444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia car rental and leasing market represents a dynamic and rapidly evolving sector within the Kingdom’s transportation ecosystem. Market dynamics indicate substantial growth driven by Vision 2030 initiatives, increasing tourism activities, and evolving mobility preferences among consumers and businesses. The sector has experienced remarkable transformation, with digital platforms and innovative service models reshaping traditional rental and leasing operations.

Economic diversification efforts have significantly impacted the car rental and leasing landscape, creating new opportunities for both domestic and international operators. The market demonstrates strong resilience with annual growth rates consistently outpacing regional averages. Tourism sector expansion has emerged as a primary catalyst, with religious tourism, business travel, and leisure activities driving sustained demand for rental vehicles.

Technology integration has revolutionized service delivery, with mobile applications, contactless transactions, and smart vehicle management systems becoming standard offerings. The market shows impressive adoption rates of 78% for digital booking platforms among urban consumers, reflecting the Kingdom’s commitment to digital transformation initiatives.

The Saudi Arabia car rental and leasing market refers to the comprehensive ecosystem of vehicle rental services, long-term leasing arrangements, and mobility solutions operating within the Kingdom’s borders. This market encompasses short-term rental services for tourists and business travelers, corporate fleet leasing programs, and specialized vehicle rental categories including luxury cars, commercial vehicles, and specialized transportation equipment.

Market participants include international car rental giants, domestic operators, fleet management companies, and emerging mobility service providers. The sector serves diverse customer segments ranging from individual tourists and business travelers to multinational corporations requiring comprehensive fleet solutions. Service offerings have expanded beyond traditional rental models to include subscription-based services, peer-to-peer sharing platforms, and integrated mobility solutions.

Regulatory frameworks governing the market have evolved to accommodate new business models while ensuring consumer protection and operational standards. The market operates under guidelines established by the Saudi Arabian Monetary Authority and various municipal authorities, creating a structured environment for sustainable growth and innovation.

Strategic positioning within the Saudi Arabia car rental and leasing market reveals significant opportunities driven by economic transformation and demographic shifts. The sector benefits from government initiatives promoting tourism development, business environment improvements, and infrastructure modernization. Market penetration rates show substantial room for growth, particularly in emerging segments such as electric vehicle rentals and premium mobility services.

Competitive dynamics reflect a healthy mix of established international operators and innovative local companies. The market demonstrates strong customer satisfaction rates of 82% across major service categories, indicating effective service delivery and operational excellence. Digital transformation initiatives have accelerated, with online bookings representing the majority of transactions in urban markets.

Investment flows into the sector have increased substantially, supporting fleet expansion, technology upgrades, and service diversification. The market shows particular strength in corporate leasing segments, where long-term contracts provide stability and predictable revenue streams. Sustainability initiatives are gaining traction, with hybrid and electric vehicle options becoming increasingly available across major operators.

Market intelligence reveals several critical insights shaping the Saudi Arabia car rental and leasing landscape:

Vision 2030 implementation serves as the primary catalyst driving market expansion, with ambitious tourism targets and economic diversification goals creating sustained demand for mobility services. Infrastructure development projects across the Kingdom have improved accessibility and created new business opportunities for rental operators. The NEOM project and other mega-developments are expected to generate substantial long-term demand for specialized vehicle services.

Tourism sector growth continues to fuel market expansion, with international visitor arrivals showing strong recovery and growth trajectories. Religious tourism remains a cornerstone of demand, while leisure tourism and business travel segments contribute increasingly significant volumes. The entertainment sector development, including theme parks and cultural attractions, has created new rental demand patterns.

Demographic shifts within Saudi society support market growth, with younger populations demonstrating higher propensity for rental services over vehicle ownership. Urbanization trends and changing lifestyle preferences favor flexible mobility solutions. Women’s driving legalization has expanded the customer base significantly, creating new market segments and service requirements.

Business environment improvements have attracted international companies establishing operations in the Kingdom, driving corporate fleet leasing demand. Economic zone development and special economic areas create concentrated demand for transportation services. Event hosting capabilities have expanded, with major international conferences and sporting events requiring substantial temporary vehicle fleets.

