444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Saudi Arabia aesthetic market represents one of the fastest-growing segments within the Kingdom’s healthcare and beauty industry, driven by increasing consumer awareness, rising disposable income, and evolving beauty standards. This dynamic market encompasses a comprehensive range of cosmetic procedures, non-invasive treatments, and aesthetic enhancement services that cater to both men and women across various age demographics.

Market expansion has been particularly robust in recent years, with the sector experiencing a 12.5% annual growth rate as more Saudi consumers embrace aesthetic treatments as part of their wellness routines. The market’s evolution reflects broader societal changes, including increased urbanization, growing female workforce participation, and enhanced social acceptance of cosmetic procedures.

Regional distribution shows significant concentration in major metropolitan areas, with Riyadh and Jeddah accounting for approximately 68% of total market activity. The Kingdom’s Vision 2030 initiative has further accelerated market development by promoting medical tourism and encouraging private sector investment in healthcare infrastructure, creating favorable conditions for aesthetic service providers.

Consumer demographics reveal a diverse customer base, with millennials and Generation Z representing the largest segments of aesthetic treatment seekers. The market serves both local residents and international visitors, positioning Saudi Arabia as an emerging destination for medical and aesthetic tourism in the Middle East region.

The Saudi Arabia aesthetic market refers to the comprehensive ecosystem of cosmetic and beauty enhancement services, products, and treatments available within the Kingdom’s borders. This market encompasses surgical and non-surgical cosmetic procedures, dermatological treatments, aesthetic devices, skincare products, and related professional services designed to enhance physical appearance and boost consumer confidence.

Market scope includes various treatment categories such as facial rejuvenation, body contouring, hair restoration, skin treatments, and minimally invasive procedures. The sector operates through multiple channels including specialized aesthetic clinics, dermatology centers, medical spas, and hospital-based cosmetic surgery departments.

Service providers range from internationally certified plastic surgeons and dermatologists to licensed aesthetic practitioners and beauty therapists. The market also encompasses the distribution and retail of aesthetic equipment, injectable products, skincare formulations, and cosmeceutical brands specifically targeting the Saudi consumer base.

Market performance in Saudi Arabia’s aesthetic sector demonstrates exceptional momentum, characterized by robust demand growth, expanding service offerings, and increasing consumer sophistication. The market benefits from favorable demographic trends, including a young population with growing beauty consciousness and substantial purchasing power.

Key growth drivers include social media influence, celebrity endorsements, improved treatment accessibility, and enhanced safety standards across service providers. The sector has witnessed a 45% increase in treatment adoption rates over the past three years, indicating strong consumer acceptance and market maturation.

Competitive landscape features a mix of international aesthetic brands, regional players, and local service providers competing across various price segments and treatment categories. Market consolidation trends show increasing collaboration between global aesthetic companies and Saudi healthcare providers to establish comprehensive service networks.

Regulatory environment continues to evolve with enhanced oversight from the Saudi Food and Drug Authority and the Ministry of Health, ensuring higher safety standards and professional qualifications for practitioners. These developments have strengthened consumer confidence and market credibility.

Consumer behavior analysis reveals several critical insights shaping market development and service delivery strategies:

Economic prosperity serves as a fundamental driver, with increased disposable income enabling more consumers to invest in aesthetic treatments and premium beauty services. The Kingdom’s economic diversification efforts have created new employment opportunities and enhanced consumer spending power across various demographic segments.

Social media influence plays a crucial role in market expansion, with platforms like Instagram and Snapchat driving beauty trends and treatment awareness. Influencer marketing and user-generated content have normalized aesthetic procedures and increased consumer interest in various treatment options.

Cultural evolution reflects changing attitudes toward beauty enhancement and self-care, with younger generations more open to cosmetic procedures and aesthetic treatments. This cultural shift has reduced stigma associated with aesthetic procedures and encouraged broader market participation.

Healthcare infrastructure development supports market growth through improved medical facilities, advanced equipment availability, and enhanced practitioner training programs. Government investments in healthcare sector development have created favorable conditions for aesthetic service expansion.

Tourism initiatives under Vision 2030 promote medical tourism and position Saudi Arabia as a regional destination for aesthetic treatments. These efforts attract international patients and encourage domestic market development through improved service standards and facility upgrades.

