444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia chemical logistics market represents a critical component of the Kingdom’s industrial infrastructure, facilitating the transportation, storage, and distribution of chemical products across diverse sectors. Chemical logistics encompasses specialized handling of hazardous and non-hazardous chemicals, requiring sophisticated supply chain management, regulatory compliance, and safety protocols. The market has experienced substantial growth driven by the Kingdom’s expanding petrochemical industry, manufacturing sector diversification, and strategic positioning as a regional chemical hub.

Market dynamics indicate robust expansion with the sector growing at a compound annual growth rate of 8.2%, reflecting increased industrial activity and infrastructure development. The Kingdom’s Vision 2030 initiative has significantly influenced chemical logistics demand, promoting industrial diversification and attracting international chemical manufacturers to establish regional operations. Petrochemical complexes in Jubail and Yanbu serve as major logistics hubs, generating substantial demand for specialized transportation and storage services.

Regional distribution shows the Eastern Province commanding approximately 45% market share, followed by the Western Province with 28%, reflecting the concentration of chemical production facilities and port infrastructure. The market encompasses various service segments including transportation, warehousing, inventory management, and value-added services, each requiring specialized expertise and regulatory compliance capabilities.

The Saudi Arabia chemical logistics market refers to the comprehensive ecosystem of services and infrastructure dedicated to the safe, efficient, and compliant movement of chemical products throughout the Kingdom. This specialized logistics sector encompasses the transportation, storage, handling, and distribution of both hazardous and non-hazardous chemicals, serving industries ranging from petrochemicals and pharmaceuticals to agriculture and manufacturing.

Chemical logistics differs significantly from general freight logistics due to stringent safety requirements, regulatory compliance mandates, and specialized handling procedures. The market includes third-party logistics providers, integrated chemical companies with internal logistics capabilities, and specialized service providers offering temperature-controlled storage, hazardous material handling, and regulatory documentation services. Supply chain integration within this market ensures seamless connectivity between chemical producers, distributors, and end-users while maintaining safety standards and regulatory compliance throughout the logistics process.

Market expansion in Saudi Arabia’s chemical logistics sector reflects the Kingdom’s strategic transformation into a global chemical manufacturing hub. The sector benefits from substantial government investment in industrial infrastructure, port facilities, and transportation networks, creating a robust foundation for chemical logistics operations. Industrial diversification initiatives have attracted international chemical companies, generating increased demand for specialized logistics services and driving market growth.

Key growth drivers include the expansion of petrochemical production capacity, increasing pharmaceutical manufacturing, and growing demand for specialty chemicals across various industries. The market demonstrates strong resilience with logistics efficiency improvements of 35% achieved through digital transformation and automation initiatives. Regulatory compliance remains a critical factor, with service providers investing heavily in safety systems, training programs, and certification processes to meet international standards.

Competitive landscape features a mix of international logistics giants, regional specialists, and integrated chemical companies offering logistics services. Market consolidation trends indicate increasing collaboration between logistics providers and chemical manufacturers to optimize supply chain efficiency and reduce operational costs. Technology adoption has accelerated, with digital platforms and IoT solutions enhancing visibility, tracking, and safety management across chemical logistics operations.

Strategic positioning of Saudi Arabia as a chemical logistics hub continues to strengthen, supported by world-class port infrastructure and strategic geographic location connecting Asia, Europe, and Africa. The market demonstrates several critical insights that shape its development trajectory and competitive dynamics.

Petrochemical industry expansion serves as the primary driver for chemical logistics market growth, with major complexes in Jubail and Yanbu generating substantial transportation and storage demand. The Kingdom’s position as a leading global petrochemical producer creates continuous logistics requirements for raw materials, intermediate products, and finished chemicals. Production capacity increases of approximately 15% annually in key petrochemical segments drive corresponding logistics demand growth.

Vision 2030 initiatives promote industrial diversification and manufacturing sector development, creating new chemical logistics opportunities across pharmaceutical, agricultural, and specialty chemical industries. Government investment in industrial cities and economic zones generates demand for comprehensive logistics infrastructure and services. Foreign direct investment in chemical manufacturing has increased logistics service requirements as international companies establish regional operations.