Regulatory complexities present ongoing challenges for market participants, particularly regarding licensing requirements and operational compliance across different regions. Insurance frameworks require careful navigation, with varying requirements for different vehicle categories and customer segments. Cross-border operations face regulatory hurdles that limit regional expansion opportunities.

Economic volatility related to oil price fluctuations can impact consumer spending patterns and business travel budgets. Seasonal demand variations create operational challenges, with significant peaks during religious seasons followed by quieter periods. Competition intensity has increased pricing pressures, particularly in commodity segments of the market.

Infrastructure limitations in some regions restrict service expansion and operational efficiency. Parking availability in major cities creates logistical challenges for fleet positioning and customer convenience. Traffic congestion in urban areas impacts vehicle utilization rates and operational costs.

Technology adoption barriers among certain customer segments limit digital service penetration. Cultural preferences for vehicle ownership in some demographics create resistance to rental alternatives. Skilled workforce availability for specialized services and technology operations remains a constraint for rapid expansion.

Electric vehicle integration presents substantial opportunities as the Kingdom pursues sustainability goals and infrastructure development. Charging network expansion creates possibilities for specialized EV rental services and partnerships with energy companies. Green mobility initiatives align with Vision 2030 environmental objectives, potentially attracting government support and incentives.

Technology partnerships offer opportunities for enhanced service delivery through artificial intelligence, IoT integration, and predictive analytics. Autonomous vehicle preparation positions forward-thinking operators for future market evolution. Blockchain applications could revolutionize contract management and vehicle tracking systems.

Regional expansion opportunities exist through partnerships with operators in neighboring GCC countries. Cross-border tourism development could create integrated regional rental networks. Franchise models offer scalable expansion strategies for established operators.

Specialized services development presents niche opportunities, including luxury vehicle experiences, adventure tourism support, and corporate event services. Subscription models could attract customers seeking alternatives to traditional ownership or rental arrangements. Integration with ride-sharing platforms offers hybrid service possibilities.

Supply and demand equilibrium in the Saudi Arabia car rental and leasing market reflects complex interactions between tourism cycles, business activity levels, and seasonal variations. Fleet management strategies have evolved to optimize vehicle utilization while maintaining service quality standards. Pricing dynamics demonstrate sophisticated revenue management approaches, with dynamic pricing becoming standard practice among major operators.

Customer behavior patterns show increasing sophistication, with advance booking rates reaching 72% for leisure travel and same-day bookings remaining significant for business travel. Service expectations have elevated, with customers demanding seamless digital experiences, flexible terms, and comprehensive support services. Brand loyalty factors include service reliability, vehicle quality, and pricing competitiveness.

Operational efficiency improvements through technology adoption have reduced processing times and enhanced customer satisfaction. Fleet optimization algorithms help operators maintain optimal inventory levels across different locations and vehicle categories. Maintenance scheduling systems ensure vehicle availability while minimizing downtime and operational disruptions.

Market consolidation trends indicate potential for strategic partnerships and acquisitions as operators seek scale advantages and market coverage expansion. Innovation cycles accelerate as companies invest in differentiation strategies and competitive positioning. Regulatory evolution continues to shape operational frameworks and market entry strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and actionable insights into the Saudi Arabia car rental and leasing market. Primary research includes extensive interviews with industry executives, fleet operators, and key stakeholders across the value chain. Customer surveys provide insights into usage patterns, satisfaction levels, and emerging preferences among different demographic segments.

Secondary research encompasses analysis of government publications, industry reports, and regulatory filings to understand market structure and competitive dynamics. Data validation processes ensure accuracy and reliability of market intelligence through cross-referencing multiple sources and expert verification. Statistical analysis employs advanced modeling techniques to identify trends and forecast future market developments.

Market segmentation analysis utilizes both quantitative and qualitative approaches to understand customer behavior and market opportunities. Competitive intelligence gathering includes monitoring of pricing strategies, service offerings, and market positioning across major operators. Technology assessment evaluates digital transformation initiatives and their impact on market dynamics.

