444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia concealed cistern market represents a rapidly expanding segment within the Kingdom’s construction and sanitary ware industry. Concealed cisterns have gained significant traction among Saudi consumers and developers due to their space-saving design, aesthetic appeal, and water efficiency features. The market is experiencing robust growth driven by increasing urbanization, rising disposable income, and growing awareness of modern bathroom solutions.

Market dynamics indicate that the Saudi Arabia concealed cistern market is benefiting from the Kingdom’s Vision 2030 initiative, which emphasizes sustainable development and modern infrastructure. The construction boom across residential, commercial, and hospitality sectors has created substantial demand for premium sanitary solutions. Growth projections suggest the market is expanding at a compound annual growth rate of 8.2%, reflecting strong consumer preference for concealed systems over traditional exposed cisterns.

Regional distribution shows that major cities including Riyadh, Jeddah, and Dammam account for approximately 75% of market demand. The increasing focus on water conservation and modern architectural designs has positioned concealed cisterns as preferred choices for new construction projects and bathroom renovations throughout the Kingdom.

The Saudi Arabia concealed cistern market refers to the commercial ecosystem encompassing the manufacturing, distribution, and installation of hidden toilet cisterns within the Kingdom’s borders. Concealed cisterns are water storage tanks that are installed behind walls or within specially designed frames, providing a streamlined bathroom appearance while maintaining full functionality for toilet flushing systems.

These systems differ from traditional exposed cisterns by being completely hidden from view, with only the flush plate visible on the wall surface. The market includes various product categories such as wall-hung concealed cisterns, floor-standing concealed units, and dual-flush concealed systems. Market participants include international manufacturers, local distributors, installation specialists, and end-users ranging from residential homeowners to commercial property developers.

The market scope encompasses both new installation projects and replacement of existing traditional cistern systems. It serves multiple customer segments including luxury residential developments, commercial buildings, hospitality establishments, and public facilities throughout Saudi Arabia’s major urban centers and emerging development zones.

The Saudi Arabia concealed cistern market demonstrates exceptional growth potential driven by evolving consumer preferences and substantial infrastructure investments. Key market indicators reveal strong adoption rates across residential and commercial segments, with premium product categories experiencing particularly robust demand growth.

Market penetration has reached approximately 35% in urban areas, indicating significant room for expansion as awareness and availability continue to improve. The market benefits from favorable demographic trends including a young, tech-savvy population with increasing disposable income and preference for modern home amenities. Construction activity remains a primary growth driver, with new residential projects increasingly specifying concealed cistern systems as standard features.

Competitive landscape features a mix of established international brands and emerging local players, creating a dynamic market environment. Product innovation focuses on water efficiency, smart technology integration, and enhanced durability to meet Saudi Arabia’s specific climate and usage requirements. The market outlook remains highly positive, supported by continued urbanization and government initiatives promoting sustainable building practices.

Strategic analysis reveals several critical insights shaping the Saudi Arabia concealed cistern market landscape:

Several key factors are propelling the growth of the Saudi Arabia concealed cistern market, creating a favorable environment for sustained expansion.

Urbanization and construction boom represent the primary market driver, with Saudi Arabia experiencing unprecedented infrastructure development. The Kingdom’s mega-projects including NEOM, The Red Sea Project, and Qiddiya are incorporating modern sanitary solutions as standard features. Residential construction activity has increased substantially, with new developments prioritizing contemporary bathroom designs that feature concealed cistern systems.

Rising disposable income among Saudi consumers has enabled greater investment in premium home improvement products. The growing middle class demonstrates increasing willingness to invest in modern bathroom amenities that offer both functional and aesthetic benefits. Consumer awareness of concealed cistern advantages including space optimization and improved bathroom aesthetics continues to expand through digital marketing and showroom experiences.

Water conservation initiatives aligned with Saudi Arabia’s sustainability goals have created favorable conditions for dual-flush concealed cisterns. Government programs promoting water-efficient technologies provide additional market support. Building regulations increasingly favor modern sanitary solutions that meet international efficiency standards, further driving adoption of concealed cistern systems.

Despite positive growth trends, the Saudi Arabia concealed cistern market faces several challenges that may impact expansion rates and market penetration.

High initial investment costs represent a significant barrier for price-sensitive consumer segments. Concealed cistern systems typically require higher upfront expenditure compared to traditional exposed cisterns, including specialized installation requirements and wall modifications. Installation complexity demands skilled technicians and may involve additional construction work, potentially deterring some consumers from adoption.