Infrastructure development continues to enhance logistics capabilities with port expansions, rail network improvements, and specialized storage facility construction. The development of integrated logistics parks and chemical handling facilities creates economies of scale and operational efficiencies. Digital transformation initiatives improve supply chain visibility, reduce operational costs, and enhance safety management across logistics networks.

Regional trade growth positions Saudi Arabia as a chemical distribution hub for Middle East and North African markets, increasing transshipment and re-export logistics activities. Growing demand from downstream industries including plastics, textiles, and construction materials drives chemical logistics requirements throughout the supply chain.

Regulatory complexity presents significant challenges for chemical logistics operators, requiring extensive compliance with safety, environmental, and transportation regulations. The stringent approval processes for hazardous material handling licenses and facility certifications can delay market entry and expansion plans. Compliance costs represent substantial operational expenses, particularly for smaller logistics providers seeking to enter specialized chemical handling segments.

Safety requirements necessitate significant investment in specialized equipment, training programs, and safety systems, creating barriers for new market entrants. The need for certified personnel and ongoing safety training programs increases operational costs and complexity. Insurance costs for chemical logistics operations remain elevated due to inherent risks associated with hazardous material handling and transportation.

Infrastructure limitations in certain regions restrict logistics network expansion and operational efficiency. Limited rail connectivity for chemical transportation increases dependence on road transport, creating capacity constraints and safety concerns. Storage capacity for specialized chemicals remains limited in some regions, constraining market growth and service expansion opportunities.

Skilled workforce shortage in specialized chemical handling and logistics management creates operational challenges and limits service quality. The requirement for certified personnel with hazardous material handling expertise constrains operational capacity and increases labor costs across the industry.

Downstream industry expansion creates substantial opportunities for chemical logistics providers as Saudi Arabia develops its manufacturing capabilities in plastics, pharmaceuticals, and specialty chemicals. The growth of local manufacturing reduces import dependence while creating new logistics requirements for raw materials and finished products. Value chain integration opportunities enable logistics providers to offer comprehensive services from production support to final distribution.

Technology adoption presents significant opportunities for operational improvement and service differentiation. Implementation of IoT sensors, blockchain technology, and artificial intelligence can enhance supply chain visibility, improve safety management, and optimize logistics operations. Automation initiatives in warehousing and transportation can reduce operational costs while improving service reliability and safety standards.

Regional expansion opportunities exist as Saudi chemical companies increase exports to regional markets, requiring comprehensive logistics support for international distribution. The development of free trade zones and special economic areas creates opportunities for specialized chemical logistics services. Cross-border logistics capabilities can capture growing trade flows between Saudi Arabia and neighboring countries.

Sustainability initiatives create opportunities for green logistics solutions, including alternative fuel transportation, energy-efficient storage facilities, and waste reduction programs. Growing environmental awareness among chemical companies drives demand for sustainable logistics practices and carbon footprint reduction services.

Supply chain evolution in Saudi Arabia’s chemical logistics market reflects the complex interplay between industrial growth, regulatory requirements, and technological advancement. The market demonstrates dynamic characteristics with rapid adaptation to changing customer needs and regulatory environments. Operational efficiency has improved by approximately 25% through digital transformation and process optimization initiatives across major logistics providers.

Customer expectations continue to evolve toward integrated logistics solutions that combine transportation, storage, and value-added services under single-source arrangements. Chemical companies increasingly seek logistics partners capable of providing end-to-end supply chain management with real-time visibility and performance analytics. Service differentiation has become critical as providers compete on reliability, safety standards, and technological capabilities rather than price alone.

Regulatory dynamics shape market structure and competitive positioning, with compliance capabilities serving as key differentiators among service providers. The implementation of international safety standards and environmental regulations creates ongoing adaptation requirements for logistics operators. Market consolidation trends reflect the need for scale and expertise to meet complex regulatory and operational requirements.

