444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia cash management services market represents a rapidly evolving financial ecosystem that has undergone significant transformation in recent years. This dynamic sector encompasses comprehensive solutions for cash handling, processing, transportation, and optimization services across various industries throughout the Kingdom. Financial institutions, retail establishments, government entities, and commercial enterprises increasingly rely on sophisticated cash management solutions to streamline operations and enhance security protocols.

Market dynamics indicate robust growth driven by Saudi Arabia’s Vision 2030 initiative, which emphasizes financial sector development and digital transformation. The market demonstrates strong expansion with projected growth rates of 8.2% CAGR over the forecast period, reflecting increasing demand for automated cash handling solutions and secure transportation services. Banking sector modernization and retail industry expansion contribute significantly to market momentum, while regulatory frameworks continue evolving to support enhanced cash management practices.

Technology integration plays a pivotal role in market evolution, with advanced cash recycling systems, intelligent deposit solutions, and real-time monitoring platforms gaining widespread adoption. The market benefits from 65% adoption rate of automated cash management systems among major financial institutions, demonstrating the sector’s commitment to operational efficiency and security enhancement.

The Saudi Arabia cash management services market refers to the comprehensive ecosystem of financial services and technological solutions designed to optimize cash handling, processing, storage, and transportation activities across various sectors within the Kingdom. This market encompasses specialized services including cash-in-transit operations, vault management, ATM servicing, currency processing, and automated cash handling systems that enable organizations to efficiently manage their cash flow operations while maintaining security and compliance standards.

Cash management services integrate multiple components including physical cash transportation, secure storage facilities, counting and sorting technologies, and digital monitoring systems. These services address critical business needs such as reducing operational costs, minimizing security risks, ensuring regulatory compliance, and optimizing cash availability across different locations and channels.

Service providers in this market deliver end-to-end solutions ranging from basic cash collection and delivery to sophisticated automated cash management platforms that integrate with banking systems and point-of-sale networks. The market encompasses both traditional cash handling services and innovative digital solutions that leverage artificial intelligence and data analytics for enhanced operational efficiency.

Strategic market positioning reveals the Saudi Arabia cash management services sector as a cornerstone of the Kingdom’s financial infrastructure modernization efforts. The market demonstrates exceptional resilience and growth potential, driven by increasing commercial activity, expanding retail networks, and government initiatives promoting financial sector development. Key market participants include international cash management specialists, local financial service providers, and technology companies offering innovative automation solutions.

Market segmentation encompasses diverse service categories including cash-in-transit services, ATM management, vault operations, currency processing, and integrated cash management platforms. The retail sector represents the largest application segment, accounting for 42% market share, followed by banking and financial services, government institutions, and healthcare facilities. Geographic distribution shows concentrated activity in major urban centers including Riyadh, Jeddah, and Dammam, with expanding presence in secondary cities.

Technological advancement drives market evolution through implementation of smart cash management systems, biometric security features, and real-time tracking capabilities. The market benefits from increasing investment in digital infrastructure and growing awareness of cash management optimization benefits among end-users across various industries.

Market intelligence reveals several critical insights shaping the Saudi Arabia cash management services landscape:

Economic diversification initiatives under Saudi Arabia’s Vision 2030 program significantly drive cash management services demand. The Kingdom’s strategic focus on developing non-oil sectors including retail, tourism, and financial services creates substantial opportunities for cash management service providers. Commercial sector expansion generates increasing requirements for sophisticated cash handling solutions across diverse business environments.

Banking sector modernization represents a primary market driver, with financial institutions investing heavily in automated cash management systems and outsourced services to improve operational efficiency. The growing network of ATMs and banking branches requires comprehensive cash management support, driving demand for specialized services including cash replenishment, maintenance, and security solutions.

Retail industry growth contributes significantly to market expansion, as shopping centers, supermarkets, and commercial establishments require reliable cash management services to handle increasing transaction volumes. The market benefits from 35% growth in retail cash transactions, reflecting continued consumer preference for cash payments alongside digital alternatives.

Regulatory framework development encourages adoption of professional cash management services through enhanced security requirements and compliance standards. Government initiatives promoting financial sector transparency and security drive organizations toward outsourced cash management solutions that ensure regulatory adherence while reducing operational risks.

