444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The satellite manufacturing and launch market represents one of the most dynamic and rapidly evolving sectors in the global aerospace industry. This comprehensive market encompasses the design, development, production, and deployment of satellites for various applications including communications, earth observation, navigation, scientific research, and defense purposes. Market dynamics indicate unprecedented growth driven by increasing demand for satellite-based services, technological advancements in miniaturization, and the emergence of new space economy players.

Commercial satellite manufacturing has experienced remarkable transformation with the rise of small satellites, CubeSats, and constellation deployments. The market demonstrates robust expansion with growth rates reaching 8.2% CAGR across various segments, reflecting strong investor confidence and technological innovation. Launch services have become increasingly competitive with reusable rocket technology reducing costs and improving accessibility for satellite operators worldwide.

Key market participants include established aerospace giants alongside emerging commercial space companies, creating a diverse ecosystem that spans from traditional geostationary satellites to innovative mega-constellations. The integration of artificial intelligence, advanced materials, and propulsion technologies continues to reshape manufacturing processes and satellite capabilities, positioning the market for sustained long-term growth.

The satellite manufacturing and launch market refers to the comprehensive industry ecosystem encompassing the design, production, testing, and orbital deployment of artificial satellites for commercial, government, and scientific applications. This market includes satellite hardware manufacturing, ground equipment production, launch vehicle services, and associated support systems required for successful satellite operations.

Manufacturing components span satellite buses, payloads, solar panels, communication systems, and propulsion modules, while launch services encompass rocket manufacturing, mission planning, and orbital insertion capabilities. The market serves diverse end-users including telecommunications providers, government agencies, research institutions, and emerging commercial space ventures seeking to leverage satellite technology for various applications.

Market scope extends from traditional large geostationary satellites weighing several tons to innovative small satellites and CubeSats weighing just a few kilograms. This broad spectrum enables customized solutions for different mission requirements, budget constraints, and operational objectives, making satellite technology increasingly accessible to a wider range of organizations and applications.

Strategic market analysis reveals the satellite manufacturing and launch industry is experiencing unprecedented transformation driven by technological innovation, cost reduction initiatives, and expanding commercial applications. The market demonstrates strong growth momentum with increasing adoption of small satellite constellations, reusable launch vehicles, and advanced manufacturing techniques that significantly reduce production timelines and costs.

Key growth drivers include rising demand for global connectivity, earth observation services, and navigation systems, with commercial applications accounting for 67% of market activity. The emergence of mega-constellations for broadband internet services has fundamentally altered market dynamics, creating substantial opportunities for both satellite manufacturers and launch service providers.

Competitive landscape features established aerospace companies alongside innovative startups, fostering rapid technological advancement and market expansion. The integration of artificial intelligence, machine learning, and advanced materials science continues to enhance satellite capabilities while reducing manufacturing costs and improving operational efficiency across the entire value chain.

Market intelligence indicates several critical trends shaping the satellite manufacturing and launch industry:

Primary growth catalysts propelling the satellite manufacturing and launch market include increasing global demand for high-speed internet connectivity, particularly in underserved regions where terrestrial infrastructure remains limited. The proliferation of Internet of Things (IoT) applications requires extensive satellite coverage for remote monitoring, asset tracking, and data collection across industries including agriculture, logistics, and environmental monitoring.

Commercial space initiatives have dramatically expanded market opportunities with private companies investing heavily in satellite constellations for broadband services, earth observation, and navigation enhancement. Government space programs continue driving demand for advanced satellite systems supporting national security, weather monitoring, and scientific research missions that require sophisticated manufacturing capabilities and reliable launch services.

Technological advancement in satellite miniaturization has made space access more affordable and accessible to smaller organizations, universities, and emerging markets. The development of standardized satellite platforms, modular designs, and mass production techniques enables cost-effective manufacturing while maintaining high performance standards essential for successful mission outcomes.

Earth observation applications are experiencing rapid growth driven by climate monitoring requirements, precision agriculture, disaster management, and urban planning initiatives. These applications demand high-resolution imaging satellites with advanced sensors and data processing capabilities, creating substantial opportunities for specialized satellite manufacturers and launch service providers.

Significant challenges facing the satellite manufacturing and launch market include high capital investment requirements for manufacturing facilities, testing equipment, and launch infrastructure. The complex regulatory environment governing satellite operations, spectrum allocation, and orbital debris management creates substantial compliance costs and operational constraints that can limit market entry for smaller companies.