Innovation cycles drive continuous improvement in logistics processes, safety systems, and customer service capabilities. The adoption of predictive analytics and automated systems enhances operational reliability while reducing human error risks in chemical handling operations.

Comprehensive analysis of Saudi Arabia’s chemical logistics market employs multiple research methodologies to ensure accuracy and reliability of findings. The research approach combines primary data collection through industry interviews and surveys with secondary data analysis from government sources, industry associations, and regulatory bodies. Market segmentation analysis provides detailed insights into service categories, customer segments, and regional distribution patterns.

Primary research includes structured interviews with logistics service providers, chemical manufacturers, and industry experts to gather insights on market trends, challenges, and opportunities. Survey data from logistics operators provides quantitative information on capacity utilization, service offerings, and growth projections. Stakeholder engagement encompasses discussions with regulatory authorities, port operators, and infrastructure developers to understand market dynamics and future development plans.

Secondary research analyzes government statistics, industry reports, and regulatory filings to validate primary findings and provide historical context for market development. Trade data analysis reveals import and export patterns that influence logistics demand and service requirements. Competitive intelligence gathering through public sources and industry publications provides insights into market structure and competitive positioning.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert review of findings. Statistical analysis techniques identify trends and correlations within market data to support strategic insights and projections.

Eastern Province dominates Saudi Arabia’s chemical logistics market with approximately 45% market share, driven by the concentration of petrochemical production facilities in Jubail Industrial City and the strategic port of Dammam. The region benefits from integrated infrastructure including specialized chemical terminals, rail connections, and extensive pipeline networks. Jubail Industrial City serves as the primary chemical logistics hub with world-class storage facilities and specialized handling capabilities for hazardous materials.

Western Province accounts for approximately 28% market share, centered around Yanbu Industrial City and Jeddah Islamic Port. The region’s strategic location on the Red Sea provides access to European and African markets, making it a critical logistics gateway for chemical exports. Yanbu facilities specialize in petrochemical and refinery product logistics with dedicated storage and transshipment capabilities.

Central Province represents a growing market segment with 18% market share, driven by Riyadh’s role as a distribution center for chemical products serving domestic markets. The region’s logistics infrastructure focuses on last-mile distribution and specialty chemical handling for pharmaceutical and industrial applications. Industrial development in the capital region creates increasing demand for chemical logistics services.

Northern and Southern Provinces collectively account for the remaining 9% market share, with emerging opportunities in mining-related chemical logistics and agricultural chemical distribution. These regions show potential for growth as industrial diversification initiatives expand beyond traditional petrochemical centers.

Market structure in Saudi Arabia’s chemical logistics sector features a diverse mix of international logistics companies, regional specialists, and integrated chemical companies with internal logistics capabilities. The competitive environment emphasizes safety standards, regulatory compliance, and technological capabilities as key differentiators among service providers.

Competitive strategies focus on service differentiation through technology adoption, safety excellence, and comprehensive service offerings. Market leaders invest heavily in digital platforms, automation systems, and specialized infrastructure to maintain competitive advantages and meet evolving customer requirements.

Service-based segmentation reveals distinct market categories with varying growth rates and competitive dynamics. Transportation services represent the largest segment, followed by warehousing and storage, with value-added services showing the highest growth potential. Market distribution across service categories reflects the diverse needs of chemical industry customers and the evolution toward integrated logistics solutions.

By Service Type:

By Chemical Type:

By End-User Industry:

Transportation category dominates market activity with road transport accounting for the majority of chemical movements within Saudi Arabia. Specialized tank trucks and container transport systems ensure safe handling of various chemical products while meeting regulatory compliance requirements. Pipeline transportation serves major petrochemical complexes with dedicated networks for liquid chemical products, offering cost-effective and safe transport solutions for high-volume movements.

Storage and warehousing category demonstrates strong growth driven by increasing chemical production and inventory management requirements. Specialized storage facilities incorporate temperature control, hazardous material handling capabilities, and automated inventory systems. Tank farm operations provide bulk storage for liquid chemicals with sophisticated loading and unloading systems connected to transportation networks.

