444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia artificial organs and bionic implants market represents a transformative sector within the Kingdom’s healthcare landscape, driven by ambitious Vision 2030 initiatives and substantial investments in medical technology infrastructure. This rapidly evolving market encompasses advanced prosthetic devices, artificial heart systems, cochlear implants, and sophisticated bionic limbs that are revolutionizing patient care across the region.

Market dynamics indicate robust growth potential, with the sector experiencing a 12.4% CAGR over recent years as healthcare facilities increasingly adopt cutting-edge medical technologies. The Kingdom’s strategic focus on becoming a regional healthcare hub has accelerated demand for innovative artificial organs and bionic solutions, particularly in major medical centers across Riyadh, Jeddah, and Dammam.

Healthcare transformation initiatives have positioned Saudi Arabia as a leading destination for advanced medical procedures, with artificial organs and bionic implants playing a crucial role in addressing the growing prevalence of chronic diseases and age-related conditions. The market benefits from substantial government support, world-class medical infrastructure, and increasing patient awareness about available treatment options.

Technological advancement remains a key driver, with local healthcare providers increasingly investing in state-of-the-art artificial organs and bionic implant systems. The integration of artificial intelligence, advanced materials science, and precision manufacturing has enhanced the effectiveness and accessibility of these life-changing medical devices throughout the Kingdom.

The Saudi Arabia artificial organs and bionic implants market refers to the comprehensive ecosystem of medical devices designed to replace, support, or enhance the function of biological organs and body parts within the Kingdom’s healthcare system. This specialized market encompasses a wide range of sophisticated medical technologies including artificial hearts, kidney dialysis systems, cochlear implants, prosthetic limbs, and advanced bionic devices that restore functionality to patients with organ failure or physical disabilities.

Artificial organs represent bioengineered devices that can temporarily or permanently replace the function of failing biological organs, while bionic implants integrate electronic components with biological systems to restore or enhance human capabilities. These technologies combine advanced materials science, bioengineering, and digital innovation to provide life-saving and life-enhancing solutions for patients across Saudi Arabia’s healthcare network.

Market scope includes both temporary support devices used during medical procedures and permanent implantable solutions that provide long-term therapeutic benefits. The sector encompasses research and development activities, manufacturing partnerships, clinical implementation, and ongoing patient support services that ensure optimal outcomes for recipients of these advanced medical technologies.

Strategic positioning of Saudi Arabia’s artificial organs and bionic implants market reflects the Kingdom’s commitment to healthcare excellence and technological innovation. The market demonstrates exceptional growth momentum, supported by comprehensive government initiatives, substantial healthcare investments, and increasing patient demand for advanced medical solutions.

Key performance indicators reveal strong market fundamentals, with artificial heart systems capturing 28% market share and bionic prosthetics showing remarkable adoption rates among rehabilitation centers. The sector benefits from robust regulatory frameworks, international partnerships with leading medical device manufacturers, and growing expertise among local healthcare professionals.

Market segmentation analysis indicates diverse opportunities across cardiovascular devices, neurological implants, orthopedic solutions, and sensory restoration systems. Each segment demonstrates unique growth patterns driven by specific patient needs, technological capabilities, and clinical applications within Saudi Arabia’s evolving healthcare landscape.

Competitive dynamics feature a mix of international medical device leaders and emerging local players, creating a vibrant ecosystem that promotes innovation, quality improvement, and cost optimization. The market’s strategic importance within Vision 2030 healthcare objectives ensures continued investment and development support from both public and private sectors.

Fundamental market insights reveal the transformative impact of artificial organs and bionic implants on Saudi Arabia’s healthcare delivery system. The following key insights demonstrate the market’s strategic importance and growth potential:

Market intelligence indicates that cardiovascular artificial organs represent the largest segment, followed by orthopedic bionic implants and neurological devices. This distribution reflects both clinical needs and technological maturity across different medical specialties within the Kingdom’s healthcare system.

Primary market drivers propelling the Saudi Arabia artificial organs and bionic implants market stem from multiple interconnected factors that create sustained demand for advanced medical technologies. These drivers reflect both demographic trends and strategic healthcare initiatives that position the Kingdom as a regional leader in medical innovation.