Technical complexity associated with satellite design, manufacturing, and launch operations requires specialized expertise and extensive testing protocols that extend development timelines and increase project costs. The harsh space environment demands exceptional reliability standards, necessitating rigorous quality control processes that can significantly impact manufacturing efficiency and profitability.

Launch availability constraints continue affecting market growth as demand for launch services often exceeds available capacity, particularly for specific orbital requirements and mission timelines. Weather dependencies, range scheduling conflicts, and technical issues can cause significant delays that impact satellite operators’ business plans and revenue projections.

Orbital debris concerns are increasingly limiting available orbital slots and creating additional operational risks for satellite operators. International efforts to address space debris through active removal technologies and improved tracking systems require substantial investment and coordination among multiple stakeholders, potentially constraining future market expansion.

Emerging opportunities in the satellite manufacturing and launch market include the development of next-generation satellite technologies incorporating artificial intelligence, quantum communications, and advanced propulsion systems. These innovations enable new applications in autonomous satellite operations, secure communications, and extended mission capabilities that create premium market segments with higher profit margins.

Space-based manufacturing represents a transformative opportunity as companies explore producing goods in microgravity environments, including fiber optics, pharmaceuticals, and advanced materials. This emerging sector requires specialized satellite platforms and manufacturing equipment, creating new market segments for innovative satellite manufacturers and launch service providers.

Interplanetary missions are gaining momentum with increasing interest in lunar exploration, Mars missions, and asteroid mining initiatives. These applications demand highly specialized satellite systems with extended operational capabilities, radiation hardening, and autonomous operation features that command premium pricing and long-term service contracts.

Developing markets present substantial growth opportunities as countries invest in national satellite capabilities for communications, earth observation, and navigation services. Technology transfer agreements, joint ventures, and local manufacturing partnerships enable market expansion while supporting economic development in emerging space-faring nations.

Market forces shaping the satellite manufacturing and launch industry reflect the complex interplay between technological innovation, regulatory frameworks, and commercial demand. The rapid pace of technological advancement continues driving down costs while improving satellite capabilities, creating positive feedback loops that expand market accessibility and application diversity.

Competitive dynamics have intensified with the entry of numerous commercial space companies challenging traditional aerospace contractors. This competition has accelerated innovation cycles, reduced pricing, and improved customer service levels across the entire value chain, benefiting satellite operators and end-users through enhanced value propositions.

Supply chain evolution reflects the industry’s maturation with specialized component suppliers, standardized interfaces, and economies of scale reducing manufacturing costs. The development of commercial off-the-shelf components and modular satellite architectures enables faster development cycles and more cost-effective solutions for diverse mission requirements.

Regulatory environment continues evolving to address emerging challenges including orbital debris mitigation, spectrum coordination, and space traffic management. These regulatory developments influence market dynamics by establishing operational standards, safety requirements, and international cooperation frameworks that shape industry practices and investment decisions.

Comprehensive market analysis employs multiple research methodologies including primary interviews with industry executives, technical experts, and government officials to gather firsthand insights into market trends, challenges, and opportunities. Secondary research encompasses analysis of industry reports, financial statements, patent filings, and regulatory documents to establish market baselines and identify emerging patterns.

Data collection processes utilize both quantitative and qualitative approaches to ensure comprehensive market coverage. Quantitative analysis includes satellite launch databases, manufacturing capacity assessments, and financial performance metrics, while qualitative research explores strategic initiatives, technology roadmaps, and market positioning strategies among key industry participants.

Market segmentation analysis examines various dimensions including satellite size categories, application sectors, orbital regimes, and geographic markets to identify growth patterns and opportunity areas. Cross-referencing multiple data sources ensures accuracy and reliability of market insights while accounting for regional variations and sector-specific dynamics.

Validation procedures include expert review panels, industry stakeholder feedback, and cross-verification with established market benchmarks to ensure research findings accurately reflect current market conditions and future growth prospects. This rigorous approach provides stakeholders with reliable intelligence for strategic decision-making and investment planning.

North American markets maintain leadership positions in satellite manufacturing and launch services, driven by strong government space programs, established aerospace infrastructure, and significant commercial space investment. The region accounts for approximately 42% of global satellite manufacturing capacity and hosts numerous innovative companies developing next-generation satellite technologies and launch systems.