Value-added services represent the fastest-growing category as chemical companies seek integrated logistics solutions beyond basic transportation and storage. Services include chemical blending, packaging, quality testing, and regulatory documentation support. Digital services such as supply chain visibility platforms and predictive analytics enhance operational efficiency and customer service capabilities.

Cross-border logistics category shows significant potential as Saudi chemical exports increase and regional trade relationships expand. Specialized services for international chemical shipments include customs clearance, documentation management, and compliance with destination country regulations. Port logistics capabilities continue to expand with dedicated chemical terminals and transshipment facilities supporting export growth.

Chemical manufacturers benefit from specialized logistics services that ensure safe, compliant, and efficient distribution of their products. Professional logistics providers offer expertise in regulatory compliance, reducing the burden on manufacturers while ensuring adherence to safety standards. Cost optimization through outsourced logistics enables chemical companies to focus on core production activities while accessing specialized infrastructure and capabilities.

Logistics service providers gain access to a growing market with stable demand patterns and opportunities for service differentiation. The chemical logistics sector offers higher margins compared to general freight due to specialized requirements and regulatory barriers to entry. Technology investment in chemical logistics creates competitive advantages and enables expansion into higher-value service segments.

Government stakeholders benefit from enhanced industrial competitiveness and economic diversification through efficient chemical logistics infrastructure. Professional logistics services support the Kingdom’s Vision 2030 objectives by enabling industrial growth and export expansion. Safety improvements through professional chemical handling reduce environmental risks and enhance public safety standards.

End-user industries receive reliable supply chain services that ensure consistent availability of chemical inputs for manufacturing processes. Professional logistics providers offer supply chain optimization, inventory management, and just-in-time delivery capabilities that improve operational efficiency. Quality assurance through specialized handling and storage maintains chemical product integrity throughout the supply chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping Saudi Arabia’s chemical logistics market, with companies investing heavily in IoT sensors, blockchain technology, and artificial intelligence to enhance supply chain visibility and operational efficiency. Real-time tracking systems provide customers with complete visibility of chemical shipments while enabling proactive management of potential issues or delays.

Sustainability focus drives adoption of green logistics practices including alternative fuel vehicles, energy-efficient storage facilities, and waste reduction programs. Chemical companies increasingly evaluate logistics providers based on environmental performance and carbon footprint reduction capabilities. Circular economy principles influence logistics design with emphasis on packaging optimization and reverse logistics for chemical containers and materials.

Automation advancement continues across warehousing and transportation operations with robotic systems, automated storage and retrieval systems, and autonomous vehicle technologies improving operational efficiency while reducing human exposure to hazardous materials. Safety automation includes advanced monitoring systems and emergency response capabilities integrated throughout logistics operations.

Service integration trend sees logistics providers expanding beyond traditional transportation and storage to offer comprehensive supply chain management including procurement support, inventory optimization, and customer service integration. Partnership models between chemical manufacturers and logistics providers create long-term strategic relationships focused on supply chain optimization and cost reduction.

Infrastructure expansion projects continue to enhance Saudi Arabia’s chemical logistics capabilities with major port developments, specialized storage facility construction, and transportation network improvements. The expansion of King Abdulaziz Port in Dammam includes new chemical terminals with advanced handling capabilities for hazardous materials. Rail network development creates new opportunities for chemical transportation with dedicated freight corridors connecting major industrial centers.

Technology partnerships between logistics providers and technology companies accelerate digital transformation across the chemical logistics sector. Implementation of blockchain platforms for supply chain transparency and smart contracts for automated logistics processes improve operational efficiency and reduce administrative costs. IoT deployment enables real-time monitoring of chemical storage conditions and transportation parameters ensuring product quality and safety compliance.

Regulatory updates continue to enhance safety standards and environmental protection requirements for chemical logistics operations. New licensing requirements for hazardous material handling and updated transportation regulations ensure alignment with international best practices. Compliance technology solutions help logistics providers maintain regulatory adherence while reducing administrative burden and operational complexity.