Limited awareness in certain market segments, particularly in smaller cities and rural areas, restricts market expansion potential. Many consumers remain unfamiliar with concealed cistern benefits and installation processes. Maintenance concerns related to accessing concealed systems for repairs may create hesitation among potential buyers who prefer easily accessible traditional cisterns.

Supply chain challenges occasionally impact product availability and pricing, particularly for imported premium brands. Skilled installer shortage in some regions may limit market growth, as proper installation is crucial for system performance and customer satisfaction. Additionally, building design limitations in older structures may restrict retrofit opportunities for concealed cistern installation.

The Saudi Arabia concealed cistern market presents numerous growth opportunities driven by evolving consumer preferences and supportive market conditions.

Smart technology integration offers significant potential for market differentiation and premium positioning. Opportunities exist for developing concealed cisterns with IoT connectivity, water usage monitoring, and smartphone app control features. Sustainability focus creates demand for ultra-efficient dual-flush systems and water recycling capabilities that align with Saudi Arabia’s environmental objectives.

Market expansion into secondary cities and emerging development zones presents substantial growth potential. As urbanization spreads beyond major metropolitan areas, demand for modern sanitary solutions is expected to increase significantly. Retrofit market opportunities in existing buildings undergoing renovation or modernization provide additional revenue streams for market participants.

Partnership opportunities with construction companies, interior designers, and plumbing contractors can accelerate market penetration. E-commerce expansion enables direct-to-consumer sales and improved market reach, particularly among tech-savvy younger demographics. The growing hospitality and commercial sectors offer substantial opportunities for bulk installations and long-term service contracts.

The Saudi Arabia concealed cistern market operates within a complex ecosystem of interconnected factors that influence supply, demand, and competitive positioning.

Demand dynamics are primarily driven by construction activity levels, consumer spending patterns, and aesthetic preferences. The market experiences seasonal variations aligned with construction cycles and Ramadan period adjustments. Supply dynamics involve a combination of imported products and local assembly operations, with logistics and inventory management playing crucial roles in market efficiency.

Competitive dynamics feature intense rivalry among international brands seeking market share expansion. Price competition exists primarily in mid-market segments, while premium categories compete on features, quality, and brand reputation. According to MarkWide Research analysis, market consolidation trends are emerging as larger players acquire local distributors to strengthen their market presence.

Technology dynamics continue evolving with smart features and water efficiency improvements driving product differentiation. Regulatory dynamics influence product specifications and installation standards, with increasing emphasis on water conservation and building code compliance. The market demonstrates resilience to economic fluctuations due to essential nature of sanitary infrastructure and continued construction activity.

Comprehensive market research for the Saudi Arabia concealed cistern market employs multiple data collection and analysis methodologies to ensure accuracy and reliability of findings.

Primary research activities include structured interviews with industry stakeholders including manufacturers, distributors, installers, and end-users. Survey methodologies capture consumer preferences, purchasing behavior, and satisfaction levels across different market segments and geographic regions. Field research involves direct observation of installation processes and product performance in real-world applications.

Secondary research encompasses analysis of industry reports, government statistics, construction data, and import/export records. Market sizing calculations utilize bottom-up and top-down approaches, incorporating construction activity data, penetration rates, and replacement cycles. Competitive intelligence gathering involves monitoring company announcements, product launches, and strategic initiatives.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical verification methods. Analytical frameworks employ both quantitative and qualitative assessment techniques to provide comprehensive market insights. Regular market monitoring ensures data currency and identifies emerging trends that may impact future market dynamics.

Geographic distribution of the Saudi Arabia concealed cistern market reveals distinct regional patterns influenced by urbanization levels, economic development, and construction activity.

Riyadh region represents the largest market segment, accounting for approximately 35% of total demand. The capital’s status as the political and business center drives substantial residential and commercial construction activity. High-end developments in North Riyadh and emerging districts consistently specify concealed cistern systems as standard features.

Western region, anchored by Jeddah and Mecca, contributes roughly 28% of market volume. The region benefits from religious tourism infrastructure development and Red Sea coastal projects. Commercial installations in hotels, shopping centers, and public facilities drive significant demand for premium concealed cistern solutions.

Eastern Province, including Dammam and Al Khobar, accounts for approximately 22% of market share. The region’s industrial base and expatriate population create demand for modern residential amenities. Emerging regions including Tabuk, Abha, and planned cities represent growing market opportunities with increasing construction activity and urban development initiatives.

The Saudi Arabia concealed cistern market features a diverse competitive environment with international brands, regional players, and local distributors competing across different market segments.

