444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia fisheries and aquaculture sector represents a rapidly evolving industry that plays an increasingly vital role in the Kingdom’s food security strategy and economic diversification efforts. As part of Vision 2030, Saudi Arabia has prioritized the development of its marine resources and aquaculture capabilities to reduce dependence on food imports and create sustainable employment opportunities. The sector encompasses both traditional fishing activities along the Red Sea and Arabian Gulf coastlines, as well as modern aquaculture operations that leverage advanced technologies and sustainable practices.

Market dynamics indicate that the sector is experiencing robust growth, driven by government initiatives, technological advancements, and increasing domestic demand for fresh seafood products. The Kingdom’s extensive coastline of approximately 2,640 kilometers provides substantial opportunities for both capture fisheries and marine aquaculture development. Recent investments in infrastructure, research facilities, and training programs have positioned Saudi Arabia as an emerging leader in the regional aquaculture market, with growth rates consistently exceeding 8.5% annually across key segments.

Strategic positioning within the sector reflects the government’s commitment to achieving 70% self-sufficiency in fish production by 2030, up from current levels of approximately 35%. This ambitious target has catalyzed significant private sector investment and international partnerships, creating a dynamic ecosystem that supports both traditional fishing communities and modern aquaculture enterprises. The integration of smart technologies, sustainable practices, and value-added processing capabilities has enhanced the sector’s competitiveness and export potential.

The Saudi Arabia fisheries and aquaculture sector market refers to the comprehensive ecosystem encompassing capture fisheries, aquaculture production, processing facilities, distribution networks, and supporting services that collectively contribute to the Kingdom’s seafood supply chain. This sector includes both marine and inland aquaculture operations, traditional fishing activities, fish processing and packaging facilities, feed production, equipment manufacturing, and related technological services that support sustainable fish production and distribution throughout the Kingdom.

Aquaculture operations within this context include land-based recirculating aquaculture systems (RAS), marine cage farming, integrated multi-trophic aquaculture (IMTA), and innovative desert aquaculture projects that utilize brackish groundwater resources. The sector also encompasses the entire value chain from hatchery operations and juvenile fish production to final consumer products, including fresh, frozen, and value-added seafood products that meet both domestic consumption needs and export market requirements.

Fisheries components include both artisanal and commercial fishing operations along the Red Sea and Arabian Gulf coasts, targeting species such as hamour, king mackerel, tuna, sardines, and various shellfish species. The sector integrates traditional fishing methods with modern technologies, sustainable fishing practices, and comprehensive fisheries management systems designed to ensure long-term resource sustainability while maximizing economic benefits for fishing communities and the broader economy.

Saudi Arabia’s fisheries and aquaculture sector is undergoing a transformative period characterized by substantial government investment, technological innovation, and strategic partnerships that are reshaping the industry landscape. The sector’s evolution from traditional fishing activities to a modern, technology-driven industry reflects the Kingdom’s broader economic diversification objectives and commitment to food security enhancement. Current production capacity has expanded significantly, with aquaculture operations contributing an increasing share of total fish production.

Key performance indicators demonstrate the sector’s robust growth trajectory, with aquaculture production increasing at an average annual rate of 12.3% over the past five years. The government’s National Fisheries Development Program has allocated substantial resources to infrastructure development, research and development initiatives, and capacity building programs that support both traditional fishing communities and modern aquaculture enterprises. These investments have resulted in improved productivity, enhanced product quality, and expanded market reach.

Strategic initiatives include the development of specialized aquaculture zones, establishment of research and development centers, implementation of sustainable fishing practices, and creation of integrated value chains that connect producers with domestic and international markets. The sector’s contribution to employment generation has grown significantly, with over 45,000 direct jobs created across various segments, while indirect employment effects have multiplied these benefits throughout coastal and rural communities.

Market positioning reflects Saudi Arabia’s emergence as a regional hub for aquaculture technology and sustainable fishing practices, with several flagship projects serving as models for other Gulf Cooperation Council countries. The integration of circular economy principles, renewable energy utilization, and water conservation technologies has enhanced the sector’s environmental sustainability while improving economic viability and competitiveness in regional and international markets.

Production diversification has become a defining characteristic of Saudi Arabia’s fisheries and aquaculture sector, with operations spanning multiple species, production systems, and market segments. The following key insights highlight the sector’s current status and future potential:

Market maturation is evidenced by the increasing sophistication of production systems, quality management protocols, and market development strategies. The sector’s evolution from primarily import-substitution focused to export-oriented reflects improved competitiveness and product quality standards that meet international market requirements.

