444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia agriculture market represents a dynamic and rapidly evolving sector that plays a crucial role in the Kingdom’s economic diversification strategy under Vision 2030. This comprehensive market encompasses various agricultural activities including crop production, livestock farming, aquaculture, and modern farming technologies. Saudi Arabia’s agricultural landscape has undergone significant transformation in recent years, driven by government initiatives to enhance food security and reduce dependency on imports.

Market dynamics indicate substantial growth potential, with the sector experiencing a 6.2% annual growth rate in agricultural productivity over the past five years. The Kingdom’s commitment to sustainable agriculture and technological innovation has positioned it as a regional leader in modern farming practices. Government investments in agricultural infrastructure, research and development, and farmer support programs have created a robust foundation for continued market expansion.

Strategic initiatives such as the National Agriculture Development Program and the Saudi Green Initiative have accelerated market growth, focusing on water-efficient farming techniques, greenhouse cultivation, and precision agriculture. The market benefits from 65% adoption rate of modern irrigation systems across commercial farms, demonstrating the sector’s commitment to sustainability and efficiency.

The Saudi Arabia agriculture market refers to the comprehensive ecosystem of agricultural activities, technologies, and services operating within the Kingdom’s borders, encompassing traditional farming, modern agricultural techniques, livestock production, and supporting industries that contribute to food production and rural economic development.

This market definition includes primary agricultural production such as crop cultivation, animal husbandry, and aquaculture, as well as secondary activities including food processing, agricultural machinery, fertilizers, seeds, and technological solutions. The market also encompasses agricultural services such as consulting, research and development, logistics, and distribution networks that support the entire agricultural value chain.

Modern agricultural practices within this market include hydroponics, vertical farming, precision agriculture, smart irrigation systems, and biotechnology applications. The market extends beyond traditional boundaries to include agtech solutions, sustainable farming practices, and integrated supply chain management systems that enhance productivity and efficiency across the agricultural sector.

Saudi Arabia’s agricultural market demonstrates remarkable resilience and growth potential, driven by strategic government initiatives and increasing private sector investment. The market has experienced significant transformation through the adoption of advanced technologies and sustainable farming practices, positioning the Kingdom as a regional agricultural innovation hub.

Key market drivers include food security concerns, population growth, and the government’s Vision 2030 diversification strategy. The sector has achieved 78% self-sufficiency in vegetable production and continues to expand its capabilities in protein production and specialty crops. Investment flows into agricultural technology and infrastructure have increased substantially, supporting market modernization efforts.

Market challenges primarily revolve around water scarcity, climate conditions, and the need for skilled agricultural workers. However, innovative solutions such as desalination-powered irrigation, climate-controlled farming environments, and comprehensive training programs are addressing these constraints effectively.

Future prospects remain highly positive, with projected growth driven by continued government support, technological advancement, and increasing domestic and regional demand for high-quality agricultural products. The market is expected to maintain robust growth momentum through strategic partnerships and sustainable development initiatives.

Strategic market insights reveal several critical factors shaping the Saudi Arabia agriculture market landscape:

Government policy support serves as the primary driver for agricultural market growth in Saudi Arabia. The Kingdom’s Vision 2030 initiative emphasizes food security and agricultural self-sufficiency, leading to substantial public investment in agricultural infrastructure, research facilities, and farmer support programs. Policy incentives including subsidies, low-interest loans, and tax benefits encourage private sector participation and innovation.

Food security imperatives drive continuous market expansion as the Kingdom seeks to reduce import dependency and ensure stable food supplies for its growing population. Strategic crop diversification programs and protein production initiatives are addressing nutritional needs while building resilient food systems. Population growth and changing dietary preferences create sustained demand for diverse agricultural products.

Technological advancement accelerates market development through improved productivity, efficiency, and sustainability. Integration of precision agriculture, automated systems, and data analytics enables farmers to optimize resource utilization and maximize yields. Innovation adoption is supported by government programs and private sector investment in agricultural technology solutions.

Water resource management innovations drive market growth by enabling sustainable agricultural expansion in arid conditions. Advanced irrigation systems, desalination integration, and water recycling technologies allow for increased agricultural production while conserving precious water resources. Climate adaptation strategies ensure continued productivity despite challenging environmental conditions.

