444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Russia satellite communications market represents a critical component of the nation’s telecommunications infrastructure, encompassing a comprehensive range of satellite-based communication services and technologies. Russia’s vast geographical expanse spanning eleven time zones creates unique challenges and opportunities for satellite communication systems, making them essential for connecting remote regions and supporting national security initiatives.

Market dynamics in Russia’s satellite communications sector are influenced by government policies, technological advancements, and increasing demand for reliable connectivity across diverse industries. The market experiences steady growth at approximately 6.2% CAGR, driven by modernization efforts in telecommunications infrastructure and expanding commercial applications.

Key market segments include military and defense communications, commercial telecommunications, broadcasting services, and maritime communications. The integration of advanced satellite technologies with terrestrial networks creates opportunities for enhanced coverage and improved service quality across Russia’s challenging terrain.

Government initiatives play a crucial role in market development, with significant investments in domestic satellite manufacturing capabilities and launch infrastructure. The emphasis on technological sovereignty drives demand for indigenous satellite communication solutions, reducing dependence on foreign technologies.

The Russia satellite communications market refers to the comprehensive ecosystem of satellite-based communication services, equipment, and infrastructure operating within Russian territory and serving Russian entities globally. This market encompasses satellite manufacturing, launch services, ground equipment, and various communication applications.

Satellite communications in Russia involve the transmission of voice, data, and video signals through artificial satellites positioned in various orbital configurations. These systems provide essential connectivity for remote areas where terrestrial infrastructure is impractical or unavailable, supporting both civilian and military applications.

Market participants include satellite operators, equipment manufacturers, service providers, and end-users across multiple sectors. The market structure reflects Russia’s strategic approach to maintaining communication sovereignty while meeting growing connectivity demands.

Russia’s satellite communications market demonstrates resilient growth despite global challenges, with domestic capabilities strengthening across all market segments. The market benefits from substantial government support and increasing commercial demand for satellite-based services.

Key growth drivers include expanding broadband requirements in remote regions, modernization of defense communication systems, and growing demand for satellite-based internet services. The market shows approximately 45% concentration in government and defense applications, reflecting strategic priorities.

Technological advancement remains a primary focus, with investments in next-generation satellite technologies and ground infrastructure improvements. The market experiences steady expansion in commercial segments, particularly in broadcasting and telecommunications applications.

Regional distribution shows significant concentration in major urban centers and strategic locations, with expanding coverage in remote areas through government-sponsored connectivity programs. The market outlook remains positive with continued investment in domestic capabilities.

Strategic market insights reveal several critical factors shaping Russia’s satellite communications landscape:

Government policy support serves as the primary driver for Russia’s satellite communications market, with substantial investments in domestic satellite capabilities and infrastructure development. Strategic initiatives focus on achieving technological independence and enhancing national communication security.

Geographical challenges create natural demand for satellite communications, as Russia’s vast territory includes numerous remote regions where terrestrial infrastructure deployment is economically unfeasible. Satellite solutions provide the most practical approach for ensuring comprehensive connectivity across the nation.

Defense and security requirements drive significant market demand, with military applications requiring reliable, secure communication channels that satellite systems uniquely provide. The emphasis on communication sovereignty strengthens domestic satellite industry development.

Commercial sector expansion contributes to market growth through increasing demand for satellite-based internet services, broadcasting capabilities, and specialized communication applications. The growing digital economy requires robust communication infrastructure that satellites help provide.

Technological advancement in satellite technologies enables new applications and improved service quality, driving market expansion. Enhanced satellite capabilities support growing data transmission requirements and emerging communication technologies.

International sanctions present significant challenges for Russia’s satellite communications market, limiting access to advanced foreign technologies and components. These restrictions necessitate greater reliance on domestic capabilities while potentially slowing technological advancement.

High capital requirements for satellite development, manufacturing, and launch operations create barriers to market entry and expansion. The substantial investment needed for satellite infrastructure development limits the number of active market participants.

Technical complexity in satellite system design, manufacturing, and operation requires specialized expertise and advanced facilities. The shortage of skilled personnel and sophisticated manufacturing capabilities can constrain market growth.

Regulatory challenges related to spectrum allocation, orbital positions, and international coordination create operational complexities. Compliance with international satellite communication regulations while maintaining national interests requires careful navigation.

Competition from terrestrial alternatives in certain applications limits satellite market expansion, particularly in areas where fiber optic and cellular networks provide adequate coverage and performance.

Remote area connectivity presents substantial opportunities for satellite communications expansion, with vast underserved regions requiring reliable communication services. Government initiatives to improve rural connectivity create market demand for satellite-based solutions.