Market consolidation activities include strategic acquisitions and partnerships as companies seek to expand capabilities and geographic coverage. International logistics companies continue to establish local operations while regional providers enhance service offerings through technology investment and infrastructure development. MarkWide Research analysis indicates that consolidation trends will continue as the market matures and customer requirements become more sophisticated.

Investment priorities should focus on technology adoption and safety system enhancement to maintain competitive positioning in the evolving chemical logistics market. Companies should prioritize digital platform development, automation implementation, and data analytics capabilities to improve operational efficiency and customer service quality. Safety investment remains critical with continuous upgrades to handling equipment, monitoring systems, and emergency response capabilities.

Market positioning strategies should emphasize service differentiation through specialized capabilities and industry expertise rather than competing solely on price. Logistics providers should develop niche specializations in specific chemical categories or industry segments to create competitive advantages. Partnership development with chemical manufacturers can create long-term revenue stability and opportunities for service expansion.

Geographic expansion opportunities exist in underserved regions and emerging industrial areas as Saudi Arabia’s industrial diversification continues. Companies should evaluate expansion into secondary cities and industrial zones where chemical logistics demand is growing but competition remains limited. Cross-border capabilities development can capture growing regional trade opportunities and export logistics requirements.

Workforce development initiatives should address the critical need for skilled personnel with chemical handling expertise and regulatory knowledge. Investment in training programs and certification processes will ensure operational capability and regulatory compliance while supporting business growth. Succession planning and knowledge transfer programs help maintain operational continuity and expertise development.

Market expansion prospects remain strong with projected growth rates of 8-10% annually driven by continued industrial diversification and chemical industry development. The Kingdom’s strategic initiatives to develop downstream industries and attract international chemical manufacturers will create sustained demand for specialized logistics services. Infrastructure development projects will enhance logistics capabilities and operational efficiency across all regions.

Technology evolution will continue to reshape operational practices with artificial intelligence, machine learning, and advanced automation becoming standard capabilities across chemical logistics operations. MWR projections indicate that technology adoption will accelerate with digital integration rates reaching 75% among major logistics providers within the next five years. Predictive analytics and autonomous systems will enhance safety and efficiency while reducing operational costs.

Sustainability requirements will become increasingly important with environmental regulations and customer expectations driving adoption of green logistics practices. Carbon neutrality goals and circular economy principles will influence logistics network design and operational procedures. Alternative energy adoption in transportation and storage operations will become competitive differentiators as environmental consciousness increases.

Regional integration opportunities will expand as trade relationships strengthen and chemical exports increase to neighboring countries. The development of regional logistics networks and cross-border capabilities will create new growth opportunities for Saudi chemical logistics providers. Export growth projections suggest increasing demand for international logistics services supporting chemical industry expansion beyond domestic markets.

Saudi Arabia’s chemical logistics market demonstrates robust growth potential driven by industrial diversification, infrastructure development, and strategic positioning as a regional chemical hub. The market benefits from strong government support, world-class infrastructure, and growing demand from expanding chemical industries. Competitive dynamics favor providers with specialized capabilities, strong safety records, and advanced technology platforms that can meet evolving customer requirements.

Future success in this market will depend on continuous investment in technology, safety systems, and workforce development while maintaining focus on regulatory compliance and operational excellence. The integration of digital technologies, sustainability practices, and comprehensive service offerings will differentiate market leaders from competitors. Strategic partnerships between logistics providers and chemical manufacturers will create opportunities for long-term growth and market expansion.

Market outlook remains positive with sustained growth expected across all service segments and geographic regions. The Kingdom’s Vision 2030 initiatives will continue to drive industrial development and create new opportunities for chemical logistics providers. Companies that invest in capabilities development, technology adoption, and safety excellence will be well-positioned to capitalize on the expanding Saudi Arabia chemical logistics market and contribute to the Kingdom’s economic diversification objectives.

What is Chemical Logistics?

Chemical logistics refers to the specialized transportation, storage, and distribution of chemical products. This includes managing hazardous materials, ensuring compliance with safety regulations, and optimizing supply chain processes for chemicals used in various industries.