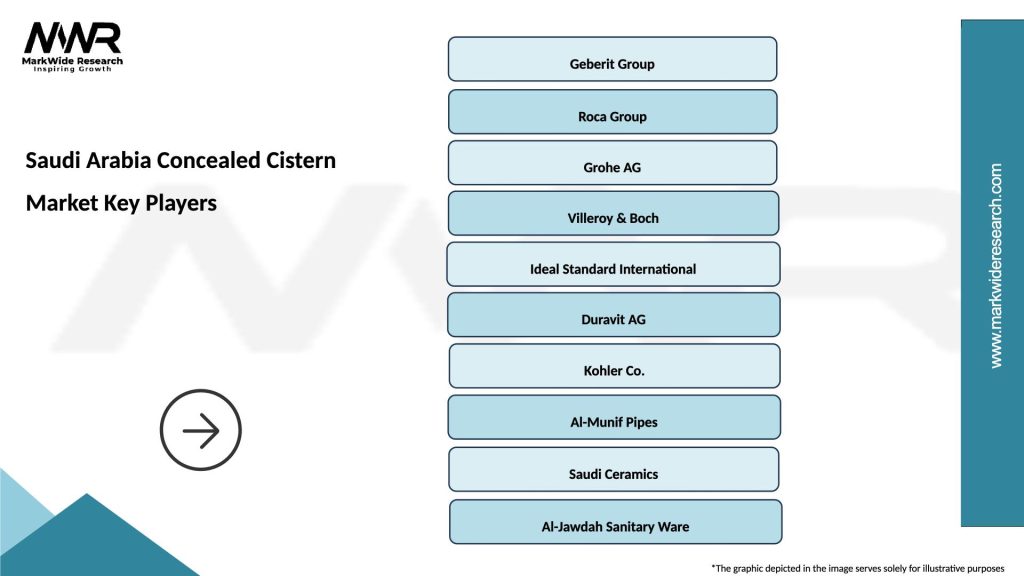

Leading market participants include:

Competitive strategies focus on product differentiation, local partnership development, and comprehensive service offerings. Market positioning varies from premium luxury brands to value-oriented solutions targeting different consumer segments and project requirements.

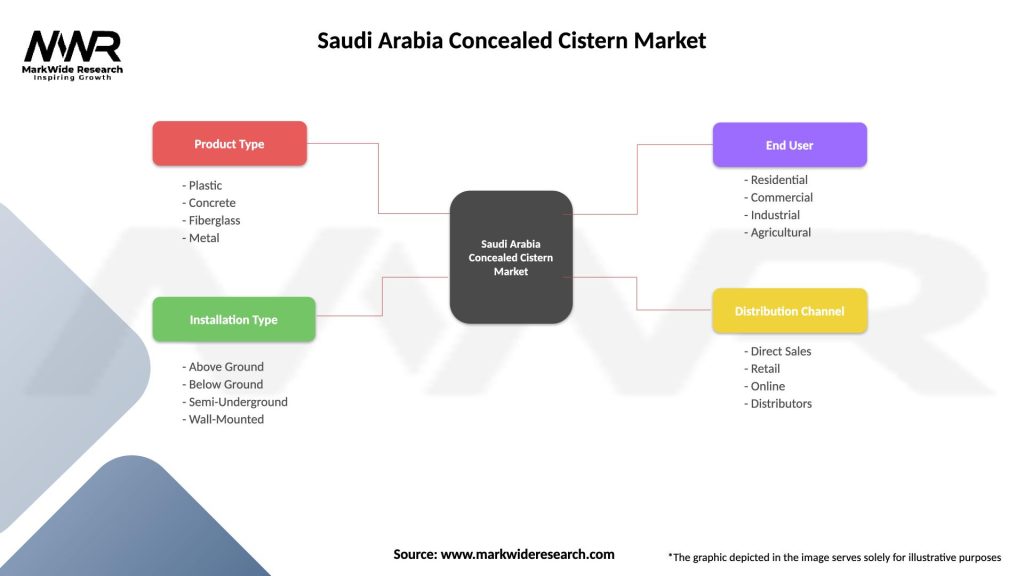

The Saudi Arabia concealed cistern market can be segmented across multiple dimensions to provide detailed analysis of different market components and customer requirements.

By Product Type:

By Application:

By Price Range:

Detailed analysis of different product categories reveals distinct market dynamics and growth patterns within the Saudi Arabia concealed cistern market.

Wall-hung concealed cisterns represent the fastest-growing category, experiencing approximately 12% annual growth. These systems appeal to consumers seeking maximum space optimization and contemporary aesthetics. Installation requirements include reinforced wall structures and professional mounting systems, creating opportunities for specialized installation services.