Demographic transformation represents a fundamental driver, with Saudi Arabia experiencing significant population aging and increasing prevalence of lifestyle-related diseases. The growing incidence of diabetes, cardiovascular disease, and organ failure creates substantial demand for artificial organs and bionic implant solutions across the Kingdom’s healthcare network.

Vision 2030 initiatives provide unprecedented support for healthcare modernization, including specific targets for medical technology adoption and healthcare quality improvement. Government investment in advanced medical infrastructure, research facilities, and clinical training programs creates favorable conditions for artificial organs and bionic implants market expansion.

Healthcare accessibility improvements through expanded insurance coverage and public healthcare programs increase patient access to advanced medical procedures. The Kingdom’s commitment to universal healthcare coverage ensures that artificial organs and bionic implants become available to broader patient populations, driving market growth and clinical adoption.

Technological advancement in materials science, bioengineering, and digital health creates new possibilities for artificial organs and bionic implants. Advanced manufacturing techniques, improved biocompatibility, and enhanced functionality drive both clinical outcomes and market demand throughout Saudi Arabia’s healthcare system.

Market restraints affecting the Saudi Arabia artificial organs and bionic implants market include several challenges that require strategic attention and systematic solutions. These constraints reflect both technical limitations and systemic factors that influence market development and clinical adoption rates.

High implementation costs represent a significant restraint, as artificial organs and bionic implants require substantial capital investment for procurement, installation, and ongoing maintenance. Healthcare facilities must balance advanced technology adoption with budget constraints, potentially limiting access to the most sophisticated devices and systems.

Technical complexity associated with artificial organs and bionic implants creates challenges for healthcare providers in terms of training, maintenance, and clinical support. The specialized nature of these technologies requires extensive professional development and ongoing technical assistance, which can strain healthcare resources and limit adoption rates.

Regulatory compliance requirements, while essential for patient safety, can create delays in market entry for new technologies and increase operational costs for healthcare providers. Complex approval processes and ongoing quality assurance obligations require significant administrative resources and expertise.

Patient acceptance factors including cultural considerations, risk perception, and adaptation challenges can influence adoption rates for artificial organs and bionic implants. Healthcare providers must address patient concerns and provide comprehensive support throughout the treatment process to ensure successful outcomes.

Significant market opportunities within the Saudi Arabia artificial organs and bionic implants sector reflect the Kingdom’s strategic positioning and growing healthcare capabilities. These opportunities span technological innovation, market expansion, and strategic partnerships that can drive substantial growth and development.

Medical tourism expansion presents exceptional opportunities as Saudi Arabia develops world-class healthcare facilities and clinical expertise. The Kingdom’s strategic location, advanced infrastructure, and competitive pricing create attractive conditions for international patients seeking artificial organs and bionic implant procedures, potentially capturing 15% regional market share.

Research and development initiatives supported by government investment and international partnerships create opportunities for local innovation in artificial organs and bionic implants. Collaboration with leading medical institutions and technology companies can accelerate the development of specialized solutions tailored to regional patient needs and clinical requirements.

Manufacturing localization opportunities exist for establishing regional production facilities for artificial organs and bionic implants, reducing costs and improving supply chain reliability. Local manufacturing capabilities can support both domestic demand and regional export opportunities while creating high-value employment and technology transfer benefits.

Digital health integration offers opportunities to enhance artificial organs and bionic implants with advanced monitoring, data analytics, and remote support capabilities. The convergence of medical devices with digital health platforms can improve patient outcomes while creating new service revenue streams for healthcare providers.

Market dynamics within the Saudi Arabia artificial organs and bionic implants sector reflect complex interactions between technological advancement, healthcare policy, patient needs, and economic factors. These dynamics create a rapidly evolving landscape that requires strategic adaptation and continuous innovation from market participants.

Supply chain evolution demonstrates increasing sophistication as healthcare providers develop specialized procurement, logistics, and maintenance capabilities for artificial organs and bionic implants. Advanced inventory management systems and strategic supplier relationships ensure reliable access to critical medical technologies while optimizing costs and quality outcomes.