Digital payment adoption presents a significant challenge to traditional cash management services, as increasing consumer preference for electronic transactions reduces overall cash circulation volumes. The growing popularity of mobile payment platforms and digital wallets creates pressure on cash-intensive businesses to adapt their operational models, potentially impacting demand for conventional cash management services.

High implementation costs associated with advanced cash management systems create barriers for small and medium enterprises seeking to upgrade their cash handling capabilities. The substantial capital investment required for automated cash management infrastructure, including hardware, software, and training components, limits market penetration among cost-sensitive organizations.

Security concerns related to cash transportation and storage continue challenging market growth, particularly in regions with heightened security risks. Organizations must balance operational efficiency with security requirements, often resulting in increased service costs and complex operational procedures that may deter potential customers from adopting comprehensive cash management solutions.

Skilled workforce limitations impact service quality and market expansion capabilities, as specialized cash management operations require trained personnel with expertise in security protocols, technology systems, and regulatory compliance. The shortage of qualified professionals in certain regions constrains service provider capacity and affects overall market development potential.

Technology integration opportunities present substantial growth potential through development of artificial intelligence-powered cash management platforms that optimize cash flow predictions and automate decision-making processes. The integration of Internet of Things sensors, blockchain technology, and advanced analytics creates opportunities for innovative service offerings that deliver enhanced value to customers across various industries.

Geographic expansion potential exists in underserved regions and emerging commercial centers throughout Saudi Arabia, where growing business activity creates demand for professional cash management services. The development of new economic zones and commercial districts provides opportunities for service providers to establish comprehensive cash management infrastructure and capture market share in developing areas.

Industry-specific solutions represent significant opportunities for specialized cash management services tailored to unique sector requirements. Healthcare facilities, educational institutions, government agencies, and hospitality businesses require customized cash management approaches that address specific operational challenges and regulatory requirements, creating niche market opportunities for service providers.

Partnership development with fintech companies and digital payment providers offers opportunities to create integrated financial service ecosystems that combine traditional cash management with digital payment solutions. These collaborations enable service providers to offer comprehensive financial management platforms that address evolving customer needs while maintaining competitive positioning in the changing market landscape.

Competitive dynamics within the Saudi Arabia cash management services market reflect intense competition among established international providers and emerging local companies. Market leaders leverage advanced technology platforms and comprehensive service portfolios to maintain competitive advantages, while newer entrants focus on specialized solutions and competitive pricing strategies to gain market share.

Customer behavior evolution significantly influences market dynamics, as organizations increasingly demand integrated solutions that combine traditional cash management services with digital capabilities. The market experiences 28% increase in demand for hybrid solutions that bridge physical cash handling with electronic payment processing and financial analytics platforms.

Regulatory environment changes create dynamic market conditions requiring continuous adaptation from service providers. Enhanced security regulations, compliance requirements, and reporting standards drive innovation in service delivery while creating barriers for companies unable to meet evolving regulatory expectations. MarkWide Research analysis indicates that regulatory compliance costs represent approximately 15% of total operational expenses for major service providers.

Technology disruption reshapes market dynamics through introduction of automated cash management systems, artificial intelligence applications, and blockchain-based security solutions. These technological advances create opportunities for efficiency improvements while requiring significant investment in infrastructure upgrades and staff training programs.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves extensive interviews with industry executives, service providers, end-users, and regulatory officials across various sectors within Saudi Arabia. This approach provides firsthand insights into market trends, challenges, and opportunities from diverse stakeholder perspectives.

Secondary research methodology incorporates analysis of industry reports, government publications, financial statements, and regulatory documents to establish comprehensive market understanding. Data collection encompasses historical market performance, current industry dynamics, and projected future trends based on economic indicators and policy developments affecting the cash management services sector.

Quantitative analysis utilizes statistical modeling and data analytics to identify market patterns, growth trajectories, and correlation factors influencing market development. The research methodology incorporates market sizing calculations, competitive analysis, and segmentation studies to provide detailed market intelligence for strategic decision-making purposes.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert consultations, and industry feedback mechanisms. The research approach maintains objectivity while providing actionable insights that support informed business decisions and strategic planning initiatives for market participants and stakeholders.