Dual-flush concealed cisterns demonstrate strong adoption rates driven by water conservation awareness. These systems typically offer 30-40% water savings compared to traditional single-flush units. Government incentives and building regulations increasingly favor dual-flush systems, supporting market expansion.

Smart concealed cisterns represent an emerging high-growth category with significant potential. Features include leak detection, usage monitoring, and remote control capabilities. Tech-savvy consumers and luxury developments drive demand for these advanced systems. Premium pricing reflects advanced technology integration and enhanced functionality.

Commercial-grade concealed cisterns focus on durability and high-usage performance. These systems require robust construction and easy maintenance access. Bulk purchasing by construction companies and facility managers creates opportunities for volume-based pricing strategies.

The Saudi Arabia concealed cistern market offers substantial benefits across the entire value chain, from manufacturers to end-users.

For manufacturers: Market expansion opportunities in a growing economy with increasing construction activity. Product differentiation potential through technology integration and design innovation. Long-term revenue streams through replacement cycles and maintenance services.

For distributors and retailers: High-margin product category with growing consumer demand. Partnership opportunities with construction companies and interior designers. Recurring revenue through installation services and spare parts supply.

For installers and contractors: Specialized service opportunities requiring technical expertise. Premium pricing for professional installation and maintenance services. Growing market demand creating business expansion potential.

For end-users: Space optimization in bathroom design with improved aesthetics. Water conservation benefits reducing utility costs and environmental impact. Enhanced property value through modern amenity installation. Reduced maintenance requirements compared to traditional exposed cisterns.

For property developers: Competitive advantage through modern amenity offerings. Sustainability credentials supporting green building certifications. Increased property values and buyer appeal through premium bathroom features.

Strengths:

Weaknesses:

Opportunities:

Threats:

Several significant trends are shaping the evolution of the Saudi Arabia concealed cistern market, influencing product development and consumer adoption patterns.

Smart technology integration represents a major trend with manufacturers incorporating IoT capabilities, leak detection systems, and smartphone connectivity. Water monitoring features enable users to track consumption patterns and identify potential issues proactively. These smart systems appeal to tech-savvy consumers and support water conservation initiatives.

Sustainability focus drives demand for ultra-efficient dual-flush systems and water recycling capabilities. Green building certifications increasingly require water-efficient sanitary fixtures, supporting market growth for environmentally friendly concealed cisterns. Manufacturers are developing systems with enhanced water savings and recyclable materials.

Design customization trends include flush plates with various finishes, materials, and aesthetic options. Architectural integration focuses on seamless incorporation into bathroom designs with minimal visual impact. Premium segments offer customizable flush plates matching specific interior design themes.

Installation innovation includes pre-fabricated wall systems and modular installation components reducing complexity and installation time. Maintenance accessibility improvements address consumer concerns through better access panels and diagnostic features.

Recent industry developments highlight the dynamic nature of the Saudi Arabia concealed cistern market and emerging opportunities for growth and innovation.

Product launches by major manufacturers include next-generation smart concealed cisterns with enhanced connectivity features and improved water efficiency. Technology partnerships between sanitary ware companies and IoT solution providers are creating innovative product offerings with advanced monitoring capabilities.

Distribution expansion initiatives include new showroom openings in secondary cities and enhanced e-commerce platforms. Local manufacturing investments by international brands aim to reduce costs and improve supply chain efficiency. Several companies have established assembly facilities within Saudi Arabia to serve the growing regional market.

Sustainability initiatives include development of concealed cisterns with recycled materials and enhanced water conservation features. Certification programs for installers and service technicians are improving market professionalism and customer confidence. MWR data indicates increasing investment in training programs and technical support infrastructure.

Strategic partnerships between manufacturers and construction companies are creating integrated solutions for large-scale projects. Government initiatives supporting water conservation and modern building standards provide favorable market conditions for continued growth.

Market analysis reveals several strategic recommendations for stakeholders seeking to optimize their position in the Saudi Arabia concealed cistern market.

For manufacturers: Focus on developing products specifically designed for Saudi Arabia’s climate and usage patterns. Local partnerships with distributors and installers can improve market penetration and customer service capabilities. Investment in smart technology features will support premium positioning and differentiation strategies.

For distributors: Expand geographic coverage to secondary cities and emerging development zones. Training programs for installation partners will improve service quality and customer satisfaction. Development of comprehensive service packages including maintenance and warranty support can create competitive advantages.