Water scarcity challenges represent the most significant constraint facing Saudi Arabia’s agricultural market. Limited freshwater resources and high costs associated with desalination and water treatment impact production costs and expansion capabilities. Irrigation infrastructure requirements demand substantial capital investment, potentially limiting smaller operators’ participation in modern agricultural practices.

Climate limitations including extreme temperatures, low rainfall, and harsh environmental conditions restrict crop selection and require specialized farming techniques. Seasonal variations and weather unpredictability can affect production planning and yield consistency, requiring adaptive management strategies and protective infrastructure investments.

Skilled labor shortage constrains market growth as modern agricultural operations require technically trained workers capable of operating advanced equipment and implementing precision farming techniques. Training programs and educational initiatives are addressing this gap, but workforce development remains an ongoing challenge requiring sustained attention and investment.

High initial investment costs for modern agricultural infrastructure, including greenhouse facilities, irrigation systems, and technology integration, can limit market entry for smaller producers. Financial barriers may prevent widespread adoption of advanced farming techniques, potentially creating disparities in productivity and competitiveness across different market segments.

Export market expansion presents significant opportunities for Saudi agricultural producers to access regional and international markets with high-quality products. Growing demand for premium agricultural products in neighboring countries and global markets creates revenue potential for specialized crops and value-added products. Brand development and quality certification programs can position Saudi agricultural products as premium offerings in export markets.

Agtech innovation opportunities include development and deployment of cutting-edge agricultural technologies tailored to arid climate conditions. Research partnerships with international technology companies and academic institutions can accelerate innovation and create competitive advantages in agricultural productivity and sustainability.

Value chain integration opportunities exist throughout the agricultural sector, from farm-to-fork solutions that enhance efficiency and reduce waste. Processing facilities, cold storage infrastructure, and logistics networks represent areas for significant investment and development, creating comprehensive agricultural ecosystems that maximize value creation.

Sustainable agriculture initiatives offer opportunities to develop environmentally friendly farming practices that align with global sustainability trends. Carbon credit programs, organic certification, and renewable energy integration in agricultural operations can create additional revenue streams while supporting environmental objectives.

Supply and demand dynamics in Saudi Arabia’s agricultural market are influenced by population growth, changing consumer preferences, and government food security policies. Domestic production capacity continues to expand through technological improvements and infrastructure development, while import requirements remain significant for certain commodity categories.

Price volatility affects market dynamics through fluctuating input costs, including energy, fertilizers, and imported agricultural materials. Government price support mechanisms and strategic reserves help stabilize market conditions and protect both producers and consumers from extreme price fluctuations.

Seasonal production patterns create dynamic market conditions throughout the year, with greenhouse and controlled environment agriculture helping to smooth supply variations. Storage and preservation technologies enable better market timing and reduce post-harvest losses, improving overall market efficiency.

Competitive dynamics involve both domestic producers and international suppliers, with local production gaining market share through quality improvements and government support. Market consolidation trends are emerging as larger agricultural enterprises acquire smaller operations to achieve economies of scale and operational efficiency.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Saudi Arabia’s agricultural market. Primary research includes extensive interviews with agricultural producers, government officials, technology providers, and industry experts to gather firsthand market intelligence and validate market trends.

Secondary research incorporates analysis of government publications, industry reports, statistical databases, and academic studies to provide comprehensive market context and historical perspective. Data triangulation methods ensure consistency and accuracy across different information sources and research approaches.

Field research involves direct observation of agricultural operations, technology implementations, and market conditions across different regions of Saudi Arabia. Quantitative analysis includes statistical modeling of production data, market trends, and economic indicators to identify patterns and project future market developments.

Expert consultation with agricultural specialists, economists, and industry analysts provides professional insights and validation of research findings. Continuous monitoring of market developments ensures research remains current and relevant to evolving market conditions and emerging trends.

Central Region dominates Saudi Arabia’s agricultural market, accounting for approximately 35% of total agricultural production, with Riyadh Province leading in modern farming techniques and greenhouse cultivation. The region benefits from proximity to major consumption centers and advanced infrastructure supporting agricultural development. Investment concentration in research facilities and agricultural technology centers makes this region the innovation hub for the Kingdom’s agricultural sector.