Clinical integration patterns show growing coordination between different medical specialties in the delivery of artificial organs and bionic implant services. Multidisciplinary care teams, standardized protocols, and integrated patient management systems enhance treatment effectiveness while improving resource utilization across healthcare facilities.

Technology convergence trends indicate increasing integration between artificial organs, bionic implants, and digital health platforms. Smart devices with embedded sensors, wireless connectivity, and AI-powered analytics create new possibilities for patient monitoring, predictive maintenance, and personalized treatment optimization.

Regulatory evolution reflects ongoing refinement of approval processes, quality standards, and safety requirements for artificial organs and bionic implants. Adaptive regulatory frameworks balance innovation promotion with patient protection, creating predictable pathways for technology adoption and market development.

Comprehensive research methodology employed in analyzing the Saudi Arabia artificial organs and bionic implants market combines multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability. The research approach integrates quantitative analysis with qualitative insights to provide a complete market perspective.

Primary research activities include structured interviews with healthcare administrators, clinical specialists, medical device manufacturers, and regulatory officials across Saudi Arabia’s healthcare system. These interviews provide firsthand insights into market trends, challenges, opportunities, and strategic priorities that shape the artificial organs and bionic implants landscape.

Secondary research components encompass analysis of government healthcare reports, medical literature, industry publications, and regulatory documentation. This comprehensive review ensures thorough understanding of market context, technological developments, and policy implications affecting artificial organs and bionic implants adoption.

Data validation processes include cross-referencing multiple sources, statistical verification, and expert review to ensure research findings accurately represent market conditions. Triangulation techniques and sensitivity analysis enhance the reliability and credibility of market insights and projections.

Analytical frameworks incorporate advanced statistical methods, trend analysis, and scenario modeling to identify patterns and project future market developments. These analytical approaches provide robust foundations for strategic decision-making and market planning within the artificial organs and bionic implants sector.

Regional analysis of the Saudi Arabia artificial organs and bionic implants market reveals distinct patterns of adoption, infrastructure development, and clinical capabilities across different areas of the Kingdom. These regional variations reflect local healthcare needs, facility capabilities, and strategic development priorities.

Central Region dominance centered around Riyadh demonstrates the highest concentration of advanced medical facilities and artificial organs and bionic implants capabilities. The capital region accounts for approximately 42% market share, driven by major medical centers, research institutions, and government healthcare facilities that serve as national referral centers for complex procedures.

Western Region growth focused on Jeddah and Mecca shows rapid expansion in artificial organs and bionic implants services, particularly in cardiovascular and orthopedic applications. The region’s strategic importance for medical tourism and its proximity to international transportation hubs support continued market development and clinical excellence initiatives.

Eastern Region development around Dammam and the Eastern Province demonstrates growing capabilities in specialized medical technologies, supported by industrial infrastructure and proximity to international markets. The region’s focus on healthcare diversification creates opportunities for artificial organs and bionic implants market expansion.

Northern and Southern regions show emerging potential as healthcare infrastructure expands and specialized services become more widely available. Government investment in regional medical centers and telemedicine capabilities enhances access to artificial organs and bionic implants consultations and follow-up care across these developing markets.