For installers: Obtain certifications from major manufacturers to access premium product lines and technical support. Digital marketing strategies can improve visibility and customer acquisition in competitive markets. Specialization in smart system installation and maintenance creates opportunities for premium service pricing.

For investors: Consider opportunities in local assembly operations and distribution networks. Technology companies developing IoT solutions for sanitary applications represent emerging investment opportunities. Service sector investments in installation and maintenance capabilities offer steady revenue potential.

The future prospects for the Saudi Arabia concealed cistern market remain highly positive, supported by multiple growth drivers and favorable market conditions.

Market expansion is expected to continue at a robust pace, with growth rates projected to maintain 7-9% annually over the next five years. Urban development initiatives including NEOM, The Red Sea Project, and other mega-projects will create substantial demand for modern sanitary solutions. The growing middle class and increasing disposable income support continued market expansion.

Technology evolution will drive product innovation with enhanced smart features, improved water efficiency, and better integration with home automation systems. Sustainability requirements will become increasingly important, favoring products with superior water conservation capabilities and environmentally friendly materials.

Market maturation in major cities will shift focus toward replacement and upgrade markets, while secondary cities offer significant growth potential. MarkWide Research projections indicate that market penetration could reach 55-60% in urban areas within the next decade. The commercial and hospitality sectors will continue driving demand for premium concealed cistern systems.

Competitive landscape evolution will likely include increased local manufacturing, enhanced service capabilities, and greater emphasis on customer experience. Digital transformation will impact both product features and distribution channels, creating new opportunities for market participants.

The Saudi Arabia concealed cistern market represents a dynamic and rapidly growing segment within the Kingdom’s construction and sanitary ware industry. Strong fundamentals including urbanization, rising disposable income, and government support for modern infrastructure create favorable conditions for sustained market expansion.

Key success factors for market participants include product innovation, local partnership development, and comprehensive service offerings. The integration of smart technology and sustainability features will become increasingly important for competitive positioning. Market opportunities extend beyond major cities to emerging development zones and retrofit applications.

Challenges including high initial costs and installation complexity require strategic approaches through education, financing solutions, and improved installer networks. The market’s evolution toward premium products and smart features creates opportunities for differentiation and margin improvement.

Overall market outlook remains highly positive, with continued growth expected across all segments and geographic regions. The Saudi Arabia concealed cistern market is well-positioned to benefit from the Kingdom’s ongoing economic diversification and infrastructure development initiatives, making it an attractive opportunity for manufacturers, distributors, and service providers seeking growth in the Middle East region.

What is Concealed Cistern?

A concealed cistern is a plumbing fixture that is hidden behind a wall or in a cabinet, used to store water for flushing toilets. This design helps to save space and improve the aesthetic appeal of bathrooms.

What are the key players in the Saudi Arabia Concealed Cistern Market?

Key players in the Saudi Arabia Concealed Cistern Market include Geberit, Roca, Kohler, and Duravit, among others. These companies are known for their innovative designs and high-quality products in the bathroom fixtures sector.

What are the growth factors driving the Saudi Arabia Concealed Cistern Market?

The growth of the Saudi Arabia Concealed Cistern Market is driven by increasing urbanization, rising demand for modern bathroom designs, and a growing focus on water conservation. Additionally, the trend towards luxury and smart bathrooms is contributing to market expansion.

What challenges does the Saudi Arabia Concealed Cistern Market face?

The Saudi Arabia Concealed Cistern Market faces challenges such as high installation costs and the need for specialized plumbing skills. Additionally, consumer awareness regarding the benefits of concealed cisterns remains limited, which can hinder market growth.

What opportunities exist in the Saudi Arabia Concealed Cistern Market?

Opportunities in the Saudi Arabia Concealed Cistern Market include the potential for product innovation and the introduction of eco-friendly models. The increasing trend of home renovations and the growth of the hospitality sector also present significant opportunities for market players.

What trends are shaping the Saudi Arabia Concealed Cistern Market?

Trends shaping the Saudi Arabia Concealed Cistern Market include the rise of smart bathroom technologies, the integration of water-saving features, and a growing preference for minimalist designs. These trends reflect changing consumer preferences towards functionality and aesthetics.

Saudi Arabia Concealed Cistern Market

| Segmentation Details | Description |

|---|---|

| Product Type | Plastic, Concrete, Fiberglass, Metal |

| Installation Type | Above Ground, Below Ground, Semi-Underground, Wall-Mounted |

| End User | Residential, Commercial, Industrial, Agricultural |

| Distribution Channel | Direct Sales, Retail, Online, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Concealed Cistern Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at