European markets demonstrate strong growth in satellite applications including earth observation, navigation, and scientific missions. The European Space Agency’s initiatives and commercial partnerships have fostered a robust satellite manufacturing ecosystem that emphasizes international cooperation and technology sharing, contributing 26% of global market activity.

Asia-Pacific regions are experiencing rapid market expansion with countries including China, India, and Japan investing heavily in national satellite capabilities and commercial space ventures. This region now represents 23% of satellite launches and demonstrates the fastest growth rates in small satellite manufacturing and constellation deployments.

Emerging markets in Latin America, Africa, and the Middle East are developing satellite capabilities for communications, earth observation, and navigation applications. These regions present significant growth opportunities as governments and commercial entities recognize the strategic importance of satellite technology for economic development and national security objectives.

Market leadership encompasses both established aerospace giants and innovative commercial space companies that have transformed industry dynamics through technological innovation and cost reduction initiatives. The competitive environment features diverse business models ranging from traditional satellite manufacturing to integrated space services providers.

Key industry players include:

Strategic partnerships and joint ventures are increasingly common as companies seek to combine complementary capabilities, share development costs, and access new markets. These collaborations often span satellite manufacturing, launch services, and ground segment operations to provide integrated solutions for complex mission requirements.

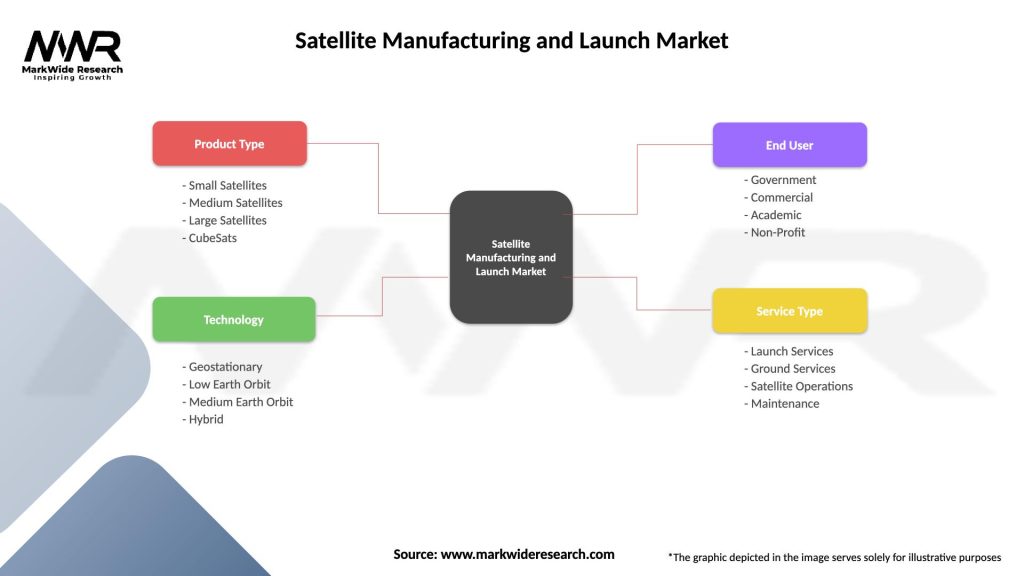

Market segmentation reveals diverse categories based on satellite size, application, orbit type, and end-user requirements:

By Satellite Size:

By Application:

By Orbit Type:

Small satellite manufacturing has emerged as the fastest-growing market segment, driven by cost advantages, shorter development cycles, and innovative applications. These platforms enable rapid technology demonstration, constellation deployments, and specialized missions that were previously economically unfeasible with traditional large satellites.

Communication satellites continue representing the largest market segment by revenue, with increasing demand for high-throughput satellites, software-defined payloads, and flexible beam coverage. The transition from traditional bent-pipe architectures to intelligent, reconfigurable systems creates opportunities for advanced satellite manufacturers.

Earth observation satellites demonstrate strong growth driven by climate monitoring requirements, precision agriculture applications, and disaster management needs. High-resolution imaging capabilities, hyperspectral sensors, and real-time data processing features command premium pricing in this expanding market segment.

Launch services are experiencing transformation through reusable rocket technology, rideshare programs, and dedicated small satellite launchers. These innovations have significantly reduced launch costs while improving schedule flexibility, making satellite deployment more accessible to diverse customer segments.

Ground segment equipment represents a critical market component including satellite control systems, data processing facilities, and user terminals. The integration of cloud computing, artificial intelligence, and edge processing capabilities enhances ground segment value propositions and operational efficiency.