Government policy support serves as the primary driver for sector growth, with Vision 2030 providing a comprehensive framework for fisheries and aquaculture development. The National Fisheries Development Program has established clear targets, allocated substantial funding, and created enabling regulatory frameworks that encourage private sector investment and innovation. Policy initiatives include streamlined licensing procedures, tax incentives for aquaculture investments, and subsidized access to land and water resources for qualified operators.

Food security imperatives drive continued expansion as Saudi Arabia seeks to reduce its dependence on food imports and enhance domestic production capabilities. The Kingdom currently imports approximately 65% of its seafood consumption, creating substantial opportunities for domestic producers to capture market share through competitive pricing, superior freshness, and customized product offerings that meet local consumer preferences and cultural requirements.

Technological advancement enables more efficient and sustainable production systems that overcome traditional constraints related to water scarcity, climate conditions, and geographic limitations. Innovations in recirculating aquaculture systems, automated feeding technologies, water treatment systems, and environmental monitoring have significantly improved production efficiency while reducing environmental impact and operational costs.

Consumer demand evolution reflects increasing awareness of seafood’s nutritional benefits, growing preference for fresh and locally-produced products, and expanding culinary diversity that incorporates various fish species and preparation methods. Rising disposable incomes and changing dietary patterns have created premium market segments that value quality, traceability, and sustainability attributes.

Investment attraction from both domestic and international sources provides the capital necessary for sector expansion and modernization. Government co-investment programs, development fund financing, and private equity participation have created a robust investment ecosystem that supports projects across the entire value chain, from production facilities to processing plants and distribution networks.

Water resource limitations present ongoing challenges for sector expansion, particularly for inland aquaculture operations that compete with other sectors for freshwater access. While technological solutions such as recirculating systems and brackish water utilization help mitigate these constraints, water costs and availability remain significant factors in project feasibility and operational sustainability, requiring careful resource management and conservation strategies.

Technical expertise shortage constrains rapid sector expansion, as specialized knowledge in aquaculture management, fish health, water quality management, and processing technologies requires extensive training and experience. The Kingdom is addressing this challenge through educational programs, international partnerships, and knowledge transfer initiatives, but skills development remains a medium-term constraint on growth rates.

Climate variability affects both capture fisheries and aquaculture operations, with temperature fluctuations, seasonal variations, and extreme weather events impacting production schedules, fish health, and operational efficiency. Climate adaptation strategies and resilient production systems are being developed, but environmental risks continue to influence operational planning and investment decisions.

Market competition from established international suppliers creates pricing pressure and quality expectations that require continuous improvement in production efficiency and product differentiation. Imported seafood products often benefit from economies of scale and established supply chains, requiring domestic producers to compete through freshness, quality, and specialized product offerings.

Regulatory complexity associated with environmental permits, food safety requirements, and international trade standards can create barriers to entry and operational challenges for smaller operators. While regulatory frameworks are being streamlined, compliance costs and administrative requirements continue to influence business planning and operational procedures.

Export market expansion presents substantial opportunities as Saudi Arabia develops production capacity that exceeds domestic consumption requirements. Regional markets in the GCC, broader Middle East, and North Africa offer significant potential for high-quality seafood products, particularly premium species and value-added products that command higher margins and support sector profitability and growth.

Value-added processing opportunities include the development of convenience products, ready-to-eat meals, specialty preparations, and functional foods that incorporate seafood ingredients. These higher-margin products can capture greater value from raw material inputs while meeting evolving consumer preferences for convenient, healthy, and innovative food products.

Technology commercialization offers opportunities to develop and export aquaculture technologies, equipment, and expertise to other countries facing similar challenges in arid and semi-arid environments. Saudi Arabia’s innovations in desert aquaculture, water-efficient production systems, and integrated farming approaches have potential applications in similar geographic and climatic conditions globally.

Circular economy integration creates opportunities to develop integrated production systems that combine aquaculture with agriculture, renewable energy generation, and waste management. These systems can improve resource efficiency, reduce environmental impact, and create additional revenue streams through by-product utilization and ecosystem services.

Research and development partnerships with international institutions, technology companies, and academic organizations can accelerate innovation, technology transfer, and capacity building while positioning Saudi Arabia as a regional center of excellence for aquaculture research and development activities.