Central Region dominance characterizes the Saudi Arabia cash management services market, with Riyadh metropolitan area accounting for 38% of total market activity. The capital city’s concentration of government institutions, financial headquarters, and major commercial enterprises drives substantial demand for comprehensive cash management solutions. Banking sector presence and corporate headquarters concentration create opportunities for high-value service contracts and long-term partnerships.

Western Region significance emerges through Jeddah’s role as a major commercial and industrial hub, representing 29% market share in cash management services. The region benefits from port activities, international trade operations, and growing retail sector development that generates consistent demand for cash handling and transportation services. Mecca and Medina contribute additional market opportunities through religious tourism and associated commercial activities.

Eastern Region growth reflects the area’s industrial development and oil sector activities, accounting for 22% of market presence. Dammam, Khobar, and surrounding industrial cities require specialized cash management services for manufacturing facilities, petrochemical companies, and supporting commercial infrastructure. The region demonstrates strong potential for industrial-focused cash management solutions.

Northern and Southern Regions represent emerging opportunities with 11% combined market share, driven by government development initiatives and expanding commercial activities. These regions show increasing demand for cash management services as economic diversification efforts create new business centers and commercial districts requiring professional cash handling solutions.

Market leadership reflects a competitive environment featuring both international cash management specialists and local service providers. The competitive landscape demonstrates consolidation trends as larger companies acquire specialized providers to expand service capabilities and geographic coverage throughout Saudi Arabia.

Service Type Segmentation reveals diverse market categories addressing specific customer requirements:

End-User Segmentation demonstrates diverse application areas:

Technology-Enabled Services represent the fastest-growing category within the Saudi Arabia cash management services market. These solutions integrate advanced hardware and software components to deliver automated cash handling, real-time monitoring, and predictive analytics capabilities. Smart cash management systems demonstrate 45% adoption growth among large enterprises seeking to optimize operational efficiency and reduce manual handling requirements.

Traditional Cash Services maintain significant market presence despite digital transformation trends, particularly among small and medium enterprises that require cost-effective cash handling solutions. These services focus on reliable cash transportation, basic processing, and secure storage without extensive technology integration. Service reliability and competitive pricing remain primary selection criteria for this category.

Integrated Financial Solutions emerge as a premium category combining cash management services with broader financial management capabilities. These comprehensive platforms address multiple financial service needs including treasury management, payment processing, and financial reporting. Corporate clients increasingly prefer integrated solutions that streamline financial operations while maintaining cash management efficiency.

Specialized Industry Solutions cater to specific sector requirements including healthcare cash management, retail optimization, and government compliance services. These tailored solutions address unique operational challenges and regulatory requirements within specific industries, commanding premium pricing due to specialized expertise and customization requirements.

Operational Efficiency Enhancement represents the primary benefit for organizations utilizing professional cash management services. Companies experience significant reductions in cash handling time, improved accuracy in cash processing, and optimized cash flow management through professional service provider expertise. Cost reduction benefits include decreased internal staffing requirements, reduced security risks, and improved cash utilization efficiency.

Security Risk Mitigation provides substantial value through professional security protocols, trained personnel, and advanced security systems that minimize theft, fraud, and operational risks associated with cash handling. Organizations benefit from comprehensive insurance coverage, secure transportation methods, and professional risk management expertise that exceeds internal capabilities.

Regulatory Compliance Support ensures adherence to evolving financial regulations and security requirements through professional expertise and compliance monitoring systems. Service providers maintain current knowledge of regulatory changes and implement necessary procedures to ensure client compliance while reducing administrative burden on internal staff.

Technology Access Benefits enable organizations to leverage advanced cash management technologies without substantial capital investment. Professional service providers offer access to sophisticated cash handling equipment, monitoring systems, and analytics platforms that would be cost-prohibitive for individual organizations to implement independently.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration Acceleration represents the dominant trend shaping the Saudi Arabia cash management services market. Organizations increasingly adopt automated cash handling systems, smart safes, and intelligent deposit solutions that reduce manual processing requirements while improving accuracy and security. MWR analysis indicates that automation adoption rates have increased by 52% annually among major service providers, reflecting strong market momentum toward technology-enabled solutions.

Real-time Monitoring Implementation emerges as a critical trend enabling enhanced operational visibility and security management. Advanced tracking systems, GPS monitoring, and real-time reporting capabilities provide customers with comprehensive oversight of cash management operations while enabling proactive risk management and operational optimization.