Satellite manufacturers benefit from expanding market opportunities, technological innovation incentives, and economies of scale achieved through standardized platforms and mass production techniques. The diverse application portfolio enables risk diversification while premium technology segments offer higher profit margins and long-term customer relationships.

Launch service providers gain from increasing launch demand, technology advancement opportunities, and market expansion into emerging regions. Reusable launch technology and operational efficiency improvements create competitive advantages while enabling cost reduction benefits that can be shared with customers.

Satellite operators benefit from reduced satellite costs, improved performance capabilities, and enhanced service offerings that enable new business models and market expansion. Advanced satellite technologies provide operational flexibility, extended mission life, and improved return on investment for diverse applications.

End-users receive enhanced services including improved connectivity, higher-resolution earth observation data, and more accurate navigation services. Cost reductions in satellite manufacturing and launch services translate to more affordable satellite-based services for commercial and consumer applications.

Government agencies gain access to advanced satellite capabilities for national security, scientific research, and public service applications. Commercial space industry growth provides alternative suppliers, cost competition, and innovative solutions that enhance government space program effectiveness and efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Constellation deployment represents the most significant trend transforming the satellite industry, with multiple companies developing large-scale satellite networks for global broadband services, earth observation, and IoT connectivity. These mega-constellations require hundreds or thousands of satellites, fundamentally changing manufacturing approaches and launch service requirements.

Artificial intelligence integration is revolutionizing satellite operations through autonomous decision-making, predictive maintenance, and intelligent data processing capabilities. AI-powered satellites can adapt to changing conditions, optimize performance parameters, and reduce ground control requirements while improving operational efficiency.

Software-defined satellites enable flexible mission reconfiguration, payload optimization, and service adaptation throughout satellite operational life. This trend allows satellite operators to modify services, adjust coverage areas, and implement new applications without physical hardware changes, maximizing asset utilization and revenue potential.

Sustainable space practices are gaining importance with increased focus on orbital debris mitigation, satellite end-of-life disposal, and environmentally responsible manufacturing processes. Industry initiatives include active debris removal technologies, design for demise satellites, and green propulsion systems that reduce environmental impact.

Commercial space services continue expanding beyond traditional satellite operations to include space-based manufacturing, orbital logistics, and satellite servicing capabilities. These emerging services create new market opportunities while extending satellite operational life and reducing replacement costs for satellite operators.

Recent industry developments highlight the rapid pace of innovation and market evolution within the satellite manufacturing and launch sector. Major aerospace companies are investing heavily in next-generation satellite technologies, advanced manufacturing facilities, and innovative launch systems that promise to further reduce costs and improve capabilities.

Breakthrough technologies include electric propulsion systems that extend satellite operational life, advanced solar panel designs that improve power generation efficiency, and miniaturized components that enable smaller, more capable satellites. These innovations continue driving market growth while opening new application possibilities.

Strategic partnerships between satellite manufacturers, launch service providers, and technology companies are accelerating development timelines and reducing costs through shared expertise and resources. Collaborative approaches enable companies to focus on core competencies while accessing complementary capabilities from partners.

Regulatory developments include streamlined licensing processes, updated orbital debris guidelines, and international cooperation frameworks that facilitate market growth while ensuring safe and sustainable space operations. These regulatory improvements reduce barriers to market entry while maintaining operational safety standards.

Investment trends show continued strong venture capital and private equity funding for innovative space companies, supporting technology development and market expansion. Government space agencies are also increasing commercial partnerships and procurement from private sector suppliers, further stimulating market growth.

Strategic recommendations for market participants emphasize the importance of technology innovation, cost optimization, and market diversification to maintain competitive advantages in the rapidly evolving satellite industry. Companies should invest in research and development capabilities while building strategic partnerships to access complementary technologies and markets.

MarkWide Research analysis suggests that successful companies will focus on developing standardized satellite platforms, automated manufacturing processes, and integrated service offerings that provide comprehensive solutions for customer requirements. Vertical integration strategies may offer advantages in controlling costs and ensuring quality standards.

Market entry strategies should consider niche applications, emerging geographic markets, and specialized technology segments where smaller companies can compete effectively against established players. Focusing on specific customer segments or unique capabilities can provide sustainable competitive advantages and growth opportunities.

Risk management approaches should address supply chain vulnerabilities, technology obsolescence risks, and regulatory compliance requirements that could impact business operations. Diversifying supplier relationships, maintaining technology roadmaps, and engaging with regulatory authorities can help mitigate potential risks.

