444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The tequila market in Russia has witnessed steady growth in recent years, driven by increasing consumer interest in international spirits, growing demand for premium alcoholic beverages, and rising popularity of cocktails among urban consumers. Despite being traditionally dominated by vodka, the Russian market presents opportunities for tequila producers to establish a presence and cater to evolving consumer preferences.

Meaning: The Russia tequila market encompasses the production, importation, distribution, and consumption of tequila, a distilled spirit made primarily from the blue agave plant in Mexico. Tequila is available in various categories, including blanco, reposado, añejo, and extra añejo, each offering distinct flavor profiles and aging characteristics.

Executive Summary: The Russia tequila market offers promising prospects for industry participants, characterized by a growing consumer base, expanding distribution channels, and increasing awareness and appreciation for tequila as a premium and versatile spirit. With the rise of cocktail culture and the influence of global beverage trends, tequila has emerged as an attractive option for Russian consumers seeking new and exciting drinking experiences.

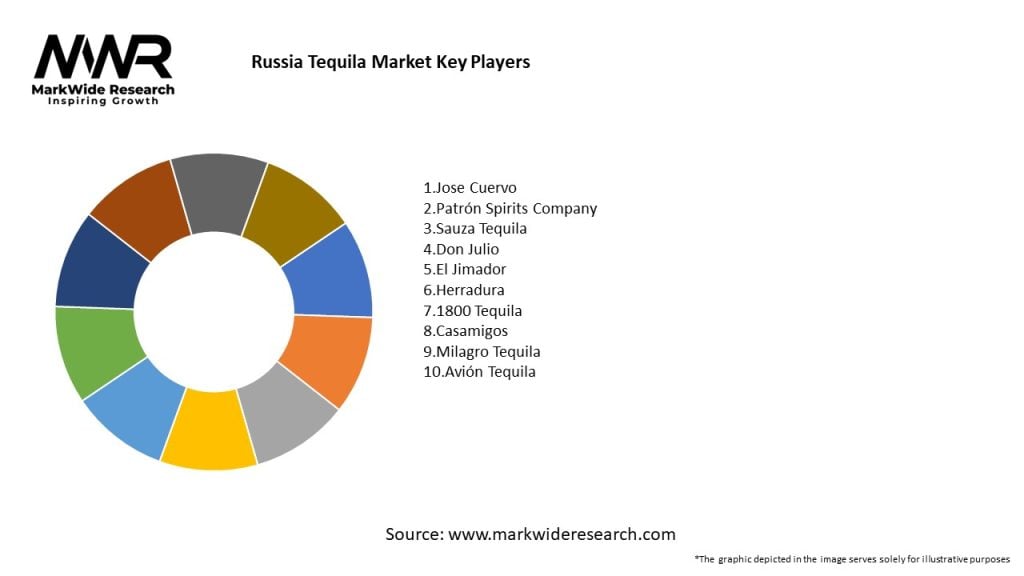

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Russia tequila market operates within a dynamic environment shaped by evolving consumer preferences, economic trends, regulatory developments, and competitive forces. Understanding these dynamics is essential for industry participants to identify opportunities, mitigate risks, and formulate effective strategies for market entry and expansion.

Regional Analysis: Consumption patterns and preferences for tequila may vary across different regions of Russia, influenced by factors such as demographic composition, urbanization levels, cultural influences, and local drinking traditions. Major urban centers like Moscow and St. Petersburg are likely to exhibit higher levels of tequila consumption due to greater exposure to global trends and influences.

Competitive Landscape:

Leading Companies in Russia Tequila Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The Russia tequila market can be segmented based on various factors, including product type, price range, distribution channel, and consumer demographics. Segmentation allows tequila brands to target specific consumer segments with tailored marketing messages and product offerings.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has affected the Russia tequila market in various ways:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Russia tequila market remains positive, driven by factors such as increasing consumer interest in premium spirits, growing cocktail culture, and expanding distribution channels. Tequila brands that prioritize innovation, sustainability, consumer education, and digital engagement are well-positioned to capitalize on emerging opportunities and drive growth in the market.

Conclusion: In conclusion, the Russia tequila market presents promising opportunities for tequila producers, importers, and distributors seeking to capitalize on growing consumer demand for premium and international spirits. Despite challenges such as regulatory complexities, cultural perceptions, and competitive pressures, tequila brands can succeed in the Russian market by focusing on product innovation, brand differentiation, localization, and consumer engagement strategies that resonate with Russian consumers’ preferences and lifestyles. By understanding market dynamics, leveraging key industry trends, and implementing strategic initiatives, tequila brands can establish a strong foothold and achieve long-term success in Russia’s evolving beverage landscape.

What is Tequila?

Tequila is a distilled alcoholic beverage made from the blue agave plant, primarily produced in the region surrounding the city of Tequila in Mexico. It is known for its distinct flavor and is often enjoyed in cocktails or as a shot.

What are the key players in the Russia Tequila Market?

Key players in the Russia Tequila Market include brands like Jose Cuervo, Sauza, and Don Julio, which are well-known for their premium tequila offerings. These companies compete on quality, brand recognition, and distribution channels, among others.

What are the growth factors driving the Russia Tequila Market?

The growth of the Russia Tequila Market is driven by increasing consumer interest in premium spirits, the rise of cocktail culture, and a growing acceptance of tequila as a versatile drink. Additionally, the expansion of bars and restaurants offering tequila-based cocktails contributes to market growth.

What challenges does the Russia Tequila Market face?

The Russia Tequila Market faces challenges such as regulatory hurdles, competition from other spirits like vodka, and potential supply chain disruptions affecting agave sourcing. These factors can impact pricing and availability for consumers.

What opportunities exist in the Russia Tequila Market?

Opportunities in the Russia Tequila Market include the potential for product innovation, such as flavored tequilas and ready-to-drink cocktails. Additionally, increasing tourism and interest in Mexican culture can enhance market penetration.

What trends are shaping the Russia Tequila Market?

Trends in the Russia Tequila Market include a growing preference for artisanal and organic tequilas, as well as an increase in tequila-based cocktails among younger consumers. Social media marketing is also playing a significant role in promoting tequila brands.

Russia Tequila Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blanco, Reposado, Añejo, Extra Añejo |

| Distribution Channel | Retail, Online, Bars, Restaurants |

| Customer Type | Millennials, Gen Z, Affluent Consumers, Casual Drinkers |

| Packaging Type | Glass Bottles, PET Bottles, Cans, Tetra Packs |

Leading Companies in Russia Tequila Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at