Eastern Province represents 28% of agricultural output, leveraging its industrial infrastructure and water resources for large-scale agricultural operations. The region specializes in livestock production and feed crop cultivation, supported by modern processing facilities and logistics networks. Aquaculture development in coastal areas adds diversity to the regional agricultural portfolio.

Western Region contributes 22% of agricultural production, focusing on high-value crops and specialty agriculture suited to its diverse climate conditions. The region’s proximity to major ports facilitates both import of agricultural inputs and export of finished products. Organic farming initiatives and sustainable agriculture practices are particularly prominent in this region.

Northern and Southern Regions collectively account for 15% of agricultural production, with growing emphasis on climate-adapted crops and innovative farming techniques. These regions are experiencing increased investment in agricultural infrastructure and technology adoption, supported by government development programs and private sector initiatives.

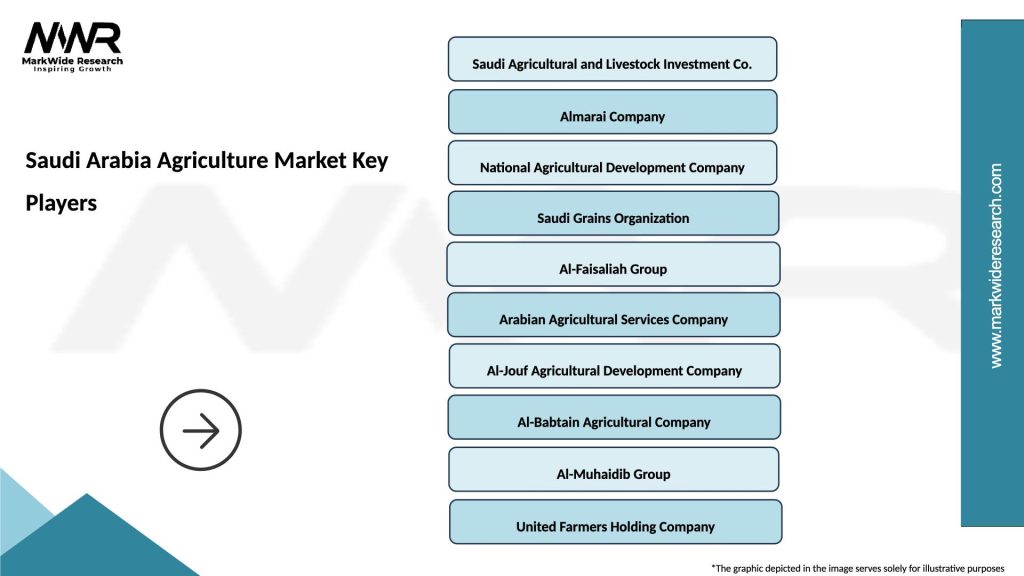

Market leadership in Saudi Arabia’s agricultural sector is characterized by a mix of large-scale commercial operations, government-supported entities, and innovative private companies driving technological advancement and productivity improvements.

By Product Type:

By Technology:

By Farm Size:

Vegetable Production represents the most dynamic segment of Saudi Arabia’s agricultural market, achieving 78% self-sufficiency through advanced greenhouse technologies and hydroponic systems. Tomatoes, cucumbers, and leafy greens dominate production volumes, with increasing focus on organic and premium varieties for domestic and export markets.

Dairy and Livestock operations have modernized significantly, incorporating automated milking systems, climate-controlled housing, and advanced breeding programs. Milk production efficiency has improved substantially through genetic improvement programs and nutritional optimization, supporting the Kingdom’s goal of dairy self-sufficiency.

Poultry Industry demonstrates strong growth momentum with modern processing facilities and integrated production systems. Broiler production utilizes advanced housing systems and feed optimization to achieve competitive production costs while maintaining high quality and food safety standards.

Aquaculture Development is emerging as a high-potential segment, with investments in marine fish farming and shrimp cultivation. Sustainable aquaculture practices and recirculating aquaculture systems are being implemented to maximize production while minimizing environmental impact.

Specialty Crops including dates, herbs, and high-value vegetables are gaining market attention through premium positioning and export development. Value-added processing and packaging innovations are enhancing market competitiveness and profit margins for specialty agricultural products.

Farmers and Producers benefit from government support programs, access to modern technology, and expanding market opportunities. Financial incentives including subsidized loans, equipment grants, and technical assistance enable agricultural modernization and productivity improvements. Training programs and extension services provide knowledge transfer and skill development opportunities.

