444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Satellite internet refers to the provision of internet access through communication satellites orbiting the Earth. It enables users in remote and underserved areas to connect to the internet without relying on traditional terrestrial infrastructure such as cables or fiber-optic networks. Satellite internet has gained significant traction in recent years due to its ability to bridge the digital divide and provide connectivity to areas where traditional internet services are unavailable or inadequate.

Meaning

Satellite internet is a technology that utilizes satellites to transmit and receive data for internet connectivity. It involves the use of a dish antenna to send and receive signals to and from a satellite in geostationary orbit. The satellite acts as a relay station, allowing users to access the internet even in remote or rural areas where terrestrial infrastructure is lacking. Satellite internet can provide high-speed internet access, making it a viable option for both residential and commercial users.

Executive Summary

The satellite internet market has witnessed significant growth in recent years, driven by the increasing demand for internet connectivity in underserved areas. The market is characterized by the presence of both established players and new entrants, leading to intense competition. The COVID-19 pandemic has further accelerated the adoption of satellite internet as remote work, online education, and telemedicine became essential during lockdowns. However, the market also faces challenges such as high installation costs and latency issues.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

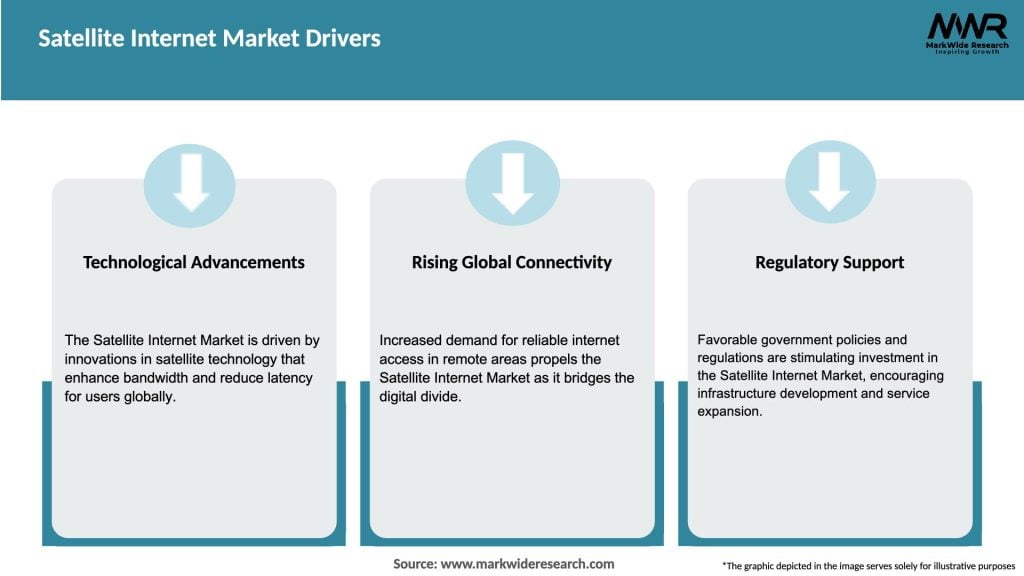

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The satellite internet market is characterized by intense competition among established players and new entrants. Technological advancements and innovation are driving the market, leading to the development of more efficient and cost-effective satellite communication systems. Additionally, partnerships and collaborations between satellite internet providers and other stakeholders such as governments, telecommunications companies, and equipment manufacturers are shaping the market landscape. Regulatory policies and spectrum availability also influence market dynamics, as they determine the licensing and allocation of satellite frequencies.

Regional Analysis

The satellite internet market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds a significant market share due to the presence of established satellite internet providers and high demand for connectivity in remote regions. Europe is also a prominent market, driven by government initiatives to expand internet access. The Asia Pacific region, with its large population and underserved areas, presents substantial growth opportunities. Latin America, the Middle East, and Africa are witnessing increasing adoption of satellite internet, supported by efforts to bridge the digital divide.