Investment priorities should emphasize sustainable competitive advantages including proprietary technologies, manufacturing capabilities, and customer relationships that provide long-term value creation opportunities. Companies should balance growth investments with operational efficiency improvements to optimize financial performance.

Long-term market prospects indicate continued strong growth driven by expanding satellite applications, technological advancement, and increasing global demand for satellite-based services. The market is expected to maintain robust expansion with growth rates exceeding 7.5% CAGR across multiple segments through the next decade.

Technology evolution will continue driving market transformation through advances in artificial intelligence, quantum communications, advanced materials, and propulsion systems. These innovations will enable new applications while improving satellite performance, reducing costs, and extending operational capabilities.

Market expansion into emerging regions and new application areas will create substantial growth opportunities for satellite manufacturers and launch service providers. Developing countries’ increasing investment in satellite capabilities and the emergence of space-based manufacturing represent significant long-term growth drivers.

Industry consolidation may occur as the market matures, with larger companies acquiring innovative startups and smaller players to access new technologies and market segments. However, the diverse application portfolio and technology requirements will likely maintain opportunities for specialized companies and niche players.

Regulatory framework evolution will continue addressing emerging challenges including space traffic management, orbital debris mitigation, and international cooperation requirements. These developments will shape industry practices while ensuring sustainable growth and operational safety standards.

The satellite manufacturing and launch market represents one of the most dynamic and promising sectors in the global aerospace industry, characterized by rapid technological innovation, expanding applications, and strong growth prospects. The convergence of advanced manufacturing techniques, cost-effective launch solutions, and diverse market applications has created unprecedented opportunities for industry participants across the entire value chain.

Market transformation driven by small satellite technologies, reusable launch systems, and commercial space initiatives has fundamentally altered industry dynamics while making satellite capabilities more accessible to diverse customer segments. The emergence of mega-constellations, AI-powered satellites, and sustainable space practices continues reshaping market opportunities and competitive landscapes.

Future success in this evolving market will depend on companies’ ability to innovate continuously, optimize costs, and adapt to changing customer requirements while maintaining the highest standards of reliability and performance. Strategic partnerships, technology investments, and market diversification will be essential for capturing growth opportunities and building sustainable competitive advantages in the expanding satellite manufacturing and launch market.

What is Satellite Manufacturing and Launch?

Satellite manufacturing and launch refers to the processes involved in designing, building, and deploying satellites into orbit. This includes various stages such as engineering, assembly, testing, and the actual launch using rockets.

What are the key players in the Satellite Manufacturing and Launch Market?

Key players in the Satellite Manufacturing and Launch Market include SpaceX, Boeing, Lockheed Martin, and Northrop Grumman, among others. These companies are involved in both the manufacturing of satellites and the launch services required to place them in orbit.

What are the main drivers of growth in the Satellite Manufacturing and Launch Market?

The main drivers of growth in the Satellite Manufacturing and Launch Market include the increasing demand for satellite-based services such as telecommunications, Earth observation, and global positioning. Additionally, advancements in technology and reduced launch costs are also contributing to market expansion.

What challenges does the Satellite Manufacturing and Launch Market face?

The Satellite Manufacturing and Launch Market faces challenges such as high development costs, regulatory hurdles, and the complexity of satellite technology. Additionally, competition from emerging players and the need for sustainable practices are also significant concerns.

What opportunities exist in the Satellite Manufacturing and Launch Market?

Opportunities in the Satellite Manufacturing and Launch Market include the growing interest in small satellites for various applications, advancements in launch vehicle technology, and the potential for international collaborations. These factors can lead to new business models and expanded service offerings.

What trends are shaping the Satellite Manufacturing and Launch Market?

Trends shaping the Satellite Manufacturing and Launch Market include the rise of mega-constellations for broadband internet, increased investment in satellite technology, and a focus on reusable launch systems. These trends are driving innovation and efficiency in satellite deployment.

Satellite Manufacturing and Launch Market

| Segmentation Details | Description |

|---|---|

| Product Type | Small Satellites, Medium Satellites, Large Satellites, CubeSats |

| Technology | Geostationary, Low Earth Orbit, Medium Earth Orbit, Hybrid |

| End User | Government, Commercial, Academic, Non-Profit |

| Service Type | Launch Services, Ground Services, Satellite Operations, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Satellite Manufacturing and Launch Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at