Regional analysis incorporates geographic variations in demand patterns, regulatory requirements, and competitive landscapes. Trend identification processes combine historical data analysis with forward-looking indicators to predict market evolution. Expert consultation with industry specialists provides contextual understanding and strategic insights.

Riyadh metropolitan area dominates the Saudi Arabia car rental and leasing market, accounting for approximately 35% of total market activity. The capital city benefits from concentrated business activity, government operations, and major corporate headquarters driving consistent demand for both short-term rentals and long-term leasing arrangements. Infrastructure development projects and the upcoming Riyadh Metro system create additional opportunities for integrated mobility services.

Jeddah region represents the second-largest market segment, with 28% market share driven by its role as the commercial capital and gateway for religious tourism. The city’s port activities and business district concentration support strong corporate leasing demand. Red Sea tourism development projects promise substantial future growth opportunities for leisure-focused rental services.

Eastern Province markets, centered around Dammam and Al Khobar, contribute 18% of market volume, primarily driven by oil industry activities and industrial operations. Corporate fleet services dominate this region, with long-term leasing arrangements preferred by multinational companies and industrial operators. Cross-border business with neighboring countries creates additional demand for specialized rental services.

Makkah and Madinah regions show unique seasonal patterns, with religious tourism accounting for 85% of rental demand during peak seasons. These markets require specialized operational strategies to manage extreme seasonal variations. Infrastructure improvements and capacity expansions support growing visitor volumes and extended stay patterns.

Emerging regions including NEOM, Qiddiya, and other Vision 2030 projects represent future growth opportunities with projected annual growth rates exceeding 25% as development progresses. These areas require innovative service models and strategic positioning for long-term success.

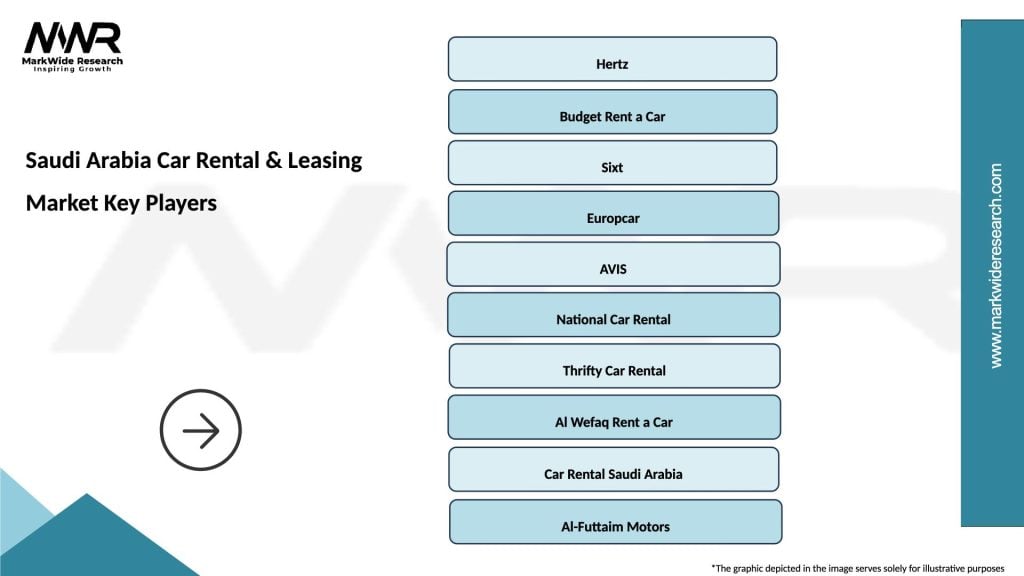

Market leadership in the Saudi Arabia car rental and leasing sector reflects a diverse competitive environment with both international and domestic operators maintaining significant market positions:

Competitive strategies emphasize service differentiation, technology integration, and customer experience enhancement. Fleet modernization initiatives and sustainability programs have become key differentiators among major operators. Strategic partnerships with airlines, hotels, and tourism operators create competitive advantages and customer acquisition channels.