Competitive Landscape

Leading Companies in the Satellite Internet Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

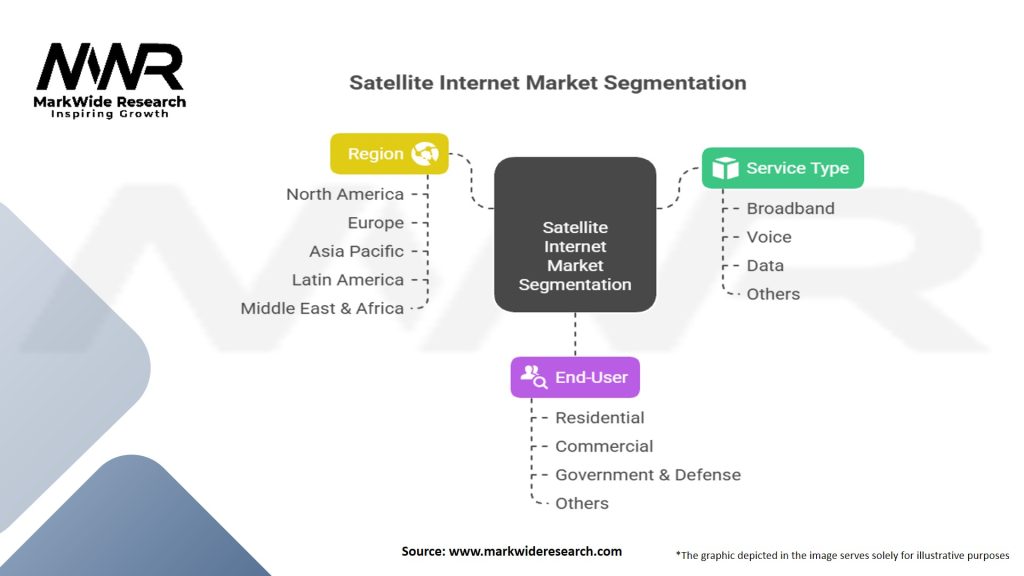

The satellite internet market can be segmented based on technology, end-user, and region.

By Technology:

By End-user:

By Region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the satellite internet market. As lockdowns and restrictions were implemented worldwide, the demand for reliable internet connectivity surged. Satellite internet played a crucial role in enabling remote work, online education, telemedicine, and access to essential information and services. The pandemic highlighted the importance of satellite internet in ensuring connectivity in remote and underserved areas where traditional terrestrial services were strained. As a result, the market witnessed increased adoption and accelerated growth during the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The satellite internet market is poised for significant growth in the coming years. The increasing demand for internet connectivity in remote and underserved areas, coupled with advancements in satellite communication systems, will drive market expansion. The entry of prominent players such as SpaceX, Amazon, and OneWeb will intensify competition and fuel innovation. Continued government initiatives to bridge the digital divide and the proliferation of IoT devices will further contribute to market growth. However, challenges such as installation costs, latency issues, and competition from terrestrial networks will need to be addressed to unlock the full potential of the satellite internet market.

Conclusion

Satellite internet is revolutionizing connectivity by providing internet access to remote and underserved areas globally. The market is driven by increasing demand, technological advancements, and government initiatives to bridge the digital divide. While challenges such as high installation costs and latency issues persist, the market presents significant opportunities for expansion, particularly in emerging markets and new application areas. As satellite internet continues to evolve, it will play a vital role in ensuring universal internet access, supporting economic growth, and transforming various sectors such as education, healthcare, and commerce.

What is Satellite Internet?

Satellite Internet refers to a type of internet connection that uses satellite technology to provide broadband access. It is particularly useful in remote areas where traditional wired connections are not available, enabling applications such as streaming, online gaming, and telecommuting.

Who are the key players in the Satellite Internet Market?

Key players in the Satellite Internet Market include companies like SpaceX, HughesNet, and Viasat, which are known for their innovative satellite technologies and services. These companies are competing to expand their coverage and improve service quality, among others.

What are the main drivers of growth in the Satellite Internet Market?

The main drivers of growth in the Satellite Internet Market include the increasing demand for high-speed internet in rural areas, advancements in satellite technology, and the rising need for reliable connectivity for remote work and education. Additionally, the expansion of IoT applications is fueling demand.

What challenges does the Satellite Internet Market face?

The Satellite Internet Market faces challenges such as high latency issues, limited bandwidth compared to terrestrial options, and the significant costs associated with satellite deployment and maintenance. These factors can hinder widespread adoption in some regions.

What opportunities exist for the future of the Satellite Internet Market?

Opportunities in the Satellite Internet Market include the potential for new satellite constellations to enhance global coverage, partnerships with telecommunications companies, and the growing demand for internet access in underserved regions. Innovations in technology may also lead to improved service offerings.

What trends are shaping the Satellite Internet Market?

Trends shaping the Satellite Internet Market include the launch of low Earth orbit (LEO) satellite systems, which promise lower latency and higher speeds, and the increasing integration of satellite services with mobile networks. Additionally, there is a growing focus on sustainability and reducing the environmental impact of satellite launches.

Satellite Internet Market

| Segmentation | Details |

|---|---|

| Service Type | Broadband, Voice, Data, Others |

| End-User | Residential, Commercial, Government & Defense, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Satellite Internet Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at