Internet of Things (IoT) applications offer emerging opportunities for satellite communications, particularly in remote monitoring, asset tracking, and industrial automation. The growing IoT ecosystem requires ubiquitous connectivity that satellites can provide.

Emergency and disaster response applications create opportunities for specialized satellite communication services, with increasing recognition of satellite systems’ critical role in maintaining communications during emergencies.

Commercial space industry development opens new opportunities for satellite manufacturing, launch services, and specialized communication applications. The growing commercial space sector creates demand for diverse satellite communication solutions.

International cooperation in specific areas may provide opportunities for technology exchange and market expansion, despite broader geopolitical challenges. Selective partnerships could enhance market capabilities and reach.

Supply chain dynamics in Russia’s satellite communications market reflect the emphasis on domestic production capabilities and reduced foreign dependency. The market experiences ongoing transformation as local manufacturers expand their capabilities and product offerings.

Demand patterns show strong government and defense sector requirements alongside growing commercial interest in satellite services. The market demonstrates approximately 35% growth in commercial applications over recent years, indicating diversification beyond traditional government uses.

Competitive dynamics feature a mix of established state-owned enterprises and emerging private companies, with increasing collaboration between government and commercial entities. Market consolidation trends reflect strategic priorities and resource optimization.

Technology evolution drives market dynamics through continuous advancement in satellite capabilities, ground equipment, and service offerings. The transition to next-generation satellite technologies creates opportunities for market expansion and improved service quality.

Pricing dynamics reflect the balance between government-subsidized services and commercial market rates, with ongoing efforts to develop sustainable business models for satellite communication services.

Market research methodology for Russia’s satellite communications market employs comprehensive analysis of industry data, government publications, and market participant information. The research approach combines quantitative analysis with qualitative insights to provide accurate market assessment.

Primary research includes interviews with industry experts, government officials, and market participants to gather firsthand insights into market trends and developments. Direct engagement with stakeholders provides valuable perspective on market dynamics and future prospects.

Secondary research encompasses analysis of government reports, industry publications, and technical documentation to understand market structure and regulatory environment. Comprehensive review of available data sources ensures thorough market coverage.

Data validation processes ensure accuracy and reliability of market information through cross-referencing multiple sources and expert verification. Rigorous validation methodology maintains research quality and credibility.

Market modeling techniques project future market trends based on historical data, current developments, and identified growth drivers. Analytical models account for various market scenarios and potential influencing factors.

Moscow and Central Federal District represent the primary hub for Russia’s satellite communications market, hosting major industry participants, government agencies, and research institutions. This region accounts for approximately 40% of market activity and serves as the center for strategic decision-making and industry coordination.

Siberian Federal District presents significant opportunities for satellite communications due to its vast territory and sparse population density. The region’s challenging geography makes satellite solutions essential for connectivity, creating substantial demand for communication services.

Far Eastern Federal District demonstrates growing importance in satellite communications, particularly for maritime applications and international connectivity. The region’s strategic location and economic development drive demand for advanced communication infrastructure.

Northwestern Federal District shows strong market presence in satellite manufacturing and technology development, with established aerospace industry capabilities supporting market growth. The region contributes significantly to domestic satellite production capacity.

Southern Federal District exhibits increasing satellite communication requirements for agricultural, industrial, and commercial applications. The region’s economic diversification creates opportunities for various satellite-based services.

Major market participants in Russia’s satellite communications sector include both established state enterprises and emerging commercial entities:

Competitive strategies emphasize technological advancement, domestic capability development, and strategic partnerships. Market participants focus on expanding their service offerings while strengthening their technological foundations.

By Application:

By Technology:

By End User:

Military and defense communications dominate the Russian satellite communications market, accounting for the largest share of market activity. This segment benefits from consistent government investment and strategic priority, with approximately 55% market concentration in defense-related applications.

Commercial telecommunications represent the fastest-growing segment, driven by increasing demand for satellite-based internet services and business communications. The segment shows strong potential for continued expansion as commercial space activities increase.

Broadcasting applications maintain stable market presence, providing essential television and radio distribution services across Russia’s vast territory. The segment benefits from established infrastructure and consistent demand for content distribution.

Maritime communications show steady growth driven by expanding shipping activities and regulatory requirements for vessel tracking systems. The segment benefits from Russia’s extensive coastline and maritime industry development.

Emergency services represent an emerging category with increasing recognition of satellite communications’ critical role in disaster response and emergency management. Government initiatives support segment development and expansion.