Service type segmentation reveals distinct market categories with unique characteristics and growth patterns:

By Service Type:

By Vehicle Category:

By Customer Type:

Economy vehicle segment maintains the largest market share due to price sensitivity among leisure travelers and budget-conscious customers. This category benefits from high utilization rates and consistent demand across all regions. Fleet optimization in this segment focuses on fuel efficiency and maintenance cost control to maintain competitive pricing.

Luxury vehicle category demonstrates the highest growth rates, driven by increasing affluence and demand for premium experiences. High-net-worth individuals and special event requirements support premium pricing strategies. This segment requires specialized marketing approaches and exclusive service standards to maintain brand positioning.

Corporate leasing segment provides stable revenue streams through long-term contracts and comprehensive service packages. Fleet management services have evolved to include telematics, driver training, and sustainability reporting. This category shows strong resilience during economic uncertainties due to contractual commitments.

Commercial vehicle rentals serve growing logistics and construction sectors, with specialized equipment requirements driving service diversification. E-commerce growth creates additional demand for delivery vehicles and last-mile transportation solutions. This segment requires technical expertise and specialized maintenance capabilities.

Religious tourism segment shows unique seasonal patterns with extreme peaks during Hajj and Umrah periods. Operational strategies must accommodate massive capacity requirements followed by significant downscaling. This category requires cultural sensitivity and specialized customer service approaches.

Revenue diversification opportunities enable operators to reduce dependence on single market segments through comprehensive service portfolios. Scalable business models allow for rapid expansion and contraction based on demand fluctuations. Technology integration provides operational efficiencies and enhanced customer experiences that drive competitive advantages.

Market expansion potential offers growth opportunities through geographic expansion and service line extensions. Partnership opportunities with tourism operators, airlines, and hospitality providers create additional revenue channels and customer acquisition strategies. Data monetization possibilities emerge through customer insights and usage pattern analysis.

Stakeholder benefits extend beyond direct market participants to include:

Economic impact includes job creation, foreign investment attraction, and contribution to GDP growth through tourism and business activity support. Environmental benefits emerge through fleet modernization and shared mobility concepts reducing overall vehicle requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping customer interactions and operational processes throughout the Saudi Arabia car rental and leasing market. Mobile-first strategies have become essential, with contactless pickup and return processes gaining widespread adoption. Artificial intelligence applications in customer service and fleet management demonstrate significant efficiency improvements and cost reductions.

Sustainability initiatives gain momentum as operators respond to environmental concerns and government policies. Electric vehicle integration accelerates with charging infrastructure development and customer awareness campaigns. Carbon footprint reduction programs attract environmentally conscious customers and corporate clients with sustainability mandates.

Subscription-based models emerge as alternatives to traditional rental and leasing arrangements, offering customers flexible access to vehicles without long-term commitments. Mobility-as-a-Service concepts integrate rental services with other transportation options, creating comprehensive mobility solutions. Peer-to-peer sharing platforms introduce new competitive dynamics and market segments.

Premium service expansion reflects growing affluence and demand for luxury experiences among Saudi consumers. Concierge services and personalized customer experiences differentiate operators in competitive markets. Brand partnerships with luxury hotels and exclusive venues create premium positioning opportunities.

Data analytics utilization enhances operational efficiency and customer insights, enabling predictive maintenance and personalized service offerings. IoT integration provides real-time vehicle monitoring and enhanced security features. Blockchain applications explore possibilities for secure transactions and transparent contract management.

Strategic partnerships between international operators and local companies have accelerated market expansion and service enhancement. Technology collaborations with software providers and automotive manufacturers create innovative service delivery capabilities. Government partnerships support tourism development and infrastructure projects requiring specialized transportation services.

Fleet modernization programs across major operators emphasize fuel efficiency, safety features, and customer comfort improvements. Electric vehicle pilots test market readiness and operational requirements for sustainable fleet transitions. Autonomous vehicle preparations position forward-thinking operators for future technology adoption.

Market consolidation activities include strategic acquisitions and partnerships aimed at achieving scale advantages and market coverage expansion. International expansion by successful domestic operators explores regional growth opportunities. Franchise development programs enable rapid geographic expansion with reduced capital requirements.