Regulatory complexity presents ongoing challenges for market participants, with evolving licensing requirements, product approval processes, and practitioner certification standards creating operational hurdles for service providers and equipment suppliers.

Cultural sensitivities continue to influence market development, particularly regarding certain types of procedures and marketing approaches. Conservative social attitudes in some segments limit market expansion and require careful positioning of aesthetic services.

High treatment costs restrict market accessibility for price-sensitive consumer segments, limiting overall market penetration despite growing interest in aesthetic procedures. Premium pricing for advanced treatments creates barriers for middle-income consumers.

Skilled practitioner shortage constrains service capacity and quality consistency across different regions and provider types. Limited availability of internationally certified aesthetic professionals affects market growth potential and service standardization.

Safety concerns related to unqualified practitioners and substandard facilities impact consumer confidence and market reputation. Incidents involving unlicensed providers create negative publicity and regulatory scrutiny that affects the entire sector.

Male aesthetic market represents significant untapped potential, with growing acceptance of cosmetic procedures among Saudi men creating new service categories and revenue streams. This segment shows 28% annual growth potential based on regional trends and demographic analysis.

Medical tourism expansion offers substantial opportunities for market growth through international patient attraction and premium service development. Strategic positioning as a regional aesthetic hub could capture significant market share from neighboring countries.

Technology integration presents opportunities for service differentiation and efficiency improvements through AI-powered treatment planning, virtual consultations, and advanced diagnostic tools. Digital transformation initiatives can enhance customer experience and operational effectiveness.

Franchise development enables rapid market expansion through standardized service delivery models and brand recognition. International aesthetic brands seeking regional expansion represent partnership opportunities for local healthcare providers.

Preventive aesthetics targeting younger demographics offers long-term growth potential through early intervention treatments and skincare programs. This segment aligns with wellness trends and provides recurring revenue opportunities for service providers.

Supply chain evolution reflects increasing sophistication in product sourcing, equipment procurement, and service delivery systems. Market participants are developing more efficient distribution networks and establishing direct relationships with international suppliers to ensure product quality and availability.

Competitive intensity continues to increase as new entrants join the market and existing players expand their service offerings. This competition drives innovation, improves service quality, and creates more options for consumers across different price segments and treatment categories.

Technology adoption accelerates market transformation through advanced treatment modalities, improved patient outcomes, and enhanced operational efficiency. Service providers increasingly invest in cutting-edge equipment and digital platforms to maintain competitive advantages.

Consumer education initiatives by industry participants and regulatory bodies improve treatment awareness and safety understanding. These efforts contribute to market maturation and help establish realistic expectations among potential patients.

Regulatory alignment with international standards enhances market credibility and facilitates cross-border collaboration with global aesthetic companies. Harmonized regulations support market development while ensuring patient safety and treatment efficacy.

Primary research methodology encompasses comprehensive surveys of aesthetic service providers, consumer interviews, and expert consultations with industry professionals across major Saudi cities. Data collection includes quantitative analysis of treatment volumes, pricing trends, and consumer preferences through structured questionnaires and focus group discussions.

Secondary research involves extensive analysis of industry reports, regulatory publications, trade association data, and academic studies related to aesthetic market development in Saudi Arabia and the broader Middle East region. This approach ensures comprehensive market coverage and validates primary research findings.

Market segmentation analysis utilizes demographic data, treatment category information, and geographic distribution patterns to identify key market segments and growth opportunities. Statistical modeling techniques help project future market trends and consumer behavior patterns.

Competitive intelligence gathering includes analysis of major market participants, service offerings, pricing strategies, and market positioning approaches. This research component provides insights into competitive dynamics and strategic opportunities for market participants.

Riyadh region dominates the Saudi aesthetic market, accounting for approximately 38% of total market activity due to its status as the capital city and major economic center. The region hosts numerous premium aesthetic clinics, international brand outlets, and specialized medical facilities serving both local residents and visitors from other regions.

Western region centered around Jeddah and Mecca represents the second-largest market segment with 30% market share, benefiting from its cosmopolitan population, international business presence, and religious tourism influx. This region shows particular strength in luxury aesthetic services and premium treatment categories.

Eastern region including Dammam and Al Khobar captures 18% of market activity, supported by oil industry prosperity and expatriate population demand for aesthetic services. The region demonstrates growing interest in advanced aesthetic technologies and international treatment standards.