Government agencies benefit from enhanced communication capabilities supporting national security, emergency response, and remote area connectivity. Satellite communications provide essential infrastructure for maintaining government operations across Russia’s vast territory.

Commercial enterprises gain access to reliable communication services enabling business operations in remote locations and international markets. Satellite solutions support business continuity and operational efficiency across various industries.

Technology companies benefit from market opportunities in satellite manufacturing, ground equipment development, and service provision. The growing market creates demand for innovative solutions and technological advancement.

End users receive improved connectivity options, particularly in underserved areas where terrestrial infrastructure is limited. Satellite communications enhance access to information, entertainment, and communication services.

Economic development benefits from improved communication infrastructure supporting business growth, remote work capabilities, and digital economy expansion. Enhanced connectivity contributes to regional development and economic diversification.

Strengths:

Weaknesses:

Opportunities:

Threats:

Domestic capability development represents the most significant trend in Russia’s satellite communications market, with substantial investments in indigenous satellite manufacturing and technology development. This trend reflects strategic priorities for technological sovereignty and reduced foreign dependency.

Commercial sector expansion shows accelerating growth as private companies increasingly adopt satellite communication solutions. The trend toward commercial space activities creates new opportunities for satellite service providers and equipment manufacturers.

Technology modernization drives market evolution through adoption of advanced satellite technologies, improved ground systems, and enhanced service capabilities. The transition to next-generation satellite systems enables new applications and improved performance.

Integration with terrestrial networks becomes increasingly important as satellite systems complement fiber optic and cellular infrastructure. Hybrid communication solutions provide enhanced coverage and reliability for various applications.

Emergency preparedness focus grows in importance as satellite communications play critical roles in disaster response and emergency management. Government initiatives emphasize satellite systems’ essential function in maintaining communications during crises.

Satellite constellation expansion represents major industry development, with new satellite launches enhancing coverage and capacity. Recent deployments improve service quality and expand market reach across various applications.

Manufacturing capability enhancement through facility upgrades and technology investments strengthens domestic satellite production capacity. Industry developments focus on reducing production costs while improving satellite performance and reliability.

Ground infrastructure modernization improves satellite communication system performance through advanced ground stations and network equipment. Infrastructure developments enhance service quality and operational efficiency.

Regulatory framework evolution adapts to changing market conditions and technological advancement. Recent regulatory developments aim to support market growth while maintaining national security priorities.

International partnership initiatives in selected areas create opportunities for technology exchange and market expansion. Strategic partnerships focus on mutually beneficial cooperation while respecting national interests.

MarkWide Research analysis suggests that market participants should focus on developing comprehensive domestic capabilities while maintaining technological competitiveness. The emphasis on indigenous development creates opportunities for companies investing in advanced satellite technologies and manufacturing capabilities.

Strategic recommendations include diversifying market focus beyond traditional government applications to capture growing commercial opportunities. Companies should develop innovative service offerings targeting emerging market segments such as IoT applications and remote connectivity solutions.

Technology investment remains critical for maintaining market competitiveness, with particular emphasis on next-generation satellite systems and ground infrastructure modernization. Companies should prioritize research and development activities to support technological advancement.

Partnership strategies should focus on domestic collaboration and selective international cooperation where possible. Strategic alliances can enhance capabilities while supporting market expansion and technology development objectives.

Market positioning should emphasize unique value propositions and specialized capabilities that differentiate companies in competitive market segments. Focus on niche applications and specialized services can create sustainable competitive advantages.

Market growth prospects remain positive despite global challenges, with continued government support and expanding commercial demand driving market expansion. The outlook shows projected growth of approximately 6.8% CAGR over the next five years, supported by strategic investments and technological advancement.

Technology evolution will continue shaping market development through advanced satellite systems, improved ground infrastructure, and enhanced service capabilities. Future developments focus on increasing efficiency, reducing costs, and expanding application possibilities.

Commercial market expansion presents significant growth opportunities as private sector adoption of satellite communications increases. The growing digital economy and remote work trends support demand for satellite-based connectivity solutions.

Government investment will remain a key market driver, with continued emphasis on national communication infrastructure and security requirements. Strategic priorities support sustained market growth and capability development.

MWR projections indicate that Russia’s satellite communications market will achieve approximately 25% increase in commercial segment participation over the next decade, reflecting diversification beyond traditional government applications. The market outlook emphasizes balanced growth across multiple segments and applications.

Russia’s satellite communications market demonstrates resilient growth potential despite global challenges, supported by strong government commitment and expanding commercial opportunities. The market benefits from strategic investments in domestic capabilities and growing recognition of satellite communications’ essential role in national infrastructure.

