444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia data center server market represents a rapidly expanding segment within the Kingdom’s ambitious digital transformation landscape. As part of Saudi Vision 2030, the country is experiencing unprecedented growth in digital infrastructure investments, driving substantial demand for advanced server technologies. The market encompasses various server types including rack servers, blade servers, tower servers, and micro servers, serving diverse applications across government, enterprise, and cloud service provider segments.

Digital transformation initiatives across Saudi Arabia are accelerating server adoption rates, with organizations modernizing their IT infrastructure to support cloud computing, artificial intelligence, and big data analytics. The market is characterized by increasing demand for high-performance computing solutions, energy-efficient server architectures, and scalable data center infrastructure. Government digitization programs and smart city projects are creating significant opportunities for server vendors and system integrators.

Cloud adoption in Saudi Arabia is driving server market growth at an impressive 12.5% CAGR, with hyperscale data centers and colocation facilities expanding rapidly. The Kingdom’s strategic location as a regional hub for digital services is attracting international cloud providers and telecommunications companies to establish local data center operations. Edge computing deployment is also gaining momentum, with organizations requiring distributed server infrastructure to support low-latency applications and IoT implementations.

The Saudi Arabia data center server market refers to the comprehensive ecosystem of server hardware, software, and related services deployed within data center facilities across the Kingdom. This market encompasses physical servers, virtualization platforms, server management software, and associated infrastructure components that enable organizations to process, store, and manage digital information efficiently.

Data center servers serve as the computational backbone for various applications including enterprise resource planning, customer relationship management, web hosting, cloud services, and high-performance computing workloads. The market includes both traditional on-premises server deployments and modern cloud-native architectures that support scalable, distributed computing environments.

Market dynamics in Saudi Arabia’s data center server segment are driven by accelerating digital transformation initiatives, government modernization programs, and increasing enterprise cloud adoption. The Kingdom’s commitment to becoming a regional technology hub is creating substantial opportunities for server vendors, system integrators, and managed service providers.

Key growth drivers include the expansion of hyperscale data centers, increasing demand for edge computing solutions, and the deployment of 5G networks requiring distributed server infrastructure. Organizations across sectors are investing in modern server technologies to support artificial intelligence, machine learning, and big data analytics applications. Energy efficiency has become a critical consideration, with 78% of organizations prioritizing green server technologies to reduce operational costs and environmental impact.

Competitive landscape features both international technology giants and regional system integrators competing for market share. The market is witnessing increased localization efforts, with vendors establishing regional partnerships and service capabilities to better serve Saudi customers. Government procurement represents a significant market segment, with public sector organizations modernizing their IT infrastructure to support digital government initiatives.

Strategic insights reveal several critical trends shaping the Saudi Arabia data center server market landscape:

Digital transformation acceleration serves as the primary catalyst driving Saudi Arabia’s data center server market expansion. Organizations across all sectors are modernizing their IT infrastructure to support digital business models, cloud computing adoption, and advanced analytics capabilities. The Kingdom’s Vision 2030 initiative emphasizes technology adoption and digital innovation, creating substantial demand for modern server infrastructure.

Government digitization programs are generating significant server procurement opportunities as public sector organizations implement e-government services, smart city platforms, and digital citizen services. The National Digital Transformation Program is driving systematic modernization of government IT infrastructure, requiring scalable server solutions to support citizen-facing applications and backend processing systems.

Cloud service provider expansion is creating substantial demand for hyperscale server deployments as international and regional cloud providers establish data center operations in Saudi Arabia. The growing enterprise adoption of cloud services, with 65% of organizations implementing hybrid cloud strategies, is driving demand for both public cloud infrastructure and private cloud server deployments.

Artificial intelligence and machine learning adoption across industries is driving demand for specialized server configurations including GPU-accelerated computing platforms and high-performance computing clusters. Organizations in sectors such as healthcare, finance, and energy are implementing AI-driven applications requiring advanced server infrastructure to support complex computational workloads.