Regulatory developments streamline licensing processes and create frameworks for new service models. Insurance innovations address evolving risk profiles and customer needs in changing market conditions. Cross-border agreements facilitate regional integration and tourism development initiatives.

Investment flows into the sector support technology upgrades, fleet expansion, and service diversification initiatives. Venture capital interest in mobility startups creates innovation opportunities and competitive pressures. Infrastructure investments by government and private sectors enhance operational capabilities and market accessibility.

MarkWide Research analysis indicates that successful operators should prioritize digital transformation initiatives to meet evolving customer expectations and operational efficiency requirements. Investment priorities should focus on mobile platform development, contactless service delivery, and data analytics capabilities that enhance customer experience and operational insights.

Strategic positioning recommendations emphasize the importance of service differentiation through technology integration and customer experience enhancement. Fleet optimization strategies should balance cost efficiency with service quality, incorporating sustainability considerations and emerging vehicle technologies. Partnership development with tourism operators, airlines, and hospitality providers creates competitive advantages and customer acquisition opportunities.

Market expansion strategies should consider regional variations in demand patterns and regulatory requirements. Seasonal management capabilities require sophisticated planning and flexible operational models to optimize resource utilization. Corporate segment focus provides stability and growth opportunities through long-term relationships and comprehensive service packages.

Technology adoption should prioritize customer-facing innovations while building operational efficiency through backend systems integration. Sustainability initiatives align with government policies and customer preferences, creating differentiation opportunities and regulatory compliance benefits. Risk management strategies should address economic volatility, regulatory changes, and competitive pressures through diversified service portfolios and flexible operational models.

Long-term growth prospects for the Saudi Arabia car rental and leasing market remain highly positive, driven by Vision 2030 implementation and continued economic diversification efforts. Tourism sector expansion is expected to generate sustained demand growth, with international visitor targets creating substantial market opportunities. Projected growth rates of 15-20% annually through 2030 reflect the sector’s strategic importance and development potential.

Technology evolution will continue reshaping market dynamics, with artificial intelligence, IoT integration, and autonomous vehicle preparation becoming competitive necessities. Electric vehicle adoption is projected to accelerate significantly, with EV penetration rates reaching 40% of rental fleets by 2030. Digital service delivery will become standard across all market segments, with contactless operations and mobile-first customer experiences driving market leadership.

Market consolidation trends are expected to continue, with strategic partnerships and acquisitions creating larger, more efficient operators capable of serving diverse customer needs. Regional integration opportunities through GCC cooperation and cross-border tourism development will expand market scope and service requirements. Subscription models and mobility-as-a-service concepts are projected to capture 25% of market volume by 2028.

Regulatory evolution will support market development through streamlined processes and frameworks accommodating innovative service models. Infrastructure development will enhance market accessibility and operational efficiency, particularly in emerging regions and mega-project areas. MWR projections indicate that the market will achieve mature status by 2030, with established competitive dynamics and comprehensive service coverage across the Kingdom.

The Saudi Arabia car rental and leasing market represents a dynamic and rapidly evolving sector positioned for substantial growth through Vision 2030 implementation and economic diversification initiatives. Market fundamentals remain strong, supported by tourism expansion, business development, and changing mobility preferences among consumers and corporations. The sector demonstrates resilience and adaptability, with operators successfully navigating challenges while capitalizing on emerging opportunities.

Technology integration has emerged as a critical success factor, with digital transformation initiatives reshaping customer experiences and operational efficiency. Sustainability considerations are becoming increasingly important, driving fleet modernization and service innovation that align with environmental objectives and customer preferences. Strategic partnerships and market consolidation trends create opportunities for scale advantages and comprehensive service delivery.

Future prospects indicate continued robust growth driven by tourism development, infrastructure expansion, and evolving mobility concepts. The market’s strategic importance to Saudi Arabia’s economic diversification goals ensures continued government support and policy alignment. Successful operators will be those that embrace technology innovation, prioritize customer experience, and develop flexible business models capable of adapting to changing market conditions and customer needs in this dynamic and promising sector.

What is Car Rental & Leasing?