Technology Providers find substantial opportunities in Saudi Arabia’s agricultural market through government initiatives promoting agricultural innovation. Research partnerships and pilot programs provide platforms for technology testing and commercialization. Market demand for water-efficient and climate-adapted agricultural solutions creates sustainable business opportunities.

Investors and Financial Institutions benefit from government backing and strategic importance of agricultural development. Risk mitigation through government guarantees and support programs enhances investment attractiveness. Long-term growth potential and stable demand fundamentals provide attractive investment returns.

Consumers benefit from improved food security, higher quality products, and competitive pricing through increased domestic production. Fresh produce availability year-round through greenhouse cultivation enhances nutrition and dietary diversity. Food safety standards and traceability systems ensure product quality and consumer confidence.

Government and Society benefit from reduced import dependency, job creation, and rural development. Economic diversification through agricultural development supports Vision 2030 objectives. Environmental benefits through sustainable farming practices and water conservation contribute to long-term sustainability goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision Agriculture Adoption is accelerating across Saudi Arabia’s agricultural sector, with farmers increasingly utilizing IoT sensors, GPS-guided equipment, and data analytics to optimize crop management. Smart farming technologies enable precise application of water, fertilizers, and pesticides, resulting in improved yields and resource efficiency.

Vertical Farming Expansion represents a growing trend as producers seek to maximize production in limited space while minimizing water usage. Multi-story growing systems and LED lighting technologies are enabling year-round production of leafy greens and herbs in urban and peri-urban areas.

Sustainable Agriculture Practices are gaining momentum through organic farming, integrated pest management, and renewable energy integration. Environmental certification and sustainable production methods are becoming important differentiators in domestic and export markets.

Supply Chain Digitization is transforming agricultural logistics through blockchain technology, cold chain monitoring, and e-commerce platforms. Digital traceability systems enhance food safety and quality assurance while improving market access for producers.

Agtech Startups are emerging as important innovation drivers, developing solutions specifically adapted to arid climate agriculture. Entrepreneurial initiatives supported by government incubators and private investment are creating new technologies and business models for the agricultural sector.

Government Initiative Launches include the Saudi Green Initiative and circular carbon economy programs that promote sustainable agricultural practices and environmental conservation. Policy frameworks supporting agricultural innovation and investment have been strengthened through regulatory reforms and incentive programs.

Technology Partnerships between Saudi agricultural companies and international technology providers are accelerating innovation adoption and knowledge transfer. Research collaborations with leading agricultural universities and institutes are advancing crop breeding, farming techniques, and agricultural biotechnology.

Infrastructure Investments in agricultural processing facilities, cold storage networks, and logistics infrastructure are enhancing market efficiency and reducing post-harvest losses. Mega projects including large-scale greenhouse complexes and integrated agricultural parks are expanding production capacity.

Export Market Development initiatives are establishing Saudi agricultural products in regional and international markets through trade missions, quality certifications, and brand development programs. Market access agreements and trade facilitation measures are opening new opportunities for agricultural exports.

Investment Attraction efforts have successfully drawn private sector capital into agricultural development through public-private partnerships and investment incentives. Foreign direct investment in agricultural technology and infrastructure is contributing to sector modernization and growth.

MarkWide Research recommends that agricultural stakeholders focus on water-efficient technologies and climate-adapted crop varieties to ensure long-term sustainability and competitiveness. Investment priorities should emphasize precision agriculture, greenhouse cultivation, and integrated supply chain solutions that maximize resource efficiency and market reach.

Strategic partnerships with international technology providers and research institutions can accelerate innovation adoption and competitive advantage development. Knowledge transfer programs and technical training initiatives should be prioritized to address skilled labor shortages and enhance operational capabilities.

Market diversification through export development and value-added product creation can reduce dependency on domestic markets and improve profitability. Quality certification and brand development initiatives should be implemented to position Saudi agricultural products as premium offerings in regional and international markets.

Sustainability integration across all agricultural operations will become increasingly important for market competitiveness and regulatory compliance. Environmental management systems and renewable energy adoption should be incorporated into long-term business planning and investment strategies.