High capital investment requirements present significant challenges for organizations considering server infrastructure modernization. The substantial upfront costs associated with enterprise-grade server hardware, software licensing, and implementation services can strain organizational budgets, particularly for small and medium enterprises seeking to upgrade legacy systems.

Skills shortage in server administration, virtualization, and cloud technologies creates implementation and operational challenges for organizations deploying modern server infrastructure. The limited availability of qualified IT professionals with expertise in advanced server technologies can delay project implementations and increase operational risks.

Regulatory compliance requirements related to data sovereignty, privacy protection, and cybersecurity standards can complicate server deployment strategies. Organizations must ensure their server infrastructure meets local regulatory requirements while maintaining compatibility with international standards and best practices.

Energy infrastructure limitations in certain regions may constrain data center expansion and server deployment density. Power availability, cooling requirements, and utility costs can impact the feasibility of large-scale server installations, particularly for energy-intensive high-performance computing applications.

Smart city initiatives across Saudi Arabia present substantial opportunities for server vendors and system integrators as municipalities implement IoT platforms, traffic management systems, and citizen services requiring distributed server infrastructure. The Kingdom’s commitment to developing smart urban environments creates demand for edge computing servers and centralized data processing capabilities.

NEOM and megaproject developments offer unique opportunities for deploying cutting-edge server technologies in greenfield environments. These large-scale development projects require comprehensive digital infrastructure including advanced server platforms to support smart building systems, autonomous transportation, and integrated city services.

Financial sector modernization is driving demand for high-performance server solutions as banks and financial institutions implement digital banking platforms, real-time payment systems, and regulatory compliance applications. The growing fintech ecosystem requires scalable server infrastructure to support innovative financial services and customer-facing applications.

Healthcare digitization presents opportunities for specialized server deployments supporting electronic health records, medical imaging, telemedicine, and healthcare analytics applications. The Kingdom’s focus on healthcare sector development creates demand for secure, compliant server infrastructure meeting healthcare industry requirements.

Supply chain dynamics in the Saudi Arabia data center server market are influenced by global semiconductor availability, international trade relationships, and local distribution capabilities. Organizations are increasingly focusing on supply chain resilience and vendor diversification to mitigate risks associated with component shortages and delivery delays.

Technology evolution continues to reshape market dynamics as organizations evaluate next-generation server architectures including ARM-based processors, composable infrastructure, and software-defined server platforms. The transition toward more flexible, scalable server solutions is driving changes in procurement strategies and vendor relationships.

Pricing pressures from increased competition and commoditization of standard server components are creating opportunities for organizations to upgrade infrastructure while managing costs. However, specialized server configurations for AI, high-performance computing, and edge applications command premium pricing due to their advanced capabilities.

Service integration is becoming increasingly important as organizations seek comprehensive solutions combining server hardware, software, implementation services, and ongoing support. The shift toward outcome-based service models is changing how vendors approach market opportunities and customer relationships.

Comprehensive market analysis for the Saudi Arabia data center server market employs multiple research methodologies to ensure accurate and actionable insights. Primary research includes structured interviews with key market participants including server vendors, system integrators, end-user organizations, and industry experts across various sectors.

Secondary research encompasses analysis of industry reports, government publications, vendor announcements, and market intelligence from technology research organizations. MarkWide Research analysts leverage proprietary databases and industry contacts to validate market trends and competitive dynamics.

Market sizing methodology utilizes bottom-up analysis based on server shipment data, pricing trends, and deployment patterns across different market segments. Cross-validation through top-down analysis ensures consistency and accuracy in market assessments and growth projections.

Trend analysis incorporates technology roadmaps, regulatory developments, and macroeconomic factors influencing server market dynamics. Scenario modeling helps identify potential market developments and their implications for various stakeholder groups.