Supply chain evolution reflects the sector’s maturation from fragmented, small-scale operations to integrated value chains that connect production, processing, and distribution activities. This integration has improved product quality, reduced post-harvest losses, and enhanced market access for producers while providing consumers with fresher, higher-quality products at competitive prices.

Competitive landscape is characterized by a mix of large-scale commercial operations, medium-sized specialized producers, and traditional fishing enterprises that serve different market segments and geographic areas. Competition drives innovation, efficiency improvements, and product differentiation while creating opportunities for collaboration and knowledge sharing across the industry.

Regulatory environment continues to evolve in response to sector growth, international best practices, and sustainability requirements. Recent regulatory developments have streamlined permitting processes, clarified environmental standards, and established quality certification programs that support market development and export competitiveness.

Investment patterns show increasing private sector participation alongside continued government support, with foreign direct investment contributing expertise, technology, and market access. Joint ventures and strategic partnerships are becoming more common as the sector seeks to leverage international experience while building domestic capabilities.

Market segmentation has become more sophisticated, with distinct segments emerging for premium products, mass market offerings, export-oriented production, and specialized applications such as aquaponics and ornamental fish. This segmentation allows producers to focus on specific market niches and develop targeted strategies for growth and profitability.

Comprehensive data collection for this analysis incorporated multiple primary and secondary research methodologies to ensure accuracy and completeness of market insights. Primary research included structured interviews with industry stakeholders, government officials, technology providers, and market participants across the entire value chain, from production facilities to retail outlets and export operations.

Secondary research encompassed analysis of government publications, industry reports, academic studies, trade statistics, and regulatory documents to establish baseline data and identify trends, challenges, and opportunities within the sector. Statistical data from the Ministry of Environment, Water and Agriculture, Saudi Food and Drug Authority, and other relevant government agencies provided quantitative foundations for market analysis.

Field research included site visits to major aquaculture facilities, fishing ports, processing plants, and research institutions to observe operations, assess technological capabilities, and understand practical challenges and opportunities facing industry participants. These visits provided valuable insights into operational realities and future development potential.

Stakeholder consultation involved engagement with industry associations, research institutions, international organizations, and development agencies to gather diverse perspectives on market dynamics, policy implications, and future growth prospects. These consultations helped validate findings and identify emerging trends and opportunities.

Data validation processes included cross-referencing multiple sources, triangulating quantitative data, and conducting follow-up interviews to ensure accuracy and reliability of research findings. MarkWide Research analytical frameworks were applied to synthesize diverse data sources into coherent market insights and strategic recommendations.

Eastern Province dominates aquaculture production, accounting for approximately 45% of total output, driven by favorable coastal conditions, established infrastructure, and proximity to major population centers. The region hosts several large-scale commercial operations, research facilities, and processing plants that serve both domestic and export markets. Continued expansion is supported by government investment in port facilities, transportation infrastructure, and specialized industrial zones.

Red Sea coastal regions contribute approximately 30% of national production, with particular strength in marine cage farming and traditional fishing activities. The region’s unique marine environment supports diverse species cultivation and has attracted significant investment in sustainable aquaculture technologies. Tourism integration opportunities and premium market positioning enhance the region’s economic potential and development prospects.

Central regions are emerging as important centers for inland aquaculture, utilizing brackish groundwater resources and advanced recirculating systems to overcome traditional geographic constraints. These operations account for approximately 15% of current production but represent significant growth potential as technology costs decline and operational expertise expands.

Northern regions contribute approximately 10% of total production, with operations focused on specialized species and niche markets. The region’s development potential is supported by available land resources, renewable energy potential, and strategic location for export market access. Investment in infrastructure and technology transfer programs is expected to accelerate regional development.

Regional integration initiatives are creating synergies between different production areas, with specialized facilities in each region contributing to a comprehensive national supply chain. Transportation networks, cold chain infrastructure, and processing capabilities are being developed to support inter-regional trade and market optimization.

Market leadership is distributed among several major players that have established significant production capacity, technological capabilities, and market presence across different segments of the fisheries and aquaculture sector. The competitive environment encourages innovation, efficiency improvements, and market development while creating opportunities for collaboration and knowledge sharing.

Competitive strategies focus on technological innovation, sustainability certification, product differentiation, and market expansion through both domestic growth and export development. Companies are investing in research and development, international partnerships, and capacity building to maintain competitive advantages and capture emerging opportunities.