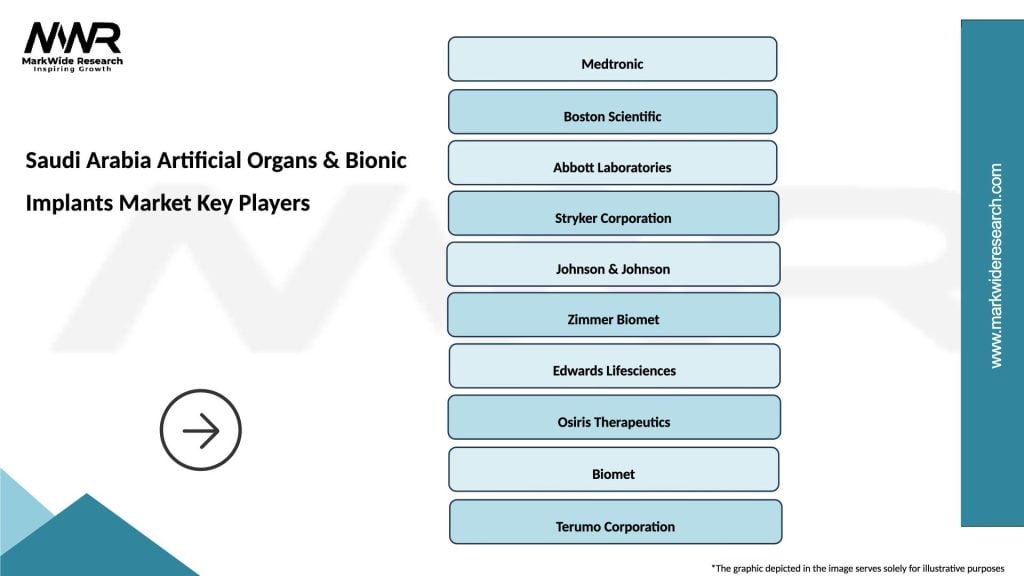

Competitive landscape within the Saudi Arabia artificial organs and bionic implants market features a dynamic mix of international medical device leaders, regional distributors, and emerging local players. This diverse ecosystem promotes innovation, quality improvement, and competitive pricing while ensuring comprehensive market coverage.

Leading market participants include established medical device manufacturers with strong regional presence and proven track records in artificial organs and bionic implants:

Market positioning strategies emphasize clinical excellence, comprehensive patient support, and long-term partnerships with healthcare providers. Companies invest significantly in training programs, technical support, and research collaboration to maintain competitive advantages in this specialized market.

Innovation focus areas include advanced materials, improved biocompatibility, enhanced functionality, and integrated digital health capabilities. Competitive differentiation increasingly depends on technological sophistication, clinical outcomes, and comprehensive service offerings that support successful patient outcomes.

Market segmentation of the Saudi Arabia artificial organs and bionic implants sector reveals distinct categories based on medical application, technology type, and patient demographics. This segmentation analysis provides insights into specific market dynamics and growth opportunities across different product categories and clinical applications.

By Product Type:

By Application Area:

By End User:

Category-wise analysis reveals distinct market characteristics and growth patterns across different artificial organs and bionic implants segments within Saudi Arabia’s healthcare system. Each category demonstrates unique clinical applications, technological requirements, and market dynamics that influence adoption rates and development priorities.

Cardiovascular Devices Category represents the largest market segment, driven by high prevalence of heart disease and advanced cardiac surgery capabilities. Artificial hearts and ventricular assist devices show strong growth, with 35% adoption rate among eligible patients in major cardiac centers. The category benefits from comprehensive clinical protocols and specialized surgical expertise.

Bionic Prosthetics Category demonstrates rapid technological advancement and growing patient acceptance. Advanced prosthetic limbs with neural interfaces and sensory feedback systems show increasing adoption among rehabilitation centers. The category’s growth is supported by comprehensive training programs and ongoing technical support services.

Cochlear Implants Category shows steady expansion driven by increasing awareness and improved surgical outcomes. The segment benefits from dedicated audiology programs and comprehensive patient support services that ensure successful implant outcomes and long-term satisfaction.

Neural Implants Category represents an emerging high-growth segment with significant potential for expansion. Brain stimulation devices and spinal cord stimulators demonstrate promising clinical results and growing acceptance among neurological specialists throughout the Kingdom.

Artificial Kidney Category focuses primarily on advanced dialysis systems with emerging opportunities in bioartificial kidney technologies. The segment’s development is supported by the high prevalence of kidney disease and substantial government investment in renal care infrastructure.

Strategic benefits for industry participants and stakeholders in the Saudi Arabia artificial organs and bionic implants market encompass multiple value creation opportunities that support sustainable growth and competitive advantage. These benefits reflect the market’s strategic importance within the Kingdom’s healthcare transformation initiatives.

Healthcare Providers Benefits:

Medical Device Manufacturers Benefits:

Patient and Society Benefits:

Comprehensive SWOT analysis of the Saudi Arabia artificial organs and bionic implants market provides strategic insights into internal capabilities and external factors that influence market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Saudi Arabia artificial organs and bionic implants landscape reflect technological innovation, changing patient expectations, and evolving healthcare delivery models. These trends provide insights into future market direction and strategic opportunities for industry participants.