Car Rental & Leasing refers to the services that allow individuals and businesses to rent or lease vehicles for short or long-term use. This sector includes various types of vehicles, such as sedans, SUVs, and commercial vehicles, catering to diverse consumer needs.

What are the key players in the Saudi Arabia Car Rental & Leasing Market?

Key players in the Saudi Arabia Car Rental & Leasing Market include companies like Al-Futtaim Motors, Budget Saudi Arabia, and Sixt Rent a Car, among others. These companies offer a range of vehicles and services to meet the demands of both local and international customers.

What are the growth factors driving the Saudi Arabia Car Rental & Leasing Market?

The growth of the Saudi Arabia Car Rental & Leasing Market is driven by factors such as increasing tourism, a growing expatriate population, and the rise of ride-sharing services. Additionally, the expansion of infrastructure and urban development projects contributes to the demand for rental vehicles.

What challenges does the Saudi Arabia Car Rental & Leasing Market face?

The Saudi Arabia Car Rental & Leasing Market faces challenges such as regulatory hurdles, fluctuating fuel prices, and competition from ride-sharing platforms. These factors can impact profitability and operational efficiency for rental companies.

What opportunities exist in the Saudi Arabia Car Rental & Leasing Market?

Opportunities in the Saudi Arabia Car Rental & Leasing Market include the potential for growth in electric vehicle rentals, the expansion of digital platforms for booking, and partnerships with tourism agencies. These trends can enhance customer experience and broaden market reach.

What trends are shaping the Saudi Arabia Car Rental & Leasing Market?

Trends shaping the Saudi Arabia Car Rental & Leasing Market include the increasing adoption of technology for fleet management, the rise of subscription-based rental models, and a focus on sustainability through the introduction of eco-friendly vehicles. These trends are influencing consumer preferences and operational strategies.

Saudi Arabia Car Rental & Leasing Market

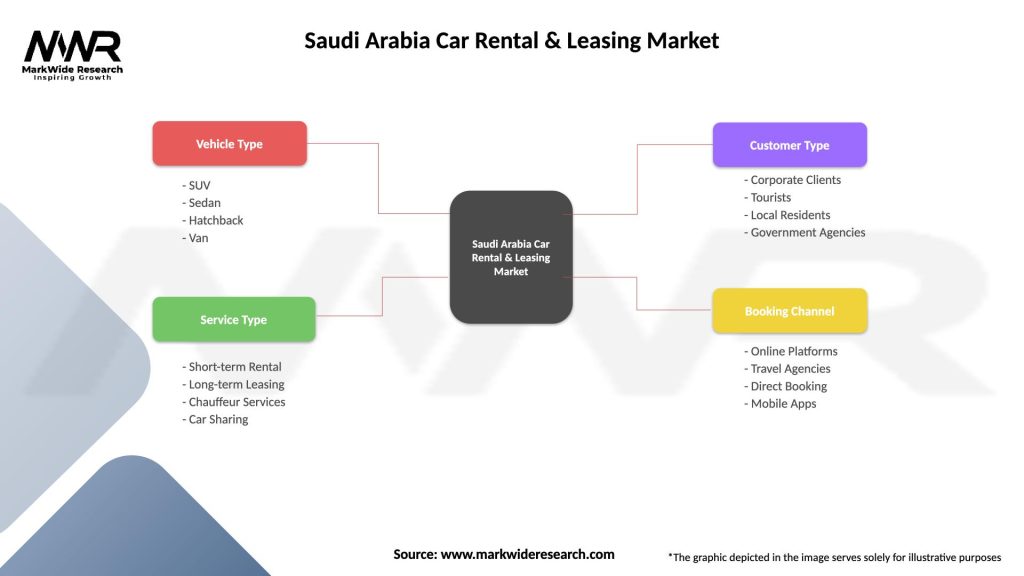

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Hatchback, Van |

| Service Type | Short-term Rental, Long-term Leasing, Chauffeur Services, Car Sharing |

| Customer Type | Corporate Clients, Tourists, Local Residents, Government Agencies |

| Booking Channel | Online Platforms, Travel Agencies, Direct Booking, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Car Rental & Leasing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at