Southern regions including Asir and Jazan represent emerging markets with 14% combined market share, showing rapid growth potential as healthcare infrastructure develops and consumer awareness increases. These areas present opportunities for market expansion and service accessibility improvement.

Regional variations in consumer preferences, cultural attitudes, and service availability create distinct market characteristics that require tailored approaches from service providers and product suppliers seeking comprehensive market coverage.

Market leadership is distributed among various player categories, including international aesthetic chains, regional healthcare groups, and specialized local providers. The competitive environment encourages innovation and service quality improvements across all market segments.

Key market participants include:

Competitive strategies focus on service differentiation, technology adoption, practitioner expertise, and customer experience enhancement. Market participants increasingly emphasize safety credentials, treatment outcomes, and patient satisfaction to build competitive advantages.

Partnership trends show increasing collaboration between international brands and local healthcare providers to combine global expertise with regional market knowledge and regulatory compliance capabilities.

By Treatment Type:

By Consumer Demographics:

By Service Provider:

Facial Aesthetics represents the dominant treatment category, driven by consumer focus on facial rejuvenation and anti-aging procedures. This segment benefits from social media influence and the desire for photogenic appearance, with treatments like botox, fillers, and facial contouring showing consistent demand growth.

Body Contouring demonstrates strong growth potential, particularly among consumers seeking non-surgical alternatives to traditional cosmetic surgery. Advanced technologies like CoolSculpting and radiofrequency treatments gain popularity due to minimal downtime and natural-looking results.

Skin Treatments encompass a broad range of dermatological and cosmetic procedures addressing various skin concerns. This category benefits from increasing awareness of skincare importance and the availability of advanced treatment technologies for acne, pigmentation, and skin texture improvement.

Hair Restoration serves both male and female consumers experiencing hair loss concerns, with modern techniques offering more natural results and faster recovery times. This segment shows particular strength among professional demographics seeking to maintain youthful appearance.

Preventive Aesthetics targets younger consumers interested in maintaining skin health and preventing aging signs before they become prominent. This emerging category aligns with wellness trends and offers long-term revenue potential for service providers.

Healthcare Providers benefit from aesthetic service integration through revenue diversification, higher profit margins, and enhanced patient relationships. Aesthetic treatments often generate recurring revenue and create opportunities for cross-selling additional healthcare services.

Equipment Suppliers gain access to a rapidly expanding market with strong demand for advanced technologies and regular equipment upgrades. The Saudi market’s preference for premium solutions creates opportunities for high-value product sales and ongoing service contracts.

Pharmaceutical Companies find significant opportunities in injectable products, skincare formulations, and aesthetic pharmaceuticals. The market’s growth trajectory supports product portfolio expansion and brand development initiatives.

Real Estate Developers benefit from demand for specialized medical and aesthetic facilities, creating opportunities for purpose-built developments and medical district projects. Premium locations command higher rents and attract quality tenants.

Training Organizations serve the growing need for qualified aesthetic practitioners through certification programs, continuing education, and skill development initiatives. This sector supports market growth while ensuring safety and quality standards.

Insurance Providers explore opportunities in aesthetic treatment coverage and medical tourism insurance products, though current market penetration remains limited due to elective procedure classifications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Minimally Invasive Procedures dominate market preferences, with consumers increasingly seeking treatments that offer significant results with minimal downtime and recovery periods. This trend drives innovation in non-surgical alternatives and advanced technology adoption across service providers.

Personalized Treatment Plans gain importance as consumers demand customized aesthetic solutions tailored to their specific needs, skin types, and desired outcomes. Service providers invest in diagnostic technologies and consultation processes to deliver individualized treatment experiences.

Digital Integration transforms patient experience through virtual consultations, AI-powered treatment planning, and mobile applications for appointment scheduling and follow-up care. MarkWide Research indicates that digital adoption rates among aesthetic providers have increased by 55% over the past two years.

Combination Therapies become more popular as practitioners develop comprehensive treatment protocols combining multiple modalities for enhanced results. This approach maximizes treatment efficacy while providing better value propositions for consumers.

Wellness Integration reflects broader health and wellness trends, with aesthetic treatments positioned as part of comprehensive self-care routines rather than purely cosmetic interventions. This positioning expands market appeal and reduces stigma associated with aesthetic procedures.

