geographic expansion, and service diversification initiatives. MWR data indicates that investment in delivery platforms has increased by 40% year-over-year.

Strategic acquisitions and mergers among platform operators create opportunities for market consolidation, operational synergies, and enhanced service capabilities. These transactions often result in improved service quality and expanded geographic coverage for consumers.

Regulatory developments including updated business licensing requirements and consumer protection frameworks provide clearer operational guidelines while ensuring market stability and consumer confidence in delivery services.

Market participants should prioritize geographic expansion into underserved regions while maintaining service quality standards and operational efficiency. This expansion strategy requires careful market analysis, local partnership development, and culturally appropriate service adaptation.

Technology investment priorities should focus on artificial intelligence, machine learning, and automation technologies that enhance operational efficiency while improving user experience. These investments create competitive advantages and support long-term sustainability in an increasingly competitive market.

Partnership strategies with local businesses, government entities, and international brands can accelerate market penetration while supporting community development objectives. Strategic partnerships should align with Vision 2030 goals and create mutual value for all stakeholders.

Service diversification initiatives beyond traditional food delivery can capture larger shares of consumer spending while reducing dependence on single service categories. Successful diversification requires careful market research, operational capability development, and customer education programs.

Sustainability programs should be integrated into core business strategies to meet growing consumer expectations and regulatory requirements. These programs can create competitive differentiation while supporting corporate social responsibility objectives.

Data analytics capabilities should be enhanced to support personalized service offerings, predictive demand management, and operational optimization. Advanced analytics enable better decision-making while creating opportunities for new revenue streams through insights and advertising services.

The Saudi Arabia delivery apps market demonstrates strong potential for continued expansion and evolution, driven by technological advancement, changing consumer preferences, and supportive government policies aligned with Vision 2030 objectives.

Growth projections indicate sustained market expansion with delivery app adoption expected to reach 90% of smartphone users within the next five years. This growth will be supported by improved service quality, expanded geographic coverage, and enhanced technology integration across all platform categories.

Technology evolution will continue to reshape the market through artificial intelligence, autonomous delivery vehicles, and Internet of Things integration. These technological advances will improve delivery efficiency while creating new service possibilities and customer experience enhancements.

Market maturation will likely result in consolidation among smaller players while creating opportunities for specialized service providers and niche market segments. This evolution will benefit consumers through improved service quality and competitive pricing structures.

Regulatory frameworks will continue evolving to support market growth while ensuring consumer protection and fair competition. These developments will create clearer operational guidelines while encouraging innovation and investment in the sector.

International expansion opportunities may emerge for successful Saudi platforms seeking regional growth, while international players will continue evaluating market entry strategies. According to MarkWide Research projections, cross-border delivery services could capture 15% market share by 2028.

The Saudi Arabia delivery apps market represents a dynamic and rapidly evolving sector that plays a crucial role in the Kingdom’s digital transformation journey. The market demonstrates strong fundamentals including robust consumer demand, supportive government policies, and advanced technological infrastructure that collectively create favorable conditions for sustained growth and innovation.

Key success factors for market participants include technology investment, service quality maintenance, geographic expansion capabilities, and strategic partnership development. The competitive landscape rewards platforms that can effectively balance growth ambitions with operational efficiency while maintaining customer satisfaction and regulatory compliance.

Future market evolution will be shaped by technological advancement, changing consumer preferences, and regulatory developments that collectively create both opportunities and challenges for industry participants. The sector’s alignment with Vision 2030 objectives positions it favorably for continued government support and investment attraction.

The market’s contribution to economic diversification, job creation, and digital economy development makes it a strategic priority for stakeholders across the ecosystem. Continued collaboration between platform operators, government entities, and business partners will be essential for realizing the sector’s full potential while ensuring sustainable and inclusive growth that benefits all participants in Saudi Arabia’s delivery apps market.

What is Delivery Apps?

Delivery apps are mobile applications that facilitate the ordering and delivery of goods and services, primarily food and groceries, directly to consumers. They have gained significant popularity due to their convenience and efficiency in urban areas.