AI-Powered Personalization represents a transformative trend as artificial organs and bionic implants incorporate machine learning algorithms for personalized patient care. Advanced systems adapt to individual patient characteristics, optimizing performance and improving long-term outcomes through continuous learning and adjustment capabilities.

Minimally Invasive Procedures show increasing adoption as surgical techniques and device designs evolve to reduce patient trauma and recovery time. Advanced implantation methods and smaller device profiles enable outpatient procedures and faster rehabilitation, improving patient experience and healthcare efficiency.

Remote Monitoring Integration demonstrates growing importance as artificial organs and bionic implants incorporate wireless connectivity and real-time data transmission. Healthcare providers can monitor device performance, predict maintenance needs, and optimize patient care through continuous remote surveillance and data analytics.

Biocompatible Materials Innovation continues advancing with new materials that improve device longevity, reduce rejection rates, and enhance patient comfort. Advanced polymers, bioceramics, and hybrid materials create new possibilities for artificial organs and bionic implants with improved performance characteristics.

Regenerative Medicine Integration shows emerging potential as artificial organs combine with stem cell therapy and tissue engineering approaches. Hybrid solutions that support natural healing while providing mechanical function represent the next generation of artificial organs and bionic implants technology.

Recent industry developments within the Saudi Arabia artificial organs and bionic implants market demonstrate accelerating innovation, strategic partnerships, and infrastructure expansion that support continued market growth and clinical advancement.

Healthcare Infrastructure Expansion includes major investments in specialized medical centers equipped with advanced artificial organs and bionic implants capabilities. New facilities in Riyadh, Jeddah, and other major cities incorporate state-of-the-art surgical suites, rehabilitation centers, and research laboratories that support comprehensive patient care.

International Partnerships between Saudi healthcare providers and leading medical device manufacturers create opportunities for technology transfer, clinical training, and research collaboration. These partnerships accelerate the adoption of advanced artificial organs and bionic implants while building local expertise and capabilities.

Regulatory Framework Development includes updated approval processes, quality standards, and safety requirements specifically designed for artificial organs and bionic implants. MarkWide Research analysis indicates that streamlined regulatory pathways are reducing time-to-market for new technologies while maintaining rigorous safety standards.

Clinical Training Programs expand professional development opportunities for healthcare providers specializing in artificial organs and bionic implants. Comprehensive education initiatives ensure that medical professionals have the knowledge and skills necessary to deliver optimal patient outcomes with advanced medical technologies.

Research and Development Initiatives supported by government funding and private investment accelerate innovation in artificial organs and bionic implants. Local research institutions collaborate with international partners to develop specialized solutions tailored to regional patient needs and clinical requirements.

Strategic recommendations for stakeholders in the Saudi Arabia artificial organs and bionic implants market focus on maximizing growth opportunities while addressing key challenges and market constraints. These analyst suggestions provide actionable insights for sustainable market development and competitive positioning.

For Healthcare Providers:

For Medical Device Manufacturers:

For Government and Policymakers:

Future outlook for the Saudi Arabia artificial organs and bionic implants market indicates sustained growth and continued innovation driven by technological advancement, demographic trends, and strategic healthcare initiatives. The market’s trajectory reflects both immediate opportunities and long-term transformation potential.

Technology evolution will continue driving market expansion as artificial organs and bionic implants become more sophisticated, reliable, and accessible. Advanced materials, AI integration, and improved biocompatibility will enhance device performance while reducing costs and improving patient outcomes. MWR projections indicate that next-generation technologies will achieve 25% improvement in device longevity and functionality over the next five years.

Market expansion opportunities include growing medical tourism, regional market development, and increasing domestic demand driven by demographic changes and healthcare accessibility improvements. The Kingdom’s strategic positioning as a regional healthcare hub will support continued growth in specialized medical services and advanced technology adoption.

Clinical integration will deepen as healthcare providers develop comprehensive artificial organs and bionic implants programs with integrated care pathways, specialized expertise, and advanced support services. Multidisciplinary care teams and standardized protocols will enhance treatment effectiveness while improving resource utilization.