Sustainability Focus emerges as consumers and providers increasingly consider environmental impact in treatment selection and facility operations. Eco-friendly products and sustainable practices become competitive differentiators in the market.

Regulatory Framework Enhancement includes updated licensing requirements for aesthetic practitioners, stricter facility standards, and improved product approval processes. These developments strengthen market credibility while ensuring higher safety standards across all service categories.

International Partnership Expansion sees global aesthetic companies establishing strategic alliances with Saudi healthcare providers to enter the market and expand service offerings. These partnerships bring advanced technologies and international expertise to the local market.

Technology Innovation Adoption accelerates with introduction of next-generation laser systems, advanced injectable products, and AI-powered diagnostic tools. Service providers invest heavily in cutting-edge equipment to maintain competitive advantages and attract discerning consumers.

Training Program Development addresses practitioner shortage through comprehensive education initiatives, certification programs, and international exchange opportunities. These programs ensure adequate skill development while maintaining high professional standards.

Facility Infrastructure Expansion includes construction of specialized aesthetic centers, medical spa developments, and hospital-based cosmetic surgery departments. This expansion improves service accessibility and creates more options for consumers across different regions.

Digital Platform Integration transforms patient engagement through telemedicine capabilities, virtual reality treatment previews, and comprehensive patient management systems. These technological advances enhance service delivery efficiency and patient satisfaction levels.

Market Entry Strategy recommendations emphasize the importance of regulatory compliance, local partnership development, and cultural sensitivity in service positioning. New entrants should prioritize safety credentials and practitioner qualifications to build consumer trust and market credibility.

Investment Priorities should focus on advanced technology acquisition, staff training programs, and facility upgrades to meet evolving consumer expectations and regulatory requirements. Service providers must balance premium positioning with accessibility to capture broader market segments.

Geographic Expansion opportunities exist in underserved regions, though market development requires careful assessment of local demographics, cultural factors, and infrastructure availability. Phased expansion approaches minimize risk while maximizing growth potential.

Service Diversification strategies should consider emerging treatment categories, male consumer segments, and preventive aesthetic services to capture new revenue streams and reduce dependence on traditional procedure categories.

Partnership Development with international brands, technology suppliers, and training organizations can accelerate market entry and enhance competitive positioning. Strategic alliances provide access to expertise, resources, and established market presence.

Digital Transformation initiatives should prioritize patient experience enhancement, operational efficiency improvement, and marketing effectiveness. Technology investments must align with consumer preferences and regulatory requirements while delivering measurable returns.

Market trajectory indicates continued robust growth driven by demographic trends, economic prosperity, and cultural evolution toward aesthetic treatment acceptance. The sector is positioned for sustained expansion with projected annual growth rates of 11-13% over the next five years, according to industry analysis.

Technology advancement will continue reshaping treatment options and service delivery methods, with artificial intelligence, robotics, and personalized medicine playing increasingly important roles. These innovations will enhance treatment precision, reduce recovery times, and improve patient outcomes.

Market maturation processes will lead to increased standardization, improved safety protocols, and enhanced consumer protection measures. Regulatory evolution will support market development while ensuring sustainable growth and professional standards maintenance.

Consumer sophistication will drive demand for more advanced treatments, personalized services, and comprehensive aesthetic solutions. Service providers must adapt to evolving expectations while maintaining competitive pricing and accessibility.

Regional integration opportunities will position Saudi Arabia as a leading aesthetic destination in the Middle East, attracting international patients and establishing the Kingdom as a regional hub for advanced cosmetic treatments and medical tourism.

MWR analysis suggests that market consolidation trends will continue, with successful providers expanding through acquisition, partnership, and franchise development strategies to achieve economies of scale and comprehensive market coverage.

The Saudi Arabia aesthetic market represents a dynamic and rapidly evolving sector with substantial growth potential driven by favorable demographics, economic prosperity, and changing cultural attitudes toward beauty enhancement. Market participants benefit from strong consumer demand, government support through Vision 2030 initiatives, and increasing acceptance of aesthetic procedures across diverse demographic segments.

Strategic opportunities exist across multiple market segments, from traditional cosmetic procedures to emerging preventive treatments and male-focused services. Success in this market requires careful attention to regulatory compliance, cultural sensitivity, and consumer safety while maintaining competitive positioning through technology adoption and service excellence.