By Production System:

By Species Category:

By Market Channel:

Marine Aquaculture represents the fastest-growing segment, with production increasing at 15.2% annually as operators expand cage farming operations and adopt advanced technologies. This category benefits from strong consumer preference for marine species, premium pricing, and export market potential. Investment in offshore cage systems and automated feeding technologies is driving productivity improvements and cost reductions.

Land-based Systems are gaining prominence due to their environmental control capabilities, water efficiency, and year-round production potential. Recirculating aquaculture systems account for the majority of new installations, offering advantages in water conservation, waste management, and biosecurity. These systems enable production in inland areas and reduce dependence on coastal locations.

Integrated Production systems are emerging as innovative approaches that combine aquaculture with agriculture, renewable energy, and waste management to create circular economy benefits. These systems demonstrate superior resource efficiency and environmental sustainability while generating multiple revenue streams and reducing operational costs.

Capture Fisheries continue to play an important role in the sector, providing employment for traditional fishing communities and supplying specific species that are not yet commercially cultured. Modernization efforts focus on sustainable fishing practices, improved post-harvest handling, and value chain integration to enhance profitability and sustainability.

Processing and Value Addition activities are expanding rapidly as producers seek to capture greater value from raw materials and meet evolving consumer preferences. Investment in processing facilities, cold chain infrastructure, and product development capabilities is creating opportunities for premium products and export market development.

Economic Benefits for industry participants include access to a growing domestic market, export opportunities, government support programs, and attractive investment returns. The sector offers diversification opportunities for agricultural companies, employment generation for coastal communities, and foreign exchange earnings through export development. Tax incentives, subsidized financing, and infrastructure support enhance project viability and profitability.

Technological Advantages available to stakeholders include access to cutting-edge aquaculture technologies, research and development support, and knowledge transfer programs. International partnerships provide opportunities to learn from global best practices while adapting technologies to local conditions. Innovation centers and research facilities offer technical assistance and collaborative development opportunities.

Market Access Benefits include preferential access to government procurement programs, export facilitation services, and market development support. Quality certification programs and traceability systems enhance product credibility and market acceptance. Distribution network development and cold chain infrastructure improvements reduce market access barriers and transaction costs.

Sustainability Advantages encompass environmental stewardship recognition, resource efficiency improvements, and circular economy integration opportunities. Certification programs provide market differentiation and premium pricing opportunities while demonstrating commitment to responsible production practices. Renewable energy integration and water conservation technologies reduce operational costs and environmental impact.

Strategic Positioning benefits include participation in a priority sector under Vision 2030, alignment with national food security objectives, and contribution to economic diversification goals. Stakeholders gain access to policy dialogue, regulatory development processes, and strategic planning initiatives that shape sector development and create long-term competitive advantages.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration has become a dominant trend as producers adopt environmentally responsible practices, pursue international certifications, and implement circular economy principles. This trend is driven by consumer preferences, regulatory requirements, and export market demands for sustainably-produced seafood products. Companies are investing in renewable energy, water conservation, and waste reduction technologies to enhance their sustainability profiles.

Technology Adoption is accelerating across all segments, with particular emphasis on automation, monitoring systems, and data analytics. Internet of Things (IoT) sensors, artificial intelligence applications, and remote monitoring capabilities are improving production efficiency, reducing labor requirements, and enhancing product quality. These technologies enable precise control of environmental conditions and early detection of potential problems.

Product Diversification reflects evolving consumer preferences and market opportunities, with producers expanding beyond traditional species to include premium varieties, value-added products, and specialized applications. Innovation in product development, packaging, and marketing is creating new market segments and revenue opportunities while reducing dependence on commodity products.

Vertical Integration strategies are becoming more common as companies seek to control quality, reduce costs, and capture greater value throughout the supply chain. Integration encompasses feed production, hatchery operations, grow-out facilities, processing plants, and distribution networks to create comprehensive production and marketing systems.

Export Orientation is increasing as domestic production capacity expands beyond local consumption requirements. Companies are developing export-quality products, obtaining international certifications, and establishing distribution partnerships to access regional and global markets. This trend is supported by government export promotion programs and trade facilitation initiatives.