Sustainability Focus Integration reflects growing environmental consciousness among organizations seeking eco-friendly cash management solutions. Service providers increasingly implement sustainable practices including route optimization, energy-efficient equipment, and environmentally responsible disposal methods that align with corporate sustainability objectives.

Customization Demand Growth drives development of tailored cash management solutions addressing specific industry requirements and operational challenges. Healthcare facilities, educational institutions, and government agencies require specialized services that accommodate unique security protocols, compliance requirements, and operational procedures.

Strategic Partnership Formations characterize recent industry developments as cash management companies collaborate with technology providers, financial institutions, and fintech companies to deliver comprehensive service portfolios. These partnerships enable service providers to offer integrated solutions that combine traditional cash management with digital payment processing and financial analytics capabilities.

Technology Platform Launches demonstrate industry commitment to innovation through introduction of advanced cash management platforms incorporating artificial intelligence, machine learning, and predictive analytics. These platforms enable customers to optimize cash levels, predict demand patterns, and automate decision-making processes while maintaining security and compliance standards.

Geographic Expansion Initiatives reflect market growth opportunities as established service providers expand operations into underserved regions and emerging commercial centers. These expansion efforts include establishment of new service centers, recruitment of local personnel, and development of region-specific service capabilities.

Regulatory Compliance Enhancements drive continuous improvement in service delivery standards as providers implement advanced security measures, reporting systems, and compliance monitoring capabilities to meet evolving regulatory requirements while maintaining operational efficiency.

Technology Investment Prioritization represents the primary recommendation for cash management service providers seeking sustainable competitive advantages. Companies should focus investment on automation technologies, real-time monitoring systems, and predictive analytics platforms that enhance operational efficiency while delivering superior customer value. Strategic technology adoption enables providers to differentiate services and justify premium pricing in competitive market conditions.

Partnership Strategy Development emerges as a critical success factor for market participants seeking comprehensive service capabilities. Collaboration with fintech companies, digital payment providers, and technology specialists enables traditional cash management companies to offer integrated solutions that address evolving customer requirements while maintaining market relevance.

Geographic Diversification Focus provides opportunities for sustainable growth through expansion into underserved regions and emerging commercial centers. Service providers should evaluate market potential in secondary cities and developing economic zones where growing commercial activity creates demand for professional cash management services.

Specialization Strategy Implementation enables companies to capture premium market segments through development of industry-specific solutions addressing unique sector requirements. Healthcare, education, and government sectors offer opportunities for specialized services that command higher margins while building long-term customer relationships.

Market evolution trajectory indicates continued growth potential for the Saudi Arabia cash management services market despite increasing digital payment adoption. The market demonstrates resilience through adaptation to changing customer requirements and integration of advanced technologies that enhance service value. MarkWide Research projects sustained market expansion driven by economic diversification initiatives and ongoing commercial sector development throughout the Kingdom.

Technology transformation will fundamentally reshape service delivery models through implementation of artificial intelligence, blockchain security, and Internet of Things integration. These technological advances enable development of intelligent cash management ecosystems that optimize operations while providing enhanced security and compliance capabilities. Innovation adoption rates are expected to accelerate by 40% over the next five years as organizations recognize technology benefits.

Service integration trends point toward comprehensive financial service platforms that combine traditional cash management with digital payment processing, treasury services, and financial analytics. This evolution creates opportunities for service providers to expand revenue streams while delivering enhanced customer value through integrated solution offerings.

Market maturation processes will drive consolidation among service providers as larger companies acquire specialized firms to expand capabilities and geographic coverage. This consolidation trend creates opportunities for enhanced service delivery while potentially reducing competition in certain market segments.

The Saudi Arabia cash management services market presents a dynamic and evolving landscape characterized by strong growth potential, technological innovation, and increasing customer sophistication. Market development reflects the Kingdom’s broader economic transformation initiatives while addressing fundamental business needs for secure, efficient cash handling solutions across diverse industry sectors.

Strategic market positioning requires service providers to balance traditional cash management expertise with advanced technology integration and specialized service development. Companies that successfully navigate digital transformation challenges while maintaining operational excellence will capture significant market opportunities in this growing sector.