Riyadh region dominates the Saudi Arabia data center server market, accounting for approximately 45% of total server deployments due to its concentration of government agencies, financial institutions, and major enterprises. The capital city hosts numerous data center facilities and serves as the primary hub for cloud service providers establishing regional operations.

Eastern Province represents a significant market segment driven by the oil and gas industry’s digital transformation initiatives and the presence of major industrial companies. The region’s focus on industrial automation and smart manufacturing is creating demand for specialized server configurations supporting operational technology applications.

Western Province including Jeddah and Mecca is experiencing growing server demand driven by the expansion of logistics, tourism, and retail sectors. The region’s role as a commercial hub and gateway for international trade is driving investments in e-commerce platforms and supply chain management systems requiring robust server infrastructure.

NEOM and northern regions present emerging opportunities for next-generation server deployments as mega-development projects progress. These greenfield developments offer opportunities to implement cutting-edge server technologies and sustainable data center designs from the ground up.

Market leadership in the Saudi Arabia data center server market is characterized by intense competition among international technology vendors and regional system integrators. Key players are establishing local partnerships and service capabilities to better serve Saudi customers and comply with localization requirements.

By Server Type: The market segments into rack servers, blade servers, tower servers, and micro servers, with rack servers maintaining the largest market share due to their versatility and scalability in data center environments. Blade servers are gaining traction in high-density deployments, while micro servers are emerging for edge computing applications.

By Processor Type: x86-based servers dominate the market, accounting for approximately 85% of deployments, while ARM-based and RISC-based servers are gaining interest for specialized applications. GPU-accelerated servers represent a growing segment driven by AI and machine learning workloads.

By Application: Enterprise applications, web hosting, cloud services, and high-performance computing represent the primary application segments. Cloud services are experiencing the fastest growth, driven by hyperscale data center expansion and enterprise cloud adoption.

By End-User: Government, telecommunications, banking and financial services, healthcare, education, and manufacturing sectors represent the key end-user segments. Government sector accounts for a significant portion of server procurement due to ongoing digitization initiatives.

Rack Servers: This category maintains market leadership due to standardization, scalability, and cost-effectiveness in data center deployments. Organizations prefer rack servers for their modularity and ability to support diverse workloads within standardized data center infrastructure. 2U and 4U rack servers are particularly popular for enterprise applications requiring balanced performance and density.

Blade Servers: Growing adoption in high-density computing environments where space and power efficiency are critical. Blade server deployments are increasing in hyperscale data centers and organizations requiring maximum compute density. The shared infrastructure model reduces costs and simplifies management for large-scale deployments.

Tower Servers: Primarily deployed in small to medium enterprises and remote office environments where dedicated data center space is limited. Tower servers offer cost-effective solutions for organizations with modest computing requirements and limited IT infrastructure.

Edge Servers: Emerging category driven by 5G deployment, IoT applications, and distributed computing requirements. Edge server deployments are increasing as organizations implement low-latency applications and distributed analytics capabilities closer to data sources and end users.

For Server Vendors: The expanding Saudi market offers substantial revenue opportunities through direct sales, channel partnerships, and service contracts. Vendors benefit from government digitization initiatives creating large-scale procurement opportunities and the growing enterprise adoption of modern server technologies.

For System Integrators: Increasing demand for complex server deployments creates opportunities for value-added services including design, implementation, and ongoing support. System integrators benefit from organizations seeking comprehensive solutions rather than standalone hardware purchases.

For End Users: Modern server technologies enable digital transformation, improved operational efficiency, and enhanced customer experiences. Organizations benefit from scalable infrastructure supporting business growth and innovation while reducing operational costs through energy-efficient designs.

For Service Providers: Growing demand for managed services, cloud hosting, and colocation creates opportunities for service providers to expand their offerings. Service providers benefit from organizations preferring operational expenditure models over capital investments in server infrastructure.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hyperconverged Infrastructure adoption is accelerating as organizations seek simplified server deployments combining compute, storage, and networking in integrated platforms. This trend is driven by the need for easier management, reduced complexity, and faster deployment times in modern data center environments.