Infrastructure Investment programs have significantly expanded production capacity and supporting facilities across the Kingdom. Major developments include new aquaculture zones, specialized ports, processing facilities, and research centers that enhance sector capabilities and competitiveness. Government investment in transportation networks and cold chain infrastructure has improved market access and product quality maintenance.

International Partnerships have brought advanced technologies, management expertise, and market access to Saudi operators. Strategic alliances with leading global aquaculture companies have accelerated technology transfer and capability development while providing access to international markets and best practices. These partnerships have been instrumental in establishing world-class production facilities and management systems.

Research and Development initiatives have established Saudi Arabia as a regional center for aquaculture innovation, particularly in areas related to desert aquaculture, water conservation, and climate adaptation. Collaboration between government research institutions, universities, and private companies has generated practical solutions to local challenges while creating intellectual property and export opportunities.

Regulatory Framework development has streamlined permitting processes, established quality standards, and created enabling conditions for sector growth. Recent regulatory improvements have reduced administrative barriers, clarified environmental requirements, and established certification programs that support market development and export competitiveness.

Market Development programs have increased consumer awareness, improved product availability, and enhanced market infrastructure. Government initiatives to promote local seafood consumption, combined with private sector marketing efforts, have expanded domestic market demand and created opportunities for premium product positioning.

Strategic Focus recommendations emphasize the importance of continued investment in technology, sustainability, and market development to maintain competitive advantages and achieve long-term growth objectives. MarkWide Research analysis suggests that companies should prioritize vertical integration, export market development, and innovation capabilities to capture emerging opportunities and mitigate competitive threats.

Technology Investment should focus on systems that provide competitive advantages through improved efficiency, quality, and sustainability. Priority areas include automation technologies, environmental monitoring systems, and data analytics capabilities that enable precision management and cost optimization. Investment in renewable energy integration and water conservation technologies will enhance long-term sustainability and cost competitiveness.

Market Development strategies should emphasize product differentiation, brand building, and customer relationship development to create sustainable competitive advantages. Companies should invest in quality certification, traceability systems, and marketing programs that communicate value propositions to target customers. Export market development requires systematic approach to market research, product adaptation, and distribution network establishment.

Collaboration Opportunities include partnerships with research institutions, technology providers, and international companies that can accelerate capability development and market access. Industry associations and collective marketing initiatives can help smaller operators access resources and markets that would be difficult to reach independently.

Risk Management strategies should address climate variability, market volatility, and regulatory changes through diversification, insurance programs, and adaptive management approaches. Companies should develop contingency plans for various scenarios and maintain financial flexibility to respond to changing conditions and opportunities.

Growth Projections indicate continued expansion of the Saudi Arabia fisheries and aquaculture sector, with production capacity expected to increase at an average annual rate of 9.2% over the next five years. This growth will be driven by ongoing government support, private sector investment, and expanding domestic and export market opportunities. Aquaculture production is expected to account for an increasing share of total output as new facilities become operational.

Technology Evolution will continue to drive productivity improvements and cost reductions, with particular emphasis on automation, environmental control, and sustainability technologies. Advanced monitoring systems, artificial intelligence applications, and biotechnology innovations will enhance production efficiency while reducing environmental impact and labor requirements. Integration of renewable energy and circular economy principles will become standard practice.

Market Expansion opportunities will emerge from both domestic consumption growth and export market development. Regional market integration, particularly within the GCC, will create larger market opportunities and economies of scale. Premium product segments and value-added processing will provide higher-margin opportunities for differentiated producers.

Sustainability Leadership will become increasingly important as environmental regulations tighten and consumer preferences evolve. Saudi Arabia’s investments in sustainable technologies and practices position the Kingdom to become a regional leader in responsible aquaculture development. This leadership will create competitive advantages and export opportunities for certified sustainable products.

Industry Maturation will result in consolidation, specialization, and increased efficiency as the sector evolves from its current development phase to a mature industry. Successful companies will be those that establish strong market positions, develop technological capabilities, and create sustainable competitive advantages through innovation and customer focus.

Saudi Arabia’s fisheries and aquaculture sector represents a dynamic and rapidly evolving industry that plays an increasingly important role in the Kingdom’s food security strategy and economic diversification objectives. The sector’s transformation from traditional fishing activities to a modern, technology-driven industry reflects the success of government policy support, private sector investment, and international collaboration in creating a competitive and sustainable aquaculture ecosystem.