Future market success depends on continuous adaptation to changing customer requirements, regulatory developments, and technological advances that reshape service delivery models. The market offers substantial opportunities for organizations that invest in innovation, develop strategic partnerships, and focus on delivering superior customer value through comprehensive cash management solutions tailored to Saudi Arabia’s unique business environment.

What is Cash Management Services?

Cash Management Services refer to a suite of financial services that help businesses manage their cash flow efficiently. This includes services such as payment processing, liquidity management, and treasury management, which are essential for optimizing cash resources.

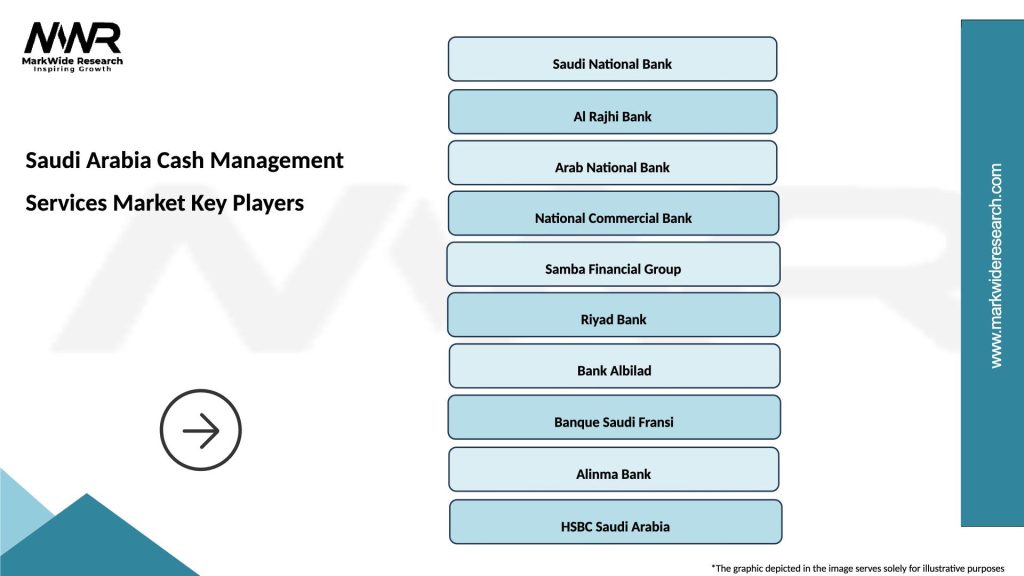

What are the key players in the Saudi Arabia Cash Management Services Market?

Key players in the Saudi Arabia Cash Management Services Market include banks and financial institutions such as Saudi National Bank, Al Rajhi Bank, and Arab National Bank, among others. These companies provide a range of cash management solutions tailored to various business needs.

What are the growth factors driving the Saudi Arabia Cash Management Services Market?

The growth of the Saudi Arabia Cash Management Services Market is driven by increasing digitalization in banking, the rise of e-commerce, and the need for efficient cash flow management among businesses. Additionally, government initiatives to enhance financial services contribute to market expansion.

What challenges does the Saudi Arabia Cash Management Services Market face?

Challenges in the Saudi Arabia Cash Management Services Market include regulatory compliance issues, cybersecurity threats, and the need for continuous technological upgrades. These factors can hinder the adoption of advanced cash management solutions by businesses.

What opportunities exist in the Saudi Arabia Cash Management Services Market?

Opportunities in the Saudi Arabia Cash Management Services Market include the growing demand for automated cash management solutions and the potential for fintech innovations. As businesses seek to streamline operations, there is a significant opportunity for service providers to offer tailored solutions.

What trends are shaping the Saudi Arabia Cash Management Services Market?

Trends in the Saudi Arabia Cash Management Services Market include the increasing adoption of cloud-based solutions, the integration of artificial intelligence for predictive analytics, and a focus on enhancing customer experience. These trends are transforming how businesses manage their cash flow.

Saudi Arabia Cash Management Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Cash Concentration, Payment Processing, Fraud Detection, Reconciliation |

| End User | BFSI, Retail, Government, Corporates |

| Technology | Cloud-Based, On-Premises, Mobile Solutions, API Integration |

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Cash Management Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at