What are the key players in the Saudi Arabia Chemical Logistics Market?

Key players in the Saudi Arabia Chemical Logistics Market include Saudi Arabian Oil Company (Saudi Aramco), SABIC, and Bahri. These companies are involved in the transportation and storage of chemicals, providing essential services to various sectors, including petrochemicals and pharmaceuticals, among others.

What are the growth factors driving the Saudi Arabia Chemical Logistics Market?

The growth of the Saudi Arabia Chemical Logistics Market is driven by increasing industrial activities, the expansion of the petrochemical sector, and rising demand for efficient supply chain solutions. Additionally, investments in infrastructure and logistics technology are enhancing operational efficiencies.

What challenges does the Saudi Arabia Chemical Logistics Market face?

The Saudi Arabia Chemical Logistics Market faces challenges such as stringent regulatory compliance, the need for specialized handling of hazardous materials, and fluctuating demand in the chemical sector. These factors can complicate logistics operations and increase costs.

What opportunities exist in the Saudi Arabia Chemical Logistics Market?

Opportunities in the Saudi Arabia Chemical Logistics Market include the adoption of advanced logistics technologies, such as automation and digital tracking systems. Additionally, the growing focus on sustainability and green logistics presents avenues for innovation and efficiency improvements.

What trends are shaping the Saudi Arabia Chemical Logistics Market?

Trends shaping the Saudi Arabia Chemical Logistics Market include the increasing use of digital solutions for supply chain management, a shift towards sustainable practices, and the integration of IoT technologies for real-time monitoring. These trends are enhancing operational efficiency and safety in chemical logistics.

Saudi Arabia Chemical Logistics Market

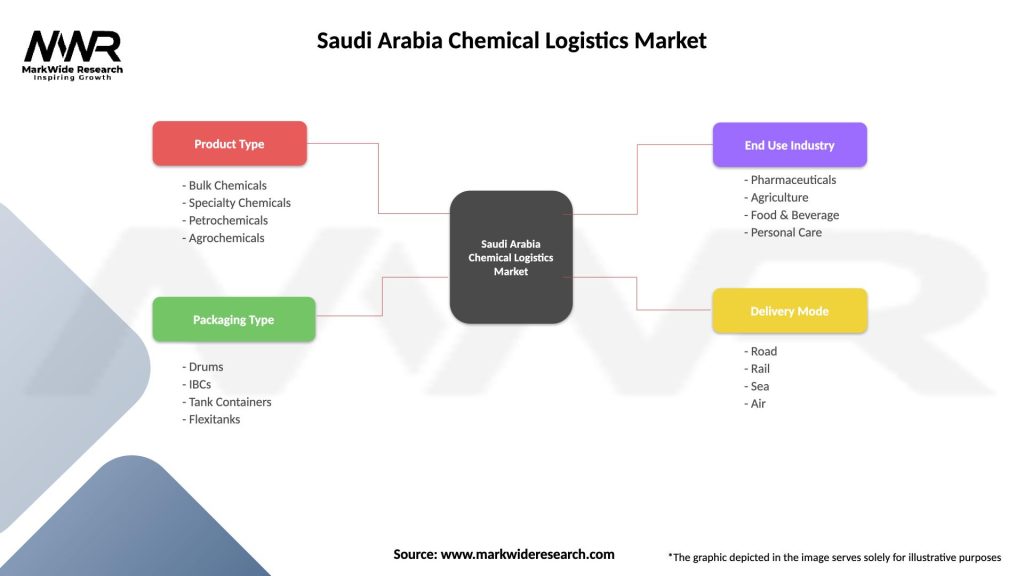

| Segmentation Details | Description |

|---|---|

| Product Type | Bulk Chemicals, Specialty Chemicals, Petrochemicals, Agrochemicals |

| Packaging Type | Drums, IBCs, Tank Containers, Flexitanks |

| End Use Industry | Pharmaceuticals, Agriculture, Food & Beverage, Personal Care |

| Delivery Mode | Road, Rail, Sea, Air |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Chemical Logistics Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at