Edge Computing Expansion is creating new server deployment patterns as organizations implement distributed computing architectures. Edge servers are being deployed closer to data sources and end users to support low-latency applications, IoT processing, and real-time analytics requirements.

Sustainability Focus is driving adoption of energy-efficient server technologies as organizations prioritize environmental responsibility and operational cost reduction. Green server initiatives are gaining momentum, with 72% of organizations considering energy efficiency as a primary selection criterion for new server purchases.

As-a-Service Models are transforming server procurement as organizations prefer operational expenditure models over capital investments. Server-as-a-Service offerings are expanding, providing organizations with flexible, scalable infrastructure without large upfront investments.

Major cloud providers are establishing regional data center presence in Saudi Arabia, driving substantial server deployments and creating opportunities for local partnerships. These developments include hyperscale facilities requiring thousands of servers and supporting infrastructure.

Government digitization initiatives are accelerating with multiple ministries and agencies modernizing their IT infrastructure. Recent developments include large-scale server procurement programs and the establishment of government cloud platforms requiring substantial server capacity.

5G network deployment is progressing rapidly, creating demand for edge computing infrastructure and distributed server deployments. Telecommunications operators are investing in server infrastructure to support 5G services and enable new applications requiring low-latency processing.

Artificial intelligence adoption is expanding across sectors, driving demand for GPU-accelerated servers and high-performance computing platforms. Organizations in healthcare, finance, and energy are implementing AI applications requiring specialized server configurations.

MarkWide Research analysts recommend that server vendors focus on developing local partnerships and service capabilities to better serve the Saudi market. Establishing regional presence through partnerships with local system integrators and service providers can improve market penetration and customer relationships.

Organizations considering server infrastructure investments should prioritize energy efficiency and scalability to support future growth requirements. Hybrid cloud strategies combining on-premises and cloud infrastructure can provide flexibility while managing costs and compliance requirements.

System integrators should invest in developing expertise in emerging technologies including edge computing, artificial intelligence, and hyperconverged infrastructure. These specialized capabilities will differentiate service providers in an increasingly competitive market.

Government agencies should consider standardization initiatives to improve procurement efficiency and reduce operational complexity. Establishing common server platforms and management frameworks can reduce costs and improve service delivery capabilities.

Market growth is expected to continue at a robust pace, driven by ongoing digital transformation initiatives and expanding cloud service adoption. The server market is projected to maintain strong growth momentum with increasing deployment of next-generation technologies and infrastructure modernization programs.

Technology evolution will continue shaping market dynamics as organizations adopt ARM-based processors, composable infrastructure, and software-defined server platforms. Edge computing deployments are expected to accelerate, with 40% of organizations planning edge server implementations within the next two years.

Sustainability initiatives will become increasingly important as organizations focus on reducing environmental impact and operational costs. Energy-efficient server technologies and sustainable data center designs will drive vendor innovation and customer selection criteria.

Service transformation will continue as organizations prefer managed services and as-a-service models over traditional hardware purchases. This trend will create opportunities for service providers while changing how vendors approach market opportunities and customer relationships.

The Saudi Arabia data center server market represents a dynamic and rapidly expanding segment driven by ambitious digital transformation initiatives, government modernization programs, and increasing enterprise cloud adoption. The Kingdom’s commitment to becoming a regional technology hub through Vision 2030 creates substantial opportunities for server vendors, system integrators, and service providers.

Key market drivers including hyperscale data center expansion, edge computing deployment, and artificial intelligence adoption are reshaping server requirements and creating demand for specialized configurations. Organizations across sectors are investing in modern server infrastructure to support digital business models and innovative applications.