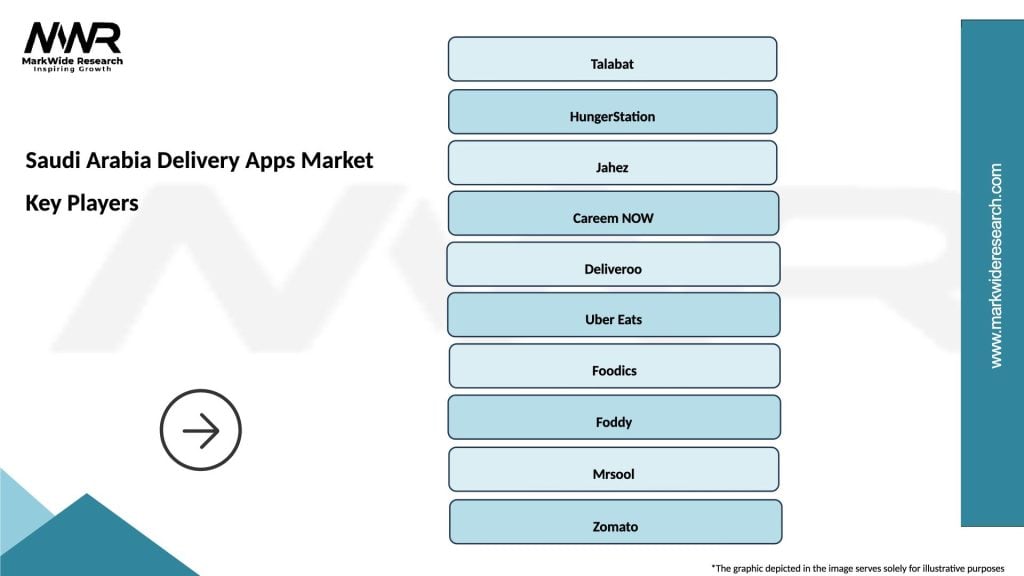

What are the key players in the Saudi Arabia Delivery Apps Market?

Key players in the Saudi Arabia Delivery Apps Market include Talabat, HungerStation, and Jahez, which offer a range of services from food delivery to grocery shopping. These companies compete on factors such as delivery speed, user experience, and service variety, among others.

What are the growth factors driving the Saudi Arabia Delivery Apps Market?

The growth of the Saudi Arabia Delivery Apps Market is driven by increasing smartphone penetration, a growing preference for online shopping, and the rising demand for convenience among consumers. Additionally, the expansion of restaurant partnerships enhances service offerings.

What challenges does the Saudi Arabia Delivery Apps Market face?

Challenges in the Saudi Arabia Delivery Apps Market include intense competition among existing players, regulatory hurdles, and the need for reliable logistics infrastructure. These factors can impact service quality and operational efficiency.

What opportunities exist in the Saudi Arabia Delivery Apps Market?

Opportunities in the Saudi Arabia Delivery Apps Market include the potential for expansion into underserved regions, the integration of advanced technologies like AI for personalized services, and the growing trend of subscription-based delivery models. These factors can enhance customer loyalty and market reach.

What trends are shaping the Saudi Arabia Delivery Apps Market?

Trends in the Saudi Arabia Delivery Apps Market include the rise of contactless delivery options, the incorporation of sustainability practices, and the increasing use of data analytics to improve customer experience. These trends reflect changing consumer preferences and technological advancements.

Saudi Arabia Delivery Apps Market

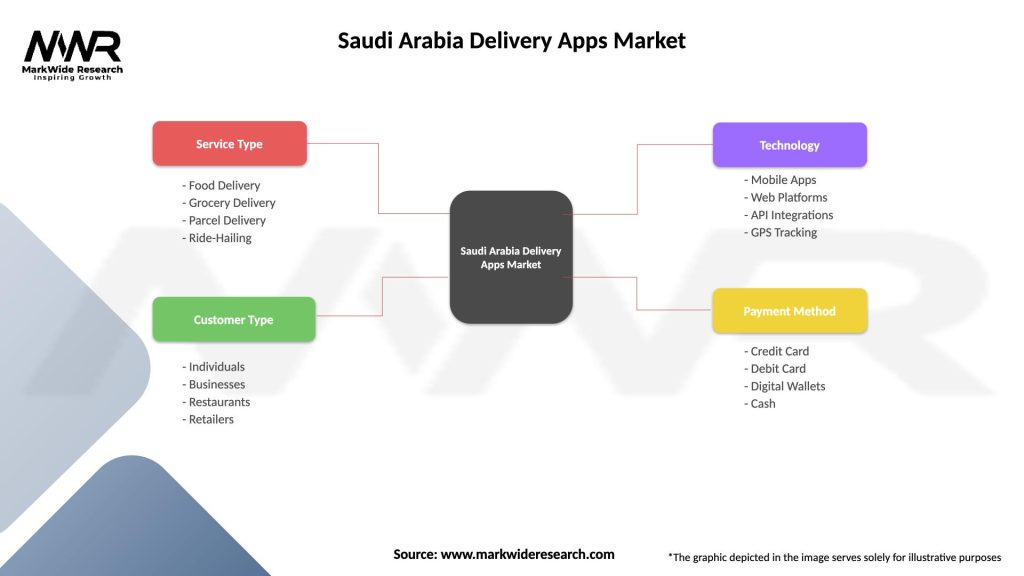

| Segmentation Details | Description |

|---|---|

| Service Type | Food Delivery, Grocery Delivery, Parcel Delivery, Ride-Hailing |

| Customer Type | Individuals, Businesses, Restaurants, Retailers |

| Technology | Mobile Apps, Web Platforms, API Integrations, GPS Tracking |

| Payment Method | Credit Card, Debit Card, Digital Wallets, Cash |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Delivery Apps Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at