444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Russia OTR Tire Market is a thriving industry that plays a crucial role in supporting the country’s construction, mining, and industrial sectors. OTR (Off-The-Road) tires are specifically designed to operate in challenging terrains and harsh environments, providing reliable traction and durability. These tires are primarily used in heavy-duty vehicles such as dump trucks, loaders, bulldozers, and graders.

Meaning

OTR tires are essential for ensuring the smooth operation of heavy machinery in industries where standard tires would not suffice. These specialized tires are characterized by their robust construction, deep treads, and puncture-resistant properties. The Russia OTR Tire Market caters to various industries, including mining, construction, agriculture, and port handling, where the demand for heavy machinery and equipment is significant.

Executive Summary

The Russia OTR Tire Market is witnessing steady growth due to the expanding construction and mining activities in the region. The market is driven by the need for durable and high-performing tires that can withstand demanding work conditions. OTR tires are designed to provide exceptional traction, stability, and load-bearing capacity, making them indispensable for heavy machinery operators.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Russia OTR Tire Market is characterized by dynamic factors that shape its growth trajectory. Key dynamics include market drivers, restraints, opportunities, and trends, which collectively influence the industry’s development and competitiveness.

Regional Analysis

The Russia OTR Tire Market exhibits regional variations in terms of demand, infrastructure development, and industrial activities. The market is concentrated in major cities, industrial clusters, and resource-rich regions. Central Russia, Siberia, and the Ural Mountains are key regions driving the demand for OTR tires due to their construction, mining, and agricultural activities.

Competitive Landscape

Leading companies in the Russia OTR Tire Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

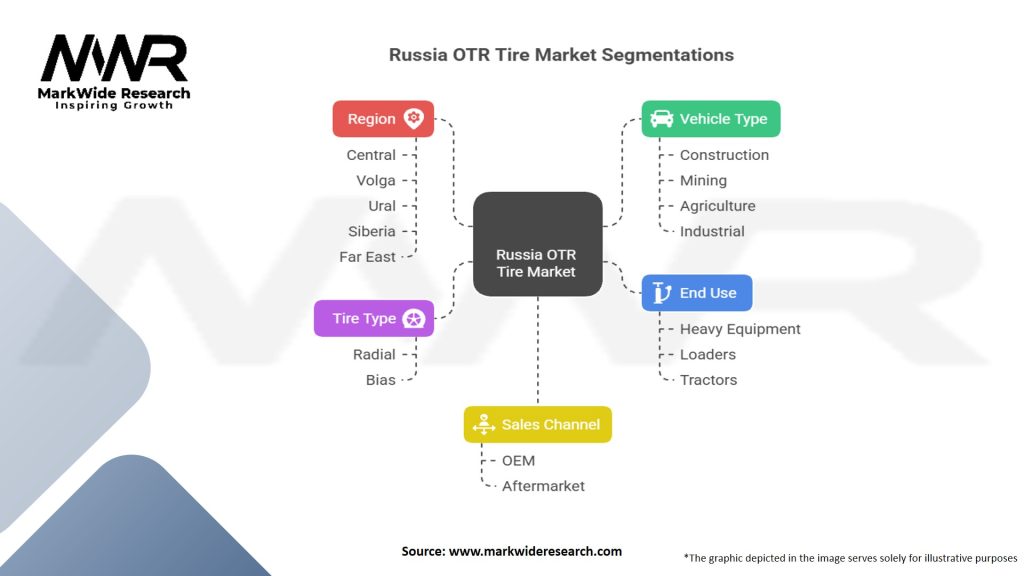

Segmentation

The Russia OTR Tire Market can be segmented based on tire type, application, and end-user industry.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Russia OTR Tire Market experienced the impact of the Covid-19 pandemic, primarily due to disruptions in supply chains, temporary suspension of construction and mining activities, and reduced demand for heavy machinery. However, the market showed resilience as economic activities resumed, and government stimulus measures supported infrastructure development projects. The pandemic also highlighted the importance of robust supply chains and the need for reliable and durable OTR tires to ensure uninterrupted operations in critical sectors.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Russia OTR Tire Market looks promising, driven by the growing demand for heavy machinery in construction, mining, and agricultural sectors. Technological advancements, increasing emphasis on sustainability, and government initiatives for infrastructure development and modernization present favorable market conditions. However, manufacturers need to adapt to evolving customer needs, invest in innovation, and strengthen their distribution networks to capitalize on the market’s potential.

Conclusion

The Russia OTR Tire Market is witnessing steady growth, supported by the construction, mining, and agricultural sectors. OTR tires play a crucial role in ensuring the smooth operation of heavy machinery in challenging terrains and harsh environments. The market is driven by factors such as infrastructure development projects, expanding mining activities, and increasing agricultural mechanization. While the market offers significant opportunities, it also faces challenges such as price volatility, intense competition, and slow adoption of advanced tire technologies. By embracing technological advancements, focusing on sustainability, and collaborating with end-users, OTR tire manufacturers can position themselves for success in the dynamic Russian market.

What is the Russia OTR Tire?

The Russia OTR Tire refers to off-the-road tires designed for heavy vehicles used in various applications such as mining, construction, and agriculture within the Russian market.

Who are the key players in the Russia OTR Tire Market?

Key players in the Russia OTR Tire Market include companies like Kamaz, Voltyre, and Belshina, which are known for their production of durable tires for heavy machinery, among others.

What are the growth factors driving the Russia OTR Tire Market?

The growth of the Russia OTR Tire Market is driven by increasing investments in infrastructure development, a rise in mining activities, and the expansion of agricultural operations.

What challenges does the Russia OTR Tire Market face?

Challenges in the Russia OTR Tire Market include fluctuating raw material prices, competition from imported tires, and regulatory hurdles affecting manufacturing processes.

What opportunities exist in the Russia OTR Tire Market?

Opportunities in the Russia OTR Tire Market include the potential for technological advancements in tire manufacturing, increasing demand for eco-friendly tires, and the growth of the electric vehicle segment in heavy machinery.

What trends are shaping the Russia OTR Tire Market?

Trends in the Russia OTR Tire Market include a shift towards more sustainable tire solutions, the integration of smart technology in tire design, and a focus on enhancing tire performance for specific applications.

Russia OTR Tire Market Segmentations

| Segment | Details |

|---|---|

| Vehicle Type | Construction, Mining, Agriculture, Industrial |

| Tire Type | Radial, Bias |

| Sales Channel | OEM, Aftermarket |

| End Use | Heavy Equipment, Loaders, Tractors |

| Region | Central, Volga, Ural, Siberia, Far East |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Russia OTR Tire Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at