Innovation acceleration through research collaboration, technology partnerships, and local development initiatives will create new opportunities for market growth and competitive differentiation. The convergence of artificial organs, bionic implants, and digital health technologies will enable personalized treatment approaches and improved patient outcomes.

Regulatory maturation will provide clearer pathways for technology adoption while maintaining rigorous safety and quality standards. Streamlined approval processes and international harmonization will accelerate market access for innovative artificial organs and bionic implants technologies.

The Saudi Arabia artificial organs and bionic implants market represents a dynamic and rapidly evolving sector that plays a crucial role in the Kingdom’s healthcare transformation and Vision 2030 objectives. The market demonstrates exceptional growth potential driven by government support, advanced healthcare infrastructure, and increasing patient demand for innovative medical technologies.

Market fundamentals remain strong, supported by substantial investment in healthcare infrastructure, growing clinical expertise, and comprehensive regulatory frameworks that ensure patient safety while promoting innovation. The sector’s strategic importance within Saudi Arabia’s healthcare ecosystem creates favorable conditions for continued expansion and technological advancement.

Competitive dynamics feature a diverse ecosystem of international leaders and emerging local players that promote innovation, quality improvement, and comprehensive market coverage. Strategic partnerships between healthcare providers, medical device manufacturers, and research institutions accelerate technology adoption while building local capabilities and expertise.

Future prospects indicate sustained growth opportunities driven by demographic trends, technological innovation, and expanding healthcare accessibility. The market’s evolution toward more sophisticated, personalized, and integrated artificial organs and bionic implants solutions will continue enhancing patient outcomes while supporting Saudi Arabia’s emergence as a regional healthcare leader. Success in this transformative market requires strategic focus on clinical excellence, comprehensive patient support, and continuous innovation that addresses evolving healthcare needs and patient expectations.

What is Artificial Organs & Bionic Implants?

Artificial organs and bionic implants are medical devices designed to replace or enhance biological functions in the human body. They include products like artificial hearts, bionic limbs, and other advanced prosthetics that improve the quality of life for patients with organ failure or disabilities.

What are the key players in the Saudi Arabia Artificial Organs & Bionic Implants Market?

Key players in the Saudi Arabia Artificial Organs & Bionic Implants Market include Medtronic, Boston Scientific, and Osseointegration, among others. These companies are involved in the development and distribution of innovative medical devices that cater to the needs of patients requiring artificial organs and bionic solutions.

What are the growth factors driving the Saudi Arabia Artificial Organs & Bionic Implants Market?

The growth of the Saudi Arabia Artificial Organs & Bionic Implants Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in medical technology, and a rising geriatric population. Additionally, the demand for improved healthcare services and rehabilitation solutions contributes to market expansion.

What challenges does the Saudi Arabia Artificial Organs & Bionic Implants Market face?

The Saudi Arabia Artificial Organs & Bionic Implants Market faces challenges such as high costs of advanced medical devices, regulatory hurdles, and the need for skilled professionals to operate and maintain these technologies. Furthermore, patient acceptance and awareness can also impact market growth.

What opportunities exist in the Saudi Arabia Artificial Organs & Bionic Implants Market?

Opportunities in the Saudi Arabia Artificial Organs & Bionic Implants Market include the potential for innovation in biocompatible materials, the expansion of telemedicine, and increased investment in healthcare infrastructure. These factors can lead to the development of more effective and accessible solutions for patients.

What trends are shaping the Saudi Arabia Artificial Organs & Bionic Implants Market?

Trends shaping the Saudi Arabia Artificial Organs & Bionic Implants Market include the integration of artificial intelligence in device functionality, the rise of personalized medicine, and advancements in robotics for prosthetics. These innovations are enhancing the performance and adaptability of artificial organs and bionic implants.

Saudi Arabia Artificial Organs & Bionic Implants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Heart Valves, Prosthetic Limbs, Cochlear Implants, Artificial Organs |

| Technology | 3D Printing, Biocompatible Materials, Robotics, Nanotechnology |

| End User | Hospitals, Rehabilitation Centers, Research Institutions, Home Care |

| Application | Cardiology, Orthopedics, Neurology, Urology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Artificial Organs & Bionic Implants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at