Competitive dynamics favor vendors that can establish local presence, develop regional partnerships, and provide comprehensive solutions combining hardware, software, and services. The market’s evolution toward sustainability, edge computing, and as-a-service models will continue influencing vendor strategies and customer preferences, positioning Saudi Arabia as a key growth market in the regional data center server landscape.

What is Data Center Server?

Data Center Server refers to the specialized computing hardware used in data centers to manage, store, and process large volumes of data. These servers are designed for high performance, reliability, and scalability to support various applications and services.

What are the key players in the Saudi Arabia Data Center Server Market?

Key players in the Saudi Arabia Data Center Server Market include companies like Dell Technologies, Hewlett Packard Enterprise, and Cisco Systems, which provide a range of server solutions tailored for data center environments, among others.

What are the growth factors driving the Saudi Arabia Data Center Server Market?

The growth of the Saudi Arabia Data Center Server Market is driven by the increasing demand for cloud computing services, the rise in data generation from various sectors, and the government’s initiatives to enhance digital infrastructure.

What challenges does the Saudi Arabia Data Center Server Market face?

Challenges in the Saudi Arabia Data Center Server Market include high operational costs, the need for skilled workforce, and concerns regarding data security and compliance with regulations.

What opportunities exist in the Saudi Arabia Data Center Server Market?

Opportunities in the Saudi Arabia Data Center Server Market include the expansion of smart city projects, the growth of the Internet of Things (IoT), and increasing investments in artificial intelligence and machine learning technologies.

What trends are shaping the Saudi Arabia Data Center Server Market?

Trends in the Saudi Arabia Data Center Server Market include the adoption of edge computing, the shift towards energy-efficient server solutions, and the integration of advanced technologies like virtualization and containerization.

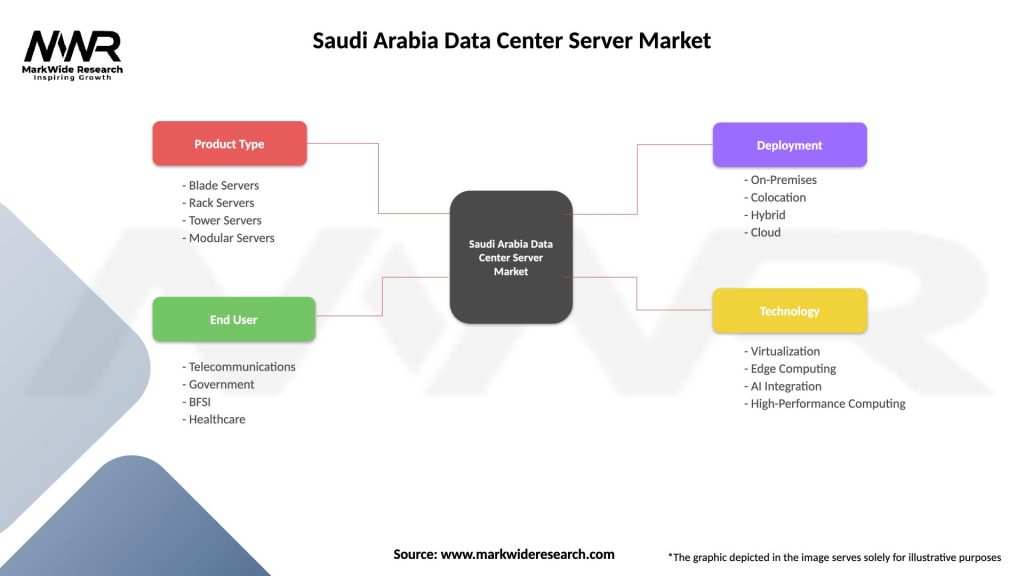

Saudi Arabia Data Center Server Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blade Servers, Rack Servers, Tower Servers, Modular Servers |

| End User | Telecommunications, Government, BFSI, Healthcare |

| Deployment | On-Premises, Colocation, Hybrid, Cloud |

| Technology | Virtualization, Edge Computing, AI Integration, High-Performance Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Data Center Server Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at