Strategic positioning within the global aquaculture industry has been enhanced through significant investments in infrastructure, technology, and human capital development. The sector’s achievement of substantial production growth, export market development, and sustainability leadership demonstrates the effectiveness of comprehensive development strategies that integrate policy support, private sector capabilities, and international best practices.

Future prospects remain highly positive, with continued growth expected across all major segments of the industry. The combination of strong domestic market demand, expanding export opportunities, and ongoing technological innovation creates a favorable environment for sustained sector development. MWR analysis indicates that companies and stakeholders who invest in technology, sustainability, and market development will be best positioned to capture emerging opportunities and achieve long-term success in this rapidly evolving market.

The Saudi Arabia fisheries and aquaculture sector stands as a testament to the Kingdom’s ability to develop new industries and create competitive advantages through strategic planning, investment, and collaboration. As the sector continues to mature and expand, it will play an increasingly important role in supporting food security, economic diversification, and sustainable development objectives while creating substantial opportunities for industry participants and stakeholders throughout the value chain.

What is Fisheries and Aquaculture?

Fisheries and aquaculture refer to the sectors involved in the harvesting and farming of fish and other aquatic organisms. This includes both wild capture fisheries and the cultivation of species such as shrimp, tilapia, and sea bass in controlled environments.

What are the key companies in the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market?

Key companies in the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market include Saudi Fisheries Company, Almarai, and National Aquaculture Group, among others.

What are the growth factors driving the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market?

The growth of the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market is driven by increasing domestic demand for seafood, government initiatives to enhance food security, and investments in aquaculture technology.

What challenges does the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market face?

Challenges in the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market include overfishing, environmental concerns related to water quality, and competition from imported seafood products.

What opportunities exist in the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market?

Opportunities in the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market include the potential for expanding aquaculture operations, developing sustainable fishing practices, and increasing exports of high-demand seafood products.

What trends are shaping the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market?

Trends in the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market include a shift towards sustainable aquaculture practices, the adoption of advanced technologies for fish farming, and growing consumer interest in locally sourced seafood.

Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market

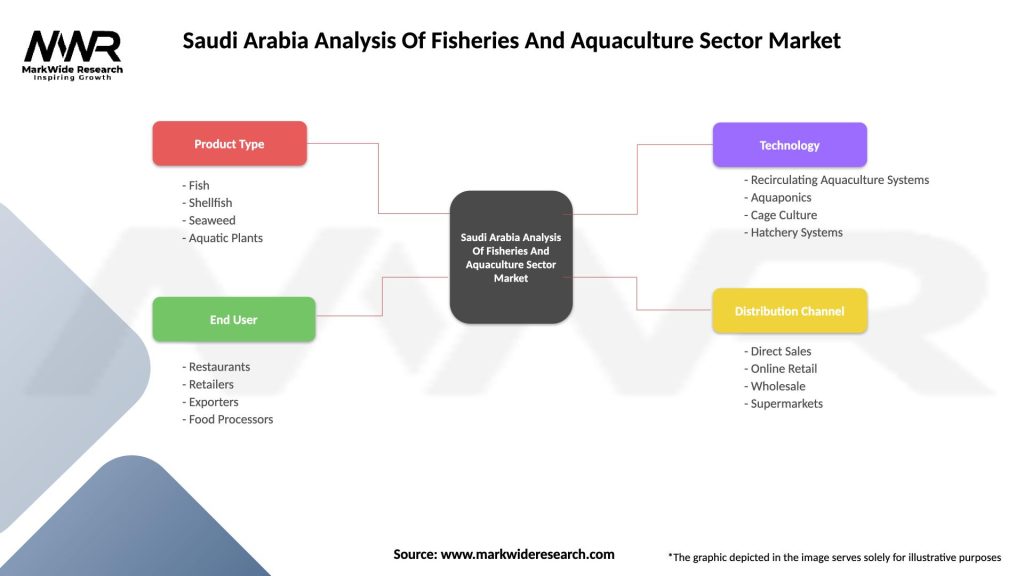

| Segmentation Details | Description |

|---|---|

| Product Type | Fish, Shellfish, Seaweed, Aquatic Plants |

| End User | Restaurants, Retailers, Exporters, Food Processors |

| Technology | Recirculating Aquaculture Systems, Aquaponics, Cage Culture, Hatchery Systems |

| Distribution Channel | Direct Sales, Online Retail, Wholesale, Supermarkets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Analysis Of Fisheries And Aquaculture Sector Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at