Future market development will be shaped by continued economic growth, technological innovation, and evolving consumer preferences toward personalized, minimally invasive treatments. Service providers who invest in advanced capabilities, qualified practitioners, and comprehensive patient care systems will be best positioned to capture market opportunities and achieve sustainable growth in this promising sector.

What is Aesthetic?

Aesthetic refers to the study and appreciation of beauty, particularly in art and design. In the context of the Saudi Arabia Aesthetic Market, it encompasses various aspects such as cosmetic procedures, beauty products, and fashion trends that enhance physical appearance and personal expression.

What are the key players in the Saudi Arabia Aesthetic Market?

Key players in the Saudi Arabia Aesthetic Market include companies like Allergan, Galderma, and Merz Pharmaceuticals, which offer a range of aesthetic products and services. These companies are known for their innovations in cosmetic injectables and skincare solutions, among others.

What are the growth factors driving the Saudi Arabia Aesthetic Market?

The growth of the Saudi Arabia Aesthetic Market is driven by increasing consumer awareness about beauty and personal care, rising disposable incomes, and the influence of social media on beauty standards. Additionally, the expansion of aesthetic clinics and the availability of advanced technologies contribute to market growth.

What challenges does the Saudi Arabia Aesthetic Market face?

The Saudi Arabia Aesthetic Market faces challenges such as regulatory hurdles, the need for skilled professionals, and potential cultural resistance to certain aesthetic practices. These factors can impact the growth and acceptance of aesthetic treatments in the region.

What opportunities exist in the Saudi Arabia Aesthetic Market?

Opportunities in the Saudi Arabia Aesthetic Market include the rising demand for non-invasive procedures, the introduction of innovative products, and the potential for growth in medical tourism. As consumers seek more personalized and effective solutions, the market is poised for expansion.

What trends are shaping the Saudi Arabia Aesthetic Market?

Trends in the Saudi Arabia Aesthetic Market include a growing preference for natural-looking results, the rise of minimally invasive treatments, and increased investment in skincare products. Additionally, the integration of technology in aesthetic procedures is becoming more prevalent, enhancing patient experiences.

Saudi Arabia Aesthetic Market

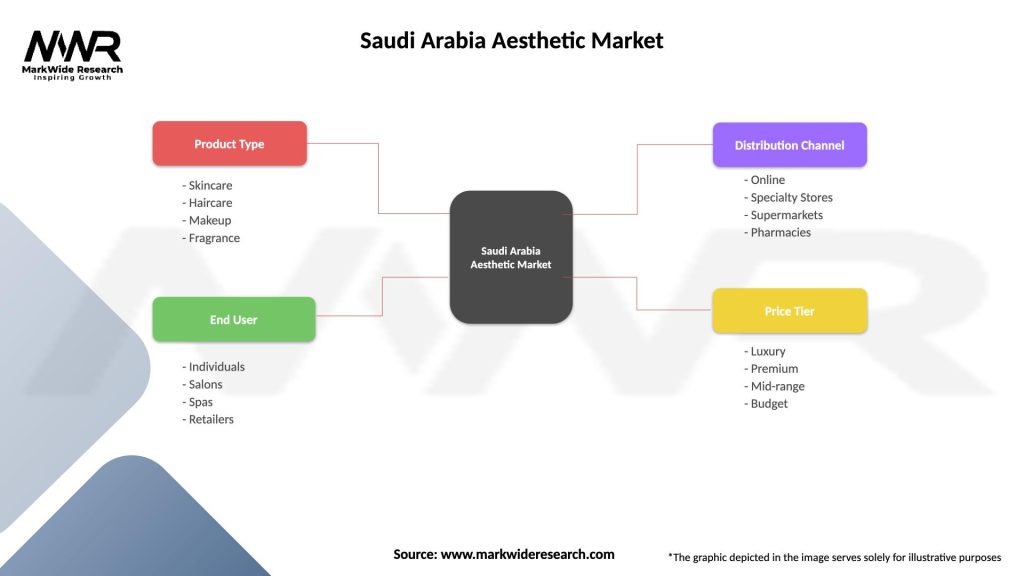

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Haircare, Makeup, Fragrance |

| End User | Individuals, Salons, Spas, Retailers |

| Distribution Channel | Online, Specialty Stores, Supermarkets, Pharmacies |

| Price Tier | Luxury, Premium, Mid-range, Budget |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Saudi Arabia Aesthetic Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at