Digital transformation initiatives including farm management software, supply chain digitization, and e-commerce platforms should be prioritized to enhance operational efficiency and market access. Data-driven decision making capabilities will become essential for competitive advantage in the evolving agricultural landscape.

Long-term growth prospects for Saudi Arabia’s agricultural market remain highly positive, supported by continued government commitment, technological advancement, and increasing market demand. Projected growth rates indicate sustained expansion across all major agricultural segments, with particularly strong performance expected in greenhouse cultivation and precision agriculture applications.

Technology integration will continue accelerating, with artificial intelligence, robotics, and biotechnology playing increasingly important roles in agricultural production. Innovation adoption rates are expected to reach 85% among commercial farms within the next decade, driven by competitive pressures and government incentives.

Export market development will become a major growth driver as Saudi agricultural products gain recognition for quality and sustainability. Regional market share in specialty crops and processed agricultural products is projected to increase significantly through strategic marketing and trade development initiatives.

Sustainability leadership will position Saudi Arabia as a model for arid climate agriculture, with potential for technology export and consulting services to other regions facing similar environmental challenges. Carbon neutrality goals and circular economy principles will guide future agricultural development strategies.

Investment flows into the agricultural sector are expected to maintain strong momentum, supported by attractive returns and strategic importance of food security. MWR analysis indicates that private sector investment will increasingly complement government funding, creating a balanced and sustainable financing ecosystem for agricultural development.

Saudi Arabia’s agriculture market stands at a transformative juncture, characterized by unprecedented government support, rapid technology adoption, and growing market opportunities. The sector’s evolution from traditional farming to modern, technology-driven agriculture demonstrates the Kingdom’s commitment to food security and economic diversification under Vision 2030.

Market fundamentals remain strong, with continued investment in infrastructure, research and development, and human capital development supporting sustainable growth. The successful integration of advanced technologies, sustainable practices, and market-oriented approaches positions Saudi agriculture for long-term competitiveness and success.

Strategic advantages including government backing, technological innovation, and regional market access create a favorable environment for continued expansion and development. While challenges such as water scarcity and climate conditions persist, innovative solutions and adaptive strategies are effectively addressing these constraints.

Future success will depend on continued collaboration between government, private sector, and international partners to maintain innovation momentum and market development. The Saudi Arabia agriculture market is well-positioned to achieve its ambitious goals of food security, export growth, and sustainable development, contributing significantly to the Kingdom’s economic transformation and regional agricultural leadership.

What is Agriculture?

Agriculture refers to the practice of cultivating soil, growing crops, and raising animals for food, fiber, and other products. It plays a crucial role in the economy and food security of countries, including Saudi Arabia.

What are the key players in the Saudi Arabia Agriculture Market?

Key players in the Saudi Arabia Agriculture Market include companies like Almarai, Savola Group, and National Agricultural Development Company. These companies are involved in various segments such as dairy, food processing, and crop production, among others.

What are the growth factors driving the Saudi Arabia Agriculture Market?

The growth of the Saudi Arabia Agriculture Market is driven by factors such as increasing population demand for food, government initiatives to enhance food security, and advancements in agricultural technology. These elements contribute to the expansion of both crop and livestock production.

What challenges does the Saudi Arabia Agriculture Market face?

The Saudi Arabia Agriculture Market faces challenges such as water scarcity, harsh climatic conditions, and reliance on imports for certain food products. These factors can hinder sustainable agricultural practices and affect overall productivity.

What opportunities exist in the Saudi Arabia Agriculture Market?

Opportunities in the Saudi Arabia Agriculture Market include the adoption of modern farming techniques, investment in agritech innovations, and the potential for organic farming. These trends can enhance productivity and sustainability in the sector.

What trends are shaping the Saudi Arabia Agriculture Market?

Trends shaping the Saudi Arabia Agriculture Market include the increasing use of precision agriculture, vertical farming, and sustainable practices. These innovations aim to improve efficiency and reduce environmental impact in agricultural operations.

Saudi Arabia Agriculture Market

| Segmentation Details | Description |

|---|---|

| Product Type | Crops, Livestock, Aquaculture, Horticulture |

| Technology | Precision Farming, Hydroponics, Drip Irrigation, Organic Farming |

| End User | Farmers, Agribusinesses, Cooperatives, Research Institutions |

| Distribution Channel | Direct Sales, Retail, Online, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Agriculture Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at