Key success factors include continued technology development, market diversification, and strategic capability building. Companies that focus on innovation, quality, and specialized applications are well-positioned to capitalize on market opportunities and achieve sustainable growth.

Future market development will depend on balancing strategic priorities with commercial opportunities while maintaining technological competitiveness. The emphasis on domestic capability development creates a foundation for long-term market growth and technological advancement.

Market participants should prepare for continued evolution in technology, applications, and competitive dynamics. Success requires strategic planning, technological investment, and adaptive approaches to changing market conditions while maintaining focus on core competencies and market positioning.

What is Satellite Communications?

Satellite communications refer to the use of satellite technology to provide communication services, including television broadcasting, internet access, and telephony. This technology plays a crucial role in connecting remote areas and facilitating global communication.

What are the key players in the Russia Satellite Communications Market?

Key players in the Russia Satellite Communications Market include companies like RSCC (Russian Satellite Communications Company), Gazprom Space Systems, and Intersputnik. These companies provide a range of satellite services, including broadband internet and broadcasting, among others.

What are the growth factors driving the Russia Satellite Communications Market?

The growth of the Russia Satellite Communications Market is driven by increasing demand for broadband services in remote areas, advancements in satellite technology, and the rising need for secure communication channels. Additionally, the expansion of IoT applications is contributing to market growth.

What challenges does the Russia Satellite Communications Market face?

The Russia Satellite Communications Market faces challenges such as regulatory hurdles, high operational costs, and competition from terrestrial communication networks. These factors can hinder the expansion and adoption of satellite services in the region.

What opportunities exist in the Russia Satellite Communications Market?

Opportunities in the Russia Satellite Communications Market include the potential for expanding services to underserved regions, the integration of satellite technology with emerging technologies like AI and IoT, and the growing demand for secure communication solutions in various sectors.

What trends are shaping the Russia Satellite Communications Market?

Trends in the Russia Satellite Communications Market include the shift towards high-throughput satellites, the increasing use of satellite constellations for global coverage, and the growing emphasis on sustainability in satellite operations. These trends are influencing how services are delivered and expanding market capabilities.

Russia Satellite Communications Market

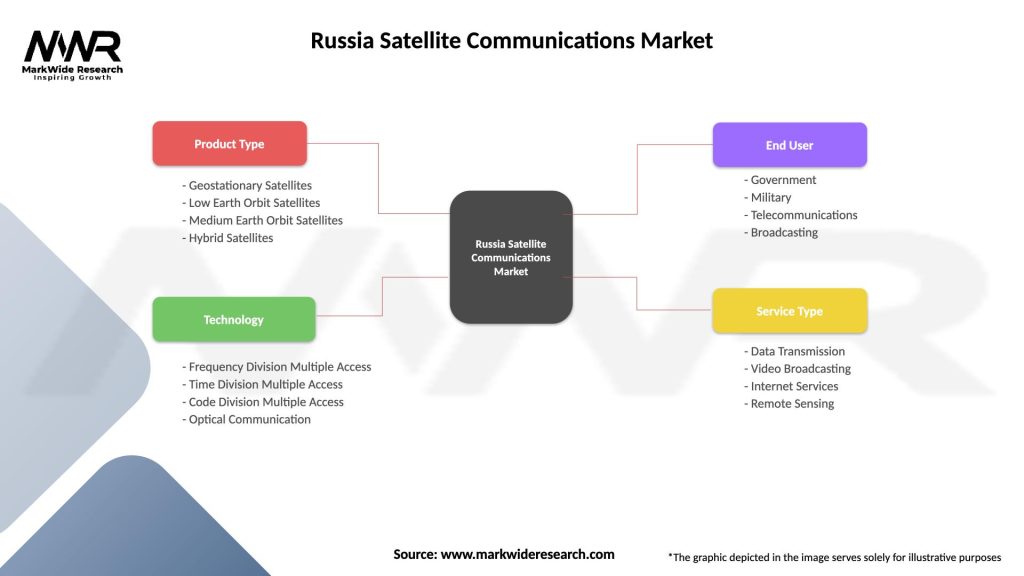

| Segmentation Details | Description |

|---|---|

| Product Type | Geostationary Satellites, Low Earth Orbit Satellites, Medium Earth Orbit Satellites, Hybrid Satellites |

| Technology | Frequency Division Multiple Access, Time Division Multiple Access, Code Division Multiple Access, Optical Communication |

| End User | Government, Military, Telecommunications, Broadcasting |

| Service Type | Data Transmission, Video Broadcasting, Internet Services, Remote Sensing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Russia Satellite Communications Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at